Fill Out Your St5 Form

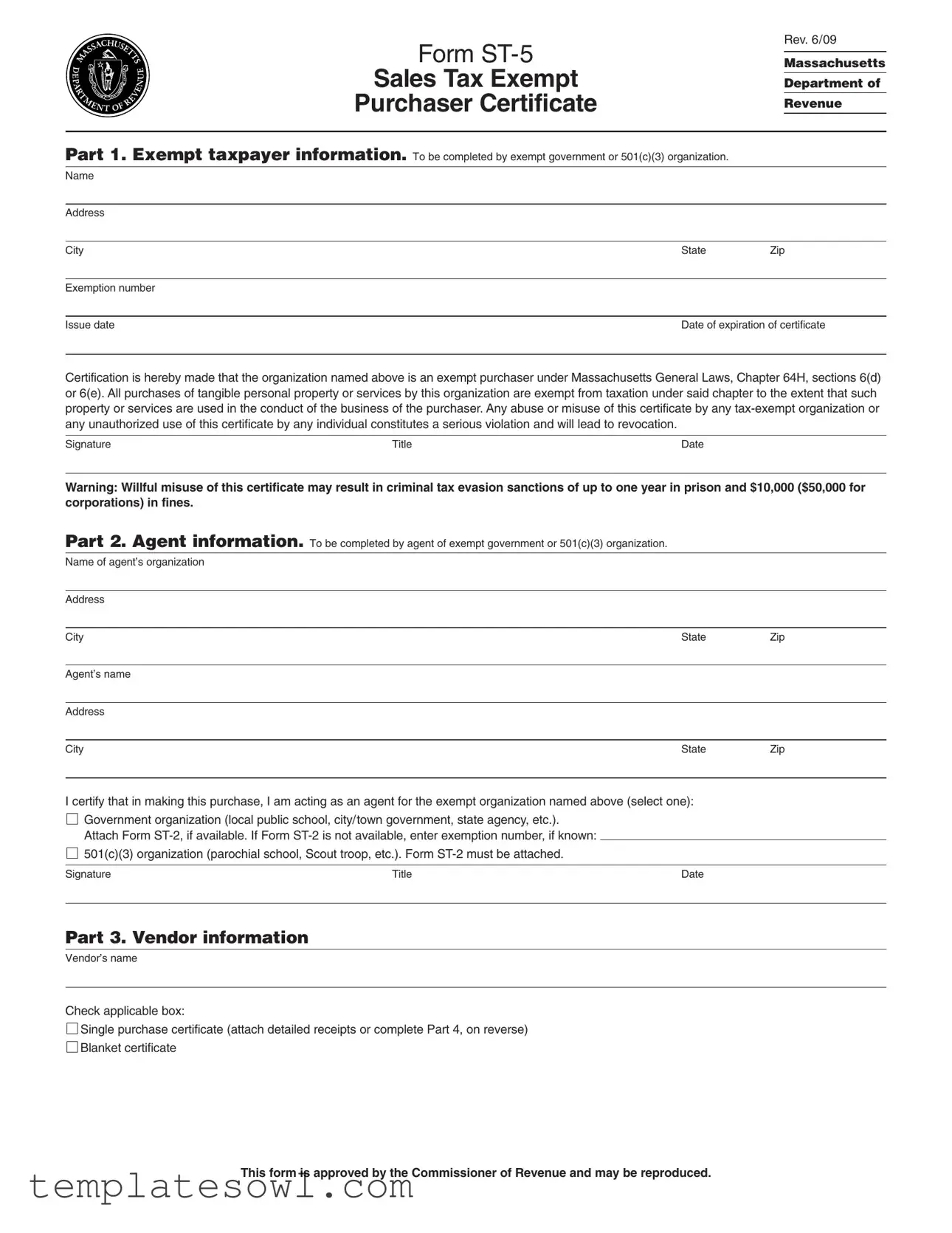

The ST-5 form, known as the Sales Tax Exempt Purchaser Certificate, serves a vital role in Massachusetts for exempt government entities and certain nonprofit organizations, particularly those classified under 501(c)(3). Designed to allow these organizations to make tax-exempt purchases, the form requires information about the exempt purchaser, including their name, address, exemption number, and the certificate's issue and expiration dates. With this certificate, the purchasing organization attests that they qualify for tax exemption under relevant state laws, specifically Massachusetts General Laws, Chapter 64H, sections 6(d) or 6(e). Misuse or unauthorized use of the ST-5 can lead to serious consequences, such as revocation of the certificate and potential criminal penalties, underscoring the need for accurately completed documentation. In addition to the exempt purchaser's information, the ST-5 also includes sections for agents representing these organizations, vendor details, and a description of the purchased items. Compliance is key; government organizations and 501(c)(3) groups must attach the appropriate supporting Form ST-2 to substantiate their tax-exempt status. Vendors must scrutinize the ST-5 for validity and its expiration date to ensure they uphold compliance with state tax regulations.

St5 Example

Form

Sales Tax Exempt

Purchaser Certificate

Rev. 6/09

Massachusetts

Department of

Revenue

Part 1. Exempt taxpayer information. To be completed by exempt government or 501(c)(3) organization.

Name

Address

City |

State |

Zip |

|

|

|

Exemption number |

|

|

|

|

|

Issue date |

Date of expiration of certificate |

|

Certification is hereby made that the organization named above is an exempt purchaser under Massachusetts General Laws, Chapter 64H, sections 6(d) or 6(e). All purchases of tangible personal property or services by this organization are exempt from taxation under said chapter to the extent that such property or services are used in the conduct of the business of the purchaser. Any abuse or misuse of this certificate by any

Signature |

Title |

Date |

Warning: Willful misuse of this certificate may result in criminal tax evasion sanctions of up to one year in prison and $10,000 ($50,000 for corporations) in fines.

Part 2. Agent information. To be completed by agent of exempt government or 501(c)(3) organization.

Name of agent’s organization

Address

City |

State |

Zip |

Agent’s name

Address

City |

State |

Zip |

I certify that in making this purchase, I am acting as an agent for the exempt organization named above (select one):

