Fill Out Your State Farm Change Of Beneficiary Form

When managing your financial assets, it's essential to ensure that your loved ones are adequately protected in the event of your passing. The State Farm Change Of Beneficiary form is a crucial tool designed to help you designate or change the beneficiaries of your various accounts, including Traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, Tax Sheltered Accounts, and Archer Medical Savings Accounts. By filling out this form, you revoke any previous beneficiary designations and have the opportunity to specify new beneficiaries, giving you peace of mind regarding your financial legacy. This form requires essential information, such as the names, Social Security numbers, and relationships of your chosen beneficiaries, and mandates your signature to validate the changes. For couples, the signature of a spouse or partner may be necessary, especially in certain states where community property laws apply. If you intend to name more than four beneficiaries, additional pages can be attached, ensuring everyone you wish to include is documented. Should you encounter questions or need assistance throughout this process, State Farm provides a dedicated customer service line for support. Remember, filing the completed form with the custodian prior to your passing is vital for it to take effect, making it an important step in securing your financial intentions.

State Farm Change Of Beneficiary Example

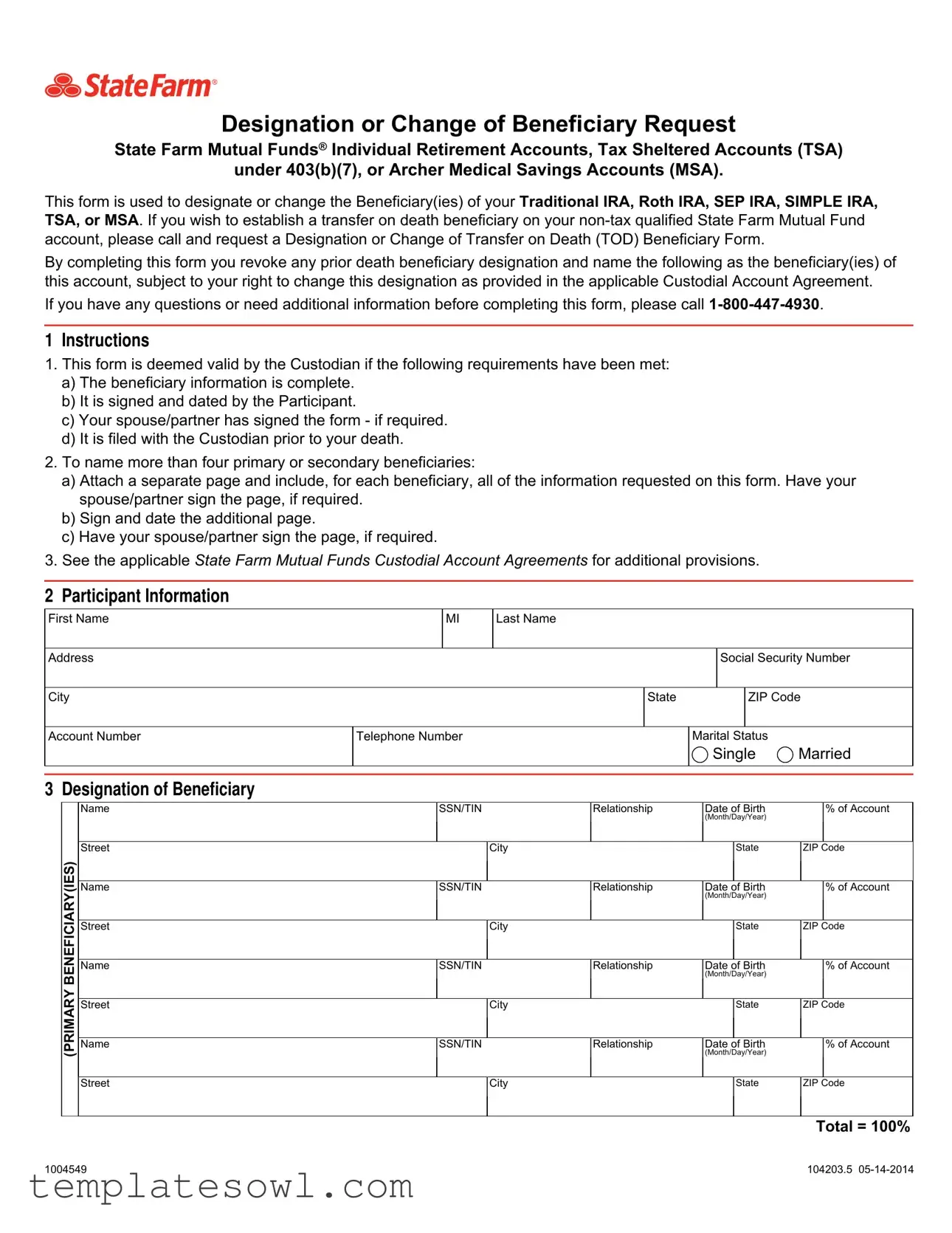

Designation or Change of Beneficiary Request

State Farm Mutual Funds® Individual Retirement Accounts, Tax Sheltered Accounts (TSA)

under 403(b)(7), or Archer Medical Savings Accounts (MSA).

