Fill Out Your Standard 1188 Form

The Standard Form 1188 is an essential document for federal employees wishing to discontinue the automatic deduction of labor organization dues from their paychecks. Designed by the Office of Personnel Management and revised in April 2011, this form allows employees to communicate their intention to stop the deductions to both their agency and the labor organization involved. While completing the form is voluntary, clarity and accuracy are crucial, as incomplete submissions may not be processed. The form collects basic information, including the employee’s name, identification number, agency details, and the specific labor organization from which dues are being canceled. Furthermore, it requires a signature and date to validate the request. The cancellation generally takes effect in the first full pay period after the form is processed. Also noteworthy is the Privacy Act Statement included with the form, which governs the use of personal information and provides details regarding potential disclosures to various agencies. Understanding the Standard Form 1188 is vital for employees seeking to manage their dues effectively and maintain clear communication with their employer and labor representatives.

Standard 1188 Example

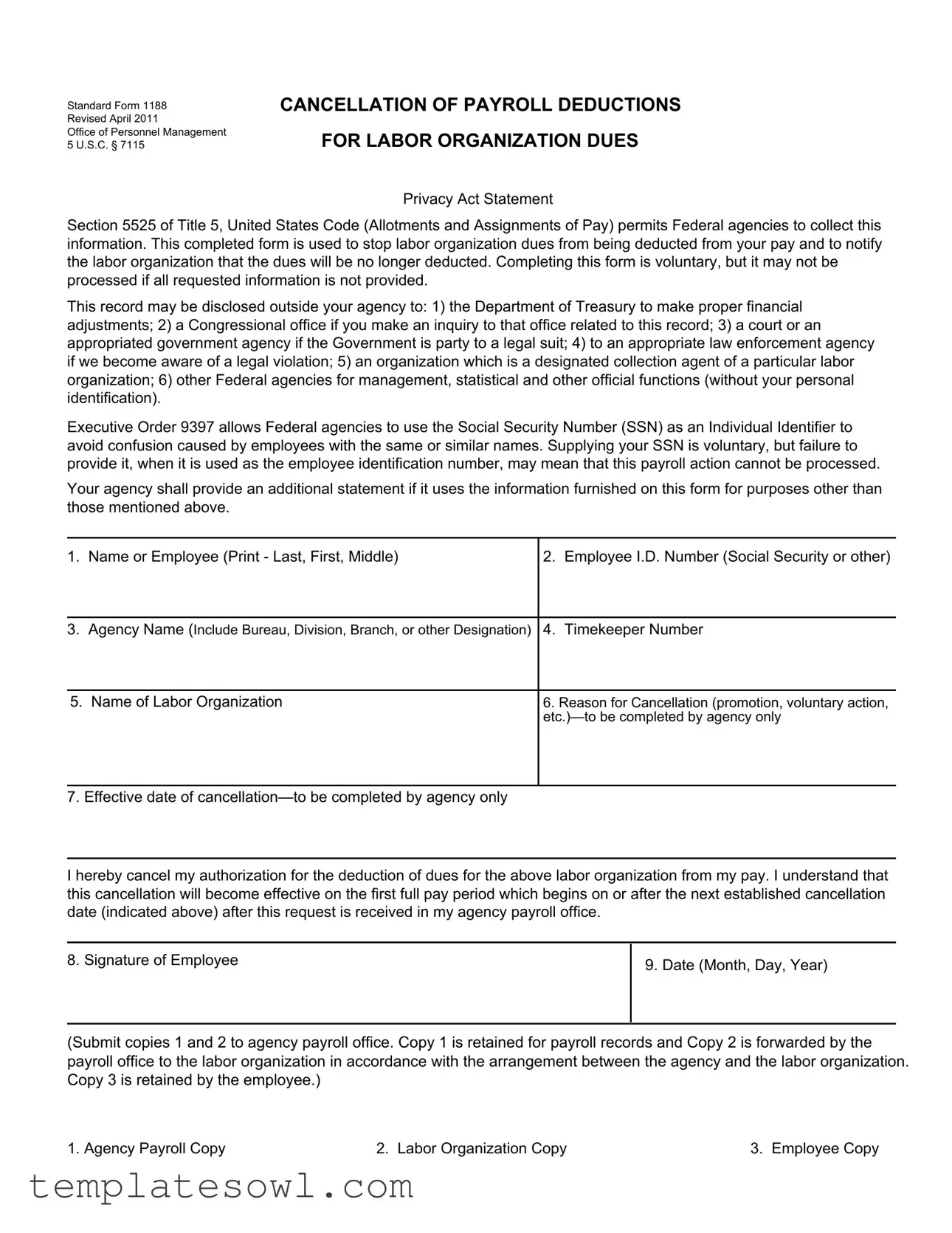

Standard Form 1188

Revised April 2011

Office of Personnel Management

5 U.S.C. § 7115

CANCELLATION OF PAYROLL DEDUCTIONS

FOR LABOR ORGANIZATION DUES

Privacy Act Statement

Section 5525 of Title 5, United States Code (Allotments and Assignments of Pay) permits Federal agencies to collect this information. This completed form is used to stop labor organization dues from being deducted from your pay and to notify the labor organization that the dues will be no longer deducted. Completing this form is voluntary, but it may not be processed if all requested information is not provided.

