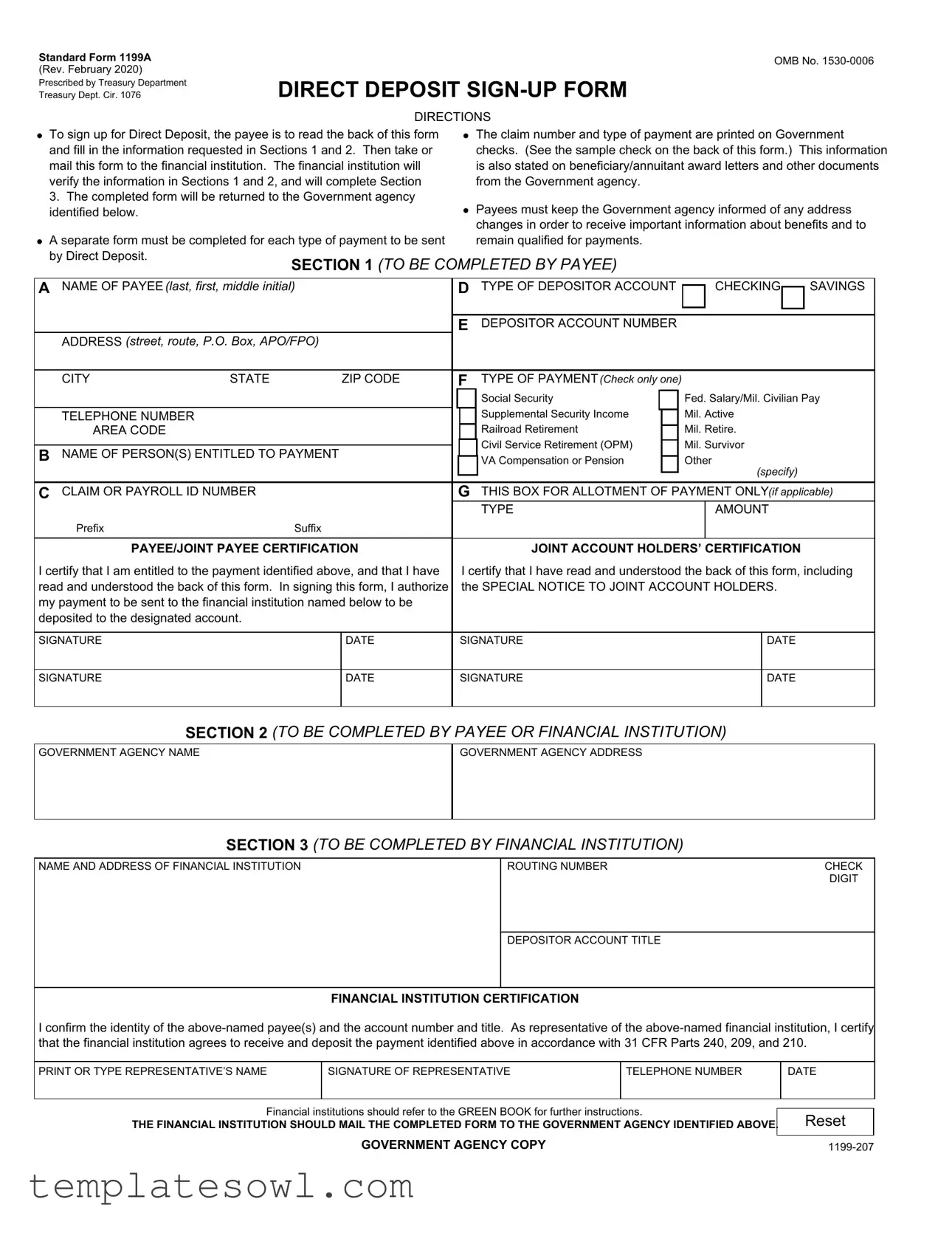

Fill Out Your Standard 1199A Direct Deposit Form

The Standard Form 1199A, often referred to simply as the Direct Deposit Sign-Up Form, plays a crucial role in facilitating the direct deposit of federal payments into the accounts of eligible payees. Designed by the U.S. Department of the Treasury, this form outlines a straightforward process for individuals to establish or change direct deposit arrangements with their financial institutions. It consists of multiple sections, which are divided between information to be completed by the payee and the bank or credit union. The payee must provide personal details such as their name, address, and account information, as well as specify the type of payment they are eligible to receive, whether Social Security benefits, military pay, or other government-issued funds. An important aspect of the process is the requirement for the financial institution to verify this information and confirm its accuracy before processing the form. Additionally, each direct deposit payment type necessitates a separate application, ensuring clarity in payment allocation. To maintain continued eligibility for receiving payments, it’s essential for individuals to inform the government agency of any changes to their address. The form also incorporates specific provisions for joint account holders, emphasizing the necessity of communication regarding any changes in eligibility or account status. Overall, understanding how to properly complete and submit the Standard 1199A form is vital for ensuring timely and accurate receipt of federal payments.

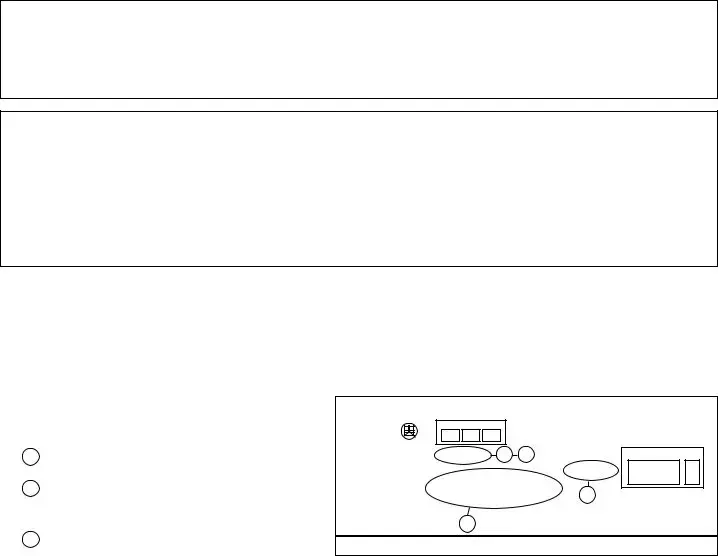

Standard 1199A Direct Deposit Example

Standard Form 1199A |

OMB No. |

(Rev. February 2020) |

|

Treasury Dept. Cir. 1076 |

DIRECT DEPOSIT |

Prescribed by Treasury Department |

|

|

DIRECTIONS |

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

3.The completed form will be returned to the Government agency identified below.

