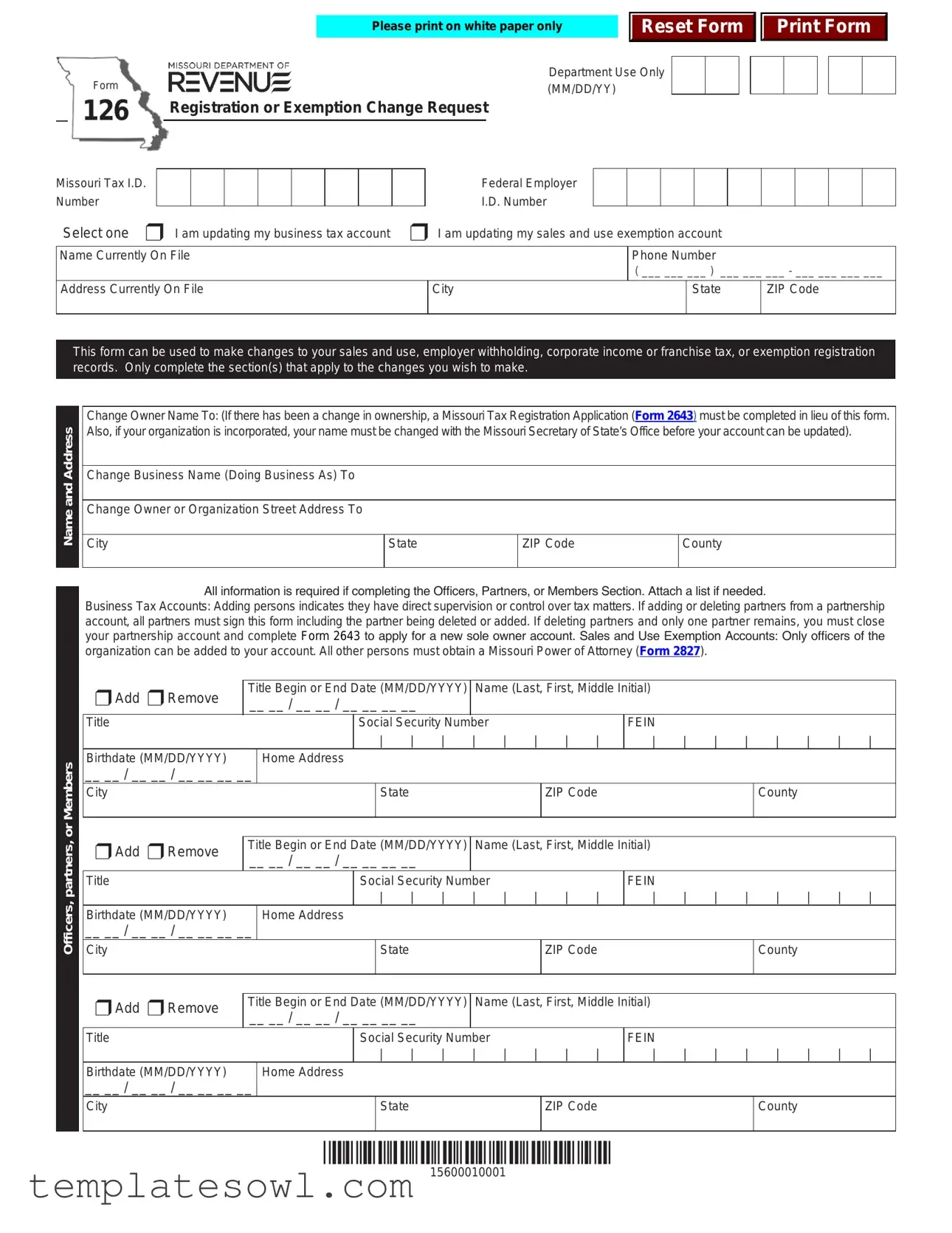

Fill Out Your State Tax 126 Form

The State Tax 126 form is an essential tool for businesses operating in Missouri, allowing them to manage various tax-related accounts with ease. Whether you're updating your sales tax registration, changing your corporate identity, or modifying exemption records, this form serves multiple purposes that cater to the needs of business owners. It facilitates changes to sales and use tax accounts, employer withholding records, and corporate income or franchise tax registrations. Additionally, the form includes sections for updating business officers or partners and managing the authorization of representatives who can discuss tax matters with the Department of Revenue. Completing the form requires careful attention to detail, as each section must be filled out based on the specific changes being made. It's vital to note that certain modifications, such as a change in business ownership, necessitate additional forms to ensure compliance. Understanding the structure and requirements of the State Tax 126 form can ensure that your business remains in good standing while navigating Missouri's tax landscape.

State Tax 126 Example

Please print on white paper only

Reset Form

Print Form

|

Form |

|

|

|

|

|

|

|

|

|

Department Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

(MM/DD/YY) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

126 |

|

Registration or Exemption Change Request |

|||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Missouri Tax I.D. |

|

|

|

|

|

|

|

|

|

Federal Employer |

|

|

|

|

|

|

|

|

|

||||||||

Number |

|

|

|

|

|

|

|

|

|

I.D. Number |

|

|

|

|

|

|

|

|

|

||||||||