This form is used to designate or change the Beneficiary(ies) of your Traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA, TSA, or MSA. If you wish to establish a transfer on death beneficiary on your

By completing this form you revoke any prior death beneficiary designation and name the following as the beneficiary(ies) of this account, subject to your right to change this designation as provided in the applicable Custodial Account Agreement.

If you have any questions or need additional information before completing this form, please call

1 Instructions

1.This form is deemed valid by the Custodian if the following requirements have been met:

a)The beneficiary information is complete.

b)It is signed and dated by the Participant.

c)Your spouse/partner has signed the form - if required.

d)It is filed with the Custodian prior to your death.

2.To name more than four primary or secondary beneficiaries:

a)Attach a separate page and include, for each beneficiary, all of the information requested on this form. Have your spouse/partner sign the page, if required.

b)Sign and date the additional page.

c)Have your spouse/partner sign the page, if required.

3.See the applicable State Farm Mutual Funds Custodial Account Agreements for additional provisions.

2 Participant Information

First Name

MI

Last Name

Address

Social Security Number

City

Account Number

|

State |

|

ZIP Code |

|

|

|

|

|

|

Telephone Number |

Marital Status |

|

||

|

|

Single |

Married |

|

|

|

|

|

|

3 Designation of Beneficiary

(PRIMARY BENEFICIARY(IES)

Name |

SSN/TIN |

Relationship |

Date of Birth |

|

% of Account |

||

|

|

|

|

(Month/Day/Year) |

|

|

|

|

|

|

|

|

|

|

|

Street |

|

City |

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

SSN/TIN |

Relationship |

Date of Birth |

|

% of Account |

||

|

|

|

|

(Month/Day/Year) |

|

|

|

|

|

|

|

|

|

|

|

Street |

|

City |

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

SSN/TIN |

Relationship |

Date of Birth |

|

% of Account |

||

|

|

|

|

(Month/Day/Year) |

|

|

|

|

|

|

|

|

|

|

|

Street |

|

City |

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

SSN/TIN |

Relationship |

Date of Birth |

|

% of Account |

||

|

|

|

|

(Month/Day/Year) |

|

|

|

|

|

|

|

|

|

|

|

Street |

|

City |

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total = 100%

1004549 |

104203.5 |

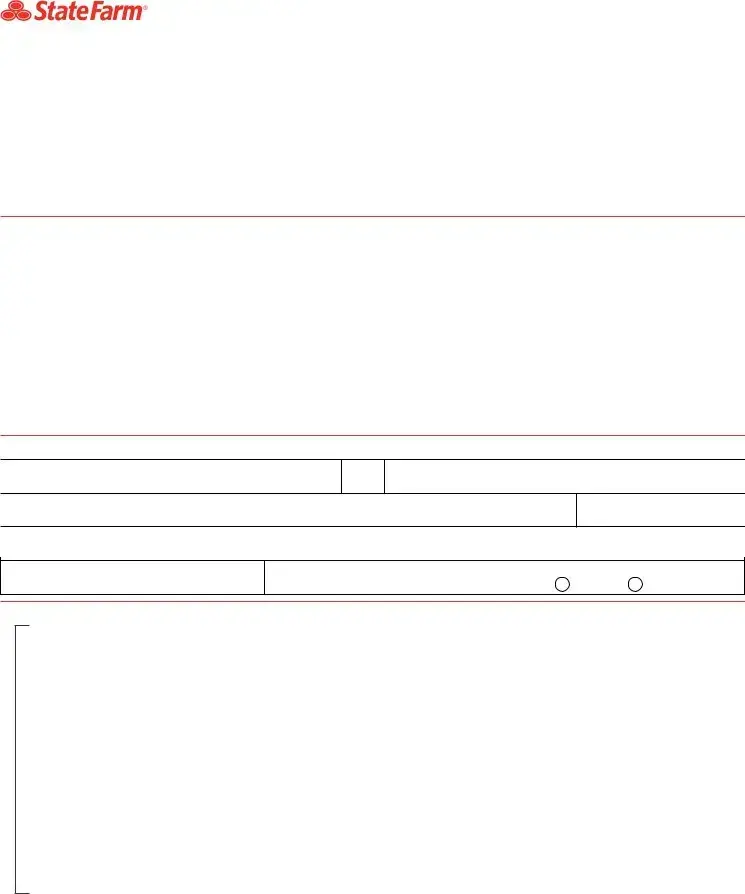

(SECONDARY BENEFICIARY(IES)

