Fill Out Your Syndicat E Banking Form

The Syndicat E Banking form marks a significant step towards modernizing banking services, facilitating an easier and more efficient way for retail users to access their accounts online. By filling out this application, banking customers can request Internet Banking services, which allow them to manage their finances from the comfort of their homes, 24 hours a day, seven days a week. This form requires applicants to provide essential information, including details about their accounts, personal identification, and designated Corporate Admin for company accounts. The process emphasizes the importance of security and verification by outlining responsibilities, such as confirming the accuracy of provided information and understanding the associated terms and conditions. Furthermore, the form includes several guidelines on best practices for ensuring a secure online banking experience. From advising users to avoid unsolicited emails to requirements for browser compatibility, these steps help protect sensitive information. Through clear instructions and user-friendly support, the Syndicat E Banking form ensures that customers are well-prepared to navigate the world of internet banking.

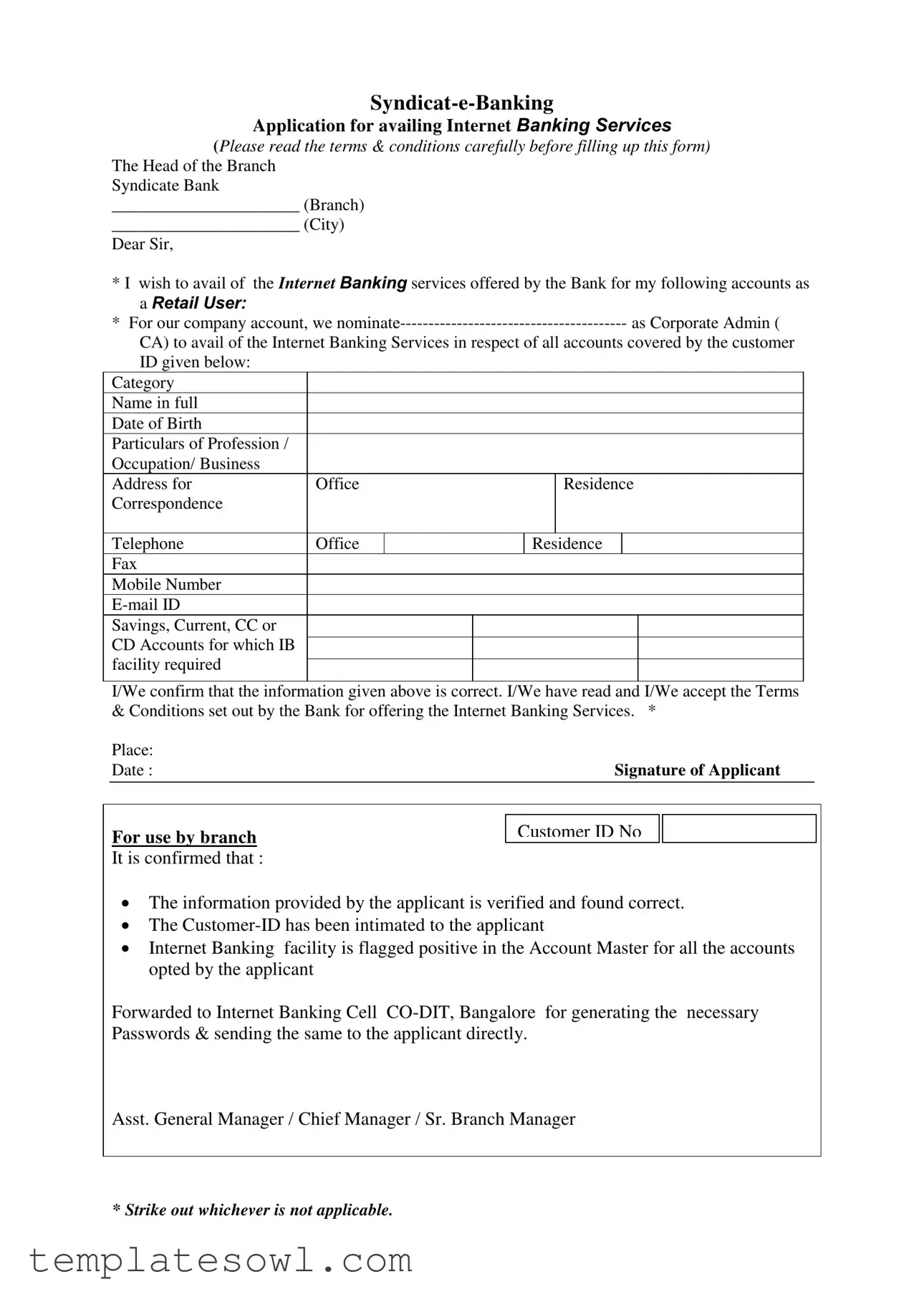

Syndicat E Banking Example

Application for availing Internet Banking Services

(Please read the terms & conditions carefully before filling up this form) The Head of the Branch

Syndicate Bank

______________________ (Branch)

______________________ (City)

Dear Sir,

*I wish to avail of the Internet Banking services offered by the Bank for my following accounts as a Retail User:

*For our company account, we

Category |

|

|

|

|

|

|

|

Name in full |

|

|

|

|

|

|

|

Date of Birth |

|

|

|

|

|

|

|

Particulars of Profession / |

|

|

|

|

|

|

|

Occupation/ Business |

|

|

|

|

|

|

|

Address for |

Office |

|

|

|

Residence |

||

Correspondence |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone |

Office |

|

|

Residence |

|

|

|

Fax |

|

|

|

|

|

|

|

Mobile Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings, Current, CC or |

|

|

|

|

|

|

|

CD Accounts for which IB |

|

|

|

|

|

|

|

facility required |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/We confirm that the information given above is correct. I/We have read and I/We accept the Terms & Conditions set out by the Bank for offering the Internet Banking Services. *

Place: |

|

Date : |

Signature of Applicant |

For use by branch It is confirmed that :

Customer ID No

The information provided by the applicant is verified and found correct.

The

Internet Banking facility is flagged positive in the Account Master for all the accounts opted by the applicant

Forwarded to Internet Banking Cell

Asst. General Manager / Chief Manager / Sr. Branch Manager

