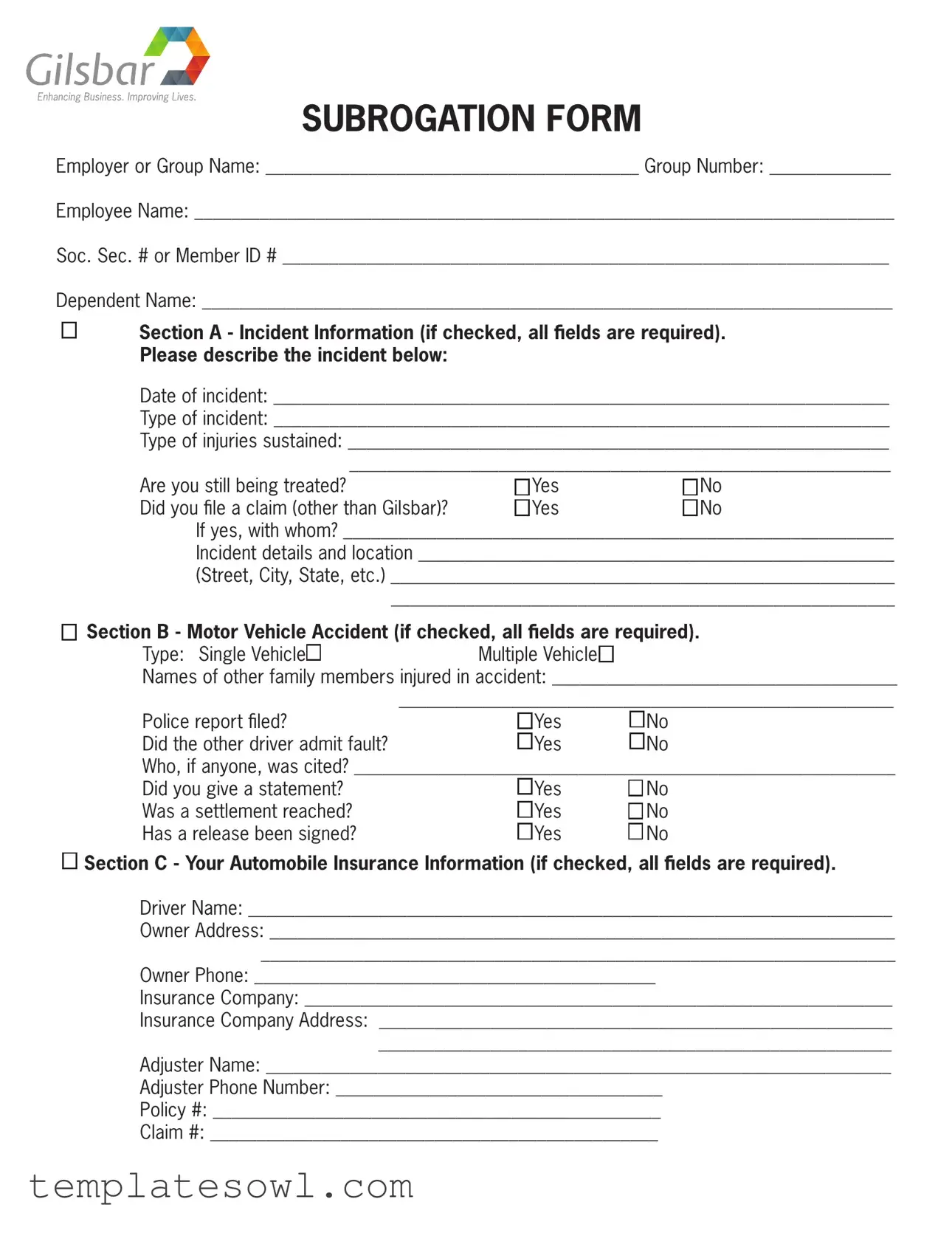

Fill Out Your Subrogation Sample Form

In navigating the complexities of insurance claims and reimbursements, the Subrogation Sample form serves a crucial role in facilitating communication between the insured and their insurance providers. This document is specifically designed for instances where an individual seeks to recover medical expenses that have already been paid by their insurance company due to an injury resulting from an incident, often involving a third party. Key elements of the form include sections for personal identification, such as the employer or group name, individual name, and identifying numbers like Social Security or member ID. The form systematically collects detailed information about the incident—date, type, and location—allowing for a comprehensive understanding of the context in which the injuries occurred. Furthermore, specific sections are dedicated to motor vehicle accidents to capture pertinent details, such as whether a police report was filed or if fault was admitted by other parties involved. Insurance information is meticulously gathered, both from the individual’s own automobile insurance and any third-party insurance, ensuring that all avenues for recovery are explored. Additionally, legal representation is addressed, highlighting the relationship between the insured and their attorney. The form concludes with an acknowledgment of the medical plan’s subrogation and reimbursement agreement, emphasizing the insured's commitment to repaying any benefits that have been previously disbursed. With this structure, the Subrogation Sample form is both comprehensive and clear, guiding users through the necessary steps in claiming their rightful reimbursements.

