Fill Out Your Stock Power Form

The Stock Power form serves as a crucial tool for individuals looking to manage their shareholdings efficiently. This form facilitates the transfer of shares from one account to another, enabling changes in ownership, addition of beneficiaries, or adjustments in account details. Each transaction necessitates careful completion of the form, where precision is vital—any alterations, corrections, or white-outs will invalidate the document. The first section requires the account information of the current owner, including the account number and the name of the company whose shares are being transferred. Following that, users must specify the details of the shares involved, whether transferring all or a specific number of shares. It is essential to include original stock certificates if applicable and, if those certificates are lost, to complete the appropriate section. Furthermore, this form includes sections that address cost basis for tax implications, ensure the reissuance of uncashed checks if necessary, and require a Medallion Signature Guarantee—a stamp from authorized institutions confirming the legality of the transaction. The final portion guides the user on providing details for the new account, including registration, tax identification, and online access preferences. Overall, the Stock Power form streamlines the process of share transfer, ensuring compliance and clarity throughout the transaction.

Stock Power Example

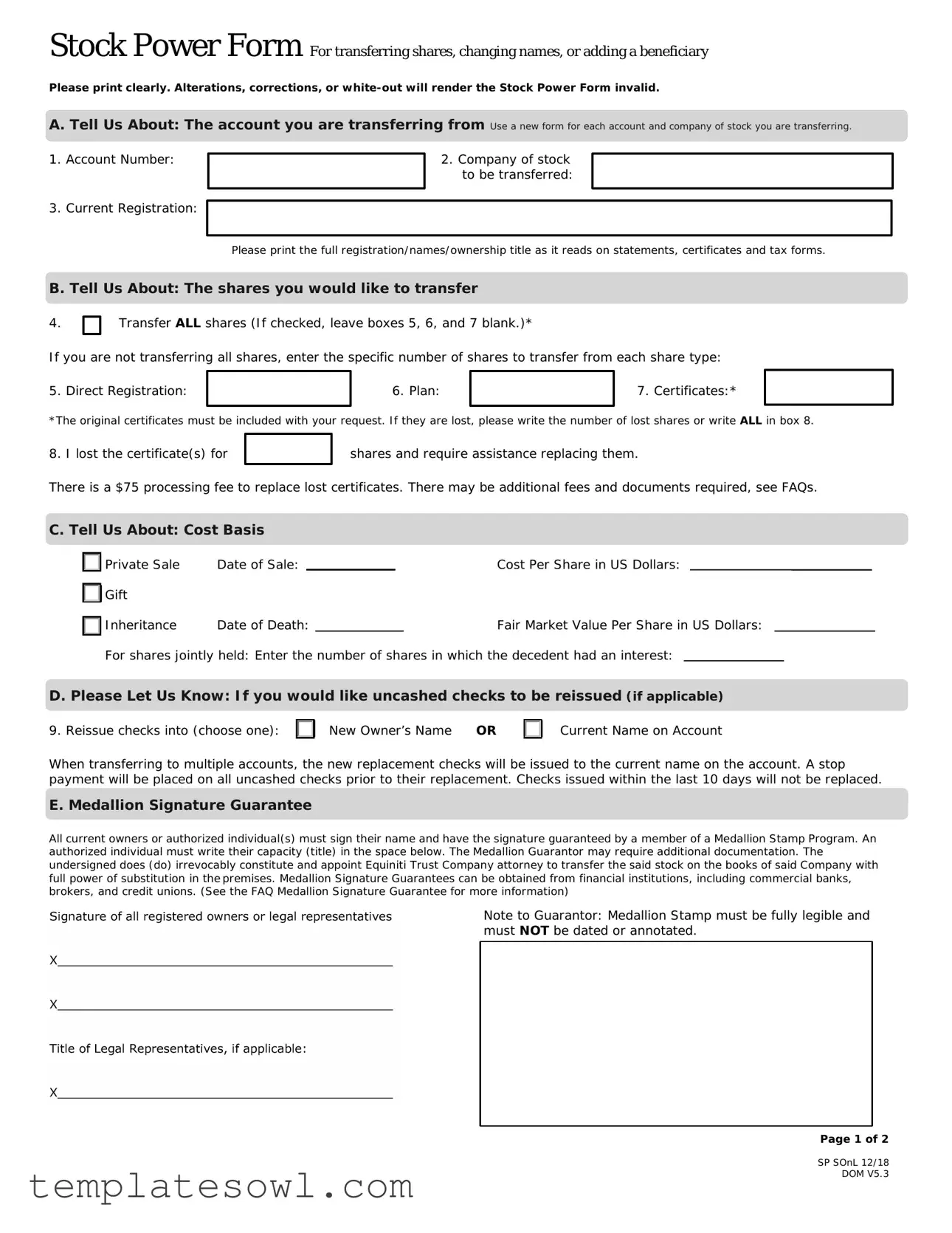

Stock Power Form For transferring shares, changing names, or adding a beneficiary

Please print clearly. Alterations, corrections, or

A. Tell Us About: The account you are transferring from Use a new form for each account and company of stock you are transferring.

1. Account Number:

3. Current Registration:

2.Company of stock to be transferred:

Please print the full registration/names/ownership title as it reads on statements, certificates and tax forms.

B. Tell Us About: The shares you would like to transfer

4. |

|

Transfer ALL shares (If checked, leave boxes 5, 6, and 7 blank.)* |

If you are not transferring all shares, enter the specific number of shares to transfer from each share type:

5. Direct Registration: |

|

6. Plan: |

|

7. Certificates:* |

|

|

|

|

|

*The original certificates must be included with your request. If they are lost, please write the number of lost shares or write ALL in box 8.

8. I lost the certificate(s) for

shares and require assistance replacing them.

There is a $75 processing fee to replace lost certificates. There may be additional fees and documents required, see FAQs.

C. Tell Us About: Cost Basis

Private Sale |

Date of Sale: |

|

|

Cost Per Share in US Dollars: |

|

Gift |

|

|

|

|

|

Inheritance |

Date of Death: |

|

|

Fair Market Value Per Share in US Dollars: |

|

For shares jointly held: Enter the number of shares in which the decedent had an interest:

D. Please Let Us Know: If you would like uncashed checks to be reissued (if applicable)

9. Reissue checks into (choose one):

New Owner’s Name OR

Current Name on Account

When transferring to multiple accounts, the new replacement checks will be issued to the current name on the account. A stop payment will be placed on all uncashed checks prior to their replacement. Checks issued within the last 10 days will not be replaced.

