Fill Out Your State Farm Personal Financial Statement Form

The State Farm Personal Financial Statement form serves as a vital tool for individuals looking to summarize their financial standing clearly. Beginning with detailed schedules, users must carefully list their assets, including cash accounts, stocks, real estate, and any other valuable possessions. Each asset should reflect its current market value to provide an accurate snapshot. Following this, the form prompts users to detail their liabilities, which encompass any debts owed, such as mortgages, credit cards, and personal loans. This side of the ledger demands precision too, as incomplete or inaccurate data can lead to misunderstandings about one’s financial obligations. Ultimately, the form calculates total net worth by subtracting total liabilities from total assets, giving a straightforward view of financial health. Completing this form requires thoroughness and attention to detail, as the information will be used for various purposes, including insurance applications and financial planning.

State Farm Personal Financial Statement Example

statefarm.com/agents/career

Instructions

Personal Financial Statement Instructions

Note: Start with completing the Schedules irst. he totals will carry forward to the Statement. Ater completing ALL applicable sections of the Schedules, please make sure all sections of the Statement are also completed as well.

Schedules

Complete each item as thoroughly as possible and provide all pertinent information requested.

Assets

Assets are things you own that are of monetary value.

·Complete Schedules

·Include dollar value/present market value for all items listed as assets.

·“Other Assets” includes anything of monetary value not previously addressed.

·On the Statement, include cash surrender value of life insurance.

·On the Statement, list the number of automobiles owned and the total value of all automobiles.

·On the Statement, include amounts due from others.

·“Total Assets” will calculate automatically.

Liabilities

Liabilities are monies you owe to others.

·Complete Schedules

·List outstanding balances on each line item.

·“Other Liabilities” includes any monies you owe to others not previously addressed.

·On Schedule 4, include your mortgage due on real estate/residence.

·On the Statement, include your real estate taxes due.

·On the Statement, include any rents and interest due.

·On the Statement, include any other accounts and notes payable to others.

·“Total Liabilities” will calculate automatically.

Total Net Worth

Total Net Worth is found by subtracting your liabilities from your assets. his will calculate automatically.

This is proprietary information owned by State Farm® and it may be lawfully used only as authorized by appropriate Agency management. |

statefarm.com/agents/career

Schedules

No. 1 Checking & Savings Accounts (A list of all household checking and savings accounts)

Name and Location |

Cash Balance |

Checking: |

$ |

|

$ |

|

|

Savings: |

$ |

|

$ |

|

|

Total: |

$ |

No. 2 Stocks and Bonds

Description of |

Registered in |

Cost |

Present |

Income Rec’d |

If Pledged State |

Security |

Name of |

|

Market Value |

Last Year |

to Whom |

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

Total: |

$ |

$ |

$ |

|

|

|

|

|

|

|

No. 3 S&T Plan, 401(k), Keogh, etc.

Registered in Name Of |

Present Market Value |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

Total: |

$ |

No. 4 Real Estate (Solely or partially owned. If partially owned, provide dollar amounts based on percentage owned.)

|

Address / Description |

Purchase |

|

Purchase |

Mortgages |

Present |

|

Payment |

|

|

|

Date |

|

Price |

or Liens |

Market Value |

|

Amount |

|

|

|

|

$ |

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total: |

|

$ |

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This is proprietary information owned by State Farm® and it may be lawfully used only as authorized by appropriate Agency management. |

