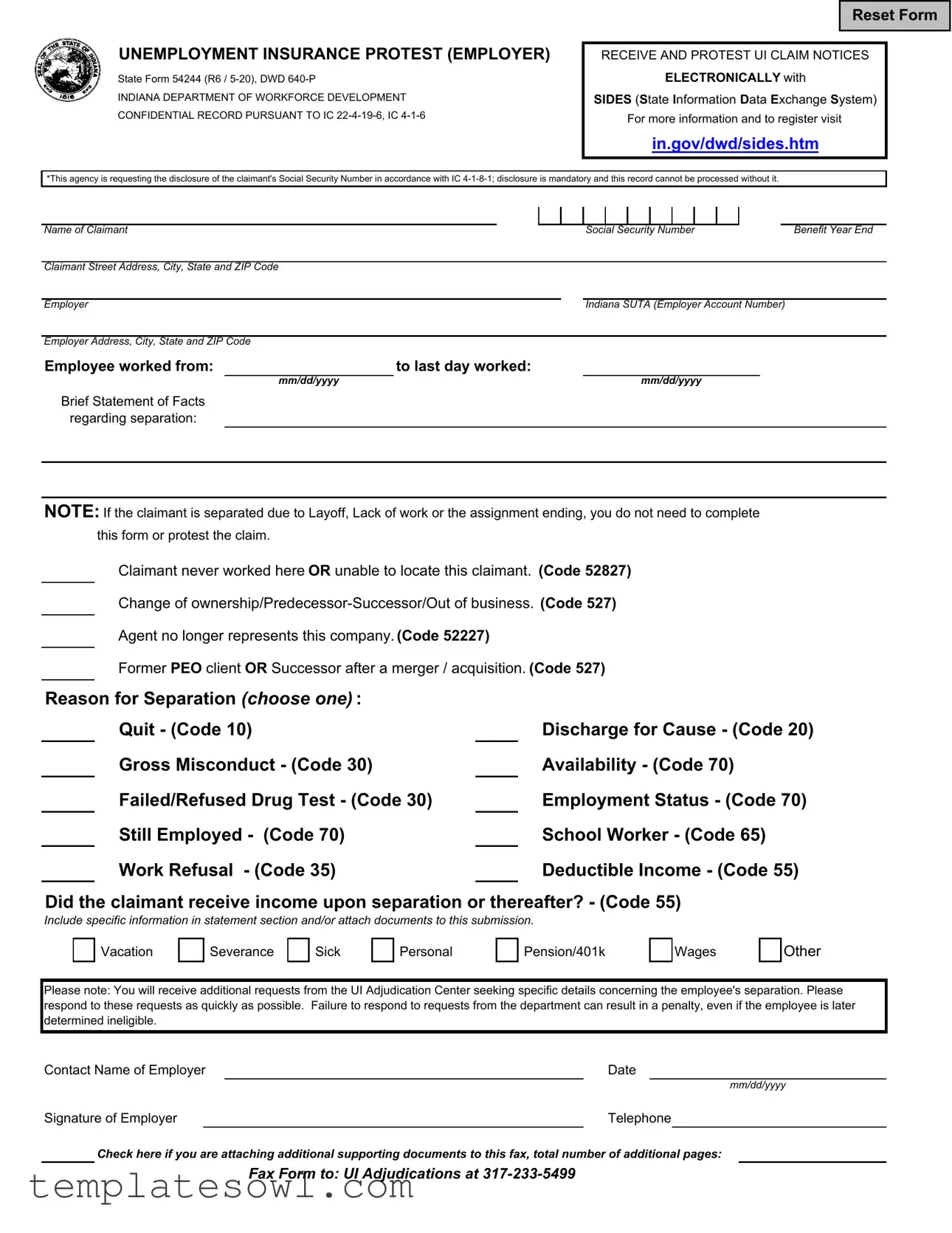

Fill Out Your State 54244 Form

The State 54244 form, also known as the Unemployment Insurance Protest (Employer) form, is a vital document within Indiana's unemployment benefits framework. Designed for employers, this form serves as a means to formally protest unemployment insurance claims filed by former employees. It details essential information about both the claimant and the employer, including names, addresses, and Social Security Numbers, which the agency requires for processing. The form prompts employers to provide specifics about the separation of employment, such as the dates of employment, reasons for separation, and any income the claimant may have received upon leaving their job. It is crucial to understand that not every separation warrants the completion of this form; for instance, claims resulting from layoffs or lack of work do not necessitate a protest. Failure to submit this form and respond to subsequent requests can impose penalties on employers, underscoring the importance of thorough and timely submissions. By participating actively in the unemployment claims process, employers ensure that their position is clearly represented and that they fulfill their legal obligations while navigating the complexities of unemployment insurance. When filled out correctly, the information on State Form 54244 helps protect the employer’s interests and contributes to a fair adjudication process.

