Fill Out Your Survivorship Deed Sample Form

When navigating the complexities of property ownership, understanding a Survivorship Deed can be incredibly beneficial, especially for couples or joint owners. A Survivorship Deed, often outlined in a sample form, serves to ensure that property ownership transfers smoothly upon the death of one owner to the surviving owner. This document begins with a straightforward acknowledgment of the parties involved—typically a married couple—who agree upon the terms of the property transfer. The deed stipulates that the property will be held by the parties for their lifetimes and, upon death, will pass seamlessly to the surviving partner. This arrangement not only simplifies the transfer of property but also helps to avoid potential probate complications. Essential elements of the Survivorship Deed include the description of the property, the source of the title, and a guarantee of the right to defend the title against any claims from third parties. Additionally, the signatures of the involved parties and witnesses, along with notarization, affirm its legal standing. An understanding of this deed's structure and purpose lays the foundation for more informed discussions about property rights and succession planning.

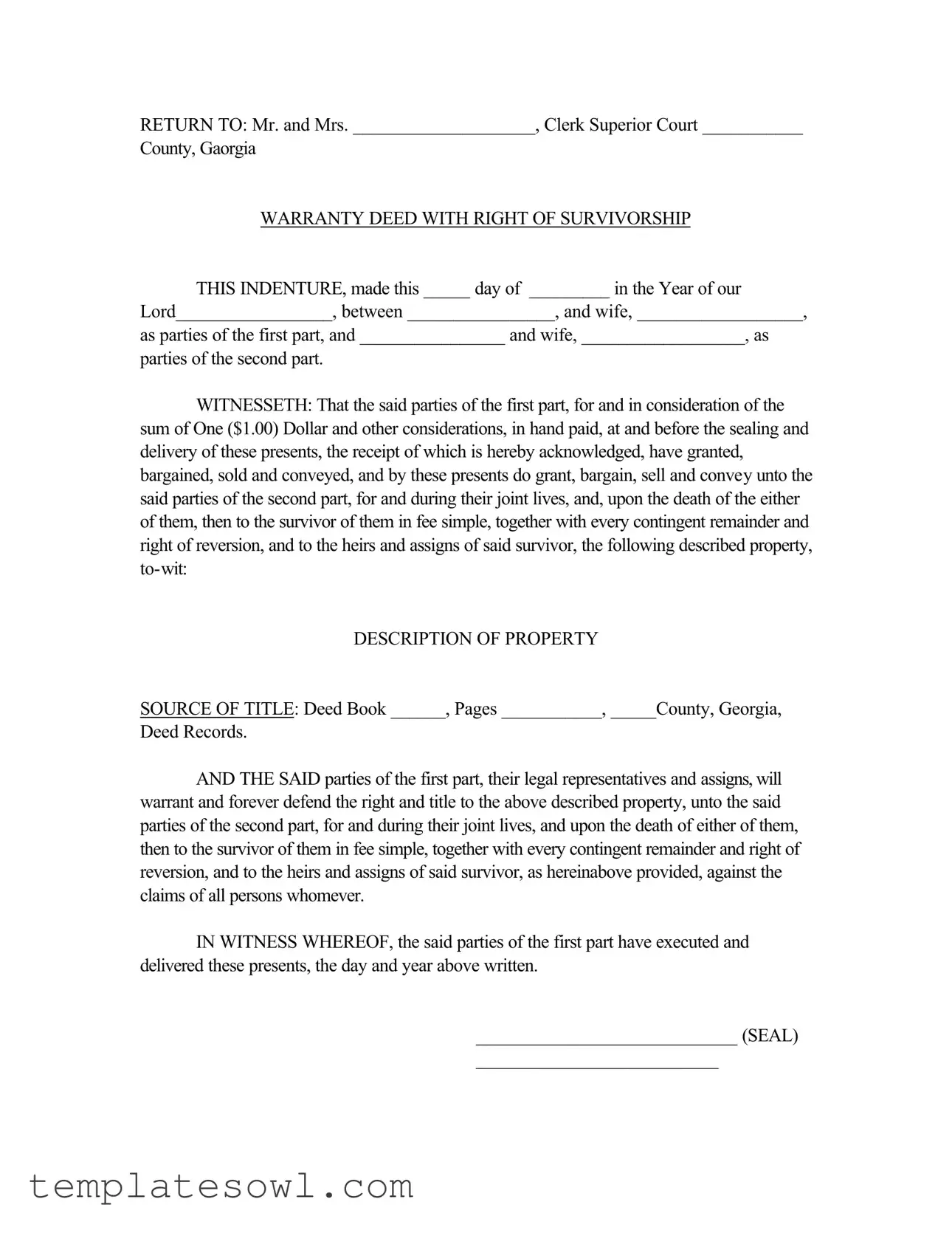

Survivorship Deed Sample Example

RETURN TO: Mr. and Mrs. ____________________, Clerk Superior Court ___________

County, Gaorgia

WARRANTY DEED WITH RIGHT OF SURVIVORSHIP

THIS INDENTURE, made this _____ day of _________ in the Year of our

Lord_________________, between ________________, and wife, __________________,

as parties of the first part, and ________________ and wife, __________________, as

parties of the second part.

