Fill Out Your Stock Transfer Ledger Form

The Stock Transfer Ledger form serves as a vital record-keeping tool for corporations issuing or transferring shares. This document captures essential information about both the company and its stockholders, ensuring a clear account of ownership changes. At the top, users enter the corporation’s name, followed by a detailed breakdown of stockholder information. Each stockholder's place of residence, the certificates issued, and the corresponding certificate numbers are meticulously documented. The ledger notes the date when shares were issued, as well as the original source of the shares during any transfer—providing a complete history of ownership. It also captures vital financial details, including the amount paid for shares and the date of transfer. When shares are transferred, the recipient’s information and the certificates surrendered are entered, creating a comprehensive record of transactions. Finally, the ledger calculates the balance of shares held by each stockholder, maintaining accuracy in ownership tracking. This form benefits corporations by ensuring compliance with regulations and easing the process of tracking stock movements among shareholders.

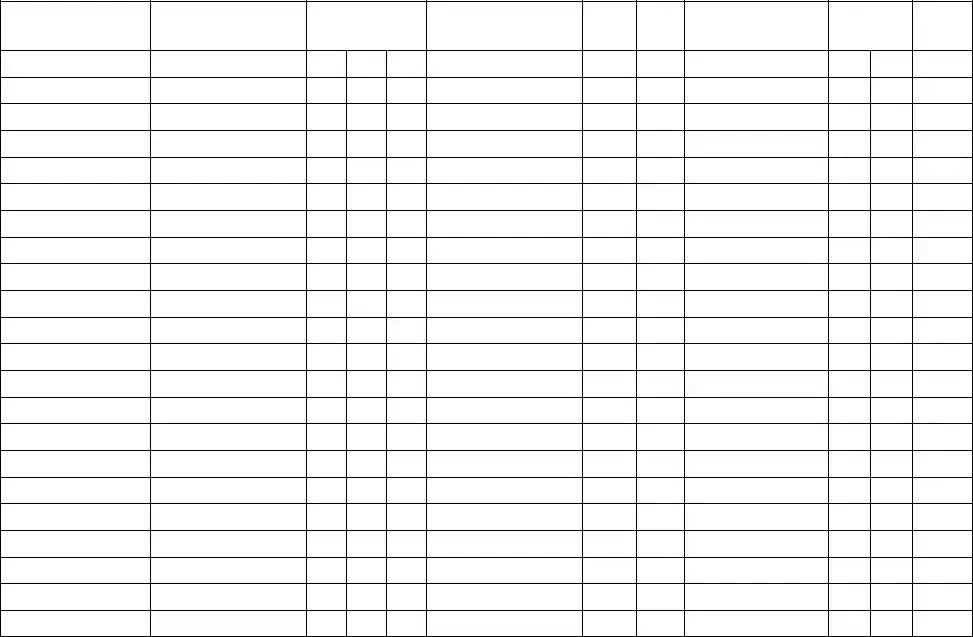

Stock Transfer Ledger Example

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger records details of stock issuance and transfers for a corporation. |

| Form Requirement | This form is essential for keeping an accurate record of stockholders and their shares. |

| Corporation's Name | The form must include the name of the corporation associated with the stock transactions. |

| Stockholder Details | It captures the name and residence of each stockholder involved in any transaction. |

| Certificates Issued | The form tracks the certificate numbers for the stocks issued. |

| Transfer Information | It includes details about the transfer, such as the date and the parties involved. |

| Original Issue | If applicable, the form allows for the documentation of original stock issues. |

| Amount Paid | Details of the amount paid for the shares must be recorded to ensure clarity. |

| State Law | Governed by state corporate laws, which can vary by location. Be sure to verify specific state requirements. |

Guidelines on Utilizing Stock Transfer Ledger

After completing the Stock Transfer Ledger form, the information will be recorded accurately to reflect stock issuances and transfers. This is critical in maintaining proper corporate records. Follow the steps below to ensure that the form is filled out completely and correctly.

- Start by entering the Corporation’s Name at the top of the form where indicated.

- In the first section, list the Name of Stockholder and their Place of Residence.

- Next, move to the Certificates Issued section. Fill in the Cert. No. assigned to each certificate.

- In the Date column, indicate when the shares were issued.

- Specify the No. of Shares Issued for each entry.

- If shares were transferred, indicate From Whom Shares Were Transferred. If the transfer involves the original issue, denote that clearly.

- Document the Amount Paid Thereon for the shares.

- Next, fill in the Date of Transfer of Shares.

- Identify the recipient by entering the To Whom Shares Were Transferred.

- If applicable, list the Certificates Surrendered with their respective Cert. No.

- Finally, calculate and enter the No. Shares remaining, reflecting the Number of Shares Held (Balance).

Ensure all fields contain accurate information to maintain clear records for corporate compliance and reporting purposes. When complete, the form can be properly filed as necessary.

What You Should Know About This Form

What is the purpose of the Stock Transfer Ledger form?

