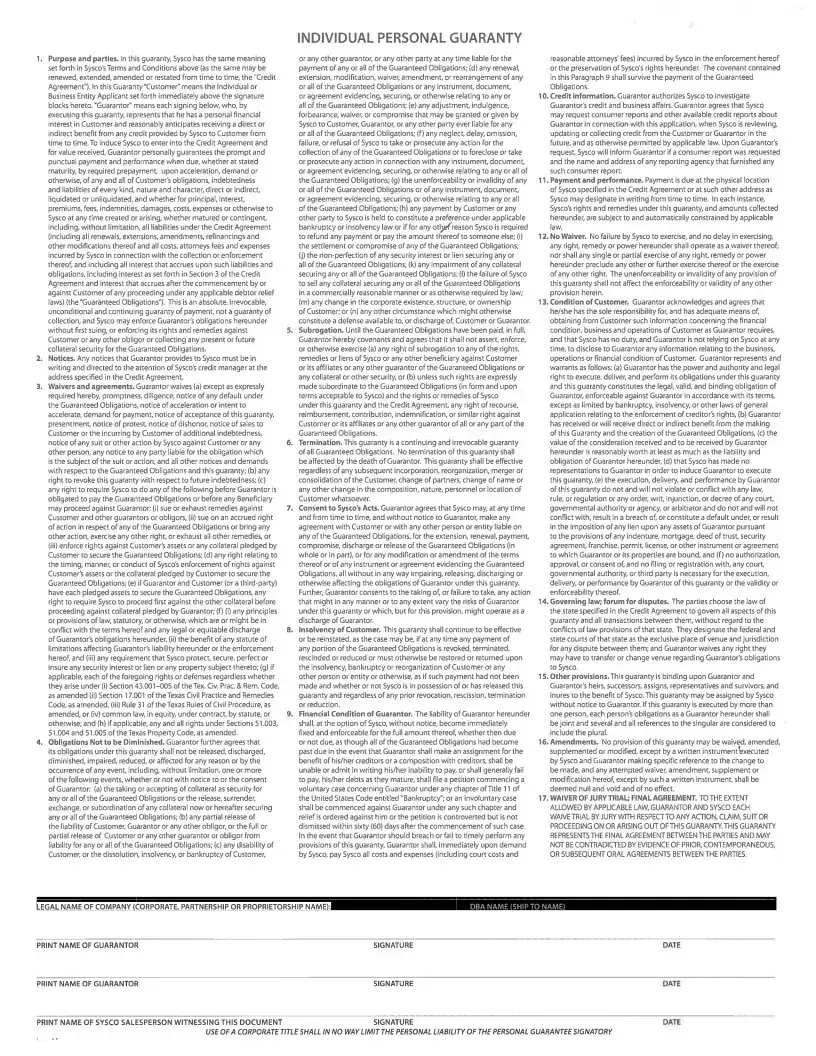

Fill Out Your Sysco Customer Account Application Form

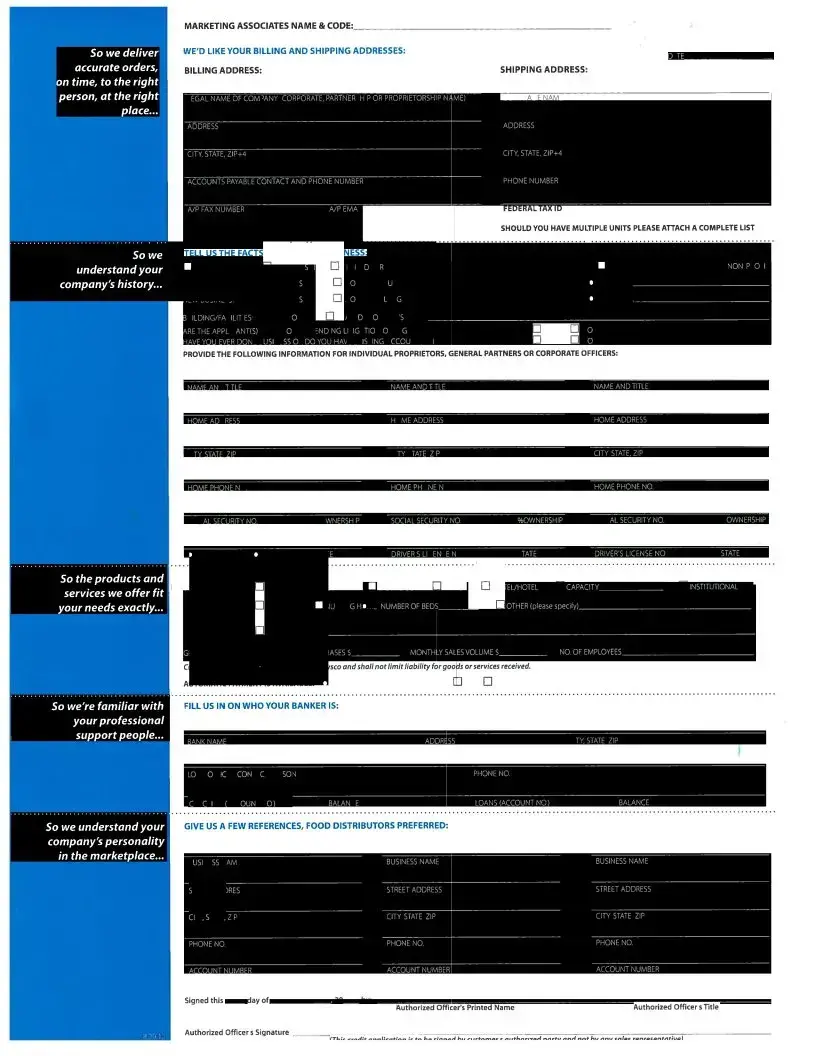

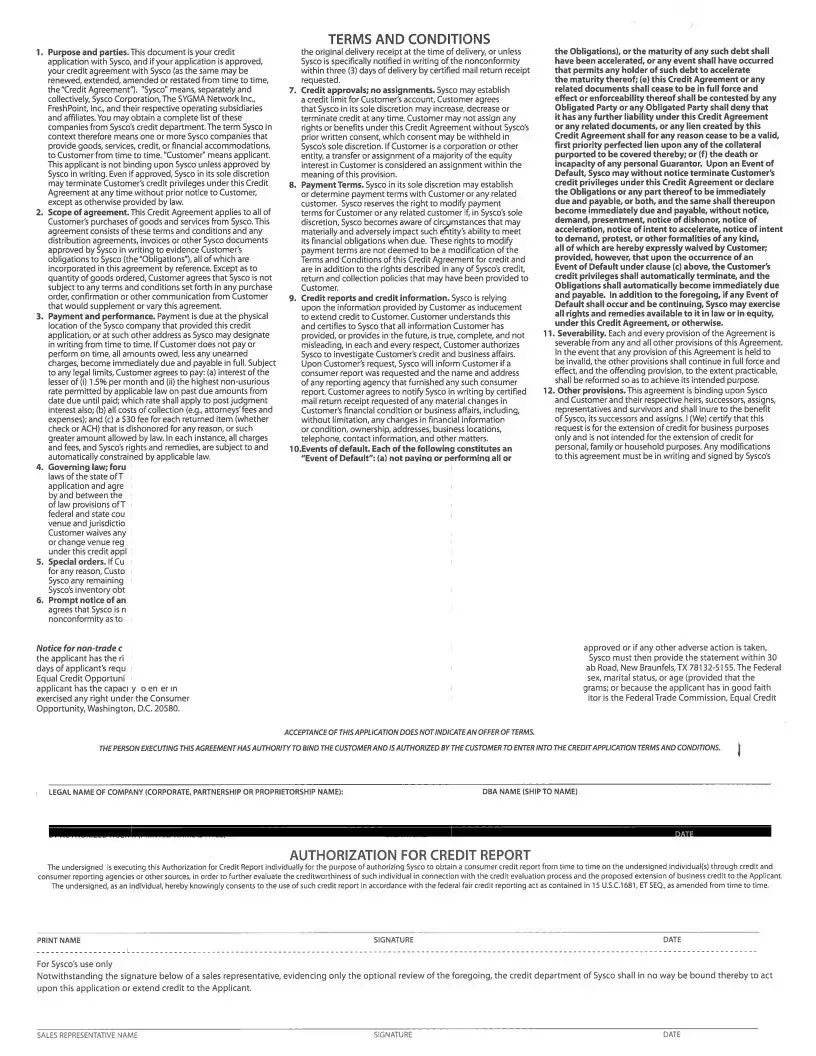

The Sysco Customer Account Application form serves as a vital tool for businesses seeking to partner with Sysco, specifically Sysco Central Texas, Inc. This form contains essential sections that gather important information regarding a company’s identity and operations. Applicants are required to provide their legal business name, contact information for accounts payable, and shipping addresses. It also captures details about the business structure and ownership, making it clear whether the entity is a corporation, partnership, or sole proprietorship. Understanding the background of your business is crucial, so you will be asked to share insights on its history, including the length of time in operation, ownership transfers, and any existing relationships with Sysco entities. The form encourages applicants to describe their business operations in-depth, including the type of cuisine offered, weekly purchases, and monthly sales volume, which helps Sysco align its product offerings with your specific needs. Important banking information and references from food distributors are also requested to provide Sysco with a comprehensive picture of the business’s financial health and industry connections. Lastly, signatures of authorized officers are required to confirm the accuracy of the information provided, ensuring that all details are up to date and reliable.

Sysco Customer Account Application Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Entity Type | The application accommodates various business structures, including sole proprietorships, partnerships, limited partnerships, corporations, and limited liability companies. |

| Business Information | Applicants must provide details about the type of business, including capacity for restaurants and institutions. |

| Contact Information | Each applicant is required to submit contact information for accounts payable, including phone numbers and email addresses. |

| Federal Tax ID | Applicants are requested to provide a Federal Tax ID, which is necessary for tax reporting purposes. |

| Owner's Information | The form requires detailed personal information about owners, including their names, addresses, and Social Security numbers. |

| Credit References | Three business references are required. These references preferably include food distributors. |

