Fill Out Your Standard Disclosure Form

The Standard Disclosure form plays a crucial role in the interaction between individuals seeking medical treatment after a motor vehicle accident and the necessary insurance claims process. This form ensures that the insured person, or their guardian, confirms that the medical services listed were indeed rendered and clarifies their understanding of the treatment provided. It emphasizes the insured's responsibility to verify that the services were solicited without external pressure from third parties. Additionally, the form outlines the importance of transparency from the medical provider. It requires the healthcare professional to affirm that they did not influence the insured’s decision to claim Personal Injury Protection benefits and that the treatment has been adequately explained. The form also includes provisions that inform the insured of their rights regarding potential billing errors, stating that they may be entitled to a percentage of any reductions in the payment amounts made by their insurer. Lastly, it underscores the significance of accurate billing practices and compliance with insurance regulations to avoid fraudulent claims. Both the insured individual and the medical provider must securely sign this document to validate their agreement and understanding of these critical components.

Standard Disclosure Example

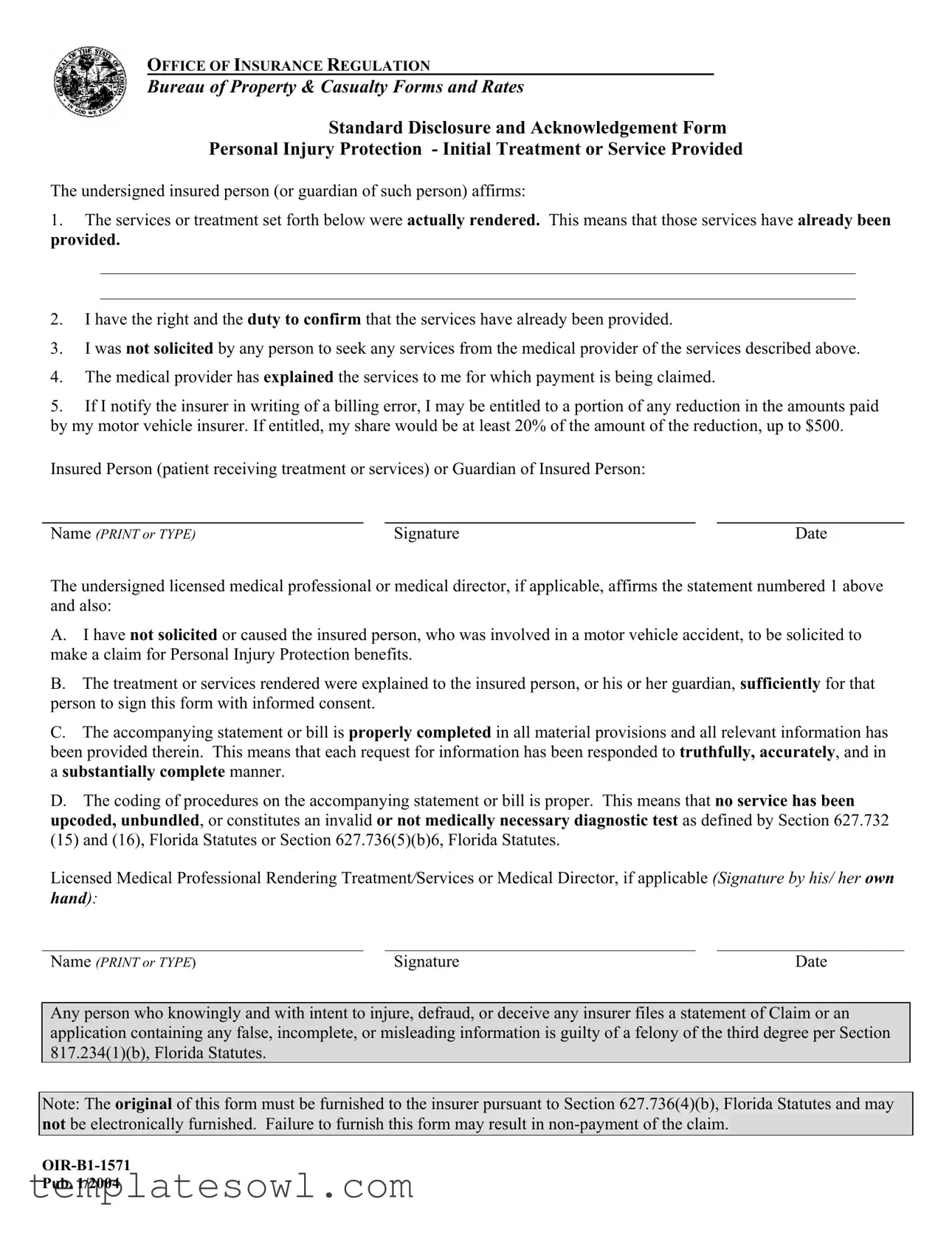

OFFICE OF INSURANCE REGULATION

Bureau of Property & Casualty Forms and Rates

Standard Disclosure and Acknowledgement Form

Personal Injury Protection - Initial Treatment or Service Provided

The undersigned insured person (or guardian of such person) affirms:

1.The services or treatment set forth below were actually rendered. This means that those services have already been provided.