WITNESSETH: That the said parties of the first part, for and in consideration of the sum of One ($1.00) Dollar and other considerations, in hand paid, at and before the sealing and delivery of these presents, the receipt of which is hereby acknowledged, have granted, bargained, sold and conveyed, and by these presents do grant, bargain, sell and convey unto the said parties of the second part, for and during their joint lives, and, upon the death of the either of them, then to the survivor of them in fee simple, together with every contingent remainder and right of reversion, and to the heirs and assigns of said survivor, the following described property,

DESCRIPTION OF PROPERTY

SOURCE OF TITLE: Deed Book ______, Pages ___________, _____County, Georgia,

Deed Records.

AND THE SAID parties of the first part, their legal representatives and assigns, will warrant and forever defend the right and title to the above described property, unto the said parties of the second part, for and during their joint lives, and upon the death of either of them, then to the survivor of them in fee simple, together with every contingent remainder and right of reversion, and to the heirs and assigns of said survivor, as hereinabove provided, against the claims of all persons whomever.

IN WITNESS WHEREOF, the said parties of the first part have executed and delivered these presents, the day and year above written.

____________________________ (SEAL)

__________________________

SIGNED, SEALED and DELIVERED on the ____ day of _________________,

_________, in the presence of:

____________________________

WITNESS

______________________________

NOTARY PUBLIC

My Commission Expires: __________

__________________________ (SEAL)

_____________________________

SIGNED, SEALED and DELIVERED on the ____ day of ____________, _______,

, in the presence of:

_____________________________

WITNESS

________________________________

NOTARY PUBLIC

My Commission Expires: __________

THIS INSTRUMENT PREPARED BY:

________________________

Attorney at Law

________________________

________________________

________________________

________________________

Georgia Bar No. __________

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Survivorship Deed is designed to transfer property to a surviving spouse or partner automatically upon the death of one party, ensuring a smooth transition of ownership. |

| Governing Law | This deed form is governed by the laws of Georgia. Specifically, it follows the regulations set forth in Georgia Code Title 44, Chapter 7. |

| Consideration | A nominal consideration, often set at one dollar, is typically stated in the deed. This acknowledges that something of value is exchanged, which is a requirement for the deed to be valid. |

| Execution Requirements | The deed must be signed, sealed, and delivered in front of witnesses and a notary public to ensure its legal enforceability and recognition in the state of Georgia. |

| Title Warranty | The parties of the first part provide a warranty of title, meaning they promise that the title to the property is clear and that they can defend that title against any claims. |

Guidelines on Utilizing Survivorship Deed Sample

Completing the Survivorship Deed Sample form is an important step in ensuring that property rights are clearly defined and protected. This document facilitates the transfer of property ownership, allowing for the surviving party to inherit the property without the need for probate proceedings. Follow the steps below to fill out the form accurately.

- At the top of the form, fill in the names of Mr. and Mrs. who will be returning the document.

- Indicate the specific county in Georgia where the deed will be filed.

- In the first blank, enter the day on which the deed is being executed.

- In the next blank, insert the month of the execution date.

- Fill in the year of the Lord in the following blank.

- In the space for parties of the first part, write the full name of the first party and their spouse.

- For the parties of the second part, enter the full names of the surviving parties who will receive the property.

- In the section labeled “consideration,” reaffirm the amount as shown: One ($1.00) Dollar, along with any other considerations if applicable.

- Enter the full description of the property being transferred in the designated area labeled “DESCRIPTION OF PROPERTY.”

- For the “SOURCE OF TITLE,” include the relevant details such as Deed Book number and page numbers.

- In the blanks under “SIGNED, SEALED and DELIVERED,” record the date of signing.

- Fill in the names of witnesses for both parties in the spaces provided.

- Both parties must have notarization. Provide the Notary Public’s details along with the expiration date of their commission for both sections.

- At the bottom of the form, the attorney’s information must be completed, including their Georgia Bar Number.

What You Should Know About This Form

What is a Survivorship Deed Sample form?

A Survivorship Deed Sample form is a legal document used to transfer property ownership to two or more parties with the provision that, upon the death of one party, the surviving parties automatically inherit the deceased party's share. This form helps ensure that property passes directly to the surviving owner(s) without going through probate, simplifying the process for heirs.

Who should use a Survivorship Deed?

