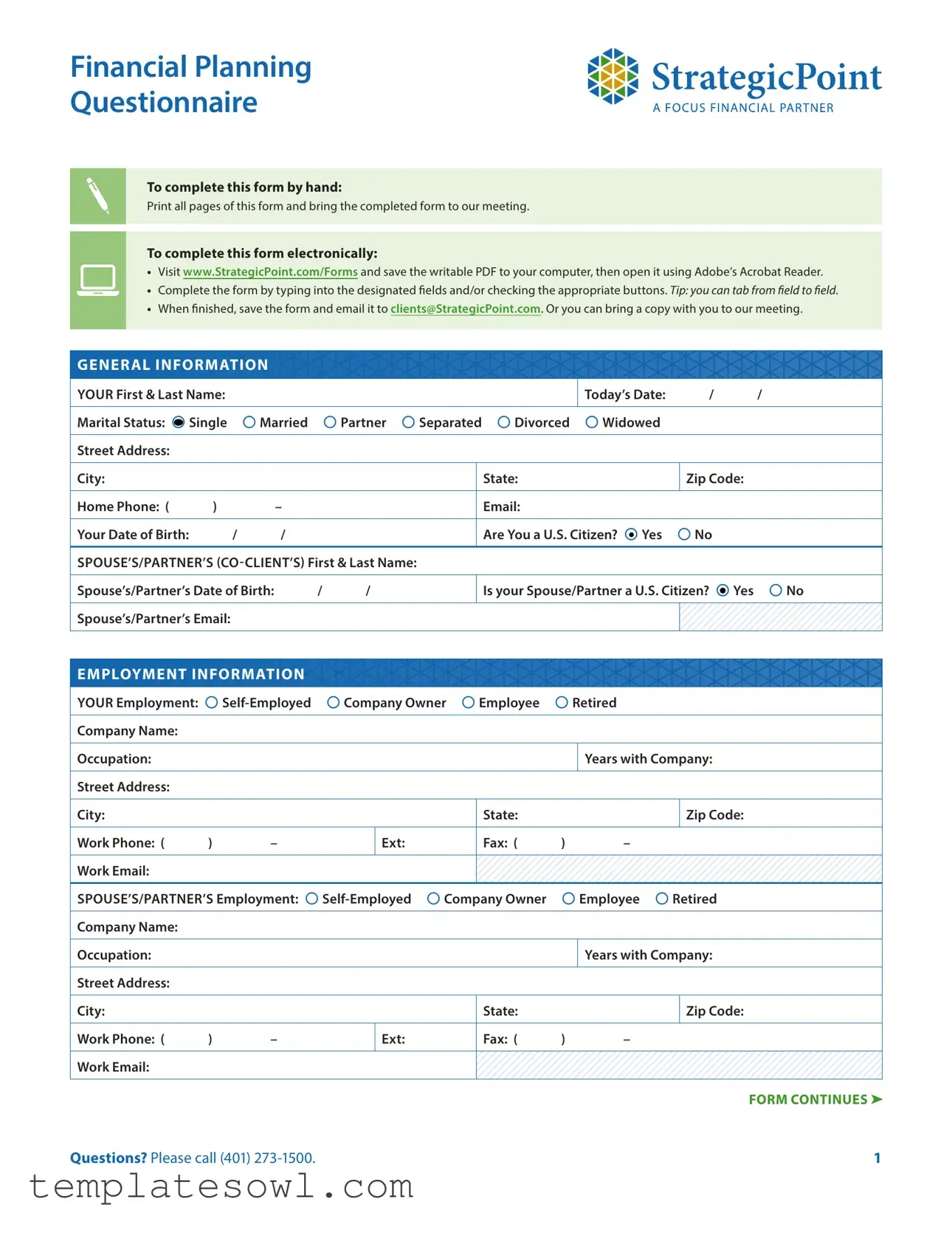

Fill Out Your Strategic Point Questionnaire Form

Completing the Strategic Point Questionnaire form is a crucial step in your financial planning process, offering a comprehensive view of your financial situation. The form is structured to gather fundamental information, beginning with general details about you and your spouse or partner, including names, marital status, and contact information. Following this, it delves into employment information, requesting specifics about your job and your partner’s job, as well as the nature of your employment. Understanding your assets is essential for future financial strategies, and this section covers various types of accounts, including bank accounts, retirement accounts, and investments. You will also have the opportunity to outline business ownership and personal property, providing a fuller picture of your financial assets. Furthermore, the form addresses education funding needs for children or dependents, while a dedicated section examines existing liabilities, such as mortgages and other debts, which influence your net worth. Finally, it wraps up with an income and retirement analysis, helping to define your financial goals and expectations while preparing for your future. Prompt completion of the Strategic Point Questionnaire can pave the way for effective financial planning discussions during your meeting, ensuring critical elements are addressed without delay.

Strategic Point Questionnaire Example

Financial Planning

Questionnaire

To complete this form by hand:

Print all pages of this form and bring the completed form to our meeting.

To complete this form electronically:

•Visit www.StrategicPoint.com/Forms and save the writable PDF to your computer, then open it using Adobe’s Acrobat Reader.

•Complete the form by typing into the designated fields and/or checking the appropriate buttons. Tip: you can tab from field to field.

•When finished, save the form and email it to clients@StrategicPoint.com. Or you can bring a copy with you to our meeting.

GENERAL INFORMATION

YOUR First & Last Name: |

|

|

|

|

|

|

|

Today’s Date: |

/ |

/ |

||

|

|

|

|

|

|

|

|

|

|

|||

Marital Status: Single |

Married |

|

Partner Separated Divorced |

Widowed |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City: |

|

|

|

|

|

|

State: |

|

|

|

Zip Code: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Phone: ( |

) |

– |

|

|

|

|

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Your Date of Birth: |

/ |

/ |

|

|

|

|

Are You a U.S. Citizen? Yes |