Name |

SSN/TIN |

Relationship |

Date of Birth |

|

% of Account |

||

|

|

|

|

(Month/Day/Year) |

|

|

|

|

|

|

|

|

|

|

|

Street |

|

City |

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

SSN/TIN |

Relationship |

Date of Birth |

|

% of Account |

||

|

|

|

|

(Month/Day/Year) |

|

|

|

|

|

|

|

|

|

|

|

Street |

|

City |

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

SSN/TIN |

Relationship |

Date of Birth |

|

% of Account |

||

|

|

|

|

(Month/Day/Year) |

|

|

|

|

|

|

|

|

|

|

|

Street |

|

City |

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

SSN/TIN |

Relationship |

Date of Birth |

|

% of Account |

||

|

|

|

|

(Month/Day/Year) |

|

|

|

|

|

|

|

|

|

|

|

Street |

|

City |

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total = 100%

4 Signature(s)

Participant's Signature |

Date |

Signature of Spouse/Partner (if required*)

*Note: Spouse or partner's signature is required if the spouse/partner is not the sole primary beneficiary for this account and the spouse/partner and/or Participant resides in Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington or Wisconsin. By signing, the spouse/partner voluntarily and irrevocably consents to the beneficiary designation set forth above and waives all rights he/she may have with respect to the account, except for any rights provided under the applicable Custodial Account Agreement.

Please fax or mail all signed completed forms to: State Farm Mutual Funds

P.O. Box 219548

Kansas City, Missouri

FAX:

1004549 |

104203.5 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | This form is used to change or designate beneficiaries for various accounts such as Traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA, TSA, or MSA. |

| Revocation of Prior Designations | Completing this form cancels any previous beneficiary designations, ensuring your current wishes are clear. |

| Requirements for Validity | The form is valid if completed accurately, signed, and if any required spouse/partner signature is included and submitted before your death. |

| Additional Beneficiaries | For more than four beneficiaries, attach a separate page with the required information and appropriate signatures. |

| State-Specific Rules | If you reside in certain states, your spouse’s signature is necessary unless they are the only primary beneficiary. These states include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. |

Guidelines on Utilizing State Farm Change Of Beneficiary

After completing the State Farm Change of Beneficiary form, ensure that it is submitted promptly. Follow these steps carefully to avoid any delays or issues with your beneficiary designation.

- Gather necessary information about your beneficiaries, including their full names, Social Security Numbers (or Tax Identification Numbers), relationship to you, dates of birth, and addresses.

- Fill out the Participant Information section at the top of the form. Include your first name, middle initial, last name, address, Social Security Number, city, state, ZIP code, account number, telephone number, and marital status.

- Complete the Designation of Beneficiary section by listing primary beneficiaries. For each beneficiary, provide their name, SSN/TIN, relationship to you, date of birth, percentage of the account, and their street address, city, state, and ZIP code.

- If you have more than four primary beneficiaries, attach a separate page with the same beneficiary information for each additional person. Ensure you sign and date this page.

- Next, move to the SECONDARY BENEFICIARY(IES) section and repeat the process for any secondary beneficiaries, including their relevant details.

- Confirm that the total percentage allocation for primary and secondary beneficiaries equals 100%.

- Sign and date the form in the designated Signature(s) section. Ensure you complete this step carefully.

- If applicable, have your spouse or partner sign the form as well, especially if they are not the sole primary beneficiary and reside in a state that requires this.

- Send the completed form to State Farm Mutual Funds via fax or mail to the address and fax number provided on the form.

What You Should Know About This Form

What is the State Farm Change Of Beneficiary form used for?

The State Farm Change Of Beneficiary form is utilized to designate or modify the beneficiaries of various accounts, including Traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, Tax Sheltered Accounts (TSA), and Archer Medical Savings Accounts (MSA). By filling out this form, you effectively revoke any previous beneficiary designations, ensuring your current wishes are clearly documented. If you are looking to establish a transfer on death beneficiary for other non-tax qualified investments, you should reach out to State Farm directly for a different form.

What are the requirements for submitting the form?

