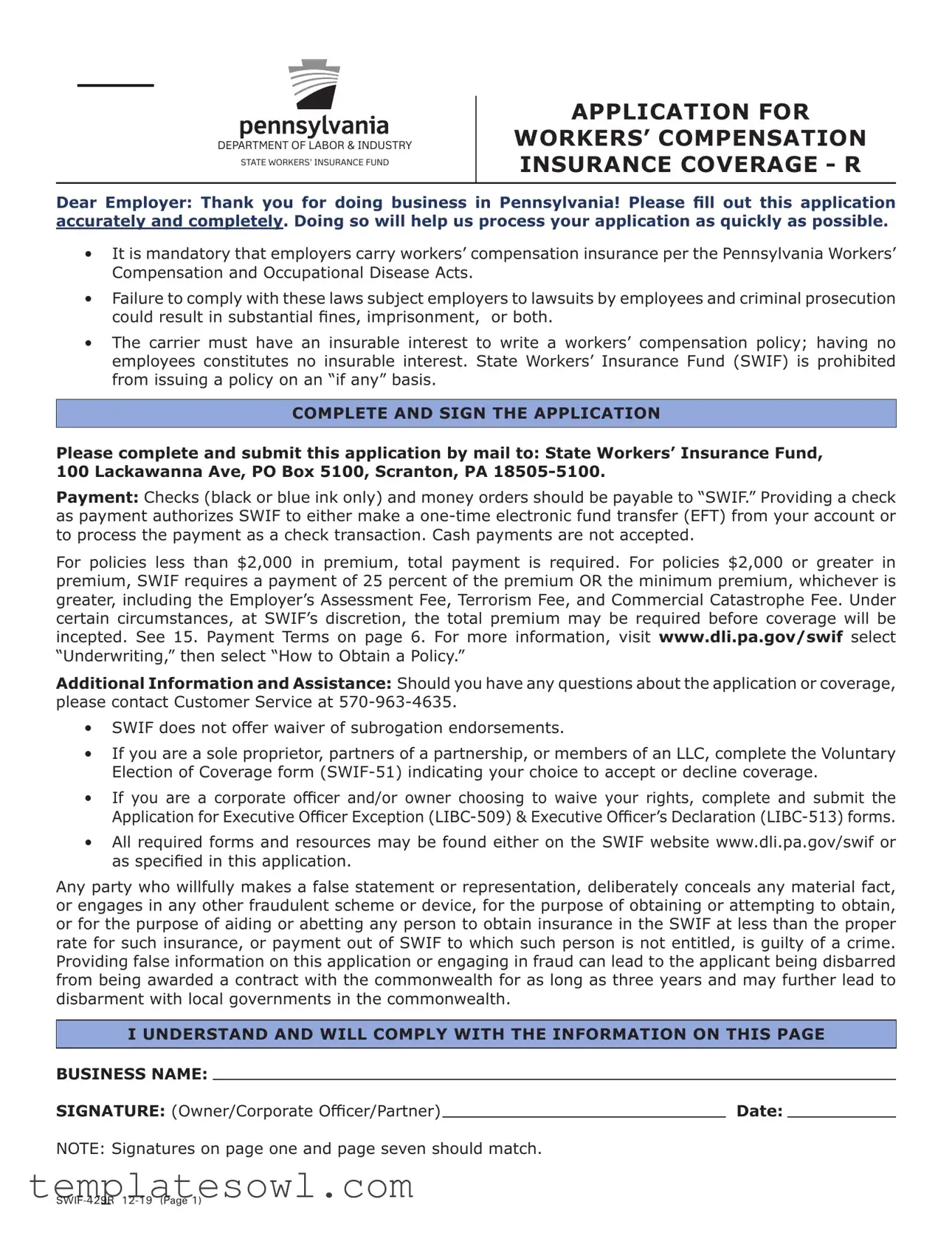

Fill Out Your Swif 429 Form

The SWIF 429 form serves as an essential application for workers’ compensation insurance coverage in Pennsylvania. This application is specifically designed for employers who must comply with state laws mandating that workers' compensation insurance is carried. By accurately completing the form, employers can speed up the processing of their application, which is vital for staying compliant and avoiding potential legal troubles. The form outlines the necessary details that employers must provide, such as business information, Federal Employer Identification Number (FEIN), and the structure of the business entity. Additionally, it emphasizes the importance of including all required documentation, as incomplete applications may result in denial of coverage. Each employer needs to understand the implications of noncompliance, which could lead to lawsuits or hefty fines. The application also clarifies specific terms regarding premium payments, outlines the types of entities eligible for coverage, and points out the importance of submitting supporting forms for sole proprietors or corporate officers who may wish to waive coverage. For assistance, employers can contact the State Workers’ Insurance Fund’s Customer Service, ensuring they have access to the help they need during the application process. Frequent amendments or updates to the law emphasize the need for vigilance and proper handling throughout the application process.

Swif 429 Example

DEPARTMENT OF LABOR & INDUSTRY

STATE WORKERS’ INSURANCE FUND

APPLICATION FOR

WORKERS’ COMPENSATION INSURANCE COVERAGE - R

Dear Employer: Thank you for doing business in Pennsylvania! Please fill out this application accurately and completely. Doing so will help us process your application as quickly as possible.

