Fill Out Your State Farm Authorization To Pay Form

The State Farm Authorization To Pay form plays a crucial role in the claims process for homeowners and businesses alike. When damage occurs and repairs are needed, this form allows policyholders to authorize State Farm to pay contractors or service providers directly for the repairs covered under their insurance policy. By signing this document, you acknowledge your understanding that it applies strictly to the expenses detailed in your policy following a specific loss. It is essential to recognize that any services or enhancements outside the scope of your coverage will require your personal payment to the independent providers. This form also serves as a confirmation that you have received and reviewed the final estimates and warranties from your service provider, ensuring that all work performed meets your satisfaction. Additionally, it outlines that if there is a lien on your property, your lender may conduct an inspection to ensure that the repairs are completed as outlined in the estimates. Furthermore, California law mandates that individuals presenting false claims may face serious repercussions, underscoring the importance of accuracy and honesty in the claims process. Understanding these key elements can help streamline communication with your insurance company and contractors, making the repair process more efficient and effective.

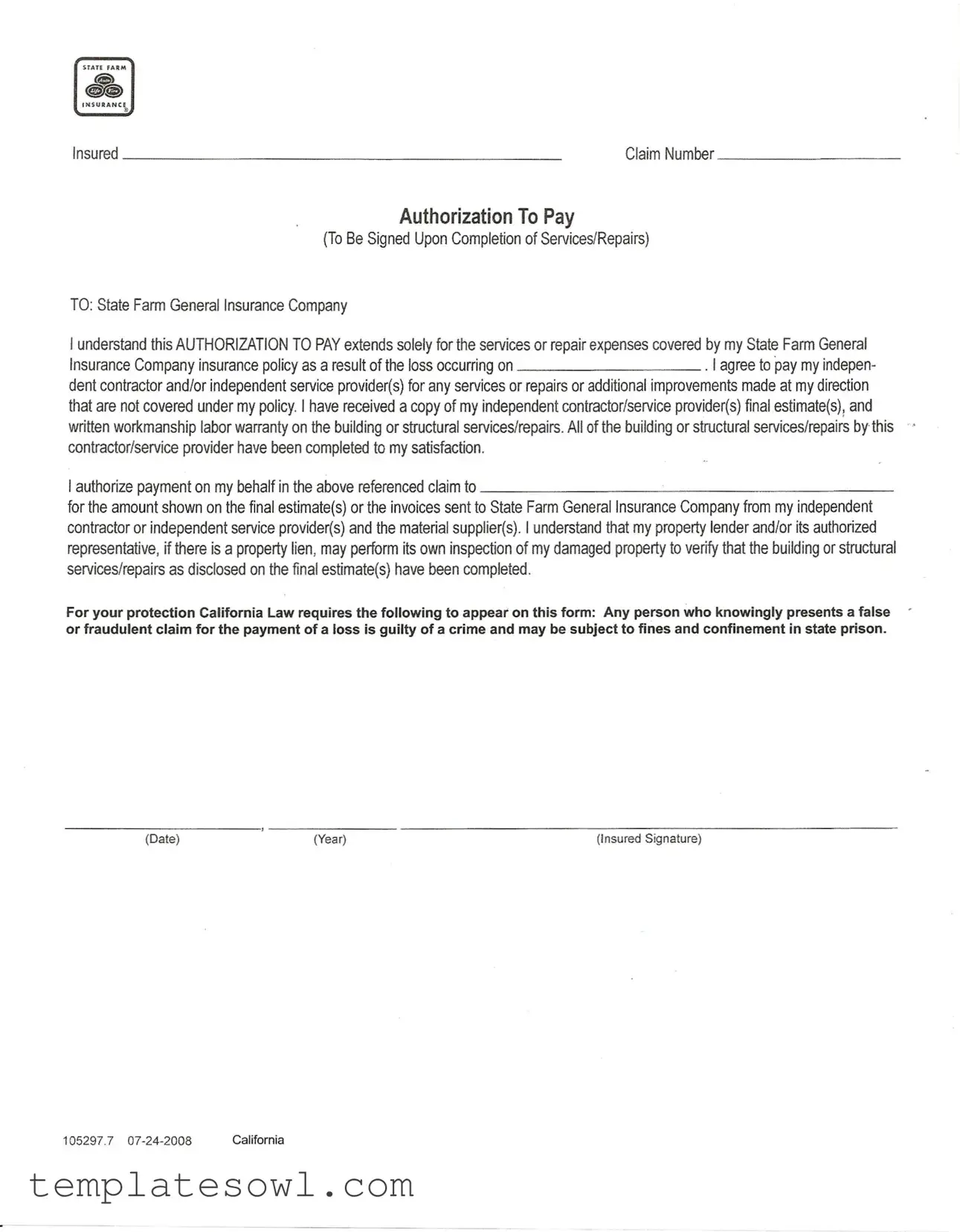

State Farm Authorization To Pay Example

STATE FARM

te\

~

INSURANCE

E

Insured |

_ |

Claim Number |

_ |

Authorization To Pay

(To Be Signed Upon Completion of Services/Repairs)

