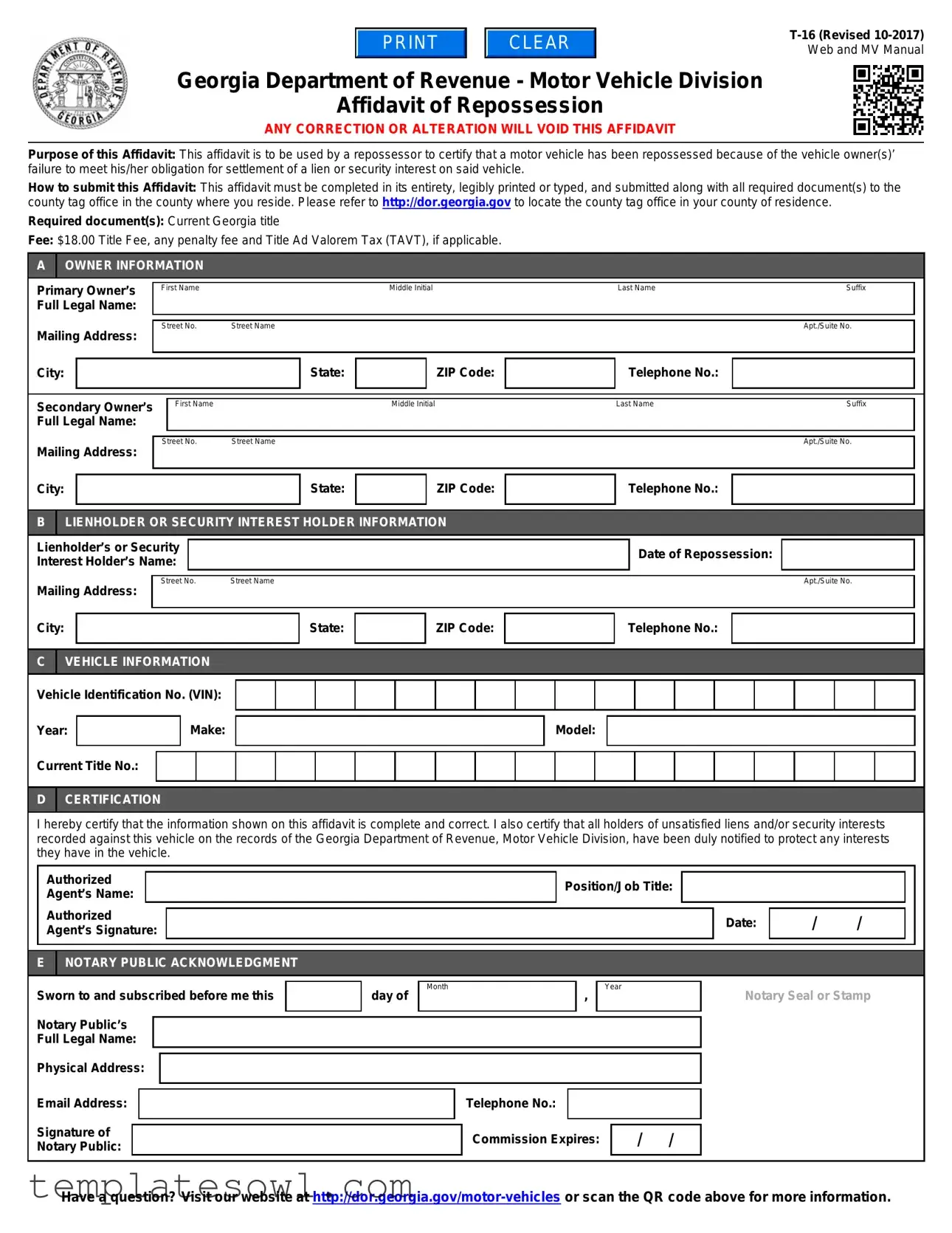

Fill Out Your T 16 Form

The T-16 form, also known as the Affidavit of Repossession, serves a crucial role in the vehicle repossession process in Georgia. This document must be filled out by a repossessor to confirm that a motor vehicle has been repossessed due to the owner's failure to satisfy a lien or security interest. It requires accurate and legible information regarding both the primary and secondary owners, as well as details about any lienholders involved. Important sections include vehicle identification information, which necessitates the Vehicle Identification Number (VIN), make, model, year, and current title number. Maintaining integrity in this affidavit is essential; any corrections or alterations can lead to its invalidation. Alongside the completed form, the repossessor must submit a current Georgia title and may incur associated fees, such as a title fee and potential penalty fees. The entire affidavit must be certified before a Notary Public, ensuring the accuracy of the information reported. For those unsure of the submission process, the completed form and required documents should be turned in to the county tag office in the repossessor's county of residence. This meticulous process helps protect the rights of all parties involved and maintains order in vehicle ownership transitions.

T 16 Example

CLEAR

Web and MV Manual

Georgia Department of Revenue - Motor Vehicle Division

Affidavit of Repossession

ANY CORRECTION OR ALTERATION WILL VOID THIS AFFIDAVIT

Purpose of this Affidavit: This affidavit is to be used by a repossessor to certify that a motor vehicle has been repossessed because of the vehicle owner(s)’ failure to meet his/her obligation for settlement of a lien or security interest on said vehicle.

How to submit this Affidavit: This affidavit must be completed in its entirety, legibly printed or typed, and submitted along with all required document(s) to the county tag office in the county where you reside. Please refer to http://dor.georgia.gov to locate the county tag office in your county of residence.

