Fill Out Your Suntrust Direct Deposit Form

Managing your finances can often feel overwhelming, but tools like the SunTrust Direct Deposit enrollment form simplify the process of receiving your paycheck. This form allows employees to authorize their employers to deposit earnings directly into their bank accounts, minimizing the hassle of paper checks and providing immediate access to funds. To initiate direct deposit, it is essential to complete this form and submit it to your employer, who may also request a voided check for validation purposes. The form gathers necessary account information, including the primary account where your funds will be deposited, as well as options for additional accounts if you wish to distribute your pay among multiple accounts. Each account can be prioritized, ensuring that your salary is allocated according to your preferences. Understanding the components of this form can empower you to make informed decisions about your direct deposit setup. Additionally, the authorization remains effective until you provide written notice to your employer about any changes, ensuring that your financial setup adapts to your evolving needs.

Suntrust Direct Deposit Example

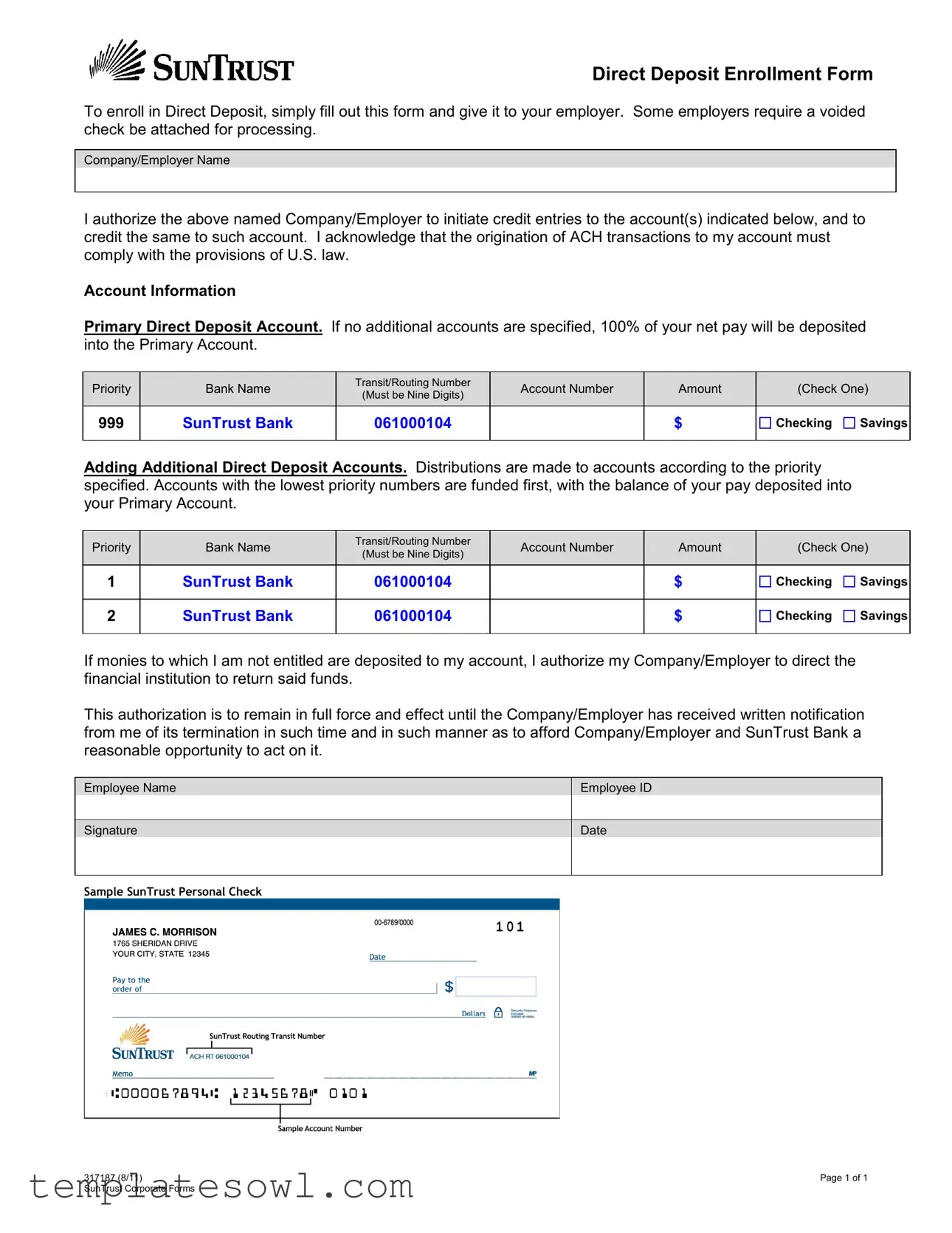

Direct Deposit Enrollment Form

To enroll in Direct Deposit, simply fill out this form and give it to your employer. Some employers require a voided check be attached for processing.