No |

|

|||

|

|

|

|

|

|

|

|

|

||||

SPOUSE’S/PARTNER’S |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

||||||

Spouse’s/Partner’s Date of Birth: |

/ |

/ |

|

|

Is your Spouse/Partner a U.S. Citizen? Yes |

No |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/Partner’s Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

EMPLOYMENT INFORMATION |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||

YOUR Employment: |

|

Company Owner |

Employee |

Retired |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Occupation: |

|

|

|

|

|

|

|

|

Years with Company: |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City: |

|

|

|

|

|

|

State: |

|

|

|

Zip Code: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Work Phone: ( |

) |

– |

|

|

Ext: |

|

Fax: ( |

) |

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Work Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

SPOUSE’S/PARTNER’S Employment: |

Employee Retired |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Occupation: |

|

|

|

|

|

|

|

|

Years with Company: |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City: |

|

|

|

|

|

|

State: |

|

|

|

Zip Code: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Work Phone: ( |

) |

– |

|

|

Ext: |

|

Fax: ( |

) |

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Work Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM CONTINUES ➤

Questions? Please call (401) |

1 |

Financial Planning Questionnaire (continued)

ASSETS

Bank Accounts

Type of Account |

Owner |

Balance |

|

|

|

Checking |

|

$ |

|

|

|

Money Market / Savings |

|

$ |

|

|

|

All CDs |

|

$ |

|

|

|

Crypto/Other: |

|

$ |

|

|

|

How much of the above amount do you want earmarked for retirement? |

|

$ |

|

|

|

Retirement Accounts

List

TSA, Annuities, Traditional IRA and Roth IRA. Please attach copies of most recent statements.

Name of Account |

At |

Owner |

Balance |

|

|

|

|

Example: Lifespan 403(b) |

Fidelity |

Mary |

$42,000 |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

Taxable Accounts

List accounts separately and include: brokerage accounts, joint accounts, trusts, TODs, PODs,

|

Name of Account |

At |

Owner |

Balance |

|

|

|

|

|

|

|

|

Example: Individual Account |

Vanguard |

John |

$51,000 |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM CONTINUES ➤ |

|

|

|

|

|

|

|

Questions? Please call (401) |

2 |

Financial Planning Questionnaire (continued)

Business Ownership

Include businesses in which you have direct ownership.