Government organization (local public school, city/town government, state agency, etc.).

Attach Form

501(c)(3) organization (parochial school, Scout troop, etc.). Form

Signature |

Title |

Date |

|

|

|

Part 3. Vendor information

Vendor’s name

Check applicable box:

Single purchase certificate (attach detailed receipts or complete Part 4, on reverse)

Single purchase certificate (attach detailed receipts or complete Part 4, on reverse)

Blanket certificate

Blanket certificate

This form is approved by the Commissioner of Revenue and may be reproduced.

Part 4. Description of property purchased

Date |

Description |

Quantity |

Cost |

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Total cost |

$ |

|

|

|

|

General information

An exempt 501(c)(3) organization must have obtained a Certificate of Ex- emption (Form

Any person, group or organization purchasing as an agent on behalf of a 501(c)(3) organization must certify that it is doing so by presenting to the vendor a properly completed Form

Any government organization is encouraged to obtain a Certificate of Ex- emption (Form

Any person, group or organization purchasing on behalf of exempt govern- ment organizations must certify that they are doing so by presenting to the vendor a properly executed Form

1 of Form

Other information for vendors

Vendors should verify the validity of the certificate presented to them by checking the expiration date on the certificate. Vendors must not honor a Certificate of Exemption that has expired.

Government organization maintain Form

Vendors should call the Customer Service Bureau at (617)

If you have any questions about completing this certificate, please contact:

Massachusetts Department of Revenue, Customer Service Bureau, 200 Arlington Street, Chelsea, MA 02150; (617)

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The ST-5 form certifies that an organization is exempt from sales tax when purchasing tangible personal property or services in Massachusetts. |

| Governing Laws | This form is governed by Massachusetts General Laws, Chapter 64H, sections 6(d) and 6(e). |

| Requirements for 501(c)(3) | Exempt 501(c)(3) organizations must submit a completed Form ST-5 along with a Certificate of Exemption (Form ST-2) to vendors. |

| Penalties for Misuse | Improper use of the ST-5 form may lead to serious penalties, including criminal charges and up to one year in prison. |

Guidelines on Utilizing St5

After completing the ST5 form, you will have the necessary documentation to inform vendors about your tax-exempt status. Ensure all parts of the form are accurately filled out. This will help prevent any potential issues with tax compliance and ensure that your purchases are recognized as exempt from sales tax.