E. Medallion Signature Guarantee

All current owners or authorized individual(s) must sign their name and have the signature guaranteed by a member of a Medallion Stamp Program. An authorized individual must write their capacity (title) in the space below. The Medallion Guarantor may require additional documentation. The undersigned does (do) irrevocably constitute and appoint Equiniti Trust Company attorney to transfer the said stock on the books of said Company with full power of substitution in the premises. Medallion Signature Guarantees can be obtained from financial institutions, including commercial banks, brokers, and credit unions. (See the FAQ Medallion Signature Guarantee for more information)

Note to Guarantor: Medallion Stamp must be fully legible and must NOT be dated or annotated.

Page 1 of 2

SP SOnL 12/18 DOM V5.3

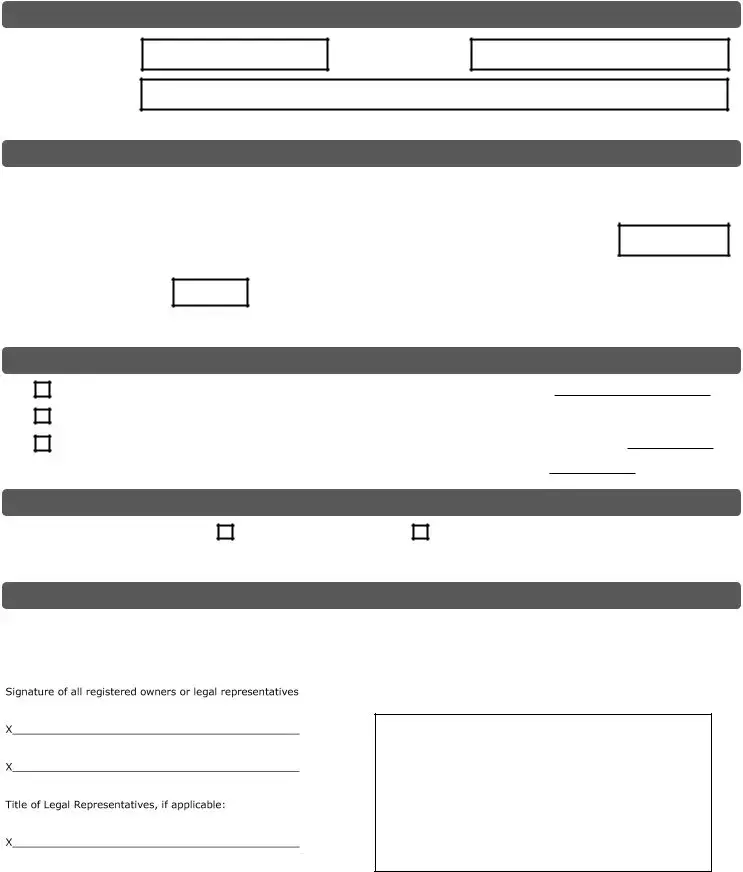

Alterations, corrections, or

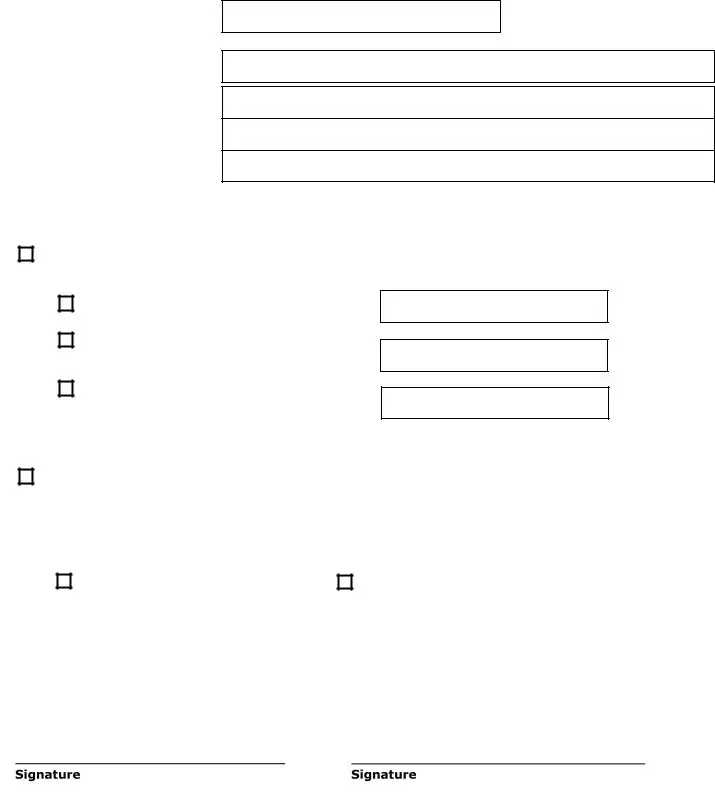

F. Tell Us About: The account you want the shares transferred to A separate page is needed for each new account

Enter the number of shares to transfer into the account indicated on this page. When transferring to multiple accounts, you must submit a separate copy of this page and indicate the number of shares to transfer into each new account.

If you are transferring to an existing Shareowner Services account, enter the

Registration for the New Account check only one box below, complete the indicated lines, new address, and Tax ID

Individual – Line 1 |

|

|

Joint Tenancy – Lines 1 and 2a |

|

Tenants in Common – Lines 1 and 2a |

||

Estate – Lines 1 and 4a |

|

|

Trust – Lines 1, 4a, and 4b |

|

Tenants by Entirety – Lines 1 and 2a |

||

|

|

|

|||||

Custodian for Minor – Lines 1, 2a, and 2b |

|

|

TOD Beneficiary – Lines 1 and 4a |

|

Corporation – Line 1 |

||

|

|

|

|||||

|

|

|

|

|

|

|

|

LLC C Corporation – Line 1 |

|

LLC S Corporation – Line 1 |

|

LLC Partnership – Line 1 |

|||

|

|

||||||

Other – Line 1 and enter type of registration: |

|

|

|

|

|||

Line 1. New Owner/Custodian/Trustee/Executor/Other (First Name, Middle Initial, Last Name)

Line 2a. Joint Owner/Minor/Second Trustee/Other (First Name, Middle Initial, Last Name) |

2b. Minor’s State of Residence |

||

|

|

|

|

|

|

|

|

Line 3. Any additional Joint Owners/Trustees/Other (First Name, Middle Initial, Last Name)

Line 4a. Name of Trust/Estate/TOD Beneficiary |

4b. Date of Trust (MM/DD/YY) |

||

|

|

|

|

|

|

|

|

Address for the New Account Including City, State, and Zip Code

Tax ID for the New Account

Enter the Social Security Number OR Employer Identification Number (then check one box to identify type)

SSN OR

EIN

G. Substitute Form

Certification: Under penalties of perjury, I certify that: 1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be

issued to me), and 2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and 3. I am a U.S. citizen or other U.S. person (defined in the instructions). 4. The FATCA code entered on this form (if any) indicating that the payee is exempt from FATCA reporting is correct. (This does not apply to accounts located in the U.S.)

