Fill Out Your Standard Health Application Form

The Standard Health Application form, introduced by Blue Cross and Blue Shield of Illinois (BCBSIL), serves as a unified enrollment document for small employers with groups of 2 to 150 employees. Designed under the guidelines of the Illinois Insurance Fairness Act, this form replaces previous small group enrollment applications, streamlining the process for both employers and employees seeking health coverage. Employees can use this single application to request quotes from multiple insurance providers, eliminating the need for various forms. It contains several sections that cover essential information, such as employer details, requested coverage types, and any existing waivers for employee and dependent enrollment. Employees must select health coverage from the options offered by their employer, including PPO, HMO, and plans with Health Savings Accounts. Notably, BCBSIL enforces specific enrollment rules—employees must enroll themselves to include dependents in their chosen health plans. Additionally, the form requests pertinent details about applicants, including height, weight, and healthcare providers, particularly those selecting HMO coverage. Furthermore, it provides sections for current health coverage and additional health statement requirements based on the size of the enrolling group. As a vital tool for securing health insurance, the Standard Health Application form significantly simplifies what could otherwise be a complicated enrollment experience.

Standard Health Application Example

Blue Cross and Blue Shield of Illinois Cover Page to the

Illinois Standard Health Employee Application for Small Employers

(Groups sized 2 - 150)

The purpose of this document is to help you – an employee requesting coverage from Blue Cross and Blue Shield of Illinois (BCBSIL) – fill out the new standard enrollment application created by the State of Illinois Department of Insurance.

As a result of the Illinois Insurance Fairness Act (Public Act

The attached standard application goes into effect January 1, 2011 and replaces the small group enrollment applications previously used by insurance companies.

Although all insurance companies must use this standard enrollment application, the business needs and practices of all insurance companies are not the same. Not all the information requested on the new standard enrollment application is required by BCBSIL. However, there is information BCBSIL needs for the enrollment process that is not on the standard enrollment application.

The information below will help you understand how to complete each section of the standard enrollment application for enrollment with BCBSIL.

1.Employer Information

Your employer can use the Illinois Standard Health Employee Application with one or more insurance companies to request quotes for employee health insurance. This standard enrollment application means you do not need to fill out different applications from each insurance company. For your benefit, space is provided on the standard enrollment application so your employer can list the different insurance companies that will receive your health information.

You will see references to "spouse/domestic partner" and "retiree" in the standard enrollment application. Domestic partners and retirees are eligible only if your employer chooses to cover them. Check with your employer if you are not sure.

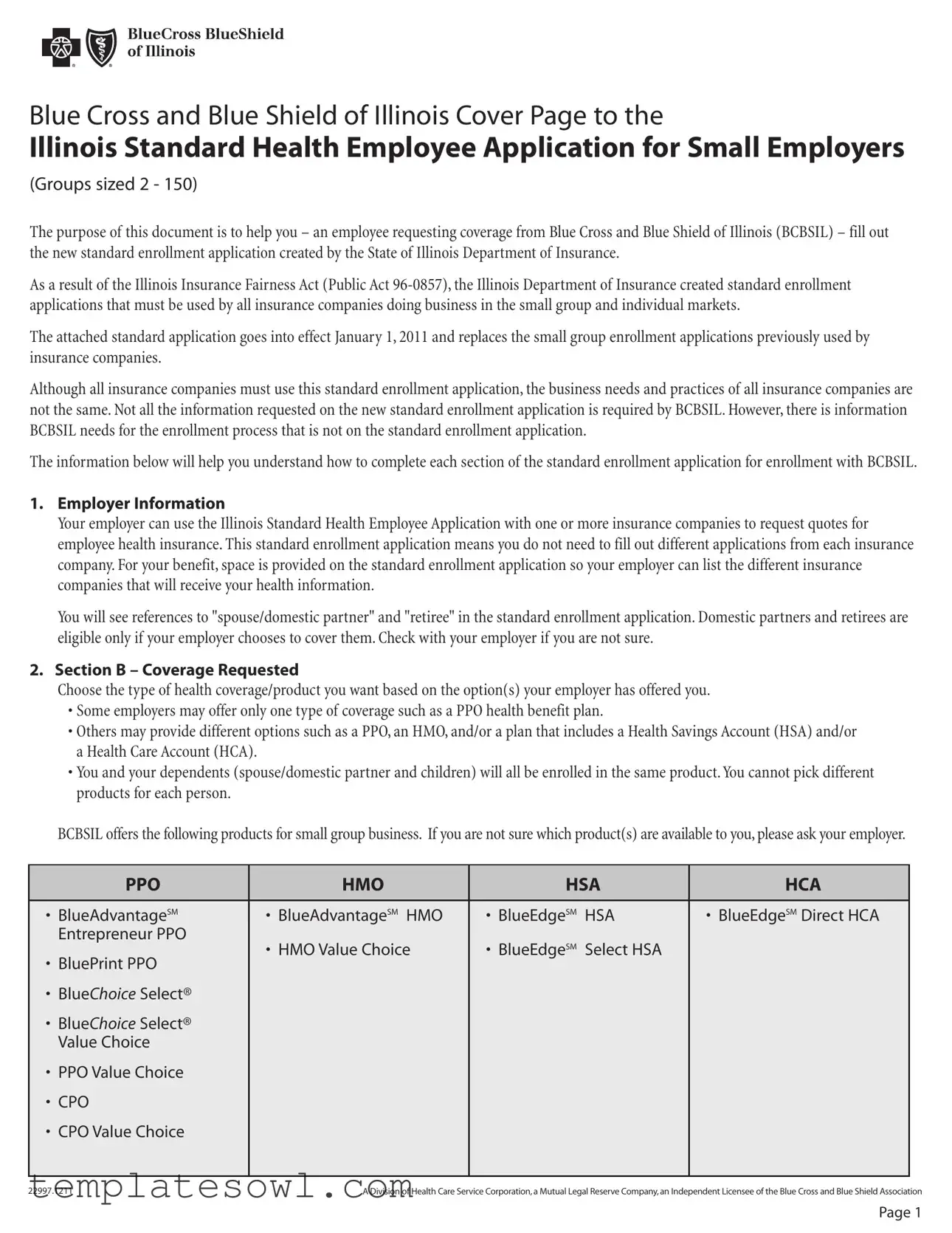

2.Section B – Coverage Requested

Choose the type of health coverage/product you want based on the option(s) your employer has offered you.

