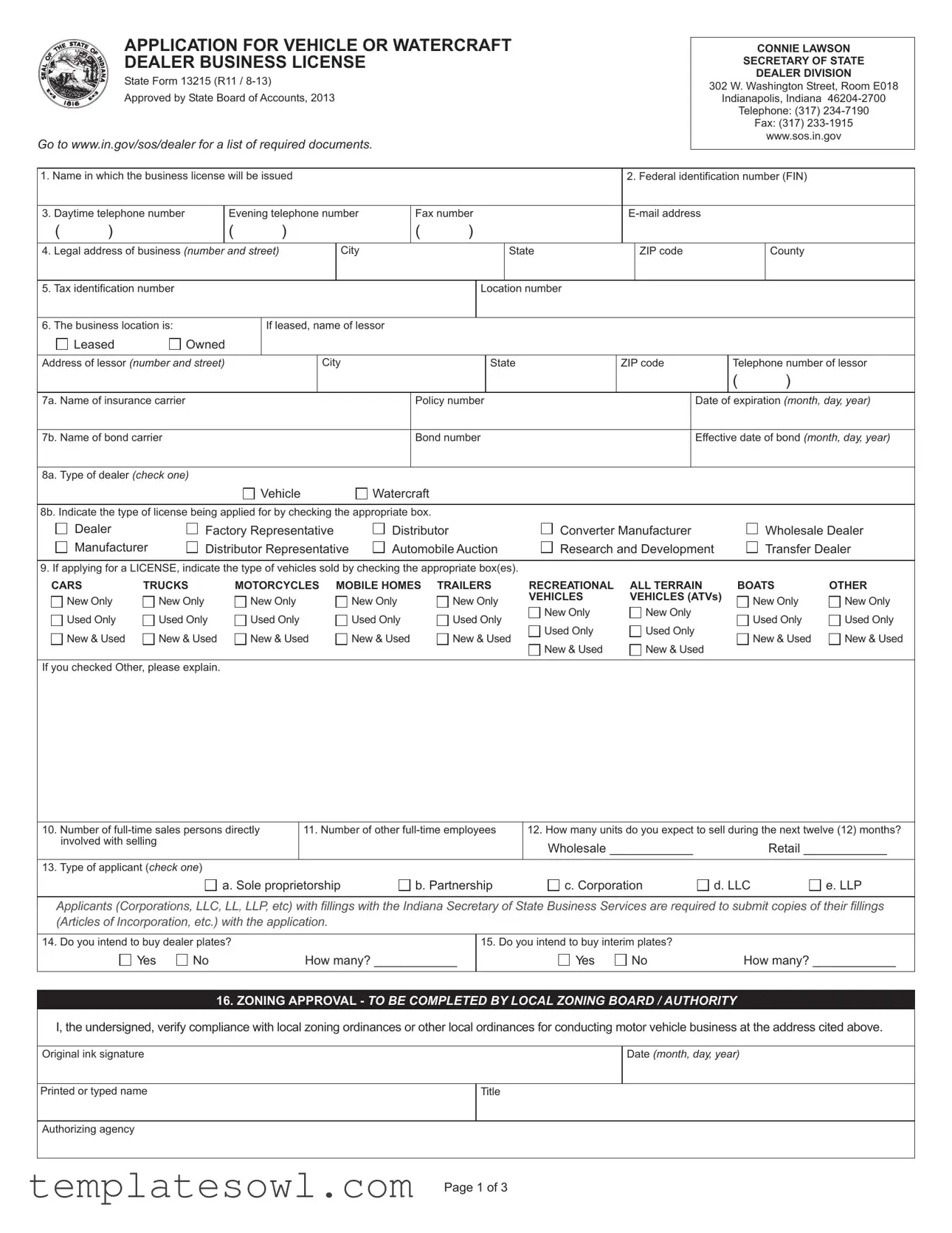

Fill Out Your State 13215 Form

The State Form 13215 serves as a comprehensive application for obtaining a vehicle or watercraft dealer business license in Indiana. This essential document requires key details about the business, including its legal name, federal identification number, contact information, and type of dealer, whether for vehicles or watercraft. Applicants must also provide various pieces of information about their business location, owners, and organizational structure, alongside disclosure of any previous criminal history or license issues. To ensure compliance, the form includes sections for zoning approval and necessary background checks, emphasizing the importance of adhering to local regulations. Also, a bond and insurance details must be submitted as part of the application process. All applicants should prepare to submit relevant documents alongside this form, such as Articles of Incorporation if applicable, and pay the associated licensing fees. From ensuring compliance with local zoning laws to documenting the expected sales volume, completing State Form 13215 is a critical step towards legally running a dealership. Moreover, the form also outlines the obligations of the dealer concerning record-keeping and ensures all details remain accurate under penalties of perjury.

