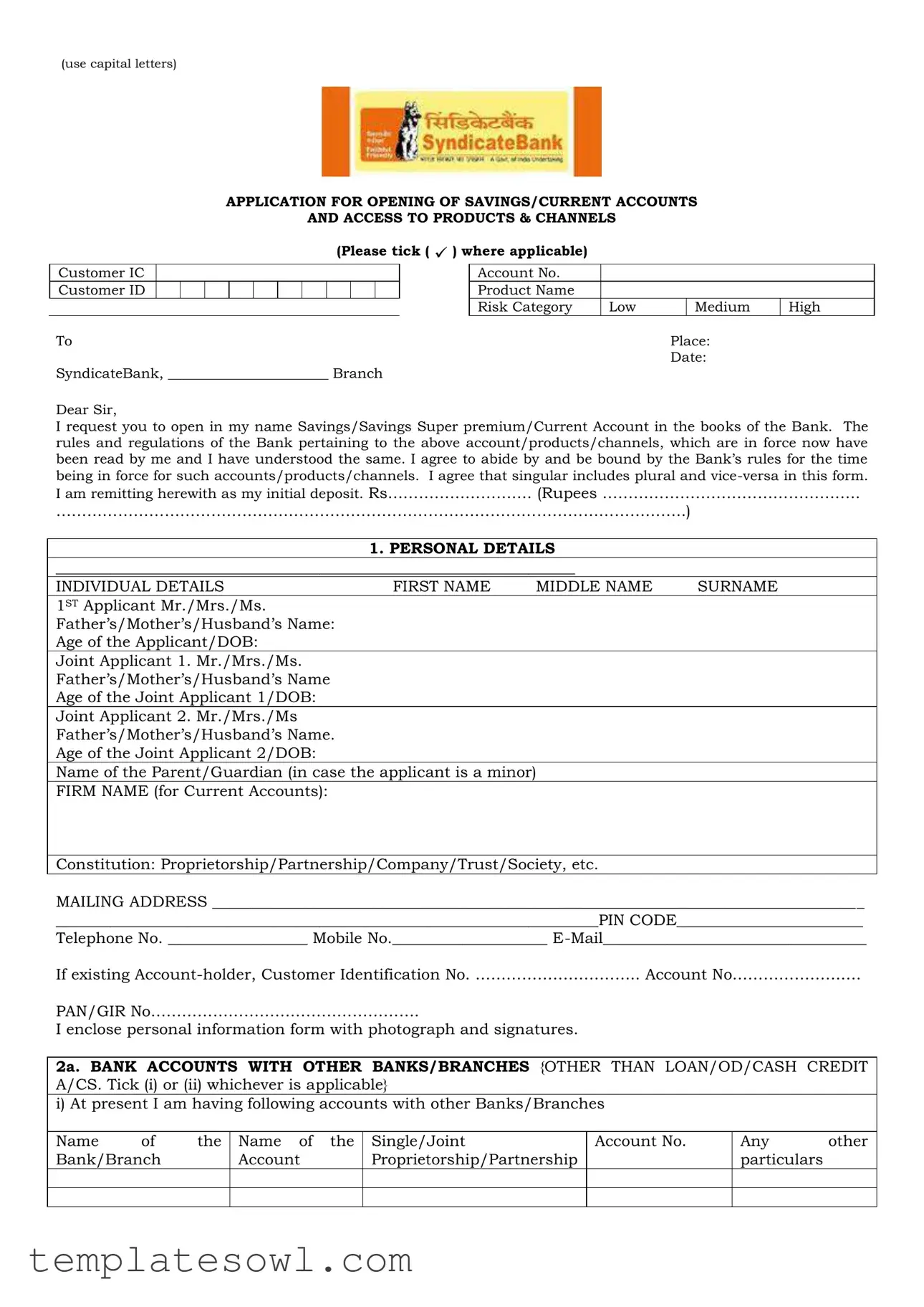

Fill Out Your Syndicate Bank Account Opening Form

Opening a bank account is a crucial step in managing personal finances, and the Syndicate Bank Account Opening form is designed to facilitate this process for both individual and joint applicants. This comprehensive document begins with a request to establish either a savings or current account, alongside essential details such as the applicant’s name, address, and contact information. The form also prompts customers to declare their understanding of the bank's rules and regulations. It features sections for personal and financial information, including existing bank accounts and credit facilities, allowing the bank to gauge the applicant's financial background. The instruction section is particularly important for those setting up joint accounts, detailing how transactions will be managed among account holders. Furthermore, it covers aspects like the sweep in and sweep out facility for managing funds efficiently, and offers the option for customers to nominate beneficiaries. Verification of identity and address, as well as an introducer’s signature, are necessary for compliance with regulatory standards. The various channels for accessing the account—like ATM services and online banking—are clearly outlined, ensuring applicants can easily access their funds and manage transactions. Overall, the form is structured to provide clarity while ensuring that all legal requirements are met. Completing this form accurately paves the way for a smooth banking experience at Syndicate Bank.

Syndicate Bank Account Opening Example

(use capital letters)

APPLICATION FOR OPENING OF SAVINGS/CURRENT ACCOUNTS

AND ACCESS TO PRODUCTS & CHANNELS

(Please tick ( ) where applicable)

Customer IC

Customer ID

To

SyndicateBank, _______________________ Branch

Account No. |

|

|

|

Product Name |

|

|

|

Risk Category |

Low |

Medium |

High |

Place:

Date:

Dear Sir,

I request you to open in my name Savings/Savings Super premium/Current Account in the books of the Bank. The

rules and regulations of the Bank pertaining to the above account/products/channels, which are in force now have been read by me and I have understood the same. I agree to abide by and be bound by the Bank’s rules for the time

being in force for such accounts/products/channels. I agree that singular includes plural and

…………………………………………………………………………………………………………..)