Exempt Payee Code (if any): |

|

(Codes are available with the official IRS Form |

Exemption from FATCA Reporting Code (if any): NOT APPLICABLE (codes are available with the official IRS Form

Certification instructions: You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you failed to report all interest and dividends on your tax return.

The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding.

(Rev. 10/18)

NOTICE TO

H. Sign up for Online Access: If the new owner would like to receive instructions for online access

Check the box to the left to send instructions for online access. An Authentication ID and sign up instructions will be mailed to the address in Section F. Some restrictions may apply. Online account access is not available for accounts registered in the name of a Corporation, Partnership, Investment Club, Bank, or Brokerage firm where multiple individuals are authorized to perform transactions.

Page 2 of 2

How to complete a Stock Power Form

A. Tell Us About: The account you are transferring from

1.Enter the 10 digit account number for the current account.

2.Enter the name of the company of stock to be transferred. A separate Stock Power Form is needed for each account and company of stock you are transferring.

3.List the current registration names/ownership title as it reads on statements, certificates and tax forms.

B. Tell Us About: The shares you would like to transfer

4.Check the first box only if you are transferring all shares. If checked, leave boxes 5, 6, and 7 blank.

If you are not transferring all shares, enter the specific number of shares to transfer from each share type into boxes 5, 6, or 7 as needed:

5.Enter the number of Direct Registration shares being transferred or leave blank. These shares are held electronically.

6.Enter the number of Plan shares being transferred or leave blank. These shares are held electronically.

7.Enter the number of certificate shares being transferred or leave blank. These shares have been issued as paper stock certificates. Original stock certificate(s) must be mailed with your Stock Power Form.

8.Enter the number of lost certificate shares or write ALL in box 8. If this does not apply, leave blank. There is a $75 processing fee to replace lost certificates. There may be additional fees and documents required.

C. Tell Us About: Cost Basis

See the enclosed “Frequently Asked Questions about Cost Basis” for further information.

Please check the box next to the purpose of the transfer. We recommend that you consult with your tax advisor regarding the tax implications for each type of transfer.

•Private Sale: Include the Date of Sale and the Cost Per Share.

•Gift: Select this box if gifting shares, the gift date will default to the date that the transfer is processed.

•Inheritance: Include the Date of Death and Fair Market

Value Cost per Share. For shares jointly held: Enter the number of shares or percentage of shares in which the decedent had an interest.

D. Please Let Us Know: If you would like uncashed checks to be reissued

9.Check only one box. If the shares are going to multiple new owners, the checks must be reissued into the current name on the account.

E. Medallion Signature Guarantee

All owners must sign their name and have their signature guaranteed in the medallion format.

If an owner is unable to sign, a legal representative such as a Power of Attorney, Custodian, or Successor Trustee may sign on behalf of the shareowner. List the title of the legal representative below their signature. Medallion Signature Guarantees can be obtained from financial institutions, including commercial banks, brokers, and credit unions.

Where to get a medallion signature guarantee stamp?

We have entered into an arrangement for US shareholders to

obtain a medallion signature guarantee via an online platform at www.eSignatureGuarantee.com

1.Go to the website eSignatureGuarantee.com

2.Have your ID validated (no prior account required)

3.Use promo code EQ to receive a discount on the medallion signature guarantee purchase

Please note that there is a $500,000 limit on the value of transactions that eSignatureGuarantee.com is able to guarantee. For more information email info@eSignatureGuarantee.com

F. Tell Us About: The account you want the shares transferred to

If you are transferring to multiple accounts, enter the number of shares to transfer into the account indicated on this page.

If you are transferring to an existing account, enter the 10 digit account number and complete Line 1. with the full account registration. Then, skip to Section H.

Registration for the New Account:

Check only one box to indicate the type of registration and complete the indicated lines, new address, and Tax ID.

We recommend using capital letters when completing section F to avoid registration and spelling errors, (e.g., JOHN A DOE).

Line 1. Enter the name of the New Owner, Custodian, Trustee, Executor, or Other name (First Name, Middle Initial, Last Name). This should match the name shown on the income tax return filed with the IRS.

Line 2a. If applicable, enter the Joint Owner, Minor, Second Trustee, or Other name (First Name, Middle Initial, Last Name). This should match the name shown on the income tax return filed with the IRS.

Line 2b. If applicable, enter Minor’s state of residence.

Line 3. If applicable, enter any additional Joint Owner, Trustee, or Other name (First Name, Middle Initial, Last Name). This should match the name shown on the income tax return filed with the IRS.

Line 4a. If applicable, enter Name of Trust, Estate name, or the TOD Beneficiary’s name. Only one TOD Beneficiary is allowed per account. This should match the name shown on the income tax return filed with the IRS.

Line 4b. If applicable, enter the date of the Trust.

Address for the New Account:

Enter full mailing address including City, State, and Zip Code.

Tax ID for the New Account:

Enter the 9 digit Social Security Number (SSN) or Employer Identification Number (EIN) for the new account and then check the applicable box. If there are multiple owners, enter the number you would like the income reported under. Only one number is allowed per account. If Custodian for Minor is selected, enter the Minor’s Social Security Number (SSN).

G. Substitute Form

The new owner, whose SSN or EIN is listed in the Tax ID for the New Account box, must sign and date this section.

H. Please Let Us Know: if the new owner would like to receive instructions for online access

Check the box to request instructions sent to the new owner. The necessary information will be mailed to the address provided in Section F.

Frequently asked questions (FAQs) about transferring stock

__________________________________________________________________________________________________________

Where can I find the account number?

Account numbers are printed on statements, tax documents and dividend stubs. Shareowners with an online account can locate account numbers when signed on to shareowneronline.com. You may also obtain a Share Balance Summary statement, which contains your account number, through our automated phone system. Select Account Information from the main menu and then Request Share Balance Summary.

How do I find the current balance?

If you own certificates, the number of shares owned is printed on the front of the certificate. If the shares are held electronically in the Plan or Direct Registration, please refer to the most recent statement for the current balance. Shareholders with an online account can locate balance information on shareowneronline.com.

What if I can’t find the certificates?