State 13215 Example

APPLICATION FOR VEHICLE OR WATERCRAFT DEALER BUSINESS LICENSE

State Form 13215 (R11 /

Approved by State Board of Accounts, 2013

Go to www.in.gov/sos/dealer for a list of required documents.

CONNIE LAWSON

SECRETARY OF STATE

DEALER DIVISION

302 W. Washington Street, Room E018

Indianapolis, Indiana

Telephone: (317)

Fax: (317)

www.sos.in.gov

1. Name in which the business license will be issued |

|

|

|

|

|

|

|

|

2. Federal identification number (FIN) |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

3. Daytime telephone number |

|

Evening telephone number |

Fax number |

|

|

|

|

|

|

|

|

||||||||||||||

( |

) |

|

|

( |

|

) |

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

4. Legal address of business (number and street) |

|

|

|

City |

|

|

|

|

State |

|

|

ZIP code |

|

|

|

County |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

5. Tax identification number |

|

|

|

|

|

|

|

|

|

Location number |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

6. The business location is: |

|

If leased, name of lessor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Leased |

Owned |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Address of lessor (number and street) |

|

|

|

|

City |

|

|

|

|

State |

ZIP code |

|

Telephone number of lessor |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

7a. Name of insurance carrier |

|

|

|

|

|

|

|

Policy number |

|

|

|

|

|

Date of expiration (month, day, year) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

7b. Name of bond carrier |

|

|

|

|

|

|

|

Bond number |

|

|

|

|

|

Effective date of bond (month, day, year) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

8a. Type of dealer (check one) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Vehicle |

Watercraft |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

8b. Indicate the type of license being applied for by checking the appropriate box. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Dealer |

Factory Representative |

Distributor |

|

Converter Manufacturer |

|

|

|

Wholesale Dealer |

|||||||||||||||||

Manufacturer |

Distributor Representative |

Automobile Auction |

|

Research and Development |

|

|

Transfer Dealer |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

9. If applying for a LICENSE, indicate the type of vehicles sold by checking the appropriate box(es). |

|

|

|

|

|

|

|

|

|

||||||||||||||||

CARS |

TRUCKS |

MOTORCYCLES MOBILE HOMES |

TRAILERS |

|

RECREATIONAL |

|

ALL TERRAIN |

|

BOATS |

OTHER |

|||||||||||||||

New Only |

New Only |

New Only |

New Only |

|

New Only |

|

VEHICLES |

|

VEHICLES (ATVs) |

|

New Only |

New Only |

|||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Used Only |

Used Only |

Used Only |

Used Only |

|

Used Only |

|

New Only |

|

|

New Only |

|

|

Used Only |

Used Only |

|||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

New & Used |

New & Used |

New & Used |

New & Used |

|

|

|

|

|

Used Only |

|

|

Used Only |

|

|

New & Used |

New & Used |

|||||||||

|

New & Used |

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New & Used |

|

|

New & Used |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

If you checked Other, please explain. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

10. Number of |

|

11. Number of other |

|

12. How many units do you expect to sell during the next twelve (12) months? |

|||||||||||||||||||||

involved with selling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wholesale ____________ |

|

|

|

Retail ____________ |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

13. Type of applicant (check one) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

a. Sole proprietorship |

|

b. Partnership |

|

c. Corporation |

d. LLC |

|

|

e. LLP |

|||||||||||||||

Applicants (Corporations, LLC, LL, LLP, etc) with fillings with the Indiana Secretary of State Business Services are required to submit copies of their fillings (Articles of Incorporation, etc.) with the application.