1.PERSONAL DETAILS

___________________________________________________________________

INDIVIDUAL DETAILS |

FIRST NAME |

MIDDLE NAME |

SURNAME |

1ST Applicant Mr./Mrs./Ms. |

|

|

|

Father’s/Mother’s/Husband’s Name: |

|

|

|

Age of the Applicant/DOB: |

|

|

|

Joint Applicant 1. Mr./Mrs./Ms. |

|

|

|

Father’s/Mother’s/Husband’s Name |

|

|

|

Age of the Joint Applicant 1/DOB: |

|

|

|

Joint Applicant 2. Mr./Mrs./Ms

Father’s/Mother’s/Husband’s Name.

Age of the Joint Applicant 2/DOB:

Name of the Parent/Guardian (in case the applicant is a minor)

FIRM NAME (for Current Accounts):

Constitution: Proprietorship/Partnership/Company/Trust/Society, etc.

MAILING ADDRESS ____________________________________________________________________________________

______________________________________________________________________PIN CODE________________________

Telephone No. __________________ Mobile No.____________________

If existing

PAN/GIR No…………………………………………….

I enclose personal information form with photograph and signatures.

2a. BANK ACCOUNTS WITH OTHER BANKS/BRANCHES {OTHER THAN LOAN/OD/CASH CREDIT A/CS. Tick (i) or (ii) whichever is applicable}

i) At present I am having following accounts with other Banks/Branches

Name |

of |

the |

Name of the |

Single/Joint |

Bank/Branch |

|

Account |

Proprietorship/Partnership |

|

|

|

|

|

|

Account No.

Any other particulars

ii)At present, I do not have any account with any other Bank/Branch. I undertake to inform you as and when accounts are opened with other Banks/Branches

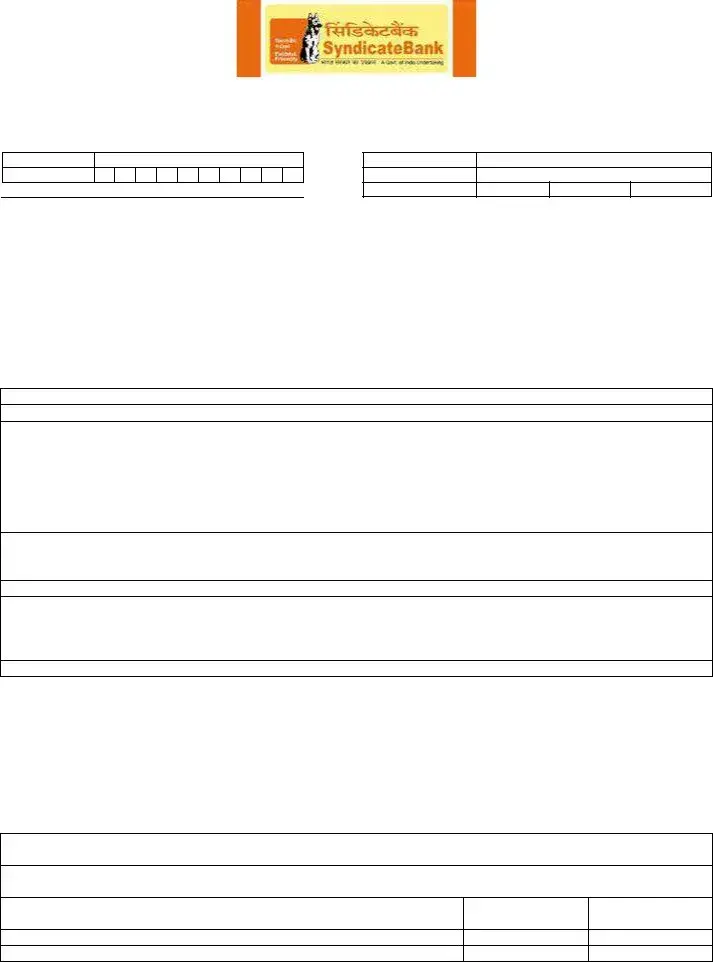

2b. LOAN/OD/CASH CREDIT FACILITY, ETC., ENJOYED WITH OTHER BANKS/BRANCHES : (tick (i) or (ii) whichever is applicable)

i) At present I am enjoying the following facilities with other Banks/Branches

Name of the Bank/Branch

Nature of facility

Original Advance/Limit

Balance outstanding

Securities

ii)At present I do not enjoy any credit facilities with any Bank/Branch. I undertake to inform you as and when credit facilities are availed by me with other Banks/Branches

|

3. OPERATING INSTRUCTIONS FOR JOINT SB/CURRENT ACCOUNTS: |

|||

Single |

|

Jointly |

|

either/any one or survivor |

|

|

|||

We request and authorize you, until any one of us shall give you notice in writing to the contrary, to

honour all cheques or other orders drawn or Bills of Exchange accepted or notes made on our behalf signed by (1) …………………………………… (2) ………………………………………… (3) ……………………………

of us jointly and/or severally and to debit such cheques to our account with you whether such account be for the time being in credit or overdrawn. We also request you to accept the endorsement of

(1)…………………………….. (2) ……………………………………. (3) ………………………………….. of us jointly and/or severally on Cheques, Orders, Bills or Notes payable to us. We shall be jointly and severally liable to you for any monies owing to you from time to time in case the account is overdrawn and/debit balance is caused including your commission, interest at the appropriate rate and other incidental charges.

In the event of death, insolvency or withdrawal of any of us, the Survivor/s of us shall have full control of any monies then and thereafter standing to our credit in our Account with you, and in that event the Survivor/s will have full powers to operate the Account and/or to close the Account.