Select one r I am updating my business tax account |

r I am updating my sales and use exemption account |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name Currently On File |

|

|

|

|

Phone Number |

||||||||||||||||||||||

( ___ ___ ___ ) ___ ___ ___ - ___ ___ ___ ___

Address Currently On File

City

State

ZIP Code

This form can be used to make changes to your sales and use, employer withholding, corporate income or franchise tax, or exemption registration records. Only complete the section(s) that apply to the changes you wish to make.

Officers, partners, or MembersName and Address

Officers, partners, or MembersName and Address

Change Owner Name To: (If there has been a change in ownership, a Missouri Tax Registration Application (Form 2643) must be completed in lieu of this form. Also, if your organization is incorporated, your name must be changed with the Missouri Secretary of State’s Office before your account can be updated).

Change Business Name (Doing Business As) To

Change Owner or Organization Street Address To

City |

State |

ZIP Code |

County |

|

|

|

|

All information is required if completing the Officers, Partners, or Members Section. Attach a list if needed.

Business Tax Accounts: Adding persons indicates they have direct supervision or control over tax matters. If adding or deleting partners from a partnership account, all partners must sign this form including the partner being deleted or added. If deleting partners and only one partner remains, you must close your partnership account and complete Form 2643 to apply for a new sole owner account. Sales and Use Exemption Accounts: Only officers of the organization can be added to your account. All other persons must obtain a Missouri Power of Attorney (Form 2827).

