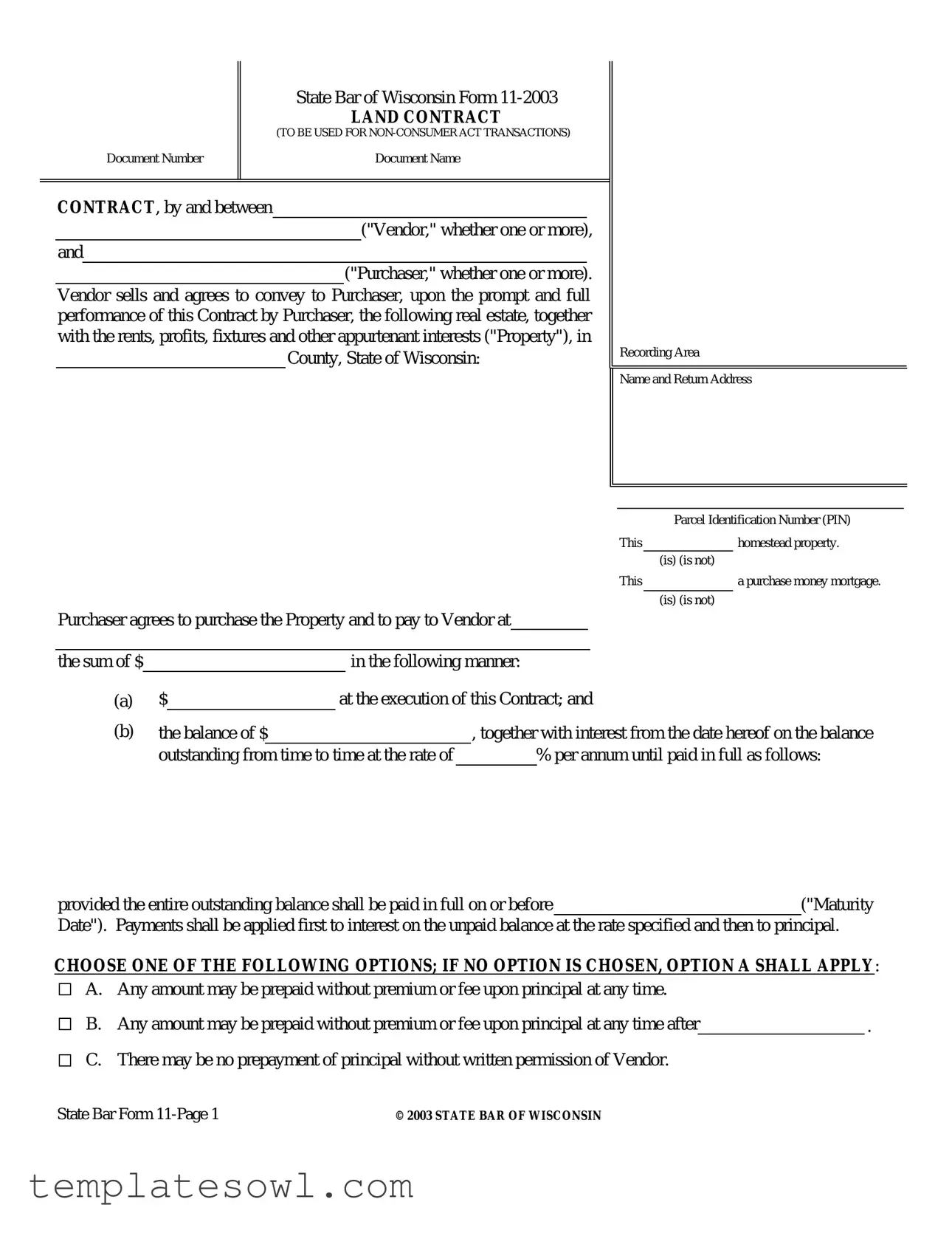

Fill Out Your State Land Contract Form

The State Land Contract form is a crucial document that facilitates the purchase of real estate in Wisconsin, particularly for non-consumer transactions. This form outlines the relationship between the Vendor, who is selling the property, and the Purchaser, who aims to buy it. It specifies the details such as the property description, the purchase price, payment schedule, and terms regarding taxes and insurance. Essential provisions detail what happens in case of defaults and how prepayments can be managed. Furthermore, it covers insurance obligations and property maintenance responsibilities, ensuring that both parties have clear guidelines to follow throughout the contract period. By addressing these key areas, the form protects the interests of both the Vendor and Purchaser while guiding them through their real estate transaction.