A separate form must be completed for each type of payment to be sent by Direct Deposit.

A separate form must be completed for each type of payment to be sent by Direct Deposit.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

A NAME OF PAYEE (last, first, middle initial) |

|

D TYPE OF DEPOSITOR ACCOUNT |

|

CHECKING |

|

SAVINGS |

|||||||

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

DEPOSITOR ACCOUNT NUMBER |

|

|

|

|

|

||

ADDRESS (street, route, P.O. Box, APO/FPO) |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

STATE |

|

ZIP CODE |

|

F |

TYPE OF PAYMENT (Check only one) |

|

|

|

|

|

||

|

|

|

|

|

|

Social Security |

|

|

Fed. Salary/Mil. Civilian Pay |

||||

TELEPHONE NUMBER |

|

|

|

|

|

Supplemental Security Income |

|

|

Mil. Active |

|

|||

AREA CODE |

|

|

|

|

|

Railroad Retirement |

|

|

Mil. Retire. |

|

|||

|

|

|

|

|

|

Civil Service Retirement (OPM) |

|

|

Mil. Survivor |

|

|||

B NAME OF PERSON(S) ENTITLED TO PAYMENT |

|

|

|

||||||||||

|

|

VA Compensation or Pension |

|

|

Other |

|

|||||||

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

(specify) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C CLAIM OR PAYROLL ID NUMBER |

|

|

|

G THIS BOX FOR ALLOTMENT OF PAYMENT ONLY(if applicable) |

|||||||||

|

|

|

|

|

|

TYPE |

|

AMOUNT |

|

||||

Prefix |

|

Suffix |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

PAYEE/JOINT PAYEE CERTIFICATION |

|

|

JOINT ACCOUNT HOLDERS’ CERTIFICATION |

|

|||||||||

I certify that I am entitled to the payment identified above, and that I have |

|

I certify that I have read and understood the back of this form, including |

|||||||||||

read and understood the back of this form. In signing this form, I authorize |

|

the SPECIAL NOTICE TO JOINT ACCOUNT HOLDERS. |

|

||||||||||

my payment to be sent to the financial institution named below to be |

|

|

|

|

|

|

|

|

|

|

|||

deposited to the designated account. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

