Fill Out Your Statement Of Dissolution Sample Form

The Statement of Dissolution form serves as a critical document for Limited Liability Companies (LLCs) in Nebraska seeking to formally end their legal existence. This form, filed with the Secretary of State, not only signals the LLC's intent to dissolve but also outlines essential steps that must be taken throughout the dissolution process. It requires the name of the company, along with the necessary declarations about the discharge of debts and liabilities, the settlement of company activities, and the distribution of any remaining assets. Additionally, the form allows for an effective dissolution date, should it differ from the filing date, and mandates the signature and printed name of an authorized representative to validate the request. Minimal filing fees apply, varying based on whether the submission is made in-person or online. Updated in July 2021, the form aligns with Nebraska’s statutory requirements, ensuring that companies comply with legal standards as they complete the winding-down process.

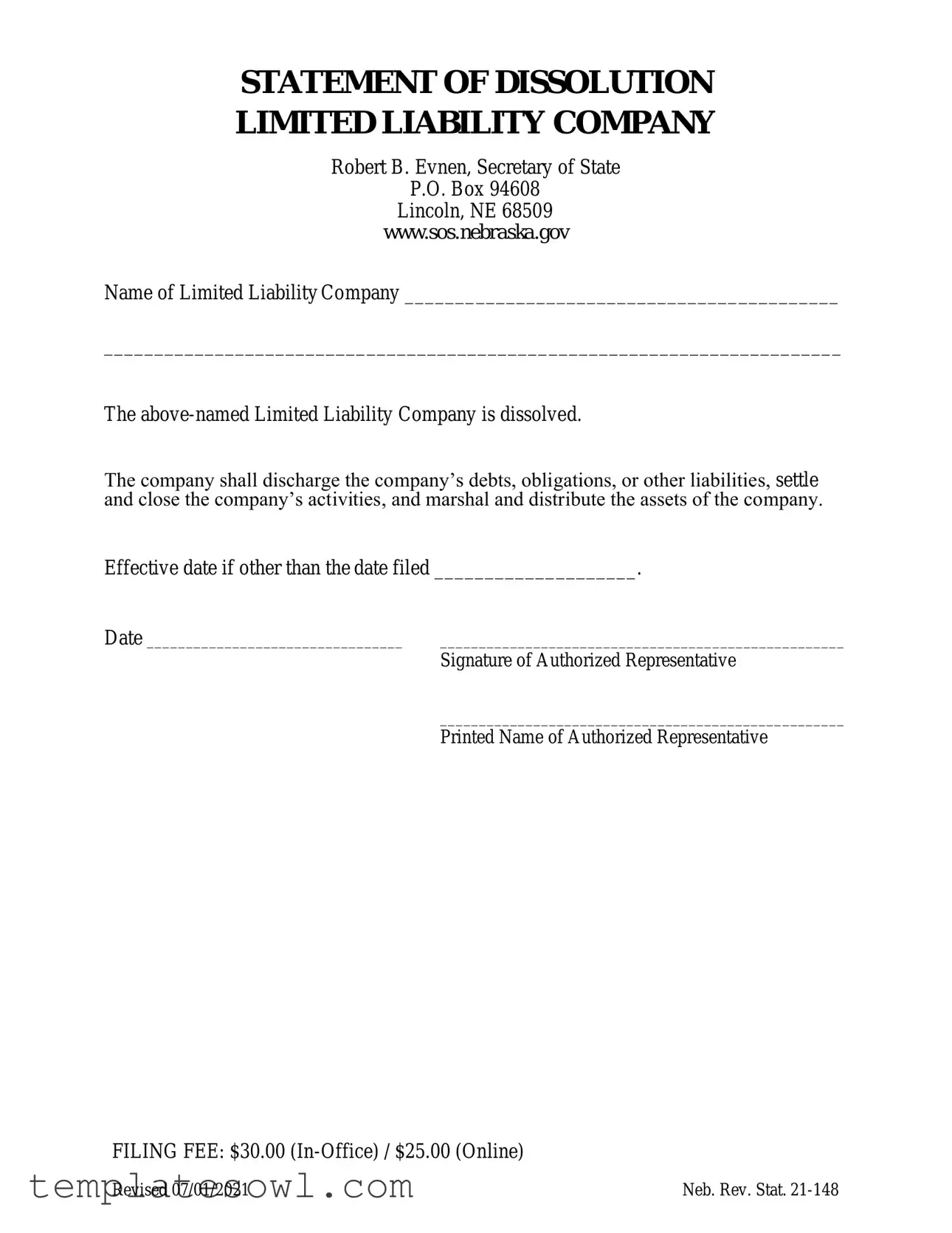

Statement Of Dissolution Sample Example

STATEMENT OF DISSOLUTION

LIMITED LIABILITY COMPANY

Robert B. Evnen, Secretary of State

P.O. Box 94608

Lincoln, NE 68509

www.sos.nebraska.gov

Name of Limited Liability Company ___________________________________________

_________________________________________________________________________

The

The company shall discharge the company’s debts, obligations, or other liabilities, settle and close the company’s activities, and marshal and distribute the assets of the company.

Effective date if other than the date filed ____________________.

Date _________________________________ |

____________________________________________________ |

|

Signature of Authorized Representative |

|

____________________________________________________ |

|

Printed Name of Authorized Representative |

FILING FEE: $30.00

Revised 07/01/2021 |

Neb. Rev. Stat. |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Document Title | The form is officially titled "Statement of Dissolution" for Limited Liability Companies. |

| Governing Authority | This form is governed by Nebraska Revised Statutes, specifically Neb. Rev. Stat. 21-148. |

| Filing Fee | A fee of $30 is required for in-office submissions, while online submissions incur a $25 fee. |

| Authorization Requirement | The form must be signed by an authorized representative of the Limited Liability Company. |

| Debt Management | The dissolved company must manage and discharge all debts and obligations before finalizing its dissolution. |

| Effective Date | The form allows for the specification of an effective date for dissolution if different from the filing date. |

Guidelines on Utilizing Statement Of Dissolution Sample

Completing the Statement of Dissolution for a Limited Liability Company is a critical step in ensuring that the company is officially and legally dissolved. After filling out this form, it will need to be submitted to the appropriate state office along with the applicable filing fee. Below are the steps to effectively fill out the form.

