Fill Out Your State Farm Personal Worksheet Form

In today's increasingly uncertain world, safeguarding personal property has never been more essential. The State Farm Personal Worksheet serves as a practical tool for homeowners, enabling them to compile a comprehensive home inventory. This detailed inventory is vital in the unfortunate event of loss due to fire, theft, or other perils. By taking the time to accurately document possessions—complete with receipts, descriptions, and photographs—property owners position themselves to navigate any potential claims more swiftly and efficiently. The worksheet is structured to facilitate organization, categorizing items by room and type, making it easier for users to track everything from furniture in the living room to appliances in the kitchen and personal collectibles. Each section of the checklist prompts users to note significant details, including the year of purchase and costs incurred, thus providing crucial evidence of ownership. Investing time in creating this inventory can ultimately save homeowners from future headache and frustration, proving its value well beyond the initial effort required.

State Farm Personal Worksheet Example

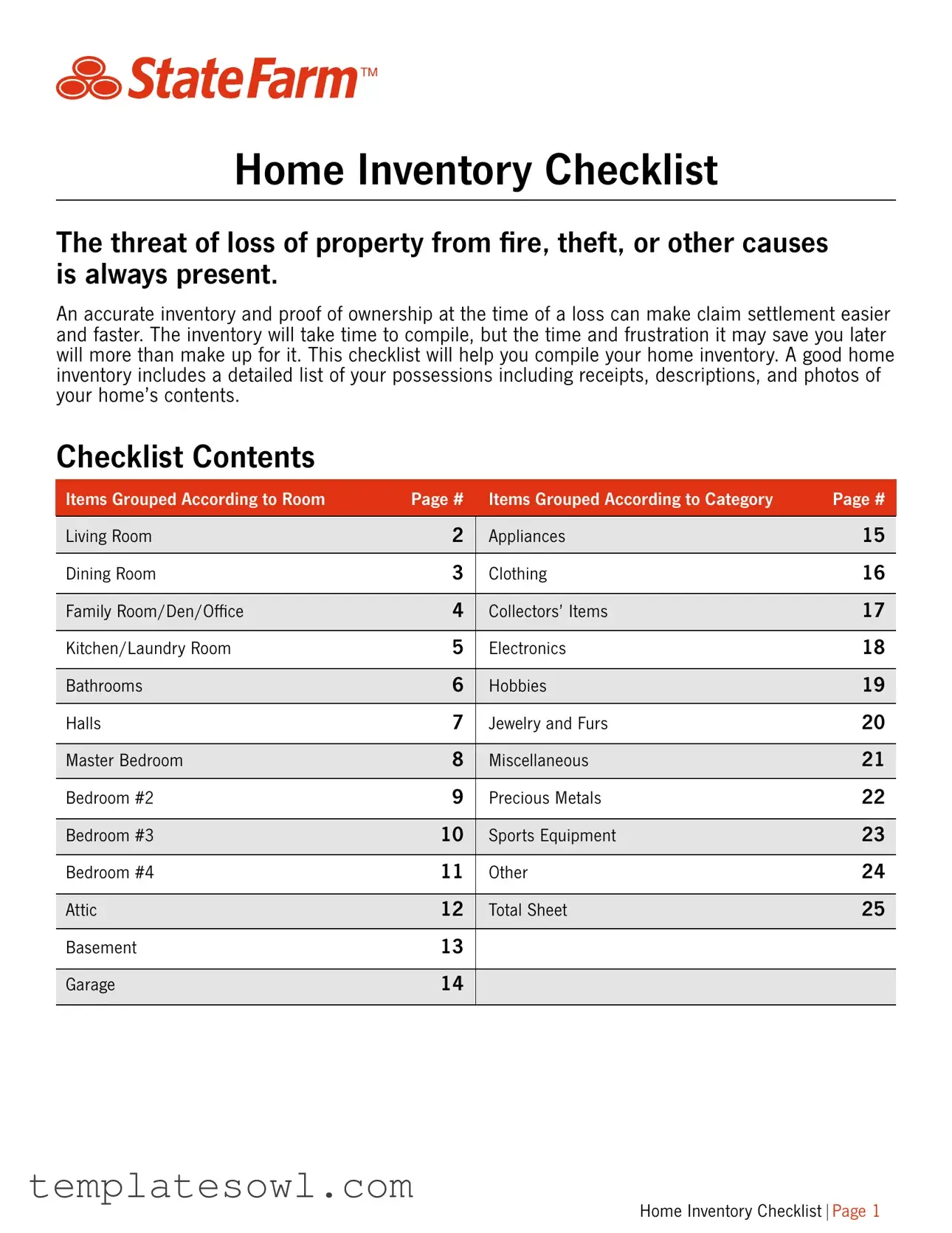

Home Inventory Checklist

The threat of loss of property from fire, theft, or other causes is always present.

An accurate inventory and proof of ownership at the time of a loss can make claim settlement easier and faster. The inventory will take time to compile, but the time and frustration it may save you later will more than make up for it. This checklist will help you compile your home inventory. A good home inventory includes a detailed list of your possessions including receipts, descriptions, and photos of your home’s contents.