DATE |

|

SIGNATURE |

|

|

DATE |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

DATE |

|

SIGNATURE |

|

|

DATE |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 2 (TO BE COMPLETED BY PAYEE OR FINANCIAL INSTITUTION)

GOVERNMENT AGENCY NAME

GOVERNMENT AGENCY ADDRESS

SECTION 3 (TO BE COMPLETED BY FINANCIAL INSTITUTION)

NAME AND ADDRESS OF FINANCIAL INSTITUTION |

ROUTING NUMBER |

CHECK |

|

|

DIGIT |

|

|

|

|

DEPOSITOR ACCOUNT TITLE |

|

|

|

|

FINANCIAL INSTITUTION CERTIFICATION

I confirm the identity of the

PRINT OR TYPE REPRESENTATIVE’S NAME |

SIGNATURE OF REPRESENTATIVE |

TELEPHONE NUMBER |

DATE |

|

|

|

|

|

|

Financial institutions should refer to the GREEN BOOK for further instructions. |

|

|

||

|

Reset |

|||

THE FINANCIAL INSTITUTION SHOULD MAIL THE COMPLETED FORM TO THE GOVERNMENT AGENCY IDENTIFIED ABOVE. |

|

|||

|

GOVERNMENT AGENCY COPY |

|

|

|

|

|

|

||

Standard Form 1199A |

OMB No. |

(Rev. February 2020) |

|

Treasury Dept. Cir. 1076 |

DIRECT DEPOSIT |

Prescribed by Treasury Department |

|

|

DIRECTIONS |

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

3.The completed form will be returned to the Government agency identified below.

A separate form must be completed for each type of payment to be sent by Direct Deposit.

A separate form must be completed for each type of payment to be sent by Direct Deposit.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

A NAME OF PAYEE (last, first, middle initial) |

D TYPE OF DEPOSITOR ACCOUNT |

|

CHECKING |

|

SAVINGS |

|||||||||

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

DEPOSITOR ACCOUNT NUMBER |

|

|

|

|

|

||||

ADDRESS (street, route, P.O. Box, APO/FPO) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

STATE |

|

ZIP CODE |

|

F |

TYPE OF PAYMENT (Check only |

one) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security |

|

|

|

Fed. Salary/Mil. Civilian Pay |

||||

TELEPHONE NUMBER |

|

|

|

|

|

Supplemental Security Income |

|

|

|

Mil. Active |

|

|||

AREA CODE |

|

|

|

|

|

Railroad Retirement |

|

|

|

Mil. Retire. |

|

|||

B NAME OF PERSON(S) ENTITLED TO PAYMENT |

|

|

Civil Service Retirement (OPM) |

|

|

Mil. Survivor |

|

|||||||

|

|

VA Compensation or Pension |

|

|

Other |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

(specify) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C CLAIM OR PAYROLL ID NUMBER |

|

|

G THIS BOX FOR ALLOTMENT OF PAYMENT ONLY(if applicable) |

|||||||||||

|

|

|

|

|

|

TYPE |

|

AMOUNT |

|

|||||

Prefix |

|

Suffix |

|

|

|

|

|

|

|

|

|

|

|

|

PAYEE/JOINT PAYEE CERTIFICATION |

|

|

JOINT ACCOUNT HOLDERS’ CERTIFICATION |

|

||||||||||

I certify that I am entitled to the payment identified above, and that I have |

|

I certify that I have read and understood the back of this form, including |

||||||||||||

read and understood the back of this form. In signing this form, I authorize |

|

the SPECIAL NOTICE TO JOINT ACCOUNT HOLDERS. |

|

|||||||||||

my payment to be sent to the financial institution named below to be |

|

|

|

|

|

|

|

|

|

|

|

|||

deposited to the designated account. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