•Some employers may offer only one type of coverage such as a PPO health benefit plan.

•Others may provide different options such as a PPO, an HMO, and/or a plan that includes a Health Savings Account (HSA) and/or a Health Care Account (HCA).

•You and your dependents (spouse/domestic partner and children) will all be enrolled in the same product. You cannot pick different products for each person.

BCBSIL offers the following products for small group business. If you are not sure which product(s) are available to you, please ask your employer.

PPO |

HMO |

HSA |

HCA |

|

|

• BlueAdvantageSM |

• BlueAdvantageSM HMO |

• BlueEdgeSM |

HSA |

• BlueEdgeSM Direct HCA |

|

Entrepreneur PPO |

• HMO Value Choice |

• BlueEdgeSM |

Select HSA |

|

|

• BluePrint PPO |

|

|

|||

|

|

|

|

|

|

• BlueChoice Select® |

|

|

|

|

|

• BlueChoice Select® |

|

|

|

|

|

Value Choice |

|

|

|

|

|

• PPO Value Choice |

|

|

|

|

|

• CPO |

|

|

|

|

|

• CPO Value Choice |

|

|

|

|

|

|

|

|

|

|

|

22997.1211 |

A Division of Health Care Service Corporation, a Mutual Legal Reserve Company, an Independent Licensee of the Blue Cross and Blue Shield Association |

||||

Page 1

3.Section C – Waiver of Coverage

You may enroll yourself and your dependents (spouse/domestic partner and children) in any coverage that your employer makes available to you, and that BCBSIL offers. While the standard enrollment application may appear to suggest that you can waive enrolling yourself for coverage but still enroll your dependents, BCBSIL’s policy requires that you (the employee) enroll in order to also enroll your dependents. If you choose to waive any coverage, your dependents cannot enroll in that coverage. However, you can enroll yourself in a coverage and choose to waive it for any of your dependents.

Please use this section to indicate if you do not wish to enroll yourself and/or any of your dependents in the following types of coverage:

• Medical |

• Dental |

• Basic Life |

• Dependent Life |

• |

• Voluntary Life (BCBSIL offers only to employees) |

||

While you may see these types of coverage on the standard application, they are not available from BCBSIL for small group business:

•Vision

•

For small group business, BCBSIL does not consider “Individual Coverage” (the second option on the standard application) as a valid reason to decline your

4.Section D – Individuals Requesting Coverage

•Weight and Height - BCBSIL requires the weight and height for yourself and your spouse/domestic partner. BCBSIL also requests weight and height be provided for any dependent that is 18 or older.

•Military Veteran Dependents - If you have dependents that are military veterans, you must include their honorable discharge documentation (Form

•Disabled Dependents - Medical certification must be provided for disabled dependents.

•HMO Coverage - If you have elected to enroll in HMO coverage, information about your Primary Care Physician (PCP) is needed. The standard enrollment application provides space for your PCP and his or her identification number. However, BCBSIL requires more information about your physician. To accommodate this, a separate HMO / CPO Provider Selection Enrollment and Change Form is also required for HMO enrollees. This form is used to collect the following information:

•Independent Practice Association (IPA) / Medical Group Number – this is required for BCBSIL to correctly identify the location you have chosen to access care from your PCP.

•PCP name and the identification number.

•Female enrollees may also choose a Woman’s Principal Health Care Provider (WPHCP), so there is space to list this provider’s name and identification number as well.

•CPO Coverage - BCBSIL offers a Community Participating Option (CPO) health benefit plan. This is similar to a PPO health benefit plan, but the member can gain greater savings by using providers at specific hospitals in the CPO network. Therefore, if you have chosen the CPO product, please use the HMO / CPO Provider Selection Enrollment and Change Form to indicate the number of the CPO network you have selected.

5.Section E – Current / Prior Coverage Information: Medicare

For small group business,“Dual Enrollment” is not an applicable Medicare entitlement reason for BCBSIL.

6.Sections F & G – Health Statement / Additional Information

This section should be completed by employees of groups that have

•For health coverage, BCBSIL does not require the health statement questions to be completed by employees of groups that have more than 50 employees enrolling.

•For basic life coverage, the health statement questions must be completed by the employee if the group has two or more eligible employees AND is applying for an amount over the guarantee issue, applying for voluntary life coverage or for any late enrollment.

•Two pages are left blank so that information in these sections can be pulled out for underwriting (if applicable).

7.Section H – Additional Coverage Options

As stated in item #3, the following types of coverage are not available from BCBSIL for small group business:

•Vision

•

22997.1211 |

Page 2 |

|

Illinois Standard Health Employee Application for Small Employers

INSURER USE ONLY

Policy/Group No.

Section No.

