Fill Out Your Statement Of Repossession Form

The Statement of Repossession form is a vital document used in Colorado to officially record the repossession of a vehicle. This form is essential for lienholders who need to certify that a chattel mortgage is in arrears, leading to the repossession of the vehicle in question. It includes several critical components, such as details about the lienholder, the borrower, and the vehicle itself, including the Vehicle Identification Number (VIN), make, model, and year. Additionally, it serves multiple purposes by encompassing the Statement of Repossession, Certificate of Extension of Chattel Mortgage, and Floor Plan Declaration all in one comprehensive document. By signing the form, lienholders affirm that they are in possession of the vehicle and that the noted mortgage is indeed in default. It’s important for both lenders and borrowers to understand the legal implications of this form, especially when it comes to the transfer of ownership and the status of any secured debts. Accurately completing this document helps ensure transparency and legality in the repossession process.

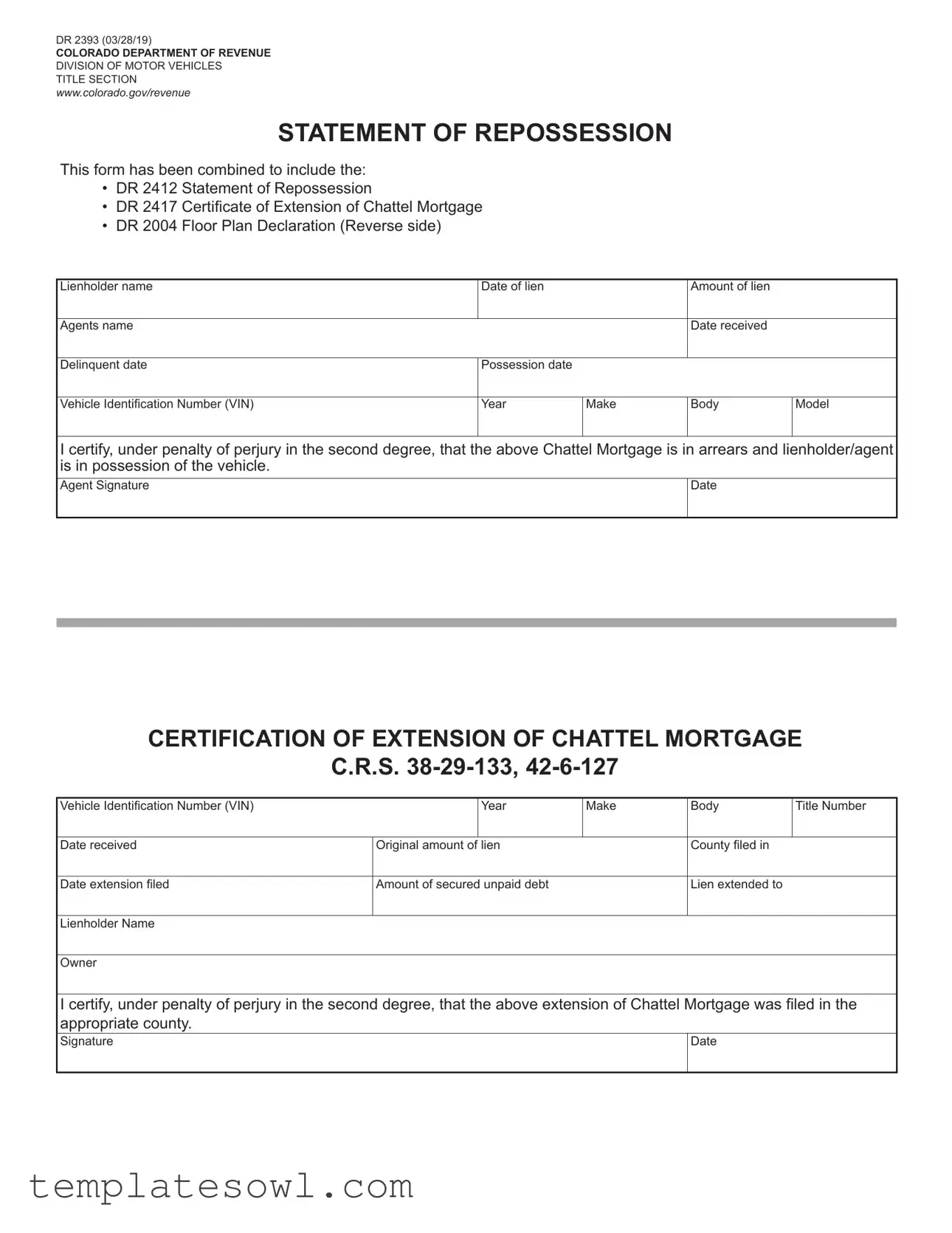

Statement Of Repossession Example

DR 2393 (03/28/19)

COLORADO DEPARTMENT OF REVENUE

DIVISION OF MOTOR VEHICLES

TITLE SECTION

www.colorado.gov/revenue

STATEMENT OF REPOSSESSION

This form has been combined to include the:

•DR 2412 Statement of Repossession

•DR 2417 Certificate of Extension of Chattel Mortgage