State Land Contract Example

State Bar of Wisconsin Form

LAND CONTRACT

(TO BE USED FOR

Document Number |

Document Name |

CONTRACT, by and between

("Vendor," whether one or more),

and

("Purchaser," whether one or more). Vendor sells and agrees to convey to Purchaser, upon the prompt and full performance of this Contract by Purchaser, the following real estate, together with the rents, profits, fixtures and other appurtenant interests ("Property"), in

County, State of Wisconsin:

Recording Area

Name and Return Address

|

|

|

|

|

|

|

|

|

|

|

|

Parcel Identification Number (PIN) |

|

|

|

|

|

|

|

|

|

|

|

|

This |

|

homestead property. |

|

|

|

|

|

|

|

|

|

|

|

|

(is) (is not) |

|

|

|

|

|

|

|

|

|

|

|

|

This |

|

a purchase money mortgage. |

|

|

|

|

|

|

|

|

|

|

|

|

(is) (is not) |

|

Purchaser agrees to purchase the Property and to pay to Vendor at |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||

the sum of $ |

|

|

|

|

in the following manner: |

|

|

|

|

|

|||

(a) |

$ |

|

|

at the execution of this Contract; and |

|

|

|||||||

(b) |

the balance of $ |

|

|

|

|

, together with interest from the date hereof on the balance |

|||||||

|

outstanding from time to time at the rate of |

|

% per annum until paid in full as follows: |

||||||||||

provided the entire outstanding balance shall be paid in full on or before("Maturity

Date"). Payments shall be applied first to interest on the unpaid balance at the rate specified and then to principal.

CHOOSE ONE OF THE FOLLOWING OPTIONS; IF NO OPTION IS CHOSEN, OPTION A SHALL APPLY:

A. |

Any amount may be prepaid without premium or fee upon principal at any time. |

|

|

B. |

Any amount may be prepaid without premium or fee upon principal at any time after |

. |

|

C. |

There may be no prepayment of principal without written permission of Vendor. |

|

|

State Bar Form |

© 2003 STATE BAR OF WISCONSIN |

CHOOSE ONE OF THE FOLLOWING OPTIONS; IF NEITHER IS CHOSEN, OPTION A SHALL APPLY:

A. Any prepayment shall be applied to principal in the inverse order of maturity and shall not delay the due dates or change the amount of the remaining payments until the unpaid balance of principal and interest is paid in full.

B. In the event of any prepayment, this Contract shall not be treated as in default with respect to payment so long as the unpaid balance of principal and interest (and in such case accruing interest from month to month shall be treated as unpaid principal) is less than the amount that said indebtedness would have been had the monthly payments been made as specified above; provided that monthly payments shall continue in the event of credit of any proceeds of insurance or condemnation, the condemned premises being thereafter excluded from this Contract.

Purchaser shall pay prior to delinquency all taxes and assessments levied on the Property at the time of the execution of this Contract and thereafter, and deliver to Vendor on demand receipts showing such payment.

Purchaser shall keep the improvements on the Property insured against loss or damage occasioned by fire, extended coverage perils and such other hazards as Vendor may require, without

Purchaser is required to pay Vendor amounts sufficient to pay reasonably anticipated taxes, assessments, and insurance premiums as part of Purchaser's regular payments [CHECK BOX AT LEFT IF APPLICABLE].

Purchaser shall not commit waste nor allow waste to be committed on the Property, keep the Property in good tenantable condition and repair, and free from liens superior to the lien of this Contract, and comply with all laws, ordinances and regulations affecting the Property. If a repair required of Purchaser relates to an insured casualty, Purchaser shall not be responsible for performing such repair if Vendor does not make available to Purchaser the insurance proceeds therefor.