State 54244 Example

UNEMPLOYMENT INSURANCE PROTEST (EMPLOYER)

State Form 54244 (R6 /

INDIANA DEPARTMENT OF WORKFORCE DEVELOPMENT

CONFIDENTIAL RECORD PURSUANT TO IC

Reset Form

RECEIVE AND PROTEST UI CLAIM NOTICES

ELECTRONICALLY with

SIDES (State Information Data Exchange System)

For more information and to register visit

in.gov/dwd/sides.htm

*This agency is requesting the disclosure of the claimant's Social Security Number in accordance with IC

Name of Claimant

Claimant Street Address, City, State and ZIP Code

Social Security Number

Benefit Year End

Employer |

|

|

Indiana SUTA (Employer Account Number) |

||

|

|

|

|

|

|

Employer Address, City, State and ZIP Code |

|

|

|

|

|

Employee worked from: |

to last day worked: |

||||

|

mm/dd/yyyy |

|

|

mm/dd/yyyy |

|

Brief Statement of Facts

regarding separation:

NOTE: If the claimant is separated due to Layoff, Lack of work or the assignment ending, you do not need to complete this form or protest the claim.

Claimant never worked here OR unable to locate this claimant. (Code 52827)

Change of

Agent no longer represents this company. (Code 52227)

Former PEO client OR Successor after a merger / acquisition. (Code 527)

Reason for Separation (choose one) : |

|

|

|

|

Quit - (Code 10) |

|

Discharge for Cause - (Code 20) |

|

Gross Misconduct - (Code 30) |

|

Availability - (Code 70) |

|

Failed/Refused Drug Test - (Code 30) |

|

Employment Status - (Code 70) |

|

Still Employed - (Code 70) |

|

School Worker - (Code 65) |

|

Work Refusal - (Code 35) |

|

Deductible Income - (Code 55) |

Did the claimant receive income upon separation or thereafter? - (Code 55)

Include specific information in statement section and/or attach documents to this submission.

Vacation

Severance

Sick

Personal

Pension/401k

Wages

Other

Please note: You will receive additional requests from the UI Adjudication Center seeking specific details concerning the employee's separation. Please respond to these requests as quickly as possible. Failure to respond to requests from the department can result in a penalty, even if the employee is later determined ineligible.

Contact Name of Employer |

|

Date |

|||

|

|

|

|

|

mm/dd/yyyy |

Signature of Employer |

|

|

Telephone |

|

|

Check here if you are attaching additional supporting documents to this fax, total number of additional pages:

Fax Form to: UI Adjudications at

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | UNEMPLOYMENT INSURANCE PROTEST (EMPLOYER) |

| Form Number | State Form 54244 (R6 / 5-20) |

| Governing Law | Indiana Code (IC) 22-4-19-6 |

| Disclosure Requirement | Disclosure of the claimant's Social Security Number is mandatory (IC 4-1-8-1). |

| Submission Method | Form can be faxed to UI Adjudications at 317-233-5499. |

| Protest Conditions | If the claimant was separated due to Layoff, Lack of Work, or Assignment Ending, the form is not required. |

Guidelines on Utilizing State 54244

Completing the State 54244 form is an important process for employers who wish to protest unemployment insurance claims. This form helps ensure that all necessary information about the claimant and the separation is submitted correctly. Following these steps will guide you through filling out the form.

- Download the State 54244 form from the Indiana Department of Workforce Development website or obtain a physical copy.

- Fill in the Claimant's Information:

- Name of Claimant

- Claimant's Street Address, City, State, and ZIP Code

- Claimant's Social Security Number (mandatory)

- Benefit Year End

- Enter Employer's Information:

- Employer Indiana SUTA (Account Number)

- Employer Address, City, State, and ZIP Code

- Provide Employment Details:

- Employee worked from (mm/dd/yyyy)

- to (last day worked - mm/dd/yyyy)

- Write a Brief Statement of Facts: Describe the reason for separation clearly, including any relevant information.

- Select the Reason for Separation: Choose one from the provided options (e.g., Quit, Discharge for Cause, etc.) and insert the corresponding code.

- Provide Income Information: Indicate if the claimant received any income upon separation or thereafter. List the types of income (e.g., Vacation, Severance, etc.) and attach supporting documents if necessary.

- Complete the Employer's Details:

- Contact Name of Employer

- Date (mm/dd/yyyy)

- Signature of Employer

- Telephone Number

- If applicable, check the box to indicate attachment of additional supporting documents, and specify the total number of pages attached.

- Fax the completed form to: UI Adjudications at 317-233-5499.

Once the form is sent, be prepared for further correspondence from the UI Adjudication Center. They may request additional details about the employee's situation. Prompt responses will help avoid penalties and ensure the process runs smoothly.