The stock certificates will need to be replaced before a transfer can be completed. There is always a $75 processing fee to replace lost certificates. Please enclose a check made payable to Shareowner Services. Depending upon the value of the lost shares, there may be additional fees and documents required. The necessary paperwork will then be mailed to you.

Should I sign the back of the certificates?

For security purposes, we recommend you do not sign the back of the stock certificates.

Will I get a new stock certificate?

After the transfer is completed all shares will be held electronically in the new account. You may request to have a certificate issued by including a written request with your transfer paperwork.

What is a Medallion Signature Guarantee?

A Medallion Signature Guarantee is a stamp from an eligible Guarantor institution, such as a bank, broker, or credit union that indicates the individual signing a form is legally authorized to conduct the requested transaction.

We suggest contacting your Guarantor institution for their document requirements to obtain the stamp. You will complete Section E and sign the Stock Power in their presence. The Guarantor may also require the physical certificates or a statement evidencing the account number for uncertificated shares prior to affixing the Medallion Signature Guarantee.

Please note the stamp must be legible and may not be dated or annotated. A Notary Seal is not a substitute for a Medallion Signature Guarantee.

Where to get a medallion signature guarantee stamp? EQ Shareowner Services has entered into an arrangement for US shareholders to obtain a Medallion Signature Guarantee online at www.eSignatureGuarantee.com at a discount rate.

1.Go to the website eSignatureGuarantee.com

2.Have your ID validated (no prior account required)

3.Use promo code EQ to receive a discount on the Medallion Signature Guarantee purchase

There is a $500,000 limit on the value of transactions that eSignatureGuarantee.com is able to guarantee. For more information, email info@eSignatureGuarantee.com

Can I fax or email the Stock Power Form?

The original documents must be mailed into our office. We are unable to accept faxed copies or emails of the completed Stock Power Form. The signatures and the Medallion Signature Guarantee stamp must be original.

How do I transfer stock to multiple new owners? Complete page one of the Stock Power Form, and then complete a separate page two for each new account. Each completed form will need to have the exact number of shares (not a percentage), the full registration, address, and Social Security Number (SSN) or Employer Identification Number (EIN) for each new account.

Please note a separate Stock Power Form must be completed when transferring from multiple accounts, companies of stock, or both.

How do I change the address on the account I am transferring from?

Please include a letter with instructions for the address change on the existing account. If you are signing on behalf of the registered shareholder or a business entity, documentation supporting your capacity is required.

How can I get the outstanding checks reissued? Complete number 9 on the Stock Power Form. When checks are reissued, outstanding checks in the account are cancelled.

How do I transfer shares if I live outside the United States?

If you are able to obtain a Medallion Guarantee, it must be provided by an eligible guarantor institution participating in a Medallion program approved by the Securities Transfer Association Inc. and must cover the value of the transaction.

If you are unable to obtain a Medallion Guarantee, a Signature Guarantee must be provided by a bank or financial institution having a New York bank correspondent relationship. When signing on behalf of the registered owner, additional documentation may be required. Please contact us with questions.

Is there a limit to the amount of shares I can transfer? If the value of the shares exceeds $14 million, please contact us for further assistance.

Why do I have to complete a Substitute Form

If a Substitute Form

SP TS 6/20

DOM V5.5

What are the different ways I can register my stock?

Shareowners have a number of ways to register their stock; in most cases a new account will be created. Some of the more common types of ownership are listed below.

Individual: Only one individual name is listed on the account. Upon the death of the individual the shares are subject to probate proceedings.

Joint Tenant: Two or more individuals are listed on the account. Upon the death of one joint owner, the survivors are entitled to the shares.

Tenants by the Entirety: A form of ownership recognized by certain states as an appropriate form of registration for a married couple. Upon the death of one spouse, the survivor is entitled to the shares.

Tenants in Common: A form of ownership where two or more individuals are listed on the account. Each tenant owns an undivided interest. Upon the death of one tenant, the decedent’s ownership passes to the heirs of the decedent’s estate and not the surviving owners on the account.

TOD Beneficiary (Transfer on Death): A form of individual or joint tenant ownership where a beneficiary has been designated. Only one beneficiary can be designated per account registration. Upon the death of the security owners, the ownership passes to the TOD beneficiary. TOD is not offered outside of the United States.

Custodial: A form of ownership that can be established for a minor who has not reached the age of majority as defined by the laws of their state of residence. We do not recommend registrations in a minor’s name alone. A custodial registration may be created under the Uniform Transfer to Minors Act (UTMA) for their state. UTMA has replaced the Uniform Gift to Minors Act (UGMA) in most states for new accounts. Custodial accounts for minors must be reported under the Minor’s Social Security Number (SSN).

Trust: A form of ownership governed by a trust agreement created during the lifetime of a grantor or created under a decedent’s will. The account registration must include the names of the Trustees, the name of the Trust, and the date of the Trust. The date must be the original Trust date and not an amendment date. A date will not be applicable for a Trust which falls under a will.

Estate: A registration used by the

If I have changed my name, how do I change my registration?

To change the name on the account, complete all sections of the Stock Power Form. A new account will be created and a new Form

How do I name a beneficiary?

To register an account with a beneficiary, you can choose a TOD Beneficiary (Transfer on Death) registration in section F and complete all sections of the Stock Power Form. A new account will be created and a new Form

How do I remove the Custodian if I am now over the age of majority?

If you have reached the age of majority, complete a Stock Power Form to create a new account. While getting a Medallion Signature Guarantee in Section E, please sign the Stock Power Form as your name is listed on the current account. The registered custodian does not need to sign the form.

How do I correct an error in my registration?

You can correct the name on the account by completing all sections of the Stock Power Form. While getting a Medallion Signature Guarantee in Section E, please sign your correct name and again as listed on the current account, adding “incorrectly registered as” (e.g., Jane Doe incorrectly registered as Janey Doe).

How do I transfer shares when one or more of the shareowners are deceased?

To transfer the shares, the surviving tenant, beneficiary, or legal representative will complete all sections of the Stock Power Form.

When required by the state where the decedent lived, we will also need an Inheritance Tax Waiver.

What is an Inheritance Tax Waiver, and where do I get one?

An Inheritance Tax Waiver is a document issued by the state certifying the estate tax or inheritance tax has been paid or waived by the state. If the decedent was a legal resident of Puerto Rico or one of the states listed below, a Tax Waiver form may be required. To confirm if you will need a Tax Waiver or to get the form, please contact the tax agency of the decedent’s state of residence. Please refer to

Indiana New Jersey Ohio Pennsylvania Rhode Island Tennessee

How do I transfer shares due to a divorce?