TO: State Farm General Insurance Company

I understand this AUTHORIZATION TO PAY extends solely for the services or repair expenses covered by my State Farm General

Insurance Company insurance policy as a result of the loss occurring on. I agree to pay my indepen- dent contractor and/or independent service provider(s) for any services or repairs or additional improvements made at my direction that are not covered under my policy. I have received a copy of my independent contractor/service provider(s) final estimate(s), and written workmanship labor warranty on the building or structural services/repairs. All of the building or structural services/repairs by this contractor/service provider have been completed to my satisfaction.

I authorize payment on my behalf in the above referenced claim to_ for the amount shown on the final estimate(s) or the invoices sent to State Farm General Insurance Company from my independent contractor or independent service provider(s) and the material supplier(s). I understand that my property lender and/or its authorized representative, if there is a property lien, may perform its own inspection of my damaged property to verify that the building or structural services/repairs as disclosed on the final estimate(s) have been completed.

For your protection California Law requires the following to appear on this form: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

(Date) |

(Year) |

(Insured Signature) |

105297.7

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The form authorizes State Farm to pay for services or repairs covered by an insurance policy after a loss occurs. |

| Insured Information | It requires the insured’s details, including their name and claim number, to identify the specific case. |

| Contractor Agreement | The insured agrees to pay for any services beyond those covered by the insurance policy. |

| Completion Confirmation | The form asserts that all services and repairs have been completed satisfactorily. |

| Payment Authorization | The insured authorizes payment to contractors or service providers based on the final estimates or invoices. |

| Lien Inspections | If there is a property lien, the lender may inspect the property to verify completed repairs. |

| Legal Warning | California law states that presenting a false claim may lead to criminal penalties, including fines and imprisonment. |

| Date and Signature | The form must include the date, year, and the insured's signature upon completion of services. |

Guidelines on Utilizing State Farm Authorization To Pay

Once you have gathered all necessary information and documents, you can proceed to complete the State Farm Authorization To Pay form. This process ensures that payments can be facilitated efficiently once the required services or repairs have been finished. Carefully follow the instructions below to ensure the form is filled out accurately.

- Begin by locating the Insured section on the form. Enter your name as the insured individual or entity.

- Move to the Claim Number field. Input the specific claim number associated with your insurance case.

- In the section that states TO:, write “State Farm General Insurance Company” if it's not pre-filled.

- Read the statement regarding the authorization carefully. Ensure that you understand that this authorization only covers services or repairs mentioned in your policy.

- Next, indicate the date of the loss covered by your policy. Specify the exact date to maintain accurate records.

- In the following part, fill in the name of your independent contractor or service provider to whom the payment will be directed.

- Write the total amount to be paid, as specified in the final estimate or invoice. Ensure this number accurately reflects the agreed costs.

- Sign and date the form in the designated area. This signature indicates your agreement to authorize payments as described in the form.

After you have completed the form, review it carefully for any missing or incorrect information. Once verified, you can submit it to State Farm for processing.

What You Should Know About This Form

What is the purpose of the State Farm Authorization To Pay form?

The State Farm Authorization To Pay form is designed to allow State Farm to directly pay your independent contractor or service provider for services or repairs related to your insurance claim. By completing this form, you confirm that the work has been completed to your satisfaction and agree to the terms laid out regarding payment and coverage.

What should I expect after submitting the Authorization To Pay form?

Once you submit the Authorization To Pay form, State Farm will process the payment based on the final estimates provided by your contractor or service provider. You can expect that the payment will be made directly to those parties involved, provided all conditions are met and the services rendered fall under the coverage of your policy.

Do I need to pay my contractor directly if the services are covered by my insurance?

If the services or repairs are covered by your insurance policy, the Authorization To Pay form allows the payment to be directed to your contractor, so you typically would not need to pay them directly. However, if any improvements or additional services are requested beyond the scope of your insurance coverage, you would be responsible for those costs.

What happens if my insurance claim is denied?