What You Should Know About This Form

What is the State Form 54244 used for?

The State Form 54244 is used by employers to protest unemployment insurance claims made by former employees. Employers can outline the reasons for their protest and submit relevant information about the claimant's separation from the company.

Who needs to fill out the State Form 54244?

Primarily, employers who receive a notice regarding an unemployment insurance claim from a former employee should complete this form. If an employer disputes the claim, they must provide the requested information to support their case.

When should I not fill out the form?

If the former employee was separated due to a layoff, lack of work, or if their assignment simply ended, you do not need to complete the State Form 54244. Additionally, if the claimant never worked for your company or if they are unlocatable, a different code should be used instead.

What information do I need to provide on the form?

You'll need to provide the claimant's name, address, Social Security Number, and specific details related to their separation from your company. You will also indicate the reason for the separation, such as whether they quit, were discharged, or if any misconduct occurred during employment.

What happens after I submit the State Form 54244?

After submitting the form, expect to receive additional inquiries from the Unemployment Insurance Adjudication Center. They will ask for further details related to the employee’s separation. Timely responses to these requests are crucial to avoid penalties, even if the claimant is later found ineligible.

Is there a deadline for submitting the form?

Can I attach additional documents to the State Form 54244?

Yes, you are encouraged to include any relevant supporting documents that can strengthen your protest. Just remember to indicate how many additional pages you are attaching when you submit the form.

Common mistakes

Completing the State Form 54244, which pertains to unemployment insurance protests in Indiana, can be a straightforward process. However, there are common mistakes that individuals frequently encounter. One of the foremost errors is failing to provide the claimant's Social Security Number. This number is mandatory for processing the form and not including it can delay or completely void the application.

Another mistake involves incorrect or incomplete information related to the claimant’s employment details. This includes not accurately documenting the dates of employment. Specific dates must be provided, and any discrepancies could lead to confusion or complications during the review process. Employers should ensure that the employment period is precisely stated.

A third error that often occurs is neglecting to select a valid Reason for Separation. This section requires careful consideration, as it provides insight into the circumstances of the claimant’s departure from the company. Selecting an incorrect code not only undermines the integrity of the submission but can also lead to unnecessary disputes.

Additionally, many employers fail to attach any necessary supporting documents. If there are specific facts regarding the separation, such as written warnings or statements, these should be included with the submission. Ensuring that all documents are accounted for reinforces the clarity of the case and aids in the adjudication process.

Finally, one common oversight is not responding promptly to any follow-up requests from the Unemployment Insurance Adjudication Center. It is crucial to monitor any communications from the department and provide additional information as required. Delays in responding can result in penalties, which could impact the employer adversely.

Documents used along the form

The State Form 54244 is used by employers in Indiana to protest unemployment insurance claims. When filing this form, other related documents may often be needed to provide additional information about the claimant and the circumstances surrounding their separation from employment. Below is a list of commonly used forms and documents that may accompany the State 54244 form, along with brief descriptions for each.

- Employer Response Form: This document is submitted to provide a detailed account of the employee's separation, including the reasons for termination and any relevant circumstances surrounding the dismissal.

- Separation Notice: This notice outlines the reasons for an employee's termination. It is often required by state law and can help clarify the employer's position regarding the unemployment claim.

- Claimant's Employment Record: This record includes dates of employment, job titles, and pertinent job performance notes. It can help establish the context of the claimant's employment history.

- Documentation of Company Policies: Copies of relevant company policies or procedures related to employee conduct, disciplinary actions, or termination protocols may be needed to substantiate the employer's claims.

- Additional Evidence: Any other supporting evidence, such as emails, performance reviews, or witness statements can be submitted to strengthen the employer's case.

- Request for Hearing Form: If an employer wishes to formally contest a decision made by the adjudication agency, this form is used to request a hearing to present their case in front of a review board.

It is important to complete and submit these documents in a timely manner, as delays can affect the outcome of the case. Ensuring all information is accurate and comprehensive can help in effectively addressing unemployment insurance claims.

Similar forms

The State Form 54244, which efficiently addresses unemployment insurance protests by employers, resembles several other important documents related to the unemployment claims process. Below is a list of seven similar documents, including a brief explanation of how they compare to State Form 54244.

- State Form 54243 - Unemployment Insurance Claim (Employer Response): This form allows employers to respond to a claimant's initial unemployment claim. Like Form 54244, it seeks to establish the facts surrounding the claimant's eligibility and the circumstances of their separation from employment.

- State Form 54245 - Request for Additional Information: This document serves to gather further details about the unemployment claim process. It is similar in that it requires specific explanations and supporting documentation from the employer, much like what is requested in Form 54244.

- State Form 54246 - Appeal of Unemployment Benefits Decision: Employers can use this document when contesting a decision made regarding a claimant's benefits. This is akin to the purpose of Form 54244 as both documents are utilized in the context of disputing employment-related claims.