2.I have the right and the duty to confirm that the services have already been provided.

3.I was not solicited by any person to seek any services from the medical provider of the services described above.

4.The medical provider has explained the services to me for which payment is being claimed.

5.If I notify the insurer in writing of a billing error, I may be entitled to a portion of any reduction in the amounts paid by my motor vehicle insurer. If entitled, my share would be at least 20% of the amount of the reduction, up to $500.

Insured Person (patient receiving treatment or services) or Guardian of Insured Person:

Name (PRINT or TYPE) |

Signature |

Date |

The undersigned licensed medical professional or medical director, if applicable, affirms the statement numbered 1 above and also:

A.I have not solicited or caused the insured person, who was involved in a motor vehicle accident, to be solicited to make a claim for Personal Injury Protection benefits.

B.The treatment or services rendered were explained to the insured person, or his or her guardian, sufficiently for that person to sign this form with informed consent.

C.The accompanying statement or bill is properly completed in all material provisions and all relevant information has been provided therein. This means that each request for information has been responded to truthfully, accurately, and in a substantially complete manner.

D.The coding of procedures on the accompanying statement or bill is proper. This means that no service has been

upcoded, unbundled, or constitutes an invalid or not medically necessary diagnostic test as defined by Section 627.732 (15) and (16), Florida Statutes or Section 627.736(5)(b)6, Florida Statutes.

Licensed Medical Professional Rendering Treatment/Services or Medical Director, if applicable (Signature by his/ her own hand):

Name (PRINT or TYPE) |

Signature |

Date |

Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of Claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree per Section 817.234(1)(b), Florida Statutes.

Note: The original of this form must be furnished to the insurer pursuant to Section 627.736(4)(b), Florida Statutes and may not be electronically furnished. Failure to furnish this form may result in

Pub. 1/2004

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Standard Disclosure form is used to affirm that medical services have been rendered after a motor vehicle accident. |

| Affirmation Requirement | The insured person or their guardian must confirm that the services listed in the form were actually provided. |

| Solicitation Statement | The insured person asserts they were not encouraged by anyone to seek services from the medical provider listed. |

| Explanation of Services | The medical provider must explain the services billed for so that the insured person can give informed consent. |

| Billing Error Rights | If a billing error is reported, the insured may receive 20% of any reduction in payment by the insurer, up to $500. |

| Professional Declaration | The licensed medical professional must affirm that treatment was not solicited and was adequately explained. |

| Legal Implications | Filing false information with the insurer can lead to felony charges under Florida Statutes, Section 817.234(1)(b). |

Guidelines on Utilizing Standard Disclosure

Once you have prepared to fill out the Standard Disclosure form, it’s crucial to approach each section with care and accuracy. Providing correct information ensures that your claim processes smoothly and helps avoid delays. Below are the steps to guide you through the completion of the form.

- Begin by locating the section intended for the insured person or their guardian. Enter the full name of the insured person—this is the patient receiving treatment or services. Ensure you print or type this clearly.

- Next, sign the document in the designated space to confirm acknowledgment. This signature acts as a verification of the information you are providing.

- Write down the date on which you are filling out this form, indicating when the acknowledgment is made.

- Move to the section for the licensed medical professional or medical director. The professional must affirm that the services rendered were not solicited and that the patient was informed adequately.

- Instruct the medical professional to print or type their full name in the appropriate field.

- Have the licensed medical professional also provide their signature in the designated space, confirming their part in the acknowledgment process.

- Record the date when the medical professional completes their section of the form, ensuring it matches the timeframe of the treatment or services provided.

- Make sure to deliver the original form to the insurer as mandated. Electronic transmission is not permitted for this form, so ensure it is sent as a physical document.

Completing this form accurately is essential for processing claims related to personal injury protection. Each step is designed to protect your rights and ensure compliance with regulations. Proceed with diligence, and stay informed about any follow-ups needed with your insurer.

What You Should Know About This Form

What is the Standard Disclosure form?

The Standard Disclosure form is a document required by the Office of Insurance Regulation that provides assurance that services related to Personal Injury Protection (PIP) have been delivered. It confirms that the insured person acknowledges the treatment received and agrees that the information provided is accurate.

Who needs to fill out this form?