•DR 2004 Floor Plan Declaration (Reverse side)

Lienholder name |

Date of lien |

|

Amount of lien |

|

Agents name |

|

|

Date received |

|

Delinquent date |

Possession date |

|

|

|

Vehicle Identification Number (VIN) |

Year |

Make |

Body |

Model |

I certify, under penalty of perjury in the second degree, that the above Chattel Mortgage is in arrears and lienholder/agent is in possession of the vehicle.

Agent Signature |

Date |

CERTIFICATION OF EXTENSION OF CHATTEL MORTGAGE

C.R.S.

Vehicle Identification Number (VIN) |

Year |

Make |

Body |

Title Number |

Date received |

Original amount of lien |

|

County filed in |

|

Date extension filed |

Amount of secured unpaid debt |

|

Lien extended to |

|

Lienholder Name |

|

|

|

|

Owner |

|

|

|

|

I certify, under penalty of perjury in the second degree, that the above extension of Chattel Mortgage was filed in the appropriate county.

Signature |

Date |

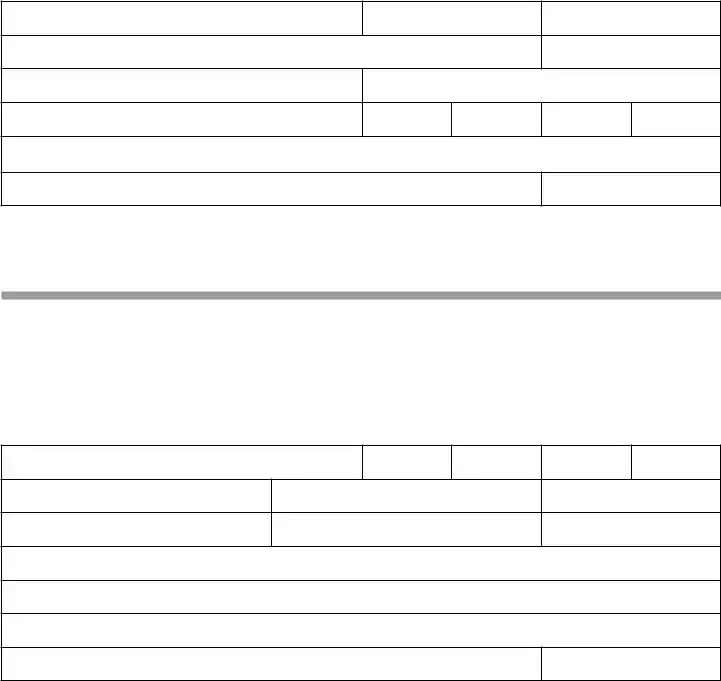

DR 2393 (03/28/19)

COLORADO DEPARTMENT OF REVENUE

DIVISION OF MOTOR VEHICLES

TITLE SECTION

www.colorado.gov/revenue

STATEMENT OF REPOSSESSION

FLOOR PLAN DECLARATION

This form has been combined to include the:

•DR 2004 Floor Plan Declaration

•DR 2412 Statement of Repossession (Reverse side)

•DR 2417 Certificate of Extension of Chattel Mortgage (Reverse side)

•This Floor Plan Declaration must be accompanied by all documents of ownership;

Manufacturer’s Statement of Origin or Title properly assigned to defaulting dealer.