- UI Adjudication Center Communication Template: This template encompasses the communication between employers and the adjudication center regarding claims. It shares similarities with Form 54244 regarding the necessity for clear statements and timelines in responding to claims issues.

- State Form 54247 - Wage Verification Form: This document is used to verify a claimant's earnings during their period of employment. Form 54244, while focusing on protests, also requires wage-related information, linking them both to employment history verification.

- State Form 54248 - Employer Registration for Unemployment Insurance: This registration is essential for employers and parallels Form 54244 in its role within the broader unemployment system. Both documents emphasize the importance of maintaining accurate employer records with the state.

- SIDE System Employer Notification: This electronic notification aids employers in managing their claims electronically. Similar to Form 54244, this document generates necessary responses from employers to inform the state about claim issues and statuses.

Each of these documents, much like State Form 54244, plays a critical role in the administration of unemployment insurance and the maintenance of accurate records, ensuring that both employers and claimants are fairly represented in the claims process.

Dos and Don'ts

When filling out the State Form 54244 for unemployment insurance protest, consider the following important guidelines to ensure accurate completion.

- Do provide the claimant's Social Security Number; it is mandatory for processing.

- Do clearly state the reason for separation from employment.

- Do check for accuracy in the employer’s contact information.

- Do attach any necessary supporting documents as required.

- Do respond promptly to any additional requests from the UI Adjudication Center.

- Don’t fill out the form if the claimant was separated due to layoff or lack of work.

- Don’t omit any relevant details in the statement section.

- Don’t forget to include the exact dates of employment.

- Don’t submit incomplete forms, as this can delay processing.

- Don’t use abbreviations that might confuse the reviewers.

Following these do’s and don’ts will facilitate a smoother process in submitting your protest and increase the likelihood of a successful outcome.

Misconceptions

Misconceptions about the State 54244 form can lead to confusion for employers. Here is a list of seven common myths surrounding this form, along with clarifications to help set the record straight.

- The State 54244 form is necessary for every claim. Many employers believe they must complete this form for all unemployment claims. In reality, you only need to file this form if the claimant's separation was not due to layoffs or lack of work.

- Filing a protest guarantees a decision in the employer's favor. Some might think that simply submitting the State 54244 form will result in a favorable outcome for their protest. However, the determination is made based on the facts presented and the law, not on the submission of the form alone.

- Claimants must have worked for the company recently for the form to be applicable. It's a common misconception that only recent employees can trigger the need for a protest. Even if the claimant’s last day was some time ago, you may still need to respond if the separation circumstances warrant it.

- All sections of the form need to be filled out for it to be valid. Some people believe that every field on the form is mandatory. While it’s essential to include specific information, certain sections can be left blank if they do not apply to your situation.

- Providing the claimant's Social Security Number is optional. This is a critical misunderstanding. The inclusion of the claimant's Social Security Number is mandatory for processing the State 54244 form. Without it, the form will not be processed.

- Responses to requests from the UI Adjudication Center are negotiable in time. Employers might think they can take their time in responding to inquiries from the UI Adjudication Center. In reality, timely responses are crucial; failure to respond promptly can result in penalties.

- An agent can always represent the employer on this form. Some might assume that any representative can file this paperwork for an employer. It's important to note that if an agent represents your company, clear communication about their authority must be established to avoid complications.

Understanding these misconceptions can help employers navigate the State 54244 process more effectively, ensuring that they are well-prepared and informed.

Key takeaways

When filling out and using the State Form 54244, several key points should be kept in mind to ensure a successful protest of an unemployment insurance claim.

- Purpose: The State Form 54244 serves as a means for employers to officially protest unemployment insurance claims made by former employees.

- Completeness: Fill out all required fields accurately, including the claimant's Social Security Number, which is mandatory for processing.

- Reason for Protest: Clearly state the reason for the protest by selecting one of the designated codes, such as Quit (Code 10) or Discharge for Cause (Code 20).

- Separation Facts: Provide a brief yet concise statement of facts regarding the claimant's separation from employment.

- Documentation: If applicable, attach supporting documents that provide evidence for the protest. Make a note in the designated area if you are submitting additional pages.

- Timeliness: Respond promptly to any requests from the UI Adjudication Center for further details, as delays can lead to penalties.

- Submission Method: The completed form can be submitted via fax to UI Adjudications at the specified number.

- Preparation: Be prepared for follow-up inquiries regarding the claimant’s eligibility and separation circumstances.

Understanding these points can help clarify the process and improve the chances of a favorable resolution.

Browse Other Templates

Af Form 63 - Proper usage of the AF 1297 promotes efficient operations.

Osha 5020 - Indicate if the employee was hospitalized overnight.

Security Deposit Return Letter - By signing the receipt, tenants forfeit any additional claims regarding the deposit.