If your insurance claim is denied, the Authorization To Pay form becomes void in terms of payment. You will then be responsible for settling any amounts owed directly to the contractor or service provider personally. It's important to review the reasons for the claim denial and consider appealing if you feel the decision was incorrect.

Is there any risk involved in signing the Authorization To Pay form?

Signing the Authorization To Pay form is a commitment to allow payment on your behalf and confirm satisfaction with the services rendered. Ensure that you are comfortable with the work completed before signing. Furthermore, be wary of any false claims, as presenting inaccurate information can lead to legal repercussions.

What should I do if there are additional repairs needed after I have signed the form?

If additional repairs are needed after signing the form, you will need to discuss this with your contractor. Be aware that these new repairs may not be covered under your original insurance claim. It would be necessary to file a new claim with State Farm for these additional costs, should they fall within the coverage of your policy.

Common mistakes

Filling out the State Farm Authorization To Pay form may seem straightforward, but mistakes can lead to delays or issues with claims. One common error is failing to fill in the claim number. This number is crucial, as it helps the insurance company identify and process the claim efficiently. Omitting this detail can cause confusion and result in unnecessary delays.

Another mistake often made is not including the correct amount. Individuals sometimes write an estimated figure instead of the actual amount shown on the final estimate or invoice. This discrepancy may lead to incorrect payments and could complicate the entire claims process.

People frequently overlook providing their signature. It is essential to sign the form for it to be valid. Without a signature, State Farm cannot proceed with payment, and it may be returned for correction, wasting valuable time.

Many individuals also forget to indicate the date of completion of the services or repairs. This date is important for record-keeping and helps prevent confusion regarding when the work was done. If the date is missing, it could lead to additional follow-up questions from the insurance company.

Another common error is not retaining a copy of the final estimate or invoices submitted with the form. Keeping these documents is vital, as they provide proof of the services rendered and the agreed-upon amounts. Losing these documents can complicate future disputes or questions regarding the claim.

Sometimes, individuals fail to review the terms and conditions of their policy before filling out the form. This oversight can lead to misunderstandings about what is covered and what services are eligible for payment. Familiarity with the policy sets clear expectations and helps ensure that all necessary expenses are included.

People often neglect to provide documentation related to warranties or guarantees on the work done. Providing this documentation can strengthen the claim and demonstrate the quality and assurance of the repairs made. Omitting such details can weaken the insurance company’s ability to approve the claim swiftly.

Another mistake is rushing through the form, leading to typos or unclear handwriting. Errors such as these can create confusion about the details of the claim and delay processing time. Taking a moment to double-check for clarity can significantly enhance the form's effectiveness.

Another point of practice is failing to understand the implications of the form’s authorization. Some individuals may not realize that by signing it, they authorize State Farm to pay the contractor directly. This lack of clarity can lead to surprises later when payments are processed without the insured's explicit consent.

Lastly, individuals sometimes submit the form without confirming that all repairs have been satisfactorily completed. It is essential to ensure that the work meets expectations before authorizing payment. Skipping this step can lead to dissatisfaction and complicate the resolution of potential disputes with the contractor.

Documents used along the form

The State Farm Authorization To Pay form is an essential document in the claims process. It facilitates the payment for services or repairs related to a covered loss under an insurance policy. Alongside this form, several other documents often come into play. Each has its unique purpose, contributing to a smooth and transparent claims experience for the insured.

- Claim Form: This document provides the basic details of the insurance claim, such as the insured's information, the nature of the loss, and any relevant policy numbers. It is typically the first step in initiating the claims process.

- Contractor Estimate: An estimate provided by the independent contractor or service provider detailing the projected costs for the necessary repairs or services. It sets the groundwork for what the insured can expect in terms of expenses.

- Invoice: After the services have been rendered, an invoice outlines the total charges incurred. It reflects the actual costs as opposed to the initial estimate and is crucial for processing payments.

- Final Inspection Report: This report documents the completion of repairs and verifies that the work has been done according to the terms agreed upon. It serves as a confirmation for the insurer regarding the quality of work performed.

- Assignment of Benefits (AOB): AOB allows the insured to transfer the right to receive payment to the contractor or service provider. This is particularly useful in streamlining the payment process and ensuring prompt settlement.

- Proof of Loss: This document details the circumstances surrounding the loss, including when and how it occurred. It might be necessary for the insurer to assess the validity of the claim.

- Labor Warranty: A warranty provided by the contractor that guarantees the quality of workmanship for the repairs done. This protects the insured from future issues related to the repairs.