4. PROPRIETORSHIP ACCOUNTS

I………………………………… am trading under the name and style of ……………………………………………

and that I am the sole proprietor of the said concern. I authorize you to open the account in the name of

M/s…………………………………………….. and any cheques, instruments etc. payable to self and/or

M/s……………………………………………… may also be accepted, collected and credited in the said account

at my risk and responsibility. I further wish to intimate that I am responsible for all the transactions entered into and obligations incurred with you whether under the trade name or in my individual name or in conjunction with others till I inform in writing otherwise.

Signature of the Proprietor

(without Rubber Stamp of the Firm)

5. MINOR’S ACCOUNTS

I ………………………………………………. hereby declare that I will represent the said Minor as *Natural

Guardian/Guardian appointed by the Court in all future transactions of any description in the above account until the said Minor attains majority, I shall indemnify the Bank against the claim of above Minor for any withdrawal/transaction made by me in his/her account.

*Strike out whatever is not applicable

Relationship with the Minor:Signature of the Guardian with Date:

6. AUTHORISATION FOR AVAILING “SWEEP OUT, SWEEP IN” FACILITY:

I hereby authorize you to transfer amounts in excess of Rs………………………... in my SB Account

No…………………………… on any day into a fixed deposit of 180 days/one year one day/3 years tenor in

units of Rs.1000/10000. I further authorize that inadequacy of funds in my SB account referred above may be met any time by prematurely breaking the fixed deposit into units of Rs.1000/10000 and transferring the required amount into the said SB Account.

7. Nomination

I, __________________________________________________________________________________________________

(Name & Address of the customer) nominate following person to whom, in the event of my/our/minor’s death, the amount of the deposit outstanding in the above said account, (after adjusting the amount due, if any, to the Bank) may be paid by SyndicateBank .

Nature of Account |

Account Number |

Additional details, if any |

SB/Current Account |

|

|

Nominee |

|

|

Name & address of the Nominee

Relationship with the accountholder

Age

If nominee is a minor,

Date of Birth *

*As the nominee is a minor on this date, I appoint Sri/Smt./Kum._______________________________________

__________________________________________________________________________________________________________________

(name, age, relationship and address)

to receive the balance lying in above said a/c. on behalf of the nominee in the event of my/our/minor's death during the minority of the minor.

I do not require any nomination.

I request you to indicate/not to indicate the name of the nominee on the passbook.

*Strike out if nominee is not a minor. Place:

Date:

**Signature(s) of Account holder(s)

**Where account is in the name of a minor, the nomination should be signed by a person lawfully entitled to act on behalf of the minor.

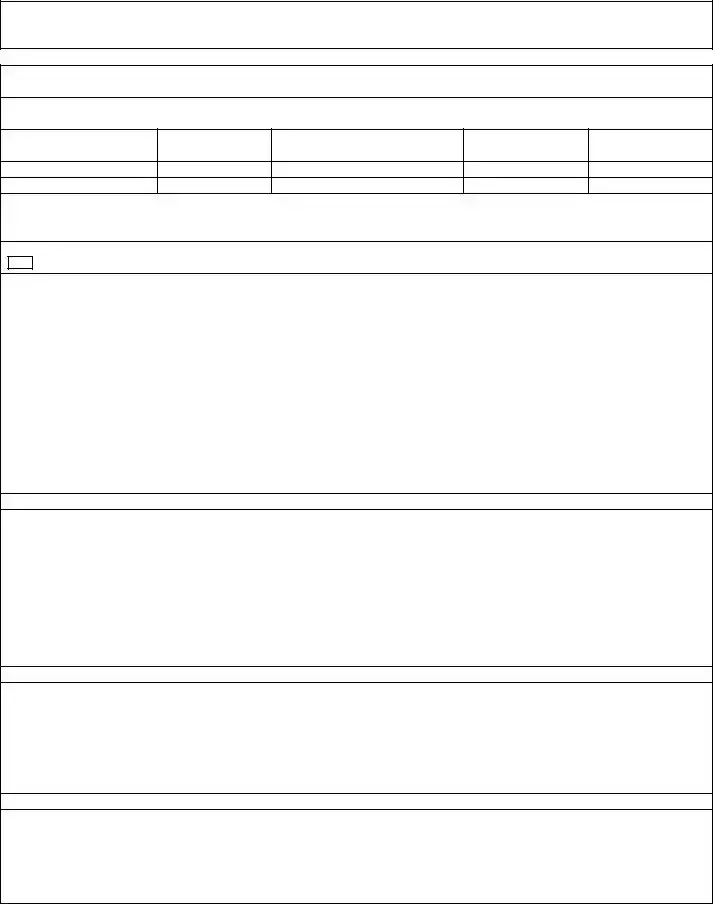

8. APPLICATION FOR CHANNEL REGISTRATION

I hereby apply for access to/use of the following channels (Please tick the appropriate Box)

Global Debit/ATM Card

SMS facility

SMS facility

SyndinetBanking

Any Branch Banking with Multicity cheques

The Global Debit/ATM Card should Carry my name as

(Operate account |

|

particulars for identification |

from any |

over phone etc. |

CBS branch) |

…………………………………………….. ………………….. ………………………………….. …………………….

1st Applicant

…………………………………………….. ………………….. …………………………………. …………………….

Joint Applicant 1

…………………………………………….. ………………….. …………………………………. …………………….

Joint Applicant 2

*Please write unique personal identification information, for authenticating the card holder, which will, be useful to the Bank to identify you in case you forgot your ATM PIN or to service any other specific request.

Declaration

I have read and understood the Terms and conditions (a copy of which supplied to me by the bank and I am in possession of) relating to the Channels mentioned hereinabove.