•If the lienholder is a licensed Colorado dealer, they may transfer this vehicle using a Colorado

Dealer’s Bill of Sale (DR 2407).

•If the lienholder is not a licensed Colorado dealer, they must establish title in their name before transferring ownership.

this is to declare that

Lienholder

IS THE OWNER AND HOLDER OF A NOTE SECURED BY A CHATTEL MORTGAGE EXECUTED ON

Date

UCC Filing Number

against the following dealer:

Dealer’s Name

Dealer Number

the note and chattel mortgage is a valid and existing lien against the vehicles held under agreement;

the note and chattel mortgage is a valid and existing lien against the vehicles held under agreement;  the following described motor vehicle is included in that agreement:

the following described motor vehicle is included in that agreement:

Vehicle Identification Number (VIN)

Year

Make

the note and chattel mortgage described above is in default;

the note and chattel mortgage described above is in default;

in accordance with the provisions of the chattel mortgage, the undersigned has taken possession of the above described vehicle;

in accordance with the provisions of the chattel mortgage, the undersigned has taken possession of the above described vehicle;

and,

the vehicle is now in his/her possession.

the vehicle is now in his/her possession.

i certify, under penalty of perjury in the second degree, that the above statements are true and accurate to the best of my knowledge.

Lienholder

Agent Signature

Date

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | This form serves as a legal document for lienholders to officially declare the repossession of a vehicle. |

| Governing Laws | In Colorado, repossession forms are governed by Colorado Revised Statutes (C.R.S.) 38-29-133 and 42-6-127. |

| Form Components | The Statement of Repossession form combines multiple documents, including the DR 2412 and DR 2417, along with the Floor Plan Declaration. |

| Required Information | Lienholders must include specific details such as the vehicle's VIN, year, make, and model, as well as lien information and agent signatures. |

| Penalty of Perjury | The form requires certification under penalty of perjury in the second degree, which emphasizes the seriousness of providing accurate information. |

| Possession Confirmation | Only lienholders or authorized agents can confirm possession. They must provide their signature and date on the form. |

| Document Submission | Accompanying documents, such as the Manufacturer's Statement of Origin or properly assigned title, must be submitted with the form to validate ownership transfer. |

Guidelines on Utilizing Statement Of Repossession

Once you have gathered all necessary documents and information, filling out the Statement of Repossession form can be straightforward. This document must be completed accurately to reflect the current status of the repossession in compliance with state laws. Be sure that all sections are filled out thoroughly, as any missing or incorrect information could delay the process.

- Obtain the form: Make sure you have the correct version of the Statement of Repossession form, which is DR 2393 (03/28/19).

- Fill in lienholder information: Start by entering your name as the lienholder, then the date of the lien, and the amount of the lien.

- Provide agent details: Write the name of the agent handling the repossession and the date you received possession of the vehicle.

- Include delinquent and possession dates: Specify the date the lien became delinquent and the date you took possession of the vehicle.

- Input vehicle details: Fill in the Vehicle Identification Number (VIN), year, make, body style, and model of the vehicle.

- Certification: You will need to certify under penalty of perjury that the chattel mortgage is in arrears and that you, the lienholder, are in possession of the vehicle. Sign and date this section.

- Complete extension certification (if applicable): If extending the chattel mortgage, list the vehicle's details again, including VIN and year, and provide the original amount of the lien.