To ensure that your Change Of Beneficiary form is accepted, several key criteria must be met. Firstly, make sure that all beneficiary information is fully and accurately filled out. The form must be signed and dated by you, the participant. If you are not naming your spouse or partner as the sole primary beneficiary, a signature from them is also necessary, especially if you reside in certain states like California or Texas. Finally, it is crucial that the form is submitted to the Custodian before your passing to be deemed valid.

Can I designate more than four beneficiaries?

Yes, you can designate more than four beneficiaries, both primary and secondary. To do this, simply attach an additional sheet of paper to the form. Ensure this page contains the same detailed information for each beneficiary as required on the original form. Don’t forget to sign and date this additional page, and if your spouse or partner is involved, have their signature included as well if required.

What do I do if I have questions about the form?

If you have any uncertainties or need further clarification regarding the Change Of Beneficiary form, don’t hesitate to contact State Farm directly. You can reach them at 1-800-447-4930 for assistance. Getting the correct information is essential for ensuring that your beneficiary designations align with your intentions.

Common mistakes

Filling out the State Farm Change of Beneficiary form can be straightforward, but many individuals make common mistakes that can lead to complications. One frequent error is failing to provide complete beneficiary information. Each beneficiary requires specific details, such as their Social Security number, date of birth, and relationship to the account holder. Omitting any of this information could render the form invalid, causing delays in processing.

Another mistake is neglecting to sign and date the form. A signature validates the request, and without it, the changes to beneficiary designations are not considered official. Similarly, if a participant's spouse is not the sole primary beneficiary, the spouse's signature is also necessary, depending on the state of residence. Many individuals forget this requirement, complicating the process further.

Including multiple beneficiaries can lead to confusion if not handled correctly. Some people assume they can list more than four beneficiaries directly on the form. However, if you wish to name more than four beneficiaries, it's essential to attach a separate page. Failure to do so results in incomplete submissions, forcing the institution to revert to previous designations.

Account holders often overlook the need to review the total percentage allocation for primary and secondary beneficiaries. Each beneficiary must equal 100%. If this detail is incorrect, it raises red flags during processing. It’s a simple check, but missing this can delay the necessary updates to your account.

It’s also common for individuals to ignore the associated deadlines. The form must be filed with the Custodian before the account holder's death for it to be valid. Many assume that submitting the form late will not cause issues. Unfortunately, beneficiaries lost or overlooked as a result of late submission can create significant disputes among heirs.

Another misguided action is failing to consult the applicable Custodial Account Agreements. Each account may have unique provisions that affect how beneficiaries are designated. Skipping this step can lead to unexpected complications down the road.

Lastly, individuals may not seek assistance when needed. If there are questions about the form or the process, it's vital to reach out for help. Many mistakenly think they can figure it all out on their own, which can lead to additional errors that complicate the designation of beneficiaries. Remember, clarity and precision are fundamental when filling out such important documents.

Documents used along the form

When changing a beneficiary for a State Farm account, several forms and documents may accompany the State Farm Change of Beneficiary form. Each serves a specific purpose in ensuring that your wishes are accurately reflected and legally recognized.

- Authorization Form: This document provides your consent for State Farm to share your account information with designated parties, such as an attorney or financial advisor, which may be necessary when processing the beneficiary change.

- Transfer on Death (TOD) Beneficiary Form: Required for non-tax qualified accounts, this form allows you to set up a transfer on death beneficiary, ensuring assets are passed directly to your chosen beneficiaries upon your death without going through probate.

- Power of Attorney (POA): This legal document grants authority to another person to manage your financial matters, including beneficiary designations, should you be unable to do so yourself.

- Will: Your last will and testament may also outline beneficiary designations for your assets, providing clarity on your wishes and avoiding potential disputes among heirs.

- Trust Documents: If you establish a trust, these documents govern how your assets are managed and distributed, and can include terms about beneficiary designations.

- Financial Disclosure Statement: Though not always required, this form can summarize your financial situation, potentially aiding in the evaluation of beneficiary changes with regard to tax implications.

- Change of Address Form: If your address has changed, this form updates your account records to reflect your current information, ensuring that all correspondence related to your beneficiary change reaches you.

- Identification Verification Documents: Often, financial institutions require you to provide proof of identity, which may include a driver's license or passport, corroborating your identity during the beneficiary change process.

Collectively, these documents provide a robust framework for ensuring your beneficiary designations are clearly articulated and legally sound. Engaging in proper documentation not only safeguards your assets but also eases the process for your beneficiaries in the future.