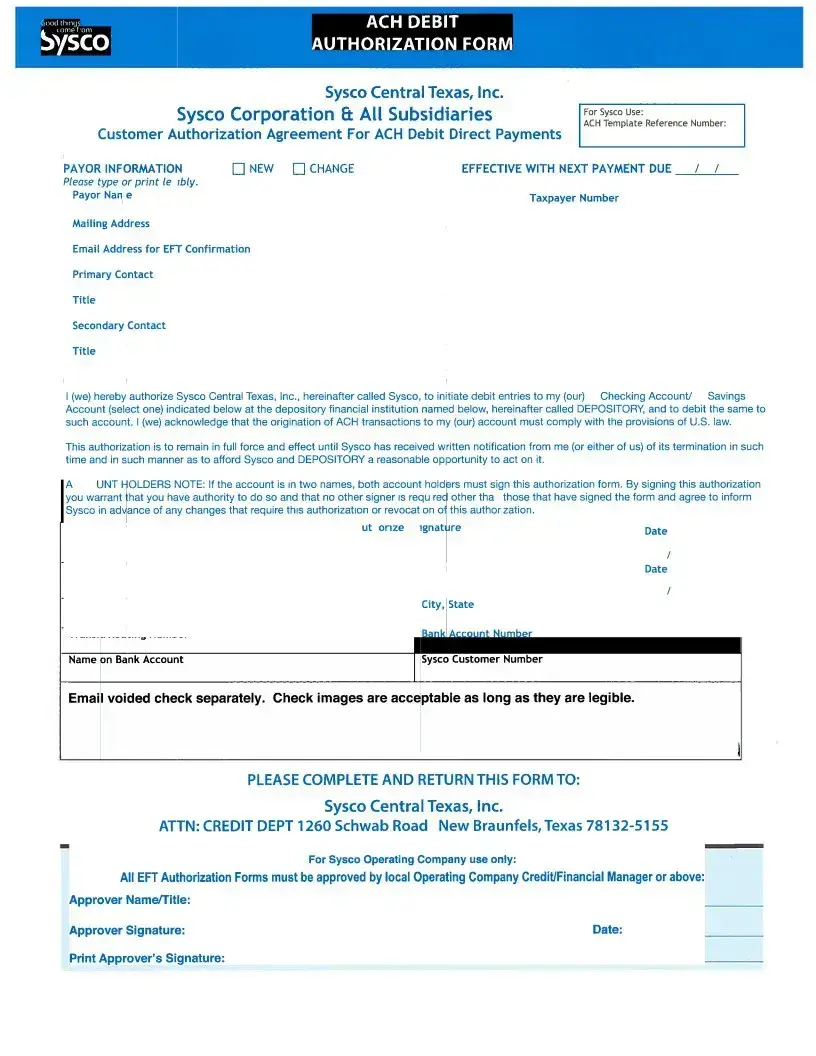

| Automatic Payment Option | The application mentions that automatic payment options are available for customers who inquire. |

| Legal Proceedings | Applicants must disclose if they are involved in any pending litigation or legal proceedings. |

| Historical Context | The form asks for information regarding the ownership history and the length of time in business. |

| Governing Laws | The application is governed by Texas law, as indicated by the address of Sysco Central Texas, Inc. |

Guidelines on Utilizing Sysco Customer Account Application

After completing the Sysco Customer Account Application form, you will submit it for processing. This application allows Sysco to establish a customer account in your name, enabling you to access their products and services.

- Begin by filling in the marketing associates' name and code at the top of the form.

- Provide your billing address, including the legal name of your company and any trade name (DBA) if applicable.

- Include the complete address with city, state, and ZIP+4 code for the billing address.

- Provide your accounts payable contact name along with their phone number, fax number, and email address.

- Next, fill out your shipping address, using the same format as the billing address.

- Indicate your federal tax ID number.

- If you have multiple business units, attach a complete list of them to the application.

- Answer questions concerning your business operations, such as ownership type (proprietorship, partnership, corporation, limited liability company), new ownership, and length of time in business.

- If applicable, indicate whether you are owned or leased and provide relevant owner information, including name, home address, and social security number.

- Describe your business operation, including the type of business, number of employees, and estimated weekly purchases or monthly sales volume.

- Provide banking information, including your bank's name, address, contact person, account numbers, and balances.

- List three references or food distributors, including their business names, addresses, phone numbers, and account numbers.

- Finally, sign and date the application. Include your printed name and title as the authorized officer.

What You Should Know About This Form

What is the Sysco Customer Account Application form used for?

The Sysco Customer Account Application form is designed to gather essential information about your business. By filling it out, you provide Sysco with the necessary details to set up your account, including billing and shipping addresses, business type, and financial references. This helps ensure accurate order processing and timely delivery of services.

What information do I need to provide regarding my business?

You will need to provide several key details about your business. This includes the legal name of your company, business structure (such as corporation or partnership), billing and shipping addresses, and relevant contact information. Additionally, you should include information about your operation type, sales volume, and any existing relationships with Sysco entities.

Are there any specific requirements for the business references?

Yes, when providing business references, it is preferred that you include references from food distributors. You should include the business name, address, phone number, and account number if applicable. These references help Sysco understand your business relationships within the food distribution industry.

How does Sysco ensure that orders are accurate and delivered on time?

Sysco focuses on efficient data collection and processing through the Customer Account Application form. By gathering accurate information upfront regarding your delivery locations and billing, coupled with systematic order management, Sysco can deliver precisely what you need, when you need it.

What should I do if I have multiple business locations?

If your business operates multiple units or locations, you should attach a complete list of these addresses to the application. This ensures that Sysco has full visibility of your operations and can cater to all your locations appropriately.

Can I apply for automatic payments through this application?

Yes, while filling out the application, you can express your interest in automatic payment options. Sysco offers additional information on automatic payments, which can help you streamline your billing process. Just indicate your desire for more information in the specified section of the application.

What if my business is a non-profit organization?

If your business is a non-profit organization, you should still complete the application form. Indicate your status as a non-profit in the appropriate section, and provide any required details regarding ownership and operation for accurate processing of your application.

Who needs to sign the application form?

The application form must be signed by an authorized officer of the business. This individual should also print their name and title under their signature. This step ensures that the application is legitimate and that the signer has the authority to commit the business to the terms outlined in the form.