14. Do you intend to buy dealer plates? |

|

15. Do you intend to buy interim plates? |

|

||

Yes |

No |

How many? ____________ |

Yes |

No |

How many? ____________ |

|

|

|

|

|

|

16. ZONING APPROVAL - TO BE COMPLETED BY LOCAL ZONING BOARD / AUTHORITY

I, the undersigned, verify compliance with local zoning ordinances or other local ordinances for conducting motor vehicle business at the address cited above.

Original ink signature |

|

Date (month, day, year) |

|

|

|

Printed or typed name |

Title |

|

|

|

|

Authorizing agency |

|

|

Page 1 of 3

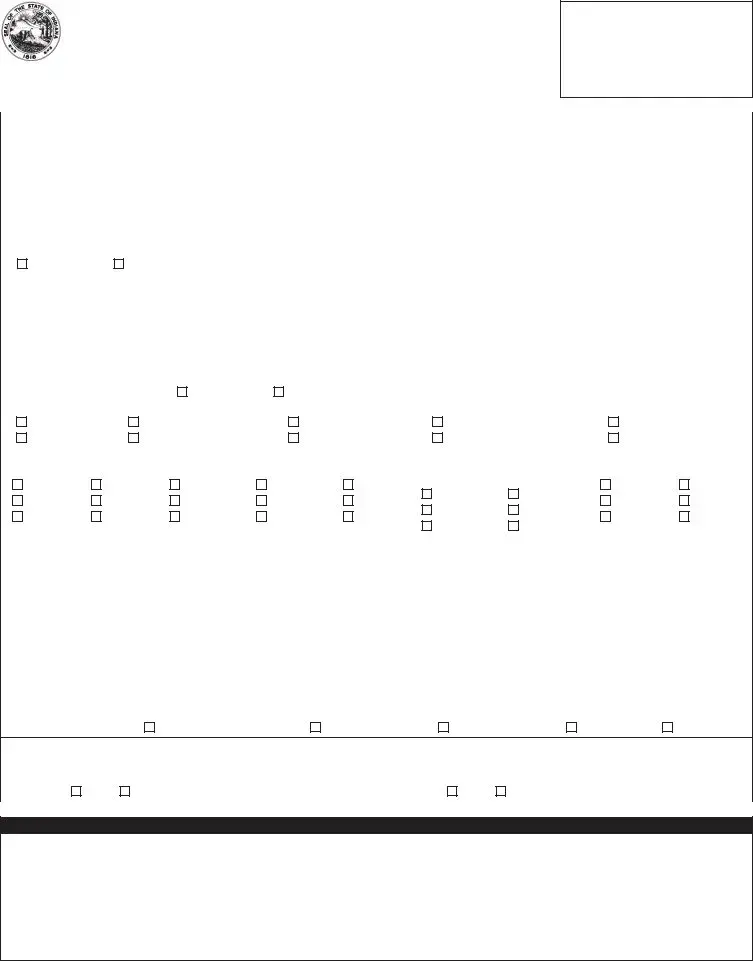

17. OWNER / OFFICER INFORMATION

A. Name of primary owner |

|

Title |

|

|

|

|

|

|

|

|

|

Home address (number and street) |

|

|

|

|

ZIP code |

|

|

|

|

|

|

City |

State |

|

Home telephone number |

||

|

|

|

( |

) |

|

|

|

|

|

|

|

B. Name of additional owner |

|

Title |

|

|

|

|

|

|

|

|

|

Home address (number and street) |

|

|

|

|

ZIP code |

|

|

|

|

|

|

City |

State |

|

Home telephone number |

||

|

|

|

( |

) |

|

|

|

|

|

|

|

C. Name of additional owner |

|

Title |

|

|

|

|

|

|

|

|

|

Home address (number and street) |

|

|

|

|

ZIP code |

|

|

|

|

|

|

City |

State |

|

Home telephone number |

||

|

|

|

( |

) |

|

|

|

|

|

|

|

The applicant and all corporate officers, partners, and owners must submit to a national criminal history background check (as defined in IC

