Fill Out Your Subordination Division Form

The Subordination Division form is an essential tool for homeowners looking to alter the priority of their loans, specifically in relation to their first mortgage. Subordination occurs when a lender agrees to allow a loan that is in a subordinate position to remain behind a new or refinanced loan or mortgage. This process can play a critical role in various scenarios, such as refinancing or obtaining a home equity line of credit (HELOC). However, submitting a subordination request is not a simple task; it requires careful adherence to specific guidelines and the completion of a detailed package. The completion time for these requests typically spans up to two weeks, and requests are processed in the order they are received. It is important to note that certain types of requests may not be accepted outright, including those involving negative amortization or properties currently under construction. Additionally, the required documentation—including a uniform loan application and a current property valuation report—must be submitted in full to prevent delays. Homeowners must also understand that Bank of America does not bear the responsibility for any consequences that arise from expired interest rate locks or funding deadlines.

Subordination Division Example

PLEASE NOTE:

1.Subordination requests take up to two weeks to complete and mail.

2.We are unable to expedite any subordination requests. All requests are processed in the order in which the complete subordination package is received.

Thank you for reaching out about our subordination process. You need to complete the included subordination request form and provide the required information so we can begin our review. Please keep the following guidelines in mind when submitting your request.

IMPORTANT GUIDELINES

•For qualification purposes, the HELOC monthly payment included in the

•Bank of America is not responsible for expiring interest rate locks or funding deadlines.

•Subordination requests behind a first mortgage loan with the potential for negative amortization or a reverse mortgage loan or an Equity Credit Line won’t be considered.

•Subordination requests for a lien currently in senior position (1st mortgage) won’t be considered.

•Subordination requests for a property under construction and vacant won’t be considered.

•Subordination requests behind a first mortgage loan with a balloon payment, a line of credit, interest only payments or an ARM with an initial fixed rate period of less than 36 months won’t be considered.

If you have additional questions regarding the subordination request process, please contact our customer service department at:

Home Equity Lines or Credit (HELOC) or Home |

|

Equity Loan (HELOAN) with account numbers of |

|

10 digits or less |

|

|

|

Home Equity Lines of Credit (HELOC) with |

|

account number of 14 digits beginning with 68 |

|

and ending with 99 |

|

|

|

PROCEDURE AND FORM SUBJECT TO CHANGE WITHOUT PRIOR NOTICE

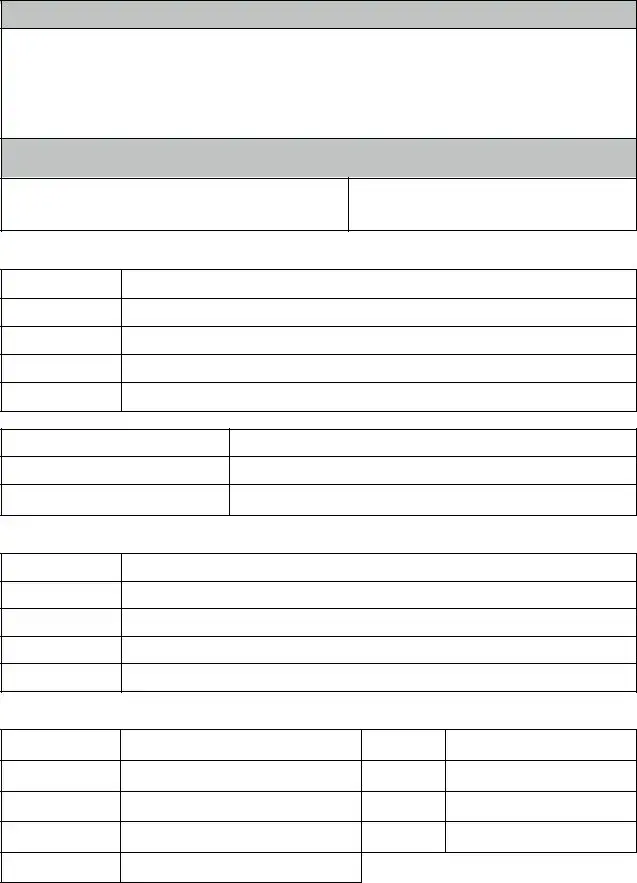

Subordination Request Information and Checklist

CHECK LOAN PROGRAM TYPE:

☐TRADITIONAL RATE/TERM REFI

☐

☐FHA/VA STREAMLINE

☐ARM

☐FHA/VA

LINE REDUCTION REQUEST:

**Required ONLY if Bank of America Line of Credit needs to be modified to a lower loan amount**

MODIFIED HELOC LINE AMOUNT:

**Recordable MOD Required for any LOC Decrease

$

YES / NO

Requestor Contact Information:

Name:

Company Name:

Phone:

Fax:

Email:

Bank of America Account Number:

Customer Name(s):

AMENDED VESTING:

New Lender Information:

Company Name:

Address:

City/State/Zip:

Contact:

Phone:

Bank of America should send subordination documents to:

Company Name:

Address:

City/State/Zip:

Contact:

Email:

Attention:

Suite/Floor:

Fax:

Phone:

PROCEDURE AND FORM SUBJECT TO CHANGE WITHOUT PRIOR NOTICE

2

Required documents for the subordination package include:

(Note: Incomplete packages, illegibility and counter offers may extend the standard processing times)

REQUIRED DOCUMENTATION |

|

|

|

|

|

Rate / Term |

|

|

|

|

REFI or Cash |

FHA |

VA |

|

|

Out REFI |

|

|

|

|

|

|

|

|

Subordination Request Information and Checklist |

|

|

|

|

|

||||

|

|

|

|

|

Uniform Loan Application (form 1003) |

|

|

|

|

|

||||

|

|

|

|

|

Uniform Underwriting and Transmittal Summary (form 1008)1 |

|

|

|

|

|

||||

|

|

|

|

|

30 day current Payoff Letter of existing 1st Mortgage |

|

|

|

|

|

||||

|

|

|

|

|

Current Property Valuation Report (within 120 day) |

|

|

|

|

*Waivers are not permitted |

N/A |

N/A |

||

|

|

|

|

|

Preliminary Title Report (with complete recording information for all liens within |

|

|

|

|

90 days) |

||||

|

|

|

||

|

|

|

|

|

Closing Disclosure or Loan Estimate |

|

|

|

|

|

||||

|

|

|

|

|

Computer generated label for overnight shipping of completed subordination |

|

|

|

|

docs2 |

||||

|

|

|

||

|

|

|

|

|

Supporting documentation showing the loan is eligible under a FHA Streamline |

|

|

|

|

program |

N/A |

N/A |

||

|

||||

|

|

|

|

|

VA IRRRL or VA Loan Analysis if the loan is eligible under a VA Streamline |

|

|

|

|

program |

N/A |

N/A |

||

|

||||

|

|

|

|

|

Borrower’s Authorization to Release Information |

|

|

|

|

|

||||

|

|

|

|

|

Flood Hazard Determination for all requests and also |

|

|

|

|

Flood Insurance Policy if property is in Flood Zone |

||||

|

|

|

||

|

|

|

|

|

Conditional / Loan Approval Letter |

|

|

|

|

|

||||

|

|

|

|

1Including occupancy of subject property, as well as dollar amount, interest rate, term, payment, and mortgage type

2Note: Overnight shipping is not guaranteed if using a vendor other than Federal Express. No handwritten labels will be accepted.

PROCEDURE AND FORM SUBJECT TO CHANGE WITHOUT PRIOR NOTICE

3

* Please mail your request to the appropriate address as provided below *

Appraisal Requirements:

|

PROPERTY TYPE |

|

HELOC/HELOAN <= $250,000 |

|

HELOC/HELOAN > $250,000 |

|

|

|

AVM from BAC Approved AVM Provider |

|

|

|

1 Unit Property |

|

- or - |

|

Full Appraisal - FNMA Form |

|

|

Desktop Appraisal, |

|

||

|

|

|

|

|

|

|

|

|

Appraisal |

|

|

|

|

|

|

|

|

Full Appraisal - FNMA Form

NOTE: The lesser of an adjusted AVM value generated by Bank of America or the appraised value provided will be used to calculate the CLTV for consideration of this request.