DATE |

|

SIGNATURE |

|

|

DATE |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

DATE |

|

SIGNATURE |

|

|

DATE |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 2 (TO BE COMPLETED BY PAYEE OR FINANCIAL INSTITUTION)

GOVERNMENT AGENCY NAME

GOVERNMENT AGENCY ADDRESS

SECTION 3 (TO BE COMPLETED BY FINANCIAL INSTITUTION)

NAME AND ADDRESS OF FINANCIAL INSTITUTION |

ROUTING NUMBER |

CHECK |

|

|

DIGIT |

|

|

|

|

DEPOSITOR ACCOUNT TITLE |

|

|

|

|

FINANCIAL INSTITUTION CERTIFICATION

I confirm the identity of the

PRINT OR TYPE REPRESENTATIVE’S NAME |

SIGNATURE OF REPRESENTATIVE |

TELEPHONE NUMBER |

DATE |

|

|

|

|

|

|

Financial institutions should refer to the GREEN BOOK for further instructions. |

|

|

||

|

Reset |

|||

THE FINANCIAL INSTITUTION SHOULD MAIL THE COMPLETED FORM TO THE GOVERNMENT AGENCY IDENTIFIED ABOVE. |

|

|||

|

FINANCIAL INSTITUTION COPY |

|

|

|

Standard Form 1199A |

OMB No. |

(Rev. February 2020) |

|

Treasury Dept. Cir. 1076 |

DIRECT DEPOSIT |

Prescribed by Treasury Department |

|

|

DIRECTIONS |

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

3.The completed form will be returned to the Government agency identified below.

A separate form must be completed for each type of payment to be sent by Direct Deposit.

A separate form must be completed for each type of payment to be sent by Direct Deposit.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

A NAME OF PAYEE (last, first, middle initial) |

D TYPE OF DEPOSITOR ACCOUNT |

|

|

CHECKING |

|

SAVINGS |

|||||||||

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

DEPOSITOR ACCOUNT NUMBER |

|

|

|

|

|

|

||||

ADDRESS (street, route, P.O. Box, APO/FPO) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

STATE |

|

ZIP CODE |

|

F |

TYPE OF PAYMENT (Check only |

one) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security |

|

|

Fed. Salary/Mil. Civilian Pay |

|||||

|

|

|

|

|

|

|

Supplemental Security Income |

|

|

Mil. Active |

|

||||

TELEPHONE NUMBER |

|

|

|

|

|

|

|

||||||||

AREA CODE |

|

|

|

|

|

|

Railroad Retirement |

|

|

Mil. Retire. |

|

||||

|

|

|

|

|

|

|

Civil Service Retirement (OPM) |

|

|

Mil. Survivor |

|

||||

B NAME OF PERSON(S) ENTITLED TO PAYMENT |

|

|

|

|

|||||||||||

|

|

|

VA Compensation or Pension |

|

|

Other |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

(specify) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C CLAIM OR PAYROLL ID NUMBER |

|

|

G THIS BOX FOR ALLOTMENT OF PAYMENT ONLY(if applicable) |

||||||||||||

|

|

|

|

|

|

|

TYPE |

|

|

AMOUNT |

|

||||

Prefix |

|

Suffix |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

PAYEE/JOINT PAYEE CERTIFICATION |

|

|

|

JOINT ACCOUNT HOLDERS’ CERTIFICATION |

|

||||||||||

I certify that I am entitled to the payment identified above, and that I have |

|

I certify that I have read and understood the back of this form, including |

|||||||||||||

read and understood the back of this form. In signing this form, I authorize |

|

the SPECIAL NOTICE TO JOINT ACCOUNT HOLDERS. |

|

||||||||||||

my payment to be sent to the financial institution named below to be |

|

|

|

|

|

|

|

|

|

|

|

|

|||

deposited to the designated account. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

DATE |

|

SIGNATURE |

|

|

|

DATE |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

DATE |

|

SIGNATURE |

|

|

|

DATE |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 2 (TO BE COMPLETED BY PAYEE OR FINANCIAL INSTITUTION)

GOVERNMENT AGENCY NAME

GOVERNMENT AGENCY ADDRESS

SECTION 3 (TO BE COMPLETED BY FINANCIAL INSTITUTION)