The form must be completed by the insured person or their guardian, along with the licensed medical professional who provided the treatment. Both parties need to affirm that the treatment described has been rendered and is accurately reported.

What are the key affirmations in the form?

The form includes important affirmations, such as the confirmation that services were provided, the insured person's duty to verify this information, a statement regarding solicitation for services, and an explanation of the treatment by the medical provider.

What happens if I report a billing error?

If you notify the insurer in writing about a billing error, you may be entitled to a portion of any reduction in the amounts paid by your motor vehicle insurer. You could receive at least 20% of the reduction, up to a maximum of $500.

Is it necessary to submit the original form?

Yes, the original of this form must be provided to the insurer. Electronic submissions are not permitted. Failing to furnish the original form can result in non-payment of the claim.

What could happen if someone submits false or misleading information?

Providing false, incomplete, or misleading information on the claim or application can lead to severe consequences. Under Florida law, this is classified as a felony of the third degree.

Can the medical provider solicit me for PIP claims?

No, the medical provider must not solicit or encourage the insured person to file a claim for PIP benefits. This is a crucial assurance included in the form.

What information must the medical provider confirm?

The medical provider must confirm that the treatment was explained to the insured person, ensure the statement or bill is correctly filled out, and that the coding of procedures is appropriate and legitimate according to Florida statutes.

What must be included on the form when it is submitted?

The form should be completed in full, including the names, signatures, and dates from both the insured person (or guardian) and the medical professional. All required affirmations must be affirmed to ensure clarity and legal compliance.

How can I ensure my claim is paid on time?

To avoid delays, make sure to complete and submit the original Standard Disclosure form promptly. Ensure that all information is correct and complete to facilitate a smooth claims process.

Common mistakes

When individuals fill out the Standard Disclosure form, several common mistakes can occur. These errors may hinder the processing of claims and affect the legitimacy of the information provided. Understanding these pitfalls is crucial for ensuring compliance and safeguarding rights.

One significant mistake is failing to accurately affirm that the services listed have already been rendered. This affirmation must be truthful. If an individual does not fully comprehend this requirement and inaccurately marks that services have been provided, it could jeopardize their claim.

Another error involves neglecting the duty to confirm that those services were provided. Each signatory has a responsibility to ensure that they are not submitting claims for unrendered services. Overlooking this duty could lead to serious legal ramifications.

Some individuals mistakenly believe they can be solicited to receive services from a medical provider. Misunderstanding this stipulation can lead to improperly claiming benefits. The form clearly states that the individual should not have been solicited, and ensuring compliance with this rule is essential.

A further common mistake relates to the comprehension of the services being claimed for payment. If the medical provider fails to sufficiently explain these services, it can lead to misunderstandings and disputes. Each insured person must be adequately informed to provide informed consent.

Also, individuals may overlook their right to submit a written notification regarding billing errors. This right is important, as it allows a person to claim a portion of any reduction made by their insurer. Failing to exercise this right can result in losing out on potential benefits.

The signature and identification section is often filled out carelessly. Some individuals may forget to print or type their name clearly, which can lead to confusion or denial of the claim. Clear identification is paramount for the smooth processing of insurance documents.

Medical professionals also share responsibility in avoiding errors. If a medical professional has not explained the services adequately, they cannot expect the insured person to provide informed consent. Ensuring clear communication is vital to uphold the integrity of the claim process.

Inaccurately completing the accompanying statement or bill is another frequent oversight. Each response must be truthful and complete; any omitted information could create delays in the claims process. Ensuring that all necessary information is included is essential for a successful claim submission.

Finally, incorrect coding of procedures on the billing statement can lead to serious complications. Each procedure must be coded properly, avoiding upcoding or improper billing practices. Awareness of these requirements helps prevent fraudulent issues that could impact both the patient and provider.

Documents used along the form

When dealing with Personal Injury Protection (PIP) claims, several key documents work in conjunction with the Standard Disclosure form. Understanding these documents can streamline the claims process and ensure all necessary information is provided. Here’s a concise overview of four important forms that you might encounter.

- Claim Form: This document initiates the claims process with your insurance company. It typically requires detailed information about the accident, the injured parties, and the medical treatments received. The claim form must be filled out accurately to prevent delays in processing.

- Medical Report: A detailed medical report from the treating physician or medical provider is essential. This report outlines the nature of the injuries, the treatments administered, and the prognosis. It helps substantiate the claim and confirms that medical services were necessary due to the accident.

- Itemized Bill: An itemized bill from the healthcare provider lists all services rendered, along with their costs. This document breaks down each charge, helping the insurance company assess the validity of the claim and how much they are liable to pay.

- Authorization for Release of Information: This form grants permission for medical providers to share your medical information with the insurance company. Without this authorization, the insurer may not have access to necessary records to process the claim, potentially leading to delays.