Approved AVM Providers and/or Services include the following:

•Collateral Valuation provided by Fannie Mae Desktop Underwriter (DU®)

•Collateral Valuation provided by Freddie Mac Loan Prospector (LP)

•Home Value Explorer (HVE)

•Value Point (VP4)

•Property Analytical and Statistical Simulation (PASS)

•ValueSure (VS5)

•VeroValue (Value)

•Value Finder (VF)

Requests should be routed as follows:

HELOC /HELOAN requests

Subordination Unit,

4909 Savarese Circle

Tampa FL, 33634

To AVOID DELAYS SEND COMPLETE PACKAGE and SUPPORTING Documentation.

PROCEDURE AND FORM SUBJECT TO CHANGE WITHOUT PRIOR NOTICE

4

Form Characteristics

| Fact Name | Description |

|---|---|

| Processing Time | Subordination requests take up to two weeks to complete and mail. |

| No Expedited Processing | Requests cannot be expedited. They are processed in the order they are received. |

| HELOC Payment Calculation | The HELOC monthly payment for debt-to-income ratio is calculated at .75% of the total HELOC line amount. |

| Ineligible Requests | Requests behind a first mortgage that could lead to negative amortization or that utilize reverse mortgages are not considered. |

| Eligibility of Lien | Subordination requests for a lien currently in senior position (1st mortgage) will not be accepted. |

| Extra Guidelines | Requests for properties that are under construction or vacant are also not considered. |

| Balloon Payments | Requests behind a first mortgage with balloon payments or interest-only payments will not be entertained. |

| Contact Information | For inquiries or assistance, customers can contact the Home Equity department at 800-669-5864 or 800-934-5626. |

| Documentation Requirements | A complete package should include documents such as the Uniform Loan Application, current payoff letter, and a flood hazard determination. |

Guidelines on Utilizing Subordination Division

Complete the Subordination Division form carefully to ensure a smooth processing experience. It is important to gather all necessary information and documentation outlined in the instructions provided. Once the form is filled out correctly and submitted, it will take up to two weeks for processing and mailing. Keep in mind that requests are handled in the order they are received, and no requests can be expedited.

- Check the loan program type by selecting one of the following options:

- Traditional Rate/Term Refi

- Cash-Out Refi

- FHA/VA Streamline

- ARM

- FHA/VA Line Reduction (if applicable)

- If applicable, fill in the modified HELOC line amount and select YES or NO.

- Provide the requestor's contact information, including:

- Name

- Company Name

- Phone

- Fax

- Bank of America Account Number

- Customer Name(s)

- Complete the amended vesting section.

- Enter the new lender information, filling in:

- Company Name

- Address

- City/State/Zip

- Contact

- Phone

- Specify who Bank of America should send the subordination documents to, providing:

- Company Name

- Address

- City/State/Zip

- Contact

- Attention

- Suite/Floor

- Fax

- Phone

- Gather and include all required documentation:

- Uniform Loan Application (form 1003)

- Uniform Underwriting and Transmittal Summary (form 1008)

- A current 30-day payoff letter of the existing first mortgage

- Current property valuation report (within the last 120 days)

- Preliminary title report for all liens within the last 90 days

- Closing disclosure or loan estimate

- Completed borrower’s authorization to release information

- Flood hazard determination and flood insurance policy (if applicable)

- Conditional/Loan approval letter (if applicable)

- Review all information to ensure accuracy and completeness before submitting the package to the appropriate address:

For effective processing, handle the submission promptly and ensure that all pages of the form and supporting documentation are clear and legible. Incomplete packages may delay processing time.

What You Should Know About This Form

What is a Subordination Division form?

The Subordination Division form is a document used to request subordination of a second mortgage or Home Equity Line of Credit (HELOC) when there’s a first mortgage loan involved. Essentially, it allows the second mortgage lender to agree to remain in a junior position behind a new first mortgage. Completing this form properly is crucial for the lender to consider your request.

How long does it take to process a subordination request?

Subordination requests typically take about two weeks from the time they are received for processing. It’s important to remember that all requests are handled in the order they arrive, so patience is required during this period. Unfortunately, there is no option to expedite this process.

What documents are required for the subordination request?

A complete subordination package is vital for a smooth review process. Some essential documents include a Uniform Loan Application, a Payoff Letter of the existing first mortgage, a current Property Valuation Report, and a Conditional Loan Approval Letter. Make sure to follow the complete documentation checklist to avoid delays.

Are there any types of loans that do not qualify for subordination?