I understand that any changes in terms and conditions applicable to the channels mentioned above would be made available to me on request at the branch/displayed on Branch Notice Board.

I undertake that I will be wholly liable/responsible for all types of transactions done on my above said account through my card(s) issued by the Bank to me. I have read the rules and regulations with regard to issue of SyndicateBank VISA Global Debit/ATM Card and I shall abide by the same.

I hereby declare that the transactions under this/these Debit Card(s) shall be strictly in conformity with the guidelines under Foreign Exchange Management Act (FEMA), and that they will not be designed for the purpose of any contravention or evasion of the provisions of the FEMA or any rule, regulation, notification, direction or order made thereunder from time to time.

I further undertake that it will be my sole responsibility to adhere to the provisions of the FEMA or any rule, regulation, notification, direction or order made thereunder from time to time, while transacting with this/these Debit Card(s).

I accept and agree to be bound by the Terms and Conditions including those excluding/limiting the Bank’s liability in respect of SyndinetBanking. I understand that the Bank may, at its absolute discretion, discontinue any of the services completely or partially without any notice to me. I agree that the Bank may debit my account for service charges as applicable from time to time. I confirm that I am resident of India.

I hereby confirm that all accounts under this Customer ID are operated singly and in case of joint account, operated by either or survivor/anyone of survivor(s).

I hereby authorize issuance of Global Debit/ATM Card and provision of TeleBanking/Syndinet Banking services as above. I undertake to ratify and confirm all that the user/(s) do/(es) or cause(s) to do through Global Debit/ATM Card, Telebanking/SyndinetBanking channels. This authority shall continue to be in force until any one of us revokes it by a notice in writing delivered to you.

Please dispatch the SyndicateBank Global debit/ATM card, Tele Banking

I am aware that Savings Accounts can be opened by Individuals for

I will provide all necessary documentation as mandated by the Regulatory/Bank Authorities for opening the accounts.

I declare, confirm and agree:

a.That all the particulars and information given in the Application form are true, correct, complete and up to date in all respects and I have not withheld any information.

b.That I have/had no insolvency proceedings initiated against me nor have I ever been adjudicated insolvent.

c.That the Multicity cheques/Any branch Banking facility will not be utilized for making money/profits by conducting commission agency business or otherwise.

d.That I have received a copy of the Code of Bank’s Commitment to customers.

I agree, undertake and authorize:

a.SyndicateBank or their agents to make references and enquiries relative to information in this application which SyndicateBank or their agents consider necessary.

b.to keep the Bank informed at all times, of any change in my communication address and employment and authorize the Bank to update the change in their books. I shall be solely responsible to ensure that the Bank has been informed of the correct address for communication. I agree to indemnify the Bank against any fraud or any loss or damage suffered by the Bank due to my providing any incorrect communication address or any other reason not attributable to Bank.

c.Bank to exchange, share or part with all the information relating to my loan/investment/credit facility details and repayment history information to other Banks/Financial Institutions/Credit Bureaus/Agencies, Statutory Bodies as may be required and shall not hold SyndicateBank liable for use of this information.

d.To provide any further information that SyndicateBank may require from time to time.

e.To pay any debit balance/overdrawal allowed either at my request or by compulsions of circumstances or oversight or mistake.

9. APPLICANT’S SIGNATURE / THUMB IMPRESSION

I confirm the correctness of the information furnished in this application. I am agreeable to abide by the rules pertaining to the deposit in force from time to time.

1st APPLICANT |

JOINT APPLICANT 1 |

JOINT APPLICANT 2 |

Signature |

Signature |

Signature |

|

|

|

10.ACCOUNTS OF DEPOSITORS USING THUMB IMPRESSION:

Attestor’s Name and A/c No.:

Full address of the Attestor:Signature of the Attestor with date

11. INTRODUCER’S DETAILS (FOR NEW CUSTOMER)

I have known the depositor for ………… years. I confirm the identity and address of the applicant.

Name: ……………………………………… Customer ID No………………………… A/c No……………………

Date: |

Signature of the Introducer |

(FOR BANK USE ONLY)

Signature of introducer verified and account is opened as per information furnished by depositor(s) exercising due diligence. Debit Card issue approved. Customer ID informed. Relevant flag for ATM/Debit Card/Tele- banking/Syndinet Banking/ABB has been set. Data forwarded to DCC/IVR Centre/Internet Banking Cell on

………………………………

Nomination Registration No. & Date.

KYC Certification:

The applicant has signed this form in my presence. I have verified the copy of the documents submitted as identity proof and address proof with the originals as produced by the applicant.

Whether the account is KYC compliant : YES/NO

Date:Account No.:Officer/Manager Head of the Branch

Note:

Any one of the following documents (subject to the satisfaction of the Bank) is accepted as –