Common mistakes

Filling out the Sysco Customer Account Application form is a crucial step for businesses looking to establish a relationship with Sysco. However, several common mistakes can hinder your application process. Understanding these pitfalls will help ensure a smooth experience.

One of the most frequent errors involves incomplete information. Applicants often overlook fields, such as the billing and shipping addresses. Missing out on these details can cause delays in processing your account. Double-check your entries to ensure everything is filled out correctly.

Another mistake is failing to provide accurate business details. Some applicants may not include their correct legal name or type of ownership, like partnership or corporation. This can lead to confusion and may even result in a denied application.

Not updating your business history can also be problematic. An applicant might skip over the section about how long they have been in business or their current ownership status. This information is vital for Sysco to understand your company's background and needs.

Additionally, some applicants do not disclose litigation or legal proceedings involving their businesses. It is important to be transparent about any pending legal issues, as this can impact the relationship with Sysco and future business opportunities.

Providing insufficient personal details about corporate officers or partners can prove problematic as well. Applicants might forget to include home addresses, phone numbers, or even social security numbers. These details are necessary for Sysco to verify the identities of those in charge of the business.

A lack of references can also be a significant issue. Applicants sometimes do not provide adequate references, particularly from food distributors. Sysco prefers to have a few names and contact information to understand your business relationships in the industry better.

Lastly, neglecting to review your financial information can harm your application. Entering incorrect amounts for weekly purchases or monthly sales volume could raise red flags. Make sure these figures reflect your business's real situation.

By avoiding these mistakes, you can enhance the chances of a seamless application process with Sysco. Patience and attention to detail will work in your favor as you navigate this important step for your business.