- Signature and date: Certify that the extension of the chattel mortgage was filed in the appropriate county and provide your signature and date.

- Floor plan declaration (if applicable): If relevant, declare ownership of the lien and provide the appropriate details about the dealer and the UCC filing number.

- Final signature: Sign and date the form, certifying that all statements are true and accurate to the best of your knowledge.

Once the form is completed, you can submit it as required by your state’s regulations. Keep copies of the filled-out form and any supporting documentation for your records. This helps ensure that you have everything organized should any questions arise later in the process.

What You Should Know About This Form

What is the Statement of Repossession form used for?

The Statement of Repossession form is essential for lienholders when they need to assert their rights to reclaim a vehicle due to a default on a loan agreement. It serves to document that a vehicle is in the possession of the lienholder and that the associated chattel mortgage is in arrears. This form helps protect the interests of the lienholder and ensures compliance with state laws regarding repossession procedures.

How do I fill out the Statement of Repossession form correctly?

To complete the Statement of Repossession form, begin by filling in key details such as the lienholder's name, the amount of the lien, and important dates (date of lien, possession date, etc.). You will need the vehicle's identification number (VIN), year, make, and model as well. It’s critical to certify under penalty of perjury that the information provided is true. This adds a layer of legal accountability to your statement. Make sure to sign and date the form before submitting it to the appropriate authority.

What happens if I don't complete the Statement of Repossession form?

Failure to properly complete and submit the Statement of Repossession form can create several complications. Most notably, it could lead to legal disputes with the vehicle owner and potential difficulties in asserting ownership rights. Without this documentation, you may not be able to transfer ownership of the vehicle, nor could you protect your financial interest adequately. Therefore, completing the form accurately is crucial for both the lienholder and the owner.

Can a non-licensed dealer use the Statement of Repossession form?

Yes, a non-licensed dealer can utilize the Statement of Repossession form. However, it's important to note that they must first establish the title in their name before any transfer of ownership occurs. This means that the non-licensed dealer must follow the appropriate procedures to secure the title before utilizing the Statement of Repossession for their specific situation. Ensuring proper title establishment is key to a smooth repossession process.

Common mistakes

Filling out the Statement of Repossession form can be straightforward, but many individuals make common mistakes that can lead to complications or delays. Understanding these pitfalls can save time and ensure that the process goes smoothly.

One frequent mistake is incorrect information entry. This can range from miswriting the Vehicle Identification Number (VIN) to entering the wrong date related to the lien or repossession. Each piece of information is crucial, and even small errors may require the form to be resubmitted, causing unnecessary delays.

Another common error is failing to include all necessary documents. Those submitting the form often overlook required attachments like the Manufacturer’s Statement of Origin or the properly assigned title. Without these documents, the State may reject the form entirely.

Many individuals also neglect to provide a valid signature. The lienholder or agent must sign the form, certifying that the information is true to the best of their knowledge. A missing or illegible signature can create issues in validating the form and may lead to further complications.

Furthermore, it is essential to read all sections carefully. Skimming through can lead to missed instructions or required fields. Omitting any critical section, such as the Certification of Extension of Chattel Mortgage, can hinder the processing of the form.

Another aspect that is easily overlooked is not keeping a copy of the submitted form. It’s crucial to have a personal record for future reference. This can be particularly useful if questions arise about the submission or if follow-up is necessary.

In addition, applicants sometimes fail to double-check the amount of the lien. Entering the incorrect amount can introduce discrepancies that complicate the entire process. This figure is often cross-referenced, so accuracy here is essential for approval.

Additionally, not understanding the implications of the certification statement can lead to severe consequences. The statement is serious and carries a penalty of perjury. Making false assertions, even unintentionally, could result in legal ramifications.

Some applicants also disregard the timeline for submission. Each state may have specific deadlines for filings related to repossessions. Missing these time frames can further complicate reclaiming ownership of the vehicle.