Subrogation Sample Example

Gilsbar

Enhancing Business. Improving Lives.

SUBROGATION FORM

Employer or Group Name: ________________________________________ Group Number: _____________

Employee Name: ___________________________________________________________________________

Soc. Sec. # or Member ID # _________________________________________________________________

Dependent Name: __________________________________________________________________________

□ |

Section A - Incident Information (if checked, all felds are required). |

||

|

Please describe the incident below: |

|

|

|

Date of incident: __________________________________________________________________ |

||

|

Type of incident: __________________________________________________________________ |

||

|

Type of injuries sustained: __________________________________________________________ |

||

|

__________________________________________________________ |

||

|

Are you still being treated? |

□Yes |

□No |

|

Did you fle a claim (other than Gilsbar)? |

□Yes |

□No |

|

If yes, with whom? ___________________________________________________________ |

||

|

Incident details and location ___________________________________________________ |

||

|

(Street, City, State, etc.) ______________________________________________________ |

||

|

______________________________________________________ |

||

□ |

Section B - Motor Vehicle Accident (if checked, all felds are required). |

||

|

Type: Single Vehicle□ |

Multiple Vehicle□ |

|

|

Names of other family members injured in accident: _____________________________________ |

||

|

_____________________________________________________ |

||

|

Police report fled? |

□Yes |

□No |

|

Did the other driver admit fault? |

□Yes |

□No |

|

Who, if anyone, was cited? __________________________________________________________ |

||

|

Did you give a statement? |

□Yes |

□No |

|

Was a settlement reached? |

□Yes |

□No |

|

Has a release been signed? |

□Yes |

□No |

□

Section C - Your Automobile Insurance Information (if checked, all felds are required).

Section C - Your Automobile Insurance Information (if checked, all felds are required).

Driver Name: _____________________________________________________________________

Owner Address: ___________________________________________________________________

____________________________________________________________________

Owner Phone: ___________________________________________

Insurance Company: _______________________________________________________________

Insurance Company Address: _______________________________________________________

_______________________________________________________

Adjuster Name: ___________________________________________________________________

Adjuster Phone Number: ___________________________________

Policy #: ________________________________________________

Claim #: ________________________________________________

□

Section D - Other Insurance Information (if checked, all felds are required).

Section D - Other Insurance Information (if checked, all felds are required).

The responsible party’s automobile insurance, the worker’s compensation insurance, or homeowner’s/liability insurance:

Name: __________________________________________________________________________

Address: _________________________________________________________________________

____________________________________________________________________

Phone: _______________________________________________

Insurance Company: _______________________________________________________________

Insurance Company Address: _______________________________________________________

_______________________________________________________

Adjuster Name: ___________________________________________________________________

Adjuster Phone Number: ___________________________________

Policy #: ________________________________________________

Claim #: ________________________________________________

□

Section E - Attorney Information (if checked, all felds are required).

Section E - Attorney Information (if checked, all felds are required).

Attorney Name: ___________________________________________________________________

Firm Name: ______________________________________________________________________

Firm Address: ____________________________________________________________________

____________________________________________________________________

Attorney Phone Number: _______________________________________________

Attorney Fax Number: _________________________________________________

I hereby acknowledge that my medical plan has a subrogation/reimbursement agreement provision which provides that medical benefts paid under the plan on behalf of me or any person covered under my plan. I agree to reimburse (up to the amount of such benefts paid) from any payments, awards, or settlements which may be paid by a third party because of the injury described above. I authorize Gilsbar, LLC and the Phia Group to release information regarding any claims in order to directly seek and receive such reimbursement from any third party payments that may in the future, become payable because of this injury. Furthermore, I hereby authorize any medical provider, my lawyer or agent, or any other person or corporation to release any and all medical information relating to the incident to The Phia Group.