r Add r Remove |

Title Begin or End Date (MM/DD/YYYY) |

Name (Last, First, Middle Initial) |

|

|

|

|

|

|

|

||||||||||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Title |

|

|

Social Security Number |

|

|

|

|

FEIN |

|

|

|

|

|

|

|

||||

|

|

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Birthdate (MM/DD/YYYY) |

|

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

|

|

|

|

|

ZIP Code |

|

|

|

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||||||||

r Add r Remove |

Title Begin or End Date (MM/DD/YYYY) |

Name (Last, First, Middle Initial) |

|

|

|

|

|

|

|

||||||||||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

Social Security Number |

|

|

|

|

FEIN |

|

|

|

|

|

|

|

||||

|

|

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Birthdate (MM/DD/YYYY) |

|

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

|

|

|

|

|

ZIP Code |

|

|

|

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

r Add r Remove |

Title Begin or End Date (MM/DD/YYYY) |

Name (Last, First, Middle Initial) |

|

|

|

|

|

|

|

||||||||||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

Social Security Number |

|

|

|

|

FEIN |

|

|

|

|

|

|

|

||||

|

|

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Birthdate (MM/DD/YYYY) |

|

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

|

|

|

|

|

ZIP Code |

|

|

|

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*15600010001*

15600010001

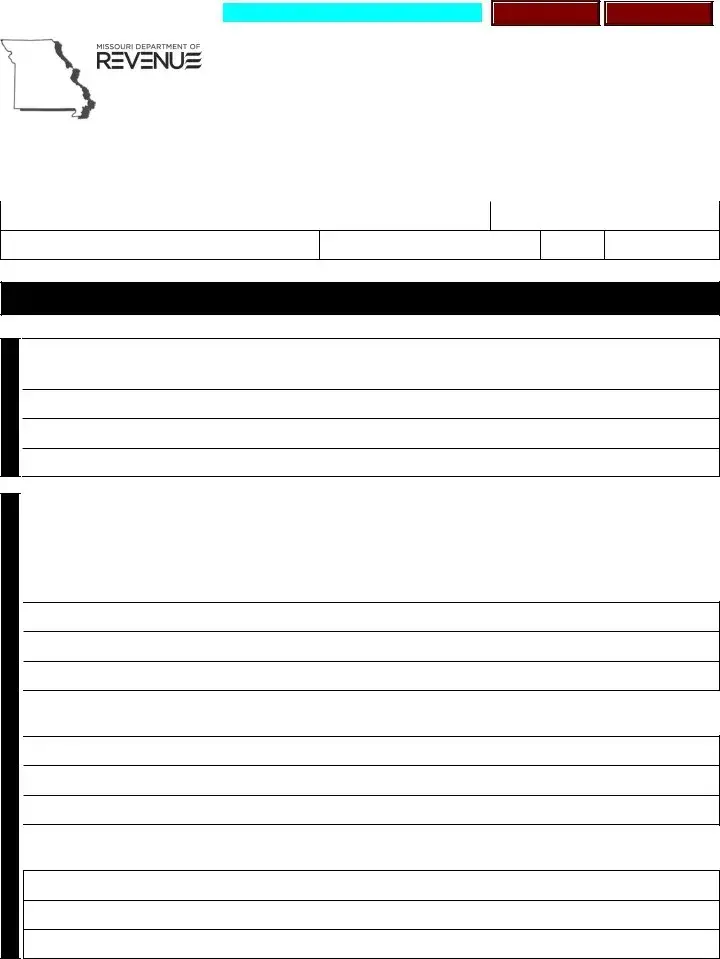

Authorized Representatives

Page 2

All information is required if completing the Authorized Representatives Section. Attach a list if needed.

Business Tax Accounts: Identify all persons who are not a partner, member (L.L.C), or officer of the business that have direct supervision or control over tax matters whom you authorize the Department to discuss your tax matters. All other persons must obtain a Missouri Power of Attorney (Form 2827). Attach a list if needed.

r Add r Remove |

Title Begin or End Date (MM/DD/YYYY) |

|

Name (Last, First, Middle Initial) |

|

|

|

|

||||||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

Title |

|

|

Social Security Number |

|

|

|

|

Birthdate (MM/DD/YYYY) |

|||||

|

|

| |

| |

| |

| |

| |

| |

| |

| |

__ __ / __ __ / __ __ __ __ |

|||

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

|

ZIP Code |

|

|

|

|

County |

|||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||||||

r Add r Remove |

Title Begin or End Date (MM/DD/YYYY) |

|

Name (Last, First, Middle Initial) |

|

|

|

|

||||||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

Title |

|

|

Social Security Number |

|

|

|

|

Birthdate (MM/DD/YYYY) |

|||||

|

|

| |

| |

| |

| |

| |

| |

| |

| |

__ __ / __ __ / __ __ __ __ |

|||

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

|

ZIP Code |

|

|

|

|

County |

|||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||||

r Add r Remove |

Title Begin or End Date (MM/DD/YYYY) |

|

Name (Last, First, Middle Initial) |

|

|

|

|

||||||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

Title |

|

|

Social Security Number |

|

|

|

|

Birthdate (MM/DD/YYYY) |

|||||

|

|

| |

| |

| |

| |

| |

| |

| |

| |

__ __ / __ __ / __ __ __ __ |

|||

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

|

ZIP Code |

|

|

|

|

County |

|||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Close Location Mailing Address