Effective Date

New Hire Waiting Period

For assistance in completing this application, please contact your employer or insurance agent. For information about your health insurance rights under state and federal law, and other resources, please contact the Illinois Department of Insurance’s Office of Consumer Health Insurance toll free at (877)

This standard application is intended to simplify your health insurance application process. You will only need to complete this one application, even when your employer has requested quotes from multiple insurance companies.

The information you provide in this application will be sent to the following insurance companies: (To be completed by employer)

Insurer: _______________________________ Insurer: _______________________________ Insurer: _______________________________

Insurer: _______________________________ Insurer: _______________________________ Insurer: _______________________________

TO BE COMPLETED BY EMPLOYER

Employer Name: |

|

|

|

Phone #: |

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

||

Reason for Enrollment (Mark all that apply) |

|

|

|

||

|

|

|

|||

New Enrollment: |

New Group Open Enrollment |

New Hire (Date: ____________________________) Late Enrollee |

|||

|

|

||||

Special Enrollment: |

Adoption Court Order Dependent Addition Divorce Domestic Partner |

||||

|

Loss of Coverage |

Marriage |

Newborn Other |

Date of Event: _________/__________/__________ |

|

|

|

||||

Employment Status: |

Active Retiree (Retirement Date: ________/________/________) |

||||

|

Illinois Continuation |

COBRA |

|

|

|

|

Employee Dependent |

|

|

|

|

|

Qualifying Event: ________________________________ |

|

|||

|

Start Date ________/________/_________ Projected End Date ________/________/_________ |

||||

A Employee Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (Last) |

|

|

(First) |

|

|

|

(MI) |

||

|

|

|

|

|

|

|

|

|

|

Job Title: |

|

|

|

|

Hire Date: |

|

|

Hrs/Week: |

|

|

|

|

|

|

|

|

|

|

|

Marital Status: Married |

Single |

Divorced Widowed Domestic Partner |

|

|

|

|

|||

|

|

|

|

|

|

|

|

||

Home Address: |

|

|

|

|

|

|

Apt #: |

||

|

|

|

|

|

|

|

|

||

City: |

|

|

|

|

State: |

Zip: |

|||

|

|

|

|

|

|

|

|

|

|

Home (or Cell) Phone: ( |

) |

|

|

|

Business Phone: ( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Address (optional): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B Coverage Requested

Medical

Employee: Yes No |

Spouse/Domestic Partner: Yes No |

Child(ren): Yes No |

Plan Choice: |

Plan Choice: |

Plan Choice: |

|

|

|

If you are waiving (declining) coverage for yourself or any member of your family, you must complete Section C below.

23071.0111 |

70670 |

ILLINOIS STANDARD HEALTH APPLICATION – SMALL EMPLOYER

Employer Name ________________________________ Employee Name __________________________________________

CWaiver of Coverage

Please complete this section only if you are waiving (declining) coverage for yourself or one or more of your family members.

I acknowledge that I have been given the opportunity to apply for group coverage available to me and my dependents through my employer.

I understand and agree:

If I am declining coverage for myself, my spouse/domestic partner, or my dependent child(ren) because of other coverage, I may in the future be able to enroll myself, my spouse/domestic partner, or my dependent child(ren) provided that I request enrollment within 31 days after the other coverage ends.

If I have a new spouse/domestic partner or child as a result of marriage, birth, adoption, or placement for adoption, I may be able to enroll myself and my new spouse/domestic partner or child provided that I request enrollment within 31 days after the marriage, birth, adoption, or placement for adoption.

If I decide to request coverage in the future, for a reason other than the termination of other coverage or the addition of a new spouse/domestic partner or child, I may be considered a late enrollee, if applicable, or I may have to wait until the plan’s next open enrollment period. I also understand that as a late enrollee, coverage for preexisting conditions may be excluded for up to a period of 18 months. This period may be offset by the time I, my spouse/domestic partner, or my dependent child(ren) was covered under a qualified health plan.

I certify that I was not pressured, forced, or unfairly induced by my employer, the agent, or the insurer(s) into waiving or declining the group coverage.

I DO NOT want, and hereby waive, coverage for (initial next to all that apply):

Medical for |

[ |

] Myself |

[ |

] My Spouse/Domestic Partner |

[ |

] My Dependent Child(ren) |

|

|

|

|

|

|

|

Dental✶ for |

[ |

] Myself |

[ |

] My Spouse/Domestic Partner |

[ |

] My Dependent Child(ren) |

|

|

|

|

|

|

|

Vision✶ for |

[ |

] Myself |

[ |

] My Spouse/Domestic Partner |

[ |

] My Dependent Child(ren) |

|

|

|

|

|

|

|

Basic Life✶ for |

[ |

] Myself |

[ |

] My Spouse/Domestic Partner |

[ |

] My Dependent Child(ren) |

|

|

|

|

|

|

|

Dependent Life✶ for |

[ |

] Myself |

[ |

] My Spouse/Domestic Partner |

[ |

] My Dependent Child(ren) |

|

|

|

|

|

|

|

Voluntary Life✶ for |

[ |

] Myself |

[ |

] My Spouse/Domestic Partner |

[ |

] My Dependent Child(ren) |

|

|

|

|

|

|

|

[ |

] Myself |

[ |

] My Spouse/Domestic Partner |

[ |

] My Dependent Child(ren) |

|

|

|

|

|

|

|

|

[ |

] Myself |

[ |

] My Spouse/Domestic Partner |

[ |

] My Dependent Child(ren) |

✶If offered.