Company/Employer Name

I authorize the above named Company/Employer to initiate credit entries to the account(s) indicated below, and to credit the same to such account. I acknowledge that the origination of ACH transactions to my account must comply with the provisions of U.S. law.

Account Information

Primary Direct Deposit Account. If no additional accounts are specified, 100% of your net pay will be deposited into the Primary Account.

Priority |

Bank Name |

Transit/Routing Number |

Account Number |

Amount |

(Check One) |

||

(Must be Nine Digits) |

|||||||

|

|

|

|

|

|

||

999 |

SunTrust Bank |

061000104 |

|

$ |

Checking |

Savings |

|

|

|

|

|

|

|

|

|

Adding Additional Direct Deposit Accounts. Distributions are made to accounts according to the priority specified. Accounts with the lowest priority numbers are funded first, with the balance of your pay deposited into your Primary Account.

Priority |

Bank Name |

Transit/Routing Number |

Account Number |

Amount |

(Check One) |

||

(Must be Nine Digits) |

|||||||

|

|

|

|

|

|

||

1 |

SunTrust Bank |

061000104 |

|

$ |

Checking |

Savings |

|

|

|

|

|

|

|

|

|

2 |

SunTrust Bank |

061000104 |

|

$ |

Checking |

Savings |

|

|

|

|

|

|

|

|

|

If monies to which I am not entitled are deposited to my account, I authorize my Company/Employer to direct the financial institution to return said funds.

This authorization is to remain in full force and effect until the Company/Employer has received written notification from me of its termination in such time and in such manner as to afford Company/Employer and SunTrust Bank a reasonable opportunity to act on it.

Employee Name

Employee ID

Signature

Date

Sample SunTrust Personal Check

317187 (8/11) |

Page 1 of 1 |

SunTrust Corporate Forms |

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Enrollment Process | To enroll, you need to fill out the SunTrust Direct Deposit form and submit it to your employer. |

| Void Check Requirement | Some employers may ask you to attach a voided check to process your direct deposit request. |

| Primary Account Allocation | If you do not specify additional accounts, 100% of your net pay will go to the Primary Account you listed. |

| Authorization Duration | This authorization stays valid until you send a written notification to your employer to terminate the agreement. |

Guidelines on Utilizing Suntrust Direct Deposit

Filling out the SunTrust Direct Deposit form is a straightforward process that facilitates the transfer of your earnings directly into your bank account. Once completed, you will submit the form to your employer for processing. In some cases, it may be necessary to attach a voided check for verification purposes.

- Obtain the SunTrust Direct Deposit form from your employer or download it from the SunTrust website.

- Fill in the Company/Employer Name where indicated at the top of the form.

- In the section labeled Primary Direct Deposit Account, provide the following information:

- Bank Name: Enter "SunTrust Bank."

- Transit/Routing Number: Input "061000104."

- Account Number: Add your specific account number.

- Amount: Check the box for either Checking or Savings.

- If you wish to add additional direct deposit accounts, fill out a section for each account by specifying the Priority number and repeating the bank information as needed.

- In the authorization statement, acknowledge your understanding of the ACH transactions.

- Provide your Employee Name and Employee ID where indicated.

- Sign and date the form in the designated areas at the bottom.

- Review the completed form for accuracy before submission.

- If required, attach a voided check to the form.

- Submit the form to your employer for processing.

What You Should Know About This Form

What is the SunTrust Direct Deposit form?

The SunTrust Direct Deposit form is a document that allows employees to enroll their bank accounts for receiving electronic deposits of their paychecks directly from their employer. This method offers convenience and enables funds to be available faster than traditional paper checks.

How do I fill out the SunTrust Direct Deposit form?

To fill out the form, start by providing your employer’s name, followed by your account details. You'll need to specify the bank name, routing number, and account number for each account you wish to enroll. If you only want your primary account to receive deposits, you simply need to fill out that section. Remember to check either "Checking" or "Savings" to indicate the type of account.

Do I need to attach anything to the form?