Similar forms

- Last Will and Testament: This document states how a person’s assets will be distributed after their death. Like the State Farm Change of Beneficiary form, it designates beneficiaries and can be modified. A will becomes effective upon the person's death, similar to how beneficiary designations activate when the account holder dies.

- Transfer on Death (TOD) Designation: This form allows the transfer of assets directly to the designated beneficiaries upon the account holder's death. It is similar in that it bypasses probate, similar to how the State Farm Change of Beneficiary form ensures direct transfer of benefits to the named beneficiaries.

- Payable on Death (POD) Account: Similar to TOD, this designation allows the account funds to bypass probate and go directly to the named beneficiary upon death. Both documents simplify the transfer of assets after death.

- Health Care Proxy: This document permits an individual to designate someone else to make medical decisions on their behalf if they are incapacitated. While it does not deal with asset distribution, it parallels the change of beneficiary form in that it specifies who will make critical decisions and can be changed at any time.

- Durable Power of Attorney: This grants authority to someone to manage a person's financial affairs when they are unable to do so. Similar to the State Farm Change of Beneficiary form, it involves selected individuals and can be amended as necessary.

- Trust Documents: A trust allows a person to set aside assets for beneficiaries, and it dictates how and when the assets are distributed. It has similarities with the beneficiary form, as both dictate the distribution of funds and can be altered throughout the individual's lifetime.

Dos and Don'ts

When filling out the State Farm Change of Beneficiary form, it's crucial to approach the process carefully. Here is a list of things you should and shouldn't do:

- Do ensure all beneficiary information is complete.

- Do sign and date the form before submitting.

- Do include your spouse/partner's signature if required by your state law.

- Do file the form with the Custodian before your death.

- Do attach a separate page if naming more than four beneficiaries.

- Don't leave any information blank; omissions could invalidate the form.

- Don't forget to review the applicable Custodial Account Agreements for additional provisions.

Following these guidelines can help ensure that your beneficiary designations are processed smoothly and reflect your wishes.

Misconceptions

Understanding the intricacies of the State Farm Change of Beneficiary form can be challenging, and several misconceptions often arise. Here are six common misconceptions, along with clarifications for each.

- All beneficiaries must be related by blood or marriage. Many people believe that only family members can be named as beneficiaries. In fact, individuals can designate anyone they choose, including friends or charities, as beneficiaries.

- A spouse's consent is not necessary in all cases. Some think that their spouse's signature is always required. However, consent is only mandatory if the spouse is not the sole primary beneficiary, depending on specific state laws.

- Changing beneficiaries invalidates previous documents automatically. It is a common belief that a new beneficiary designation automatically cancels all previous arrangements without further action. While a completed change form does revoke prior designations, ensuring that it is filed correctly with the custodian is crucial.

- You cannot have more than four beneficiaries. There is a misconception that only four beneficiaries can be named. In reality, individuals may name more than four beneficiaries by attaching a separate page that includes required information for each.

- Designating beneficiaries is a one-time event. Some individuals believe that once they designate their beneficiaries, no further action is needed. It's important to remember that beneficiaries can and should be updated as life circumstances change, such as marriage, divorce, or the birth of children.

- Beneficiary designation forms are only for tax-advantaged accounts. Many assume that these forms apply solely to accounts like IRAs. However, the Change of Beneficiary form can also be used for other account types, such as non-tax qualified funds, emphasizing the need for awareness of different financial products.

By debunking these misconceptions, individuals can make more informed decisions regarding their beneficiary designations. It's essential to approach the form with a clear understanding of its requirements and implications.

Key takeaways

1. The State Farm Change of Beneficiary form is specifically designed for various accounts, including Traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA, TSA, and MSA.

2. Completion of this form revokes any previous beneficiary designations, ensuring that your latest wishes are recorded.

3. It is essential to sign and date the form for it to be considered valid by the Custodian.

4. If you are married and designating beneficiaries, your spouse/partner's signature may be required, depending on state laws.

5. To name more than four beneficiaries, you must attach an additional page with all requested information for each beneficiary.

6. Ensure that the total percentage allocated to beneficiaries adds up to 100% to avoid complications.

7. The form must be filed with the Custodian before your death to take effect.

8. If you have questions or need assistance while filling out the form, contact State Farm at 1-800-447-4930.

9. Completed forms should be faxed or mailed to State Farm Mutual Funds to ensure proper processing.

Browse Other Templates

Form Au-11 - The AU-11 form is specifically designated for non-QEZE sales tax refunds.

Dd Form 1857 - The DD 1857 form includes sections for both member's information and transportation officer's approval.

Lynn University Transcript - Students should write their name at the time of attendance if it differs from their current name.