Checklist Contents

Items Grouped According to Room |

Page # Items Grouped According to Category |

Page # |

|

|

|

|

|

Living Room |

2 |

Appliances |

15 |

|

|

|

|

Dining Room |

3 |

Clothing |

16 |

|

|

|

|

Family Room/Den/Office |

4 |

Collectors’ Items |

17 |

|

|

|

|

Kitchen/Laundry Room |

5 |

Electronics |

18 |

|

|

|

|

Bathrooms |

6 |

Hobbies |

19 |

|

|

|

|

Halls |

7 |

Jewelry and Furs |

20 |

|

|

|

|

Master Bedroom |

8 |

Miscellaneous |

21 |

|

|

|

|

Bedroom #2 |

9 |

Precious Metals |

22 |

|

|

|

|

Bedroom #3 |

10 |

Sports Equipment |

23 |

|

|

|

|

Bedroom #4 |

11 |

Other |

24 |

|

|

|

|

Attic |

12 |

Total Sheet |

25 |

|

|

|

|

Basement |

13 |

|

|

|

|

|

|

Garage |

14 |

|

|

|

|

|

|

Home Inventory Checklist Page 1

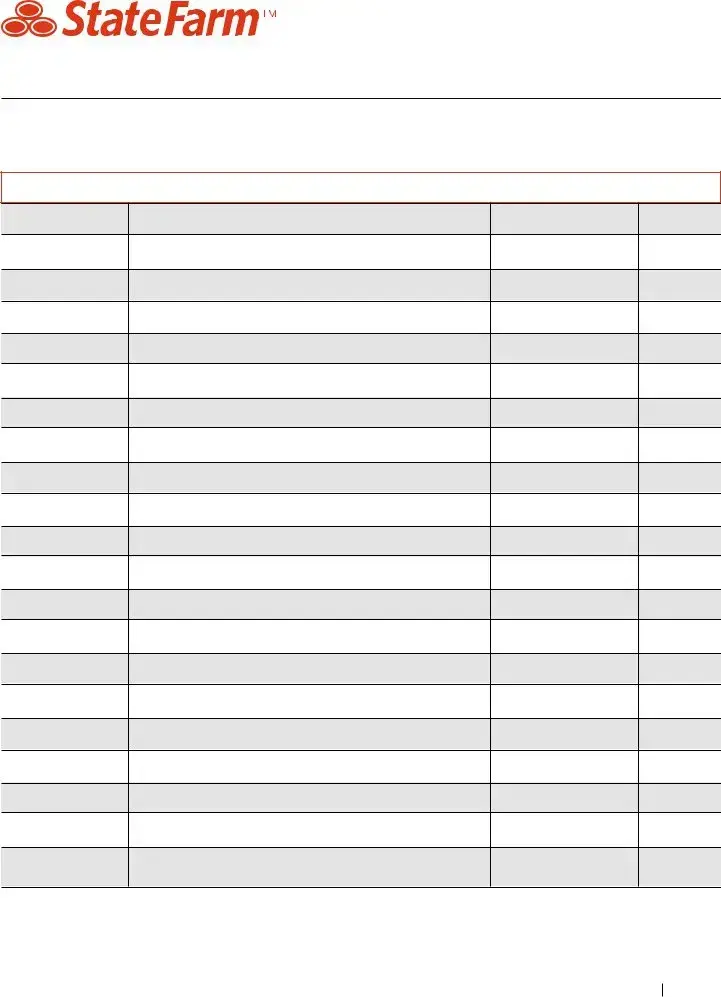

Home Inventory Checklist

Living Room

Number of Items |