NAME AND ADDRESS OF FINANCIAL INSTITUTION |

ROUTING NUMBER |

CHECK |

|

|

DIGIT |

|

|

|

|

DEPOSITOR ACCOUNT TITLE |

|

|

|

|

FINANCIAL INSTITUTION CERTIFICATION

I confirm the identity of the

PRINT OR TYPE REPRESENTATIVE’S NAME |

SIGNATURE OF REPRESENTATIVE |

TELEPHONE NUMBER |

DATE |

|

|

|

|

|

|

|

|

|||

Financial institutions should refer to the GREEN BOOK for further instructions. |

Reset |

|||

THE FINANCIAL INSTITUTION SHOULD MAIL THE COMPLETED FORM TO THE GOVERNMENT AGENCY IDENTIFIED ABOVE. |

||||

|

||||

|

PAYEE COPY |

|

||

SF 1199A (Back)

BURDEN ESTIMATE STATEMENT

The estimated average burden associated with this collection of information is 10 minutes per respondent or recordkeeper, depending on individual circumstances. Comments concerning the accuracy of this burden estimates and suggestions for reducing this burden should be directed to the Bureau of the Fiscal Service, Forms Management Officer, Parkersburg, WV

PRIVACY ACT NOTICE

Collection of the information in this Direct Deposit

or another government agency as authorized or required to verify your receipt of federal payments. Although providing the requested information is voluntary, your direct deposit cannot be processed without it.

PLEASE READ THIS CAREFULLY

All information on this form, including the individual claim number, is required under 31 USC 3322, 31 CFR 209 and/ or 210. The information is confidential and is needed to prove entitlement to payments. The information will be used to process payment data from the Federal agency to the financial institution and/or its agent. Failure to provide the requested information may affect the processing of this form and may delay or prevent the receipt of payments through the Direct Deposit/Electronic Funds Transfer Program.

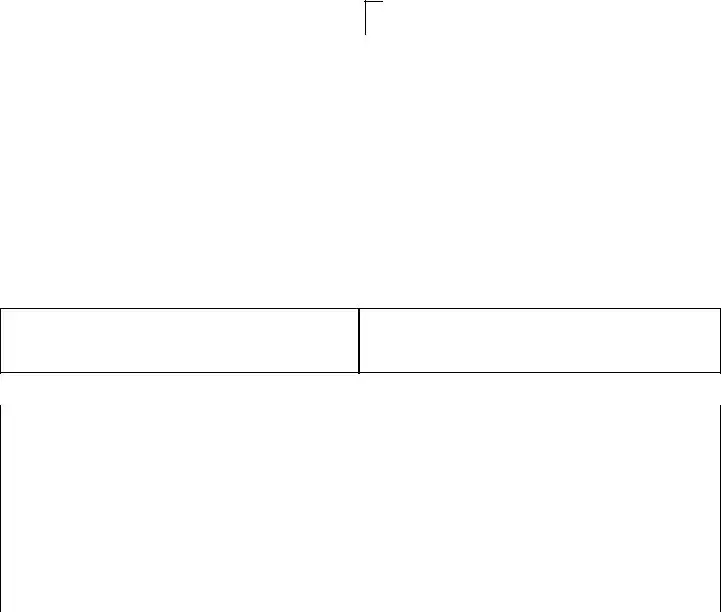

INFORMATION FOUND ON CHECKS

Most of the information needed to complete boxes A, C, and F in Section 1 is printed on your government check:

ABe sure that payee’s name is written exactly as it appears on the check. Be sure current address is shown.

CClaim numbers and suffixes are printed here on checks beneath the date for the type of payment shown here. Check the Green Book for the location of prefixes and suffixes for other types of payments.

FType of payment is printed to the left of the amount.

|

|

|

|

|

|||

Month Day Year |

000 |

|

Check No. |

||||

PHILADELPHIA, PA |

|||||||

08 |

31 |

84 |

0000 415785 |

||||

|

|

|

|||||

|

|

00 |

|

C |

28 28 DOLLARS CTS |

||

Pay to |

|

|

|

|

|

|

|

the order of |

|

|

|

|

F |

|

|

|

|

|

|

|

|

||

|

A |

|

|

|

NOT NEGOTIABLE |

||

|

:00000518’: |

0415771926” |

|

||||

SPECIAL NOTICE TO JOINT ACCOUNT HOLDERS

Joint account holders should immediately advise both the Government agency and the financial institution of the death of a beneficiary. Funds deposited after the date of death or ineligibility, except for salary payments, are to be returned to the Government agency. The Government agency will then make a determination regarding survivor rights, calculate survivor benefit payments, if any, and begin payments.