- Begin by locating the correct form titled "Statement Of Dissolution".

- In the blank space provided, enter the name of the Limited Liability Company exactly as it appears on official documents.

- Confirm that the statement "The above-named Limited Liability Company is dissolved" is clearly stated on the form.

- Provide details regarding the discharge of the company’s debts, obligations, or other liabilities in the next section.

- If applicable, write the effective date of dissolution in the space provided. This should be filled out only if the date differs from the submission date.

- Fill in the date on which you are completing the form.

- Have the Authorized Representative sign the form in the designated area.

- Beneath the signature, the Printed Name of the Authorized Representative should also be clearly written.

- Check the required filing fee: $30.00 for in-office filing or $25.00 for online submissions. Prepare the appropriate payment method accordingly.

Once the form is filled out, review it for accuracy. After ensuring all fields are complete, submit the form to the Secretary of State's office as instructed. Keeping a copy for your records is recommended as it serves as proof of the dissolution.

What You Should Know About This Form

What is a Statement of Dissolution?

A Statement of Dissolution is a formal document used by a limited liability company (LLC) to declare that it is ceasing operations. This document notifies the state and any relevant parties that the company is being dissolved. It sets the stage for settling debts, closing activities, and distributing any remaining assets.

Who needs to file a Statement of Dissolution?

Any limited liability company that has decided to cease operations needs to file this statement. This is important for ensuring that the dissolution process is legally recognized and that all obligations are addressed. Whether the decision comes from the members of the LLC, or if it’s due to other circumstances, filing is a critical step.

What details must be included in the Statement of Dissolution?

The form requires the name of the LLC, the effective date of dissolution if it differs from the filing date, and the signature of an authorized representative. Additionally, the printed name of that representative must also be included to validate the document.

Is there a fee for filing the Statement of Dissolution?

Yes, there is a filing fee associated with submitting the Statement of Dissolution. As of now, the fee is $30.00 for in-office submissions and $25.00 for online filings. It's important to be aware of these costs before initiating the process.

What happens after the Statement of Dissolution is filed?

After filing the Statement of Dissolution, the LLC must complete the process of settling its debts and obligations. It also involves distributing any remaining assets among the members. Essentially, the filing is just one step, and the company must follow through with the necessary steps to fully dissolve.

Can the Statement of Dissolution be revoked?