Item |

Year Purchased |

Cost |

|

|

|

|

|

Air Conditioner Window Units |

|

|

|

|

|

|

|

Books |

|

|

|

|

|

|

|

Bookcases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cabinets and Contents* |

|

|

|

Closet Contents* |

|

|

|

|

|

|

|

Desks |

|

|

|

|

|

|

|

Fireplace Equipment |

|

|

|

|

|

|

|

Furniture |

|

|

|

Lamps |

|

|

|

|

|

|

|

Organ |

|

|

|

Piano |

|

|

|

|

|

|

|

Rug |

|

|

|

Tables |

|

|

|

|

|

|

|

Wall Shelves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total #1 |

|

|

|

(See Page 25.) |

$ |

*Where applicable, itemize contents in extra space provided.

Home Inventory Checklist Page 2

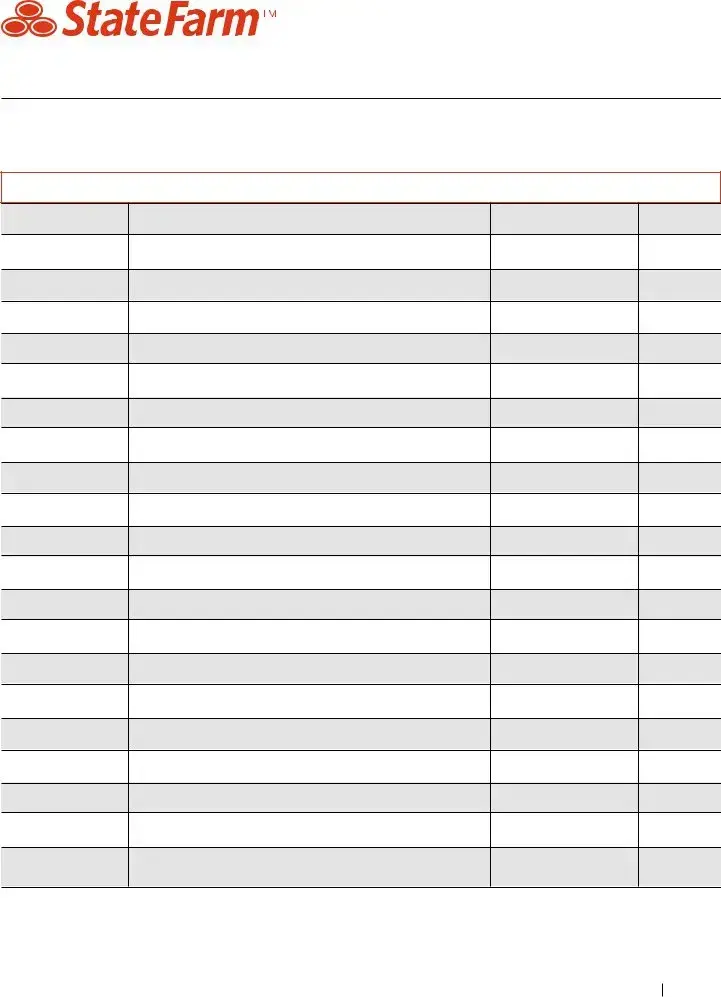

Home Inventory Checklist

Dining Room

Number of Items |

Item |

Year Purchased |

Cost |

|

|

|

|

|

Air Conditioner Window Units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Buffet |