Name of Business |

|

Owner |

Business Type |

Appraisal (your share) |

|

|

|

|

|

Example: Peter’s Painting Co. |

|

Peter |

$250,000 |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

Do you plan to sell your business to create retirement assets? |

|

Yes No |

||

|

|

|

|

|

If yes, in what approximate year? |

|

|

|

|

|

|

|||

Assumed annual growth rate of business: (If left blank, we will grow your business by 8% until sold.) |

% |

|||

|

|

|

|

|

Personal Property

Include collectibles, boats, automobiles, etc.

Property

Example: Art Collection

Owner |

Value |

Mary/John |

$75,000 |

|

$ |

|

$ |

|

|

Real Estate

For additional properties, please attach a separate sheet.

Property |

Investment or Personal |

Owner |

Value |

|

|

|

|

Example: 212 Windham |

Personal Residence |

Joint |

$315,000 |

|

|

|

|

|

Personal Residence |

|

$ |

|

|

|

|

|

Second Home |

|

$ |

|

|

|

|

|

Investment Property (1) |

|

$ |

|

|

|

|

|

Investment Property (2) |

|

$ |

|

|

|

|

|

Other: |

|

$ |

|

|

|

|

How much |

$ |

||

|

|

||

Which of these real estate properties is available to be sold with the proceeds used for retirement? |

|

||

|

|

|

|

In what year would you like to sell the property? |

|

|

|

|

|

|

|

Children and Other Dependents

Please list names, dates of birth, and relation for children, grandchildren, or any other dependents.

Name

Example: Julia

Date of Birth |

Relation |

2/23/2001 |

Daughter |

|

|

|

FORM CONTINUES ➤ |

Questions? Please call (401) |

3 |

Financial Planning Questionnaire (continued)

Assets Held for Education

List separately for each child or grandchild and include 529 Plans, Coverdell IRAs, Custodial Accounts,

Education Savings Bonds, Mutual Fund Accounts, etc.

Name of Account |

Type |

Owner |

Beneficiary |

Balance |

|

|

|

|

|

Example: CollegeBoundFund |

529 Plan |

Mary |

Julia |

$15,000 |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

FUNDING NEEDS FOR CHILDREN AND OTHER DEPENDENTS

We will use the college savings information from the Assets section to determine our education funding projections.

Name |

Date of Birth |

College Start Year |

Years to Fund |

|

|

|

|

Example: Julia |

2/23/2001 |

September 2013 |

4 years |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Cost

What is the annual cost of college you are willing to fund for each child?

Keep in mind that your children may get financial aid or choose to take out student loans to help pay for expenses. Therefore, list only the amount you are willing to pay in current dollars. For instance, if you expect a year of college (graduate school) to cost $15,000 and you plan to pay

$

Annual expenses for other dependents (for example, parents):

$

LIABILITIES

Mortgages

Primary Residence

|

Start Date: |

/ |

/ |

Original Amount: $ |

|

|

Balance Remaining: $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Term: |

|

|

Interest Rate: |

% |

Property Taxes: $ |

Insurance: $ |

||

|

|

|

|

|

|

|

|

|

|

|

Second Home |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Start Date: |

/ |

/ |

Original Amount: $ |

|

|

Balance Remaining: $ |

||

|

|

|

|

|

|

|

|

|

|

|

Term: |

|

|

Interest Rate: |

% |

Property Taxes: $ |

Insurance: $ |

||

|

|

|

|

|

|

|

|

|

|

|

Investment Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Start Date: |

/ |

/ |

Original Amount: $ |

|

|

Balance Remaining: $ |

||

|

|

|

|

|

|

|

|

|

|

|

Term: |

|

|

Interest Rate: |

% |

Property Taxes: $ |

Insurance: $ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM CONTINUES ➤ |

|

|

|

|

|

|

|

|

|||

|

Questions? Please call (401) |

|

|

|

4 |

|

|||

Financial Planning Questionnaire (continued)