|

Identity Proof |

Address Proof |

|

|

Passport |

Passport |

|

|

PAN Card |

Telephone bill |

|

|

Voter’s Identity Card |

Bank Account Statement |

|

|

Driving Licence |

Electricity bill |

|

|

Letter from a recognized public authority or public |

Ration Card |

|

|

servant verifying the identity and residence of the |

Letter from Employer (subject to satisfaction of the |

|

|

customer to the satisfaction of the Bank. |

Bank) |

|

|

|

Letter from a recognized public authority or public |

|

|

|

servant verifying the identity and residence of the |

|

|

|

customer to the satisfaction of the Bank. |

|

|

|

|

|

|

|

|

|

|

|

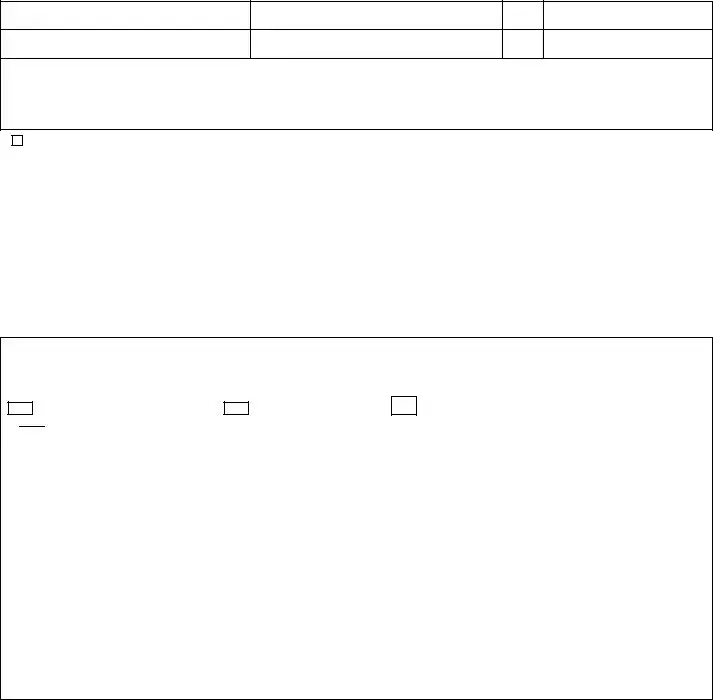

CUSTOMER PROFILE |

|||

|

|

………………………………………… Branch |

|||

Residential status: Domestic/NRI |

|

*Risk allotted: High/Medium/Low |

|||

|

|

|

|

|

|

Account No |

|

|

Date of opening |

||

Name/s of the Accountholder |

|

|

|

||

Business Name (for CA only) |

|

|

|

||

|

|

|

|

|

|

Present Address |

|

|

|

||

|

|

|

|

|

|

Profession |

|

|

|

|

|

(Advocate/Doctor/Teacher/Pensioner/Sr.Citizen/Staff/Ex- |

|

|

|

||

Servicemen/ Student Agriculturist/ Housewife/Service/ Labourer/ |

|

|

|||

unemployed etc) |

|

|

|

|

|

Telephone Number |

|

Res:………………………Office………………………. |

|||

|

|

|

|

Mobile …………………………………………………. |

|

Purpose of opening the account |

|

|

|

||

(Savings/salary/pension/remittance from relatives,friends/ |

debit |

|

|

||

card/share trading/social service, etc.) |

|

|

|

||

Potential activity expected in the account |

|

|

|

||

Turnover |

|

|

Monthly/Annual Rs. |

||

Annual Income |

|

|

Rs. |

||

Source of funds |

|

|

|

|

|

(salary/remittance from friends, relatives/pension/share trading/ |

|

|

|||

house rent/ agriculture/cooly/business income (for CA only)) |

|

|

|

||

Observations of the official opening the Account |

|

|

|||

Date: |

|

|

Signature of Branch Head/Officer |

||

*Examples of classification of customers: |

|

|

|

||

High Risk |

|

Antique dealers, Money Service Bureaus, Dealers in Arms, Casino, |

|

||

|

|

by Professional Intermediaries, Customers who live in high risk countries as per IBA list, Political exposed |

|

||

|

|

persons, Correspondent Banking. |

|

|

|

|

|

Note: Opening of above types of accounts shall be permitted by ROs only |

|

||

|

|

|

|

||

Medium Risk |

|

Trust/Charities/NGOs and Organizations receiving donations, Companies having close family share holding or |

|

||

|

|

beneficial ownership, Firms with Sleeping partners |

|

||

|

|

Note: Above type of accounts shall be opened with prior approval of ROs only |

|

||

|

|

High networth individuals with assets of Rs.1 cr. and above. |

|

||

|

|

|

|

|

|

|

|

Accounts having transactions (yearly credit summations) of Rs.20 lac & above. |

|

||

|

|

Note: The above type of accounts shall be opened by the branches and detailed information to be sent to |

|

||

|

|

ROs for noting at their end. |

|

|

|

Low Risk |

|

All customers who are not high/medium risk customers. |

|

||

|

|

These are the type of customers whose identity and source of wealth can be easily identified and the |

|

||

|

|

transactions in whose accounts by and large conform to the known profile. |

|

||

|

|

Example: Salaried employees, people belonging to lower economic strata of the society whose accounts |

|

||

|

|

shows small balances and low turnover. |

|

|

|

CUSTOMER PERSONAL INFORMATION FORM

(USE SEPARATE FORM EACH JOINT A/C HOLDER)

Customer ID

Cust IC :

Name of the Customer |

|

|

FIRST NAME |

MIDDLE NAME |

SURNAME |

Date of Birth: DD/MM/YYYY

SEX

M / F

PAN/GIR NO.

(form 60/61 to be submitted in the absence of PAN/GIRNo.)

