Fill Out Your Standard 2 T Form

The Standard 2 T form serves as a crucial document in real estate transactions within North Carolina. This form outlines the terms of the Offer to Purchase and Contract, establishing a legally binding agreement between the Buyer and Seller. Central to the form is the identification of the Property, including its location, street address, and legal description. It carefully enumerates the items that are included or excluded from the purchase price, categorizing them as fixtures or personal property. The document also addresses the financial aspects of the transaction, specifying the purchase price and detailing the earnest money deposit, which secures the Buyer’s offer. Various conditions must be met for the contract to remain valid, such as the Buyer's ability to secure financing and the satisfactory condition of the Property at the time of closing. Other essential elements include provisions for special assessments, prorations, inspections, and the responsibilities of both parties regarding expenses and title delivery. By delineating these aspects, the Standard 2 T form helps facilitate transparency and understanding, ultimately supporting a smoother transaction process.

Standard 2 T Example

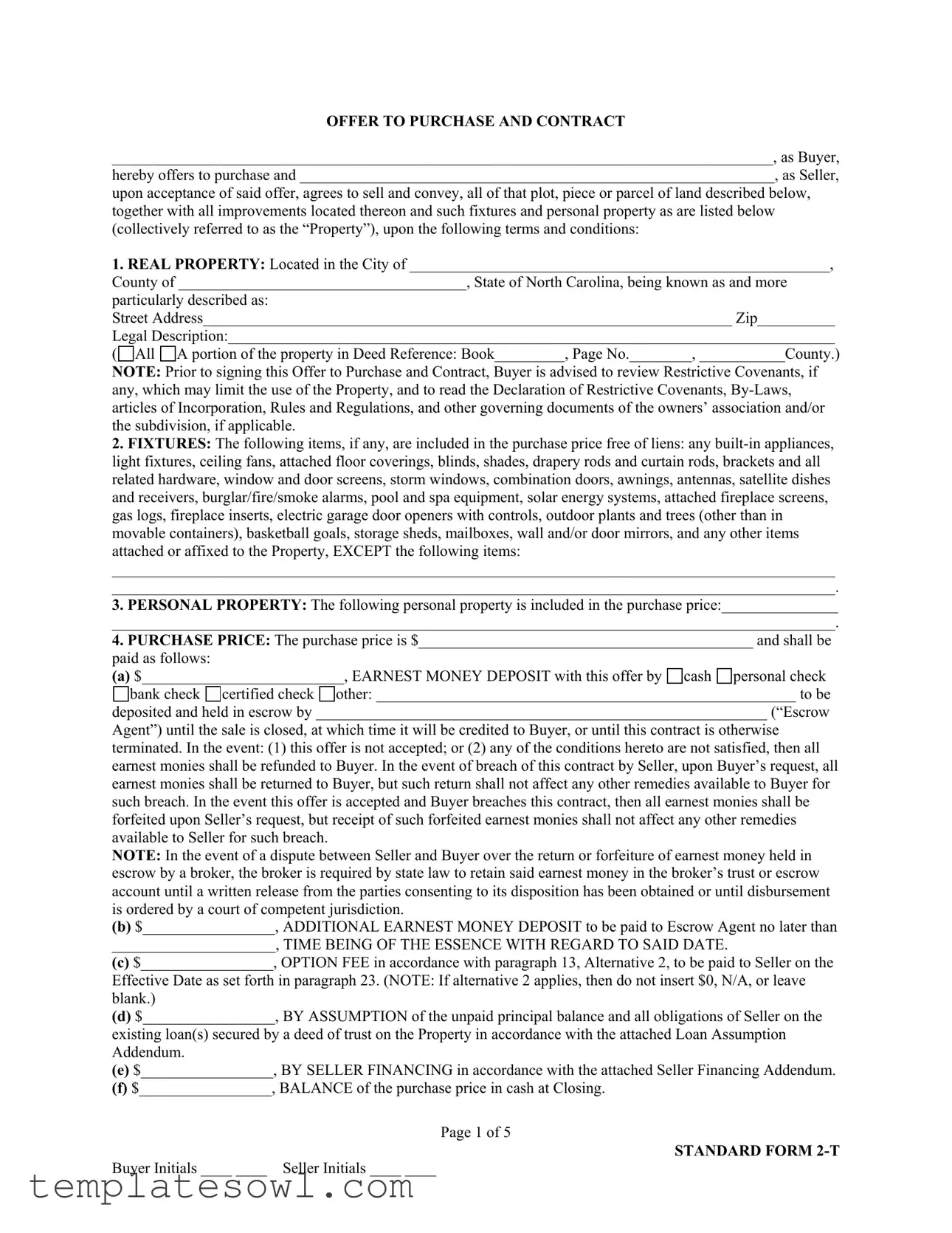

OFFER TO PURCHASE AND CONTRACT

_____________________________________________________________________________________, as Buyer,

hereby offers to purchase and _____________________________________________________________, as Seller,

upon acceptance of said offer, agrees to sell and convey, all of that plot, piece or parcel of land described below, together with all improvements located thereon and such fixtures and personal property as are listed below (collectively referred to as the “Property”), upon the following terms and conditions:

1.REAL PROPERTY: Located in the City of ______________________________________________________, County of _____________________________________, State of North Carolina, being known as and more particularly described as:

Street Address____________________________________________________________________ Zip__________

Legal Description:______________________________________________________________________________

(

All

All

A portion of the property in Deed Reference: Book_________, Page No.________, ___________County.)

A portion of the property in Deed Reference: Book_________, Page No.________, ___________County.)

NOTE: Prior to signing this Offer to Purchase and Contract, Buyer is advised to review Restrictive Covenants, if any, which may limit the use of the Property, and to read the Declaration of Restrictive Covenants,

2.FIXTURES: The following items, if any, are included in the purchase price free of liens: any

_____________________________________________________________________________________________

_____________________________________________________________________________________________.

3.PERSONAL PROPERTY: The following personal property is included in the purchase price:_______________

_____________________________________________________________________________________________.

4.PURCHASE PRICE: The purchase price is $___________________________________________ and shall be paid as follows:

(a) $__________________________, EARNEST MONEY DEPOSIT with this offer by

cash

cash

personal check

personal check

bank check

certified check

certified check

other: ______________________________________________________ to be

other: ______________________________________________________ to be

deposited and held in escrow by __________________________________________________________ (“Escrow

Agent”) until the sale is closed, at which time it will be credited to Buyer, or until this contract is otherwise terminated. In the event: (1) this offer is not accepted; or (2) any of the conditions hereto are not satisfied, then all earnest monies shall be refunded to Buyer. In the event of breach of this contract by Seller, upon Buyer’s request, all earnest monies shall be returned to Buyer, but such return shall not affect any other remedies available to Buyer for such breach. In the event this offer is accepted and Buyer breaches this contract, then all earnest monies shall be forfeited upon Seller’s request, but receipt of such forfeited earnest monies shall not affect any other remedies available to Seller for such breach.

NOTE: In the event of a dispute between Seller and Buyer over the return or forfeiture of earnest money held in escrow by a broker, the broker is required by state law to retain said earnest money in the broker’s trust or escrow account until a written release from the parties consenting to its disposition has been obtained or until disbursement is ordered by a court of competent jurisdiction.

(b)$_________________, ADDITIONAL EARNEST MONEY DEPOSIT to be paid to Escrow Agent no later than

_____________________, TIME BEING OF THE ESSENCE WITH REGARD TO SAID DATE.

(c)$_________________, OPTION FEE in accordance with paragraph 13, Alternative 2, to be paid to Seller on the Effective Date as set forth in paragraph 23. (NOTE: If alternative 2 applies, then do not insert $0, N/A, or leave blank.)

(d)$_________________, BY ASSUMPTION of the unpaid principal balance and all obligations of Seller on the existing loan(s) secured by a deed of trust on the Property in accordance with the attached Loan Assumption Addendum.

(e)$_________________, BY SELLER FINANCING in accordance with the attached Seller Financing Addendum.

(f)$_________________, BALANCE of the purchase price in cash at Closing.

Page 1 of 5

STANDARD FORM

Buyer Initials ____ ____ Seller Initials ____ ____

5.CONDITIONS: (State N/A in each blank that is not a condition to this contract.)

(a) Buyer must be able to obtain a

FHA

FHA

VA (attach FHA/VA Financing Addendum)

VA (attach FHA/VA Financing Addendum)

Conventional

Conventional

Other: _______________________ loan at a

Fixed Rate

Fixed Rate

Adjustable Rate in the principal amount of

Adjustable Rate in the principal amount of

_______________________________ (plus any financed VA Funding Fee or FHA MIP) for a term of

___________ year(s), at an initial interest rate not to exceed ____________ % per annum, with mortgage loan

discount points not to exceed ______ % of the loan amount. Buyer shall apply for said loan within ________ days of

the Effective Date of this contract. Buyer shall use Buyer’s best efforts to secure the lender’s customary loan commitment letter on or before __________________________________ and to satisfy all terms and conditions of

the loan commitment letter by Closing. After the above letter date, Seller may request in writing from Buyer a copy of the loan commitment letter. If Buyer fails to provide Seller a copy of the loan commitment letter or a written waiver of this loan condition within five days of receipt of Seller’s request, Seller may terminate this contract by written notice to Buyer at any time thereafter, provided Seller has not then received a copy of the letter or the waiver.