18. Has any owner, partner, officer, or director of the applicant owned or worked for another dealership in this or any other state? |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If yes, name of individual |

|

|

|

|

Name of dealership |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of dealership (number and street) |

|

|

|

|

City |

|

State |

|

|

|

ZIP code |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If yes, name of individual |

|

|

|

|

Name of dealership |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of dealership (number and street) |

|

|

|

|

City |

|

State |

|

|

|

ZIP code |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

19. Name of person upon whom legal service or process may be made |

Address (number and street, city, state, and ZIP code) |

|

|

Telephone number |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

20. If corporation, LLC, or LLP, state of action |

Date of action (month, day, year) |

If foreign corporation (not Indiana), date of admission to do business in Indiana |

|

|||||||||||||

|

|

|

|

|

|

(month, day, year) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

21. REPRESENTATIVE |

|

ADDRESS (NUMBER AND STREET) |

|

CITY |

|

STATE |

|

ZIP CODE |

TELEPHONE NUMBER |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22. QUESTIONS |

|

|

|

|

|

|

|

|

|

|||

Has any owner, partner, or director on the application ever been arrested or convicted of a crime that has not been |

|

|

|

Yes |

No |

|||||||||||

expunged by a court? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If yes, please give details. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Has any owner, partner, or director on the application had a license suspended, or revoked or had an application |

|

|

|

|

Yes |

No |

||||||||||

for a license denied in this or any other state? |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If yes, please explain. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Is this location devoted solely to the business of buying, selling, and/or exchanging motor vehicles? |

|

|

|

|

|

|

|

Yes |

No |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If no, please explain. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 2 of 3

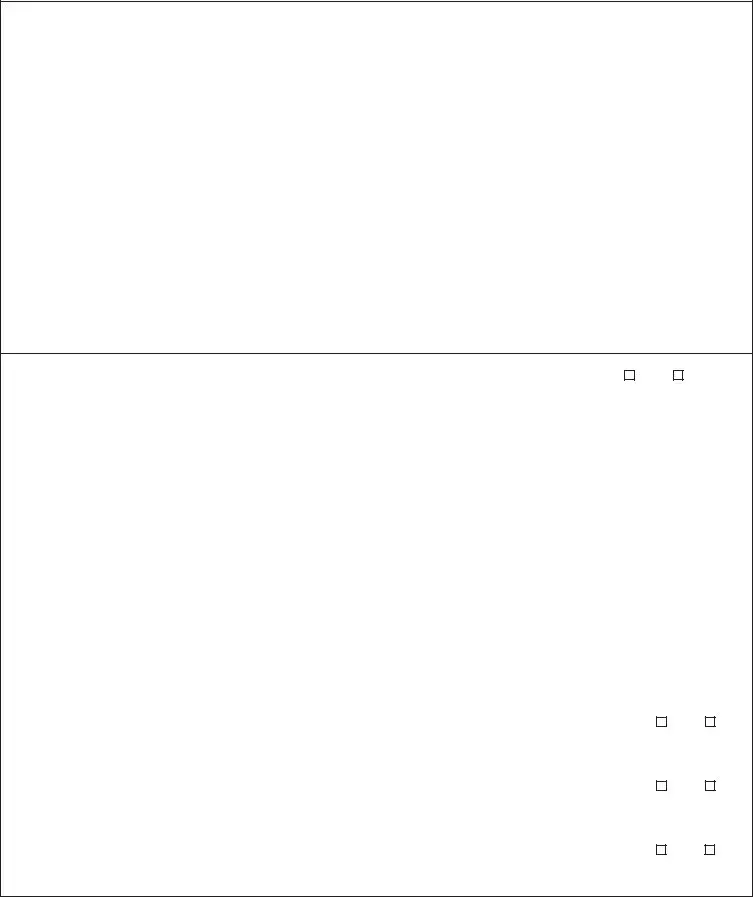

PLEASE NOTE: Every dealer, manufacturer, or distributor must file with the Secretary of State a current copy of each franchise to which it is a party; or, if multiple franchises are identical except for stated items, a copy of the franchise form with supplemental schedules of variations from the form is acceptable.

A Surety Bond is required for all dealers licensed under IC

All applications must have the application I license fee attached. Fees are posted on the Secretary of State, Auto Dealer Service Division website: www.in.gov/sos/dealer.

All books, records, and files relating to the applicant’s inventory and motor vehicle titles must be kept at the established place of business and be available for inspection.