•It is mandatory that employers carry workers’ compensation insurance per the Pennsylvania Workers’ Compensation and Occupational Disease Acts.

•Failure to comply with these laws subject employers to lawsuits by employees and criminal prosecution could result in substantial fines, imprisonment, or both.

•The carrier must have an insurable interest to write a workers’ compensation policy; having no employees constitutes no insurable interest. State Workers’ Insurance Fund (SWIF) is prohibited from issuing a policy on an “if any” basis.

COMPLETE AND SIGN THE APPLICATION

Please complete and submit this application by mail to: State Workers’ Insurance Fund, 100 Lackawanna Ave, PO Box 5100, Scranton, PA

Payment: Checks (black or blue ink only) and money orders should be payable to “SWIF.” Providing a check as payment authorizes SWIF to either make a

For policies less than $2,000 in premium, total payment is required. For policies $2,000 or greater in premium, SWIF requires a payment of 25 percent of the premium OR the minimum premium, whichever is greater, including the Employer’s Assessment Fee, Terrorism Fee, and Commercial Catastrophe Fee. Under certain circumstances, at SWIF’s discretion, the total premium may be required before coverage will be incepted. See 15. Payment Terms on page 6. For more information, visit www.dli.pa.gov/swif select “Underwriting,” then select “How to Obtain a Policy.”

Additional Information and Assistance: Should you have any questions about the application or coverage, please contact Customer Service at

•SWIF does not offer waiver of subrogation endorsements.

•If you are a sole proprietor, partners of a partnership, or members of an LLC, complete the Voluntary Election of Coverage form

•If you are a corporate officer and/or owner choosing to waive your rights, complete and submit the Application for Executive Officer Exception

•All required forms and resources may be found either on the SWIF website www.dli.pa.gov/swif or as specified in this application.

Any party who willfully makes a false statement or representation, deliberately conceals any material fact, or engages in any other fraudulent scheme or device, for the purpose of obtaining or attempting to obtain, or for the purpose of aiding or abetting any person to obtain insurance in the SWIF at less than the proper rate for such insurance, or payment out of SWIF to which such person is not entitled, is guilty of a crime. Providing false information on this application or engaging in fraud can lead to the applicant being disbarred from being awarded a contract with the commonwealth for as long as three years and may further lead to disbarment with local governments in the commonwealth.

I UNDERSTAND AND WILL COMPLY WITH THE INFORMATION ON THIS PAGE

BUSINESS NAME:

SIGNATURE: (Owner/Corporate Officer/Partner) |

|

Date: |

NOTE: Signatures on page one and page seven should match.

FOR OFFICE USE ONLY: Application # |

|

|

|

|

|

Check # |

|

|

|

Amount $ |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

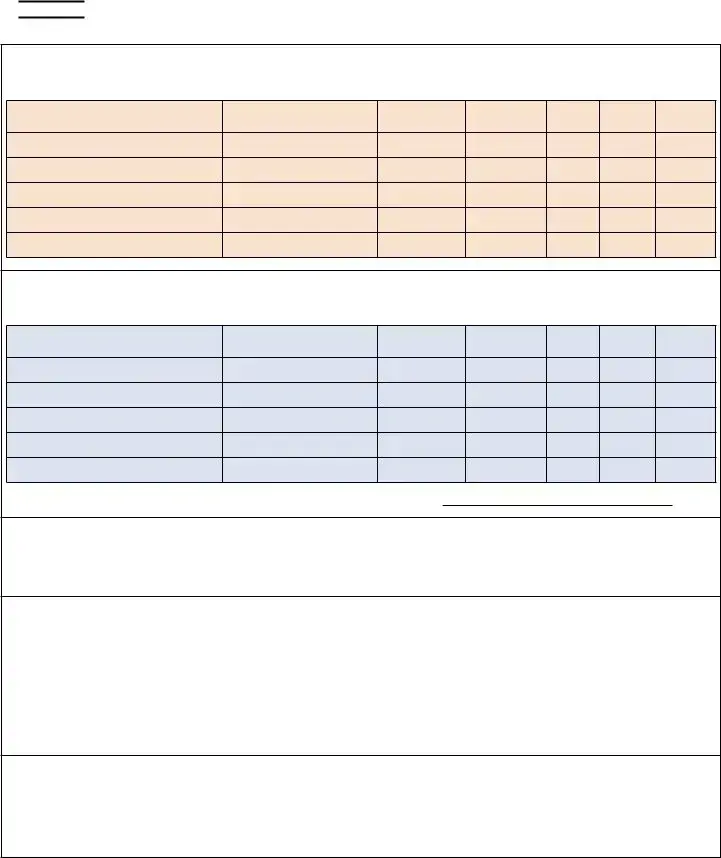

PLEASE COMPLETE THE FOLLOWING APPLICATION FOR WORKERS’ COMPENSATION INSURANCE |

||||||||||||||||||||||||

1. a. Business Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

b. Mailing Address: |

|

|

|

|

|

City: |

|

|

|

State: |

|

Zip: |

|

|

||||||||||

c. PA Primary Operating Location: |

|

|

|

|

|

|

|

|

|

|

|

|

County: |

|

|

|||||||||

d. Telephone: |

|

|

|

Business Fax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

e. Email: |

|

|

|

|

|

|

|

f. Website: |

|

|

|

|

|

|

|

|

|

|

|

|||||

2. Federal Employer Identification Number: |

|

|

|

(active FEIN is required; www.irs.gov to apply) |

||||||||||||||||||||

a. If new, date applied: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

b. List the name and FEIN of each additional business owned and operated to be included in this policy:

c.If multiple entities are to be insured on one policy, submit a Confidential Request for Information

d.Has any principle applicant had a previous business that was insured by SWIF under a different name, entity, or FEIN? If yes, include names of previous business(es), names of owners/officers of the business(es), and FEIN(s):