CANCELLATION

The agreement represented by this authorization remains in effect until cancelled by the recipient by notice to the Federal agency or by the death or legal incapacity of the recipient. Upon cancellation by the recipient, the recipient should notify the receiving financial institution that he/she is doing so.

The agreement represented by this authorization may be cancelled by the financial institution by providing the recipient a written notice 30 days in advance of the cancellation date. The recipient must immediately advise the Federal agency if the authorization is cancelled by the financial institution. The financial institution cannot cancel the authorization by advice to the Government agency.

CHANGING RECEIVING FINANCIAL INSTITUTIONS

The payee’s Direct Deposit will continue to be received by the selected financial institution until the Government agency is notified by the payee that the payee wishes to change the financial institution receiving the Direct Deposit. To effect this change, the payee will contact the paying agency with updated financial information. It is recommended that the payee maintain accounts at both financial institutions until the transaction is complete, i.e. after the new financial institution receives the payee’s Direct Deposit payment.

FALSE STATEMENTS OR FRAUDULENT CLAIMS

Federal law provides a fine of not more than $10,000 or imprisonment for not more than five (5) years or both for presenting a false statement or making a fraudulent claim.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The form is officially titled the Standard Form 1199A, Direct Deposit Sign-Up Form. |

| Governing Law | This form is governed by 31 CFR Parts 240, 209, and 210, which regulate federal payments through Direct Deposit. |

| Purpose | It allows payees to authorize direct deposit of federal payments into their chosen financial institution. |

| Completion Instructions | Payees must fill out Sections 1 and 2, then submit the form to their financial institution for verification. |

| Multiple Payments | A separate form is necessary for each type of payment, such as Social Security or Veterans Affairs benefits. |

| Address Changes | Payees are required to inform the government agency of any address changes to continue receiving benefits. |

| Certification Requirement | Both payees and financial institutions must certify their information to ensure proper processing. |

| Privacy Act Compliance | The form collects personal information under 5 U.S.C. § 552a and is protected under the Privacy Act. |

Guidelines on Utilizing Standard 1199A Direct Deposit

To successfully complete the Standard 1199A Direct Deposit form, carefully follow these steps. Each detail is important to ensure your direct deposit is processed smoothly. Ensure you have your personal and banking information handy before starting.

- Section 1: Fill out the personal information:

- In box A, enter your name (last, first, middle initial).

- In box B, write the name of the person(s) entitled to payment.

- In box C, enter your claim or payroll ID number.

- In box D, select your account type (checking or savings).

- In box E, provide your depositor account number.

- In box F, check one payment type as specified (e.g., Social Security, Civil Service Retirement).

- In the address section, write your full address (street, city, state, ZIP code).

- In the telephone number section, include your area code and phone number.

- Signature: Sign and date the certification box at the bottom of Section 1. If applicable, include signatures for joint account holders.

- Section 2: Fill out the government agency details:

- Enter the name and address of the government agency.

- Section 3: Provide details to the financial institution:

- The financial institution will complete this section with their information, including their routing number and account title.

- A representative's signature and contact information will be required here.

- Submission: Deliver or mail the completed form to your financial institution for verification. They will then forward it to the government agency.

After completing the form, ensure you keep a copy for your records. This will help you track your application and resolve any issues. Timely submission is essential for a successful transition to direct deposit.

What You Should Know About This Form

What is the Standard 1199A Direct Deposit form and why do I need it?

The Standard 1199A Direct Deposit form is used to enroll in direct deposit for federal payments, such as Social Security benefits and federal salary payments. Using this form ensures that your money gets deposited directly into your bank account, which is often faster and more secure than receiving a check in the mail. It helps you manage your funds easily and avoid delays caused by postal services.

How do I fill out the 1199A form?

To fill out the 1199A form, start by reading the instructions provided on the back. You will need to complete Sections 1 and 2, which include your personal information such as your name, account number, and type of payment you will receive. After completing your information, take the form to your financial institution. They will verify your details and fill out Section 3, after which they will return the completed form to the appropriate government agency.