Yes, certain loans are not eligible for subordination. This includes requests for loans positioned behind a first mortgage with negative amortization, reverse mortgages, or any lien in a senior position. Additionally, properties under construction or vacant are also excluded from consideration. If your loan involves a balloon payment, a line of credit, or interest-only payments, it may not qualify either.

What happens if the subordination request package is incomplete?

Submitting an incomplete package can lead to longer processing times. If documents are missing, difficult to read, or if there’s a counter offer, these issues will extend the review period and may delay your application further. It’s best to double-check everything before submission.

What is meant by debt-to-income ratio for HELOCs?

When analyzing your subordination request, Bank of America uses a specific approach to gauge your debt-to-income ratio. This includes calculating your HELOC monthly payment at a rate of 0.75% of the total HELOC line amount. This calculation helps assess your financial eligibility for the new loan terms.

Whom should I contact if I have questions regarding my subordination request?

If you have any questions, reaching out to their customer service department is highly recommended. For HELOCs, you can call 800-934-5626, and for Home Equity Loans (HELOAN), you can reach out at 800-669-5864. Remember to have your account numbers handy for quicker assistance.

Can Bank of America guarantee funding timelines with subordination requests?

No, Bank of America cannot hold responsibility for expiring interest rate locks or funding deadlines that may occur while your subordination request is being processed. It’s essential to plan accordingly and consider these timelines when seeking a subordination.

Common mistakes

When filling out the Subordination Division form, individuals often make a variety of mistakes that can lead to delays or rejection of their requests. One common error is failing to provide complete information. Incomplete applications may include missing documents or details that are crucial for processing. Subordination requests require specific paperwork, including a Uniform Loan Application and a current Payoff Letter. Without these, the review cannot begin.

Another frequent mistake is overlooking the guidelines for HELOC monthly payments in the debt-to-income ratio calculation. It is important to note that these payments are calculated at .75% of the total HELOC line amount. Incorrect calculations can lead to ineligibility or increased scrutiny of the request.

People sometimes neglect to check the type of mortgage they are requesting subordination for. Requests associated with first mortgage loans that have a potential for negative amortization, reverses mortgages, or balloon payments will not be considered. It is vital to ensure that the lien being subordinated meets eligibility criteria to avoid unnecessary processing delays.

Additionally, applicants may fail to understand the restrictions regarding properties under construction or vacant properties. Requests for these types of properties will be rejected outright. Applicants should ensure that the property is fully developed and occupied to meet submission requirements.

Another mistake is incorrectly submitting the necessary supporting documentation. Some applicants do not provide a Flood Hazard Determination or a Flood Insurance Policy when required. These omissions could significantly delay processing, as they are essential for evaluating the risk associated with the property.

Finally, individuals may overlook the need for accurate shipping and contact information. Incorrect addresses or missing contact details can lead to delays in communication and processing. Properly completed submissions, with accurate labeling for overnight shipping and clear identification of contacts, can help streamline the process and reduce the risk of misunderstandings.

Documents used along the form

The Subordination Division form is an important document, but it is often accompanied by several other forms and documents that help facilitate the process. Below are some common documents that may be required along with the subordination request.

- Uniform Loan Application (Form 1003): This is a standardized application used by lenders to assess the borrower's creditworthiness. It collects essential information about the applicant's financial history, employment, and the property being financed.

- Uniform Underwriting and Transmittal Summary (Form 1008): This document summarizes the key details of the loan application. It is used by underwriters to evaluate the application and make a lending decision based on a review of all submitted information.

- Current Property Valuation Report: A report that provides a current estimate of the property's market value. This document is necessary for assessing the loan-to-value ratio and ensuring compliance with underwriting guidelines.

- Closing Disclosure or Loan Estimate: This document outlines the final terms of the loan, including the interest rate, monthly payment, and closing costs. It provides transparency regarding the financial aspects of the transaction.

Having the required documents ready can streamline the subordination process. It is essential to provide accurate and complete submissions to avoid delays. For any further inquiries, reaching out to the relevant customer service department can provide additional assistance.

Similar forms

The Subordination Division Form documents are essential for managing various financial agreements. Here are seven documents with similarities to the Subordination Form, each serving unique yet related purposes:

- Loan Modification Agreement: This document outlines the new terms of a loan after modifications have been made. Like the subordination request, it often requires specific qualifications and documentation.