Vendor agrees that if the purchase price with interest is fully paid and all conditions fully performed as specified herein, Vendor will execute and deliver to Purchaser a Warranty Deed in fee simple of the Property, free and clear of all liens and encumbrances, except those created by the act or default of Purchaser, and:

CHOOSE ONE OF THE FOLLOWING OPTIONS; IF NO OPTION IS CHOSEN, OPTION A SHALL APPLY:

A. Purchaser states that Purchaser is satisfied with the title as shown by the title evidence submitted to Purchaser for examination, at the time of execution of this Contract.

B. Purchaser states that the following exceptions set forth in the title evidence submitted to Purchaser for examination, at the time of execution of this Contract, are unsatisfactory to Purchaser:

C. No title evidence was provided prior to execution of this Contract.

State Bar Form |

© 2003 STATE BAR OF WISCONSIN |

CHOOSE ONE OF THE FOLLOWING OPTIONS; IF NEITHER IS CHOSEN, OPTION A SHALL APPLY:

A. Purchaser agrees to pay the cost of future title evidence.

B. Vendor agrees to pay the cost of future title evidence.

Purchaser shall be entitled to take possession of the Property on |

|

. |

Time is of the essence as to all provisions hereunder.

Purchaser agrees that in the event of a default in the payment of principal or interest which continues for a period of days following the due date or a default in performance of any other obligation of Purchaser which continues

for a period ofdays following written notice thereof by Vendor (delivered personally or mailed by certified mail), the entire outstanding balance under this contract shall become immediately due and payable at Vendor's option and without notice (which Purchaser hereby waives), and Vendor may singly, alternatively or in combination: (i) terminate this Contract and either recover the Property through strict foreclosure or have the Property sold by foreclosure sale; in either event, with a period of redemption, in the court's discretion, to be conditioned on full payment of the entire outstanding balance, with interest thereon from the date of default and other amounts due hereunder (failing which all amounts previously paid by Purchaser shall be forfeited as liquidated damages for failure to fulfill this Contract and as rental for the Property); (ii) sue for specific performance of this Contract; (iii) sue for the unpaid purchase price or any portion thereof; (iv) declare this Contract at an end and remove this Contract as a cloud on title in a

Following any default in payment, interest shall accrue at the rate of% per annum on the entire amount in

default (which shall include, without limitation, delinquent interest and, upon acceleration or maturity, the entire principal balance).

Vendor may waive any default without waiving any other subsequent or prior default of Purchaser.

Purchaser may not transfer, sell or convey any legal or equitable interest in the Property, including but not limited to a lease for a term greater than one year, without the prior written consent of Vendor unless the outstanding balance payable under this Contract is paid in full. In the event of any such transfer, sale or conveyance without Vendor's written consent, the entire outstanding balance payable under this Contract shall become immediately due and payable in full at Vendor's option without notice.

Vendor may mortgage the Property, including the continuation of any mortgage in force on the date of this Contract, provided Vendor shall make timely payment of all amounts due under any mortgage, and the total due under such mortgages shall not at any time exceed the then remaining principal balance under this Contract. If Vendor defaults under such mortgages and Purchaser is not in default hereunder, Purchaser may make payments directly to Vendor's mortgagee and such payments will be credited as payments hereunder.

All terms of this Contract shall be binding upon and inure to the benefit of the heirs, legal representatives, successors and assigns of Vendor and Purchaser.