Documents used along the form

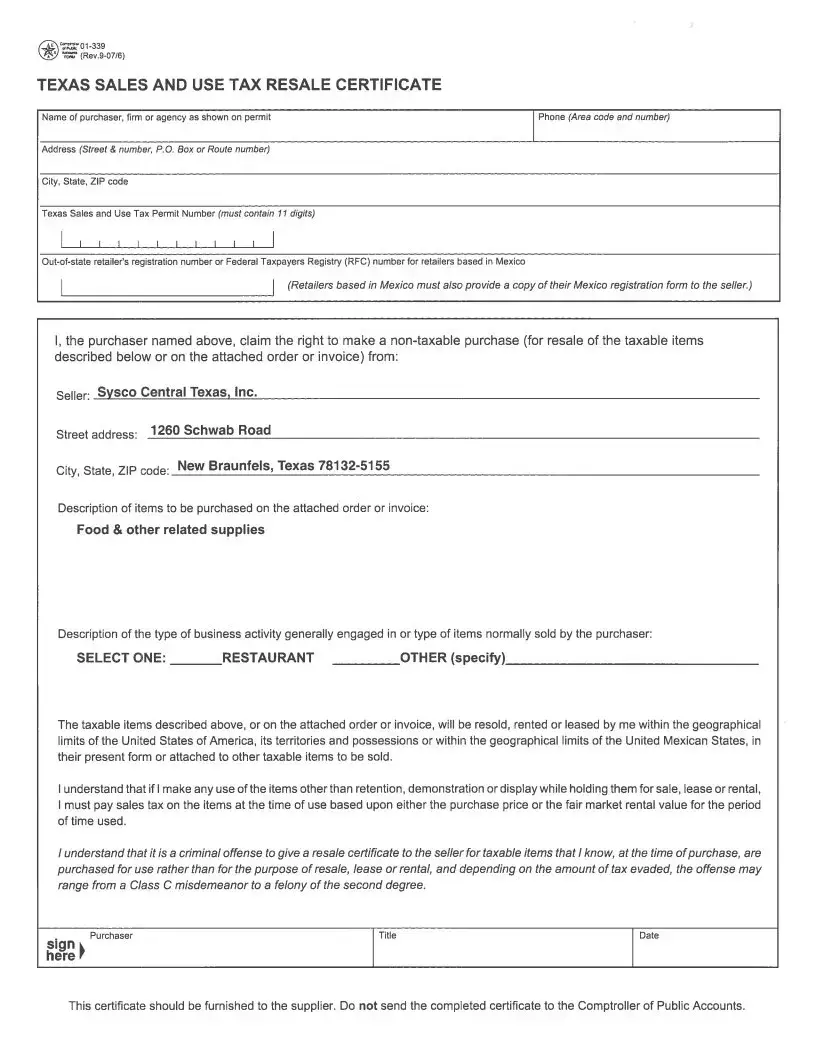

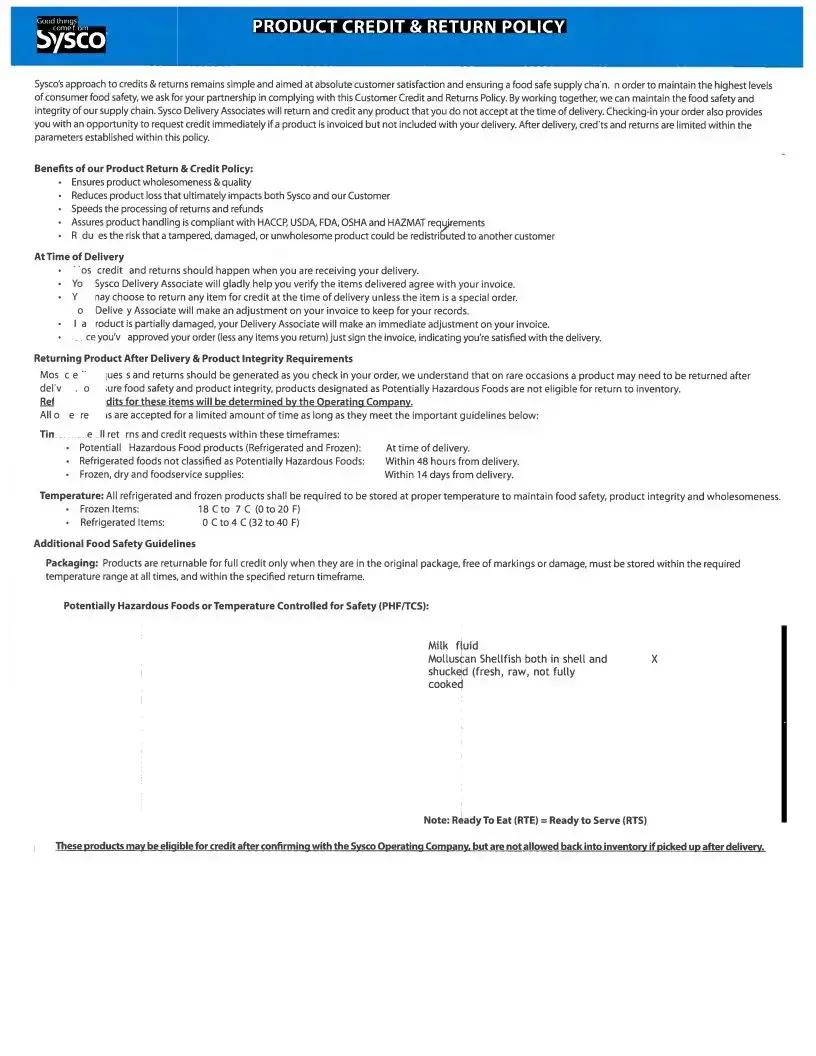

The Sysco Customer Account Application form is essential for establishing a business relationship with Sysco. However, additional documentation may be required to streamline the process and provide a clearer picture of your business operations. Below are four documents that are commonly used alongside the application form.

- Tax Identification Number (TIN) Verification: This document confirms your business’s federal tax ID number, essential for tax purposes and to confirm your business's legitimacy.

- Business License: Proof of your business license demonstrates that your business is legally allowed to operate in your locality, assuring Sysco of your compliance with local regulations.

- Bank Reference Letter: A letter from your bank provides an overview of your business’s financial status and banking relationship. It may include your account standing and any loans or credit extended to the business.

- Trade References: This document lists current suppliers or vendors, helping establish credibility and trustworthiness based on your business's payment history and relationships in the industry.