(b)There must be no restriction, easement, zoning or other governmental regulation that would prevent the reasonable use of the Property for _________________________________________________________ purposes.

(c)The Property must be in substantially the same or better condition at Closing as on the date of this offer reasonable wear and tear excepted.

(d)All deeds of trust, liens and other charges against the Property, not assumed by Buyer, must be paid and satisfied by Seller prior to or at Closing such that cancellation may be promptly obtained following Closing. Seller shall remain obligated to obtain any such cancellations following Closing.

(e)Title must be delivered at Closing by GENERAL WARRANTY DEED unless otherwise stated herein, and must be fee simple marketable and insurable title, free of all encumbrances except: ad valorem taxes for the current year (prorated through the date of Closing); utility easements and unviolated restrictive covenants that do not materially affect the value of the Property; and such other encumbrances as may be assumed or specifically approved by Buyer. The Property must have legal access to a public right of way.

6. SPECIAL ASSESSMENTS: Seller warrants that there are no pending or confirmed governmental special assessments for sidewalk, paving, water, sewer, or other improvements on or adjoining the Property, and no pending or confirmed owners’ association special assessments, except as follows: __________________________________

_____________________________________________________________________________________________. (Insert “None” or the identification of such assessments, if any.) Seller shall pay all owners’ association assessments and all governmental assessments confirmed through the time of Closing, if any, and Buyer shall take title subject to all pending assessments, if any, unless otherwise agreed as follows: ______________________________________

_____________________________________________________________________________________________. 7. PRORATIONS AND ADJUSTMENTS: Unless otherwise provided, the following items shall be prorated and either adjusted between the parties or paid at Closing: (a) Ad valorem taxes on real property shall be prorated on a calendar year basis through the date of Closing; (b) Ad valorem taxes on personal property for the entire year shall be paid by the Seller unless the personal property is conveyed to the Buyer, in which case, the personal property taxes shall be prorated on a calendar year basis through the date of Closing; (c) All late listing penalties, if any, shall be paid by Seller; (d) Rents, if any, for the Property shall be prorated through the date of Closing; (e) Owners’ association dues and other like charges shall be prorated through the date of Closing. Seller represents that the regular owners’ association dues, if any, are $_______________ per __________________.

8. EXPENSES: Buyer shall be responsible for all costs with respect to any loan obtained by Buyer. Buyer shall pay for recording the deed and for preparation and recording of all instruments required to secure the balance of the purchase price unpaid at Closing. Seller shall pay for preparation of a deed and all other documents necessary to perform Seller’s obligations under this agreement, and for excise tax (revenue stamps) required by law. Seller shall pay at closing $______________________ toward any of the Buyer’s expenses associated with the purchase of the Property, including any FHA/VA lender and inspection costs that Buyer is not permitted to pay, but excluding any portion disapproved by Buyer’s lender.

9. FUEL: Buyer agrees to purchase from Seller the fuel, if any, situated in any tank on the Property at the prevailing rate with the cost of measurement thereof, if any, being paid by Seller.

10. EVIDENCE OF TITLE: Seller agrees to use his best efforts to deliver to Buyer as soon as reasonably possible after the Effective Date of this contract, copies of all title information in possession of or available to Seller, including but not limited to: title insurance policies, attorney’s opinions on title, surveys, covenants, deeds, notes and deeds of trust and easements relating to the Property. Seller authorizes (1) any attorney presently or previously representing Seller to release and disclose any title insurance policy in such attorney's file to Buyer and both Buyer's and Seller's agents and attorneys; and (2) the Property’s title insurer or its agent to release and disclose all materials

Page 2 of 5

STANDARD FORM

Buyer Initials ____ ____ Seller Initials ____ ____

in the Property's title insurer's (or title insurer's agent's) file to Buyer and both Buyer's and Seller's agents and attorneys.

11.LABOR AND MATERIAL: Seller shall furnish at Closing an affidavit and indemnification agreement in form satisfactory to Buyer showing that all labor and materials, if any, furnished to the Property within 120 days prior to the date of Closing have been paid for and agreeing to indemnify Buyer against all loss from any cause or claim arising there from.

12.PROPERTY DISCLOSURE:

Buyer has received a signed copy of the N.C. Residential Property Disclosure Statement prior to the signing of this Offer to Purchase and Contract.

Buyer has received a signed copy of the N.C. Residential Property Disclosure Statement prior to the signing of this Offer to Purchase and Contract.