State Bar Form |

© 2003 STATE BAR OF WISCONSIN |

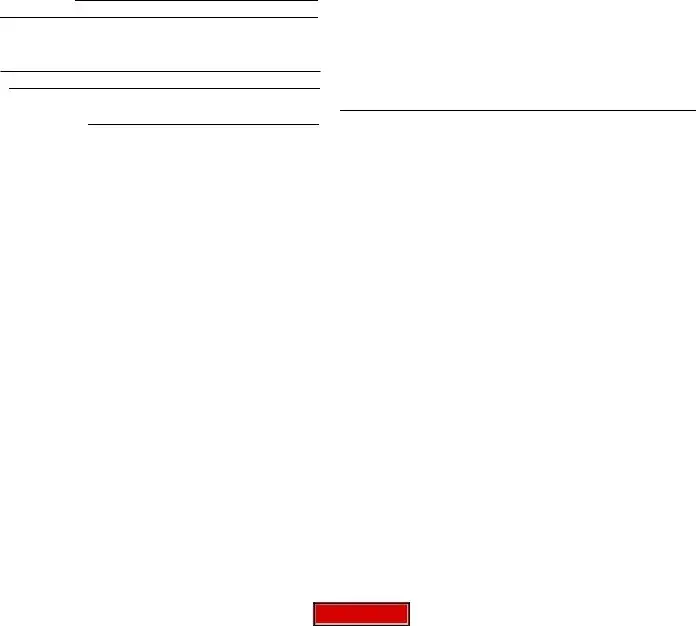

Dated |

|

. |

VENDOR:PURCHASER:

|

|

(SEAL) |

|

|

(SEAL) |

* |

|

(SEAL) |

* |

|

(SEAL) |

|

|

|

|

||

* |

|

|

* |

|

|

AUTHENTICATION

Signature(s)

authenticated on |

|

. |

*

TITLE: MEMBER STATE BAR OF WISCONSIN (If not,

authorized by Wis. Stat. § 706.06)

ACKNOWLEDGMENT |

|

|

|

|||

STATE OF WISCONSIN |

) |

|

|

|||

|

|

|

|

) ss. |

||

|

|

|

COUNTY |

) |

|

|

Personally came before me on |

, |

|||||

the |

|

|

|

|

|

|

to me known to be the person(s) who executed the foregoing instrument and acknowledged the same.

THIS INSTRUMENT DRAFTED BY: |

|

|

|

|

|

|

|

|

|

||

* |

|

|

|

||

|

|

Notary Public, State of Wisconsin |

|

||

|

|

|

|

||

|

My Commission (is permanent) (expires: |

|

) |

||

|

|||||

(Signatures may be authenticated or acknowledged. Both are not necessary.)

NOTE: THIS IS A STANDARD FORM. ANY MODIFICATIONS TO THIS FORM SHOULD BE CLEARLY IDENTIFIED.

LAND CONTRACT |

STATE BAR OF WISCONSIN |

FORM NO. |

* Type name below signatures.

State Bar Form |

© 2003 STATE BAR OF WISCONSIN |

Reset

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Laws | The State Land Contract form is governed by Wisconsin Statutes, particularly Wis. Stat. § 706.06, which outlines the requirements for real estate contracts in the state. |

| Property Description | The contract specifies that the Vendor sells and agrees to convey real estate, including all related interests such as rents and fixtures, to the Purchaser upon full performance of the contract. |

| Payment Structure | Purchaser agrees to pay a specified sum to the Vendor, which may include an upfront payment and ongoing payments with interest, culminating in a final maturity date for full payment. |

| Possession Rights | Purchaser is entitled to take possession of the property upon execution of the contract, emphasizing that time is of the essence for all contractual provisions. |

Guidelines on Utilizing State Land Contract

Completing the State Land Contract form is an important step in the process of purchasing property. After gathering all necessary details, you will need to fill in the specific information requested in the form. This ensures clarity and completeness in your agreement with the vendor.

- Identify the parties involved. Fill in the names of the Vendor and Purchaser in the designated spaces.

- Specify the property being sold. Include details such as the County, State of Wisconsin, Recording Area Name, and the Parcel Identification Number (PIN).

- Note whether the property is a homestead property. Check the appropriate box for "is" or "is not."

- Indicate whether it is a purchase money mortgage and check the appropriate box.

- Fill in the purchase price of the property and indicate the payment details, including the initial payment at execution and the remaining balance.

- Set the interest rate and state the Maturity Date when the total balance is due. Include how payments will be applied.

- Select one option regarding prepayment of principal from the given choices. Ensure you understand the implications of each.

- Specify how prepayments will be applied in relation to principal and interest from the given options.

- Detail the tax obligations by indicating that Purchaser will pay all taxes and assessments during the contract term.

- Outline the insurance requirements for the property, including the necessity for coverage against fire and other damages.