I am declining group coverage for the following reason(s): (check all that apply)

Spouse/Domestic Partner’s Employer Plan |

Individual Coverage |

COBRA/State Continuation |

Medicare or other Government Program |

Other (please explain): _________________________________________________________

✪If you are declining ALL coverage for ALL persons, please skip to the Acknowledgement & Signature section on page 10 of this application.

|

2 |

23071.0111 |

70670 |

ILLINOIS STANDARD HEALTH APPLICATION – SMALL EMPLOYER

Employer Name ________________________________ Employee Name __________________________________________

DIndividuals Requesting Coverage

List yourself and all eligible family members to be included under coverage.

Please check with your employer or insurance agent about who may qualify as an eligible family member under the policy.

Illinois’ Young Adult Dependent Coverage law allows parents to cover children up to the age of 26, and up to age 30 for military veteran dependents, regardless of whether the child may be considered a dependent for tax or other purposes. For more information, please visit the Illinois Department of Insurance website at www.insurance.illinois.gov.

Note: For purposes of this application, an “eligible military veteran” is a veteran who served in the active or reserve components of the U.S. Armed Forces, including the National Guard, and who received a release or discharge other than a dishonorable discharge.

If additional space is required, please attach a separate sheet and be sure to sign and date that sheet.

Employee Name (Last) _______________________________ (First) _______________________________ (MI) _______

Social Security Number: |

|

|

|

|

|

Date of Birth: |

/ |

/ |

|

|

|

|

|

|

|

|

|

Weight: |

lbs. |

Height: |

ft. |

in. |

|

Gender: Male |

Female |

|

|

|

|

|

|

|

|

||

HMO only (if/when applicable): Primary Care Physician: |

|

|

|

Physician ID: |

|

|||

Spouse/Domestic Partner Name (Last) ________________________ (First) ________________________ (MI) ______

Social Security Number: |

|

|

|

|

|

|

Date of Birth: |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

Weight: |

lbs. |

|

Height: |

ft. |

in. |

|

Gender: |

Male |

Female |

|

|

|

|

|

|

|

|

|

|||

HMO only (if/when applicable): Primary Care Physician: |

|

|

|

|

Physician ID: |

|

||||

|

|

|||||||||

Dependent Name (Last) _______________________________ |

(First) _______________________________ (MI) _______ |

|||||||||

Social Security Number: |

|

|

|

|

|

|

Date of Birth: |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

Weight: |

lbs. |

|

Height: |

ft. |

in. |

|

Gender: |

Male |

Female |

|

|

|

|

|

|

|

|

|

|

|

|

Eligible Military Veteran: Yes |

No |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||||

HMO only (if/when applicable): Primary Care Physician: |

|

|

|

|

Physician ID: |

|

||||

|

|

|||||||||

Dependent Name (Last) _______________________________ |

(First) _______________________________ (MI) _______ |

|||||||||

Social Security Number: |

|

|

|

|

|

|

Date of Birth: |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

Weight: |

lbs. |

|

Height: |

ft. |

in. |

|

Gender: |

Male |

Female |

|

|

|

|

|

|

|

|

|

|

|

|

Eligible Military Veteran: Yes |

No |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||||

HMO only (if/when applicable): Primary Care Physician: |

|

|

|

|

Physician ID: |

|

||||

|

|

|||||||||

Dependent Name (Last) _______________________________ |

(First) _______________________________ (MI) _______ |

|||||||||

Social Security Number: |

|

|

|

|

|

|

Date of Birth: |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

Weight: |

lbs. |

|

Height: |

ft. |

in. |

|

Gender: |

Male |

Female |

|

|

|

|

|

|

|

|

|

|

|

|

Eligible Military Veteran: Yes |

No |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||||

HMO only (if/when applicable): Primary Care Physician: |

|

|

|

|

Physician ID: |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

23071.0111 |

|

|

|

|

|

|

|

|

|

70670 |

ILLINOIS STANDARD HEALTH APPLICATION – SMALL EMPLOYER

Employer Name ________________________________ Employee Name __________________________________________

Dependent Name (Last) _______________________________ |

(First) _______________________________ (MI) _______ |

||||||||

Social Security Number: |

|

|

|

|

|

|

Date of Birth: |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

Weight: |

lbs. |

|

Height: |

ft. |

in. |

|

Gender: Male |

Female |

|

|

|

|

|

|

|

|

|

|

|

Eligible Military Veteran: Yes |

No |

|

|

|

|

|

|

||

|

|

|

|

|

|

||||

HMO only (if/when applicable): Primary Care Physician: |

|

|

|

Physician ID: |

|

||||

|

|

|

|

|

|

|

|

|

|

ECurrent/Prior Coverage Information

Please indicate for EACH person listed on this application any health coverage, including Medicare or Medicaid, in effect within 24 months prior to the proposed effective date of this coverage. Each person applying for coverage must be listed below. If no health care coverage was in effect within the past 24 months, please indicate NONE. If coverage is provided for a dependent from a previous marriage or relationship, please attach a copy of the court documentation showing who is responsible for the dependent(s)’ health care coverage so that the insurer can determine whose coverage is primary.

Note: If you have had health care coverage within the last 63 days, your

If additional space is required, please attach a separate sheet and be sure to sign and date that sheet.