A separate Stock Power Form is required for each new account. Each completed form will need to have the exact number of shares (not a percentage), the full registration, address, and Social Security Number (SSN) for the new account.

How can I sell the shares after the transfer is completed?

You can sell shares by completing the enclosed Sale Request After Transfer Form. This is an optional form for participating companies only. Other sales options may be available after the transfer is completed.

Will account features, like direct deposit of dividends, automatically carry over from the old account to the new account?

When a new account is created, the features on the previous account will not be transferred. If you have dividends paid to a bank account, this will need to be added to your new account.

Where can I get additional forms?

You may make photo copies of the blank forms prior to filling them out or you may download additional forms online at shareowneronline.com.

Please note: If you make an error, you will need to fill out a new form. Alterations, corrections, or

Will you return the paperwork?

The paperwork submitted for a transfer is not returned.

How can I contact you for other questions?

You can reach us by phone or send us an email.

•Phone: Please call our office toll free at

•Email: Select Contact Us at any time while online at shareowneronline.com.

Please include a written request with your transfer paperwork. Direct deposit requests must include a corresponding pre- printed voided check or

How will I know when the transfer is completed?

When the transfer has been completed, a statement will be sent to the original owner showing the shares have transferred out of the account. A separate statement will be sent to the new owner showing the shares have been transferred into the new account.

________________________________________________________________________________

Where do I send my request?

You can mail your completed Stock Power Forms and any applicable stock certificates by:

Regular mail: |

Overnight or courier mail: |

EQ Shareowner Services |

EQ Shareowner Services |

PO Box 64874 |

Attn: Imaging Services |

Saint Paul MN |

1110 Centre Pointe Curve Suite 101 |

|

Mendota Heights MN 55120 |

Frequently asked questions (FAQs) about cost basis

____________________________________________________________________________________________

What is cost basis?

Cost basis is the original value of a stock acquisition for tax purposes adjusted for stock splits, dividends, and return of capital distributions. This value is used to determine the capital gain or loss.

Internal Revenue Code Section 6045(g) became effective on January 1, 2011, and requires financial institutions to include each customer’s adjusted cost basis and to classify any gain or loss as short term or long term when reporting a sale of covered shares to the Internal Revenue Service (IRS). To comply with this law, we will maintain cost basis information for covered shares purchased on or after January 1, 2011.

Visit the IRS website (www.irs.gov) for further details.

What are covered securities?

Shares that are defined by the IRS Regulation

What are

What is FMV?

FMV stands for Fair Market Value. The fair market value is the price at which the shares would change hands between a willing buyer and a willing seller. If the shares are traded on the market, the FMV is typically the average between the high and low price on the specific date.

Can I transfer or sell specific shares?

Yes. We will need the acquisition date and the number of shares from the specific tax lot you would like to transfer or sell. This information may be written on the Stock Power Form or you may send a letter along with your transfer paperwork. We will transfer shares using First In, First Out (FIFO) order unless we receive written instructions asking us to transfer specific shares.

For example: Transfer 41 shares of XYZ Corporation stock from the tax lot purchased on January 2, 2009.

A tax lot is a single acquisition of a given security that has a unique acquisition price and acquisition date. A tax lot may

contain one or more shares. Tax lots are further defined as either covered or

When is a transfer considered a gift?

Typically a transfer of shares is considered a gift as long as there is not a common owner between the old and new account and the shares are not being transferred due to an inheritance or a private sale.

How does receiving shares as a gift affect the cost basis?

The cost basis for shares you receive as a gift is typically equal to the donor’s cost basis prior to the transfer. If the shares you receive as a gift were covered securities under the IRS cost basis reporting regulations, the cost basis information will be carried from the donor’s account into your new account.

In some instances, the cost basis for the gifted shares is determined to be the FMV as of the date of the gift. Please refer to IRS Publication 551 for additional information regarding cost basis of gifted shares.

What is considered the date of the gift?

The date of the gift is generally the date when the donor no longer has dominion or control of the shares.

•For shares held electronically: The date of the gift is when Shareowner Services has completed the transfer of ownership in the stock issuer’s records.

•For shares held as a stock certificate: The date of the gift is typically the date when the certificate was delivered to the recipient. The recipient may send a letter of instruction providing us the date of the gift. If the instructions are not received, we will use the date of the transfer of ownership in the stock issuer’s records.

How is cost basis affected when a shareholder is deceased?

When shares are transferred because the shareholder is deceased, the authorized estate representative determines whether to use the FMV as of the date of death or an alternate valuation date. The same valuation date would then be applied consistently to all assets in the estate. IRS regulations require the authorized estate representative to provide all estate heirs and beneficiaries with IRS Form 8971; “Information Regarding Beneficiaries Acquiring Property From a Decedent” which specifies the FMV of the property.

SP CB 12/22/2017 Dom V5

What is the Alternate Valuation Date?

The alternate valuation date is typically six months from the date of death. If the shares are sold or otherwise disposed of within six months from the date of death, the date of the sale may be used as the alternate valuation date. Please see Internal Revenue Code 2032 and a tax advisor for more information on the alternate valuation date.

What if we don’t have the inheritance information right now?

The shares will be considered

The authorized estate representative may send the missing information to us by mail at a later time and we will adjust the cost basis in the account records.

Do the inheritance rules still apply to me if the shares were registered as a Transfer on Death (TOD)?

Yes. Accounts registered as TOD are not handled by the probate process, but are considered part of the deceased shareowner’s estate. For that reason, the cost basis of the shares is the FMV on the date of death or the FMV on the alternate valuation date, as determined by the authorized estate representative.

How is cost basis on a jointly held account determined for inheritance?

When shares are held jointly and we are unable to determine that the joint owners were married, it cannot be assumed that all tenants owned an equal amount of the shares. The authorized estate representative will need to provide the number of shares in which the decedent had an interest and the FMV per share. This information will be used to adjust the basis of the inherited shares upward. The cost basis for the shares owned by the surviving owner(s) will not be adjusted.

When a married couple owns shares registered as joint tenants (JT TEN) or as tenants by entirety (TEN ENT), the surviving spouse will be treated as though he or she inherited half of each share of stock. The cost basis will remain unchanged on one half of each share of stock and will be adjusted upward for the inheritance on the other half of each share of stock. We will determine the cost basis for the inherited shares by using the FMV on the date of death or by using the FMV on the alternate valuation date, if provided.

If the joint owners reside in a community property state, additional requirements may apply. For this reason, the authorized estate representative will need to provide the number of shares in which the decedent had an interest and the FMV per share. Consult a tax attorney or advisor to determine the appropriate information to provide on the Stock Power Form. Please refer to IRS Publication 551 for specific information about community property rules and calculations.