Open Location

Change For: r All Tax Types r Corporate Income and Franchise Tax r Employer Withholding Tax r Sales and Use Tax

In Care Of (Optional) |

|

Company Name if different from owner |

|

|

|

|

|

|

|

|

|

Address |

City |

|

State |

ZIP Code |

County |

|

|

|

|

|

|

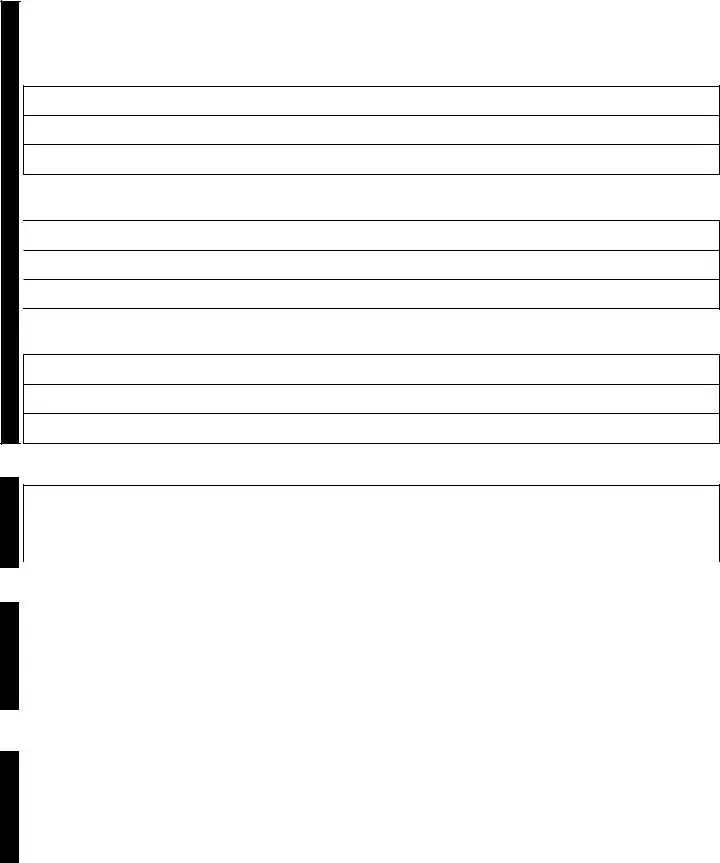

Close the following business location for: r Consumer’s Use Tax r Employer Withholding Tax |

r Sales Tax r Vendor’s Use Tax |

||||||||

Business Name |

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

State |

|

|

|

|

|

|

|

|

|

|

|

|

|

ZIP Code |

County |

|

|

|

|

Date of Closing (MM/DD/YYYY) |

|||

|

|

|

|

|

|

__ __ / __ __ / __ __ __ __ |

|||

|

|

|

|

|

|

|

|||

Open the following new business location for: |

r Consumer’s Use Tax |

r Employer Withholding Tax r Sales Tax r Vendor’s Use Tax |

|||||||

|

|

|

|

|

|

|

|

|

|

Business Name |

|

|

|

|

|

|

Taxable Sales Begin Date (MM/DD/YYYY) |

||

|

|

|

|

|

|

___ ___ / ___ ___ / ___ ___ ___ ___ |

|||

Street or Highway Address (Do not use Rural Route or PO Box) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