Can I use this form for multiple types of payments?

No, you cannot use a single form for different types of payments. If you want to set up direct deposit for multiple payments—like Social Security and a pension—you need to complete a separate Standard 1199A form for each payment type. This ensures that each payment type is correctly processed and directed to your designated account.

What should I do if I change my address?

If you change your address, it’s very important to update the government agency that sends your payments. Keeping them informed ensures that you receive all necessary correspondence regarding your benefits. You may also need to update your information on the 1199A form, especially if you are receiving direct deposits after this change.

What happens if I want to change my financial institution?

If you wish to change the bank where your direct deposit is sent, you will need to contact the government agency that pays you. You'll need to provide updated financial information to start receiving deposits at your new bank. It’s a good practice to keep your old and new accounts active until the transfer is fully completed, ensuring no interruption in receiving payments.

What should I do if I experience issues with my direct deposit?

If you're encountering issues with your direct deposit, first verify that your financial institution has your correct account information. If everything seems accurate and the problem persists, contact the government agency responsible for your payments. They can help determine where the issue might be and guide you through resolving it. It’s important to address any issues promptly to avoid disruptions in your payments.

Common mistakes

When filling out the Standard 1199A Direct Deposit form, there are common mistakes that can lead to delays or issues with payment. One of the most frequent errors is not providing the correct name of the payee. The name must match exactly as it appears on the government check. Any discrepancy can result in rejected applications or interrupted payments.

Another mistake is failing to indicate the appropriate type of depositor account. Payees must specify if they are opening a checking or savings account. Omitting this information may cause confusion for the financial institution processing the request.

Many people also forget to include their depositor account number. This unique number is essential for directing funds accurately into the correct account. If left blank or entered incorrectly, payments may not be deposited properly.

When listing the address, payees sometimes omit key details such as street numbers or zip codes. Complete and accurate address information is crucial for the financial institution to confirm the identity of the payee and ensure compliance with regulatory requirements.

It is also important for individuals to know that each type of payment requires a separate form. Some applicants mistakenly assume that one form suffices for multiple payments, which can lead to complications. Each payment must have its own form to ensure proper processing.

Another oversight occurs in the section regarding the type of payment. Payees may not check the correct box or may select multiple payment types. It is critical to check only one type of payment to prevent confusion and delays in processing.

Joint account holders need to be aware of the certification requirements. Each individual must sign and date the form. Incomplete signatures can render the form invalid, delaying the direct deposit process.

Many people neglect to read the important instructions on the back of the form. These directions provide essential information for completing the form correctly and may reduce the likelihood of mistakes.

Lastly, failing to inform the government agency about any changes in address can lead to missed communications regarding benefits. Maintaining updated contact information is vital for continuous payment eligibility.

Documents used along the form

The Standard Form 1199A Direct Deposit form is essential for setting up electronic payments from government agencies. To ensure seamless processing, several additional forms and documents may be required. Below is a list of some documents frequently used alongside the 1199A form.

- Direct Deposit Authorization Form: This document allows an employee or payee to authorize their employer or agency to deposit their pay directly into their bank account, detailing the account information for accuracy.

- Payee Certification Form: This form affirms the identity of the payee and often includes a statement verifying that the payee understands and agrees to the terms of direct deposit.

- W-9 Tax Form: Used for tax purposes, this form provides the Internal Revenue Service with the payee’s taxpayer identification number, which is crucial for reporting income for tax purposes.

- Change of Address Form: This document is utilized to update the government agency with any changes in the payee's address, ensuring that communication remains consistent and relevant.

- Benefits Application Form: When applying for benefits, this form gathers necessary information about eligibility for various payment types that may later require the 1199A form for direct deposit.

- Account Verification Form: This document confirms the details of the payee’s bank account, including the routing number and account number, to prevent errors during the direct deposit process.

- Federal Benefits Statement: This statement provides a summary of the benefits the payee is entitled to receive and serves as a guide to filling out the 1199A form accurately.

These documents work together with the Standard Form 1199A to streamline the process of setting up direct deposit, ensuring accuracy and efficiency in receiving payments. For anyone looking to sign up for direct deposit, understanding these additional requirements can help facilitate a smoother experience.