|||||||||

statefarm.com/agents/career

Schedules

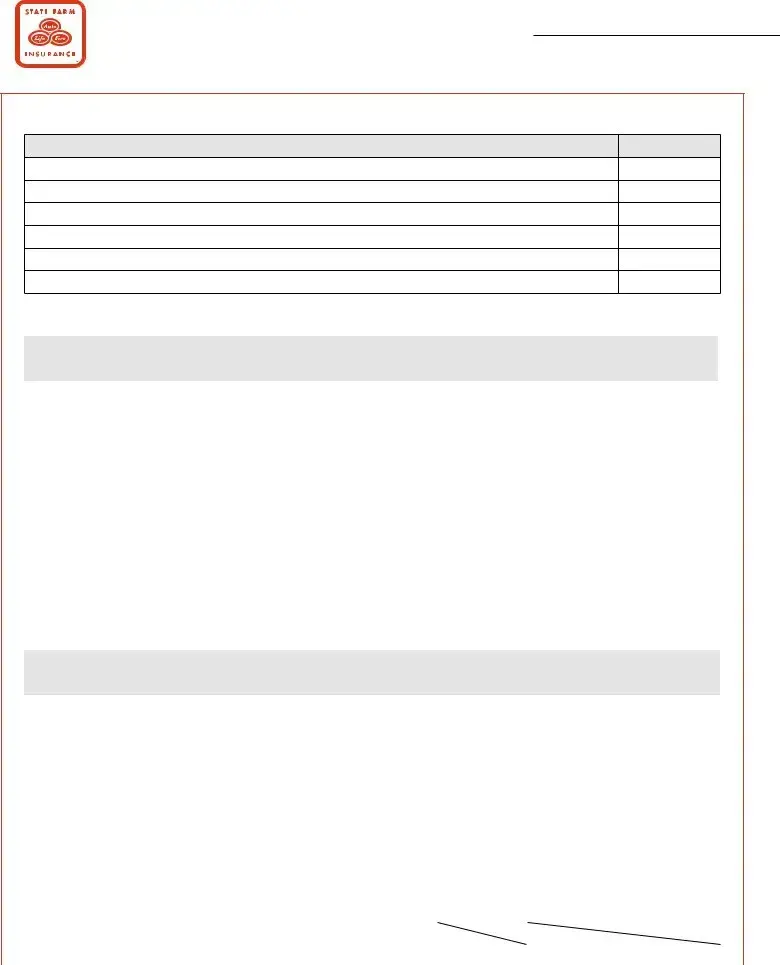

No. 5 Other Assets (excluding Auto(s))

Description |

Cash Value |

$

$

$

$

$

Total: $

No. 6 Credit Card Balance (Credit Cards in your or your spouse’s name)

Credit Card Name |

Credit |

Current |

Monthly |

|

limit |

Balance |

Payment |

|

$ |

$ |

$ |

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

Total: |

$ |

$ |

$ |

No. 7 Notes Payable to Banks (excluding real estate/mortgages) (A list of the amounts owed.)

|

Owed to Whom |

Original |

Balance |

How |

Description of Security |

|

|

|

|

Amount |

Due |

Long? |

Held |

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total: |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This is proprietary information owned by State Farm® and it may be lawfully used only as authorized by appropriate Agency management. |

|||||||

statefarm.com/agents/career

Schedules

No. 8 Other Liabilities

Description |

Cash Value |

$

$

$

$

$

Total: $

Completion and submission of this form certiies that the information provided has been carefully reviewed and is true and correct.

This is proprietary information owned by State Farm® and it may be lawfully used only as authorized by appropriate Agency management. |