I hereby certify, under the penalty of perjury, that I am authorized to make this application and that the answers and information contained in this application are true and correct.

Original ink signature of applicant

Date (month, day, year)

Printed or typed name

Title

Page 3 of 3

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used to apply for a business license to operate as a vehicle or watercraft dealer in Indiana. |

| Governing Law | The application adheres to Indiana Code IC 9-32-11, which regulates dealers of motor vehicles. |

| Required Information | Applicants must provide personal details such as federal identification number, business location, and insurance information. |

| Zoning Approval | Zoning compliance must be verified by the local zoning board to ensure the business aligns with local ordinances. |

| Background Check | All owners and partners must undergo a national criminal history background check, impacting eligibility. |

| Dealer Plates | Applicants can indicate if they intend to purchase dealer and interim plates as part of the application process. |

| Submission Requirements | Corporations and LLCs must submit copies of their filings with the Indiana Secretary of State when applying. |

Guidelines on Utilizing State 13215

Filling out the State Form 13215 is an important step for individuals or entities looking to obtain a dealer business license for vehicles or watercraft. Completing this form accurately is crucial, as it gathers essential details needed by the state. Once you've filled out the form, you must submit it along with required documents and possibly a fee. Make sure to keep copies of everything for your records.

- Start with the name that will be used for the business license.

- Enter your federal identification number.

- Provide your daytime, evening telephone numbers, along with a fax number and e-mail address.

- Fill in the legal address of the business, including city, state, ZIP code, and county.

- Add your tax identification number and the location number.

- Indicate if the business location is leased or owned. If leased, provide the name of lessor and their address, as well as the telephone number of the lessor.

- Enter the name of your insurance carrier, the policy number, and the expiration date of the policy.

- Provide the name of your bond carrier, the bond number, and the effective date of the bond.

- Check the type of dealer (vehicle or watercraft).

- Indicate the type of license being applied for by checking the appropriate box.

- If applying for a vehicle license, check the specific types of vehicles you intend to sell.

- State how many full-time salespersons are directly involved with selling, and how many other full-time employees you have.

- Estimate the number of units you expect to sell during the next twelve months.

- Check the type of applicant (sole proprietorship, partnership, corporation, LLC, or LLP).

- Indicate whether you intend to purchase dealer plates and/or interim plates, including the number of each.

- Complete the zoning approval section, requiring a signature from your local zoning authority.

- Provide information about all owners/officers, including full names, titles, home addresses, and home telephone numbers.

- Answer questions regarding criminal history and previous dealership experience.

- Provide the name and address for legal service or process.

- If applicable, provide details for the corporation, LLC, or LLP including the state of action and the date of action.

- Answer all other questions regarding arrests, license history, and business operations.

- Review the form for accuracy, then provide your signature and the date to certify your application.

What You Should Know About This Form

What is the purpose of the State Form 13215?

The State Form 13215 is an application used to obtain a vehicle or watercraft dealer business license in Indiana. This form captures essential information about the business, including the owner's details, the type of dealer being applied for, and the expected business operations. It ensures that businesses comply with state regulations before they can legally sell vehicles or watercraft.

What information is required to complete the application?

To complete the State Form 13215, various pieces of information must be provided. Applicants need to include the business name, federal identification number, legal address, tax identification number, and details of any insurance and bond carriers. Additionally, applicants should specify the type of dealer and the types of vehicles they intend to sell. Contact information for owners and relevant background information about them is also required.

Are there any specific requirements for the owners or partners?

Yes, all owners, partners, and corporate officers must undergo a national criminal history background check at the applicant's expense. The state may deny the application if any individual has felony or misdemeanor convictions relating to motor vehicle dealings. This helps ensure that only responsible parties are licensed to operate as dealers.

What happens if an owner has previously owned another dealership?

If any owner, partner, or officer has previously owned or worked for another dealership in Indiana or any other state, this information must be disclosed on the application. The details required include the name of the individual, the name of the dealership, and the dealership's address. Transparency about past business dealings helps to evaluate the credibility of the application.

Is zoning approval necessary for this application?

Yes, zoning approval is necessary and must be completed by the local zoning board or authority. The application includes a section where the undersigned must verify compliance with local zoning ordinances for conducting motor vehicle business at the specified address. This ensures the proposed business location adheres to local regulations.