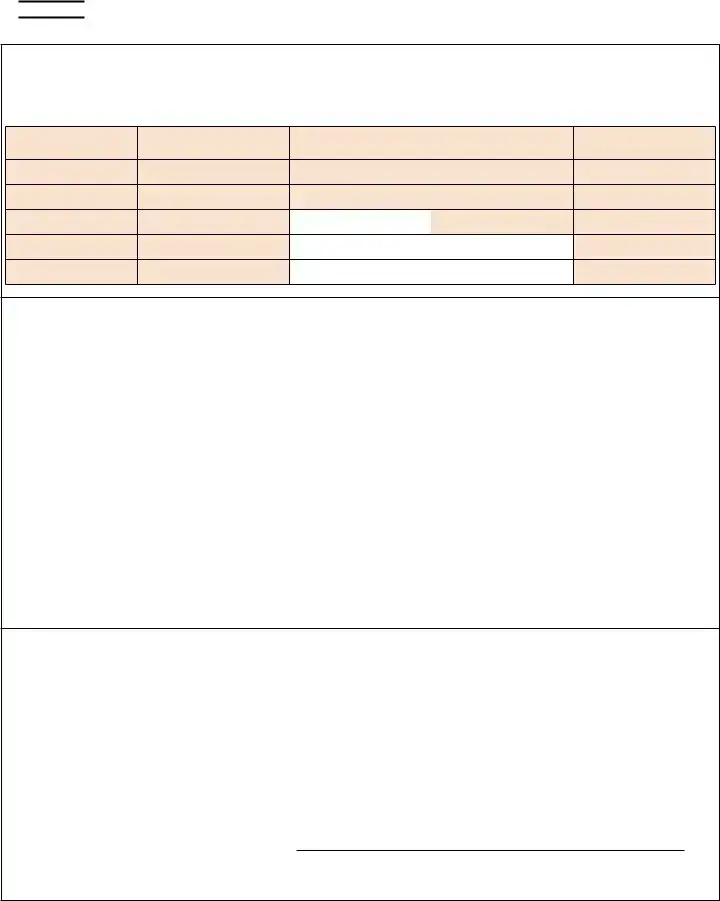

3.PLEASE USE THE FOLLOWING GUIDE TO DETERMINE WHETHER YOU MUST COMPLETE

TABLE A (3a) OR TABLE B (3b) ACCORDING TO YOUR TYPE OF ENTITY:

THIS SECTION NEEDS TO BE COMPLETED IN FULL OR YOUR APPLICATION WILL BE RETURNED WITH NO COVERAGE.

Indicate the type of business (check all that apply):

Individual/Sole Proprietor

Partnership

Limited Liability Company

Limited Liability Partnership

Complete Table A – Sole proprietors, partners of a partnership or LLP, members of an LLC electing or declining to be included under the Act must complete a Voluntary Election of Coverage

Corporation (S or C)

Professional Employer Organization

Temporary Agency

Other (Please specify, i.e. PEO client)

Complete Table B – An executive officer of a corporation, if eligible, may elect to be exempt under the Act by completing and submitting an Application for Executive Officer Exception

NOTE: ALL INCOMPLETE APPLICATIONS OR THOSE WITHOUT THE PROPER REMITTANCE WILL BE RETURNED

WITHOUT COVERAGE IN FORCE. PLEASE REVIEW FOR COMPLETENESS BEFORE YOU SEND.

Clear All Fields

3a. TABLE A: Has this business entity been insured with SWIF before? Yes No

Ownership for the Sole Proprietor / Partner / LLP / LLC – List each owner separately

First and Last Name

Sole Proprietor / Partner Member

SS#

%Class Active Covered

Ownership Code Y/N Y/N

3b. TABLE B: Has this business entity been insured with SWIF before? Yes No

Ownership/Title for: S or C Corporation /

First and Last Name

Corporate Officer Title

SS#

%Class Active Covered

Ownership Code Y/N Y/N

i. Date articles filed: |

|

ii. State: |

4.Is this business currently in the process of liquidation or termination?

No

Yes – explain:

5a. Has this business ever filed for bankruptcy?

No

Yes – date filed:

5b. Is this business currently in bankruptcy?

No

Yes – Must enclose a copy of the petition as filed in bankruptcy court, including all attachments.

6.Audit Contact

Contact Person: |

|

|

|

|

|

|

|

|

|

||

Address: |

|

|

|

|

City: |

|

State: |

|

Zip: |

|

|

Telephone: |

|

|

Email: |

|

|

|

|

|

|

||

NOTE: ALL INCOMPLETE APPLICATIONS OR THOSE WITHOUT THE PROPER REMITTANCE WILL BE RETURNED

WITHOUT COVERAGE IN FORCE. PLEASE REVIEW FOR COMPLETENESS BEFORE YOU SEND.