Lastly, individuals sometimes skip notifying the vehicle owner prior to filling out the form. Although a repossession may be justified, a lack of communication can lead to misunderstandings and disputes, which could affect future transactions.

By being aware of these mistakes and taking steps to avoid them, individuals can navigate the Statement of Repossession process more effectively and efficiently.

Documents used along the form

When dealing with the process of repossession, several forms and documents are essential to ensure everything is in order and legally compliant. Below is a list of commonly used documentation that often accompanies the Statement of Repossession form. Each document serves a specific purpose in the repossession process, aiding both the lienholder and the debtor in understanding their rights and responsibilities.

- DR 2412 Statement of Repossession: This form formally notifies the debtor of the repossession of their vehicle. It details the necessary information about the lien and vehicle, confirming the lienholder's status.

- DR 2417 Certificate of Extension of Chattel Mortgage: Used to extend the lienholder’s claim over a debtor’s property. This document specifies the original amount, the amount still owed, and the terms under which the chattel mortgage is extended.

- DR 2004 Floor Plan Declaration: This declaration confirms that the lienholder possesses the vehicles registered under a specific dealer. It outlines the terms of the financing agreement and the current standing of payments.

- UCC-1 Financing Statement: This document is filed to perfect a lien on collateral. By filing it, the lienholder establishes their interest in the property as secured, which is crucial for the enforcement of the lien in case of default.

- Colorado Dealer’s Bill of Sale (DR 2407): If the lienholder is a licensed dealer, this bill of sale is used to officially transfer ownership of the vehicle. It includes important vehicle data and signatures from both parties.

- Notice of Default: This document informs the debtor that they have defaulted on their loan agreement. It outlines the specifics of the default and requests payment or action to avoid repossession.

- Reinstatement Agreement: If applicable, this agreement allows debtors to bring their loan current by making a specific payment within a certain timeframe. It often includes the conditions that must be met to avoid further action.

- Vehicle Identification Number (VIN) Verification: This document may be used to confirm the specific VIN associated with the vehicle being repossessed, ensuring there is no confusion regarding ownership or identification.

- Account Statements: These statements provide a summary of the account activity, outlining payments made, amounts outstanding, and any applicable fees that may have accumulated due to delinquency.

Each of these documents plays a critical role in the repossession process, helping to ensure that the rights of all parties are respected and that the process adheres to the required legal standards. Familiarizing oneself with these forms can help streamline communication and clarify expectations as the situation evolves.

Similar forms

-

Statement of Repossession (DR 2412): Similar to the Statement of Repossession, this document verifies that a vehicle has been taken back by the lender due to non-payment. Both forms require details about the vehicle and the lienholder, ensuring clarity on the repossession circumstances.

-

Certificate of Extension of Chattel Mortgage (DR 2417): This document extends the lien on the vehicle, similar to the Statement of Repossession in that it concerns the lender's rights regarding the vehicle. It includes information about the amount owed and the duration of the extension.

-

Floor Plan Declaration (DR 2004): This document is akin to the Statement of Repossession as it serves to declare that certain vehicles are secure under a financial arrangement. It also addresses ownership issues and ensures the vehicle's status under the lien.

-

UCC Financing Statement: Like the Statement of Repossession, the UCC Financing Statement establishes a legal claim to collateral in case of default. It includes details about the secured debt and is crucial for asserting rights over the vehicle.

-

Notice of Default: This document informs the borrower of their default on payments. Similar in purpose to the Statement of Repossession, it outlines the lender's intention to reclaim the vehicle pending non-compliance with loan terms.

-

Vehicle Lien Release: This document is issued once a debt is settled. It shares similarities with the Statement of Repossession in that it involves the transfer of title and debt satisfaction related to the vehicle.

-

Bill of Sale: This document formally records the sale of a vehicle. Like the Statement of Repossession, it includes essential information about the vehicle and the parties involved, making it a key component in ownership transitions.