* Strike out whichever is not applicable.

(full address with telephone/fax number)

To

Shri /Smt/M/s.

Welcome to our 24 * 365, friendly Internet Banking Services. This service can be availed at any time or from anywhere! Now, all the information that you need to know and a host of services are available within the four walls of the comfort of your home. ! Just to know what

we are offering and how easy it is to avail of this facility, please read through the enclosed user’s manual and guidelines.

The booklet contains all the necessary information about the Internet Banking Services. However, we enumerate here below a few important requirements for the best usage of

Internet Banking Services.

You can browse the homepage of our website www.syndicatebank.in from where a link is provided for availing Internet Banking Services. Please do not search for our website through any search engines like Google, Yahoo etc. Also please do not click on any unsolicited emails which seek critical information like your Login ID, Passwords etc. Please be aware that using this information a fraudulent person can login to our Site and put through transactions in your account.

Your Customer ID is __________________. The same is your

We will be handing over the secret Password (one for login and another for Transaction) to you shortly. You would be required to use the login Password for logging into the Internet banking Services. Immediately after your first login, you will be taken to the Change Password screen. You are required to change both login and transaction password without fail. You may also change the password anytime subsequently.

Kindly do not disclose / divulge or let known the secret Passwords to any one. As a security measure we suggest you NOT to note down the Passwords anywhere.

Please memorise the Passwords and then destroy the Password mailers received by you from us after making sure that you have changed the passwords.

We have given some default funds transfer limits to Retail customers. If you need us to raise these limits, please give a written application to our branch. Please make sure that your email ID and mobile number is registered with us before you try to do inter bank funds transfers.

Please make sure that you use only INTERNET EXPLORER browser with version 6 and above for completing your transactions successfully.

Please feel free to contact us for any further clarifications / information. It will be our pleasure to receive your valuable suggestions for improving our services further.

Thanking you,

Yours sincerely,

The Head of Branch

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Title | Syndicat-e-Banking Application for availing Internet Banking Services |

| Responsible Authority | Head of the Branch, Syndicate Bank |

| Service Type | Internet Banking Services for Retail Users |