|

|

|

|

|

|

|

Cabinets and Contents* |

|

|

|

|

|

|

|

Dining Room Set |

|

|

|

|

|

|

|

China |

|

|

|

|

|

|

|

Crystal |

|

|

|

|

|

|

|

Rug |

|

|

|

|

|

|

|

Silverware/Goldware |

|

|

|

|

|

|

|

Table Linens |

|

|

|

|

|

|

|

Wall Shelves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total #2 |

|

|

|

(See Page 25.) |

$ |

*Where applicable, itemize contents in extra space provided.

Home Inventory Checklist Page 3

Home Inventory Checklist

Family Room/Den/Office

Number of Items |

Item |

Year Purchased |

Cost |

|

|

|

|

|

Air Conditioner Window Units |

|

|

|

|

|

|

|

Books |

|

|

|

|

|

|

|

Bookcases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cabinets and Contents* |

|

|

|

|

|

|

|

Card Table |

|

|

|

|

|

|

|

Chairs |

|

|

|

|

|

|

|

Closet Contents* |

|

|

|

|

|

|

|

Couch |

|

|

|

|

|

|

|

Desk |

|

|

|

|

|

|

|

Fireplace Equipment |

|

|

|

|

|

|

|

Lamps |

|

|

|

|

|

|

|

Organ |

|

|

|

|

|

|

|

Piano |

|

|

|

|

|

|

|

Rugs |

|

|

|

|

|

|

|

Tables |

|

|

|

|

|

|

|

Wall Shelves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total #3 |

|

|

|

(See Page 25.) |

$ |

*Where applicable, itemize contents in extra space provided.

Home Inventory Checklist Page 4

Home Inventory Checklist

Kitchen/Laundry Room

Number of Items |

Item |

Year Purchased |

Cost |

|

|

|

|

|

Appliances |

|

|

|

|

|

|

|

Books |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cabinets and Contents* |

|

|

|

|

|

|

|

Crystal |

|

|

|

|

|

|

|

Cutlery |

|

|

|

|

|

|

|

Dishes |

|

|

|

|

|

|

|

Dryer |

|

|

|

|

|

|

|

Freezer |

|

|

|

|

|

|

|

Glassware |

|

|

|

|

|

|

|

Ironing Board |

|

|

|

Kitchen Utensils |

|

|

|

|

|

|

|

Linens |

|

|

|

|

|

|

|

Portable Dishwasher |

|

|

|

|

|

|

|

Pots and Pans |

|

|

|

Refrigerator |

|

|

|

|

|

|

|

Silverware |

|

|

|

Stove |

|

|

|

|

|

|

|

Tables |

|

|

|

Washing Machine |

|

|

|

|

|

|

|

|

Total #4 |

|

|

|

(See Page 25.) |

$ |

*Where applicable, itemize contents in extra space provided.

Home Inventory Checklist Page 5

Home Inventory Checklist

Bathrooms

Number of Items |

Item |

Year Purchased |

Cost |

|

|

|

|

Cabinets and Contents*

Closet Contents*

Electrical Appliances

Linens

Total #5

(See Page 25.)

$

*Where applicable, itemize contents in extra space provided.

Home Inventory Checklist Page 6

Home Inventory Checklist

Halls

Number of Items |

Item |

Year Purchased |

Cost |

|

|

|

|

Cabinets and Contents*

Chairs

Closet Contents*

Lamps

Rugs

Tables

Total #6

(See Page 25.)

$

*Where applicable, itemize contents in extra space provided.