ZIP Code |

|

County |

||

|

|

|

|

|

|

|

|

|

|

*15600020001*

15600020001

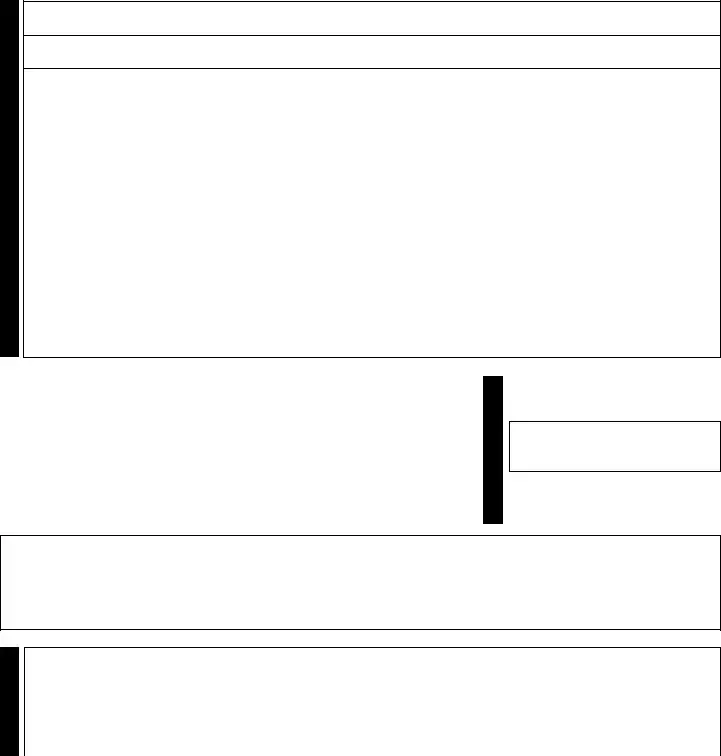

Sales and Use Tax

Page 3

Is this business located inside the city limits of any city or municipality in Missouri? For help determining this visit

mytax.mo.gov/rptp/portal/home/business/salesUseTaxRateInformation r No r Yes - Specify the city:

Is this business located inside a district(s)? For example, ambulance, fire, tourism, community, or transportation development.

rNo r Yes - Specify the district name(s):

Change Sales and Use Tax Filing Frequency To: r Monthly (Over $500 a month) r Quarterly ($500 or less a month)

r Annual (Less than $200 a quarter) |

*Continue current filing until this change is verified by the Department. |

||||

|

|

|

|||

Do you make retail sales of the following items? Select all that apply. |

|

|

|||

r Alcoholic Beverages r Alternative Nicotine r Cigarettes or Other Tobacco Products |

r Domestic Utilities |

||||

r |

r Food Subject to Reduced State Food Tax Rate r Items Qualifying for Show Me Green Sales Tax Holiday |

||||

r Items Qualifying for |

r |

r Lease or Rent Motor Vehicles |

|||

r New Tires |

r |

r Telecommunication Services |

|||

rQualifying Utilities or Items Used or Consumed in Manufacturing or Mining, Research and Development, or Processing Recovered Materials.

Do you make retail sales of aviation jet fuel to Missouri customers? |

r Yes r No |

If yes, are your sales made at: r A Missouri airport r A location outside Missouri and the fuel is transported into Missouri? |

|

If yes, is the airport located in Missouri and identified on the National Plan of Integrated Airport Systems (NPIAS)? |

r Yes r No |

If yes, provide a list of applicable locations. ________________________________________________________________________________

Do you use, store, or consume aviation jet fuel in Missouri where the seller does not collect tax? |

r Yes |

r No |

If yes, is the fuel stored, used, or consumed in an airport that is identified on the NPIAS? |

r Yes |

r No |

If yes, provide a list of applicable locations: ________________________________________________________________________________

|

|

|

|

r I would like to change from a transient employer to a regular employer. |

|

Tax |

|

|

(Must have filed 24 consecutive months in Missouri) |

|

|

|

|

|

|

Withholding |

|

|

Change* Withholding Tax Filing Frequency To: |

|

|

|

r Annually (less than $100 withholding tax per quarter) |

|

|

|

|

r Quarterly ($100 withholding tax per quarter to $499 per month) |

|

|

|

|

r Monthly ($500 to $9,000 withholding tax per month) |

|

|

|

|

|

|

|

|

|

|

r |

|

|

|

|

required to pay electronically) |

Comments

Corporate Income Tax

Change the corporation taxable year end to:

(MM/DD) __ __ / __ __

Signature

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. This form must be signed by the owner, if the business is a sole ownership; partner, if the business is a partnership; reported officer, if the business is a corporation, or by a member, if the business is an L.L.C. as reported on the application.