- Ensure compliance with property maintenance. State Purchaser's responsibilities regarding property upkeep and legal compliance.

- Identify the agreed conditions for the execution of the Warranty Deed once the purchase price and conditions are fully performed.

- Select an option regarding the title evidence as indicated in the form.

- State who will bear the costs of future title evidence, either Vendor or Purchaser.

- Indicate the date on which the Purchaser is entitled to take possession of the property.

- Detail the event of default and the consequences that will follow.

- Include any agreements about transferring, selling or conveying interests in the property.

- Finalize with the necessary dates and signatures. Ensure all parties authenticate the document as required.

What You Should Know About This Form

What is a State Land Contract?

A State Land Contract is a legal agreement between a vendor (seller) and a purchaser (buyer) for the sale of real estate. This type of contract outlines the terms of sale, including payment structures, obligations regarding the property, and the conditions under which ownership will be transferred. It is specifically designed for transactions that do not fall under consumer protection laws, which generally apply to typical home sales.

What are the primary components of a State Land Contract?

The primary components include the identification of the vendor and purchaser, a detailed description of the property being sold, the sale price, the payment schedule, and conditions for default. Additional responsibilities of both the vendor and purchaser, such as insurance requirements and maintenance obligations, are also included.

Can a purchaser prepay the contract, and under what conditions?

Yes, a purchaser can prepay the contract. The terms of prepayment options will be specified in the contract itself. For example, purchasers may have options that allow them to prepay at any time without a premium, only after a certain period, or that prohibit prepayment without the vendor's permission. It's essential to choose an option that works best for both parties at the time of execution.

What happens if the purchaser defaults on the contract?

If a purchaser defaults, the vendor has several remedies available. They can choose to terminate the contract, recover the property through foreclosure, or pursue legal action to collect any unpaid amounts. The specifics about the default period and potential consequences will be outlined in the contract, so both parties should fully understand these provisions.

What are the insurance requirements in a State Land Contract?

The purchaser must maintain insurance on the property to protect against losses like fire or natural disasters. The insurance coverage must be sufficient to cover the full replacement value of improvements on the property. The vendor may specify conditions such as naming them as an additional insured party on the policy and providing proof of coverage as needed.

Can the purchaser transfer their interest in the property?

Typically, a purchaser cannot transfer or sell their interest in the property without the vendor's written consent. If the purchaser transfers their interest without permission, the entire outstanding balance may become due immediately at the vendor's discretion. This aspect ensures that the vendor retains control over who owns the property.

What happens if the property requires repairs?

The purchaser must maintain the property in good condition and perform any necessary repairs. However, if the required repairs are due to an insured loss, the vendor must provide the insurance proceeds for the repairs. This clause protects the purchaser from bearing the entire financial burden for repairs linked to damages covered by insurance.

Is it necessary to conduct a title search before signing the contract?

Yes, a title search is essential before executing the contract. The contract allows the purchaser to review title evidence and outline any exceptions that may be unsatisfactory. Depending on the agreement, either party may be responsible for the costs associated with obtaining future title evidence, so it's crucial to clarify this ahead of time.

What does it mean for time to be of the essence in this contract?

When time is of the essence, it emphasizes that all deadlines and timelines outlined in the contract must be strictly adhered to. If either party fails to meet their obligations by the agreed-upon deadlines, it could lead to default or other legal repercussions. This clause underscores the importance of prompt action in fulfilling contract terms.

What should the parties do if they wish to modify the contract?

If either party wants to modify the State Land Contract, any changes must be clearly documented. More importantly, it is advisable for parties to consult with a legal professional to ensure that modifications are enforceable and comply with relevant laws. Keeping a record of all changes is necessary for clarity and protection.

Common mistakes

Filling out the State Land Contract form can be a straightforward task, but there are common mistakes made that can lead to confusion or complications. Here are six pitfalls to watch out for.

One frequent error is **failing to specify the real estate details** clearly. Potential buyers must provide comprehensive information about the property, including the parcel identification number (PIN) and its location. Missing or incomplete details can cause issues during the transaction.