Other

Start Date: |

/ |

/ |

Original Amount: $ |

|

|

Balance Remaining: $ |

||

|

|

|

|

|

|

|

|

|

Term: |

|

|

Interest Rate: |

% |

Property Taxes: $ |

Insurance: $ |

||

|

|

|

|

|

|

|

||

Home Equity Line of Credit Balance: |

|

|

|

|

$ |

|||

|

|

|

|

|

|

|

|

|

Amount Available: |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

Other Debt

Debt

Vehicle

Vehicle

All Credit Cards

Student Loans

Other:

Balance |

Interest Rate(s) |

$ |

% |

$ |

% |

$ |

% |

$ |

% |

$ |

% |

|

|

|

INCOME AND RETIREMENT ANALYSIS |

|

|

|

|

|

|

|

|

|

|

|

|

|

YOUR Current Annual Income? |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

At what age do YOU expect to retire? (If you are already retired, put in your current age.) |

|

|

|

|

|

|

(We will use this age to run your retirement projections.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

How much do you contribute to YOUR retirement plans each year? |

$ |

|

|

|

|

|

|

|

|

|

||

|

Is there an Employer match? |

Yes |

No |

|

||

|

|

|

|

|

|

|

|

Amount ($ or %) matched by Employer? |

$ |

|

% |

|

|

|

|

|

|

|

|

|

|

SPOUSE’S/PARTNER’S Current Annual Income? |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

At what age does your SPOUSE/PARTNER expect to retire? |

|

|

|

|

|

|

(If she/he has already retired, put in her/his current age.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

How much does your SPOUSE/PARTNER contribute to her/his retirement plans each year? |

$ |

|

|

|

|

|

|

|

|

|

||

|

Is there an Employer match? |

Yes |

No |

|

||

|

|

|

|

|

|

|

|

Amount ($ or %) matched by Employer? |

$ |

|

% |

|

|

|

|

|

|

|

|

|

|

How much will you need to spend each month in retirement? |

|

|

|

|

|

|

(Exclude taxes and think in terms of today’s dollars.) |

|

|

|

|

|

|

(If you leave this question blank, we will assume you will need 85% of your current income.) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

Additional Annual Savings: |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

Type of Account: |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|||

|

|

|

FORM CONTINUES ➤ |

|||

|

|

|

|

|

|

|

Questions? Please call (401) |

5 |

Financial Planning Questionnaire (continued)

Pensions

Client Name |

Monthly Amount at Start |

Age at Start |

|

Inflation COLA |

|||

|

|

|

|

|

|

|

|

Example: Mary |

$1,200 |

|

|

65 |

|

lYes |

No |

|

$ |

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

What payout option does this pension represent? (We will assume joint and 50% survivor unless otherwise indicated.) |

|||||||

|

|

|

|

|

|

|

|

Single Life |

Name Applicable Pension(s): |

|

|

|

|

||

|

|

|

|

|

|

|

|

Joint and 50% Survivor |

Name Applicable Pension(s): |

|

|

|

|

||

|

|

|

|

|

|

|

|

Joint and 100% Survivor |

Name Applicable Pension(s): |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Current Payment |

Payment Amount |

Payment Amount at |

Payment Amount |

|||

Client Name |

Amount (if applicable) |

at age 62 |

Full Retirement Age |

at age 70 |

|||

|

|

|

|

|

|

|

|

Example: John |

|

|

$1,474 |

|

$2,057 |

|

$2,822 |

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME AND EXPENSES |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Do YOU expect to work |

|

|

|

Yes |

No |

||

|

|

|

|

|

|||

If yes, for how many years? |

|

At what salary (in current dollars)? |

$ |

|

|||

|

|

|

|

|

|

||

Does your SPOUSE/PARTNER expect to work |

|

Yes |

No |

||||

|

|

|

|

|

|||

If yes, for how many years? |

|

At what salary (in current dollars)? |

$ |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

What is the value of any expected inheritance/gifts? |

|

|

|

$ |

|

||

|

|

|

|

||||

In what year would you estimate that you might receive this inheritance? |

|

|

|

||||

|

|

|

|||||

|

|

|

|||||

What is the value of any anticipated expenses or major purchases (other than education)? |