- Gather Necessary Information: Collect all relevant information required for the form, including the exempt organization’s name, address, and exemption number.

- Complete Part 1: Fill out the exempt taxpayer information section if you are a government or 501(c)(3) organization. Include your name, address, city, state, zip code, exemption number, issue date, and expiration date of the certificate.

- Sign and Date: Ensure that the appropriate person from your organization signs and dates this part of the form.

- Complete Part 2: If you are acting as an agent for an exempt organization, fill in the agent information section. Include the agent's organization name and address, your name and address, and select whether you are purchasing for a government organization or a 501(c)(3) organization.

- Attach Additional Forms: If applicable, attach Form ST-2 for a government organization or the required documentation for a 501(c)(3) organization.

- Complete Part 3: Fill in the vendor information section, including the vendor's name and check whether this is a single purchase certificate or a blanket certificate.

- Fill Out Part 4: Provide detailed descriptions of the property purchased, including the date, description, quantity, and cost for each item. Sum up the total cost.

- Review for Accuracy: Go through the completed form to ensure all entries are accurate and complete.

- Submit the Form: Present the completed ST5 form along with any required documentation to the vendor before making your purchase.

What You Should Know About This Form

What is an ST-5 form, and who should use it?

The ST-5 form, known as the Sales Tax Exempt Purchaser Certificate, is a crucial document for government entities and certain nonprofit organizations, specifically 501(c)(3) organizations in Massachusetts. This form allows eligible entities to make purchases without the burden of sales tax, as long as the items or services are intended for use in the organization's exempt activities. If you are part of a government agency or an exempt nonprofit group, ensuring you have this form filled out correctly is essential for tax compliance.

How do I complete the ST-5 form correctly?

Filling out the ST-5 form requires attention to detail. Start by providing the exempt taxpayer information in Part 1, including the organization’s name, address, and exemption number. Each section must be filled out as directed, ensuring accurate details for the vendor. If you are acting as an agent for the organization, Part 2 must be completed, confirming your status and attaching the necessary Form ST-2 if applicable. Lastly, in Part 4, describe the items purchased, including quantities and costs. This thoroughness helps prevent issues down the line.

What are the consequences of misusing the ST-5 form?

Misusing or improperly completing the ST-5 form carries serious repercussions. Misrepresentation or abuse of this certificate can lead to severe penalties, including criminal tax evasion charges. Individuals could face up to one year in prison and hefty fines, while corporations might incur even greater penalties. Ensuring the accurate use of this form not only protects your organization but also upholds the integrity of tax-exempt purchases in the state.

What should vendors do when presented with an ST-5 form?

For vendors, verifying the legitimacy of the ST-5 form presented is critical. Check the form for completeness and ensure that it is filled out properly, paying special attention to the expiration date, as using an expired form is not permissible. Maintain a copy of the ST-5 for your records, and if any uncertainties arise, don’t hesitate to reach out to the Massachusetts Department of Revenue’s Customer Service Bureau. Adhering to these steps will protect your business and help maintain compliance with state regulations.

Common mistakes

Filling out the ST-5 form correctly is essential for exempt organizations to avoid tax liabilities. One common mistake is failing to complete Part 1, which is crucial for providing the exempt taxpayer information.

This section requires basic information such as the name, address, and exemption number. Incomplete details can lead to the rejection of the form. Organizations often overlook this part, thinking it is optional, which is incorrect.