Signature |

Printed Name |

|

|

Title |

Date (MM/DD/YYYY) |

|

___ ___ / ___ ___ / ___ ___ ___ ___ |

|

|

Registration Change

Mail to: Taxation Division P.O. Box 3300

Jefferson City, MO

Exemption Change

Mail to: Taxation Division P.O. Box 358

Jefferson City, MO

|

Form 126 (Revised |

|

Phone: (573) |

*15600030001* |

|

TTY: (800) |

15600030001 |

|

Fax: (573) |

||

|

Phone: (573)

TTY: (800)

Fax: (573)

Ever served on active duty in the United States Armed Forces?

If yes, visit dor.mo.gov/military/ to see the services and benefits we offer to all eligible military individuals. A list of all state agency resources and benefits can be found at

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The State Tax 126 form is used to request changes to business tax accounts in Missouri, including registration and exemption updates. |

| Applicable Taxes | Changes can be made for various taxes such as sales and use tax, employer withholding tax, corporate income tax, and franchise tax. |

| Governing Law | This form is governed by the Missouri Revised Statutes Chapter 144 and other relevant tax provisions. |

| Eligibility to Sign | The form must be signed by an authorized person, such as the owner, partner, corporate officer, or LLC member. |

| Updating Ownership | In case of ownership changes, a separate Form 2643 must be completed for changes in ownership details. |

| Required Information | All relevant sections of the form must be completed, especially if adding or removing individuals associated with tax matters. |

| Submission Addresses | Completed forms should be mailed to designated addresses based on whether it is a registration or exemption request. |

Guidelines on Utilizing State Tax 126

After filling out the State Tax 126 form, it’s essential to send it to the appropriate division. Double-check your information to ensure accuracy, as this helps prevent delays in processing. Make sure to review which address to mail it to based on whether it’s a tax registration change or an exemption change.

- Print the form on white paper as instructed.

- Fill in the Department Use Only section with the date.

- Choose whether you are updating your business tax account or your sales and use exemption account by marking the corresponding box.

- Provide your Missouri Tax I.D. and Federal Employer Number I.D. Number.

- Enter your current business name and contact information, including Phone Number, Address, City, State, and ZIP Code.

- Complete the sections relevant to your changes. For example, for an Officer, Partner, or Member name and address change, clearly list the required information.

- If applicable, add or remove persons who have direct supervision over tax matters in the Authorized Representatives section.

- Indicate if you are closing or opening a business location and provide the necessary details such as Date of Closing or Taxable Sales Begin Date.

- Make selections regarding Sales and Use Tax filing frequency, indicating whether it’s monthly, quarterly, or annually.

- Complete the withholding tax information, if relevant, including the desired filing frequency.

- At the bottom of the form, sign and print your name, title, and date.

- Mail the completed form to the correct address based on your changes – either for registration or exemption.

What You Should Know About This Form

What is the State Tax 126 form used for?

The State Tax 126 form is used for making changes to business tax accounts, including sales and use tax, employer withholding tax, corporate income tax, franchise tax, and exemption registration records in Missouri. It allows businesses to update their tax-related information efficiently.

Who should fill out the State Tax 126 form?

Individuals responsible for managing a business's tax accounts—such as owners, partners, officers, or members—should complete the State Tax 126 form. It is essential that the person filling out the form has the authority to make these changes.

What types of changes can be made using this form?

This form allows for various updates, including changing the business name, address, ownership structure, adding or removing partners, or updating authorized representatives. You can also change tax filing frequencies or close and open business locations.

Do I need to attach any additional documents?

Yes, if there are significant changes such as a change in ownership or if you are adding or deleting partners, you may need to attach additional documentation. Specifically, a Missouri Tax Registration Application (Form 2643) should be submitted for ownership changes.