$ |

|

|||||

|

|

|

|

|

|

||

In what year should these expenses be applied? |

|

|

|

|

|

||

|

|

|

|

||||

Is there anything else we should know about when we plan for your retirement? |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM CONTINUES ➤

Questions? Please call (401) |

6 |

Financial Planning Questionnaire (continued)

INSURANCE ANALYSIS

For how many years will you need life insurance?

If you leave blank, we will assume until the first year of retirement.

Life Insurance: Term Policies

Please attach your latest statement.

Face Value |

Insured |

Group or Individual |

Term Remaining |

Premium per Year |

|

|

|

|

|

Example: $500,000 |

John |

Individual |

10 years |

$700 |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

Life Insurance: Permanent Policies |

|

|

|

|

|

|

|

|

|

|

||

|

Please attach your latest statement. |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

|

|

|

|

|

|

Premium |

|

|

Face Value |

Type |

Purchased |

|

Insured |

|

Cash Value |

|

per Year |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Example: $100,000 |

Whole Life |

1998 |

|

|

Mary |

|

$10,000 |

|

|

$1,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long Term Disability Insurance |

|

|

|

|

|

|

|

|

|

|

||

|

Please attach policies if available. |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

Name |

|

Monthly Benefit |

|

Group or Individual |

|

Premium per Year |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Example: John |

|

$3,000 |

|

|

Individual |

|

|

$2,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Long Term Care Insurance |

|

|

|

|

|

|

|

|

|

|

||

|

Please attach policies if available. |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

Name |

|

Daily Benefit |

|

Inflation Rider |

Term |

|

|

Premium per Year |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Example: Mary |

|

$150 |

|

lYes |

No |

3 years |

|

|

$1,500 |

|

||

|

|

|

$ |

|

Yes |

No |

|

|

years |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

Yes |

No |

|

|

years |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

FORM CONTINUES ➤ |

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

Questions? Please call (401) |

|

|

|

|

|

|

|

7 |

|

|||

Financial Planning Questionnaire (continued)

ESTATE PLANNING

Do you have updated wills? |

|

Yes |

No |

|

|

|

|

Do you have powers of attorney? |

|

Yes |

No |

|

|

|

|

Have you executed health care proxies? |

|

Yes |

No |

|

|

|

|

When were these documents last updated? |

|

|

|

|

|

|

|

Have you established any trusts? |

|

Yes |

No |

|

|

|

|

If yes, names of trust(s) you have established: |

|

|

|

|

|

|

|

1) |

2) |

|

|

|

|

|

|

3) |

4) |

|

|

|

|

|

|

General Notes

Whom may we thank for referring you?

Please bring your completed Financial Planning Questionnaire along with any appropriate supporting documents to the meeting with your StrategicPoint advisor.

Please DO NOT complete this section PRIOR to meeting with your advisor.

I acknowledge receipt of StrategicPoint Investment Advisor’s Privacy Policy, Form ADV Part 2,

Proxy Voting Policy and the BCP disclosure statement.

✘

Client Signature

Print Name

Questions? Please call (401) |

8 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Strategic Point Questionnaire is designed to gather essential financial and personal information from clients to facilitate effective financial planning. |

| Completion Options | Clients can fill out the form by hand or electronically. For electronic completion, a writable PDF is available online. |

| Submission Methods | Completed forms can be emailed to clients@StrategicPoint.com or brought to a scheduled meeting. |

| General Information | Clients must provide personal details such as their name, date of birth, and marital status, which aids in customizing financial advice. |

| Employment Details | Information about the client's employment status is vital. They must indicate their job type and additional details about their occupation. |

| Asset Inventory | The form includes sections for listing various assets, such as bank accounts, retirement accounts, and real estate properties, for a comprehensive financial overview. |

| Education Funding | Data related to assets held for education, such as 529 Plans, helps in projecting college expenses for dependents. |

| Liabilities Disclosure | Clients must disclose all liabilities, including mortgages and other debts, to create a full picture of their financial obligations. |

| Income Analysis | The questionnaire requires clients to detail their current income and retirement contributions, which is crucial for retirement planning. |

Guidelines on Utilizing Strategic Point Questionnaire

Completing the Strategic Point Questionnaire is an important step towards effective financial planning. Taking the time to fill out this form comprehensively will provide valuable insights during your meeting. Below are the steps you need to follow to ensure you fill it out correctly.