The Phia Group is the administrator who pursues subrogation and reimbursement claims on behalf of Gilsbar. Thank you for your cooperation.

I represent that, to the best of my knowledge, the information provided on this form is complete and accurate.

Signature: ____________________________________________________________________

Date: ______________________________________

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Subrogation Form is designed to collect necessary information from individuals regarding incidents that may involve reimbursement claims to the insurance provider. |

| Required Sections | The form contains multiple sections including incident information, motor vehicle accident details, insurance information, and attorney contact information, which must be filled out completely if applicable. |

| Governing Law | The subrogation process is governed by state-specific laws, which vary by jurisdiction. It is important to consult local laws for accurate guidance. |

| Authorization | The signer authorizes the release of information related to the incident to ensure the pursuit of reimbursement from any third-party payments. |

| Completeness and Accuracy | The individual completing the form must represent that the information provided is complete and accurate, acknowledging the importance of truthful disclosures for processing the claims effectively. |

Guidelines on Utilizing Subrogation Sample

Once you have reviewed the Subrogation Sample form, it's essential to gather the necessary information before you start filling it out. The form requires details about the incident, your automobile insurance, and any other relevant insurance information. Follow the outlined steps carefully to ensure that all sections are properly completed.

- Employer or Group Name: Write the name of your employer or group at the top of the form.

- Group Number: Enter the group number associated with your employer or insurance plan.

- Employee Name: Fill in your full name as it appears in the employer's records.

- Soc. Sec. # or Member ID #: Provide your Social Security number or Member ID number.

- Dependent Name: If applicable, write the name of any dependent involved in the incident.

- Section A - Incident Information: Describe the incident, including:

- Date of incident.

- Type of incident.

- Type of injuries sustained.

- Indicate if you are still receiving treatment.

- Indicate if you filed a claim with other parties.

- Details and location of the incident, including street, city, and state.

- Section B - Motor Vehicle Accident: If applicable, indicate the type of accident (Single or Multiple Vehicle) and fill in the details:

- List names of family members injured.

- Indicate if a police report was filed.

- Confirm if the other driver admitted fault and if anyone was cited.

- State if you provided a statement and if a settlement was reached.

- Indicate whether a release has been signed.

- Section C - Your Automobile Insurance Information: Complete this section with your automobile insurance details:

- Driver Name.

- Owner Address and Phone Number.

- Insurance Company name and address.

- Adjuster Name and Phone Number.

- Policy Number and Claim Number.

- Section D - Other Insurance Information: Fill in information for any applicable other insurance:

- Name and Address of the responsible party’s insurance.

- Phone Number and Insurance Company details.

- Adjuster Name, Phone Number, Policy Number, and Claim Number.

- Section E - Attorney Information: Enter your attorney's contact details, if involved:

- Attorney Name and Firm Name.

- Firm Address and Phone Number.

- Attorney Fax Number.

- Signature: Sign and date the form to confirm the accuracy of the information provided.

After completing these steps, review the form to ensure all information is accurate and complete. Once verified, submit the form as directed. Proper documentation will facilitate the subrogation process and help in receiving any appropriate reimbursements.

What You Should Know About This Form

What is a Subrogation Form and why is it important?

A Subrogation Form is a document used to recover costs after an injury or accident. Essentially, if another party is responsible for your medical expenses, your insurance may seek to recover those funds from their insurance. This process helps keep the insurance system running smoothly and ensures that costs are fairly distributed. Completing this form is important because it formally notifies your insurance company of the incident, thereby initiating the reimbursement process.

What information do I need to provide on the Subrogation Sample Form?

The form requires various details to capture the full scope of the incident. You’ll need to provide your employer's name, group number, and your own personal details, including your Social Security number or Member ID. Sections like Incident Information, Automobile Insurance, other Insurance Information, and Attorney Information will need to be filled out with specifics like dates, types of incidents, insurance policy numbers, and contact information. Each section is critical for ensuring a thorough understanding of the situation so that proper reimbursement can be pursued.

What happens after I submit the Subrogation Form?

Once you submit the Subrogation Form, Gilsbar and The Phia Group will review the information provided. They may reach out for additional documentation or clarification, depending on the details you’ve submitted. If everything is in order, they will pursue reimbursement from the third party’s insurance. This process may take time, as negotiations often occur. Keeping open lines of communication with your insurance provider can help ease any concerns or queries you may have during this time.

Why do I need to authorize the release of my medical information?