Employee Name (Last) _______________________________ (First) _______________________________ (MI) _______

Current/Most Recent Coverage: Group Medical Dental Individual Medical None

Dates of Coverage: From: _________/_________/_________ To: _________/_________/_________

Policyholder Name: ___________________________________ Insurer Name: __________________________________

Will the individual continue this coverage? Yes No

Prior Coverage (if any): Group Medical Dental Individual Medical None

Dates of Coverage: From: _________/_________/_________ To: _________/_________/_________

Policyholder Name: ___________________________________ Insurer Name: __________________________________

Spouse/Domestic Partner Name (Last) ________________________ (First) ________________________ (MI) ______

Current/Most Recent Coverage: Group Medical Dental Individual Medical None

Dates of Coverage: From: _________/_________/_________ To: _________/_________/_________

Policyholder Name: ___________________________________ Insurer Name: __________________________________

Will the individual continue this coverage? Yes No

Prior Coverage (if any): Group Medical Dental Individual Medical None

Dates of Coverage: From: _________/_________/_________ To: _________/_________/_________

Policyholder Name: ___________________________________ Insurer Name: __________________________________

Dependent Name (Last) _______________________________ (First) _______________________________ (MI) _______

Current/Most Recent Coverage: Group Medical Dental Individual Medical None

Dates of Coverage: From: _________/_________/_________ To: _________/_________/_________

Policyholder Name: ___________________________________ Insurer Name: __________________________________

Will the individual continue this coverage? Yes No

Prior Coverage (if any): Group Medical Dental Individual Medical None

Dates of Coverage: From: _________/_________/_________ To: _________/_________/_________

Policyholder Name: ___________________________________ Insurer Name: __________________________________

|

4 |

23071.0111 |

70670 |

ILLINOIS STANDARD HEALTH APPLICATION – SMALL EMPLOYER

Employer Name ________________________________ Employee Name __________________________________________

Dependent Name (Last) _______________________________ (First) _______________________________ (MI) _______

Current/Most Recent Coverage: Group Medical Dental Individual Medical None

Dates of Coverage: From: _________/_________/_________ To: _________/_________/_________

Policyholder Name: ___________________________________ Insurer Name: __________________________________

Will the individual continue this coverage? Yes No

Prior Coverage (if any): Group Medical Dental Individual Medical None

Dates of Coverage: From: _________/_________/_________ To: _________/_________/_________

Policyholder Name: ___________________________________ Insurer Name: __________________________________

Dependent Name (Last) _______________________________ (First) _______________________________ (MI) _______

Current/Most Recent Coverage: Group Medical Dental Individual Medical None

Dates of Coverage: From: _________/_________/_________ To: _________/_________/_________

Policyholder Name: ___________________________________ Insurer Name: __________________________________

Will the individual continue this coverage? Yes No

Prior Coverage (if any): Group Medical Dental Individual Medical None

Dates of Coverage: From: _________/_________/_________ To: _________/_________/_________

Policyholder Name: ___________________________________ Insurer Name: __________________________________

Dependent Name (Last) _______________________________ (First) _______________________________ (MI) _______

Current/Most Recent Coverage: Group Medical Dental Individual Medical None

Dates of Coverage: From: _________/_________/_________ To: _________/_________/_________

Policyholder Name: ___________________________________ Insurer Name: __________________________________

Will the individual continue this coverage? Yes No

Prior Coverage (if any): Group Medical Dental Individual Medical None

Dates of Coverage: From: _________/_________/_________ To: _________/_________/_________

Policyholder Name: ___________________________________ Insurer Name: __________________________________

Medicare: If you or any family members listed on this application have Medicare coverage, please complete the following information.

Enrolling Individual Name (Last) ___________________________ (First) ___________________________ (MI) _______

Medicare Part A Part B Part D Effective Date: _________/_________/_________

Reason for Medicare Entitlement: Age Disability ERSD Dual Enrollment

Medicare Number (please include

alpha prefix):

Enrolling Individual Name (Last) ___________________________ (First) ___________________________ (MI) _______

Medicare Part A Part B Part D Effective Date: _________/_________/_________

Reason for Medicare Entitlement: Age Disability ERSD Dual Enrollment

Medicare Number (please include

alpha prefix):

|

5 |

23071.0111 |

70670 |

THIS PAGE LEFT BLANK INTENTIONALLY

23071.0111 |

70670 |

ILLINOIS STANDARD HEALTH APPLICATION – SMALL EMPLOYER

Employer Name ________________________________ Employee Name __________________________________________

FHealth Statement

Instructions:

1.The information you provide in this application is confidential. You should discuss with your employer if you prefer to submit the completed health statement directly to the insurance company or insurance broker.

2.The health information you provide below will be used by the insurance company to determine the price to charge your group for the coverage applied for and whether a

3.Each medical question below applies to all persons requesting coverage.

4.Answer the questions below with either Yes or No. If you answer Yes to any question, you must provide additional information in Section G below.

5.Do not leave any question unmarked.

6.Neither your employer nor your insurance agent can waive these requirements or may authorize you to provide anything less than a complete and accurate response to each of the questions.

7.After you submit this application, the insurance company may call you to obtain additional confidential information needed to evaluate and aid the processing of your application.

1For the following conditions, within the past 5 years, have you or any dependents for whom you are requesting coverage:

•Been tested for or diagnosed with;

•Had medical treatment recommended;

•Received medical treatment, including prescription medications; or

•Been hospitalized for any illness, injury, or health condition related to any of the categories listed below?