Buyer has NOT received a signed copy of the N.C. Residential Property Disclosure Statement prior to the signing of this Offer to Purchase and Contract and shall have the right to terminate or withdraw this contract without penalty prior to WHICHEVER OF THE FOLLOWING EVENTS OCCURS FIRST: (1) the end of the third calendar day following receipt of the Disclosure Statement; (2) the end of the third calendar day following the date the contract was made; or (3) Closing or occupancy by the Buyer in the case of a sale or exchange.

Buyer has NOT received a signed copy of the N.C. Residential Property Disclosure Statement prior to the signing of this Offer to Purchase and Contract and shall have the right to terminate or withdraw this contract without penalty prior to WHICHEVER OF THE FOLLOWING EVENTS OCCURS FIRST: (1) the end of the third calendar day following receipt of the Disclosure Statement; (2) the end of the third calendar day following the date the contract was made; or (3) Closing or occupancy by the Buyer in the case of a sale or exchange.

Exempt from N.C. Residential Property Disclosure Statement because (SEE GUIDELINES)

___________________________________________________________________________________________.

The Property is residential and was built prior to 1978 (Attach

The Property is residential and was built prior to 1978 (Attach

13.PROPERTY INSPECTION, APPRAISAL, INVESTIGATION (Choose ONLY ONE of the following

Alternatives):

ALTERNATIVE 1:

ALTERNATIVE 1:

(a) Property Inspection: Unless otherwise stated herein, Buyer shall have the option of inspecting, or obtaining at Buyer’s expense inspections, to determine the condition of the Property. Unless otherwise stated herein, it is a condition of this contract that: (i) the

(b)

(c) Repairs: Pursuant to any inspections in (a) and/or (b) above, if any repairs are necessary, Seller shall have the option of completing them or refusing to complete them. If Seller elects not to complete the repairs, then Buyer shall have the option of accepting the Property in its present condition or terminating this contract, in which case all earnest monies shall be refunded. Unless otherwise stated herein, any items not covered by (a)(i), (a)(ii), (a)(iii) and

(b) above are excluded from repair negotiations under this contract.

(d) Radon Inspection: Buyer shall have the option, at Buyer's expense, to have the Property tested for radon on or before the date for completion of inspections as set forth in paragraph 13 (a) above. The test result shall be deemed satisfactory to Buyer if it indicates a radon level of less than 4.0 pico curies per liter of air (as of January 1, 1997, EPA guidelines reflect an "acceptable" level as anything less than 4.0 pico curies per liter of air). If the test result exceeds the

Page 3 of 5

STANDARD FORM

Buyer Initials ____ ____ Seller Initials ____ ____

bring the radon level within the satisfactory range, Buyer shall have the option of: a) accepting the Property with its then current radon level; or

b) terminating the contract, in which case all earnest monies shall be refunded.

(e)Cost Of Repair Contingency: Notwithstanding the above and as an additional remedy of Buyer, if a reasonable estimate obtained by Buyer of the total cost of repairs required by (a) and (b) and/or remediation required by (d) above equals or exceeds $__________________, then Buyer shall have the option to terminate this contract pursuant to the Cost of Repair Contingency no later than seven days following the inspection date and all earnest monies shall be refunded to Buyer.

(f)Appraisal Contingency: The Property must appraise at a value equal to or exceeding the purchase price or, at the option of Buyer, this contract may be terminated and all earnest monies shall be refunded to Buyer. If this contract is not subject to a financing contingency requiring an appraisal, Buyer shall arrange to have the appraisal completed on or before _____________________________. The cost of the appraisal shall be borne by Buyer.

(g)CLOSING SHALL CONSTITUTE ACCEPTANCE OF THE PROPERTY IN ITS THEN EXISTING CONDITION UNLESS PROVISION IS OTHERWISE MADE IN WRITING.

ALTERNATIVE 2: (This Alternative applies ONLY if Alternative 2 is checked AND Buyer has paid the Option Fee.)

ALTERNATIVE 2: (This Alternative applies ONLY if Alternative 2 is checked AND Buyer has paid the Option Fee.)

(a)Property Investigation with Option to Terminate: In consideration of the sum of $___________________ (do not insert $0, N/A, or leave blank) paid by Buyer to Seller (not Escrow Agent) and other valuable consideration, the receipt and sufficiency of which is hereby acknowledged (the “Option Fee”), Buyer shall have the right to terminate this contract for any reason or no reason, whether related to the physical condition of the Property or otherwise, by delivering to Seller written notice of termination (the “Termination Notice”) by 5:00 p.m. on

_________________________________, 20____, time being of the essence (the “Option Termination Date”). At any time prior to Closing, Buyer shall have the right to inspect the Property at Buyer’s expense (Buyer is advised to have all inspections and appraisals of the Property, including but not limited to those matters set forth in Alternative 1, performed prior to the Option Termination Date).