Some employers may request that you attach a voided check to your Direct Deposit form. A voided check helps verify your account details and ensures accurate processing of your direct deposit. Check with your employer for their specific requirements.

What happens if I want to change my bank account?

If you need to change the account where your Direct Deposit goes, you must fill out a new SunTrust Direct Deposit form. Make sure to notify your employer in writing so they can update their records. This ensures there is no interruption in your payment schedule.

How does direct deposit work if I have multiple accounts?

The form allows you to set up multi-account deposits. You can specify priorities for additional accounts. The lowest priority account will be funded first until the designated amount is met, with any remaining funds being deposited into your primary account. Be sure to fill out the respective priority numbers correctly.

Can I see my deposit history?

Your deposit history will typically be accessible through your bank’s online banking system. You can review transactions and verify that deposits have been made correctly. Additionally, your paystub should reflect the amounts deposited into your account.

How long does it take for direct deposit to be set up?

The setup period can vary by employer. Generally, once your employer receives your completed form, it may take one to two pay periods for the Direct Deposit to become active. Check with your HR department to get a clearer timeframe specific to your employer.

What should I do if funds are incorrectly deposited into my account?

If funds that you are not entitled to receive are deposited into your account, it's important to contact your employer immediately. The form you submitted includes a clause that allows them to direct the bank to return any incorrectly deposited funds, safeguarding both you and your employer in such situations.

What if I want to cancel my direct deposit?

To cancel your Direct Deposit, you must provide written notification to your employer. This request should be made in a timely manner to allow your employer adequate time to process your cancellation. Until they receive your notice and act upon it, your Direct Deposit will continue as initially authorized.

Is there a cost associated with setting up Direct Deposit?

Setting up Direct Deposit is generally free for both employees and employers. However, always check with your employer for any specific policies or agreements that might affect the process. There shouldn’t be any hidden fees from SunTrust for receiving direct deposits.

Common mistakes

Many people look forward to the convenience of direct deposit, but filling out the SunTrust Direct Deposit form can sometimes lead to avoidable errors. One common mistake is leaving out essential information. For instance, when submitting the form, individuals might forget to include their Employee ID or the Company/Employer Name. Without this critical data, the processing of the direct deposit may experience delays, and funds could be misrouted.

Another frequent error occurs with the Transit/Routing Number. Some people incorrectly write this nine-digit number, mistaking it for the account number. A wrong routing number can result in funds being deposited into the wrong account entirely. This oversight not only complicates the immediate transaction but can also cause significant frustration later on, as one may need to seek help to rectify the issue.

Additionally, there is a tendency to neglect the priority system for multiple direct deposit accounts. When an individual specifies various accounts for their pay, it’s vital to assign a priority to each one. Orders matter. Without indicating which account receives the first deposit, there may be confusion. The most straightforward account could receive funds, while the secondary accounts miss out entirely.

Lastly, some individuals fail to provide a voided check when required. This is vital as a voided check confirms both the account number and the routing number. Employers often need this verification to ensure everything is filled out correctly. Without it, the employer may choose to postpone processing the form until they receive the appropriate documentation. Therefore, it is always best to check the requirements beforehand and ensure that everything is in order for a smooth transition to direct deposit.

Documents used along the form

The SunTrust Direct Deposit Form is commonly used by employees to authorize their employers to deposit wages directly into their bank accounts. Alongside this form, several other documents may be required or beneficial in the direct deposit setup process. Below is a list of related forms and documents.

- Void Check: A voided check is often needed to provide accurate banking information, particularly the account and routing numbers. This ensures that deposits go to the correct account.

- Employment Offer Letter: This document outlines the terms of employment and may include direct deposit provisions as part of the onboarding process.

- Tax Form W-4: Employees fill out this IRS form to determine the withholding allowances on their paychecks, which may affect the deposit amounts received.

- Bank Account Verification Letter: This document, often requested by employers, confirms account details with the bank and verifies that the account exists.

- Pay Stub: The pay stub provides information on earnings, deductions, and net pay. Employees may want to keep it for their records after the direct deposits begin.

- Direct Deposit Authorization Agreement: Some employers provide this agreement, which outlines the terms and conditions of the direct deposit arrangement and may require a separate signature.

- Change of Address Form: If an employee moves, this form is important for ensuring that the employer has updated contact details, which can affect payroll information.

- IRS Form 8453: This form might be necessary for e-filing tax returns and can be connected to direct deposits for refunds, depending on the tax situation.