|

A. Cardiovascular disease or heart attack, stroke, high blood pressure, or any |

Yes |

No |

|

|

other disease or disorder of the heart, arteries, blood, or blood vessels? |

|

|

|

|

|

|

|

|

|

B. Cancer or cancerous tumor? |

Yes |

No |

|

|

|

|

|

|

|

C. Asthma, emphysema, tuberculosis, or any other disorder of the lungs or |

Yes |

No |

|

|

respiratory system? |

|

|

|

|

|

|

|

|

|

D. Diabetes? If yes, check all that apply: |

Yes |

No |

|

|

□ |

|

|

|

|

|

|

|

|

|

E. Hepatitis, or any disorder of the liver, stomach, colon, or intestines? |

Yes |

No |

|

|

|

|

|

|

|

F. Growth disorder or a disorder of the pancreas? |

Yes |

No |

|

|

|

|

|

|

|

G. Chronic kidney stones, or other disorders of the kidney, prostate, or bladder? |

Yes |

No |

|

|

|

|

|

|

|

H. Reproductive organ disorders or infertility? |

Yes |

No |

|

|

|

|

|

|

|

I. Arthritis, or any other disorder of the joints, muscles, back, or bones? |

Yes |

No |

|

|

|

|

|

|

|

J. Mental or emotional disorder? |

Yes |

No |

|

|

|

|

|

|

|

K. Seizures/epilepsy, paralysis, or any other disorder of the brain or nervous |

Yes |

No |

|

|

system? |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

23071.0111 |

|

70670 |

|

|

ILLINOIS STANDARD HEALTH APPLICATION – SMALL EMPLOYER

Employer Name ________________________________ Employee Name __________________________________________

|

L. HIV positive, AIDS, diseases associated with AIDS, lupus, or other disorder of |

Yes |

No |

|

|

the immune system? |

|

|

|

|

|

|

|

|

|

M. Alcohol, drug, or substance use or dependency? |

Yes |

No |

|

|

|

|

|

|

|

N. Organ or bone marrow transplant? |

Yes |

No |

|

|

|

|

|

|

2 Are you, your spouse/domestic partner, or any dependent for whom you are requesting |

Yes |

No |

|

|

|

coverage currently pregnant? |

|

|

|

|

Due Date: _____/_____/_________ (MM/DD/YYYY) |

|

|

|

|

If yes, are multiples (twins, triplets, etc.) expected? |

Yes |

No |

|

|

Are there any known complications, or is a cesarean section planned? |

Yes |

No |

|

3Within the past 12 months, have you or your spouse/domestic partner

|

used any tobacco products? |

Employee: |

Yes |

No |

|

|

Spouse/Domestic Partner: |

Yes |

No |

|

|

|

|

|

4 |

Within the past 12 months, has any applicant been prescribed medication |

Yes |

No |

|

|

(other than for the common cold or flu) that is not indicated elsewhere in |

|

|

|

|

this application? |

|

|

|

|

|

|

|

|

5 |

Within the past 5 years, has any person applying for coverage been tested for or |

Yes |

No |

|

|

diagnosed with, had medical treatment recommended, received medical treatment, |

|

|

|

|

including prescription medications, or been hospitalized for any illness, injury or |

|

|

|

|

health condition not indicated above? |

|

|

|

GAdditional Information

If you answered “Yes” to any of the questions above, you must complete this section.

If additional space is required, please attach a separate sheet and be sure to sign and date that sheet.

Question Number: _________ Name of Individual: _________________________________________________________

Condition/Diagnosis: ________________________________________ Date Diagnosed (MM/YYYY): _________________

Treatment Received: ___________________________________________________________________________________

_____________________________________________________________________________________________________

Treatment ongoing? Yes No Last Treatment Date: _____________________________________________

Surgery, additional tests or treatment recommended? ______________________________________________________

Medication Prescribed (if any): __________________________________________________________________________

______________________________________________________________ Currently taking medication? Yes No

Question Number: _________ Name of Individual: _________________________________________________________

Condition/Diagnosis: ________________________________________ Date Diagnosed (MM/YYYY): _________________

Treatment Received: ___________________________________________________________________________________

_____________________________________________________________________________________________________

Treatment ongoing? Yes No Last Treatment Date: _____________________________________________

Surgery, additional tests or treatment recommended? ______________________________________________________

Medication Prescribed (if any): __________________________________________________________________________

______________________________________________________________ Currently taking medication? Yes No

|

7 |

23071.0111 |

70670 |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Standard Health Application form is designed to simplify the enrollment process by allowing employees to request health insurance coverage from Blue Cross and Blue Shield of Illinois (BCBSIL) using a single application. |

| Effective Date | This standard application took effect on January 1, 2011, replacing previous small group enrollment applications. |

| Eligibility | Domestic partners and retirees can be included only if the employer has chosen to cover them, highlighting the importance of checking eligibility with the employer. |

| Health Coverage Selection | Employees must choose a single type of health coverage for themselves and their dependents, ensuring that everyone enrolled is on the same plan. |

| Waiver of Coverage | Employees must enroll in coverage to enroll their dependents; waiving personal coverage excludes dependents from enrolling in that coverage as well. |

| Medical Documentation | For military veteran dependents, proof of honorable discharge (Form DD-214) is required. Weight and height are needed for all dependents aged 18 and older. |

| Health Statement Requirements | Groups with 2-50 enrolling employees must complete health statements but this is not required for larger groups. Additionally, health statements are necessary for specific coverages based on enrollment amounts. |

| State Law Compliance | The form follows provisions set forth by the Illinois Insurance Fairness Act (Public Act 96-0857), which governs standardization in the health insurance application process. |

Guidelines on Utilizing Standard Health Application

Completing the Standard Health Application form is an important step in obtaining health insurance through your employer. This application streamlines the process by allowing you to submit your information to multiple insurance companies using a single form. Below, you'll find clear and detailed steps that will help you fill out the form accurately.

- Gather Personal Information: Collect necessary personal details such as your full name, Social Security number, date of birth, height, weight, and contact information. Make sure you also have this information for your spouse/domestic partner and any dependent children.

- Complete Employer Information: Your employer's name and contact details must be filled out at the top of the form. This section ensures that the insurance companies know who is submitting the application.

- Indicate Coverage Requested: In Section B, select the type of health coverage you wish to enroll in, based on the options provided by your employer. Remember that all enrolled family members will receive the same coverage plan.