This record may be disclosed outside your agency to: 1) the Department of Treasury to make proper financial adjustments; 2) a Congressional office if you make an inquiry to that office related to this record; 3) a court or an appropriated government agency if the Government is party to a legal suit; 4) to an appropriate law enforcement agency if we become aware of a legal violation; 5) an organization which is a designated collection agent of a particular labor organization; 6) other Federal agencies for management, statistical and other official functions (without your personal identification).

Executive Order 9397 allows Federal agencies to use the Social Security Number (SSN) as an Individual Identifier to avoid confusion caused by employees with the same or similar names. Supplying your SSN is voluntary, but failure to provide it, when it is used as the employee identification number, may mean that this payroll action cannot be processed.

Your agency shall provide an additional statement if it uses the information furnished on this form for purposes other than those mentioned above.

1. |

Name or Employee (Print - Last, First, Middle) |

2. |

Employee I.D. Number (Social Security or other) |

|

|

|

|

3. |

Agency Name (Include Bureau, Division, Branch, or other Designation) |

4. |

Timekeeper Number |

|

|

|

|

5. |

Name of Labor Organization |

6. Reason for Cancellation (promotion, voluntary action, |

|

|

|

||

|

|

|

|

7. Effective date of

I hereby cancel my authorization for the deduction of dues for the above labor organization from my pay. I understand that this cancellation will become effective on the first full pay period which begins on or after the next established cancellation date (indicated above) after this request is received in my agency payroll office.

8. Signature of Employee

9.Date (Month, Day, Year)

(Submit copies 1 and 2 to agency payroll office. Copy 1 is retained for payroll records and Copy 2 is forwarded by the payroll office to the labor organization in accordance with the arrangement between the agency and the labor organization. Copy 3 is retained by the employee.)

1. Agency Payroll Copy |

2. Labor Organization Copy |

3. Employee Copy |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | The Standard Form 1188 is used by federal employees to cancel payroll deductions for labor organization dues. It serves as a notification to both the employee's agency and the labor organization that dues will no longer be deducted from the employee's pay. |

| Governing Law | The form is governed by the regulations outlined in 5 U.S.C. § 7115, which pertains to federal employee relations. Additionally, the Privacy Act Statement refers to Section 5525 of Title 5, ensuring the confidentiality of collected information. |

| Voluntary Submission | Completing the Standard Form 1188 is voluntary. However, if the requested information is incomplete, the agency may not process the cancellation request. |

| Disclosure of Information | The information provided on the form may be disclosed to various entities, including the Department of Treasury for financial adjustments and law enforcement agencies if legal violations are detected. |

Guidelines on Utilizing Standard 1188

After gathering the necessary information, you can begin filling out the Standard Form 1188. This form is used to stop deductions for labor organization dues from your paycheck. Make sure you follow the steps carefully to ensure accurate processing.

- Print your name in the designated area (Last, First, Middle).

- Enter your Employee I.D. Number, which can be your Social Security Number or another identifier.

- Provide your Agency Name, including any relevant bureau, division, branch, or other designation.

- Write in your Timekeeper Number if applicable.

- Input the Name of Labor Organization from which you wish to cancel dues.

- Leave the Reason for Cancellation blank; this will be completed by your agency.

- Leave the Effective date of cancellation blank; this will also be completed by your agency.

- Sign the form in the section labeled Signature of Employee.

- Include the Date of your signature (Month, Day, Year).

Once you have completed the form, make sure to submit copies 1 and 2 to your agency payroll office; retain copy 3 for your records. Copy 1 will stay with the payroll department, while Copy 2 will be sent to the labor organization according to your agency's arrangement with them.

What You Should Know About This Form

What is the Standard 1188 form?

The Standard 1188 form is a document used by federal employees to cancel the deductions of labor organization dues from their paychecks. It serves as a formal request to stop these deductions and informs the relevant labor organization accordingly. This process ensures that the employee's wishes are documented and acted upon appropriately.