- Employment Verification Form: Sometimes needed if proof of employment is required for bank loans or other services; it may include direct deposit details.

Having these documents on hand can streamline the enrollment process and ensure that all necessary information is accurately submitted. This helps avoid delays in processing direct deposits and ensures employees are paid on time.

Similar forms

The Suntrust Direct Deposit form is a specific document that allows employees to set up automatic deposit of their paycheck into their bank account. There are several other similar documents that serve comparable purposes in the realm of financial transactions and payroll processing. Here are ten documents that are alike in function or intent:

- Direct Deposit Authorization Form: Similar to the Suntrust form, this document allows employees to authorize their employer to deposit their salary directly into their bank account, specifying bank details and account numbers.

- W-4 Form: While primarily used for tax withholding, the W-4 may also involve providing banking information for certain types of direct deposits related to refunds or other payments from the IRS.

- Automated Clearing House (ACH) Authorization Form: This form enables an individual to authorize their bank or other institution to electronically withdraw or deposit funds, much like how a direct deposit works.

- Payroll Deduction Authorization Form: Employees fill out this form to authorize specific deductions from their paychecks, which can include direct deposits to savings or retirement accounts.

- Setup for Automatic Bill Pay: This document allows a consumer to authorize a bank to automatically pay recurring bills from their account, similar to how direct deposits are set up for regular paychecks.

- Government Benefit Enrollment Form: This form helps individuals enroll in direct deposit for government benefits, such as Social Security or unemployment payments, akin to employer-directed pay deposits.

- Investment Account Transfer Form: Investors use this to authorize funds to be deposited directly into a brokerage or investment account, mirroring the direct deposit method used for payroll.

- Flexible Spending Account (FSA) Reimbursement Form: Employees might use this to request direct deposit of their FSA reimbursements, paralleling the direct deposit of paychecks into personal accounts.

- Retirement Account Contribution Form: This document allows employees to set up automatic contributions to their retirement accounts from their pay, similar to specifying amounts in a direct deposit.

- Vendor Payment Authorization Form: Businesses complete this form to provide banking information for direct payments to vendors, functioning in a manner similar to employee direct deposit forms.

Each of these documents shares a common purpose with the Suntrust Direct Deposit form: they facilitate the electronic transfer of funds, whether it’s paychecks, tax refunds, or bill payments. This makes transactions more efficient and reliable for users.

Dos and Don'ts

When filling out the SunTrust Direct Deposit form, follow these guidelines to ensure a smooth processing experience.

- Do provide accurate account numbers and routing numbers to prevent delays or errors.

- Don't use a check that does not match your name or the account details you provided.

- Do confirm the priority order for direct deposit accounts if you are listing multiple accounts.

- Don't forget to sign and date the form before submission; it is essential for authorization.

- Do attach a voided check if your employer requests it to verify your account information.

- Don't leave any fields blank; incomplete forms can lead to processing issues.

- Do notify your employer in writing if you need to terminate or change the direct deposit arrangement.

Misconceptions

- Misconception 1: Anyone can use the SunTrust Direct Deposit form without authorization.

- Misconception 2: You can allocate any percentage of your pay to multiple accounts.

- Misconception 3: A voided check is optional for all employers.

- Misconception 4: The authorization for direct deposit lasts indefinitely without action.

This is false. The form is specifically for employees of companies that have set up direct deposit with SunTrust. Without your employer's approval and setup, the form cannot be processed.

This is not entirely accurate. While you can designate different accounts, the total amount deposited must equal 100% of your net pay. Each account must be assigned a percentage that adds up to this total.

This is misleading. Some employers require a voided check to verify your account details. It's essential to check with your employer to determine if this is a requirement for your specific situation.

This misconception overlooks the need for notification. The authorization remains in effect until you provide written notice to your employer. It’s important to communicate any changes or termination of the direct deposit arrangement properly.

Key takeaways

Here are some key takeaways for filling out and using the SunTrust Direct Deposit form:

- The form must be completed and submitted to your employer for direct deposit enrollment.

- It may be necessary to attach a voided check, as some employers require this to process your request.

- You can specify multiple accounts for direct deposit, with the primary account receiving the remainder of your pay if other accounts are utilized.

- This authorization remains valid until you provide written notice to your employer to terminate it, allowing all parties sufficient time to act accordingly.

Browse Other Templates

Plumbing Work Order Template - Perform backflow prevention testing.

Authorization Letter - Ensure to provide accurate information to facilitate the passport collection process.