- Choose Your Method: Decide whether you will complete the form by hand or electronically.

- If completing by hand: Print all pages of the questionnaire. Bring the completed form with you to the meeting.

- If completing electronically:

- Visit www.StrategicPoint.com/Forms to download the writable PDF to your computer.

- Open the PDF using Adobe Acrobat Reader.

- Fill out the designated fields by typing and check the appropriate boxes. You can use the Tab key to move between fields.

- Once finished, save the form.

- Email the completed form to clients@StrategicPoint.com or bring a printed copy to your meeting.

- Complete General Information: Fill in your first and last name, marital status, address, contact numbers, and email. Include your and your partner’s date of birth and U.S. citizenship status.

- Provide Employment Information: Disclose your employment status and details, as well as your partner’s employment information.

- List Assets: Detail your bank accounts, retirement accounts, taxable accounts, business ownership, personal property, real estate, and assets held for education.

- Assess Liabilities: Enter details about mortgages, other debts, and credit card balances.

- Evaluate Income and Retirement Analysis: State your current annual income, retirement age expectations, and contributions to retirement plans for both you and your partner.

- Review Your Responses: Before submitting or bringing the form, double-check all entries for accuracy and completeness.

After you complete the form, be prepared to discuss your responses during the meeting. This will help develop a more personalized financial strategy tailored to your needs.

What You Should Know About This Form

What is the Strategic Point Questionnaire form used for?

The Strategic Point Questionnaire is designed to gather comprehensive information about your financial situation. It allows you to provide details on your assets, liabilities, income, and planned future expenses. This information is essential for creating a tailored financial plan that fits your unique needs and goals.

How do I complete the Strategic Point Questionnaire form?

You can complete the form either by hand or electronically. To fill it out by hand, print all pages of the form and bring it to your meeting. If you choose the electronic option, go to www.StrategicPoint.com/Forms. From there, save the writable PDF to your computer. Open it using Adobe Acrobat Reader, fill in the designated fields, and then either email the completed form to clients@StrategicPoint.com or print a copy to bring with you.

What information is required in the General Information section?

In the General Information section, you will need to provide your full name, today's date, marital status, street address, city, state, zip code, home phone number, email address, date of birth, and citizenship status. If applicable, you will also fill out similar details for your spouse or partner.

What types of assets do I need to report?

You'll report various types of assets, including bank accounts, retirement accounts, taxable accounts, business ownership interests, personal property, and real estate. Specific details such as the type of asset, ownership, and current balance are required to provide a full picture of your financial status.

Can I update the form after submission?

If you need to update your information after submitting the form, it is recommended to contact Strategic Point directly at 401-273-1500. They can provide guidance on how to amend your questionnaire and ensure that your most current financial data is used in your planning process.

Is there a deadline for submitting the form?

While there may not be a strict deadline, it is best to submit the form at least a few days before your scheduled meeting. This allows your financial advisor ample time to review your information and prepare for your discussion.

What if I don't know some of the answers?

It is common to feel uncertain about certain aspects of your finances. You can leave those fields blank, and your advisor can help you develop an understanding during your meeting. Providing as much information as possible will aid in more accurate financial planning.

How detailed should I be with my assets and liabilities?

Detail is important. Provide specific values and relevant account types when listing your assets and liabilities. Accurate information will help your financial advisor create a financial plan that truly reflects your current situation and future goals.

Can I get help filling out the form?