statefarm.com/agents/career

Personal Financial Statement

Name

To: State Farm Insurance Companies

Address

City |

State |

Zip |

Telephone

Date

Have you or your spouse (if married) ever defaulted on any loan? Y/N

Explain

Do you have an existing interest in any business? Y/N

Explain

Do you have an existing managerial role in any business? Y/N

Explain

Are you or your spouse (if married) the endorser or

Explain

Are you responsible for any other debt not listed? Y/N

Explain

Assets |

|

Liabilities $ Net Worth |

|

|

|

|

|

|

|

Savings & Checking Accounts (Schedule No. 1) |

$ |

Mortgage on Real Estate (Schedule No. 4) |

$ |

|

|

|

|

|

|

Cash Surrender Value of Life Insurance |

$ |

Real Estate Taxes Due |

$ |

|

|

|

|

|

|

Stocks & Bonds (Schedule No. 2) |

$ |

Rents & Interest Due |

$ |

|

|

|

|

|

|

S&T Plan, 401(k), Keogh, etc. (Schedule No. 3) |

$ |

Credit Card Balance (Schedule No. 6) |

$ |

|

|

|

|

|

|

Real Estate (Schedule No. 4) |

$ |

Notes Payable to Banks (Schedule No. 7) |

$ |

|

Automobiles – Number/Market Value |

|

$ |

Accounts & Notes Payable to Others |

$ |

|

|

|

|

|

Amounts Due from Others |

$ |

Other Liabilities (Schedule No. 8) |

$ |

|

|

|

|

|

|

Other Assets (Schedule No. 5) |

$ |

|

|

|

|

|

|

|

|

Total Assets: |

$ |

Total Liabilities: |

$ |

|

|

|

|

|

|

|

|

|

Total Net Worth: |

$ |

|

|

|

|

|

|

|

|

|

|

This is proprietary information owned by State Farm® and it may be lawfully used only as authorized by appropriate Agency management. |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of the Form | The State Farm Personal Financial Statement is designed to help individuals assess their financial status by detailing assets and liabilities. |

| Schedules Requirement | Before completing the Statement, individuals must finish Schedules 1-9. The totals from these schedules automatically transfer to the Statement. |

| Assets and Liabilities Representation | Assets must include dollar values for cash, properties, and other holdings. Liabilities should reflect all outstanding debts and obligations. |

| Calculation of Net Worth | The total net worth is calculated by subtracting total liabilities from total assets. This figure is displayed prominently at the end of the Statement. |

Guidelines on Utilizing State Farm Personal Financial Statement

Completing the State Farm Personal Financial Statement form involves several steps to ensure that all necessary financial information is accurately represented. Gathering the relevant documents will help streamline the process, so take a moment to organize your financial records before diving in.

- Start by completing the Schedules 1-5. These will calculate totals that automatically carry over to the Statement.

- Under Assets, document all items of value. Provide their present market value.

- In Schedule 1, list all checking and savings accounts, including the cash balance for each.

- For Schedule 2, enter details of your stocks and bonds, specifying the registered owner, cost, present market value, and any income received.

- Complete Schedule 3 with your retirement accounts, detailing the registered name and present market value.

- In Schedule 4, include real estate information such as address, purchase price, mortgages, and market value.

- Use Schedule 5 to document any other assets not previously listed, providing their cash values.

- Move on to Liabilities, completing Schedules 6-9 which will also integrate into the Statement.

- In Schedule 6, document credit card balances and monthly limits for each card under your name or your spouse's name.

- For Schedule 7, list notes payable to banks, including original balance and current amounts due.

- In Schedule 8, summarize any other outstanding liabilities you may have.

- Return to the Statement. Fill in values for cash surrender of life insurance and the total number and value of automobiles owned.

- Include amounts due from others in the Statement to ensure a complete picture of your financial status.

- Verify that all sections in the Statement are completed accurately, and check that totals for assets and liabilities are correctly calculated.

- Finally, certify that all information provided is true and correct by signing the form.

What You Should Know About This Form

What is the purpose of the State Farm Personal Financial Statement form?

The State Farm Personal Financial Statement form serves to provide a comprehensive overview of an individual’s financial status, listing assets and liabilities. This information is crucial for State Farm agents to assess financial qualifications and to ensure clients meet underwriting requirements for various financial products.

How should I complete the Schedules in the form?

Begin by thoroughly completing the Schedules, which are essential sections of the form. List all relevant financial information using the provided categories, such as checking accounts, stocks, bonds, real estate, and other liabilities. It is important that you provide accurate dollar values and update any amounts as necessary to reflect your current financial situation.

What types of assets should I include?

List all assets of monetary value. This includes cash in checking and savings accounts, investments like stocks and bonds, and the market value of real estate. You should account for other assets that may not have been referenced in previous Schedules, such as the cash surrender value of life insurance and amounts owed to you by others.

What liabilities must be reported?

All outstanding debts should be documented, including credit card debts, mortgages, loans, and any other financial obligations. Ensure you detail each liability accurately, as this information directly affects the calculation of your total net worth.

How is Total Net Worth calculated?

Total Net Worth is calculated by subtracting total liabilities from total assets. This value is automatically computed within the form, following your entries in the respective asset and liability sections. It is a key indicator of your financial health.

What happens if I omit my assets or liabilities?

Omitting financial information can lead to inaccurate assessments of your financial standing. Discrepancies may affect your financial product applications, and inaccuracies could prompt further inquiries from State Farm agents. Full disclosure is necessary to ensure a proper evaluation of your financial situation.

What are the consequences of submitting inaccurate information?