An additional error is neglecting to attach the necessary supporting documentation. For 501(c)(3) organizations, it is mandatory to include Form ST-2, which certifies the exemption status. Without this attachment, vendors may not honor the ST-5 form.

Another frequent mistake involves inaccurate or outdated information, specifically the exemption number and the dates listed. The issue date and expiration date must be current and correctly stated; otherwise, it could raise questions regarding validity.

Moreover, the signing authority is critical. Sometimes, individuals fail to sign or have an unauthorized person sign the form, which renders the document invalid. Ensure that the signature belongs to someone authorized to commit the organization.

Lastly, some individuals do not fully understand the distinction between a single purchase certificate and a blanket certificate. This can result in confusion during transactions. Selecting the wrong box may lead to complications, possibly resulting in tax charges that the organization intended to avoid.

Documents used along the form

The ST-5 form is a crucial document for sales tax exemption in Massachusetts. However, other forms and documents often accompany it to ensure compliance and facilitate transactions. Below is a list of these associated documents, along with brief descriptions of each.

- Form ST-2: This is the Certificate of Exemption that certifies either a 501(c)(3) organization or a government entity as tax-exempt under Massachusetts law. It should be attached to the ST-5 to validate the exemption status.

- Form ST-3: This is a sales tax resale certificate. Sellers use it when buying goods for resale purposes, allowing them to make tax-free purchases as long as they resell the items.

- W-9 Form: This form is used to collect taxpayer identification information. A vendor may ask for a W-9 from the purchaser if the vendor needs to report income or payments made to the tax-exempt entity to the IRS.

- Agency Authorization Letter: This letter designates an individual or organization to act on behalf of the 501(c)(3) for purchasing purposes. It may be required alongside the ST-5 for clarity on agency representation.

- Purchase Order: A document created by the purchaser that outlines items ordered, quantities, and agreed prices. It provides a record of the transaction and helps ensure all parties agree on the details.

- Vendor Agreement: This is a contract between the vendor and the purchasing organization. It outlines terms and conditions, including any agreements regarding tax exemption and delivery of products/services.

Having these documents in order can streamline the purchasing process and safeguard all parties' interests. It's advisable to keep copies for records and ensure compliance at every transactional stage.

Similar forms

The ST-5 form, specifically the Sales Tax Exempt Purchaser Certificate used in Massachusetts, has several similarities with other documents that facilitate tax exemption or verify eligibility for exemptions. Below is a list of these documents and their respective similarities:

- Form ST-2 (Certificate of Exemption) - This form serves as preliminary proof that a government or 501(c)(3) organization qualifies for sales tax exemption under specific Massachusetts tax laws. Just like the ST-5, it must be presented at the time of purchase.

- Form W-9 (Request for Taxpayer Identification Number) - Both forms are used by organizations to certify their tax-exempt status and provide necessary information to vendors. The W-9 is often requested to ensure accurate tax reporting.

- Form 501(c)(3) Determination Letter - This letter confirms an organization’s tax-exempt status under IRS regulations. It shares the purpose of affirming eligibility to make tax-exempt purchases similar to the ST-5.

- Sales Tax Exemption Certificate (varies by state) - Many states issue their own versions of sales tax exemption certificates, similar to the ST-5, to allow qualifying organizations to purchase goods tax-free.

- Vendor's Affidavit or Declaration - Vendors may require a declaration from the purchaser confirming their exempt status. Like the ST-5, this provides necessary assurance about the purchase’s tax-exempt nature.

- Form 4473 (Firearms Transaction Record) - While not tax related, this form must be filled out to confirm eligibility for purchasing firearms. Like the ST-5, it emphasizes compliance with regulatory requirements during a transaction.

- Form N-108 (Application for Tax Exemptions) - This form is similar in purpose, allowing organizations to apply for tax-exempt status. It establishes the groundwork for obtaining a certificate like the ST-5 for exempt purchases.

- Form M-990 (Annual Financial Report for Exempt Organizations) - This document allows tax-exempt organizations to maintain their status by reporting income and expenditures. This transparency is similar to the requirement of maintaining documentation related to the ST-5 for compliance purposes.