Where can I find additional information about cost basis?

Additional information is available on our website at shareowneronline.com. We suggest consulting a tax advisor or the IRS directly. Additional information and forms are available on the IRS website at irs.gov.

Sale Request After Transfer Form (optional)

Complete this form and return it with your transfer paperwork if you would like to sell shares after the transfer is completed. Please note this is an optional request for companies that allow sales. Additional sales options may be available after the transfer is completed. This form does not need to be returned if you do not want to sell shares.

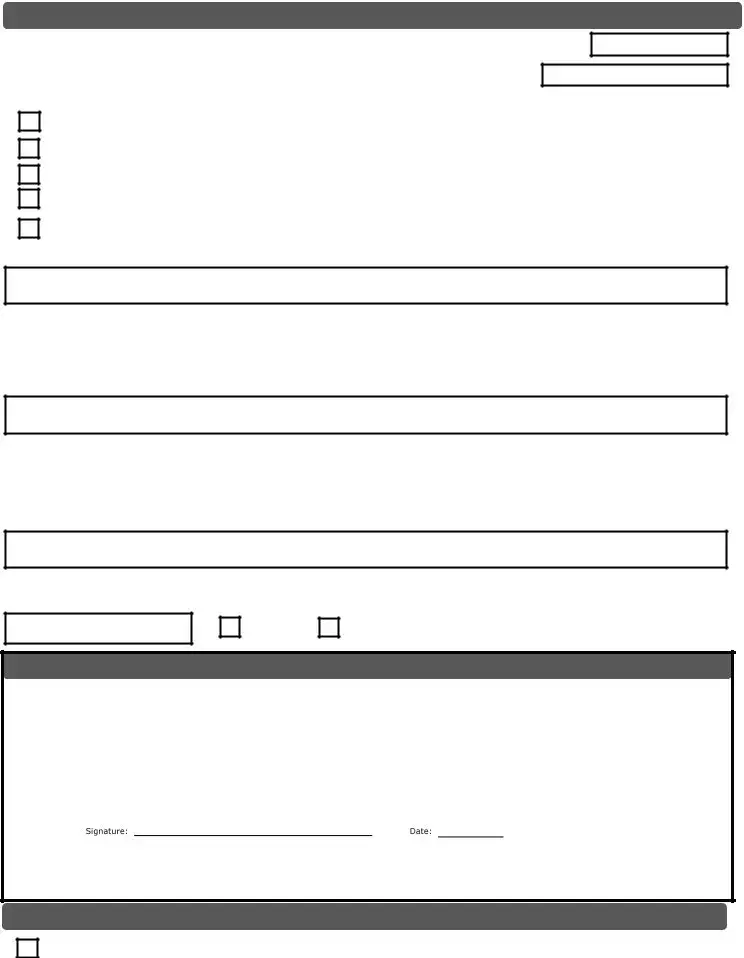

This following section should be completed with new owner’s information.

1.Social Security or Tax ID number on the new account:

2.Company name or issue of stock you are selling:

3.Names on the new Account to be sold:

To make sure backup withholdings are not deducted from the sale proceeds, refer to Section G on the Stock Power form.

4. Selling Shares:

Sell ALL shares in my account. The Plan will terminate. No additional boxes should bechecked.

OR sell a portion of shares:

Sell Direct Registration shares.

Number of Direct Registration shares to sell:

Sell Plan shares and terminate the Plan; move remaining full shares to Direct Registration. Number of Plan shares to sell:

Sell Plan shares and do not terminate the Plan.

Number of Plan shares to sell:

When shares are transferring to an existing Shareowner Services account:

Sell ALL transferred and existing shares in my account. The Plan will terminate.

No additional boxes should be checked above.

5.Direct Deposit of Sale Proceeds to a United States Bank Account (optional). Select one:

NOTE: If sale proceeds exceed $10,000 a check will be issued. Review the next page for more information.

Checking account

Include

Savings account

Include

ABA/routing number (begins with 0, 1, 2, or 3) |

|

Bank account number |

|

|

|

|

|

|

6.Signatures of the registered owners: All owners must sign as they are registered on the account.

If you are signing on behalf of a registered owner or business entity, review the next page for instructions.

SP SAT 12/18 DOM V5.3

7.Signatures on Behalf of the Registered Owners or Business Entity: You must obtain a Medallion Signature Guarantee stamp. After your signature, enter your title (e.g., John Smith, President, or Jane Smith, Power of Attorney). If the names on the account need to be changed, or if a registered owner is deceased, a transfer must be completed. You may view instructions and download forms online at shareowneronline.com. Under Download Forms, select Stock Power and Transfer Instructions.

Medallion Signature Guarantee. Note to Guarantor: Medallion stamp must be fully legible and must not be dated or noted.

Additional information regarding the Sale Request After Transfer Form

Direct deposit of sale proceeds:

•Provide us your account type, ABA/routing number (begins with 0, 1, 2, or 3), and bank account number.

•Direct deposit requests must include a corresponding

•If the names on your bank account do not match the names on your stock account, a check will be issued.

•Incomplete information or inaccurate information will result in proceeds issued by check.

•If direct deposit is not offered, a check will be issued.

•If sale proceeds exceed $10,000, a check will be issued.

All requests will be executed in accordance with the terms and conditions defined in your plan documents. Once a sale has been submitted to Shareowner Services, it cannot be modified or cancelled. You are unable to direct the date, time or price at which the shares will be sold. The share price may fall or rise during the period between a request for sale, it’s receipt by Shareowner Services, and the actual sale in the open market. This price risk is assumed by the shareowners.

Mail this form with your transfer paperwork to: |

If using a courier, please mail to: |

EQ Shareowner Services |

EQ Shareowner Services |

PO Box 64874 |

Attn: Imaging Services |

Saint Paul MN |

1110 Centre Pointe Curve Suite 101 |

|

Mendota Heights MN 55120 |

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Purpose of Stock Power Form | This form is used to transfer shares, change names, or add beneficiaries. |

| Required Accuracy | Alterations or corrections will invalidate the form, so it's essential to print clearly. |

| Medallion Signature Guarantee | A guarantee from an authorized financial institution is needed for all signatures on the form. |

| Direct Registration Shares | If transferring shares held electronically, you need to specify the number of direct registration shares. |

| Lost Certificates | A processing fee of $75 applies for replacing lost stock certificates. |

| Tax Identification Number | A Social Security Number or Employer Identification Number must be provided for the new account. |

| Transfer Not for Non-U.S. Persons | Non-U.S. persons must complete a Form W-8 instead of a W-9. |

| Separate Forms for Multiple Transfers | A separate stock power form is required for each account and company of stock being transferred. |

| Governing Law | The Stock Power Form is generally governed by the state law where the company is incorporated. |

Guidelines on Utilizing Stock Power

Filling out the Stock Power form may seem daunting, but with a step-by-step guide, it becomes quite manageable. This form is essential for transferring shares or making changes to your stock ownership. Each section requires specific information, so ensure to follow the steps closely to avoid any mistakes that might invalidate your request. Precision is key!