Home Inventory Checklist Page 7

Home Inventory Checklist

Master Bedroom

Number of Items |

Item |

Year Purchased |

Cost |

|

|

|

|

|

Air Conditioner Window Units |

|

|

|

|

|

|

|

Bedding |

|

|

|

|

|

|

|

Bed |

|

|

|

|

|

|

|

Books |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chairs |

|

|

|

|

|

|

|

Chests and Contents* |

|

|

|

|

|

|

|

Closet Contents* |

|

|

|

|

|

|

|

Desk |

|

|

|

|

|

|

|

Dressers and Contents* |

|

|

|

|

|

|

|

Dressing Table |

|

|

|

|

|

|

|

Lamps |

|

|

|

|

|

|

|

Rug |

|

|

|

|

|

|

|

Sewing Machine |

|

|

|

|

|

|

|

Tables |

|

|

|

|

|

|

|

Wall Shelves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total #7 |

|

|

|

(See Page 25.) |

$ |

*Where applicable, itemize contents in extra space provided.

Home Inventory Checklist Page 8

Home Inventory Checklist

Bedroom #2

Number of Items |

Item |

Year Purchased |

Cost |

|

|

|

|

|

Air Conditioner Window Units |

|

|

|

|

|

|

|

Bedding |

|

|

|

|

|

|

|

Bed |

|

|

|

|

|

|

|

Books |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chairs |

|

|

|

|

|

|

|

Chests and Contents* |

|

|

|

|

|

|

|

Closet Contents* |

|

|

|

|

|

|

|

Desk |

|

|

|

|

|

|

|

Dressers and Contents* |

|

|

|

|

|

|

|

Dressing Table |

|

|

|

|

|

|

|

Lamps |

|

|

|

|

|

|

|

Rug |

|

|

|

|

|

|

|

Sewing Machine |

|

|

|

|

|

|

|

Tables |

|

|

|

|

|

|

|

Wall Shelves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total #8 |

|

|

|

(See Page 25.) |

$ |

*Where applicable, itemize contents in extra space provided.

Home Inventory Checklist Page 9

Home Inventory Checklist

Bedroom #3

Number of Items |

Item |

Year Purchased |

Cost |

|

|

|

|

|

Air Conditioner Window Units |

|

|

|

|

|

|

|

Bedding |

|

|

|

|

|

|

|

Bed |

|

|

|

|

|

|

|

Books |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chairs |

|

|

|

|

|

|

|

Chests and Contents* |

|

|

|

|

|

|

|

Closet Contents* |

|

|

|

|

|

|

|

Desk |

|

|

|

|

|

|

|

Dressers and Contents* |

|

|

|

|

|

|

|

Dressing Table |

|

|

|

|

|

|

|

Lamps |

|

|

|

|

|

|

|

Rug |

|

|

|

|

|

|

|

Sewing Machine |

|

|

|

|

|

|

|

Tables |

|

|

|

|

|

|

|

Wall Shelves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total #9 |

|

|

|

(See Page 25.) |

$ |

*Where applicable, itemize contents in extra space provided.

Home Inventory Checklist Page 10

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The State Farm Personal Worksheet form assists homeowners in documenting personal property for insurance purposes. |

| Contents | This worksheet includes a detailed home inventory checklist, enabling users to categorize items by room and type. |

| Importance of Documentation | Accurate records help in claim settlements, ensuring a smoother process when reporting losses. |

| Inventory Organization | Items are grouped according to specific areas in the home, such as living room, kitchen, and bedrooms, facilitating easy access. |

| Additional Itemization | Users can itemize individual contents in the provided extra space to ensure thorough documentation. |

| Visual Proof | Photographs can be included as part of the inventory, bolstering claims with visual evidence of ownership. |

| State-Specific Use | This form is applicable across states, but local laws regarding insurance claims may vary. Users should check state requirements. |

| Total Sheet | The form includes a summary sheet that aggregates all items, streamlining the reporting process. |

| Comprehensiveness | The checklist covers various categories, including jewelry, electronics, and collectibles, ensuring a wide range of possessions are recorded. |

| Recommendation | Regular updates to the inventory are advised, especially after new purchases, to maintain accurate records for insurance purposes. |

Guidelines on Utilizing State Farm Personal Worksheet

As you prepare to fill out the State Farm Personal Worksheet form, it's essential to approach it methodically. This form will guide you in recording details about your home inventory, helping to protect your property and simplify any future claims. Taking the time to accurately complete this form will offer peace of mind and ensure your possessions are well documented.