- Waiver of Coverage: If you or any dependents will not be enrolling in certain coverages, make sure to indicate this in Section C. You'll need to check each type of coverage you wish to decline and provide reasons where applicable.

- Individuals Requesting Coverage: List yourself and any eligible family members in Section D. Include the required details for each individual, such as name, Social Security number, weight, height, and indicate if they have a Primary Care Physician (if applicable).

- Current/Prior Coverage Information: If you have any previous health coverage information, complete Section E. This data may be used for underwriting purposes.

- Health Statement: If you are part of a group with 2-50 enrolling employees, complete Sections F and G. If you're unsure about filling these sections, consult your employer for guidance.

- Review and Submit: Thoroughly review your application for accuracy. Ensure all required sections are filled out and then submit the form to your employer for processing.

Completing this form accurately is crucial in ensuring that there are no delays or complications in your health coverage enrollment. After submission, your employer will send the completed application to the selected insurance companies on your behalf.

What You Should Know About This Form

What is the purpose of the Standard Health Application form?

The Standard Health Application form is designed to simplify the process for employees seeking health insurance coverage from Blue Cross and Blue Shield of Illinois (BCBSIL). This form serves as a uniform application created by the Illinois Department of Insurance, ensuring that all employees can apply for coverage with any participating insurance company without needing to fill out multiple forms.

Who is eligible to be covered under this application?

Eligible individuals include employees and their dependents, such as spouses, domestic partners, and dependent children. Coverage for domestic partners and retirees is contingent upon employer policies, so employees should confirm eligibility with their employer if they have any doubts.

How should I complete Section B on coverage requested?

In Section B, you need to select the type of health coverage you wish to enroll in, based on what your employer has made available. Choices can include various options like PPO, HMO, or plans linked to Health Savings Accounts (HSA). Remember, all enrolled dependents must select the same coverage type as you; individual selections are not allowed.

What is the procedure for waiving coverage in Section C?

If you wish to decline health coverage for yourself or your dependents, you must fill out Section C. It's crucial to note that, according to BCBSIL policy, if you choose to waive coverage for yourself, your dependents cannot enroll in that coverage either. However, you can opt out for your dependents while still enrolling yourself. Ensure you understand the implications of being a late enrollee if you decide to apply for coverage later.

What information do I need to provide in Section D regarding those requesting coverage?

For Section D, you will need to provide the height and weight of yourself, your spouse, and any dependent aged 18 or older. Additional documentation is required for military veteran dependents, such as Form DD-214, and for disabled dependents, a medical certification must be included. If enrolling in an HMO, details about your Primary Care Physician are necessary.

Are there any health statements required in Sections F and G?

Employees of groups with 2-50 enrolled individuals must complete health statements in Sections F and G. For groups with more than 50 employees, completing these health statements is not necessary. For basic life coverage, the statements are required if there are two or more eligible employees. The application also provides space for additional information for underwriting purposes.

Can I include my children on the plan after they turn 18?

Yes, the Illinois Young Adult Dependent Coverage law allows parents to cover children up to age 26 and military veteran dependents up to age 30. This rule applies regardless of whether the child qualifies as a dependent for other purposes.

What additional coverage options are not offered by BCBSIL?

BCBSIL does not provide vision or long-term disability coverage for small group business plans. These specified types of coverage will not be available on the application, so ensure to consider other available options that may fit your needs.

What should I do if I have more dependents than the form allows for?

If there are additional dependents that you need to include on the application, you can attach a separate sheet. Just be sure to sign and date that additional information to ensure that it is clearly associated with your application.

Who can I contact if I need help completing the application?

If you require assistance with the Standard Health Application form, you should reach out to your employer or an insurance agent. For broader questions regarding your health insurance rights, the Illinois Department of Insurance’s Office of Consumer Health Insurance can be contacted at their toll-free number.

Common mistakes

When completing the Standard Health Application form, individuals often make several common mistakes that can complicate the enrollment process. One frequent error is omitting necessary personal information such as full names, Social Security numbers, or contact information. This information is crucial for processing the application efficiently. Ensure that all required fields are filled in completely to avoid delays.

Another common mistake is misunderstanding the coverage requested. Applicants sometimes select a different coverage type than what their employer offers. It is important to consult with your employer regarding the available health plans before making selections on the application. Failing to align choices with employer offerings can lead to confusion down the line.

Many people also misinterpret the waiver of coverage section. Some individuals believe they can waive coverage for their dependents while avoiding enrollment themselves. This misconception can result in denied coverage for dependents. It is essential to follow the guidelines: if an employee waives coverage, their dependents cannot enroll.

Incomplete information about dependents is another frequent issue. Applicants might forget to provide details such as weight, height, or other necessary medical information for dependents over the age of 18. This missing information can slow down the approval process. Be diligent about providing complete and accurate information for all listed individuals.

Finally, many applicants overlook the need for additional documents required for military veteran or disabled dependents. If applicable, ensure that you include necessary paperwork, like honorable discharge documentation or medical certifications. Neglecting these requirements could lead to a rejection of the application or delay in processing. Always double-check to ensure all necessary documents are included before submission.

Documents used along the form

When applying for health insurance, you may encounter several accompanying documents that are essential for the enrollment process. Each of these forms serves a specific purpose to ensure accurate and comprehensive coverage. Below is a list of common documents often used alongside the Standard Health Application form.

- Waiver of Coverage Form: This document allows employees to formally decline health coverage for themselves or their dependents. It clarifies the implications of waiving such coverage.

- Provider Selection Form: Required particularly for HMO or CPO enrollments, this form collects information about your selected primary care physician, ensuring proper access to medical services.