(b)Exercise of Option: If Buyer delivers the Termination Notice prior to the Option Termination Date, time being of the essence, this contract shall become null and void and all earnest monies received in connection herewith shall be refunded to Buyer; however, the Option Fee will not be refunded and shall be retained by Seller. If Buyer fails to deliver the Termination Notice to Seller prior to the Option Termination Date, then Buyer will be deemed to have accepted the Property in its physical condition existing as of the Option Termination Date, excluding matters of survey. The Option Fee is not refundable, is not a part of any earnest monies, and will be credited to the purchase price at Closing.

(c)CLOSING SHALL CONSTITUTE ACCEPTANCE OF THE PROPERTY IN ITS THEN EXISTING CONDITION UNLESS PROVISION IS OTHERWISE MADE IN WRITING.

14.REASONABLE ACCESS: Seller will provide reasonable access to the Property (including working, existing utilities) through the earlier of Closing or possession by Buyer, to Buyer or Buyer’s representatives for the purposes of appraisal, inspection, and/or evaluation. Buyer may conduct a

15.CLOSING: Closing shall be defined as the date and time of recording of the deed. All parties agree to execute any and all documents and papers necessary in connection with Closing and transfer of title on or before

_______________________________, at a place designated by Buyer. The deed is to be made to

___________________________________________________________.

16.POSSESSION: Unless otherwise provided herein, possession shall be delivered at Closing. In the event

possession is NOT to be delivered at Closing:

a Buyer Possession Before Closing Agreement is attached. OR, a Seller Possession After Closing Agreement is attached.

a Buyer Possession Before Closing Agreement is attached. OR, a Seller Possession After Closing Agreement is attached.

17.OTHER PROVISIONS AND CONDITIONS: (ITEMIZE ALL ADDENDA TO THIS CONTRACT AND ATTACH HERETO.)

18.RISK OF LOSS: The risk of loss or damage by fire or other casualty prior to Closing shall be upon Seller. If the improvements on the Property are destroyed or materially damaged prior to Closing, Buyer may terminate this contract by written notice delivered to Seller or Seller’s agent and all deposits shall be returned to Buyer. In the

Page 4 of 5

STANDARD FORM

Buyer Initials ____ ____ Seller Initials ____ ____

event Buyer does NOT elect to terminate this contract, Buyer shall be entitled to receive, in addition to the Property, any of the Seller’s insurance proceeds payable on account of the damage or destruction applicable to the Property being purchased.

19.ASSIGNMENTS: This contract may not be assigned without the written consent of all parties, but if assigned by agreement, then this contract shall be binding on the assignee and his heirs and successors.

20.PARTIES: This contract shall be binding upon and shall inure to the benefit of the parties, i.e., Buyer and Seller and their heirs, successors and assigns. As used herein, words in the singular include the plural and the masculine includes the feminine and neuter genders, as appropriate.

21.SURVIVAL: If any provision herein contained which by its nature and effect is required to be observed, kept or performed after the Closing, it shall survive the Closing and remain binding upon and for the benefit of the parties hereto until fully observed, kept or performed.

22.ENTIRE AGREEMENT: This contract contains the entire agreement of the parties and there are no representations, inducements or other provisions other than those expressed herein. All changes, additions or deletions hereto must be in writing and signed by all parties. Nothing contained herein shall alter any agreement between a REALTOR® or broker and Seller or Buyer as contained in any listing agreement, buyer agency agreement, or any other agency agreement between them.

23.NOTICE AND EXECUTION: Any notice or communication to be given to a party herein may be given to the party or to such party’s agent. This offer shall become a binding contract (the “Effective Date”) when signed by both Buyer and Seller and such signing is communicated to the offering party. This contract is executed under seal in signed multiple originals, all of which together constitute one and the same instrument, with a signed original being retained by each party and each REALTOR® or broker hereto, and the parties adopt the word “SEAL” beside their signatures below.

Buyer acknowledges having made an

THE NORTH CAROLINA ASSOCIATION OF REALTORS®, INC. AND THE NORTH CAROLINA BAR ASSOCIATION MAKE NO REPRESENTATION AS TO THE LEGAL VALIDITY OR ADEQUACY OF ANY PROVISION OF THIS FORM IN ANY SPECIFIC TRANSACTION. IF YOU DO NOT UNDERSTAND THIS FORM OR FEEL THAT IT DOES NOT PROVIDE FOR YOUR LEGAL NEEDS, YOU SHOULD CONSULT A NORTH CAROLINA REAL ESTATE ATTORNEY BEFORE YOU SIGN IT.