- Begin by gathering all necessary items for your home inventory, including receipts, descriptions, and photos.

- Start at the Living Room section, and list each item in the designated spaces. Include details such as the year purchased and the cost.

- Move to the Dining Room. Repeat the same process for items, making sure to provide accurate descriptions and costs.

- Proceed to the Family Room, Den, or Office, and continue documenting your possessions in this area.

- Next, fill out the Kitchen or Laundry Room section by listing each relevant item.

- Complete the other sections of the form systematically, such as Bathrooms, Halls, and if applicable, bedrooms or additional areas.

- For each room or category, ensure to add up the total number of items in the designated box at the end of each section.

- Carefully review your entries for completeness and accuracy before finalizing the form.

- If needed, make use of the extra space provided for itemizing contents where applicable.

- Once finished, store your completed form in a safe place and consider making digital copies for easier access in the future.

What You Should Know About This Form

What is the purpose of the State Farm Personal Worksheet form?

The State Farm Personal Worksheet form is designed to assist homeowners in creating a detailed inventory of their personal belongings. This form helps users document the contents of their homes, including descriptions, values, and important details such as receipts and photographs. Having a comprehensive inventory simplifies the process of filing insurance claims in case of loss due to theft, fire, or other unforeseen events.

How should I use the Home Inventory Checklist included in the form?

To use the Home Inventory Checklist effectively, begin by organizing your items room by room. The checklist provides spaces to record information such as item descriptions, purchase years, and costs. It is advisable to be as thorough as possible. Take photographs and keep receipts to provide extra proof of ownership. This organized approach will make it easier to claim your items should a loss occur.

What types of items are included in the Checklist?

The Home Inventory Checklist covers a wide range of items categorized by room and type. Rooms such as the living room, dining room, kitchen, and bedrooms are detailed. Categories range from appliances, clothing, and electronics to precious metals and jewelry. Each section encourages listing specific items along with their relevant details, promoting a comprehensive overview of your possessions.

Can I access the Home Inventory Checklist online?

Yes, the State Farm Personal Worksheet form, including the Home Inventory Checklist, is often available for download or online access through the official State Farm website. This easy access enables users to complete their inventory at their convenience. Additionally, electronic versions may allow for easier updates and changes in the inventory as items are acquired or discarded.

What are the benefits of completing a home inventory with this form?

Completing a home inventory using the State Farm Personal Worksheet form can be incredibly beneficial. It provides peace of mind knowing that, in the event of a loss, you have documented your possessions clearly. This makes it easier and faster to process claims with your insurance company. Furthermore, a well-maintained inventory can help you assess your coverage needs and ensure that you are adequately protected against potential financial loss.

Common mistakes

When filling out the State Farm Personal Worksheet, many individuals inadvertently make common mistakes that can lead to complications later on. Recognizing these pitfalls is key to ensuring that you have an accurate inventory of your possessions, helping make any future claims smoother and more efficient.

One prevalent mistake is not being detailed enough in the descriptions of items. For each possession, it is essential to include not just the name of the item, but also its age, condition, and any pertinent details that enhance its value. For instance, instead of simply writing “sofa,” a better description would be “leather sofa, purchased in 2018, good condition.” This level of detail can drastically improve your documentation.

Failing to document valuable items is another common error. Many people overlook jewelry, collectibles, and expensive electronics. Including these high-value items in your inventory with precise descriptions and receipts can save a lot of headaches during the claims process.

Another frequent mistake is not updating the inventory regularly. Life changes, such as new purchases or disposals of items, should be reflected in your worksheet. An outdated inventory may leave gaps when it comes time to file a claim, which could affect the compensation you receive.

Omitting photographs is yet another oversight. Images serve as visual proof of ownership and can be particularly helpful in validating the condition of your belongings. Capturing high-quality photographs of your items—especially those of high value—can greatly aid in expediting claims.