Individuals who wish to ensure property automatically passes to a surviving co-owner should consider using a Survivorship Deed. This is common among married couples or partners who want to maintain joint ownership of property and prevent delays or complications after one owner's death.

What are the key components of the Survivorship Deed Sample form?

The key components include the names of the parties involved, a legal description of the property, and a declaration granting survivorship rights. It also outlines that ownership will pass in fee simple to the surviving party upon death, providing clarity about property rights.

Is notarization required for a Survivorship Deed?

Yes, notarization is required for a Survivorship Deed to be considered valid. The signatures of all parties involved must be acknowledged by a notary public to ensure the legitimacy of the document and to meet legal standards.

What is the significance of the sealing in the Survivorship Deed?

The seal signifies the formal execution of the document. A sealed deed adds an extra layer of authenticity and signifies the seriousness of the agreement made by the parties involved. It should be included during the document's signing process.

How does a Survivorship Deed affect estate planning?

Utilizing a Survivorship Deed can simplify estate planning by avoiding probate for the property involved. This ensures that the surviving owner has immediate access and control over the property without delays, which can be beneficial during a difficult time after a loss.

Can a Survivorship Deed be revoked or changed after execution?

Yes, a Survivorship Deed can be revoked or changed. This often requires the execution of a new deed that clarifies the changes. Parties should consult with legal professionals to ensure all steps comply with state laws and to properly reflect new intentions regarding property ownership.

Common mistakes

Filling out a Survivorship Deed can be a straightforward process, but common mistakes can cause significant issues. Being aware of these errors may prevent complications down the line.

One frequent mistake is failing to provide complete names for all parties involved. It is vital to include full legal names rather than nicknames or abbreviations. This ensures clarity regarding who is entitled to the property upon the death of either party. Leaving out a name can create ambiguity, leading to disputes later on.

Another error is neglecting to include the exact date when the deed is executed. This date is essential for establishing the timeline of ownership and rights. Omitting it can lead to confusion about when the deed becomes effective, which is critical in legal proceedings.

Legal descriptions of the property are also often filled out incorrectly. It is important to provide a clear and accurate description, including the parcel number, dimensions, and boundaries. A vague description can lead to misunderstandings about the specific property that is being conveyed.

Some individuals may overlook the need for a notary public's signature and seal. The presence of a notary confirms that the parties willingly signed the document. Without this, the deed may not hold up in court, leading to potential claims of fraud or invalidity.

When indicating the source of the title, people sometimes use incorrect or incomplete information. Providing the wrong deed book or page number can complicate future property transactions and create challenges in establishing ownership.

Another critical aspect that is often ignored is the legal representatives of the parties. If any of the parties are deceased, their legal representatives must sign the deed. Failing to do so could result in the deed being challenged after it is filed.

Lastly, individuals sometimes forget to include witnesses during the signing process. Depending on state laws, having witnesses may be mandatory for the deed to be legally binding. This oversight can lead to questions regarding the authenticity of the signatures.

By carefully reviewing the deed, ensuring all information is complete, accurate, and validated, individuals can prevent these common mistakes and secure their property ownership rights properly.

Documents used along the form

The Survivorship Deed Sample form is an important legal document that establishes ownership rights for two or more parties during their lifetimes and provides for the transfer of property to the survivor upon the death of one party. However, several other forms and documents are often utilized alongside this deed to ensure clarity, compliance, and effective execution of the transfer process. Below is a list of commonly used documents.

- Warranty Deed: This document guarantees that the seller holds clear title to a property and has the right to sell it. It protects the buyer from any future claims against the property.

- Quitclaim Deed: Used to transfer any interest in a property without warranties about the title. It is particularly useful when transferring property between family members.

- Property Title Report: This report provides a detailed history of the property's ownership, ensuring clarity about who holds legal title.

- Affidavit of Death: This document serves to legally acknowledge the death of a property owner, which may be needed for transferring property under the Survivorship Deed.

- Change of Title Application: Required by county offices to update property records following the execution of a survivorship deed, ensuring the new title reflects the surviving owner.

- Joint Tenancy Agreement: This agreement outlines the rights and responsibilities of joint tenants, clarifying each party's interest in the property.

- Living Trust Document: This document places the property in a trust to avoid probate issues, allowing direct transfer to beneficiaries upon death.

- Real Estate Closing Statement: A summary that itemizes all costs and fees associated with the property transfer, ensuring transparency during the closing process.

- Power of Attorney: This document allows a designated individual to make legal decisions on behalf of another, which can be particularly useful in property transactions.

- Mortgages or Loan Documents: If applicable, these documents outline terms, responsibilities, and agreements involved in financing the property.

By understanding and preparing these accompanying documents, individuals can navigate the complexities of property ownership transitions with greater ease and assurance. Each document plays a crucial role in protecting rights and facilitating a smooth transfer process.