Residence |

|

|

Mobile/Cell No. |

|

|

|

|

|

Telephone No. |

|

|

|

|

|

|

|

|

|

|

Line of Business |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

RESIDENTIAL ADDRESS |

|

OFFICE/BUSINESS ADDRESS |

|

|

||||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

PIN CODE: |

FAX |

PIN: |

TEL NO.: |

FAX: |

||||

|

|

|

|

|

|

|

|

|

Customer’s Signature: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Customer Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Customer ID: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Photograph

Affix recent Photograph:

Date:

For Bank Use only

Customer ID

Cust IC :

Category

Signature of employee |

Signature of Authorised Officer |

Entered in CBS using CIM/09

Signature scanned & linked

Photograph scanned & linked

Branch Name: _____________________________________

BIC : _____________________________________

Date: _____________________________________

This information is furnished voluntarily for the bank purpose and may be used for the purpose of cross selling of Bank Products or any other purpose:

Name of the Customer:

Customer ID

If married, Spouse Name: |

|

|

|

|

|

|

|

|

|

|

Spouse occupation: |

||||||||||

Number of Children: |

|

|

|

|

|

|

|

|

|

|

No. of dependants: |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Education |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

SSC/HSC |

|

|

|

|

|

|

|

|

|

|

|

Graduate |

|

|

|

|

Professional |

||||

Annual Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Range |

|

|

|

|

|

Account holder |

|

|

|

|

|

|

|

Spouse |

|||||||

Upto Rs.50000/- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Rs.50000/- - Rs.2.00 lakh |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Rs.2.00 lakh – Rs.5.00 lakh |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Rs.5.00 lakh – Rs.10.00 lakh |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Above |

Rs.10.00 lakh |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

DO YOU OWN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

House |

|

|

Two Wheeler |

|

Car |

|

|

|

|

Computer |

|||||||||||

Mobile Phone |

|

|

Air conditioner |

|

Internet connection |

|

Club Membership |

||||||||||||||

Your Preferred investment options |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Bank Deposits |

|

|

|

|

Company Deposits |

|

|

|

Mutual funds |

|

|||||||||||

Real estate/Property |

|

|

Gold/Bullion |

|

|

|

|

|

|

Shares/Debentures |

|

||||||||||

Govt. Dep. (PPF,NSC,Relief Bonds etc.) |

|

|

|

|

|

Any Other (specify) |

|||||||||||||||

Reasons for Banking/choosing to Bank with us |

|

|

|

|

|

|

|

||||||||||||||

Convenient Location of Branch/ATM |

|

|

|

|

|

|

Approach by Bank |

Staff |

|

||||||||||||

Recommended by friends/relatives |

|

|

|

|

|

|

Receiving monthly salary |

|

|||||||||||||

Please indicate other reasons if any: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Please indicate your hobby |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Reading |

|

|

Music |

|

|

|

|

|

Sports |

|

|

|

|

Travel |

|||||||

Indicate any other area of special interest |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Do you have a Credit Card? |

Yes/No |

If yes, name of the issuer |

|

|

|

|

|

|

|||||||||||||

Do you require a bank loan? Yes/No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

If yes, purpose of the loan: |

|

|

|

|

|

|

|

Amount needed (approx.) |

|||||||||||||

Loans availed in the last 3 years (from any institution) for (tick as applicable) |

|||||||||||||||||||||

Business |

Housing |

Durables |

|

Loans against shares |

Others |

|

|

|

|||||||||||||

Facilities you would like to avail from Bank out of the following (tick as applicable) |

|||||||||||||||||||||

ATM |

Telebanking |

|

Internet Banking |

|

|

|

|

|

|

||||||||||||

Any other facility you would like the Bank to extend (like payments of electricity bills, telephone bills, tax and water bills) etc.

a) |

b) |

c) |

(Signature)

Acknowledgement of Nomination

(This acknowledgement is to be issued to the depositor/customer in respect of nomination

made under deposits/articles under safe custody/lockers)

BRANCH:

DATE:

1.Name and address of depositor(s)/customer(s):

2.Particulars of deposit/safe custody article/locker:

3.Nomination made in favour of (Mention name and address):

For SyndicateBank

Date:

OFFICER/BRANCH HEAD

Form Characteristics

| Fact Name | Description |

|---|---|

| Account Types Offered | The form allows for the opening of Savings, Savings Super Premium, and Current Accounts based on the applicant’s needs. |

| Personal Information Requirement | Applicants must provide personal details such as name, date of birth, and address, ensuring clear identification. |

| Joint Account Operating Instructions | The form provides options for operating instructions, including single or joint operation of the account, enhancing flexibility for account holders. |

| Nomination Process | Applicants may nominate a person to receive account funds upon their death, ensuring financial security for their loved ones. |

Guidelines on Utilizing Syndicate Bank Account Opening

Completing the Syndicate Bank Account Opening form is an important step toward establishing your banking relationship. In the following steps, you will gather necessary information and fill out each section accurately. Ensuring the form is completed carefully will facilitate a smooth account opening process.

- Begin by addressing the form: Write the branch name where you wish to open the account.

- Fill in the Customer IC and Customer ID if applicable, and the desired Account Number.

- Write the Product Name (Savings/Savings Super Premium/Current Account) and choose the Risk Category (Low, Medium, High) by ticking the appropriate box.

- Provide the place and date at the top of the form.

- Complete your Personal Details section: enter your first name, middle name, and surname. Indicate if you are Mr./Mrs./Ms. Fill in your Father's/Mother's/Husband's name, age, and Date of Birth.

- If applicable, provide the details of Joint Applicants by repeating the previous step for each joint account holder.

- If the applicant is a minor, include the name of the Parent/Guardian. For current account applicants, indicate the Firm Name and Constitution (e.g., Proprietorship, Partnership, etc.).

- Next, fill in your Mailing Address, including the PIN code, telephone number, mobile number, and email address.

- If you are an existing account holder, enter your Customer Identification Number and Account Number. Also provide your PAN/GIR Number.

- Go to the Bank Accounts section: tick either option (i or ii) to indicate whether you have accounts with other banks. If you tick option (i), fill in the additional details as required.

- Move to the Loan/OD/Cash Credit Facility section: again, tick either option (i) or (ii) and complete the details if necessary.

- For operating instructions for Joint SV/Current Accounts, select between 'Single', 'Jointly', or 'Either/Any One or Survivor' and fill in the names of all account holders.

- If applicable, fill in the Proprietorship Accounts section, including trading name details and signatures.