Similar forms

- Form W-4: Employee's Withholding Certificate - This form helps determine how much federal income tax an employer should withhold from an employee’s paycheck. Both forms require personal and account information, ensuring proper processing of payments.

- Form 8888: Allocation of Refund (Including Savings Bond Purchases) - This allows taxpayers to specify how they want their tax refund distributed, either to one account or multiple accounts. Similar to the Standard 1199A, it collects bank account information for direct deposits.

- Form SF-1199: Direct Deposit Sign-Up Form for Federal Employees - Like the Standard 1199A, this form enables federal employees to enroll in direct deposit, facilitating the assurance that payments go directly to their chosen bank accounts.

- Form 1099: Miscellaneous Income - Many individuals use this form to report various income types. When receiving payments, information about bank details and how payments are received can mirror the need for account verification seen in the 1199A.

- Direct Deposit Enrollment Form (for state government benefits) - Similar to the 1199A, state programs often require forms for direct deposits for benefits. They involve verifying account details to ensure recipients receive timely payments.

- Electronic Fund Transfer (EFT) Form - Businesses use this form to authorize electronic payments directly from their bank account, paralleling the need for account confirmation in the Standard 1199A.

- ACH Authorization Form - This form allows bank account holders to permit electronic debit and credit transactions. The verification process for account and recipient information is a commonality shared with the Standard 1199A, ensuring secure monetary transactions.

Dos and Don'ts

- Do read the entire form carefully before filling it out.

- Do ensure that the name of the payee is written exactly as it appears on the government check.

- Do keep your address updated with the government agency for important information about benefits.

- Don't leave any required fields blank; missing information can delay the process.

- Don't forget to double-check the depositor account number for accuracy before submission.

- Don't submit a single form for multiple types of payments; use a separate form for each type.

Misconceptions

When dealing with the Standard 1199A Direct Deposit form, misunderstandings can arise. Here are six common misconceptions explained:

- It’s only for Social Security payments. Many assume this form is exclusive to Social Security. In reality, it's used for various federal payments, including military salaries, pension payments, and more.

- You don’t need to inform the agency of address changes. Some believe that once the form is submitted, they can ignore future address changes. However, it's crucial to keep the government agency updated to ensure that all communications and payments reach you.

- You can use one form for multiple payments. A common myth is that one form suffices for different payment types. Each payment type requires a separate Standard 1199A form to be completed.

- Your bank will fill out the entire form for you. There's a notion that banks take care of everything. While banks verify account details, the individual must provide the required information on the form, ensuring accuracy and completeness.

- Once set up, there’s no need for any updates. Some people think that after establishing Direct Deposit, the process remains unchanged indefinitely. This isn't true. Payees should regularly review their information and be prepared to notify the agency of any changes in circumstances.

- Only the payee needs to sign the form. Another misconception is that only the main recipient's signature is necessary. If there are joint account holders, their signatures are also required, emphasizing the need for clarity in shared financial arrangements.

Understanding these points can help ensure a smoother experience with the Standard 1199A Direct Deposit process and avoid future complications. Keeping informed about these details is vital for anyone relying on direct payments from the government.

Key takeaways

- The Standard 1199A Direct Deposit form is essential for setting up automatic payments to a bank account.

- Payees must complete Sections 1 and 2 and provide the form to their financial institution for verification.

- It's important to submit a separate form for each type of payment that will be received via Direct Deposit.

- Payees need to provide accurate information, such as their name, account details, and payment type, to avoid payment delays.

- Changes in address must be reported to the government agency to ensure continued benefits and communication.

- Joint account holders are advised to notify both the financial institution and the government agency upon the death of a beneficiary.

- Once signed, the authorization remains valid until canceled by the payee or their financial institution.

- The selected financial institution will receive Direct Deposit payments until the payee requests a change, which must be communicated to the paying agency.

Browse Other Templates

Election to Combine Trust and Estate - Social Security numbers are recorded for the Grantor and Beneficiary for administrative purposes.

What Is a 540 Form - Acting swiftly is important, as collection activities could resume if your offer is not processed timely.

Types of Health Savings Accounts - The submission of over-the-counter medications requires a doctor’s prescription.