- Current Insurance Documentation: Employees may need to provide proof of existing health insurance coverage when applying for new policies. This aids in determining eligibility and coverage options.

- Spousal Coverage Verification: This document verifies the spouse's and any dependent’s eligibility for coverage under a separate policy, especially when multiple plans are involved.

- Medical Certification for Disabled Dependents: Families with dependents who are disabled must provide medical documentation as part of their application process to establish coverage eligibility.

- DD-214 Form: Military veterans must submit this form, which proves honorable discharge, when applying for coverage under the military veteran dependent category.

- Health Statement: This section, required for groups with fewer than 50 employees, collects health information regarding the applicants to assess risk and tailor coverage options appropriately.

Understanding these forms and their purposes can significantly ease the application process. It is essential to collaborate with your employer or insurance agent to ensure that all required documentation is accurately completed and submitted.

Similar forms

- Health Insurance Claim Form: Similar to the Standard Health Application, this form is used for health insurance purposes but focuses on submitting claims for reimbursement rather than applying for coverage. Both documents require specific patient and provider information to process requests accurately.

- COBRA Continuation Coverage Election Form: This document is used when a person is given the option to continue their health insurance after leaving employment. Like the Standard Health Application, it requires personal and coverage details, ensuring that the individual maintains necessary medical coverage.

- Medicare Enrollment Application: This application allows individuals to sign up for Medicare benefits. Both the Medicare Enrollment Application and the Standard Health Application address individual health coverage needs but target different government insurance programs.

- Short-Term Health Insurance Application: Similar to the Standard Health Application, this document is utilized for enrolling in temporary health coverage. It also collects personal information and coverage selections, but is typically shorter-term and offers different benefits.

- Group Health Insurance Policy Application: This application is for employers applying for group health insurance coverage for their employees. Both forms gather relevant information about the applicant and their dependents, ensuring that the coverage is tailored to the group’s needs.

- Long-Term Care Insurance Application: While aimed at securing long-term care benefits, this application shares similarities with the Standard Health Application by capturing health history and personal information. Both are essential for ensuring the proper coverage based on individual health status.

Dos and Don'ts

When filling out the Standard Health Application form, it is important to be thorough and accurate. Here are some guidelines on what you should and shouldn’t do:

- Do: Carefully read the instructions provided at the beginning of the application.

- Do: Ensure that you provide correct and complete information for yourself and all dependents.

- Do: Verify the type of coverage your employer offers before making your selections.

- Do: Include required documentation, such as military discharge forms for veteran dependents.

- Don’t: Assume that all information is optional; some fields may be mandatory for processing your application.

- Don’t: Waive coverage without understanding the implications for your dependents.

Misconceptions

Misconceptions about the Standard Health Application form can lead to confusion and mistakes during the enrollment process. Below are ten common misconceptions clarified:

- Everyone must fill out the same information for all insurance companies. This is incorrect. The Standard Health Application allows individuals to submit the same application to multiple insurance companies, simplifying the process.

- You can choose different health plans for each dependent. This is a misconception. All enrolled dependents must be covered under the same health plan or product.

- You can waive coverage for dependents without waiving your own coverage. This is not true. If you waive coverage for yourself, you cannot enroll your dependents.

- The application requires all requested information to be submitted. This is misleading. Some information is optional, while other information is necessary for enrollment, depending on the insurance provider.

- Dependent information is only needed for minors. This is false. Individuals 18 or older also require their weight and height provided in the application.

- All types of health coverage are available through BCBSIL. This is incorrect. Specific coverages, like vision and long-term disability, are not available through BCBSIL for small group businesses.

- A health statement is required for all groups. This is misleading. Only groups with 2-50 enrolling employees need to complete the health statement section.

- You can leave the application blank and complete it later. This is not an option. It's essential to fill out the application correctly and submit it to avoid delays in coverage.

- Individuals do not need to provide documentation for military veteran dependents. This is inaccurate. Documentation, such as honorable discharge forms, must be included for military veteran dependents.

- Dual enrollment is an acceptable reason for declining coverage. This is incorrect. BCBSIL does not accept “Dual Enrollment” as a valid reason for declining employer-offered coverage.

Understanding these misconceptions can facilitate a smoother enrollment experience. Always consult your employer or insurance agent if you have questions about the application process.

Key takeaways

Understanding how to fill out the Illinois Standard Health Application form is crucial for employees requesting health insurance coverage. Here are key takeaways to keep in mind:

- All small group insurance companies in Illinois must use this standard form as mandated by the Illinois Insurance Fairness Act.

- Employers can submit this application to multiple insurance companies, simplifying the enrollment process for employees.

- It’s essential to clarify with your employer which specific health coverage options are available to you.

- Employees must enroll themselves in order for their dependents to receive coverage.

- For HMO plans, additional forms may be required to provide detailed information about your chosen Primary Care Physician.

- Be mindful of the health statement section; it only applies to groups with 2-50 enrolling employees.

- If waiving coverage for yourself or dependents, ensure you understand the implications for future enrollment.

- Correctly report weight and height for yourself and all dependents aged 18 and older, as this information is mandatory.

- Check with your employer about the eligibility of domestic partners and retirees for coverage under your plan.

- Remember, certain coverage options like vision and long-term disability may not be available to small group employees through BCBSIL.

Browse Other Templates

Hamilton Book - Choose from a variety of genres and authors to enrich your reading experience.

California Promise - Check the boxes for the specific actions you are requesting on the form.

Employee Travel Request Form - Denial of travel requests can occur; it’s essential to understand the reasoning behind such decisions.