Once a Statement of Dissolution has been filed, it generally signifies the end of the company's existence. However, if the company changes its mind, it may need to address the issue through other legal means or potentially file for reinstatement, depending on state laws.

What is the effective date of dissolution?

The effective date is the date when the dissolution takes place. If different from the date the Statement of Dissolution is filed, this date must be specified on the form. It is critical for clarity regarding when the company is officially considered dissolved.

Where can I find the Statement of Dissolution form?

The Statement of Dissolution form can usually be obtained from your state’s Secretary of State website. In the case of Nebraska, you would visit www.sos.nebraska.gov to download the form and find additional information about the process.

What is the legal basis for filing a Statement of Dissolution?

The legal basis for filing this document can be found in Neb. Rev. Stat. 21-148. This statute outlines the procedures and requirements for dissolving a limited liability company in Nebraska, ensuring compliance with state laws.

Common mistakes

Filling out the Statement of Dissolution form can seem straightforward, but it’s easy to make mistakes that can complicate the process. One common error is neglecting to include the complete name of the Limited Liability Company (LLC). It's important to write the name exactly as it appears in the official documents. Any discrepancy might lead to delays or rejection of the filing.

Another mistake is leaving out the effective date of dissolution. If you intend for the dissolution to be effective immediately or on a specific date, this section must be completed. Omitting this detail can create confusion about when your obligations end and may lead to ongoing liabilities.

Individuals often forget to review their duties regarding debts and obligations. The form states that the LLC must settle its debts and close its activities. Failing to complete these actions before filing can lead to personal liability for the owners, especially if the business has outstanding debts.

Signature issues can also arise. Incomplete or illegible signatures can result in the form being rejected. Ensure that the authorized representative signs the form clearly and includes a printed name. Double-check that the signature matches the printed name to avoid further complications.

Another area where people falter is payment of the filing fee. Some may assume a lower fee based on different filing methods but often forget that in-office fees are $30 whereas online is $25. Missing this payment could result in the form not being processed.

It's crucial not to misfile the form as well. Some might confuse it with other business forms related to LLCs. Review the instructions carefully to confirm that the Statement of Dissolution is the correct document for your needs.

Finally, many people overlook the importance of keeping a copy of the completed form. After submitting, it's wise to retain a copy for personal records. This serves as proof of dissolution and can be vital if any legal questions arise later.

By avoiding these common mistakes, you can ensure that the dissolution of your LLC goes as smoothly as possible. Taking the time to review each section and double-check your information before submission can save you time and stress down the road.

Documents used along the form

When a limited liability company (LLC) undergoes dissolution, several important documents are typically involved in the process beyond the Statement of Dissolution. Each of these documents serves a vital role in ensuring the dissolution is properly executed and complies with legal requirements.

- Articles of Dissolution: This document officially declares that a company has ceased operations. It often includes details about the company’s dissolution and is usually filed with the state.

- Final Tax Returns: The company must file its final tax returns to report its income and expenses up to the point of dissolution. This helps ensure that all tax obligations are satisfied.

- Resolution to Dissolve: Before dissolving, the members of the LLC often draft and sign a resolution that outlines their agreement to dissolve the company. This document provides evidence of the members' consent.

- Notification to Creditors: A notice may need to be sent to creditors to inform them of the company’s dissolution. This helps ensure that any remaining debts can be settled before the company's assets are distributed.

- Asset Distribution Plan: This document outlines how the company’s remaining assets will be distributed among members and stakeholders. It helps provide clarity and prevent disputes during the dissolution process.

- Certificate of Good Standing: Sometimes, a company may need to obtain a certificate confirming that it is in good standing prior to dissolution. This may be required by some states to show that no obligations are outstanding.

- Operating Agreement Amendments: If the LLC’s operating agreement includes specific provisions regarding dissolution, amendments may be needed to reflect the process being followed. This ensures that the dissolution adheres to the company’s internal rules.

Understanding these documents can greatly assist in navigating the dissolution process smoothly. Properly preparing and filing each of these forms ensures that the company fulfills its legal obligations and protects the interests of its members and stakeholders.

Similar forms

- Certificate of Termination: Similar to the Statement of Dissolution, this document formally indicates that a business entity has ceased operations and is no longer doing business in its jurisdiction. It outlines the conclusion of the business's affairs and the distribution of its remaining assets.