- Refinance Application: Similar in process, this application seeks approval to replace an existing loan with a new one under different terms. Both forms involve assessing financial eligibility and property valuations.

- Home Equity Line of Credit (HELOC) Application: When applying for a HELOC, individuals must submit a detailed request just as they would for subordination. Both processes evaluate the borrower’s financial status and property equity.

- Closing Disclosure: This document provides borrowers with crucial details about their mortgage before closing. Like the subordination form, it ensures transparent information sharing between parties involved.

- Title Insurance Policy: Issued during the property financing process, this policy protects against title issues that may arise, similar to how subordination requests assess property liens and clearances.

- Property Appraisal Report: Valuing a property is essential in both subordination requests and standard loan agreements. Appraisals confirm property worth to ensure that the loan amount aligns with market value.

- Borrower’s Authorization Form: This document allows lenders to access the applicant's financial information. It is similar to the subordination process, where the lender may need to verify various financial details for approval.

Dos and Don'ts

When filling out the Subordination Division form, there are important dos and don'ts to keep in mind. These guidelines help ensure that your request is processed quickly and efficiently.

- Do complete the subordination request form accurately.

- Do provide all required documentation along with your request.

- Do check that your HELOC payment meets the debt-to-income ratio requirements.

- Do submit your request in the order it is received.

- Do use clear and legible handwriting or a typed format for any textual entries.

- Don’t submit requests for properties currently under construction or vacant.

- Don’t include subordination requests for loans that may negatively amortize or include balloon payments.

- Don’t forget to include your complete contact information.

- Don’t assume that your request will be expedited; processing takes time.

Misconceptions

Understanding the Subordination Division form can be crucial for homeowners considering their options. However, there are several misconceptions that might lead to confusion during the process. Below are six common misconceptions, along with clarifications to help guide you.

- Subordination requests can be expedited. Many believe these requests can be processed quickly. However, please note that all requests take up to two weeks to complete and are processed in the order they are received. No expedited options are available.

- All types of loans can be subordinated. It's a common misunderstanding that every loan can be subordinated. Subordination requests for loans that are behind a first mortgage with negative amortization, reverse mortgages, or certain Equity Credit Lines are not considered.

- Incomplete applications will still be accepted. Some people think they can submit missing documents later. In reality, incomplete packages may lead to extended processing times, so it is vital to ensure that all required documentation is included with your request.

- Subordination requests can be made on properties under construction. Many assume they can submit a subordination request for such properties. However, requests for properties that are currently under construction or vacant will not be considered.

- It is unnecessary to provide a current property valuation. Some may overlook the need for a recent property evaluation, thinking it isn't essential. In fact, a current Property Valuation Report within the last 120 days is a required part of the subordination package.

- All loans, regardless of terms, can be subordinated. There is a misconception that any type of loan can be subordinated. Unfortunately, subordination requests behind first mortgage loans with balloon payments, interest-only payments, or adjustable-rate mortgages (ARMs) with a fixed-rate period of less than 36 months won’t be considered.

By addressing these misconceptions, the subordination process can be clearer and smoother for homeowners. If you have further questions, please reach out to customer service for assistance.

Key takeaways

When considering a subordination request, it's essential to follow proper guidelines to ensure a smoother process. Here are some key takeaways to keep in mind:

- Processing Times: Subordination requests can take up to two weeks to complete. Be aware that these requests are handled in the order they are received.

- Request Limitations: Certain subordination requests will not be considered, including those involving loans with negative amortization, reverse mortgages, or properties currently under construction.

- Documentation Requirements: A complete subordination package is necessary. Missing or illegible documents can delay processing further.

- HELOC Payment Calculation: For qualification, the HELOC monthly payment in the debt-to-income ratio is calculated at 0.75% of the total HELOC line amount.

- Contact Information: If you have questions, reaching out to customer service can provide clarity. Be ready with your account numbers for assistance.

- Appraisal Requirements: Different property values have varied appraisal requirements. Ensure you are familiar with the specific needs before submitting your request.

Browse Other Templates

Apply for a Minnesota State Id Online - Renewals require the previous year’s permit number unless no changes are necessary.

Dmas 99 Form - Filling out the DMAS 99 helps determine the level of care needed for participants.

Academy of Art University Transcript - Requesting final grades requires specific information on semester and year.