Date: __________________________________ |

|

Date: ________________________________ |

|

Buyer _________________________________ (SEAL) |

Seller _______________________________ (SEAL) |

||

Date: __________________________________ |

|

Date: ________________________________ |

|

Buyer _________________________________ (SEAL) |

Seller _______________________________ (SEAL) |

||

|

|||

Escrow Agent acknowledges receipt of the earnest money and agrees to hold and disburse the same in |

|||

Accordance with the terms hereof. |

|

|

|

Date: ___________________________________ |

Firm: _____________________________________________ |

||

|

|

By: _______________________________________________ |

|

|

|

|

(Signature) |

Selling Agent/Firm/Phone________________________________________________________________________ |

|||

Acting as |

Buyer’s Agent |

Seller’s (sub)Agent Dual Agent |

|

Listing Agent/Firm/Phone________________________________________________________________________ |

|||

Acting as |

Seller’s (sub)Agent Dual Agent |

||

|

|

Page 5 of 5 |

|

|

|

|

STANDARD FORM |

Buyer Initials ____ ____ Seller Initials ____ ____

Form Characteristics

| Fact Title | Description |

|---|---|

| Name of the Form | The form is known as the Standard Form 2-T, which is an Offer to Purchase and Contract used in real estate transactions. |

| Governing Law | This form is governed by the laws of North Carolina, specifically related to residential real estate transactions. |

| Purpose | The form facilitates the formal offer from a Buyer to purchase a property from a Seller, detailing terms and conditions. |

| Inclusions | It covers the property description, fixtures, personal property, purchase price, and various contingencies related to financing and inspections. |

| Earnest Money | The Buyer provides an earnest money deposit, which holds the offer, allowing them to have a claim on the property until closing. |

| Inspection Rights | The form grants the Buyer the right to conduct inspections of the property to assess its condition, which must be completed by a specified date. |

Guidelines on Utilizing Standard 2 T

Following the completion of the Standard 2 T form, it is essential to review and ensure that all information is accurate and complete. This document serves as a formal offer for property purchase, incorporating specific terms and conditions that must be duly acknowledged by both parties. Verification of details can mitigate potential disputes later in the process.

- Identify the Buyer and Seller: Fill in your name and the seller’s name at the top of the form.

- Property Information: Provide the street address, city, county, and state of the property you intend to purchase.

- Legal Description: Enter the legal description of the property along with the deed reference details including book and page numbers.

- List Fixtures: Specify any included fixtures, along with exceptions if applicable.

- Personal Property: Include any personal property included in the sale.

- Purchase Price: Enter the total purchase price and itemize the payment structure, detailing the earnest money, additional deposits, and any other payments.

- Conditions: State any conditions for the agreement such as loan approval contingencies and acceptable property use.

- Special Assessments: Note any pending or confirmed assessments related to the property.

- Prorations and Adjustments: List items that need to be prorated like property taxes and rental agreements.

- Expenses: Document who will be responsible for closing costs and other related expenses.

- Fuel Purchase: Indicate the agreement regarding any fuel entitlements in tanks on the property.

- Evidence of Title: Agree on how title information will be provided post-agreement.

- Property Disclosure: Confirm receipt of disclosure statements and outline any exemptions.

- Property Inspection: Determine if inspections will be conducted and any specific requirements.

- Closing Details: Specify the agreed closing date and where it will take place.

- Possession: Indicate when possession will be transferred, if not at closing.

- Signatures: Ensure all relevant parties sign and date the document.

What You Should Know About This Form

What is the Standard 2 T form?

The Standard 2 T form is a legal document used in North Carolina for real estate transactions. It serves as an offer to purchase and contract, outlining the agreement between a buyer and a seller regarding the sale of property. This form specifies the property details, conditions of sale, earnest money deposits, and any included fixtures or personal property.

What should be included in the REAL PROPERTY section?

The REAL PROPERTY section requires specific information about the property being sold, including its street address, legal description, and any relevant county and city details. This information helps clearly identify the property and establishes the exact boundaries of the transaction.

What are fixtures, and how are they handled in the contract?

Fixtures refer to items that are attached to the property and are typically included in the sale. This includes built-in appliances, light fixtures, and other items affixed to the property. The contract allows sellers to specify any items that are excluded from the sale, ensuring clarity for both parties about what is included.

How is the purchase price structured on the form?

The purchase price section details how the total amount will be paid. It includes an earnest money deposit, additional earnest money, an option fee, and any financing arrangements. Having this structure in place helps ensure all parties are clear on the financial terms of the agreement.