Similar forms

-

Joint Tenancy Deed: This document allows two or more people to own property together, with each person having an equal share. Like a survivorship deed, joint tenancy includes a right of survivorship, meaning that upon one owner's death, their share automatically passes to the surviving owner(s).

-

Tenancy by the Entirety: This type of deed is specific to married couples and includes the right of survivorship. Both parties own the entire property together, and neither can sell or transfer their interest without the consent of the other.

-

Life Estate Deed: A life estate deed grants a person ownership of property for their lifetime. After their death, the property passes to someone else. Though it does not directly convey the right of survivorship, it achieves a similar goal of managing succession of property.

-

Enhanced Life Estate Deed (Lady Bird Deed): This document allows the property owner to retain control during their lifetime while ensuring that the property automatically transfers to a designated beneficiary upon death. It also avoids probate, similar to the survivorship deed.

-

Transfer on Death Deed: This deed allows owners to designate a beneficiary who will receive the property upon the owner's death. Like a survivorship deed, it bypasses probate, streamlining the process of inheritance.

Dos and Don'ts

When filling out the Survivorship Deed Sample form, it is crucial to adhere to specific best practices to ensure clarity and legal validity. Below is a list of things you should and shouldn’t do.

- Do double-check the names of all parties involved; accurate names prevent potential disputes.

- Do specify the property description clearly; include complete details to avoid ambiguity.

- Do ensure that all signatures are obtained; no document is valid without proper execution.

- Do include the date on which the deed is being executed; this establishes the timeline of the transfer.

- Don’t leave any blanks; incomplete information can lead to legal challenges in the future.

- Don’t forget to have the document notarized; notarization provides an extra layer of legitimacy to the deed.

Misconceptions

Understanding the Survivorship Deed can help clarify its purpose and implications. Here are some common misconceptions:

- It only involves married couples. Many believe a Survivorship Deed is exclusively for spouses. However, it can be used by any co-owners, such as siblings or friends, who wish to have rights of survivorship.

- It's the same as a joint tenancy. While similar, a Survivorship Deed is a specific type of joint tenancy. It explicitly states that the surviving owner will automatically inherit the property upon the death of the other.

- It eliminates the need for a will. Some think that using a Survivorship Deed means they don’t need a will. This is not true; a will is still beneficial for distributing other assets not included in the deed.

- There's no need for legal assistance. Many believe they can complete a Survivorship Deed on their own without legal help. Although it is possible, consulting an attorney can ensure all legalities are properly handled.

- It doesn’t affect creditors. Some people think that property held under a Survivorship Deed is entirely protected from creditors. In reality, creditors can still claim debts against the estate of the deceased owner.

- The deed is forever binding. Many think that a Survivorship Deed cannot be changed once created. In fact, it can be revoked or altered if all parties agree.

- It separates ownership rights. It's commonly believed that a Survivorship Deed gives separate ownership interests. However, the property is jointly owned, and both parties have equal rights during their lifetimes.

- All states have the same rules for Survivorship Deeds. Some assume that the rules governing these deeds are uniform across the country. Each state has its own laws, so it is crucial to check local regulations.

- Survivorship Deeds are only for residential property. Many think these deeds can only be used for homes. In fact, they can apply to various types of real estate, including commercial properties.

- Filing a Survivorship Deed is a quick process. While it may seem straightforward, the process can take time due to the necessary legal checks and potential delays in recording the deed.

Key takeaways

When filling out and using the Survivorship Deed Sample form, there are several important points to keep in mind. Here are some key takeaways:

- Understand the purpose: A survivorship deed allows two parties, typically spouses or partners, to share ownership of property. Upon the death of one owner, the other automatically inherits the entire property.

- Complete all sections: Every blank on the form should be filled out accurately. This includes names, addresses, property description, and signatures. Incomplete forms can lead to disputes or delays.

- Witness and notarization: The presence of a witness and a notary public is necessary for the deed to be legally valid. Their signatures confirm that the document was executed properly.

- Record the deed: After completion, the deed must be filed with the appropriate county clerk’s office. This step ensures public records reflect the ownership and the rights of the parties involved.

- Consult an attorney: While the form provides a structure, consulting with an attorney experienced in property law can help navigate specific legal requirements and ensure all provisions are correctly addressed.

Browse Other Templates

Prescription Fax Submission,Medication Order Fax Sheet,Cataramaran Rx Order Form,Cataramaran Medication Request Form,Prescription Transmission Form,Patient Prescription Fax Sheet,Cataramaran Rx Fax Application,Medication Requisition Fax,Cataramaran P - Incomplete forms may lead to delays in processing your order.

Casa Verde 2023 - Be aware of penalties for providing false information or fraudulently applying.