Fill Out Your State Of New Mexico Wc 1 Form

The WC-1 form is an essential document for employers in New Mexico, specifically relating to the Workers' Compensation Fee. This quarterly fee has seen a recent increase, now amounting to $4.30 per covered worker, marking a rise from $4. This adjustment only affects the employer's share of the fee. If an employer is covered under the Workers' Compensation Act, whether by necessity or choice, filing Form WC-1 is mandatory. It's important to note that the number of workers to whom the fee applies must be reported accurately based on the count at the end of each calendar quarter. For employers with no covered employees, a zero must be indicated. The fees are due on the last day of the month following the quarter's end, and failure to file on time may result in penalties. Completing this form requires attention to detail, including essential information such as CEIN, CRS, and contact details. After filling it out, the form must be mailed along with payment to the New Mexico Taxation and Revenue Department. Maintaining the top portion for records is imperative, while assistance is available through a dedicated helpline for any filing inquiries. Understanding these details can help ensure compliance and avoid unnecessary complications.

State Of New Mexico Wc 1 Example

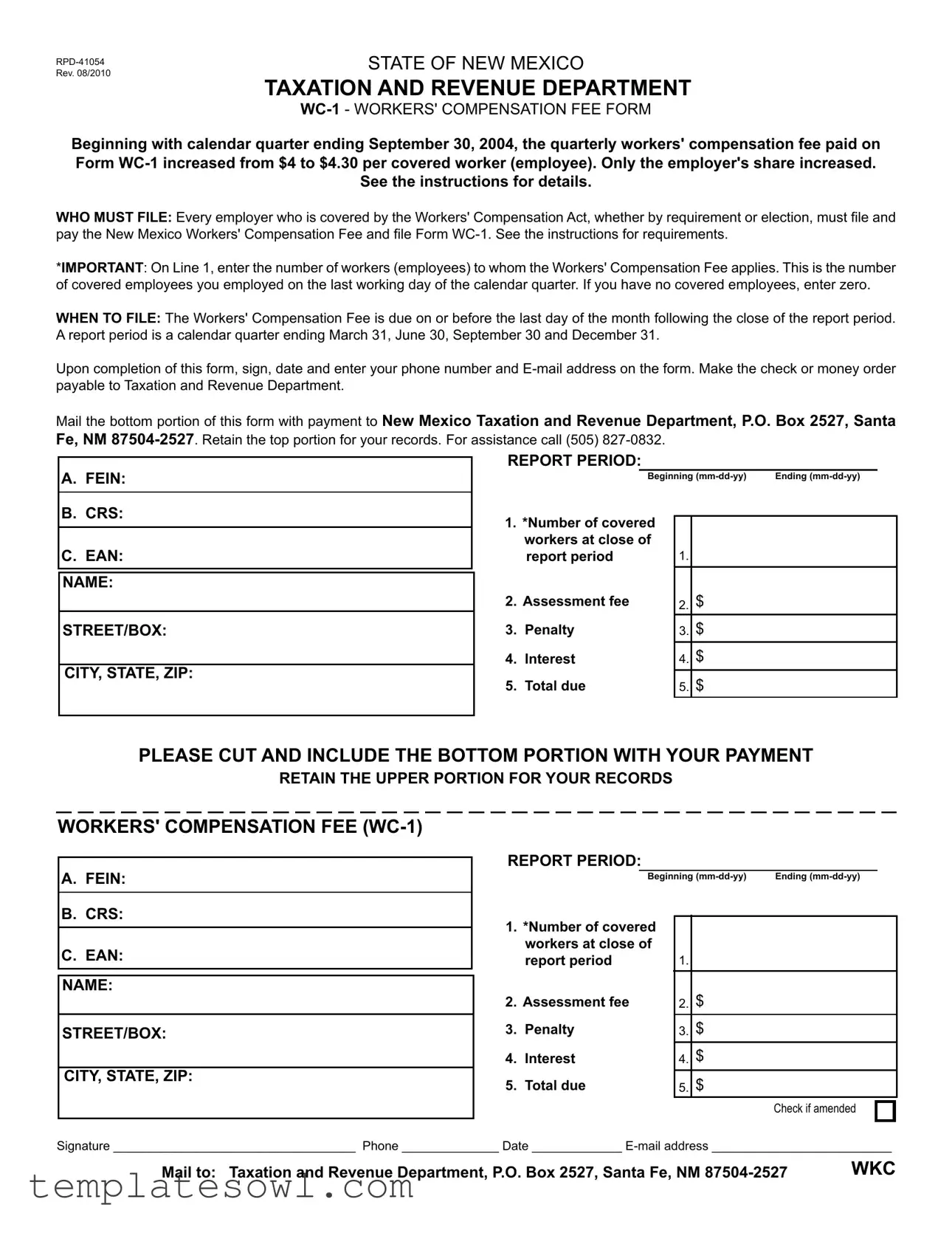

STATE OF NEW MEXICO

TAXATION AND REVENUE DEPARTMENT

Beginning with calendar quarter ending September 30, 2004, the quarterly workers' compensation fee paid on Form

See the instructions for details.