Each of these documents serves a specific role in the process of establishing or verifying tax exemption status, ensuring compliance with applicable tax regulations.

Dos and Don'ts

When filling out the ST-5 form, it is essential to ensure that all information is accurate and complies with the requirements. Here are the key do's and don'ts to keep in mind:

- Do provide complete and accurate exempt taxpayer information in Part 1.

- Do attach Form ST-2 when applicable, especially if you are representing a 501(c)(3) organization.

- Do verify the expiration date of any previously issued Certificate of Exemption.

- Do ensure that the agent's information is correctly filled out in Part 2 if applicable.

- Don't submit an incomplete form; all sections should be addressed as required.

- Don't use an expired Certificate of Exemption when making a purchase.

- Don't forge signatures or falsify information; this could lead to serious legal consequences.

- Don't ignore the requirement to include a copy of Form ST-2 if you possess one.

Following these guidelines will help ensure that the ST-5 form is filled out correctly and that you remain in compliance with Massachusetts tax laws. It is crucial to act swiftly to address any uncertainties or errors in your submissions.

Misconceptions

Misconception 1: Only charities can use the ST-5 form.

This form is not limited to 501(c)(3) charities. Government organizations can also use it to make tax-exempt purchases. Both types of organizations need to adhere to specific guidelines.

Misconception 2: The ST-5 form does not require any supporting documents.

To use the ST-5, organizations must often provide Form ST-2 as proof of their tax-exempt status. Without this form, the ST-5 may not be honored.

Misconception 3: Anyone can fill out the ST-5 form.

The form must be completed by an authorized representative of the exempt organization or their designated agent. This is important for validating the tax-exempt status during purchases.

Misconception 4: Once the ST-5 is submitted, it does not expire.

The ST-5 is valid only for a certain period. Vendors need to verify the expiration date to ensure compliance with tax regulations.

Misconception 5: The ST-5 can be used for all types of purchases.

The ST-5 is intended for tangible personal property and specific services that relate to the organization's exempt activities. It cannot be used for personal purchases or unrelated services.

Misconception 6: The ST-5 form is optional for eligible organizations.

Organizations claiming tax-exempt status must utilize the ST-5 form to avoid paying sales tax. Not using this form could result in unnecessary tax liability.

Misconception 7: There are no penalties for misusing the ST-5 form.

Misuse of the certificate is taken seriously. Any fraudulent use can lead to severe penalties, including fines and possible imprisonment.

Misconception 8: Vendors are responsible for verifying exemption status.

While vendors must check the expiration date, the responsibility to provide proof of exemption primarily lies with the purchasing organization. Adequate documentation must be presented at the time of sale.

Key takeaways

Here are some essential takeaways about using and completing the ST-5 form for sales tax exemption in Massachusetts:

- Understand who needs to complete the form: The ST-5 form must be filled out by exempt government or 501(c)(3) organizations. Individuals acting on behalf of these organizations must also provide necessary information.

- Complete all relevant parts: Ensure that Part 1 is filled out by the exempt organization and Part 2 by the agent if applicable. Incomplete forms may lead to denial of sales tax exemption.

- Attach necessary documentation: A properly completed ST-5 form must include a copy of the organization’s Form ST-2, which is the Certificate of Exemption. Without this, the vendor may reject the exemption claim.

- Pay attention to expiration dates: Vendors should verify the ST-5 form’s validity by checking the expiration date. If the form is expired, the vendor must not honor it.

- Misuse has serious consequences: Any misuse of the ST-5 form can lead to severe penalties, including potential criminal charges and significant fines. Always use it responsibly.

- Consult if in doubt: If you have questions while filling out the ST-5 form, contact the Massachusetts Department of Revenue’s Customer Service Bureau for assistance.

Browse Other Templates

Lift Recliners Covered by Medicare - Indicate the patient’s height and weight for effective device fitting.

Advance Payment - This form embodies a formal process for requesting financial assistance, reinforcing the structured nature of military operations.