7. Safety/Loss Control

Contact Person: |

|

|

|

|

|

|

|

|

|

||

Address: |

|

|

|

|

City: |

|

State: |

|

Zip: |

|

|

Telephone: |

|

|

Email: |

|

|

|

|

|

|

||

8. Has this business entity had previous workers’ compensation insurance coverage in Pennsylvania? No

Yes – answer the following completely:

a. Business Name: b. Carrier Name: c. Policy Number:

d. Date Cancelled/Expired: e. Anniversary Date:

f. Premium:

g. Carrier information for the previous three (3) years: |

|

|

|

|||||

Carrier |

|

Premium |

|

Year |

|

|||

Carrier |

|

Premium |

|

Year |

|

|||

Carrier |

|

Premium |

|

Year |

|

|||

PLEASE NOTE: IF YOUR PREMIUM IS IN EXCESS OF $20,000, ATTACH FIVE YEARS OF |

||||||||

DETAILED LOSS AND PREMIUM HISTORY. |

|

|

|

|||||

h. Pennsylvania Compensation Rating Bureau #: |

|

|

|

|||||

i. Experience Modification/Merit: |

|

|

|

|

Date: |

|

||

j. Home Improvement Contractor Number (HIC#): |

|

|

|

|||||

9. Has workers’ compensation coverage ever been cancelled for this business entity? No

Yes – explain:

10. a. Provide a COMPLETE AND DETAILED job description of all work performed by classification of your

NOTE: ALL INCOMPLETE APPLICATIONS OR THOSE WITHOUT THE PROPER REMITTANCE WILL BE RETURNED

WITHOUT COVERAGE IN FORCE. PLEASE REVIEW FOR COMPLETENESS BEFORE YOU SEND.

Provide the following where applicable on a separate page:

b. List of clerical employees and their job duties

c. Volunteer Fire Department Roster (Act 46) and Volunteer Fireman Exposure form at www.pcrb.com

d. List of the names and social security numbers for any domestic workers. Include number of hours worked per week per employee (part time – under 20 hours; full time – 20 hours or more).

e. Approval to Exempt Certain Religious Members

f.Letter of Certification Approval of Workplace Safety Committee from the Bureau of Workers’

Compensation (Safety Credit)

11.Does this business entity engage or use any of the following:

Maritime/harbor workers (NOTE: SWIF does not offer Jones Act coverage)

U.S. Department of Defense contracts, outside U.S. Territories

N/A

12.Does this business utilize the services of subcontractors,

No

Yes – Please provide the following:

•A copy of Certificates of Insurance (COI) for all subcontractors proving workers’ compensation coverage in Pennsylvania.

•A copy of the signed contracts between the applicant and the subcontractor(s) as required per Act 72.

If valid COIs cannot be provided, please submit a completed Independent Contractor Questionnaire form

Liability limits are set to state minimum ($100K/$100K/$500K);

FOR INCREASED LIMITS:

$500K/$500K/$500K $1million/$1million/$1million

$500K/$500K/$500K $1million/$1million/$1million

•Employers’ liability insurance provides coverage to employers for liability arising out of a worker’s injury that is not covered by standard workers’ compensation coverage. This can include liability to employees, their families, and other associated third parties.

•Standard employers’ liability limits are $100,000 per occurrence for bodily injury, $100,000 per employee for bodily injury by disease, and $500,000 aggregate for bodily injury by disease.

•These limits can be increased by endorsement and payment of an additional premium. The two other options for increased limits are $500,000 and $1,000,000, as shown above.

NOTE: ALL INCOMPLETE APPLICATIONS OR THOSE WITHOUT THE PROPER REMITTANCE WILL BE RETURNED

WITHOUT COVERAGE IN FORCE. PLEASE REVIEW FOR COMPLETENESS BEFORE YOU SEND.

13.Payroll: Additional information such as rates, class codes, and instructions to estimate your premium

may be found on our website: www.dli.pa.gov/swif

NOTE: Payroll for officers/owners choosing exemption in question #3 should be excluded.

Class Code or

Description

Number of

Employees per Class

Estimated Payroll for |

Class Rate per $100 |

One Year Term |

Payroll |

|

|

|

|

|

|

Estimated Premium

14.PLEASE REVIEW TO DETERMINE IF ADDITIONAL INFORMATION IS REQUIRED:

a.If this business entity uses temporary workers provided through staffing agencies, include Certificates of Insurance from each agency used.

b.If this business entity contracts with a Professional Employer Organization (PEO) for leased workers, please provide a copy of signed contracts and/or agreements from each client as well as a list of employees per contract.

c.If this business entity is a Professional Employer Organization (PEO), please include the requirements which can be found at requirements www.dli.pa.gov/swif.

d.If this business entity is a temporary agency, complete and sign the Alternate Employer Endorsement Worksheet which is located at www.dli.pa.gov/swif, select “Underwriting,” then select “How to Obtain a Policy.” SWIF must be notified of all Alternate Employers (temporary clients) immediately upon acquisition during the policy term. If any Alternate Employer is acquired during the policy term without notification to SWIF, claims attributed to those specific clients will be denied.