- Insurance Policy Document: Your original policy outlines the coverage details, including what is and is not covered. It serves as a reference throughout the claims process.

Understanding these various forms and documents is crucial for both insured individuals and service providers. Having the right paperwork not only aids in efficient handling of claims but also ensures that all parties involved can fully comprehend their rights and responsibilities during this important process.

Similar forms

The State Farm Authorization To Pay form shares similarities with several other legal and financial documents related to insurance claims and services. Here are six documents that resemble the Authorization To Pay form:

- Insurance Release Form: This document allows the insured to release their claim information to a third party. Like the Authorization To Pay, it requires the insured's consent for payment and is connected to the claim process.

- Direct Payment Authorization: This form authorizes an insurer to make direct payments to service providers on behalf of the insured. The core function is similar: facilitating payment for services under the scope of insurance coverage.

- Assigning Benefits Form: This document enables the insured to assign their insurance benefits directly to a contractor or service provider. It parallels the Authorization To Pay since both address payment methods and the consent of the insured.

- Claim Settlement Agreement: This form outlines the terms and conditions under which an insurer agrees to settle a claim. Both documents involve an agreement to payment based on the fulfillment of services specified in the agreement.

- Service Agreement: A service agreement details the terms of service and payment for repairs or services rendered. It shares a common ground with the Authorization To Pay by explicitly defining the scope of services provided and the expectations for payment.

- Proof of Loss Form: This document is used by the insured to formally document losses suffered and is a necessary component to initiate a claim. Both forms require the insured’s approval and acknowledgment regarding the covered services and expenses.

Dos and Don'ts

When filling out the State Farm Authorization To Pay form, it’s important to follow certain guidelines. Below are things you should and shouldn’t do to ensure the process goes smoothly.

- Make sure to fill in your claim number accurately.

- Provide your insured name clearly to avoid any confusion.

- Sign the form only after all services or repairs are completed.

- Keep a copy of the final estimate and warranty for your records.

- Do not alter any of the printed instructions on the form.

- Avoid filling out the form if there are unresolved issues with the services provided.

- Don’t forget to date the form before submitting it.

- Never sign the form without reading through all the details carefully.

Misconceptions

Many people have misconceptions about the State Farm Authorization To Pay form. Understanding these misconceptions helps clarify its purpose and ensure proper use. Here are seven common misunderstandings:

- It guarantees payment for all repairs. The form does not ensure payment for any and all repairs. It only authorizes payment for services directly related to the claim covered by the insurance policy.

- Signature means I accept all costs. Signing the form does not indicate agreement to pay for any costs not covered by the policy. You are only authorizing payment to the contractor for work included in the claim.

- Once signed, I cannot dispute repairs. Signing the form does not prevent you from raising concerns about the quality of work or disputing charges. You retain the right to express dissatisfaction.

- This form replaces my insurance policy terms. The Authorization To Pay form is separate from your insurance policy. It does not alter the terms, conditions, or coverage limits outlined in your policy.

- State Farm processes the payment immediately. There is no guarantee that payment will be made quickly after signing the form. Processing times can vary based on different factors, including verification of repairs.

- I'm responsible for investigating my contractor. While you should choose qualified contractors, this form does not obligate you to investigate them. However, due diligence is always a wise practice.

- It applies to any contractor or service provider. The form specifically authorizes payment to independent contractors or service providers who are directly associated with your claim. Not all contractors are covered under this authorization.

These misconceptions can lead to confusion and misunderstandings. A clearer understanding of the State Farm Authorization To Pay form can lead to better management of claims and repairs.

Key takeaways

- Understand the Purpose: The State Farm Authorization To Pay form enables you to authorize payment for services or repairs covered by your insurance policy.

- Claim Information: Ensure that you fill in the correct claim number on the form to avoid confusion.

- Service Completion: Only sign the form after all services or repairs have been completed to your satisfaction.

- Independent Contractors: You may need to pay independent contractors or service providers for any work that is not covered under your policy.

- Final Estimates: Review and retain a copy of the final estimates and written workmanship warranties provided by your contractors.

- Inspection Rights: Be aware that your property lender may inspect your damaged property, especially if there is a property lien in place.

- Fraud Warning: Know that presenting a false claim can lead to significant legal consequences, including fines and potential imprisonment.

- Signature Required: Don’t forget to sign and date the form to validate your authorization clearly.

Browse Other Templates

Llc Fees Illinois - If an express carrier account number is provided, documents can be sent via express mail for faster delivery.

Rosebud Sioux Tribe - Applications must be mailed to the specified address in Pine Ridge, SD.