-

Power of Attorney for Motor Vehicle: This document allows one party to act on behalf of another concerning their vehicle. Comparable to the Statement of Repossession in terms of authority over the vehicle, it must be executed properly for validity.

-

Warranty Deed: While primarily used for real property, a warranty deed can have analogous use for vehicles under certain conditions. It guarantees an individual’s legal right to transfer vehicle ownership, ensuring a clear title akin to the investigations made in repossession.

-

Title Transfer Document: This document facilitates the transfer of vehicle ownership. Its purpose aligns with the Statement of Repossession since both deal with the rightful ownership and legal claims to the vehicle.

Dos and Don'ts

When filling out the Statement of Repossession form, consider the following guidelines to ensure accuracy and compliance:

- Double-check all information on the form to avoid mistakes.

- Ensure that you have the correct Vehicle Identification Number (VIN) entered.

- Sign the form as required; omitted signatures may delay processing.

- Include any required supporting documents, such as the Manufacturer's Statement of Origin or Title.

There are also several pitfalls to avoid to prevent complications:

- Do not leave any fields blank; incomplete forms can be rejected.

- Avoid using white-out or erasing information; this undermines the form’s integrity.

- Do not submit the form without verifying that you are the legal lienholder.

- Refrain from providing false information; this can result in legal repercussions.

Misconceptions

Misconceptions about the Statement of Repossession form can lead to confusion and misunderstandings. Here are seven common myths explained clearly.

- This form is only for vehicles. While the Statement of Repossession is often associated with vehicles, it can also apply to other types of personal property when a chattel mortgage is involved.

- You must be a lawyer to fill it out. Anyone involved in the repossession process can complete this form. Expertise in legal language is not necessary as long as the required information is accurately provided.

- The form is optional if you have a lien. This form is necessary to legally document the repossession. Skipping it can result in complications or legal challenges later on.

- Fill out the form only when you have the vehicle. It is important to complete the form as soon as repossession occurs, even if the vehicle is not immediately in your possession.

- This form replaces all other lien documents. This form is specific to repossession. Other forms related to liens, such as those for extensions or declarations, still need to be filed according to their own requirements.

- Once submitted, the matter is resolved. Completing and submitting the form does not finalize the repossession process. Additional steps may be necessary depending on the state laws and circumstances.

- There are no penalties for incorrect information. Providing false or incorrect information on this form can lead to legal penalties, including potential criminal charges. Accuracy is crucial.

Understanding these misconceptions can help individuals navigate the repossession process more effectively. Always consider consulting with a professional if uncertainties arise.

Key takeaways

Filling out and using the Statement of Repossession form (DR 2393) is a straightforward process, but there are important aspects to consider. Here are the key takeaways:

- Ensure Accuracy: Provide accurate information for all required fields, including lienholder details and vehicle specifics.

- Certification Requirement: The agent must certify that the chattel mortgage is in arrears and that they are in possession of the vehicle.

- Multiple Functions: This form combines several documents, including the Statement of Repossession and Certificate of Extension of Chattel Mortgage.

- Document Submission: Accompany the Floor Plan Declaration with all ownership documents, such as the Manufacturer’s Statement of Origin or Title.

- Dealer Considerations: Only licensed Colorado dealers can transfer the vehicle using a Colorado Dealer's Bill of Sale.

- Title Establishment: Non-licensed dealers must establish the title in their name before any ownership transfer can occur.

- Details on Defaults: Clearly state that the note and chattel mortgage are in default to validate the repossession process.

- Possession Verification: Confirm the vehicle is in possession, and this must be noted in the form.

- Penalties for Misstatement: Be aware that false statements can lead to severe legal consequences, including perjury charges.

Filling out this form correctly is essential for legal compliance and proper ownership transfer. Double-check all entries to avoid complications.

Browse Other Templates

Driver Medical Fitness Certificate - School bus drivers aged 65 and older need to submit this report annually.

File Articles of Incorporation California - This form demonstrates compliance with Nebraska state laws when ending a business.