* Note: SWIF only provides policy information to the policyholder; that is, only the insured and/or the authorized agent may request the above information. This includes requesting Certificates of Insurance. SWIF does not take requests from third parties.

15.Payment Terms:

Policy premiums less than $2,000 |

TOTAL PREMIUM REQUIRED |

|

|

Policy premiums $2,000 to $10,000 |

25% of the total premium, or the minimum premium, |

|

whichever is greater; * with the remaining balance due |

|

in four equal installments. |

|

|

Policy premiums over $10,000 |

25% of the total premium, or the minimum premium, |

|

whichever is greater; * with the remaining balance due |

|

in 10 equal installments. |

|

|

* Total premium includes the Employer’s Assessment Fee, Terrorism Fee, and Commercial Catastrophe Fee.

Requested inception date of coverage:

PLEASE REVIEW FOR COMPLETENESS PRIOR TO SUBMISSION.

NOTE: ALL INCOMPLETE APPLICATIONS OR THOSE WITHOUT THE PROPER REMITTANCE WILL BE RETURNED

WITHOUT COVERAGE IN FORCE. PLEASE REVIEW FOR COMPLETENESS BEFORE YOU SEND.

16.CONTRACT CONDITIONS:

a.Coverage will become effective at 12:01 a.m. on the day specified on the workers’ compensation policy issued by SWIF. For an application to be deemed acceptable for review and coverage, SWIF must receive a complete and properly signed application and the specified premium due.

b.The application, including any subcontractor information elicited in Item 12 of the application, must be properly and fully completed and signed by an owner, a partner, or corporate officer. The Construction Workplace Misclassification Act (Act 72) further established a definition of an “Independent Contractor” for purposes of Workers’ Compensation as of February 10, 2011, and information regarding such can be found at www.dli.pa.gov/swif.

c.The premium quoted is based upon the nature of the operations and the estimated payroll disclosed by the employer in this application. The employer shall furnish SWIF with proper notice of any changes in the nature of its operations or its estimated payroll; such changes may result in an increase or decrease in the premium due under this policy. The employer agrees to keep an accurate record of employees and payroll expenditures, and to report injuries and occupational diseases to

SWIF immediately.

d.SWIF requires the disclosure of accurate and legitimate payroll records. Such payroll records must include, but are not limited to, a list of each employee’s Social Security number or

e.SWIF may conduct underwriting visits and/or audits during regular business hours during the policy period and within three years after the policy ends. Information developed by the underwriting visit or audit will be used to determine the estimated or final premium. If it is determined that additional premium is due, you will be billed accordingly.

f.When any claim for a temporary worker occurs at a client/Alternate Employer’s location of which SWIF has not been previously notified, the claim will be denied.

g.Employees hired in and working in another state cannot be covered by the Pennsylvania State Workers’ Insurance Fund.

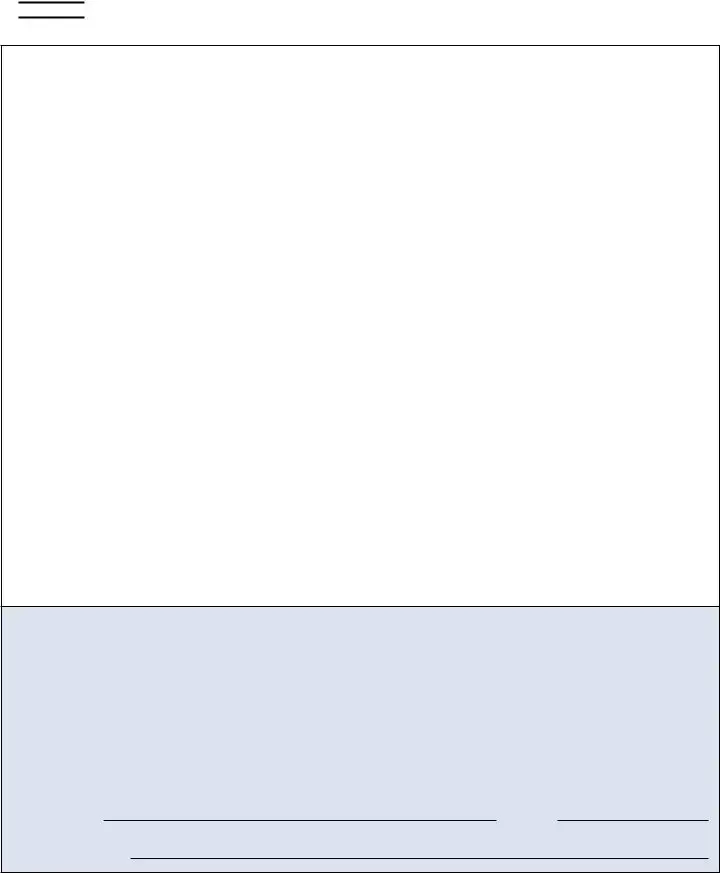

SIGNATURES AND CERTIFICATIONS:

THE APPLICATION MUST BE SIGNED BY AN OWNER, A PARTNER, OR A CORPORATE OFFICER

AND RETURNED WITH YOUR PAYMENT.

17.I certify that all information provided in this document is correct and complete. I acknowledge that false statements in this document are punishable pursuant to 18 Pa. C.S. §4904 (relating to Unsworn Falsification to Authorities), 18 Pa. C.S. §4117 (relating to Insurance Fraud) and 77 P.S. § 1039.2

(relating to the Workers’ Compensation Act). A person who knowingly makes a false statement or knowingly withholds information may be subject to a fine, imprisonment and restitution.