Many individuals also neglect to store the completed worksheet in a safe place. Simply keeping it in the house can be risky, as the very reason you create the inventory is to protect against disasters like fire or theft. A better strategy is to keep a copy in a secure location outside the home, such as a safe deposit box or with a trusted friend or relative.

Not assigning a value estimate to each item can make it challenging to determine the total worth of your belongings. For effective insurance coverage, provide an estimated value based on purchase price and current market value, whenever applicable.

People also often neglect to review their insurance policy for any specific requirements. Some policies may request particular formatting or detail in your personal inventory, which if overlooked, could jeopardize your coverage.

Using vague categories instead of specifying items can lead to confusion. When grouping items by room or category, try to break it down as specifically as possible, rather than generalizing. For instance, instead of listing “clothing,” break it down into categories such as “shirts,” “pants,” “coats,” etc.

Finally, not taking enough time to conduct an inventory can lead to important items being forgotten. Rushing may cause individuals to overlook key possessions. Dedicate sufficient time, and perhaps tackle the task room by room to ensure thoroughness.

Each of these mistakes can complicate future claims with your insurance provider, so taking the time to avoid them will significantly benefit you in the long run. A well-completed State Farm Personal Worksheet ensures that your assets are protected and accurately documented.

Documents used along the form

When dealing with personal insurance, there are several documents that complement the State Farm Personal Worksheet. These forms aid in organizing information, assessing property value, and ensuring comprehensive coverage. Below is a list of documents commonly utilized alongside the State Farm Personal Worksheet.

- Homeowners Insurance Policy: This document outlines the coverage provided by your homeowners insurance, including particulars about what is included and any exclusions that may apply.

- Inventory Valuation Report: An assessment that lists the value of all items in your home, crucial for determining insurance coverage limits and helping in claims processing.

- Proof of Ownership Documents: Receipts, warranties, or other records that establish ownership of personal property. These are important for substantiating a claim.

- Claim Form: A standard form used to report a loss to an insurance company. It details the incident and lists the items affected.

- Risk Assessment Report: An evaluation of potential risks in your home. This report helps understand vulnerabilities that could impact insurance premiums and coverage needs.

- Property Damage Evaluation Form: A document used to assess and document the extent of any damage or loss sustained during an incident.

- Additional Living Expenses (ALE) Worksheet: This form helps track and claim additional living costs incurred when a home is uninhabitable due to damage.

- Personal Property Replacement Cost Estimator: A guide for estimating the cost to replace personal belongings lost or damaged, assisting in appropriate insurance limits.

- Maintenance and Repair Records: Documents recording repairs or maintenance performed on the home. These can validate claims by proving that the property was well cared for.

- Policy Declarations Page: This is the summary page of your insurance policy. It provides essential information such as coverage limits and premium amounts.

Utilizing these forms effectively can streamline the process of managing personal insurance. Each document serves a distinct purpose, enhancing clarity and organization in insurance matters. Proper documentation ultimately facilitates smoother claims and better homeowner protection.

Similar forms

- Homeowners Insurance Policy: Like the Personal Worksheet, a homeowners insurance policy outlines the items and structures insured under your plan. It provides a comprehensive overview of coverage and details any exclusions, helping you understand how your inventory is reflected in your insurance.

- Personal Property Inventory Form: Similar to the Personal Worksheet, this form is designed to catalog personal belongings for insurance purposes. It emphasizes the importance of documenting details like item descriptions, purchase dates, and values, thus streamlining claims.

- Loss Notice Form: This form is used to report damages or losses to your insurance company, requiring specific details about the affected items. The Personal Worksheet can assist in gathering this information quickly and accurately.

- Claim Statement: When filing an insurance claim, a claim statement is often necessary. The Personal Worksheet helps you prepare by ensuring you have detailed records of your possessions, which you can reference during the claims process.