Who needs to complete the Standard 1188 form?

Any federal employee who wishes to stop their payroll deductions for labor organization dues should complete the Standard 1188 form. This may be required for various reasons, such as a change in employment status, personal choice, or other specific circumstances. It is important for all relevant information to be accurately provided to facilitate processing.

What information is required on the Standard 1188 form?

The form requires several pieces of information including the employee's name, employee identification number, agency name, timekeeper number, and name of the labor organization. Additionally, the form includes sections for stating the reason for the cancellation and the effective date. This information is crucial for processing the cancellation correctly.

What happens if I do not provide my Social Security Number?

Providing your Social Security Number (SSN) is voluntary. However, if the SSN is used as the employee's identification number and is not provided, it may delay or prevent the processing of the cancellation. Using the SSN helps avoid confusion among employees who may have similar names, ensuring that the correct individual's request is handled.

How will the information on the Standard 1188 form be used?

The information provided on the Standard 1188 form will primarily be used to process the cancellation of payroll deductions for labor organization dues. In addition, it may be disclosed to other governmental entities for various legal and administrative purposes as outlined in the Privacy Act Statement included with the form.

When does the cancellation of dues become effective?

The cancellation will become effective on the first full pay period that begins on or after the established cancellation date, as indicated on the form. This timeline ensures that there is a clear understanding of when the changes will take effect, allowing for proper financial planning.

Are there copies of the Standard 1188 form that I need to keep?

Yes, the Standard 1188 form has three copies that need to be distributed appropriately. Copy 1 is retained by the agency's payroll office, Copy 2 is sent to the labor organization, and Copy 3 remains with the employee for their personal records. Keeping a copy ensures that you have documentation of your request for your own peace of mind.

What should I do if I need assistance with the Standard 1188 form?

If you require assistance with completing the Standard 1188 form, you should reach out to your agency's human resources or payroll department. They can provide guidance and information regarding the cancellation process and ensure that you fill out the form correctly.

Is completing the Standard 1188 form mandatory?

Completing the Standard 1188 form is voluntary; however, it is recommended for anyone wishing to cancel payroll deductions for labor organization dues. Properly submitting the form is the best way to ensure that your request is processed in accordance with your wishes.

What will happen after I submit the Standard 1188 form?

Once the Standard 1188 form is submitted to your agency's payroll office, they will process your request. You should receive confirmation of the cancellation in due course. The labor organization will also be notified of the cancellation, and ongoing dues deductions will cease according to the effective date stated in your submission.

Common mistakes

Filling out the Standard Form 1188 can be straightforward, yet several common mistakes can hinder the process. One prevalent error is **not providing all required information**. Each section of the form is important—omitting details like the employee ID number or the agency's name may result in processing delays or outright rejection of the request. Every piece of information helps your agency manage the cancellation of dues effectively.

Another frequent oversight is failing to sign and date the form. This might seem minor, but without your signature and the correct date, your request cannot be validated. Employees often forget this step, leading to unnecessary back-and-forth communication. Ensure these critical details are included before submitting the form.

Some individuals mistakenly leave the reason for cancellation blank. While this section is designated for agency use, entering a brief note can facilitate smoother processing. Agencies appreciate clarity, and this small gesture can make a significant difference in how swiftly your request is handled.

Additionally, confusion often arises regarding the effective date of cancellation. Many people assume they can choose any date, but it's essential to understand that this date must align with the agency’s established cancellation periods. If you’re unsure, consult with your HR department for clarification before you submit the form.

Lastly, employees sometimes neglect to submit the appropriate copies of the form. Remember that you are responsible for ensuring that copies are sent to the correct entities: copy one goes to the payroll office, copy two is forwarded to the labor organization, and copy three should be kept for your records. This oversight can lead to complications down the line, so carefully check that all submissions are in order.

Documents used along the form

The Standard Form 1188 is typically used to cancel payroll deductions for labor organization dues. When submitting this form, individuals might encounter other documents or forms that are relevant to the process. Here is a list of related forms and documents that may also be needed.

- Standard Form 1187: This form is used to authorize payroll deductions for labor organization dues. It provides necessary details about the employee, the labor organization, and the amount to be deducted from the pay.

- Standard Form 2813: This document, also known as the "Notice of Change in Payroll Deduction," serves to notify payroll offices of any changes related to the deductions, including updates in the labor organization the employee is associated with.

- Employee Authorization for Direct Deposit: This form allows employees to authorize direct deposit of their salary and benefits into their bank accounts, which is often related to the management of dues deductions.

- Request for Payroll Deduction Changes: Employees may use this form to request changes to their payroll deductions, including adding or switching labor organization dues.