WHO MUST FILE: Every employer who is covered by the Workers' Compensation Act, whether by requirement or election, must file and pay the New Mexico Workers' Compensation Fee and file Form

*IMPORTANT: On Line 1, enter the number of workers (employees) to whom the Workers' Compensation Fee applies. This is the number of covered employees you employed on the last working day of the calendar quarter. If you have no covered employees, enter zero.

WHEN TO FILE: The Workers' Compensation Fee is due on or before the last day of the month following the close of the report period. A report period is a calendar quarter ending March 31, June 30, September 30 and December 31.

Upon completion of this form, sign, date and enter your phone number and

Mail the bottom portion of this form with payment to New Mexico Taxation and Revenue Department, P.O. Box 2527, Santa

Fe, NM

A.FEIN:

B.CRS:

C.EAN:

NAME:

STREET/BOX:

CITY, STATE, ZIP:

REPORT PERIOD:

Beginning

1. *Number of covered |

|

|

|

|

|

||

|

workers at close of |

|

|

|

report period |

1. |

|

2. |

Assessment fee |

2. |

$ |

3. |

Penalty |

3. |

$ |

4. |

Interest |

4. |

$ |

5. |

Total due |

5. |

$ |

PLEASE CUT AND INCLUDE THE BOTTOM PORTION WITH YOUR PAYMENT

RETAIN THE UPPER PORTION FOR YOUR RECORDS

WORKERS' COMPENSATION FEE

A. |

FEIN: |

|

|

B. |

CRS: |

REPORT PERIOD:

Beginning |

Ending |

C. EAN: |

NAME: |

STREET/BOX:

CITY, STATE, ZIP:

1.*Number of covered workers at close of report period

2.Assessment fee

3.Penalty

4.Interest

5.Total due

1.

2.$

3.$

4.$

5.$

Check if amended

Signature ___________________________________ Phone ______________ Date _____________

Mail to: Taxation and Revenue Department, P.O. Box 2527, Santa Fe, NM |

WKC |

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Name | WC-1 - Workers' Compensation Fee Form |

| Governing Law | New Mexico Workers' Compensation Act |

| Fee Increase | The fee increased from $4 to $4.30 per employee starting September 30, 2004. |

| Who Must File | All employers covered by the Workers' Compensation Act must file this form. |

| Filing Deadline | The fee is due by the last day of the month following each calendar quarter. |

| Report Periods | The report periods are March 31, June 30, September 30, and December 31. |

| Number of Workers | Report the number of covered employees as of the last working day of the quarter. |

| Payment Instructions | Make checks payable to the Taxation and Revenue Department and mail it to Santa Fe. |

| Contact Information | For assistance, call (505) 827-0832. |

| Record Keeping | Retain the top portion of the form for your records after mailing the bottom portion. |

Guidelines on Utilizing State Of New Mexico Wc 1

Filling out the State of New Mexico WC-1 form requires careful attention to detail to ensure compliance with state regulations regarding workers' compensation. Follow the instructions closely, and ensure accuracy in the information provided. Once completed, the form must be submitted, along with payment, to the New Mexico Taxation and Revenue Department by the specified deadlines.

- Obtain the WC-1 form from the New Mexico Taxation and Revenue Department website or your employer's resources.

- Locate the section labeled "A. FEIN" and enter your Federal Employer Identification Number.

- In the “B. CRS” section, provide your New Mexico CRS (Gross Receipts Tax) number.

- Fill in the “C. EAN” field with your Employer Account Number if applicable.

- Enter the name of your business or organization in the "NAME" section.

- Provide your street address in the “STREET/BOX” field.

- Complete the “CITY, STATE, ZIP” section with your city, state, and zip code.

- Indicate the “REPORT PERIOD” by entering the beginning date and ending date of the quarter for which you are filing, using the format mm-dd-yy.

- On Line 1, report the number of covered workers you employed on the last working day of the report period. If there are no covered employees, enter zero.