Where can I find more information about filing fees and additional requirements?

More information about filing fees, required documents, and the application process can be found on the Secretary of State's Auto Dealer Service Division website at www.in.gov/sos/dealer. It's crucial to check this site for the most current information and ensure that all necessary documents and fees are submitted with the application.

Common mistakes

Completing the State Form 13215 for a vehicle or watercraft dealer business license can be challenging. Many applicants make common errors that can delay the approval process. Here's a look at eight frequent mistakes.

First, applicants often forget to provide the correct Federal Identification Number (FIN). This number is crucial for tax purposes and verifies business identity. Omitting or entering an incorrect FIN will lead to immediate delays in processing.

Second, incomplete contact information is a common pitfall. Missing details like your daytime or evening telephone number can hinder communication. Ensure that all phone numbers and your email address are correct and clearly written.

Another mistake involves the legal address of the business. It should be complete, including the ZIP code and county. Inaccuracies here can cause confusion about your business location, potentially impacting zoning approvals.

Providing insufficient information about the business structure is also an issue. This includes improperly checking the type of applicant box, whether it’s a sole proprietorship, corporation, LLC, or another form. Not indicating this correctly can result in the application being deemed incomplete.

Many applicants fail to identify the types of vehicles or watercraft they plan to sell. The form asks you to select multiple options. Skipping this section or marking it incorrectly can lead to confusion about your business operations.

Additionally, neglecting to answer questions regarding any past criminal history can be detrimental. The application requires disclosures about arrests, convictions, or previous license denials. Providing this information accurately and completely is essential.

An often overlooked section is the zoning approval. Without the original ink signature from the local authority, the application can be rejected outright. This step requires proactive communication with local officials to ensure compliance with zoning ordinances.

Lastly, remember to include the application fee. Many applicants forget this crucial component, leading to return applications. Always check the fee amount on the Secretary of State's website before submitting your application.

By avoiding these common mistakes, you can navigate the State Form 13215 more efficiently, ensuring a smoother licensing process for your business.

Documents used along the form

When applying for a vehicle or watercraft dealer business license using State Form 13215, there are other essential documents that you may need to submit alongside it. Here’s a quick rundown of six key forms often required in the process.

- Articles of Incorporation: This document is necessary if your business is structured as a corporation. It outlines the basic information about the corporation, including its name, purpose, and structure.

- Business License Application: In addition to State Form 13215, this local or state-required document must be filled out to operate legally within your jurisdiction, confirming that you comply with local business regulations.

- Criminal Background Check Authorization: Owners and officers must authorize a background check to examine their criminal history. This is crucial for assessing eligibility for a dealer license.

- Surety Bond: A surety bond protects consumers and ensures your compliance with regulations. Its amount depends on your location and business structure and must be submitted with your application.

- Zoning Compliance Verification: This form confirms that your business location meets local zoning laws and can conduct vehicle sales at the specified address.

- Franchise Agreements: If your business operates under a franchise, you’ll need to submit copies of your franchise agreements to the Secretary of State to validate your business operations.

Gathering these forms may seem challenging, but they are vital for a smooth application process. Ensuring you have all necessary documentation can make the difference in getting your dealer business off the ground efficiently.

Similar forms

The State Form 13215 is designed for individuals and businesses applying for a vehicle or watercraft dealer business license. It shares similarities with other licensing and registration documents found across various industries. Here are ten documents that can be associated with State Form 13215, detailing their similarities:

- Business License Application: Like the State Form 13215, this document is necessary for establishing a legal business presence and often requires information about ownership, business structure, and location.

- Seller’s Permit Application: Similar in purpose, this form is needed for businesses that sell goods. Both documents ask for tax identification numbers and details about the business's activities.

- Professional License Application: This document, required for certain professions (like healthcare or legal services), also includes personal information about the applicant and may require background checks, akin to the requirements in State Form 13215.

- Franchise Disclosure Document: When applying to operate under a franchise, you’ll need to submit a document detailing business operations. Both forms require transparency about business practices and ownership details.

- Tax Registration Application: This form is critical for businesses to comply with tax laws. Like State Form 13215, it requests federal and state identification numbers and information on business type.