Authorization to release your medical information is vital to the subrogation process. By allowing Gilsbar and The Phia Group access to your medical records, they can effectively substantiate your claims and seek reimbursement from responsible parties. Without this crucial step, there may be delays or obstacles in processing your claims. This authorization ensures that all necessary information is available to facilitate the reimbursement process efficiently.

Common mistakes

Many individuals encounter challenges when filling out the Subrogation Sample form, leading to errors that can delay the claims process. One common mistake is failing to provide complete information in the required fields. Each section of the form is designed to gather specific details crucial for processing the claim. Omitting information, such as the date of the incident or the names of other parties involved, can cause significant delays.

Another frequent error involves misleading or inaccurate information. For example, some individuals may mistakenly indicate that they’ve filed claims with parties other than Gilsbar without knowing they're required to list all such instances. This can lead to confusion and complications in verifying the claim, as discrepancies in the information provided can raise questions about the accuracy of the claims being submitted.

Omitting the necessary documentation is yet another area where people go wrong. The form asks for supporting evidence, such as police reports or insurance information. Failing to attach these documents or leaving out important contact details for insurance adjusters can hinder timely processing. This oversight can result in back-and-forth communication, prolonging what should be a straightforward claims process.

Some individuals neglect to check the authorization boxes or sign where required. This step is crucial because it authorizes Gilsbar and The Phia Group to seek reimbursement on behalf of the claimant. Without proper authorization, the administration cannot act on claims lodged, leading to unnecessary delays in resolving the matter.

Lastly, misunderstanding the purpose of each section can result in incomplete responses. Certain individuals may overlook the importance of detailing all relevant information, particularly for sections regarding previous claims or legal representation. This can create gaps in the information that the claims handlers need to assess the case effectively. It is imperative to approach the form methodically, ensuring every section is addressed comprehensively.

Documents used along the form

When dealing with subrogation claims, several other forms and documents may be necessary to support the process. Understanding each of these can help you navigate your situation more effectively. Below is a list of documents commonly used alongside the Subrogation Sample form:

- Incident Report: This document provides a detailed account of the incident, including when and where it happened, the nature of the injuries sustained, and accounts from witnesses. It establishes the context for the claim and is often crucial for assessing liability.

- Claim Form: This is filed with the insurance company to formally initiate the claim process. It provides specific information about the policyholder, the incident, and the damages incurred.

- Police Report: In cases of accidents, especially motor vehicle incidents, a police report documents the facts gathered by law enforcement. This report can significantly influence the outcome of a claim by offering an official account of the incident.

- Medical Records: Comprehensive medical documentation detailing treatments and diagnoses related to the injuries sustained provides the foundation for proving the extent of damages claimed. These records are essential when calculating reimbursements.

- Proof of Insurance: Documentation showing that the involved parties had insurance coverage at the time of the incident can clarify available funds for reimbursement. It often includes policy numbers and contact details of the insurance companies.

- Settlement Agreement: This document outlines the terms agreed upon by both parties in a dispute after an accident or injury has occurred. It may include amounts agreed upon for damages, waivers, and the release of further claims.

- Medical Authorization Form: This form allows healthcare providers to share your medical information with the involved insurance companies or third parties. It ensures that the necessary medical data is accessible for processing the claim.

Gathering these documents can facilitate the subrogation process, ensuring you are well-prepared for any requirements that arise. Having the right information at your fingertips will help in managing your claim and achieving a fair resolution.

Similar forms

- Release of Liability Form: This document allows one party to relinquish their right to hold another party legally responsible for certain actions or damages. Like the Subrogation Form, it often requires detailed incident information and parties involved.

- Insurance Claim Form: This form is used to report a claim to an insurance company. Similar to the Subrogation Form, it captures incident details and medical treatments relevant to the claim.

- Personal Injury Claim Form: While specific to injury claims, it shares common elements with the Subrogation Form, particularly in documenting injuries and the details of the incident leading to the claim.

- Motor Vehicle Accident Report: This report is filed with authorities after an auto incident. It contains similar information regarding the parties involved and the nature of the incident.

- Workers’ Compensation Claim Form: This document is used by employees to claim workers' compensation benefits. It includes detailed incident information and follows a similar structure as the Subrogation Form.

- Health Insurance Claim Form: This form is for healthcare providers to bill insurance companies for services. It captures patient information and medical details, paralleling the information needed in the Subrogation Form.

- Third Party Liability Claim Form: When third parties are responsible for a claim, this form is filled out with essential details about the incident, akin to what is required in a Subrogation Form.