- In the Minor’s Accounts section, declare the Guardian’s relationship with the minor and provide the Guardian's signature.

- For Sweep Out/Sweep In Facility, authorize the transfer of funds by specifying the amount and account details.

- Complete the Nomination section by providing the nominee's name, address, and relationship to the account holder. Specify if the nominee is a minor and provide the name of the guardian if needed.

- Indicate your application for channel registration by ticking the appropriate box for services like Global Debit/ATM Card, SMS facility, or Syndicate Banking.

- Read and acknowledge the Declaration section, providing accurate information and your consent for the terms laid out. Sign as the 1st applicant, or any joint applicants if applicable.

- If applicable, include details for any account holders using a thumb impression.

- Finally, fill in the Introducer’s details if you are a new customer, signing off with your introducer’s signature.

What You Should Know About This Form

What is the Syndicate Bank Account Opening form used for?

The Syndicate Bank Account Opening form is used to apply for opening a savings or current account with the bank. It collects essential information about the applicant, such as personal details, address, and account preferences. This form also allows customers to access various banking products and channels offered by Syndicate Bank.

What information do I need to provide on the form?

You will need to provide various personal details, such as your first name, middle name, surname, and age or date of birth. You also need to include your mailing address, phone number, and email address. Additionally, details of any existing accounts with other banks, credit facilities, and your parent's or guardian's name (if applicable) must be provided. Make sure to include your initial deposit amount as well.

Can I apply for a joint account using this form?

Yes, the form includes sections where you can provide details for joint applicants. You will need to fill in the personal information for each joint account holder, including their relationship to you. Specify how you would like to operate the account, such as jointly or singly. Make sure all joint applicants sign the form as required.

What should I do if I am a minor?

If you are a minor, a guardian must fill out the application on your behalf. The guardian will need to declare their relationship to you and sign the form. They will act as your authorized representative until you reach the age of majority. It's crucial to provide all required documentation to verify the guardian's identity.

What is the 'sweep out, sweep in' facility mentioned in the form?

The 'sweep out, sweep in' facility allows you to manage your funds more effectively. If your savings account balance exceeds a certain amount, the excess funds will be moved into a fixed deposit to earn higher interest. If your account lacks sufficient funds for transactions, the bank can break the fixed deposit to meet your needs. Specify the amounts and terms when filling out the application.

Do I need to provide identification and address proof when opening an account?

Yes, you must provide valid identification and address proof documents. The bank accepts various forms of ID, such as a passport, driving license, or voter’s ID. Ensure that the documents you submit are original and match the information you have provided on the application form to meet the KYC (Know Your Customer) requirements.

What happens after I submit the account opening form?

Once you submit the form, the bank will review it along with the submitted documents. If everything is in order, your account will be opened, and you will receive details regarding your new account, including the customer ID and any debit cards you have applied for. The bank may also contact you for further verification if necessary.

Can I change my personal information after opening the account?

Yes, you can update your personal information with the bank after the account is opened. It's essential to keep your contact details current to ensure you receive all communications from the bank. To make changes, you will likely need to fill out a form or submit a written request to the bank, along with any necessary documentation supporting the change.

What if I want to nominate someone for my account?

The form includes a section for nominations. You can provide details about the person you wish to nominate, who will receive your account funds in the event of your death. If your nominee is a minor, you will also need to appoint a guardian for the nominee to handle the funds until they reach adulthood. Make sure to provide all required information accurately.

Common mistakes

When filling out the Syndicate Bank Account Opening form, many applicants stumble over common errors that can delay the process. It’s important to pay attention to details, as even small mistakes can cause significant issues. Understanding these pitfalls can help ensure a smoother experience.

First, one of the biggest mistakes is not accurately completing personal details. Missing out on crucial information, such as your full name, date of birth, or correct mailing address, can lead to processing delays. Each section must be filled out completely and accurately to avoid complications.

The second mistake is failing to select the correct account type or product. Applicants often overlook details regarding the specific type of account they wish to open, leading to confusion later on. If you are unsure, clarifying this with bank personnel beforehand can save time and hassle.

Another error is neglecting to provide proper identification and supporting documents. It’s essential to include the necessary proof of identity and residence as required by the bank. Incomplete submissions can lead to rejections and require resubmissions.

Additionally, many applicants forget to sign the application form. A missing signature can be a simple oversight but will halt the process entirely. All required signatures should be clearly present in their designated areas.

Joint account applicants often make the mistake of providing inconsistent details. Each joint applicant must ensure that their information aligns with what the other has provided. Discrepancies can raise red flags during verification.

Moreover, applicants sometimes fail to read the terms and conditions completely. Understanding the rules of the account can prevent misunderstandings regarding fees and processes. Familiarizing yourself with these details upfront can lead to a more positive banking experience.

Another common mistake centers around the nomination process. Some applicants either forget to fill it out or do it incorrectly. This can have serious implications, especially in sensitive situations. It’s vital to take this section seriously and ensure all relevant details are correctly filled in.

Lastly, neglecting to double-check the application before submission can lead to multiple errors slipping through. A final review can catch any missing information or mistakes, ensuring the application is ready for processing. Taking a moment to verify everything can make a huge difference.

Documents used along the form

When applying for an account with Syndicate Bank, several documents and forms are typically required to ensure a smooth process. Here is a list of commonly needed forms and documents that should accompany the Syndicate Bank Account Opening form. Each serves a specific purpose in the application process, helping to verify identity, address, and other critical information.

- Identity Proof: This document confirms the identity of the account holder. Common forms include a passport, PAN card, voter’s ID, or driving license.

- Address Proof: To verify the residential address, applicants may use documents such as utility bills (electricity, water), bank statements, or any official communication with a registered address.