The Stock Transfer Ledger form is used to record the issuance and transfer of stock within a corporation. This document provides a detailed account of who owns the shares, the number of shares issued, and any transfers that take place. It helps maintain accurate records for both the company and its shareholders.

How should I fill out the form?

To fill out the form, start by entering the corporation’s name at the top. Next, for each transaction, list the name of the stockholder and their place of residence. Then, record the certificate numbers, dates of issuance, details of the transferor, the amount paid for the shares, and the recipient's information. Make sure to include the certificates surrendered and the balance of shares held after the transaction.

Who needs to fill out the Stock Transfer Ledger form?

The form should be filled out by the corporation's secretary or another authorized individual responsible for maintaining stock records. This person must ensure all stock transfers are accurately documented to comply with regulations and maintain transparent shareholder records.

What kind of information is recorded on this form?

This form captures vital details such as the name of each stockholder, their residence, the certificate numbers, dates of issuance and transfer, the number of shares involved in transactions, and the amounts paid for the shares. Additionally, it includes information on certificated shares that have been surrendered and the remaining balance of shares held by the stockholder.

Is this form required by law?

While specific requirements can vary by state, it is generally advisable for corporations to maintain a Stock Transfer Ledger to track ownership accurately and comply with corporate governance standards. Keeping this form up-to-date can help prevent disputes and ensure proper record-keeping practices.

Can electronic records be used instead of a paper form?

Yes, electronic records can be used as long as they meet the state’s legal requirements for record-keeping. Ensure that the electronic system is secure and that the information is readily available for reference. Remember, the goal is to maintain accurate and thorough records of stock issuances and transfers.

What should be done with old or outdated records?

Old or outdated records should be archived in accordance with your corporation’s record retention policy. These records may still hold importance for historical reference or liability reasons. Ensure they are stored securely and can be retrieved easily if necessary.

Common mistakes

Filling out the Stock Transfer Ledger form accurately is crucial. Despite its straightforward nature, many individuals stumble upon common mistakes that can complicate the process. One significant error is not entering the corporation's name correctly at the top of the form. It should be clear and match exactly with the official business records. Failure to do this can lead to confusion and could potentially delay the transfer.

Another frequent mistake involves improperly listing the name of the stockholder. The correct legal name must be used, and typos can lead to complications later on. Additionally, submitting an incomplete address for the stockholder can also pose issues. All required contact details should be present to ensure proper communication and record-keeping.

When it comes to issuing certificates, individuals sometimes forget to include the certificate number. This number is essential for tracking ownership details accurately. Furthermore, neglecting to fill in the date of issuance can also create challenges. The date establishes when the shares were officially granted, which is important information for both the corporation and the stockholder.

In the "From Whom Shares Were Transferred" section, errors can arise if individuals do not clarify whether the shares were originally issued or transferred. If the information is ambiguous or missing, misunderstandings may occur regarding the shares’ history and ownership status. Similarly, not appropriately documenting the amount paid for the shares can lead to discrepancies in financial records.

The "Date of Transfer of Shares" must be specified correctly, as this date marks the moment ownership changes hands. Omitting this detail or providing an incorrect date can lead to legal challenges or conflict among parties. It is also a mistake to overlook the section where recipients' details are recorded. Failing to provide accurate information about who receives the shares can lead to confusion about ownership.

In completing the certificates surrendered section, individuals often forget to list the certificate number and the number of shares associated with that certificate. This detail is critical for updating the corporation’s records. Lastly, the final balance of shares held should be clearly stated. Many neglect this section, yet it serves as a summary of the stockholder's current equity position in the company, rounding out the form’s completeness.

To sum up, attention to detail is paramount when filling out the Stock Transfer Ledger form. Small oversights can have larger implications, making it essential to double-check each entry. Avoiding these ten common mistakes ensures that transfers occur smoothly and that ownership records remain accurate.

Documents used along the form

The Stock Transfer Ledger form plays a critical role in documenting the transfer of shares within a corporation. Several other forms and documents are often used alongside it to ensure a complete and accurate record of stock transactions. Below is a list of related documents commonly associated with the Stock Transfer Ledger.

- Stock Certificate: This document serves as proof of ownership for a certain number of shares in a corporation. It contains essential details, such as the shareholder's name, number of shares owned, and the corporation’s name. Stock certificates are typically issued when shares are initially purchased or transferred.

- Shareholder Agreement: A legal document that outlines the rights and obligations of shareholders. This agreement may cover aspects such as voting rights, restrictions on share transfers, and procedures for resolving disputes. It aims to provide clarity and prevent misunderstandings among shareholders.

- Transfer Agreement: This is a contract between the seller and buyer of shares, detailing the terms and conditions of the transfer. It includes the number of shares being sold, the purchase price, and any contingencies that must be met. This document formalizes the transaction and protects both parties involved.

- Minutes of the Board Meeting: These minutes document discussions and decisions made during board meetings, including approvals for stock transfers. They provide an official record of the board's actions and can be important for verifying compliance with company policies and procedures.