- Alcohol Beverage License Application: Just as State Form 13215 collects data on ownership and business intent, this application requires information about how alcohol will be sold, including criminal background checks for applicants.

- Real Estate License Application: Both forms demand disclosure of personal and professional history of the applicant, ensuring credibility within legally regulated industries.

- Motor Carrier Registration: When starting a trucking business, this registration is needed. Similar to State Form 13215, it requires compliance with regulations and often asks for details on the vehicles involved.

- Nonprofit Organization Registration: This document requires disclosures about the organization’s mission, leadership, and financials, much like how State Form 13215 seeks thorough information about dealership operations and ownership.

- Building Permit Application: Before construction or renovations, applying for this permit requires information on property ownership and intended use, paralleling the request for zoning compliance in State Form 13215.

Dos and Don'ts

Filling out the State 13215 form can be straightforward if you keep a few things in mind. Here are nine helpful dos and don’ts to consider:

- Do check all your information for accuracy. Errors can delay your application.

- Do provide complete contact information, including daytime and evening phone numbers.

- Do ensure that you have all required documents ready before starting the application.

- Do sign the application in ink. Digital signatures may not be accepted.

- Do include a surety bond if required, along with the necessary fees.

- Don’t leave any sections blank unless instructed to do so. Missing information could lead to a rejection.

- Don’t submit an incomplete application. Ensure all supporting documents are included.

- Don’t forget to verify the zoning approval before submitting your application.

- Don’t overlook any previous criminal records. This information is essential for your application.

By following these guidelines, you'll make the application process easier and more efficient!

Misconceptions

- Misconception 1: The State 13215 form is only for vehicle dealers.

- Misconception 2: Completing the State 13215 form guarantees a business license.

- Misconception 3: All applicants fill out the same sections on the form.

- Misconception 4: The form does not require ongoing updates or renewals.

While the form is primarily used by vehicle dealers, it also applies to watercraft dealers. When filling out the form, applicants must specify the type of license they are applying for, indicating whether they intend to deal in vehicles or watercraft, or both. This inclusivity is crucial to understanding the full scope of the licensing process.

It is important to note that submitting the form does not automatically result in the issuance of a business license. The application undergoes review by the Secretary of State's office. Additionally, factors such as criminal history, compliance with local zoning ordinances, and fulfillment of all documentation requirements are considered before approval. A thorough review ensures that only eligible applicants receive a license.

The State 13215 form is tailored to accommodate various types of dealers, such as manufacturers, wholesalers, and retailers. Depending on the nature of the business and the type of dealer status, different sections become relevant. Some applicants may need to provide additional information, like insurance and bond details, while others may focus on licensing specifics for their operations.

Many individuals assume that once a license is obtained through the State 13215 form, it remains valid indefinitely. However, licenses must be renewed periodically, and all dealers are obliged to maintain accurate records. Additionally, any changes in ownership, address, or business structure necessitate updates to the Secretary of State’s office. Keeping up with these requirements is vital for compliance and continued operation.

Key takeaways

Filling out and using the State 13215 form is an important process for individuals or entities looking to run a vehicle or watercraft dealer business in Indiana. Here are some key takeaways regarding this form:

- The form requires basic details about the business, including the name, legal address, and the federal identification number.

- Applicants must provide contact information such as telephone numbers and email addresses to ensure efficient communication.

- It's essential to identify the type of dealer license being applied for, whether for vehicles or watercraft, and to indicate the specific types of vehicles sold.

- Applicants need to specify whether they intend to buy dealer plates or interim plates, which are crucial for displaying registration legally.

- Zoning approval must be confirmed by the local zoning board or authority, as well as compliance with local ordinances.

- All owners, partners, and corporate officers must undergo a national criminal history background check to determine eligibility.

- Filing the required supplementary documents is crucial. Corporations and LLCs must provide copies of their articles of incorporation or similar filings.

- Finally, the completed application must include the appropriate fees to be considered for processing by the Secretary of State’s office.

Browse Other Templates

Estate Tax Ny - All attachments should be clearly labeled and included with the submission.

What Is a Ub92 Form - Patient sex is recorded as M, F, or U for unknown.