In summary, having a solid grasp of these forms enhances your readiness for filing a Personal Injury Protection claim. Each document plays a crucial role in validating claims and ensuring that you receive the benefits entitled to you. Proper preparation can save time and reduce confusion during the claims process.

Similar forms

- Patient Consent Form: Like the Standard Disclosure form, the Patient Consent Form documents a patient’s agreement to receive medical treatment. It emphasizes the importance of informed consent, assuring that the patient understands the details of the procedure and its risks, similar to how the disclosure form ensures services have been adequately explained.

- Proof of Treatment Form: This document serves to confirm that specific treatment has been provided. Much like the Standard Disclosure form, it includes sections for details of the services rendered and requires signatures from both the provider and the patient, reinforcing accountability for the treatment provided.

- Billing Statement: A billing statement outlines the charges for medical services provided. Similar to the Standard Disclosure form, it must be accurate and complete. Both documents play vital roles in the claims process, ensuring that the insurer receives the correct information to process a claim efficiently.

- Insurance Claim Form: This form initiates the process of claiming benefits from the insurance company. The Standard Disclosure form complements it by providing verification of services. Both documents require accurate information to prevent issues during claims processing, emphasizing transparency and clarity in communication.

Dos and Don'ts

Do's and Don'ts for Filling Out the Standard Disclosure Form

- Do: Ensure that all information is accurate and complete. This includes both personal details and specifics regarding the services received.

- Do: Confirm that the services described have already been rendered before signing the form.

- Do: Communicate any billing errors to the insurer in writing to potentially receive your share of any reduction in payments.

- Do: Provide a clear signature and date at the bottom of the form, ensuring that it is the original copy given to the insurer.

- Don't: Avoid signing the form if any of the services have not been provided.

- Don't: Do not allow any solicitation for services by the medical provider prior to filling out the form.

- Don't: Refrain from submitting the form electronically, as it must be the original document.

- Don't: Never provide misleading or incomplete information, as this can lead to serious legal consequences.

Misconceptions

- Misconception 1: The Standard Disclosure form is optional.

- Misconception 2: Anyone can fill out the Standard Disclosure form.

- Misconception 3: The form can be submitted electronically.

- Misconception 4: This form is just a formality with no real consequences.

- Misconception 5: All treatments and services can be claimed regardless of necessity.

- Misconception 6: You do not need to confirm the services provided.

- Misconception 7: Billing errors can’t affect your claim.

- Misconception 8: The medical provider can solicit patients to make claims.

- Misconception 9: The form doesn’t require a detailed explanation of services provided.

- Misconception 10: All information in the form is optional.

This form is required by law. Failing to submit it can lead to non-payment of your claim.

Only the insured person or their guardian, along with a licensed medical professional, may complete this form.

The original form must be physically furnished to the insurer. Electronic submissions are not permitted.

Inaccuracies or omissions can lead to serious repercussions, including criminal charges for fraud.

Only medically necessary treatments, as defined by law, can be claimed using this form.

The insured person has both the right and responsibility to verify that the services were actually rendered.

If you notify your insurer about a billing error in writing, you may be entitled to a portion of the reduced amount claimed.

Medical providers must not solicit patients to file claims for Personal Injury Protection benefits.

The medical provider must explain the services rendered, ensuring informed consent has been obtained.

All relevant information must be filled out accurately and completely for the claim to be valid.

Key takeaways

Here are some important points to remember about filling out and using the Standard Disclosure form:

- Confirmation of Services: The person filling out the form must affirm that the treatment or services listed have already been provided.

- Obligation to Verify: It is the responsibility of the insured person or their guardian to ensure that the services have indeed been rendered.

- No Solicitation: The form requires confirmation that the insured person was not urged by anyone to seek these medical services.

- Clear Explanation: The medical provider needs to adequately explain the services for which payment is being claimed to the insured person or guardian.

- Error Notification: If a billing mistake is reported in writing to the insurer, the insured may gain a percentage of any reduction in payment.

- Accurate Documentation: The medical provider must ensure that all accompanying documents are complete and truthful, following the appropriate coding standards.

Filling out this form correctly is essential to support a smooth claim process for Personal Injury Protection benefits.

Browse Other Templates

Vehicle Maintenance Record Template - This form is a useful tool for any vehicle owner.

Estate Tax Clearance Application,Vermont Tax Clearance Form,Decedent Tax Information Form,Vermont Estate Tax Documentation,Application for Estate Tax Clearance,Vermont Fiduciary Tax Form,Final Estate Tax Submission Form,Vermont Estate Tax Return Requ - A daytime telephone number must be provided for any follow-up communication.