- Proof of Loss Document: This document is submitted to your insurer as part of a claim. It typically includes a list of lost or damaged items, their values, and how the loss occurred, paralleling the detailed inventory the Personal Worksheet encourages you to maintain.

- Home Maintenance Records: Keeping a record of maintenance and upgrades can augment your home inventory. These documents show the history of your possessions and assist in claims related to loss or damage over time, analogous to how the Personal Worksheet tracks the details of your items.

Dos and Don'ts

When filling out the State Farm Personal Worksheet form, follow these guidelines to ensure a smooth process. This list includes useful tips on what to do and what to avoid.

- DO read all instructions carefully before you begin.

- DO list each item and provide as much detail as possible.

- DO include receipts and photographs for each valuable item.

- DO update the worksheet regularly to reflect new purchases.

- DO keep a copy of the completed form in a safe place.

- DON'T skip any sections, even if you feel the item is not important.

- DON'T use vague descriptions; they can delay claim processing.

- DON'T forget to date the receipts when submitting them.

- DON'T assume all contents in a room are obvious; be thorough.

- DON'T ignore the total value calculations at the end of the worksheet.

Misconceptions

Misconceptions surrounding the State Farm Personal Worksheet form can often lead to misunderstandings about its purpose and use. Here are nine common myths and the corresponding clarifications:

- It is only necessary to complete the worksheet once. Many believe that creating an inventory is a one-time task. However, it should be updated regularly to reflect new purchases or disposals of items.

- The worksheet is solely for insurance claims. While it does facilitate claims processes, an inventory also serves practical purposes, such as estate planning or disaster recovery.

- Only high-value items need to be documented. This is a myth; documenting all possessions, regardless of value, helps provide a comprehensive overview and aids in claim accuracy.

- Photos of items are unnecessary. It is essential to include photographs. Visual evidence of ownership can expedite the claims process and substantiate value.

- A professional appraiser must verify the inventory. It is not mandatory to hire an appraiser. Individuals can compile their own lists, but professional appraisals can enhance accuracy for valuable items.

- Filling out the worksheet is overly complicated. Many find the checklist user-friendly. It provides a simple format that can be filled out gradually, reducing stress.

- The worksheet is only for homeowners. Renters should also complete an inventory, as personal property coverage is often included in renters' insurance policies.

- All items must be itemized in detail. While comprehensive documentation is ideal, individuals can prioritize major categories over every single item.

- Once the worksheet is completed, it is not necessary to store it securely. In reality, keeping the completed form in a safe place, such as a fireproof safe or secure digital format, is crucial to ensure access after a loss occurs.

Understanding these misconceptions can enhance one’s preparedness in the event of loss and ensure that the inventory process is both effective and beneficial.

Key takeaways

Creating a personal inventory of your home can significantly ease the process of claiming insurance for lost items.

Utilize the State Farm Personal Worksheet to document details of each item, including its year purchased and cost.

Group items by room and category, as this organization will help in the event you need to quickly provide details to your insurer.

Don’t forget to include photos of your possessions as visual proof of ownership.

Itemize contents of larger belongings, such as cabinets and closets, since these often hold numerous valuable items.

A detailed checklist can minimize the time spent during claim settlement, making it smoother and less stressful.

The worksheet includes sections for different areas of the house, such as the living room, dining room, and kitchen, helping you stay thorough.

Consider updating your inventory regularly, especially after acquiring new items or during significant life changes.

Keep a copy of your inventory in a secure location, such as a safe deposit box or secure cloud storage, to ensure it remains accessible.

Browse Other Templates

Church Connect Card - Check your preferred method of communication: phone, email, or a personal visit.

How to Get Your Transcript - The form includes sections for both your current and prior names and details.

Daily Work Log,Employee Attendance Record,Time and Attendance Sheet,Monthly Time Tracking Form,Work Hours Verification Document,Office Attendance Register,Daily Hours Summary,Monthly Attendance Report,Staff Time Record,Work Schedule and Attendance Fo - Each month, the form must be updated for renewed accuracy.