SIGNATURE:DATE:

Print Full Name:

NOTE: ALL INCOMPLETE APPLICATIONS OR THOSE WITHOUT THE PROPER REMITTANCE WILL BE RETURNED

WITHOUT COVERAGE IN FORCE. PLEASE REVIEW FOR COMPLETENESS BEFORE YOU SEND.

18.BROKER OF RECORD LETTER: The following broker /agent has been designated as the official “Broker of Record.” The following information must be completed and signed by BOTH the broker/ agent and the applicant. No additional Broker of Record Letter is required.

**NOTE: Brokerages are NOT authorized to issue Certificates of Insurance on behalf of the SWIF. All COIs must be issued by request through SWIF only.

DO NOT ISSUE CERTIFICATES ON BEHALF OF SWIF ON ACORD FORMS OR ANY OTHER DOCUMENT.

a. BROKER/AGENT NAME OR INSURANCE AGENCY:

b. Name:

c. Address: |

|

|

|

City: |

|

|

|

State: |

|

Zip: |

|

||||||

d. Telephone: |

|

Fax: |

|

|

|

e. Email: |

|

|

|

||||||||

f. SIGNATURE OF APPLICANT: |

|

|

|

|

|

|

|

Title: |

|

|

|||||||

g. SIGNATURE OF BROKER: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

h. Print Name: |

|

|

|

|

|

|

|

|

Date: |

|

|

|

|||||

19.FINANCE COMPANY LETTER: The following finance company has been designated as the official “Finance Company.” The following must be completed and signed by the finance company and the

Insured.

ATTACH COMPLETED AND SIGNED FINANCE AGREEMENT

a. NAME OF FINANCE COMPANY: b. Name:

c. Address: |

|

|

|

City: |

|

|

|

State: |

|

|

Zip: |

|

|||||||

d. Telephone: |

|

|

Fax: |

|

|

e. Email: |

|

|

|

|

|

|

|||||||

f. SIGNATURE OF COMPANY REPRESENTATIVE: |

|

|

|

|

|

|

Title: |

||||||||||||

g. SIGNATURE OF APPLICANT: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

h. Print Name: |

|

|

|

|

|

|

|

|

|

Date: |

|

||||||||

STATE WORKERS’ INSURANCE FUND

Auxiliary aids and services are available upon request to individuals with disabilities.

Equal Opportunity Employer/Program

Form Characteristics

| Fact Name | Details |

|---|---|

| Mandatory Coverage | In Pennsylvania, it is mandatory for employers to carry workers’ compensation insurance under the Workers’ Compensation and Occupational Disease Acts. |

| Consequences of Non-Compliance | Employers who fail to comply with these laws may face lawsuits by employees and potential criminal prosecution, which could lead to significant fines or imprisonment. |

| Insurable Interest Requirement | The insurance carrier must have an insurable interest to issue a workers' compensation policy. Employers with no employees do not possess this interest, and SWIF cannot issue a policy on an "if any" basis. |

| Submission Guidelines | Applications must be completed fully and sent via mail to the State Workers’ Insurance Fund. Payments can only be made via check or money order, and cash is not accepted. |

Guidelines on Utilizing Swif 429

Completing the SWIF 429 form is an important step in obtaining workers' compensation insurance coverage in Pennsylvania. It is essential that all information is filled out accurately to avoid delays in processing. Make sure to gather all necessary documents before you start.

- Provide Business Information: Fill out the business name, mailing address, primary operating location, telephone number, fax number, email address, and website at the top of the form.

- Enter Employer Identification Number: Include your Federal Employer Identification Number (FEIN). If you are applying for a new number, note the application date.

- Detail Ownership Information: Indicate whether your business has had previous insurance coverage with SWIF. List all owners, partners, or corporate officers along with their Social Security numbers and ownership percentages.

- Check Business Type: Specify your business type based on the categories provided. Choose either Table A or Table B depending on whether you are a sole proprietor, partnership, LLC, or corporation.

- Verify Coverage History: Answer questions regarding previous workers’ compensation insurance coverage in Pennsylvania, including the name of the business, carrier, and policy details.

- Provide Job Descriptions: Include detailed job descriptions for all work performed by the business. Attach additional sheets if needed.

- Review Financial History: If applicable, provide information about any bankruptcy filed by the business and include a copy of the bankruptcy petition if current.

- Contact Information: Identify an audit contact person and their details for further communication.

- Signature: Sign and date the application at the bottom, ensuring the signature matches any prior pages.

After completing the form, double-check for accuracy and completeness. Incomplete forms may be returned without coverage. Send the application by mail along with the required payment to the State Workers’ Insurance Fund address provided on the form.

What You Should Know About This Form

What is the purpose of the SWIF 429 form?

The SWIF 429 form is an application for workers' compensation insurance coverage designed specifically for employers in Pennsylvania. It is essential for complying with state regulations that mandate employers carry workers' compensation insurance. Completing this form accurately will help ensure that your application is processed swiftly, allowing you to focus on running your business while remaining compliant with the law.

What are the consequences of not having workers' compensation insurance?