How do I submit the State Tax 126 form?

Once completed, the form should be mailed to the appropriate address based on the nature of the change. For registration changes, send it to the Taxation Division, P.O. Box 3300, Jefferson City, MO 65105-3300. For exemption changes, use P.O. Box 358, Jefferson City, MO 65105-0358.

Can all partners sign off on changes?

Yes, all partners must sign the form if you are adding or removing partners from a partnership account. If only one partner remains after deletions, the partnership account must be closed, and a new account should be established by completing Form 2643.

When should I expect a response after submitting the form?

The processing time can vary based on the volume of requests but typically takes a few weeks. It is important to continue filing under your current status until the changes are verified by the Department.

What if I am changing my business address?

When changing your business address, ensure to fill in all required fields including the new street address, city, state, and ZIP code. If the address change includes a change in business locations, specify that on the form.

Is there a fee associated with filing the State Tax 126 form?

No, there is no fee directly associated with submitting the State Tax 126 form to make changes to your business tax records. However, be aware that there may be associated fees with other filings, such as the Missouri Tax Registration Application if applicable.

Common mistakes

Filling out the State Tax 126 form can be a straightforward process, but there are common mistakes that people often make. One of the most frequent errors is failing to complete all required fields. Every section of the form has mandatory information that must be provided. If any required field is left blank, it can result in delays in processing or even the rejection of the form. It is crucial to check each section to ensure that no information is omitted, especially in the business tax accounts and authorized representatives sections.

Another common mistake is not properly identifying the type of changes being made. The form allows users to update various accounts, but specific checkboxes must be selected to indicate whether one is updating a business tax account or a sales and use exemption account. Misselecting or neglecting to select the applicable options can lead to confusion and errors in the processing of the changes. Make sure that the correct options are clearly marked to avoid complications.

People also frequently misinterpret the requirements for adding or removing individuals from their business tax accounts. If you wish to add or remove partners or members, all existing partners may need to sign the form. Incomplete authorization can slow down the processing time. Additionally, if someone is removed, confirming that there are still enough partners left in the partnership is essential. If only one partner remains, a different form must be filled out to close the partnership account.

Lastly, many individuals overlook the importance of the signature section. The signature at the bottom of the form must be from the appropriate person based on the type of business entity. A sole proprietor, partner, corporate officer, or member must sign, giving factual validity to the provided information. Not signing the form, or having it signed by someone who isn't authorized, can lead to significant delays or even legal issues. Always double-check that the correct person has signed before sending in the form.

Documents used along the form

If you’re navigating the world of state tax forms, especially the State Tax 126 form, it's crucial to know the other documents that might accompany it. These forms not only ensure compliance but also facilitate the smooth updating or changing of your tax registrations. Here’s a concise overview of other essential forms often used alongside the State Tax 126. Each serves a specific purpose that may relate to your business tax needs.

- Form 2643: This is the Missouri Tax Registration Application. You will need this form if there has been a change in ownership or if you are setting up a new business entity in the state.

- Form 2827: The Missouri Power of Attorney allows you to designate someone to act on your behalf regarding tax matters. This is especially important when adding authorized representatives on the State Tax 126 form.

- Form 115: The Missouri Business Tax Credit Form is used if you are claiming tax credits for specific business activities. Always check early in your process to ensure you qualify.

- Form 340: This form is for individuals or entities looking to apply for a sales and use tax exemption. It may be necessary when claiming certain types of exempt sales.

- Form 123: This document is required when you're requesting a refund for overpayment of taxes. Timeliness is key when submitting refund requests.

- Form 527: If you're changing your business entity's name, this form needs to be filed. It ensures all records accurately reflect the current name of your business.

- Form 504: The Employer Withholding Tax Registration form is essential for any business that withholds taxes from employee wages. Make sure this is current to avoid potential liabilities.

- Form 569: This is known as the Missouri Annual Franchise Tax Report, which may be required for certain business types. It keeps your tax obligations and filings in order.