Submitting false or misleading information can have serious implications, including denial of financial products, legal repercussions, or damage to your credibility with financial institutions. Always review your information carefully before submission to ensure accuracy.

How should I handle the form once completed?

Once you have filled out both the Schedules and Statement sections thoroughly and checked for accuracy, submit the form to State Farm according to the provided instructions. Retaining a copy for your records is advisable for future reference.

Common mistakes

Filling out the State Farm Personal Financial Statement form requires careful attention to detail. One common mistake is neglecting to complete all applicable sections of the schedules. It is essential to start with Schedules (1-5) first, as the totals carry forward automatically to the main Statement. Incomplete schedules can lead to discrepancies and a misunderstanding of one's financial position.

Another critical error involves the misrepresentation of assets. Each asset listed should have its dollar value or present market value correctly specified. Failing to include important information, such as the cash surrender value of life insurance or the total value of automobiles owned, can significantly impact the final calculations. Ensure all "Other Assets" are documented as well.

When it comes to liabilities, individuals often forget to disclose all outstanding balances. Each line item must be accounted for accurately. Omitting debts, such as personal loans or unpaid bills, can skew the true picture of one's financial health. Furthermore, "Other Liabilities" should also be carefully itemized to include all debts.

A frequent oversight occurs in the net worth calculation. It's crucial to remember that total net worth equals total assets minus total liabilities. Relying on automatic calculations is helpful, but double-checking these figures can help avoid mistakes.

Attachments or additional documentation can provide clarity and support for the claims made in the form. Some individuals neglect to include necessary supporting documentation, making it harder for evaluators to verify the information provided. When possible, provide receipts, valuations, or other evidence to substantiate claims.

Additionally, selfie-assessment is a significant issue. Complete honesty is paramount. Potential repercussions may arise from failing to disclose defaults on loans or existing debts. Transparency is necessary for establishing trust and integrity.

Another mistake involves inadequate communication regarding existing business interests. If any business ownership or managerial role exists, it should be clearly articulated in the appropriate sections. Lack of clarity might raise questions and lead to further inquiries.

Many people also overlook the importance of reviewing the form for accuracy before submission. Simple typos or arithmetic errors, though minor, can have significant consequences. A thorough review can prevent these lapses and ensure all information is correct.

Finally, forgetting to sign and date the form is a common, yet avoidable, error. The completion and submission of this form signify that all the information has been reviewed and is accurate. Not acknowledging this responsibility can lead to delays or rejection of the form.

Documents used along the form

When preparing a financial overview for State Farm or similar institutions, several documents complement the State Farm Personal Financial Statement form. Each serves a critical purpose in outlining an individual's or household's financial health, providing a comprehensive snapshot of assets, liabilities, and income sources.

- Tax Returns: Recent tax returns are often used to verify income and financial claims made on the Personal Financial Statement. They provide proof of earnings, including wages, interest, and other income sources over the past year.

- Credit Report: A current credit report shows outstanding debts and credit scores. It is essential for assessing overall financial responsibility and providing a thorough overview of existing liabilities.

- Pay Stubs: Recent pay stubs verify current employment and income. They help confirm figures submitted in the Personal Financial Statement, adding credibility to the financial claims made.

- Bank Statements: Monthly bank statements provide up-to-date information about an individual's assets. They show account balances and transactions, allowing for a clearer picture of cash flow and liquidity.

Collecting these documents ensures that the Personal Financial Statement is accurate and comprehensive, facilitating a smoother application process and better financial management.

Similar forms

The State Farm Personal Financial Statement form shares similarities with several other important financial documents. Each of these documents serves to provide a comprehensive view of an individual’s financial situation. Here are six documents that are similar, along with a brief explanation of how they compare:

- Net Worth Statement: This document summarizes an individual’s total assets and liabilities, similar to the net worth section of the State Farm form. Both help individuals understand their financial health at a specific moment in time.

- Loan Application: When applying for a loan, applicants often need to provide an overview of their assets and liabilities. This requirement parallels the financial breakdown in the State Farm form, helping lenders assess borrowing risk.

- Balance Sheet: Common in business settings, a balance sheet lists assets, liabilities, and equity. Like the State Farm form, it clearly outlines financial standing and helps evaluate fiscal stability.