- Property Damage Claim Form: This document is utilized to seek compensation for property damage. Like the Subrogation Form, it provides detailed incident descriptions and party information.

- Medical Authorization Release Form: This form grants permission to share medical information. It is similar to the Subrogation Form in that both require authorization for the release of sensitive information.

- Attorney Retainer Agreement: This document outlines the agreement between a client and attorney. Similarities include the necessity for detailed personal information and the reliance on accurate incident documentation.

Dos and Don'ts

When filling out the Subrogation Sample form, it is essential to be thorough and careful. Here’s a list of dos and don’ts to guide you in completing the form accurately.

- Do include complete and accurate information for each section, especially in the incident details.

- Do double-check your entries for spelling and numerical accuracy, particularly the Social Security and insurance policy numbers.

- Do provide all required signatures and dates in the appropriate sections of the form.

- Do keep a copy of the completed form for your records.

- Don’t leave any required fields blank; incomplete submissions can delay processing your claim.

- Don’t submit false information, as this could lead to legal consequences or claim denial.

- Don’t forget to disclose any other insurance policies or claims related to the incident.

- Don’t hesitate to ask for clarification if you do not understand any part of the form.

Following these guidelines will enhance the accuracy of your submission and help in expediting the review process of your claim.

Misconceptions

Many individuals hold misconceptions about the Subrogation Sample form. Understanding the truth can help clarify the purpose and function of this important document.

- Subrogation only applies to car accidents. This is not true. Subrogation can apply to various incidents, including workplace injuries and liability claims, depending on the situation.

- Completing the form means I have to give up my rights. This is incorrect. The form is intended to collect information for reimbursement purposes and does not waive your rights to pursue claims.

- The process is only needed if I have private insurance. This misconception overlooks that subrogation can involve any insurance claims, including employer-provided health insurance.

- A settlement will guarantee full reimbursement. Not necessarily true. The amount you receive might not cover all expenses incurred, depending on the agreements and negotiations made.

- Filing this form will result in immediate payment. This is misleading. The reimbursement process can take time, as claims must be assessed and processed.

- I don't need to provide details if I’m not at fault. This is a misunderstanding. Providing complete information, regardless of fault, is crucial for the process to move forward smoothly.

- I cannot speak to my lawyer while the subrogation process is ongoing. This is false. You can and should communicate with your lawyer throughout the process to ensure your rights and interests are protected.

- My medical information will not be shared outside my treatment providers. Actually, the form allows for the sharing of necessary information between various parties involved in the process for reimbursement purposes.

- Subrogation means I have to repay all my medical expenses. This is incorrect. You will have to repay only the amount that your insurance covered, not your personal costs.

- Once I submit the form, I am done. This is not accurate. Additional information might be requested later, and you may need to follow up on the status of your claim.

Understanding these common misconceptions can help individuals navigate the subrogation process with greater confidence and clarity.

Key takeaways

When filling out the Subrogation Sample form, keep the following key takeaways in mind:

- Accurate Information: Ensure all sections are completed with accurate details. Incomplete forms can lead to processing delays.

- Section A is Crucial: If you check Section A, every field needs to be filled in. This captures vital information about the incident.

- Specific Incident Details: Be detailed when describing the incident. Include the date, type, and location to provide a clear picture.

- Prior Claims: Disclose any claims filed aside from Gilsbar. Transparency helps in handling your situation effectively.

- Motor Vehicle Accidents: If your incident involves a motor vehicle, check Section B and provide all required information regarding other drivers and police reports.

- Insurance Information: Fill out Sections C and D thoroughly. This is essential for reaching out to insurance companies for reimbursements.

- Attorney Details: Include your attorney's information if you have one. This will facilitate communication regarding claims and legal matters.

- Review and Sign: Before submitting, double-check your entries for accuracy and completeness. Your signature confirms your agreement to the terms stated.

These steps not only help protect your rights but also streamline the reimbursement process, ensuring you receive the support you deserve.

Browse Other Templates

Shipping Declaration,International Shipping Invoice,Export Documentation,Commercial Shipping Statement,Trade Invoice,Customs Declaration Form,Delivery Invoice,Freight Invoice,Import/Export Summary,Logistics Invoice - Reports must indicate if the individual moved to a new residence during the month.

Cra Medical Travel Expenses 2023 - The Med 1 Form allows individuals to claim tax relief on eligible health expenses.