- Account Information: In Section A, provide the account number from which you are transferring shares, the name of the company, and the current registration details as they appear on statements or certificates.

- Share Transfer: In Section B, indicate whether you are transferring all shares. If not, enter the specific number of shares being moved from each category (Direct Registration, Plan, Certificates).

- Lost Certificates: If any certificates are lost, fill out box 8 accordingly. Remember, a $75 fee applies to replace lost certificates.

- Cost Basis: Section C requires you to specify the purpose of the transfer. Fill in the relevant details concerning private sale, gift, or inheritance.

- Reissue of Checks: In Section D, choose whether to reissue any uncashed checks to the new owner's name or keep them under the current account name.

- Signature Guarantee: Section E mandates that all current owners sign the form. Ensure you get a Medallion Signature Guarantee from a qualified institution.

- New Account Information: In Section F, provide the details of the account where shares will be transferred. This includes entering the account registration, address, and the new owner’s tax identification number.

- Substitute Form W-9: Complete Section G by having the new owner sign here, ensuring their details match the Tax ID provided above.

- Online Access: Finally, in Section H, check the box if the new owner wants online access instructions sent to them.

Once all the sections are filled out carefully, mail the completed Stock Power form and any required documents, such as original certificates, to the designated address. Accuracy matters! Any errors can delay the transfer process, so double-check your entries before submitting.

What You Should Know About This Form

What is a Stock Power Form?

A Stock Power Form is a document used to transfer ownership of shares from one account to another. It allows you to list the shares being transferred, the parties involved, and necessary details such as tax identification numbers. It's crucial for facilitating smooth transactions and ensuring proper records are maintained.

Why do I need a Medallion Signature Guarantee?

A Medallion Signature Guarantee is a specialized stamp that verifies the identity of the person signing the Stock Power Form. This guarantee is needed to protect against fraudulent transfers and unauthorized transactions. You can obtain this from banks, brokers, or credit unions that participate in a Medallion Stamp program.

What happens if I lose my stock certificates?

If you lose your stock certificates, you need to replace them before proceeding with a transfer. You can report the lost shares on the Stock Power Form, but there is a $75 processing fee for replacement. Additional paperwork may be required, depending on the value of the lost shares.

Can I fax or email my completed Stock Power Form?

No, you cannot fax or email the Stock Power Form. Original documents must be sent by mail to ensure signatures and Medallion Signature Guarantees are valid. Faxed copies are not accepted.

How do I transfer shares to multiple new owners?

To transfer shares to multiple new owners, you must fill out page one of the Stock Power Form and create a separate page for each new account. Each page should indicate the exact number of shares being transferred, along with the required registration and identification information for each new account.

What if I need to change the address on my existing account?

To change your existing account address, include a letter with instructions for the address change along with your Stock Power Form. If you are signing for someone else, include documentation showing your authority to do so.

Do I need to complete a Substitute Form W-9?

Yes, a Substitute Form W-9 is required for each change in registration. This form ensures that proper tax identification information is on file. Without it, your account may be subjected to federal tax withholdings.

How do I name a beneficiary on my account?

To register an account with a beneficiary, you can opt for a TOD (Transfer on Death) registration. Complete the applicable sections of the Stock Power Form, ensuring all information is accurate to designate your chosen beneficiary properly.

What should I do if I need to correct an error on my Stock Power Form?

If you find an error in your registration, complete all sections of the Stock Power Form again. When obtaining a Medallion Signature Guarantee, sign both your correct name and the name as it’s incorrectly recorded, clearly indicating the error.

Common mistakes

Filling out a Stock Power form might seem straightforward, but many people make common mistakes that can lead to delays or invalid submissions. Here are seven frequent errors to avoid when completing this crucial document.

Neglecting to Use a Separate Form for Each Account - One key mistake is using a single Stock Power form to transfer shares from multiple accounts or companies. Each account and company needs its own form. Failing to provide separate forms complicates the processing and can cause significant delays. Always remember: one form per account.

Incorrect Information on Registration - Another common problem arises when people don’t accurately report the "Current Registration" details. It’s important to replicate the names as they appear on certificates and tax documents. If the name or ownership title doesn’t match precisely, the transfer might not be recognized, rendering the form invalid. Triple-check this section for accuracy!

Leaving Key Boxes Blank - When it comes to indicating the number of shares being transferred, it’s crucial not to leave that section blank. If you’re transferring all shares, you must check the first box and leave the others empty. If transferring only some, then you must fill out the appropriate boxes. Don’t assume that leaving them blank won’t be a problem; it will be.

Overlooking Signature Guarantee Requirements - Many forget to include a Medallion Signature Guarantee. All current owners or authorized individuals must sign and have their signatures guaranteed. This guarantee is crucial; without it, the request can be rejected. Ensure you arrange for this signature guarantee through a member of a Medallion Stamp Program.

Using Alterations or Correction Fluid - Any alterations, corrections, or white-out on the form will render it invalid. Such modifications may not only confuse the processing entity but could lead to outright rejection of the form. Always fill out the Stock Power carefully, and if a mistake happens, simply start fresh with a new form.

Ignoring Tax ID Requirements - It’s important to remember that the new owner's signature must match the Tax ID entered in the required section. If the names do not align with the Tax ID on file, complications may arise. Always ensure that these details are consistent to avoid unnecessary issues.

Not Following Up on Missing Certificates - If any stock certificates are lost, it’s crucial to report that accurately in the designated section. Indicating "lost shares" or "ALL" shares is necessary for processing requests related to lost certificates. Keep in mind that replacing lost certificates incurs a fee, and this must also be properly handled.

By being mindful of these potential pitfalls, you can ensure that your Stock Power form submission goes as smoothly as possible. Taking the time to review and verify every section will help secure your stock transfer without unnecessary hiccups.

Documents used along the form

The Stock Power form is an important document used when transferring shares of stock. However, it is rarely used in isolation. There are several other forms and documents commonly involved in this process. Each plays a unique role and contributes to the accuracy and legality of the stock transfer. Here’s a look at five essential documents that often accompany the Stock Power form.