- Form 51: The Sales Tax Exemption Certificate is necessary when making purchases that are not subject to sales tax. This allows your business to properly manage tax liabilities on essential goods.

- Form 464: This form is used to report any changes to your corporate structure or information related to your business’s tax obligations. Ensure this is filed promptly to stay compliant.

Filing the correct documents in conjunction with the State Tax 126 form is vital for maintaining your business's tax compliance and good standing. Use this list as a foundational guide, but always verify specific requirements with Missouri's Department of Revenue to ensure your submissions are complete and accurate.

Similar forms

- Missouri Tax Registration Application (Form 2643): This form serves a similar purpose by allowing businesses to register their tax accounts in Missouri. However, it specifically focuses on initial registration rather than changes to existing registrations.

- Missouri Power of Attorney (Form 2827): This document enables individuals to authorize a representative to handle tax matters. Like the State Tax 126 form, it involves updates to tax representation but emphasizes the appointment of an attorney or representative.

- Employer Registration Form (Form 2695): This form is used for businesses to establish their employer accounts with the state. Both forms facilitate the authority to operate under Missouri law, though the 2695 focuses specifically on employer withholding.

- Business Entity Registration (Form 2240): This document allows businesses to register with the Missouri Secretary of State. It has a similar function of maintaining compliance but is distinctly for entity structure rather than tax accounts.

- Sales and Use Tax Return (Form 53): This form is utilized for reporting sales tax collections. While it is utilized after the fact for tax reporting, the State Tax 126 form is a proactive document focused on notifying the department about changes.

Dos and Don'ts

When filling out the State Tax 126 form, it is important to ensure accuracy and compliance. Here are five key dos and don’ts to consider:

- Do print on white paper only.

- Don’t leave any required fields blank, as incomplete information may delay processing.

- Do include all necessary signatures from partners or members when making changes.

- Don’t attempt to update business ownership details without completing a Missouri Tax Registration Application (Form 2643).

- Do follow the mailing instructions carefully to ensure your form reaches the correct address.

Misconceptions

-

Misconception 1: The State Tax 126 form is only for sales tax changes.

This form is actually quite versatile. It can be used to update various tax accounts beyond sales and use tax. Specifically, it’s also applicable for employer withholding, corporate income, and franchise tax records.

-

Misconception 2: Anyone can add or remove officers from the business tax account.

Only authorized officers of the organization can be added to the sales and use exemption account. If you wish to add other individuals, a Missouri Power of Attorney must be obtained.

-

Misconception 3: I can make any changes without confirming ownership status.

This is not the case. If there has been a change in ownership, a different form (Missouri Tax Registration Application, Form 2643) needs to be completed, alongside the State Tax 126 form.

-

Misconception 4: The form can be submitted without all required sections being filled out.

It's important to complete all applicable sections that pertain to the changes being requested. Missing information can delay the processing of the form.

-

Misconception 5: I don’t need to notify the Department after changing my business location.

When changing business locations, notification is necessary. Additionally, the filing frequency for taxes may also need to be updated, which is included in the form.

Key takeaways

When filling out the State Tax 126 form, consider the following key points to ensure a smooth process:

- Use only white paper when printing the form.

- Only fill out the sections that apply to your situation.

- If there is a change in ownership, complete a different form (Form 2643) rather than the 126 form.

- All business name changes must first be updated with the Missouri Secretary of State.

- When adding or removing partners, all affected partners must sign the form.

- Authorized representatives must be notified if they are not officers, partners, or members of the business.

- Indicate the specific type of tax account being updated or closed.

- Provide accurate contact information to prevent delays in processing.

- Mail the completed form to the appropriate address based on whether it's a registration or exemption change.

Browse Other Templates

Real Id Maryland - This form must be submitted to the Maryland Motor Vehicle Administration for processing.

How to Transfer a Car Title to a Family Member in Pennsylvania - Reference materials can be accessed online to aid in completing the correct process.