What conditions may affect the sale of the property?

Conditions outlined in the contract can include the buyer’s ability to secure financing, any restrictions or easements affecting the property, and the requirement for the property to be in satisfactory condition at closing. These conditions provide legal protections for both the buyer and seller and help facilitate a smooth transaction.

What happens if the property is damaged before closing?

If the property suffers damage before closing, the seller is responsible for the risk of loss. The buyer has the option to terminate the contract in writing or proceed with the sale and receive any insurance proceeds from the damage. This clause ensures that buyers are protected against unforeseen losses prior to closing.

What is included in the Section about closing?

The closing section of the Standard 2 T form specifies the date and location of the property transfer, along with the requirements for both buyers and sellers to execute necessary documents. Closing signifies the finalization of the sale and the legal transfer of ownership.

How does the contract address inspections and repairs?

The contract allows buyers to conduct inspections, addressing concerns about the property’s condition. If inspections reveal necessary repairs, the seller can choose to complete them or not. This provides a process for negotiation regarding repairs that may be needed before closing.

What is the significance of the earnest money deposit?

The earnest money deposit serves to demonstrate the buyer's good faith in proceeding with the purchase. It is held in escrow and will be credited toward the purchase price at closing. If the buyer fails to fulfill the contract without lawful cause, the seller may have the right to keep this deposit as a form of compensation.

Common mistakes

Completing the Standard 2 T form requires careful attention to detail. One common mistake is neglecting to provide complete and accurate information in the Real Property section. Buyers often skip filling in the city, county, or state information or mistakenly provide incorrect details about the property’s legal description. This omission can lead to confusion about the exact property being purchased, potentially causing disputes in the future.

Another frequent error occurs in the Fixtures and Personal Property sections. Buyers sometimes forget to specify which items are included in the sale. It's crucial to clearly list the included fixtures and personal property, as failing to do so can result in misunderstandings with the seller. Buyers could inadvertently lose valuable items, or they might assume items will be included that are not explicitly mentioned in the contract.

Buyers also often miscalculate or leave blank the Purchase Price section, particularly regarding the earnest money deposit. Each component of the payment must be filled in accurately, including the amount and the payment method. Leaving this section incomplete, or entering an incorrect amount, can create complications at closing and may delay the process.

Lastly, people frequently overlook the Conditions section, particularly when it comes to financing requirements. Buyers must ensure they have detailed the terms under which they can secure a mortgage, such as the loan type and interest rate. Omitting this essential information can jeopardize the contract, leading to delays or even termination of the agreement.

Documents used along the form

The Standard Form 2-T is a crucial document in real estate transactions in North Carolina. However, it is often accompanied by several other forms that provide additional information or protections for both buyers and sellers. Below are some commonly used documents that may accompany the Standard Form 2-T, along with brief descriptions of each.

- Property Disclosure Statement: This document informs the buyer about the condition of the property and outlines any known issues or defects. It helps ensure transparency and can protect sellers from future legal claims.

- Lead-Based Paint Disclosure: Required for properties built before 1978, this form discloses the potential presence of lead-based paint. Buyers must acknowledge the risks associated with this hazard.

- Loan Assumption Addendum: This addendum outlines the terms under which the buyer may assume the existing mortgage on the property. It includes details about the outstanding balance and any conditions of the loan.

- Seller Financing Addendum: If the seller is providing financing to the buyer, this form lays out the terms of that financing arrangement, including payment schedules and interest rates.

- Inspection Addendum: This document specifies the scope and conditions of any property inspections that the buyer is entitled to conduct, including timelines and obligations for addressing repairs.

- Closing Statement: Prepared before the closing date, this statement itemizes the financial aspects of the transaction, including costs, fees, and credits for both parties, ensuring both sides understand their financial obligations.

- Possession Agreement: This agreement defines when and how possession of the property will transfer from the seller to the buyer, specifying whether possession occurs before or after closing.

Understanding these accompanying forms is vital for both buyers and sellers to ensure a smooth transaction. Time-sensitive actions may be required by any party, so it is essential to manage these documents carefully to protect interests and comply with regulatory requirements.

Similar forms

-

Residential Purchase Agreement: Like the Standard 2 T form, this document outlines the terms of a property purchase, specifying details about the buyer, seller, property description, purchase price, and conditions of sale.

-

Offer to Purchase: Similar to the Standard 2 T form, this document serves as a formal proposal to buy property, detailing key aspects like price, closing date, and contingencies that must be satisfied for the sale to proceed.