- Calculate the assessment fee by multiplying the number of covered workers by $4.30, and enter the total on Line 2.

- If applicable, enter any penalties incurred on Line 3. If there are none, leave this field blank.

- On Line 4, calculate and enter any interest owed, if applicable. If there is none, leave this field blank.

- On Line 5, calculate the total amount due by adding Lines 2, 3, and 4.

- At the bottom of the form, sign, date, and include your phone number and email address.

- Make a check or money order payable to the Taxation and Revenue Department for the total amount due.

- Mail the completed bottom portion of the WC-1 form along with your payment to: New Mexico Taxation and Revenue Department, P.O. Box 2527, Santa Fe, NM 87504-2527.

- Retain the top portion of the form for your records.

What You Should Know About This Form

What is the purpose of the WC-1 form in New Mexico?

The WC-1 form is used to report and pay the Workers' Compensation Fee for employers in New Mexico. This fee is required under the Workers' Compensation Act. Every employer who has covered workers, whether through a legal requirement or self-election, must complete this form every calendar quarter. The information provided helps determine the fees owed based on the number of covered employees at the end of each quarter.

When is the WC-1 form due for submission?

The Workers' Compensation Fee, along with the completed WC-1 form, is due by the last day of the month following the close of each report period. The report periods align with the calendar quarters: March 31, June 30, September 30, and December 31. Timely submission is important to avoid potential penalties or interest on unpaid fees.

How do I complete the WC-1 form if I have no covered workers?

If you do not have any covered employees, you should still submit the WC-1 form. On Line 1 of the form, enter zero to indicate that there were no covered workers at the close of the report period. It's important to file the form even with a zero report to stay compliant with the Workers' Compensation Act.

Where do I send the completed WC-1 form and payment?

You should mail the bottom portion of the completed WC-1 form, along with your payment, to the New Mexico Taxation and Revenue Department. The address is P.O. Box 2527, Santa Fe, NM 87504-2527. Remember to keep the top portion of the form for your records, and ensure that the form is signed, dated, and includes your contact information.

Common mistakes

Completing the State of New Mexico WC-1 form can be straightforward, but many employers make common mistakes that can lead to delays or penalties. Here are ten mistakes to avoid.

One mistake is failing to report the correct number of covered workers. Line 1 specifically asks for the number of employees on the last working day of the calendar quarter. This is crucial, so double-check the figures before submitting.

Many tend to overlook the filing deadline. The WC-1 form and payment are due by the last day of the month following the close of the report period. Misjudging this date can incur penalties.

Another frequent oversight is not providing complete contact information. Always ensure that your phone number and email address are filled in. This information helps expedite communication if any issues arise.

Rounding errors in calculating the total fee can lead to complications. Ensure that the assessment fee, penalties, and interest are accurately totaled before moving forward.

Some employers forget to retain the top portion of the form for their records. Keeping a copy serves as proof of payment and submission, which can be beneficial if discrepancies occur later.

The choice of payment method can also lead to errors. Make sure the check or money order is clearly made out to the "Taxation and Revenue Department." Payments to the wrong entity can delay processing.

Using incorrect dates in the report period is another common issue. Verify that the beginning and ending dates align with the calendar quarters as required.

When amending the form, employers sometimes forget to check the “Check if amended” box. This simple action indicates a change and ensures proper processing of the information you provide.

Lastly, failing to sign and date the form is a critical mistake. An unsigned form may be returned or considered invalid, causing further delays in processing.

By being mindful of these common errors, employers can streamline the WC-1 filing process and ensure compliance with New Mexico regulations.

Documents used along the form

The State of New Mexico WC-1 form is an essential document for employers covered by the Workers' Compensation Act. Along with this form, several other documents are often required to ensure compliance with state regulations. Below is a list of these documents, along with a brief description of each.

- WC-2 Wage Statement - This form reports the wages of employees covered under the Workers' Compensation Act. It helps determine the premium amounts based on wage information for the reporting period.

- WC-3 Employer's Report of Injury - If an employee is injured on the job, this document must be filled out to notify the Workers' Compensation Administration. It includes details about the injury, how it occurred, and any medical care provided.

- WC-4 Employee's Report of Injury - This form is completed by the injured employee to document their injury. It provides essential information about the incident and any work-related factors that may have contributed to the injury.

- WC-5 Notice of Employer's Insurance - This form serves as proof of workers' compensation insurance coverage. Employers must submit it to indicate that they have the necessary insurance to protect their employees in case of work-related injuries.