- Budget Worksheet: A budget worksheet tracks income and expenses, while the State Farm form gives a snapshot of assets and debts. Both documents aid individuals in managing their finances effectively.

- Estate Planning Documents: Such documents often require a detailed listing of assets to facilitate the distribution of wealth upon passing. Similarly, the State Farm form requires a comprehensive account of assets for accurate reporting.

- Investment Portfolio Summary: This document provides an overview of investments owned, akin to the asset section of the State Farm form. Both emphasize the importance of knowing one’s investment value for overall financial clarity.

Dos and Don'ts

When filling out the State Farm Personal Financial Statement form, consider the following dos and don'ts:

- Do complete the Schedules (1-5) first. Totals will automatically carry over to the Statement.

- Do list the dollar value of all assets. This includes cash surrender value of life insurance.

- Do include all liabilities and ensure accurate outstanding balances are reported.

- Do verify that the total assets and liabilities calculate automatically after entering all information.

- Don't overlook “Other Assets” or “Other Liabilities” sections. Ensure all monetary values are provided.

- Don't leave any section incomplete. Review the Statement to confirm all applicable areas have been filled out.

- Don't submit the form without thoroughly checking for accuracy. Inaccurate information can lead to delays or issues.

Misconceptions

When dealing with the State Farm Personal Financial Statement form, several misconceptions may arise. These misunderstandings can lead to incomplete submissions or inaccurate financial assessments. Below are five common misconceptions, along with clarifications for each.

- Misconception 1: The form only requires basic information.

- Misconception 2: Only assets are important to report.

- Misconception 3: Previous financial issues will disqualify me.

- Misconception 4: It's acceptable to skip the "Other Assets" and "Other Liabilities" sections.

- Misconception 5: The totals will calculate themselves correctly every time.

Many people believe that filling out this form is straightforward and only entails providing minimal details. In reality, thorough completion of all applicable sections and schedules is essential to provide an accurate financial picture.

While assets play a significant role, liabilities are equally critical. Users often focus solely on their possessions and overlook what they owe. A complete financial statement must balance both assets and liabilities to determine net worth accurately.

Some individuals fear that past loan defaults or financial troubles will prevent them from gaining approval. However, the form allows space for explanations. A thorough and honest account may demonstrate readiness for improvement.

Skipping these sections is a common error. These categories are designed to capture financial information not detailed elsewhere. Omitting details may result in an incomplete assessment that does not reflect true financial standing.

Some users assume that the total calculations, which are meant to pull from completed schedules, will always be correct. In practice, if schedules are incomplete or inaccurately filled, the totals may be erroneous. Careful cross-checking is advised before submission.

Key takeaways

Creating a Personal Financial Statement with State Farm is a comprehensive process. Here are some key takeaways to ensure your submission is thorough and accurate.

- Start with Schedules: Before filling out the main Statement, complete Schedules 1-9 first. The totals from these will automatically transfer into the Statement, saving time and reducing errors.

- Accurate Valuation: Ensure that for all assets, you include their dollar value or current market value. This provides a clear picture of your financial standing.

- Comprehensive Listings: Don't overlook any assets or liabilities. Include everything of monetary value, whether it's cash, real estate, or accounts payable. This thoroughness is essential for an accurate statement.

- Automatic Calculations: Total Assets and Total Liabilities will calculate automatically. However, double-check the figures from the schedules to ensure everything aligns correctly.

- Review Information: After completing the forms, review all entries. This is your opportunity to catch any mistakes and confirm that your information is complete and correct.

- Certification: By submitting this form, you affirm that the information is accurate and truthful. This certification underscores the importance of transparency in financial reporting.

By keeping these takeaways in mind, you can confidently fill out the State Farm Personal Financial Statement and ensure it reflects your true financial status.

Browse Other Templates

Judicial Counsel Forms - An answer form to requests aimed at stopping harassment in civil contexts.

Ancestral Record Sheet,Heritage Overview Form,Genealogy Summary Document,Family History Profile,Kinship Documentation,Descendant Outline,Lineage Registration Form,Progenitor Information Sheet,Bloodline Chart,Family Relations Overview - Document additional information such as census details for context.