-

Lease Purchase Agreement: This document is akin to the Standard 2 T form in that it combines elements of a lease and a purchase agreement, allowing the buyer to lease the property with an option to buy it later under specified terms.

-

Real Estate Sales Contract: This document is comparable as it establishes a binding agreement between the buyer and seller of real estate, detailing the sale process, including conditions like financing and inspections similar to those in the Standard 2 T form.

-

Options to Purchase: Like the Standard 2 T form, an option allows a buyer the right to purchase property within a specified time frame and under certain conditions, thus providing an opportunity to secure a purchase without immediate obligation.

-

Counteroffer: Similar to the Standard 2 T form, a counteroffer modifies the original offer, presenting new terms or conditions while maintaining the intent of the initial purchase agreement.

-

Purchase Agreement Addendum: This document adds specific conditions to the original purchase agreement, similar to the Standard 2 T form, allowing for clarifications or additional terms without needing to rewrite the entire agreement.

-

Property Disclosure Statement: This document is similar because it requires sellers to disclose known issues about a property, which is critical for buyers and complements the conditions outlined in the Standard 2 T form for informed decision-making.

Dos and Don'ts

Filling out the Standard 2 T form requires attention to detail and careful consideration. Here are some important do's and don'ts to keep in mind:

- Do read through the entire form before you start filling it out to understand what information is required.

- Don't leave any sections blank without marking them as N/A, unless it's specifically instructed otherwise.

- Do provide accurate details about the property, such as the address and legal description, to avoid confusion later.

- Don't assume that all items listed as fixtures are included; clarify which items will be included or excluded.

- Do double-check the purchase price and payment terms to ensure everything is clearly stated.

- Don't forget to sign and date the document; your signature indicates acceptance of the terms.

- Do keep copies of the completed form for your records and to share with all parties involved.

Misconceptions

- Misconception 1: The Standard 2 T form is just a simple contract.

- Misconception 2: Only one party benefits from the Standard 2 T form.

- Misconception 3: Once signed, the agreement cannot be changed.

- Misconception 4: The sale closes automatically after signing the form.

- Misconception 5: Earnest money is non-refundable.

- Misconception 6: A standard home inspection is optional and not important.

- Misconception 7: All items in the house are automatically included in the sale.

- Misconception 8: Sellers are responsible for all repairs after the contract is signed.

- Misconception 9: The Standard 2 T form does not require legal advice.

This form serves as a detailed agreement covering various aspects of the real estate transaction. It's not just a casual handshake; it outlines specific terms and legal obligations.

In reality, both the buyer and the seller have their interests protected. The form ensures that terms are clear and that both parties understand their rights and obligations.

While the form is binding, changes can be made as long as both parties agree and sign off on any modifications. Flexibility exists in negotiations.

Closing requires additional steps, including fulfilling conditions outlined in the contract like inspections and securing financing.

Earnest money can be refunded under certain circumstances, such as if the offer is not accepted or if conditions of the contract are not met.

A home inspection is a crucial step for a buyer to understand the property’s condition. It can prevent future surprises and expenses.

Only items specifically listed in the contract are included in the sale. Personal property that isn't mentioned must be explicitly agreed upon.

Repairs may be negotiated between the buyer and seller based on inspection findings. Not all repairs are the seller's responsibility.

While it’s designed to be straightforward, consulting with a real estate attorney can help ensure that all legal needs are met and understood.

Key takeaways

Filling out and using the Standard Form 2 T for real estate transactions requires careful attention to detail. Here are key takeaways to remember:

- Complete all sections. Ensure that every relevant part of the form is filled out completely to avoid confusion.

- Review property details. Double-check the property description, including the street address and legal description.

- Understand fixtures and personal property. Clearly list items included in the sale to prevent disputes later.

- Follow earnest money guidelines. Specify the amounts for earnest money and other deposits. Understand the conditions for refunds in case of a breach.

- Clarify financing terms. Be specific about the type of loan and terms, including interest rates and application timelines.

- Inspect the property. Schedule inspections and disclose any findings to the seller promptly.

- Know seller’s obligations. The seller must clear any liens and deliver a clear title at closing.

- Watch for contingencies. Be aware of timelines and conditions that could allow you to back out of the agreement.

- Understand risk of loss. The seller bears the risk of loss or damage to the property until closing.

- Consult with experts. If unsure, seek advice from a real estate attorney to ensure all terms are clear and protective of your interests.

Use this form as a guideline, and handle each section with care for a smooth transaction process.

Browse Other Templates

Kaiser Senior Advantage Summit - If you have had employer coverage recently, check if enrolling affects your benefits.

Minimum Insurance Coverage in Michigan - The certificate must remain legible and intact to be accepted as valid proof.