Another common mistake is not properly stating the payment structure. Users should clearly outline the amount due upon execution of the contract and how the remaining balance will be paid. If this section is vague or incomplete, it could lead to misunderstandings about payment obligations.

A third mistake involves skipping the prepayment options. It’s crucial to choose which prepayment option applies; otherwise, the default option may not align with the buyer's intentions. This selection affects how any extra payments will be handled and can impact the overall loan balance.

Additionally, many overlook the requirement to confirm insurance coverage. Purchasers are responsible for obtaining the necessary insurance for the property. Neglecting to confirm this can lead to significant financial risks in case of damage or loss.

Another error is ignoring the need for compliance with local laws and regulations. Buyers must ensure that they adhere to relevant ordinances affecting the property. Failing to do so could result in penalties or additional costs in the future.

Lastly, one major mistake is not addressing the title evidence and costs associated with it. Buyers should clarify whether they will pay for future title evidence. If this is left ambiguous, it might create conflict later in the process.

By avoiding these common mistakes, individuals can navigate the State Land Contract form more effectively and enhance the likelihood of a successful transaction.

Documents used along the form

The State Land Contract form is often accompanied by a variety of additional documents. Each of these documents plays a crucial role in detailing the terms, conditions, or obligations of the parties involved. Understanding these forms can enhance clarity and help prevent disputes.

- Warranty Deed: This document serves to transfer ownership of the property from the Vendor to the Purchaser upon fulfillment of all contract terms. It ensures that the Purchaser receives clear title to the property.

- Title Evidence: Also known as a title report, this document provides an examination of the property's title history. It reveals any existing liens, claims, or encumbrances and is crucial for ensuring that the Vendor can legally convey the property.

- Insurance Policies: These must be obtained by the Purchaser to protect against loss or damage to the property. The policies need to name the Vendor as an additional insured party, ensuring that their interest is protected.

- Loan Agreement: If financing is involved, this document outlines the terms of any loans taken out by the Purchaser to purchase the property, including repayment schedules and interest rates.

- Escrow Agreement: Used to manage funds related to the sale, this agreement specifies how funds will be held and disbursed by a neutral third party until all contract conditions are met.

- Property Inspection Report: This report provides a comprehensive assessment of the property's condition. It helps the Purchaser identify any potential issues that may need addressing before finalizing the contract.

- Disclosure Statements: Vendors often provide these statements to disclose any known defects or issues with the property to the Purchaser, fostering transparency and mitigating potential liability.

- Power of Attorney: In some cases, this document is necessary if either party appoints another individual to act on their behalf in executing agreements related to the transaction.

- Affidavit of Title: This sworn statement from the Vendor confirms their ownership of the property and states that there are no undisclosed liens or ownership claims against it.

- Default Notice: This document outlines the conditions under which the Purchaser may be considered in default of the contract, providing them with notice and opportunity to remedy the situation before further actions are taken.

In summary, each document used with the State Land Contract serves a distinct purpose in defining rights, obligations, and protections for both parties. Proper utilization of these forms can significantly aid in ensuring a smooth transaction and clear communication.

Similar forms

- Purchase Agreement: Like a State Land Contract, a purchase agreement outlines the terms under which property will be sold. Both documents specify the purchase price, parties involved, and conditions for sale, establishing a binding relationship between buyer and seller.

- Mortgage Agreement: A mortgage agreement is similar as it secures the loan used to purchase property. Both require the buyer to make regular payments and address consequences of default, although a mortgage is usually associated with a financial institution rather than a private vendor.

- Lease-Purchase Agreement: This type of agreement combines elements of leasing and purchasing. It allows a buyer to rent a property with the option to buy, similar to a State Land Contract, which facilitates gradual ownership while making payments over time.

- Real Estate Sale Contract: This document stipulates the sale terms and conditions similar to a State Land Contract. Both require payment arrangements and outline what occurs in the event of default while transferring interest in the property from seller to buyer.

- Option to Purchase Agreement: An option agreement grants a buyer the right to purchase property at a specific price within a defined time frame. It shares the same underlying concept as a State Land Contract, providing a structured path to property acquisition.