- Medallion Signature Guarantee: This stamp acts as a security measure to verify that the person signing a document is legally authorized to do so. It must come from an eligible financial institution and is necessary for ensuring that the transfer is legitimate.

- Substitute Form W-9: This tax form is essential for reporting the taxpayer identification number of the new owner. Accurate completion of the W-9 helps avoid tax withholding issues and confirms the identity of the new owner.

- Lost Stock Certificate Affidavit: If there are lost stock certificates, this affidavit is required. It states the circumstances of the loss and helps facilitate the replacement of the certificates through a formal process.

- Inheritance Tax Waiver: When transferring shares due to inheritance, this document certifies that any applicable estate tax has been settled. It protects the recipient from future tax liabilities regarding the inherited shares.

- Power of Attorney (POA): If someone else is acting on behalf of the shareholder, a POA form is necessary. It grants the individual the authority to manage stock transfers and related transactions as specified in the document.

Understanding these accompanying documents is crucial for anyone involved in stock transfers. This knowledge helps ensure that all necessary paperwork is completed accurately, thus easing the transition of shares and minimizing potential legal complications.

Similar forms

The Stock Power Form is an important document in the process of transferring stock ownership. Besides the Stock Power Form, several other documents serve similar purposes in facilitating the transfer of shares or the designation of ownership. Below is a list of such documents and how they are alike with the Stock Power Form:

- Transfer Instruction Letter: This document provides written instructions to transfer stock ownership. Like the Stock Power Form, it typically includes the account details and the number of shares to be transferred.

- Stock Assignment Form: Used to assign shares from one person to another, this form resembles the Stock Power Form in that it requires the signature of the current holder, authorizing the transfer of shares.

- Medallion Signature Guarantee: This is a specific form of signature verification often required to transfer securities. It is similar because it ensures that the transferor is legitimately authorized to sign over their shares, just as a signature guarantee is necessary for a Stock Power Form.

- Certificate of Stock Ownership: This document serves as proof of ownership, and while it may not initiate a transfer, it is often required in conjunction with the Stock Power Form to verify that the shares exist before a transfer can occur.

- Form W-9: This tax form collects taxpayer identification information. It parallels the Stock Power Form in that both documents collect essential data to facilitate the processing of a transfer and to ensure the accuracy of tax reporting.

- Gift Tax Return (Form 709): If stock is transferred as a gift, this form may be necessary. Like the Stock Power Form, it documents the transfer and may have tax implications that both parties need to be aware of.

- Trust Documents: If shares are being transferred into or out of a trust, the relevant trust documents must outline how the assets are to be managed. These documents are similar in purpose to a Stock Power Form as they dictate ownership and control of shares.

- Power of Attorney Document: A Power of Attorney allows one person to act on behalf of another in legal matters, including stock transfers. This document, like the Stock Power Form, aims to authorize transactions and ensure that the correct parties are involved in the transfer process.

Understanding these related documents can aid individuals in navigating the complexities involved in transferring stock and ensuring that ownership changes are executed smoothly. Each serves a unique purpose, yet they share the common goal of establishing and documenting a transfer of ownership.

Dos and Don'ts

Things to Do When Filling Out the Stock Power Form:

- Print clearly to avoid misinterpretation of details.

- Use a separate form for each account and company of stock.

- Provide the full name and details exactly as they appear on certificates and tax forms.

- Include original certificates with the request if applicable.

- Ensure signatures are guaranteed by a Medallion Signature Guarantee.

- Double-check entries for accuracy to prevent delays in processing.

- Review the note about lost certificates and required fees.

Things to Avoid When Filling Out the Stock Power Form:

- Do not use alterations, corrections, or white-out on the form.

- Avoid incomplete forms; ensure all necessary sections are filled out.

- Do not submit a faxed or emailed copy of the form; only original documents are accepted.

- Do not forget to check the appropriate box if transferring all shares.

- Avoid using vague terms or incomplete information; be specific with details.

- Do not neglect to provide tax identification information for the new account.

- Do not presume previously provided information is still accurate; verify all details each time you submit the form.

Misconceptions

Here are eight common misconceptions about the Stock Power form:

- All alterations are acceptable. Many believe they can make corrections on the Stock Power form. However, alterations, corrections, or any type of white-out will render the form invalid.

- You can transfer shares without a Medallion Signature Guarantee. Some think a signature alone suffices. A Medallion Signature Guarantee is mandatory for the signature of all current owners or authorized individuals.

- One form suffices for multiple accounts. In reality, a separate Stock Power form is needed for each account and company of stock being transferred.

- Lost certificates are inconsequential. It is a common misconception that lost certificates can simply be disregarded. If certificates are lost, they need to be reported, and a processing fee applies to replace them.

- Tax information can be omitted. Some individuals assume that the cost basis or tax information is optional but it is necessary for tax reporting purposes when transferring shares.

- The Stock Power form can be submitted online. Many expect that faxing or emailing the form is acceptable. However, original documents must be mailed; digital copies will not be accepted.

- Identification requirements are uniform. Some believe that the identification needed for a Medallion Signature Guarantee is universal. However, different institutions may have different documentation requirements to obtain the stamp.

- Checking ‘ALL’ means automatic transfer. Checking the box for transferring all shares does not allow for flexibility. If checked, leave other share quantity boxes blank, which restricts additional specifications for varied share types.

Key takeaways

When it comes to transferring ownership of stocks, filling out the Stock Power form correctly is crucial. Here are key takeaways to keep in mind:

- Print Clearly: Ensure that all information is written clearly to avoid confusion. This helps prevent errors and delays in processing.

- One Form Per Account: Use a separate Stock Power form for each account and company of stock being transferred. This clarification aids efficient processing.

- Do Not Alter: Avoid making changes, corrections, or using white-out on the form. Any alterations will invalidate the form.

- Include Required Documentation: Remember to include any original stock certificates if transferring those shares. Lost certificates require a specific process.

- Understanding Cost Basis: Be prepared to provide details about the cost basis and purpose of the transfer, whether it’s a sale, gift, or inheritance.

- Medallion Signature Guarantee: All current owners or authorized individuals must obtain this guarantee. Check with your financial institution for their requirements to ensure validity.

- Mail the Original Documents: Once completed, mail the original Stock Power form to the appropriate office. Faxed or emailed copies are not accepted.

Use these insights to navigate the process smoothly. Each step matters, so approach the form with care and diligence.

Browse Other Templates

Payvor - This form is used to set up your direct deposit with Paycor.

How to File for a Divorce in Colorado - Investments such as stocks or bonds should also be reported on the form.

Aetna Po Box - Signature of the patient or guardian is required.