Not carrying workers' compensation insurance can have serious repercussions for employers in Pennsylvania. Failure to comply with the Workers' Compensation and Occupational Disease Acts can lead to lawsuits from employees. Additionally, employers may face criminal prosecution, which can result in substantial fines or even imprisonment. Protecting your business from these legal challenges is an essential responsibility.

How do I fill out the SWIF 429 form?

Filling out the SWIF 429 form involves providing detailed information about your business, including the business name, mailing address, Federal Employer Identification Number, and details about ownership. Make sure to indicate your type of entity accurately, as this determines which additional forms you may need to complete. It is crucial to review the form for completeness; incomplete applications will be returned without coverage. Always double-check that signatures match where required.

What payment options are available for the SWIF 429 form?

When submitting the SWIF 429 form, you may pay by check or money order, made out to "SWIF." It's important to use black or blue ink for the payment. Keep in mind that SWIF does not accept cash payments. For policies with premiums under $2,000, full payment is required upfront. Policies with premiums of $2,000 or more require an initial payment of at least 25 percent of the premium. Be aware that, under certain circumstances, SWIF may require total payment upfront before coverage begins.

Common mistakes

Filling out the SWIF 429 form can seem straightforward, but many people make mistakes along the way. One common issue is not providing a complete business name. Without the official registered name, the application can be processed incorrectly or returned.

Another mistake is failing to include the correct Federal Employer Identification Number (FEIN). An active FEIN is mandatory, and if it’s missing or incorrect, the whole application may be delayed.

Many applicants overlook the importance of signing the application appropriately. Both signatures on page one and page seven should match. Discrepancies can lead to confusion and a possible rejection of the form.

It's also essential to understand the difference between Table A and Table B when indicating the type of business. Skipping this part or misclassifying the business can result in the application being incomplete and returned without coverage.

Some individuals fail to disclose previous insurance coverage details. When businesses have been insured before, it is crucial to provide accurate information, including the carrier's name, policy number, and cancellation dates. Missing this information could raise red flags.

Additionally, applicants often forget to attach necessary documentation when applicable. For example, if there has been a bankruptcy or previous coverage, supporting documents must be included. Omitting these can stall the application process significantly.

Incomplete job descriptions are another mistake made on the application. It’s vital to provide detailed information about day-to-day operations. Failure to do so may result in the application being sent back for further clarification.

Not including contact information for key personnel can create complications as well. Providing a clear point of contact for safety and audit matters is essential for effective communication. Leaving this section blank may cause delays in processing.

Lastly, some people neglect to review their applications for completeness before submission. Taking a moment to double-check all entries ensures that everything is in place and can help avoid the frustration of an application being returned.

Documents used along the form

The SWIF 429 form serves as an important application for securing workers’ compensation insurance coverage in Pennsylvania. However, it is often accompanied by several other forms and documents that help clarify the application process and ensure compliance with relevant laws. Below is a brief overview of these documents.

- Voluntary Election of Coverage (SWIF-51): This form must be completed by sole proprietors, partners, and LLC members to indicate their choice to accept or decline workers’ compensation coverage. It is essential for those deciding on their coverage options.

- Application for Executive Officer Exception (LIBC-509): Corporate officers seeking to waive their workers’ compensation coverage must fill out this application. This document ensures that the choice to waive is properly recorded and acknowledged.

- Executive Officer’s Declaration (LIBC-513): This declaration accompanies the Application for Executive Officer Exception (LIBC-509). It provides additional affirmation of the executive officer's decision to opt-out of coverage.

- Confidential Request for Information (ERM-14): If multiple businesses are included under one policy, this form must be submitted. It identifies each business and ensures that coverage is accurately represented.

- Independent Contractor Questionnaire (SWIF-831): For businesses that utilize subcontractors, this questionnaire gathers information about the subcontractors' insurance status. It ensures that all workers have the necessary coverage.

- Trucking Questionnaire (SWIF-832): This form is specific for businesses that operate in the trucking sector. It collects information relevant to workers’ compensation coverage for owner-operators.

- Letter of Certification Approval of Workplace Safety Committee: This document confirms the establishment and approval of a workplace safety committee. It can provide employers with certain credits regarding their premiums.

- Approval to Exempt Certain Religious Members (LIBC-14C): If applicable, this form allows for the exemption of specific religious members from coverage under certain conditions.

Filling out these forms accurately and in conjunction with the SWIF 429 is crucial to ensure that employers remain compliant and protected under Pennsylvania law. Each document plays a role in facilitating proper coverage and addressing specific aspects of workers’ compensation insurance requirements.

Similar forms

- SWIF-51 - Voluntary Election of Coverage Form: Like the SWIF-429, this form is essential for businesses with sole proprietors, partners, or members of LLCs. It allows them to signify their choice to either accept or decline workers’ compensation coverage. Accurate completion ensures that the insurance provider understands the specific coverage needs of the applicants, similar to how the SWIF-429 gathers necessary information about the business.

- LIBC-509 - Application for Executive Officer Exception: This document is tailored for executive officers of corporations seeking to waive their rights to coverage. The LIBC-509 parallels the SWIF-429 as both require signatures and supporting documentation. They serve the overall purpose of ensuring clarity regarding who is covered under workers’ compensation, thus managing risk effectively.