If you require assistance with completing the form, you should not hesitate to reach out directly to Strategic Point. Their team is available to guide you through the process and answer any questions you may have.

What should I do if I have more assets or liabilities than the form allows for?

If your assets or liabilities exceed the space provided, attach additional sheets as needed. Clearly label any supplementary information so that your advisor can easily integrate it into your financial analysis.

Common mistakes

Filling out the Strategic Point Questionnaire can be an essential step in your financial planning journey. However, some common mistakes tend to arise during this process. One frequent error is failing to double-check personal information such as your name or date of birth. This may seem minor, but because these details are critical for identifying your records, inaccuracies can cause significant delays in processing your information.

Another mistake is neglecting to fully complete the employment section. It is crucial to provide accurate details about your current job status and employment history. Omitting information about your company or job title may lead to missed opportunities for tailoring your financial plan to your specific situation.

Many individuals overlook the importance of providing supporting documentation for their assets and liabilities. Attaching recent statements for bank accounts, retirement accounts, and property will help ensure accuracy. Information that is based on estimates or assumptions can lead to misunderstandings down the road, potentially impacting your financial strategy.

Some people also make the mistake of leaving fields blank, particularly in the sections regarding retirement contributions or desired annual costs for funding education. These blanks can result in incorrect assumptions being made about your financial picture. The form states what will happen if you do not provide certain information; for example, a default value may be used in lieu of what you intended.

Additionally, it is easy to forget about including other dependents or children in the questionnaire. Providing names, dates of birth, and relationships is important for accurately capturing potential future funding needs. Missing this information may leave your financial planner without a complete understanding of your obligations.

Another common error is providing outdated or inaccurate financial data. Ensure you update any figures to reflect your current financial state, whether it be income, savings, or debts. Mismatched numbers can skew projections and ultimately lead to ineffective planning.

Neglecting to specify allocations for retirement accounts can also be a misstep. When you list your retirement accounts, be sure to clarify how much you want earmarked specifically for retirement. A vague description of your savings will not provide the clear picture your financial advisor needs.

Some may also assume that the order in which they fill out sections doesn't matter. It's crucial to follow the flow of the form. Skipping sections may misplace vital information that could link to other parts of your analysis.

There’s also a tendency to rush through the questionnaire, particularly in sections related to long-term projections like retirement funding and investments. Taking time to think about these areas leads to more thoughtful responses; quick answers can often overlook essential considerations.

Lastly, be sure to review how you intend to submit the form. Failing to follow through on emailing or bringing a printed copy to your meeting can lead to unnecessary delays in your planning process. Each step in the questionnaire plays its role in aligning your financial goals with your broader life aspirations.

Documents used along the form

In addition to the Strategic Point Questionnaire form, there are several other forms and documents that may be useful for a comprehensive financial planning process. Each of these documents serves a specific purpose and provides important information that can help in creating a more tailored financial plan. Below is a brief description of each relevant document.

- Income Statement: This document outlines an individual's or household's income sources, including wages, interest, dividends, and any other earnings. It helps to evaluate overall financial health and spending capability.

- Expense Tracking Sheet: This sheet is used to record monthly expenses and categorize them. It provides insights into spending habits and areas where budgeting adjustments might be necessary.

- Net Worth Statement: This statement summarizes assets and liabilities, revealing the total net worth. It helps assess financial progress and readiness for future goals.

- Retirement Projection Report: This report estimates future retirement savings and health costs based on current assets, income, and expected payouts. It aims to determine whether individuals are on track to meet their retirement objectives.

- Investment Policy Statement: This document outlines goals and guidelines for investment management, including risk tolerance and asset allocation. It serves as a roadmap for aligning investment strategies with personal financial goals.

- Estate Planning Documents: These include wills, trusts, and powers of attorney. They ensure that an individual's wishes for asset distribution and decision-making authority are clearly articulated and legally binding.

Collectively, these forms and documents complement the Strategic Point Questionnaire, allowing for a well-rounded approach to financial planning. Properly completing all necessary documentation is crucial to make informed decisions regarding your financial future.