- Articles of Dissolution: This document serves a similar purpose, providing official notice that a company has been dissolved. It typically includes details about the company’s final activities and the date of dissolution.

- Final Tax Return: This form is filed by a business when it dissolves and effectively ceases all operations. It reports any income or losses through the date of dissolution and ensures that tax obligations are settled before the company is officially closed.

- Notice of Dissolution: This document notifies creditors and other interested parties that a business entity is dissolving. It serves to alert stakeholders about the cessation of activities and can help in settling any outstanding obligations.

- Distribution of Assets Agreement: This agreement outlines how a company's remaining assets will be distributed to shareholders or members after liabilities have been settled. It ensures an orderly distribution process following the company's dissolution.

- Liability Release Form: This form releases the company from any future liabilities or claims made against it. It is often used during the dissolution process to clarify that the entity will not be responsible for any future obligations.

- Final Operating Agreement Amendment: An amendment to a company's operating agreement may be necessary to reflect the changes resulting from dissolution. This document would state that the company has officially ceased operations and no longer has active affairs.

- Employee Notification Letter: When a business dissolves, it is important to formally notify employees of the dissolution and the impact on their positions. This letter outlines their rights, final pay, and any benefits still applicable.

Dos and Don'ts

When filling out the Statement Of Dissolution form for a Limited Liability Company, it is important to ensure accuracy and compliance. Below are five things to keep in mind:

- Double-check your information. Ensure that the name of the company, details of the authorized representative, and the effective date are correct.

- Sign the form. The signature of the authorized representative is necessary. Your submission will be invalid without it.

- Include the filing fee. Remember to submit the correct fee amount—$30 for in-office filing or $25 for online filing.

- Specify the effective date accurately. If the effective date differs from the filing date, provide it clearly.

- Keep a copy. After submission, retain a copy of your completed form for your records.

Conversely, there are also things you should avoid doing to ensure a smooth process:

- Do not rush through the form. Take your time and ensure that all sections are filled out properly.

- Avoid using abbreviations. Write out the full name of the company and other relevant details to avoid confusion.

- Don’t forget to check for recent changes. Stay updated with any modifications to dissolution rules or fees that may affect your submission.

- Never submit without a signature. An unsigned document will lead to delays or rejection.

- Do not mix up your fee submission methods. Ensure the payment method aligns with whether you file in-office or online.

Misconceptions

Here is a list of common misconceptions about the Statement of Dissolution form.

- It's only for businesses that are bankrupt. The Statement of Dissolution is used by any LLC that chooses to dissolve, regardless of its financial status.

- Filing a Statement of Dissolution is optional. If an LLC no longer operates, filing this document is necessary to legally dissolve the company.

- All debts must be paid before dissolving. While it is ideal to settle debts, the form allows for the discharge of debts, obligations, or liabilities as part of the dissolution process.

- The effective date must be the same as the filing date. An effective date can be specified on the form, allowing for future dissolution if needed.

- Only the owner can sign the Statement of Dissolution. An authorized representative can also sign the form on behalf of the LLC.

- The filing fee is the same, regardless of how you submit the form. There is a lower fee for online submissions than for in-office filings.

- The Statement of Dissolution formally ends all business activities immediately. The company must first settle and close its activities before fully dissolving.

- The form can be filled out haphazardly. All fields must be completed accurately, as incomplete forms may be rejected.

- Once filed, the dissolution cannot be reversed. In certain cases and within a specified time frame, it may be possible to withdraw the dissolution request.

Key takeaways

When completing the Statement of Dissolution form for a Limited Liability Company, it is crucial to pay attention to several important details.

- The form must include the name of the Limited Liability Company being dissolved.

- Provide the effective date of dissolution if it differs from the filing date.

- The form requires a signature from an authorized representative.

- Clearly print the name of the authorized representative below the signature.

- Filing fees are $30.00 for in-office submissions and $25.00 for online submissions.

- Ensure that the form is submitted to the correct address: P.O. Box 94608, Lincoln, NE 68509.

- Keep a copy of the completed form and any related documentation for your records.

Following these steps will help ensure the dissolution process goes smoothly and complies with necessary regulations.

Browse Other Templates

How to Set Up Direct Deposit - This form is a reliable way to manage your incoming funds.

Sanofi Patient Connection - Sanofi retains the right to modify eligibility criteria as needed.