Each of these documents plays a vital role in the management of corporate shares and ensuring a clear record is maintained for future reference. Proper documentation supports transparency and accountability within the corporation.

Similar forms

The Stock Transfer Ledger form serves as a record-keeping tool for tracking the issuance and transfer of corporate stock. Several other documents share similarities with this form, as they also play crucial roles in corporate governance and recordkeeping. Below are four such documents:

- Stock Certificate: This document serves as tangible evidence of ownership of shares in a corporation. Like the Stock Transfer Ledger, it contains details about the stockholder, the number of shares owned, and the certificate number. Both documents are vital for confirming ownership and determine the rights associated with the shares.

- Shareholder Agreement: This document outlines the rights, responsibilities, and obligations of shareholders. Similar to the Stock Transfer Ledger, it maintains detailed records about the shareholders and the shares they possess. Both are essential for clarifying relationships and terms among shareholders.

- Stock Power Form: Used to transfer ownership of shares, the Stock Power Form includes information about the stockholder and the number of shares being transferred. Like the Stock Transfer Ledger, it is a critical document in the transfer process, providing a mechanism to document ownership changes accurately.

- Corporate Bylaws: These are the rules governing the management of the corporation. While broader in scope, they may include provisions related to shares and stockholder rights. They share a relationship with the Stock Transfer Ledger by providing guidelines that govern the actions reflected in the ledger.

Dos and Don'ts

When filling out the Stock Transfer Ledger form, following the correct procedures is essential for accuracy and compliance. Below are key actions to consider.

- Do enter the corporation's full name clearly at the top of the form.

- Do provide complete information for each stockholder, including their place of residence.

- Do list the certificates issued and their corresponding numbers accurately.

- Do indicate the amount paid for shares in the appropriate section.

- Do ensure each date is correctly recorded and formatted.

- Don't leave any fields blank; fill in all required information.

- Don't use abbreviations or shorthand; clarity is crucial.

By adhering to these guidelines, you will streamline the process and help maintain accurate records.

Misconceptions

Understanding the Stock Transfer Ledger form can be tricky. Here are ten common misconceptions about this important document:

- It is only used for stock transfers. Many believe the form is solely for stock transfer purposes. In reality, it also tracks stock issuance and details related to stockholders.

- Only publicly traded companies need it. Some think that only large corporations require this form. However, private companies also need it to maintain accurate records of their stock transactions.

- This form is optional. Many assume that using this form is a choice. It’s actually essential for compliance and recordkeeping in most corporations.

- Only one Stock Transfer Ledger is needed for a company. It’s a misconception that one ledger suffices. Depending on the number of stock classes or changes over time, multiple ledgers may be necessary.

- Stock certificates are the only thing tracked. While certificates are important, the ledger also records the names of stockholders, amounts paid, and other transaction details.

- Data on the ledger can be corrected easily. Some people think corrections are simple. However, tracking changes accurately is crucial for legal compliance and transparency.

- Only the company’s secretary manages it. It’s a common belief that only one person handles the ledger. In fact, anyone involved in managing company records may need access to and familiarity with the form.

- It’s outdated in the digital age. Many feel that paper ledgers are no longer relevant. Digital versions exist, but understanding the basics of the form remains vital.

- All entries must be made at the same time. Some think all changes need to happen together. In practice, entries can be made individually as transfers or issuances occur.

- It’s only for big transactions. People might believe the form is only relevant for large stock transfers. However, even small transactions require accurate records for effective management.

Clarifying these misconceptions can help ensure proper handling of stock-related activities within a corporation. An accurate Stock Transfer Ledger is crucial for legal compliance and effective corporate governance.

Key takeaways

Filling out the Stock Transfer Ledger form is an important process for tracking stock ownership within a corporation. Here are some key takeaways to keep in mind:

- Accurate Information: Always enter the corporation's name clearly at the top of the form to ensure proper identification.

- Stockholder Details: Provide the full name and place of residence of each stockholder to help keep records organized.

- Certificate Tracking: Pay close attention to the certificate numbers issued and the corresponding date, as this is crucial for tracking ownership.

- Transfer Records: Clearly indicate from whom the shares were transferred, especially if they are newly issued shares.

- Payment Details: Note the amount paid for the shares, as this will provide clarity on the financial transaction.

- Balance Updates: After each transfer, update the number of shares held by each stockholder to reflect changes accurately.

By following these guidelines, maintaining precise records will be easier, fostering transparency and accountability in stock ownership.

Browse Other Templates

Diy Home Inspection Checklist - The form prompts users to evaluate safety features within the home.

New Mexico Medical Credentials Form,New Mexico Healthcare Provider Application,NM Practitioner License Application,New Mexico Credentialing Request,New Mexico Healthcare Certification Form,New Mexico Provider Verification Form,New Mexico Medical Prof - Space is allocated for future referrals and verification from professional peers in the field.