Similar forms

- Client Intake Form: This document gathers basic personal information about the client, including names, contact details, and marital status. Similar to the Strategic Point Questionnaire, it ensures that the advisor has essential information to assist the client effectively.

- Financial Goals Assessment: This form is used to identify the financial objectives of the client, such as saving for retirement or purchasing a home. Like the Strategic Point Questionnaire, it helps the advisor understand the client’s aspirations and preferences.

- Investment Profile Questionnaire: This document assesses the client’s risk tolerance and investment preferences. Just as the Strategic Point Questionnaire collects comprehensive financial data, this form helps tailor investment strategies to the client’s comfort level and goals.

- Retirement Planning Worksheet: This worksheet focuses specifically on retirement needs, including expected expenses and income sources in retirement. It serves a similar purpose to the Strategic Point Questionnaire by outlining the financial landscape for retirement planning.

Dos and Don'ts

When filling out the Strategic Point Questionnaire, keep the following tips in mind:

- Print out the form if completing it by hand.

- Ensure your writing is clear and legible.

- Fill in all required fields, including your personal details.

- Verify the accuracy of your financial figures.

- Review your answers before submitting or bringing the form to your meeting.

- Don't rush while filling out the form.

- Don't leave any mandatory sections blank.

- Do not provide outdated information, especially regarding accounts and balances.

- Avoid guessing on values; use your most recent statements for accuracy.

- Don’t forget to save your electronic form before emailing it.

Misconceptions

Understanding the Strategic Point Questionnaire form is crucial for accurate financial planning. However, several misconceptions about this form may lead to confusion or misuse. Here are five common misconceptions explained:

- It must be filled out by hand. Many believe that the form can only be completed by hand; however, it can also be filled out electronically. Users can download a writable PDF from the provided website, fill it in on their computer, and then save or email it.

- All information has to be provided up front. Some think they must complete every field before submitting. While providing as much information as possible is beneficial, clients can leave certain fields blank if they do not apply or if they prefer not to provide that detail initially.

- Only one person needs to fill it out. Many assume that the questionnaire is only for one individual. It is designed for both partners in a relationship or family. Both spouses or partners should complete the sections relevant to their financial situation to provide a comprehensive view.

- It’s not necessary to attach documents. Some individuals believe that they can simply submit the form without any supporting documents. However, attaching recent financial statements, particularly for retirement and taxable accounts, is encouraged to ensure accurate analysis and planning.

- Completing the form guarantees financial success. There is a misconception that simply filling out the questionnaire will automatically lead to favorable financial outcomes. While the form is a valuable tool for gathering information, the actual financial strategy and success depend on ongoing discussions and planning with qualified professionals.

Addressing these misconceptions can lead to more effective use of the Strategic Point Questionnaire, ultimately contributing to better financial planning outcomes.

Key takeaways

Here are key takeaways about filling out and using the Strategic Point Questionnaire form:

- Complete the form before the meeting: It is helpful to print and fill out the questionnaire in advance. Alternatively, you can fill it out electronically and save it to email or bring a physical copy.

- Use the provided website: To access the electronic version, go to www.StrategicPoint.com/Forms. Save the writable PDF to your computer for easy editing.

- Provide accurate information: Ensure that all your financial information, such as assets and liabilities, is up to date. This includes current balances for bank accounts, retirement accounts, and properties.

- Gather relevant documents: Attach copies of recent financial statements for bank accounts, retirement accounts, and investments. This will facilitate a smoother discussion during your meeting.

- Disclose all income sources: Detail your annual income as well as your spouse's or partner's income. This overview is crucial for accurate financial planning.

- Include dependents: List names and relationships for children, grandchildren, or any other dependents, as this information helps assess future education funding needs and other financial obligations.

Browse Other Templates

What Is a Tax Exempt Certificate - This tax-exempt form contributes to reducing costs for governmental operations.

How Do I Avoid Taxes When Buying a Boat? - Document all transactions thoroughly to avoid complications during filing.

New York State Renters Tax Credit - All fields on the form are vital for ensuring successful processing and implementation of changes.