Providing these additional forms can enhance your application and facilitate faster approval from Sysco. It's always beneficial to be prepared and present a comprehensive background of your business.

Similar forms

- Credit Application Form: Similar to the Sysco Customer Account Application, a credit application form collects essential information about a business for credit evaluation. It often asks for company details, ownership structure, and financial references.

- Supplier Account Setup Form: This form functions like the Sysco application by requesting the necessary information for establishing a new account with a supplier. It usually requires details about billing, shipping addresses, and contact information.

- Vendor Registration Form: Like the Sysco application, this document gathers relevant data from potential vendors. It typically includes business classification, ownership details, and references to determine eligibility for future business opportunities.

- Business License Application: This application shares similarities with the Sysco form as it requires company information, ownership specifics, and operational details. It ensures compliance with local regulations necessary for business operation.

- Bank Account Opening Form: This form is comparable in that it requests personal and business details like company name, address, and owner information. Banks use this data to evaluate eligibility for opening a business account.

Dos and Don'ts

When filling out the Sysco Customer Account Application form, it's important to keep a few key guidelines in mind. Here are seven things you should and shouldn't do.

- Do provide accurate and complete information for all sections of the form.

- Do include your correct federal tax ID number to avoid processing delays.

- Do clearly state the ownership structure of your business.

- Do specify the type of business and capacity to help Sysco understand your needs.

- Don't omit any required contact information, such as phone numbers or emails.

- Don't provide incorrect or misleading information about your business operations.

- Don't forget to sign and date the application to ensure it is considered valid.

Misconceptions

When filling out the Sysco Customer Account Application form, several misconceptions frequently arise. Understanding these common misunderstandings can help streamline the application process and ensure that your business gets the best service possible. Below are some of the more prevalent misconceptions:

- Misconception 1: Only large businesses need to apply. Many believe that the application is only necessary for large corporations. In reality, Sysco serves businesses of all sizes, including small restaurants and independent grocery stores. Every business, regardless of size, can benefit from having an account with Sysco.

- Misconception 2: The application process is overly complicated. While some may feel intimidated by the amount of information requested, the application is straightforward. The questions are designed to gather essential details about your business and ensure that Sysco can meet your needs effectively.

- Misconception 3: Previous accounts with Sysco make the application unnecessary. Some businesses think that if they have done business with any Sysco entity before, they can skip the application. However, even if you have an existing account, a new application is often necessary to update records and accommodate new business relationships.

- Misconception 4: You can't make changes after submitting your application. Many people fear that once the application is submitted, it’s set in stone. This is not the case. If any details change after submission, you can contact Sysco’s customer service to make necessary updates or corrections to your application.

By dispelling these misconceptions, businesses can navigate the Sysco Customer Account Application form with confidence, ultimately leading to better service and support. Being well-informed is key to maximizing the benefits of your partnership with Sysco.

Key takeaways

Filling out the Sysco Customer Account Application form requires attention to detail. Here are some key takeaways to guide you through the process:

- Provide accurate billing and shipping addresses. This ensures that orders reach the correct location.

- List the legal name of your company clearly. Include whether you are a corporation, partnership, or sole proprietorship.

- Include contact information for your accounts payable department. This adds a layer of professionalism and efficiency.

- Specify your federal tax ID number. This is essential for tax purposes and identity verification.

- Indicate the type of business you operate. This helps Sysco understand your unique needs.

- Clearly state the length of time your business has been operational. This information provides context about your experience.

- Ensure that you do not have pending litigation or legal proceedings. This can affect your application status.

- Fill out all sections regarding ownership and corporate officers thoroughly. This includes providing social security numbers and driver's license details.

- Provide references from food distributors. This can enhance your credibility.

- Review the completed application. Double-check for any errors or missing information before submission.

Following these points will facilitate a smoother application process and strengthen your relationship with Sysco.

Browse Other Templates

Us Bank Human Resources - MentorConnect pairs employees with mentors for guidance and support.

New Jersey Annual Report Due Date - Decisions to dissolve or cancel a business must involve separate forms.

How to Write a Letter to Homeowners When Buying a House - What Happens Next details the process after your offer is accepted.