- Deed of Trust: Both a deed of trust and a State Land Contract serve as security instruments in real estate transactions. They outline obligations and terms, offering protection for the lender and defining what happens if the borrower defaults.

- Installment Sales Contract: Similar to a State Land Contract, an installment sales contract allows a buyer to make payments over time rather than upfront. Both detail payment schedules and any terms regarding default and property possession.

- Quitclaim Deed: This document transfers interest in property, much like the transfer clause in a State Land Contract. However, quitclaim deeds do not guarantee clear title, while State Land Contracts detail the buyer's rights and obligations to secure ownership.

- Land Lease Agreement: A land lease agreement permits a tenant to occupy land for a defined time, similar to a State Land Contract where the purchaser effectively leases the property until the purchase price is fully paid.

- Promissory Note: This document involves a borrower's promise to repay a loan. Similar to a State Land Contract, a promissory note details payment obligations and consequences for failing to meet them while focusing solely on the monetary aspect of the transactions.

Dos and Don'ts

- Do read the entire State Land Contract thoroughly before filling it out.

- Do fill in each section completely and accurately to avoid any misunderstandings later.

- Do include the correct legal names of both the Vendor and Purchaser as they appear on official documents.

- Do understand the financial terms, including total price, down payment, and interest rates.

- Do ensure that you and the Vendor agree on timelines and conditions within the contract.

- Don't leave any sections blank; omitting information can lead to disputes.

- Don't rush through the process — take your time to ensure accuracy.

- Don't ignore the importance of obtaining title evidence before agreeing to the contract.

- Don't forget to have the document reviewed by a legal expert before signing.

- Don't take this agreement lightly; it is a legally binding document that requires commitment.

Misconceptions

- State Land Contracts are only for consumers. In reality, State Land Contracts can be utilized in both consumer and non-consumer transactions. The form is specifically designed for non-consumer use, allowing for a diverse range of transactions.

- Purchasers must always pay property taxes after a contract is signed. This is a common misunderstanding. While the Purchaser is responsible for paying property taxes, any such payments must be made prior to delinquency. This ensures that the Vendor is protected.

- Once a State Land Contract is signed, there are no options for prepayment. There are actually various options regarding prepayment, including whether any amount may be prepaid with or without a premium or fee. These options can be specified in the contract itself.

- Insurance coverage is the Purchaser's sole responsibility. Although the Purchaser must keep the property insured, the Vendor also has obligations. The Vendor must approve the insurer and is entitled to be listed on the insurance policy, protecting their interests.

- Vendor has unlimited power over the property. While the Vendor does maintain some control, the Purchaser has rights as well. For instance, any transfer of interest by the Purchaser needs prior written consent from the Vendor unless the contract is paid in full.

- Purchasers cannot modify the contract terms. This is misleading. Although it is a standard form, modifications can be made. However, any changes should be clearly identified to ensure both parties understand their rights and obligations.

- There is no recourse if the Vendor defaults. In case the Vendor defaults on their mortgage, the Purchaser has rights. Specifically, they may make payments directly to the Vendor's mortgagee if they are not in default under the contract.

Key takeaways

When utilizing the State Land Contract form, it is essential to understand its components and implications. Here are four key takeaways:

- Payment Structure: Purchasers should pay attention to the payment details outlined in the contract. The total sale price is broken down into an upfront payment and subsequent payments, which include interest. Understanding this will help in budgeting effectively.

- Insurance Obligations: The contract necessitates that purchasers maintain insurance on the property. This covers potential damages and ensures that repairs can be financed through insurance proceeds, should anything happen to the property.

- Default Consequences: It's crucial to be aware of the consequences of defaulting on payments. The vendor has several remedies including foreclosure or termination of the contract. Keeping up with payments and obligations can help avoid these serious repercussions.

- Possession and Title: The contract specifies when the purchaser can take possession of the property and the conditions under which the vendor will convey the title. Understanding this timeline is critical for effective planning regarding moving and ownership.

Browse Other Templates

H1003 Form - Form H1003 is valid as long as you only have one authorized representative at a time.

Spokane County Superior Court - Your mailing address, including city and zip code, is a required entry.