- LIBC-513 - Executive Officer’s Declaration: This declaration works in conjunction with LIBC-509. It allows corporate officers to officially declare their decision regarding coverage exemptions. Similar to the SWIF-429, this form captures critical decisions and information that help in defining the insurance coverage landscape for a business.

- ERM-14 - Confidential Request for Information: This form is necessary when multiple entities are insured under a single policy. Like the SWIF-429, the ERM-14 gathers specific data about each business to ensure proper coverage. Proper completion of this form aids in the smooth processing of applications, much like the comprehensive detail expected in the SWIF-429.

Dos and Don'ts

When filling out the SWIF 429 form for Workers’ Compensation Insurance Coverage, it is essential to follow specific guidelines to ensure your application is processed smoothly. Below are some things you should and shouldn’t do:

- Do complete all sections of the application fully and accurately. Incomplete applications will be returned.

- Do ensure that all required signatures match on the specified pages; discrepancies can delay processing.

- Do provide the correct payment according to your premium amount. Payment terms must be strictly followed.

- Do contact Customer Service if you have questions or need clarifications regarding the application process.

- Don't provide false information or incomplete responses. This can lead to penalties, including disbarment from contracts.

- Don't use cash as a form of payment, as it is not accepted.

- Don't submit the application without ensuring that all supporting documents are included; missing documents will cause returns.

- Don't neglect to review for completeness before sending; ensure all information is accurate and thorough.

Misconceptions

Misconceptions about the SWIF 429 form can lead to confusion and errors in the application process for workers’ compensation insurance coverage. Here are ten common misconceptions, alongside clarifications for each.

- Workers’ compensation insurance is optional for Pennsylvania employers. Many people believe that having workers’ compensation insurance is a choice. In reality, it is mandatory for employers under Pennsylvania law. Not having the required insurance can lead to significant legal penalties.

- Only large companies need to complete the SWIF 429 form. Some assume that only larger businesses need to worry about this application. However, any employer, regardless of size, must complete the form if they have employees.

- Completion of the form guarantees immediate insurance coverage. A common misunderstanding is that simply filling out the application guarantees that coverage starts immediately. Submission of the form is just the first step. Coverage will not begin until the application is processed and approved, and initial payments are made.

- SWIF provides coverage on an "if any" basis. Some believe that SWIF will provide coverage based on a business’s projected needs. This is inaccurate. SWIF requires that the business show an insurable interest, meaning they must have actual employees.

- Cash payments are accepted for the application fee. It may be assumed that cash payments can be used; however, SWIF does not accept cash. Only checks or money orders are acceptable when submitting payment.

- One form can cover multiple business entities without additional steps. Some applicants think that they can simply list multiple businesses on one form. If multiple entities need coverage under one policy, a separate form is required to identify each business entity.

- All forms must be completed by the owner alone. This might lead applicants to think only the owner should fill out the application. In truth, input may be needed from various parties involved in the business operations, like financial officers or safety officers.

- Providing inaccurate or incomplete information is inconsequential. Some may believe that small inaccuracies will not lead to serious consequences. In reality, providing false information can result in legal penalties and disqualification from future contracts.

- Payment terms are the same for all policies. A common mistake is thinking that payment terms are uniform. For policies with premiums under $2,000, full payment is required, while larger premiums allow for a 25% upfront payment.

- A separate application is not needed for executive officers or sole proprietors. Many falsely assume they do not need additional paperwork if they want to waive coverage. For example, specific forms must be filled out for sole proprietors or corporate officers who wish to opt out of coverage.

Understanding these misconceptions can greatly enhance the experience of filling out the SWIF 429 form and ensure compliance with Pennsylvania's workers’ compensation laws.

Key takeaways

When filling out and using the SWIF 429 form for Workers’ Compensation Insurance Coverage, consider the following key takeaways:

- Mandatory Coverage: Employers must have workers’ compensation insurance under Pennsylvania law.

- Compliance is Essential: Not following these regulations can lead to lawsuits and serious legal consequences, including fines or imprisonment.

- Insurable Interest: A carrier needs an insurable interest to write a policy; if you have no employees, you lack this interest.

- Complete and Accurate Submission: Fill out the application thoroughly to avoid delays in processing. Incomplete applications will be returned.

- Payment Guidelines: Payments can only be made by check or money order. Options for premium payments vary based on the amount.

- Document Requirements: Additional forms may be required depending on your business structure, such as SWIF-51 for sole proprietors or LIBC-509 and LIBC-513 for corporate officers.

- Fraud Consequences: Providing false information can lead to severe penalties, including disbarment from government contracts for up to three years.

- Subcontractor Coverage: If using subcontractors, you must provide proof of their workers’ compensation coverage or submit an Independent Contractor Questionnaire.

- Contact Information: For questions or assistance, reach out to Customer Service at the provided number.

Browse Other Templates

Direct Deposit Authorization,Payroll Direct Deposit Form,Employee Paycheck Deposit Request,Automatic Payroll Deposit Authorization,Bank Account Deposit Request,Employee Direct Deposit Agreement,Paycheck Direct Deposit Form,Wage Deposit Request Form,E - With this request, employees can ensure that their funds are available promptly when payday arrives.

How to Get Gun License in California 2023 - Once submitted, applications are subject to statutory review by the Bureau of Security and Investigative Services.