- Personal Information Form: This form collects personal details such as name, address, contact information, and other relevant data, usually accompanied by a photograph and signature.

- Nomination Form: In this document, the account holder designates a person to receive the account balance in the event of their death. This is important for ensuring a smooth transfer of assets.

- Minor Accounts Declaration: If the account is for a minor, this declaration must be filled out by a guardian indicating their relationship to the minor and providing necessary assurances for account management.

- Direct Debit Authorization: This document allows the bank to automatically withdraw funds from the account for set payments, such as loan repayments or service fees, when authorized by the account holder.

- Introducer’s Details: This is a written statement from an existing customer of the bank attesting to the identity and integrity of the new applicant. It helps in establishing trust within the banking community.

- Application for Channel Registration: If the account holder wishes to access online banking or mobile banking services, this application form must be completed, indicating preferences for various banking channels.

It's essential to gather all the necessary documentation before submitting the account opening application. This ensures that the process is efficient and reduces the need for follow-up submissions. Proper preparation will make your banking experience more straightforward and less stressful.

Similar forms

The Syndicate Bank Account Opening form is crucial for individuals seeking to establish a banking relationship. It shares similarities with several other important documents in the banking and legal landscape. Here are ten documents that have comparable elements with the Syndicate Bank Account Opening form:

- Bank Loan Application Form: Like the account opening form, this document requires personal details, identification verification, and an understanding of the terms and regulations related to the financial product.

- Mortgage Application Form: This form asks for personal and financial information. Both documents require consent to share financial history and details with the lending institution.

- Credit Card Application Form: Similar to the account opening form, it includes personal identification, consent to terms and fees, and a credit history declaration.

- Business Account Application Form: Both forms require information about the applicant, the nature of the account, operating instructions, and identification of joint account holders if applicable.

- Nomination Form: Just as this account opening form includes a nomination section, other nomination forms permit account holders to designate beneficiaries, which helps ensure clarity for funds distribution in case of death.

- Retirement Account Application Form: This document shares the need for personal information and agreements on operating instructions. Both focus on long-term financial planning.

- Trust Account Opening Form: Much like the Syndicate form, trust account documents often require identification of the trustee and details about how the account will be managed.

- Insurance Application Form: This application also seeks personal details and declarations of health or circumstances relevant to the risk being covered, similar to the risk assessment in bank forms.

- Utility Account Setup Form: While establishing utility accounts, individuals provide personal information, agree to terms, and set up payment instructions – mirroring aspects of banking forms.

- Investment Account Application Form: These forms require personal details, risk assessments, and agreements to the terms governing investment activities, aligning closely with those required for opening bank accounts.

Dos and Don'ts

When filling out the Syndicate Bank Account Opening form, there are key things to keep in mind to ensure a smooth application process. Here’s a list of what you should and shouldn’t do:

- Do read all sections of the application thoroughly before you start filling it out.

- Do provide accurate and complete personal information, including your name, address, and identification details.

- Do double-check the risk category you select for your account to align with your financial needs.

- Do sign where required, ensuring your signature matches the identification proof you provide.

- Don’t leave any mandatory fields blank; incomplete forms may delay your application process.

- Don’t provide false or misleading information; this can lead to the rejection of your application or future complications.

Following these guidelines will help in efficiently processing your account opening request at Syndicate Bank.

Misconceptions

Misconception 1: The account opening form is too complicated.

Many people believe that the application for opening a Syndicate Bank account is overly complex. In reality, the form is designed to be straightforward, guiding you through essential information like personal details, identification, and account preferences. All you need to do is carefully fill in the required fields and provide the necessary documents.

Misconception 2: I cannot open a joint account if I already have an individual account.

Some individuals think that holding an existing individual account prevents them from opening a joint account. This is not true. You can have multiple types of accounts, including both individual and joint accounts, at the same bank. Just ensure that you specify the account type and provide details for co-owners when filling out the form.

Misconception 3: My application will be rejected if I have accounts in other banks.

There's a common fear that having existing accounts at other banks could lead to rejection. However, this is not the case. The form even includes sections where you can list other accounts and banking relationships. Honesty is key; just accurately disclose your other accounts or banking facilities when requested.

Misconception 4: I don’t need to nominate a person for my account.

Some may overlook the importance of nominating someone for their bank account, thinking it's optional. It's actually a protective measure that ensures your funds are handled according to your wishes in the event of unforeseen circumstances. Even if you choose not to nominate anyone, be prepared to acknowledge this decision in the form.

Key takeaways

Filling out the Syndicate Bank Account Opening form involves several key steps and considerations. Here are the essential takeaways:

- Understand the Account Type: Determine whether you want to open a Savings or Current account.

- Gather Personal Information: Provide details such as name, age, and address accurately.

- Initial Deposit: Include the initial deposit amount clearly in words and numerals.

- Joint Accounts: If applicable, specify the operating instructions for joint accounts.

- Nomination: Consider nominating a person for the account in the event of your death.

- Declarations: Be prepared to declare details about your other bank accounts and loans.

- Signature Requirement: Ensure all applicants sign the form and provide thumb impressions if necessary.

- Provide Proof: Attach necessary identification and address proof documents as specified.

- Review and Understand Terms: Familiarize yourself with the bank’s rules and terms before signing.

By being thorough and prepared, you can smoothly navigate the process of opening your account with Syndicate Bank.

Browse Other Templates

What Is New York Sales Tax - When filling out the form, ensure that all provided information is accurate to prevent processing delays.

I Have Forgotten My Fcmb Account Number - Document any specific service requests or alterations you wish to make.

Dhs 38 Verification of Employment - The form includes a section dedicated to documenting disability or workers' compensation benefits.