- Employee Employment Verification Form: This document may be necessary to confirm employment status with the agency, especially if the employee’s eligibility to belong to a labor organization is in question.

- Membership Application for Labor Organization: If an employee is joining a new labor organization, this form may need to be submitted to become a member before dues can be deducted.

- Termination of Membership Form: If a member decides to leave a labor organization, this document formally ends their membership and may also need to be submitted along with the Standard Form 1188.

Understanding these documents can help streamline the process of managing payroll deductions for labor organization dues. Each form serves a specific purpose and can impact the processing of requests regarding membership and deductions.

Similar forms

- Standard Form 1199A: This form is used for direct deposit enrollment. Like Standard Form 1188, it requires personal information and provides a declaration concerning payroll deductions. Both forms facilitate communication with financial institutions and impact payroll operations.

- Form W-4: This form determines withholding for federal income tax. Similar to Standard Form 1188, it requires employee information and ensures adjustments are made according to the employee’s choices regarding deductions from their pay.

- Form DD-214: Used by military members upon discharge. While it serves a different purpose, it provides a record of service and can impact future benefits, similar to how Standard Form 1188 affects deductions and labor organization membership.

- Form I-9: This form verifies employment eligibility. Both forms require accurate employee information and data processing by federal agencies, impacting the employee's financial and legal status.

- Form SF-50: This notification of personnel action records changes in employee status. Similar to Standard Form 1188, it documents information affecting the employee's pay and employment conditions, requiring agency coordination.

- Form 1040: The individual income tax return is another critical document. Both forms relate to financial records, require personal details, and affect the employee’s financial obligations and rights.

- Standard Form 2809: This form is for health benefits enrollment. Similar to Standard Form 1188, it involves employee choices regarding payroll deductions and requires submission to the appropriate agency for processing.

- Standard Form 1152: This form is used for allotments for life insurance and other benefits. Like Standard Form 1188, it requires employee information and manages payroll finance operations concerning voluntary deductions.

Dos and Don'ts

When filling out the Standard Form 1188, keeping some best practices in mind will help ensure a smooth process. Here’s a guide on what to do and what to avoid.

- Do fill out all required fields completely. Missing information can delay processing.

- Do include your name as it appears in your official records. Accuracy matters.

- Don’t forget to sign and date the form. Your signature confirms your request.

- Don’t use abbreviations or nicknames for your agency or labor organization. Use full names for clarity.

Misconceptions

Here are some common misconceptions regarding the Standard Form 1188, which is used for the cancellation of payroll deductions for labor organization dues.

- It is mandatory to complete the form. Many believe that submitting the Standard Form 1188 is required. In reality, completing the form is voluntary, though failure to provide necessary information may delay processing.

- Your Social Security Number (SSN) must be provided. Some think that providing their SSN is mandatory. While it is used for identification, supplying an SSN is voluntary. However, not providing it may affect the processing of the cancellation.

- The form can be processed without any reason stated. It is assumed by some that they can skip stating a reason for cancellation. However, the agency needs this information to process the cancellation appropriately.

- Cancellations take effect immediately. Many people believe that once they submit the form, the cancellation occurs right away. In fact, the cancellation becomes effective on the first full pay period after the request is processed.

- All personal information is kept confidential. Some might think that any information shared on this form is completely private. While it is generally protected, certain information may be shared with specific entities for administrative purposes.

- You need to send the form directly to the labor organization. It is a common misconception that employees must submit a copy of the form to the labor organization. Instead, the payroll office is responsible for forwarding that copy as per the established arrangement.

Key takeaways

Here are key takeaways about filling out and using the Standard Form 1188:

- Understand the purpose: This form is used to cancel payroll deductions for labor organization dues.

- Voluntary completion: While filling out the form is voluntary, incomplete submissions may delay processing.

- Information to provide: Include your name, employee ID, agency name, timekeeper number, and the name of the labor organization.

- Cancellation reasons: The reason for cancellation will be filled out by your agency.

- Effective date: The effective date of cancellation is also determined by your agency.

- SSN note: Providing your Social Security Number (SSN) is voluntary, but not supplying it may complicate processing.

- Submission copies: Submit two copies to your agency payroll office: one for records, the other for the labor organization.

- Know your rights: The information on this form may be disclosed under specific circumstances, so be aware of how your data can be used.

Following these steps helps ensure a smooth cancellation process for your labor organization dues.

Browse Other Templates

Termite Inspection Arizona - It is recommended that follow-up inspections occur within 30 days of the initial report.

Us Entry Stamp - Each passenger should familiarize themselves with the form beforehand.