Filling out these forms correctly and on time is crucial for both compliance and support for injured employees. Carefully following the requirements will help ensure smooth processing and adherence to New Mexico's workers' compensation regulations.

Similar forms

The State of New Mexico WC-1 form, which is used for reporting workers' compensation fees, has several similar documents that serve specific purposes under employment and taxation regulations. Here are five such documents, along with explanations of how they relate to the WC-1 form.

- Form 941 (Employer's Quarterly Federal Tax Return): This form is required for employers to report income taxes, social security tax, and Medicare tax withheld from employee's paychecks. Like the WC-1, it is filed quarterly and pertains to employer responsibilities regarding their employees.

- Form W-2 (Wage and Tax Statement): Employers use this form to report annual wages paid and taxes withheld for employees. Whereas the WC-1 focuses on workers' compensation fees, the W-2 encompasses broader tax information regarding each employee for the entire year.

- State Unemployment Tax Act (SUTA) Form: Employers must file this form to report their state unemployment taxes. Similar to the WC-1, SUTA forms require employers to provide information about their workforce and ensure compliance with state laws regarding employee benefits.

- Form 1099-MISC (Miscellaneous Income): This form is used for reporting payments made to independent contractors or freelancers. Though the WC-1 deals exclusively with employees under regular employment agreements, both forms track compensation-related information that employers must report to their respective state and federal agencies.

- Form I-9 (Employment Eligibility Verification): This document verifies an employee's eligibility to work in the U.S. While the WC-1 forms focus on financial responsibilities toward employees, the I-9 confirms the legal standing of those employees within the workforce.

Dos and Don'ts

Filling out the State of New Mexico WC-1 form requires attention to detail. Here are six essential dos and don’ts to ensure compliance and accuracy.

- Do enter the number of covered employees correctly on Line 1. This reflects the number of workers on the last working day of the quarter.

- Do submit the form and payment by the last day of the month following the end of the calendar quarter.

- Do include your phone number and email address on the form for any future communication.

- Do retain the top portion of the form for your records after mailing the bottom portion with the payment.

- Don’t ignore the requirement to file, even if you have no covered employees; you must enter zero.

- Don’t fail to sign and date the form before submitting it, as this may cause processing delays.

Misconceptions

Below is a list of misconceptions about the State of New Mexico WC-1 form. Understanding the truths behind these can help ensure compliance and avoid unnecessary complications.

- Only large employers need to file the WC-1 form. Many believe this form only applies to big businesses. In fact, every employer covered by the Workers' Compensation Act must file, regardless of size.

- Filing the WC-1 form is optional. Some think submitting this form is a choice. It is, however, a requirement for all covered employers to report and pay the Workers' Compensation Fee.

- The fee amount is fixed and doesn’t change. A common misunderstanding is that the fee remains the same. The workers' compensation fee can adjust, as seen when it increased from $4 to $4.30 per covered worker.

- Employers can submit the form anytime. Many assume they can file whenever they wish. It's crucial to remember that the Workers' Compensation Fee is due on or before the last day of the month following the report period.

- You can estimate the number of covered employees. Some employers think they can guess the count. The actual number of covered employees should reflect those on the last working day of the calendar quarter. If there are none, zero must be entered.

- It’s okay to skip entering contact information on the form. Several people mistakenly believe that contact information isn’t essential. However, providing a phone number and email is important for any follow-up if there are questions about your submission.

These misconceptions can lead to confusion or mistakes. Stay informed and ensure that all necessary forms and fees are handled correctly.

Key takeaways

- Understanding the Fee: As of September 30, 2004, the quarterly workers' compensation fee has increased to $4.30 per covered employee. Keep in mind that only the employer's portion has changed.

- Who Needs to File: Any employer in New Mexico who is covered by the Workers' Compensation Act must complete and file the WC-1 form, regardless of whether coverage is mandatory or voluntary.

- Reporting Employees: When filling out Line 1 of the WC-1 form, report the total number of covered employees on the last working day of the calendar quarter. If there are no covered employees, simply enter zero.

- Filing Deadline: The completed WC-1 form, along with payment, is due by the last day of the month following the end of the quarter. Ensure timely submission to avoid penalties.

- Record Keeping: Remember to retain the top portion of the WC-1 form for your own records after sending the bottom portion with your payment to the New Mexico Taxation and Revenue Department.

Browse Other Templates

Mcdhh Interpreter Request - Input the applicant's information clearly and correctly.

T-22b Form - The T 22B documentation is pivotal for maintaining vehicle compliance within Georgia.