Required document(s): Current Georgia title

Fee: $18.00 Title Fee, any penalty fee and Title Ad Valorem Tax (TAVT), if applicable.

|

A |

|

|

OWNER INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary Owner’s |

First Name |

Middle Initial |

Last Name |

Suffix |

|

|

|||

|

|

|

|

|

|

|

||||

|

Full Legal Name: |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address: |

Street No. |

Street Name |

|

Apt./Suite No. |

|

|

|||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

City: |

|

|

|

|

|

|

|

|

|

|

|

|

State: |

|

|

|

ZIP Code: |

|

|

|

|

|

|

|

Telephone No.: |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secondary Owner’s |

|

First Name |

|

|

|

|

|

|

Middle Initial |

|

|

|

|

|

|

Last Name |

|

|

Suffix |

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Full Legal Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address: |

|

|

Street No. |

Street Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt./Suite No. |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City: |

|

|

|

|

|

|

|

|

|

|

|

|

State: |

|

|

|

ZIP Code: |

|

|

|

|

|

|

|

Telephone No.: |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

B |

|

|

LIENHOLDER OR SECURITY INTEREST HOLDER INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Lienholder’s or Security |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Repossession: |

/ |

|

/ |

|

|

|||||||||||||||||

|

Interest Holder’s Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Mailing Address: |

|

|

Street No. |

Street Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt./Suite No. |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

City: |

|

|

|

|

|

|

|

|

|

|

|

|

State: |

|

|

|

|

ZIP Code: |

|

|

|

|

|

|

|

Telephone No.: |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

C |

|

|

VEHICLE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Vehicle Identification No. (VIN): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

Make: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Model: |

|

|

|

|

|

|

|

|||||||||||||||

|

Year: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Current Title No.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

D |

|

|

CERTIFICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I hereby certify that the information shown on this affidavit is complete and correct. I also certify that all holders of unsatisfied liens and/or security interests recorded against this vehicle on the records of the Georgia Department of Revenue, Motor Vehicle Division, have been duly notified to protect any interests they have in the vehicle.

|

Authorized |

|

|

|

|

|

|

|

|

|

Position/Job Title: |

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Agent’s Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

/ |

/ |

|

|

||||||||

|

Agent’s Signature: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

E |

|

|

NOTARY PUBLIC ACKNOWLEDGMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sworn to and subscribed before me this |

|

day of |

Month |

|

|

|

|

, |

|

Year |

|

|

|

Notary Seal or Stamp |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Notary Public’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Full Legal Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Physical Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

Telephone No.: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Email Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Signature of |

|

|

|

|

|

|

|

|

|

|

Commission Expires: |

|

/ |

/ |

|

|

|

|

|

|

|

|||||||

|

Notary Public: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Have a question? Visit our website at

INSTRUCTIONS

How to complete the

COMPLETING THIS AFFIDAVIT

This affidavit must be completed in its entirety, legibly printed in blue or black ink or typed. Any correction or alteration will void this affidavit. Section A: Complete the owner(s)’ information. The mailing address block should contain the physical address of the owner(s).

Section B: Record the Lienholder or Security Interest Holder information.

Section C: Record the vehicle’s information.

Section D: Certify before a Notary Public that all statements are true and accurate.

REQUIRED DOCUMENT(S)

The following document is required:

|

• Current Georgia title |

|

|

|

|

|

|

|

|

|

WHAT TO DO IF THE… |

|

|

|

|

Georgia title is not available: |

The repossessor must obtain a Georgia title in their name first, unless the vehicle is “exempt” from the |

|

|

|

|

odometer disclosure requirements of the Federal Truth in Mileage Act. |

|

|

|

|

Important: If the vehicle is “exempt” from the odometer disclosure requirements but is still required to be |

|

|

|

|

titled in Georgia, the repossessor is not required to obtain a title in their name. In this situation, the |

|

|

|

|

repossessor may give the purchaser(s) a bill of sale and a completed and signed Affidavit for Repossession |

|

|

|

|

(Form |

|

|

|

|

|

|

|

|

Georgia title is not issued in the person’s |

The title must be submitted properly assigned to that person. |

|

|

|

name from whom the vehicle was |

|

|

|

|

repossessed: |

|

|

|

|

|

|

|

|

|

Current title is an |

The title must be submitted or the repossessor must secure a title in their name first from the state where |

|

|

|

|

the vehicle is currently titled. |

|

|

|

|

|

|

|

|

Repossessor is not recorded on the face of |

A copy of the contract between the repossessor and the party from whom the vehicle was repossessed |

|

|

|

the title or in the title assignment as the |

must be submitted. |

|

|

|

lienholder or security interest holder: |

|

|

|

|

|

|

|

|

|

Repossessor has sold the vehicle: |

The repossessor should complete the first title assignment transferring the ownership of the vehicle to the |

|

|

|

|

purchasing parties using the purchaser(s)’ full legal name(s). A natural person’s full legal name is his or her |

|

|

|

|

complete name as it appears on his or her valid Georgia driver’s license or Georgia identification card. |

|

|

|

|

|

|

|

|

|

|

|

|

|

FEE |

|

|

|

|

|

|

|

|

The following fees may apply:

•$18.00 Title Fee

•Any Penalty Fee

•Title Ad Valorem Tax (TAVT), if applicable

SUBMITTING THIS AFFIDAVIT

This affidavit must be submitted along with all required document(s) and fee(s) to the county tag office in the county where you reside. Please refer to http://dor.georgia.gov to locate the county tag office in your county of residence.

Have a question? Visit our website at

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The official title of the form is the Affidavit of Repossession, designated as T-16. |

| Governing Law | This form is governed by the laws of the State of Georgia, specifically under the Georgia Department of Revenue regulations. |

| Submission Requirement | It must be completed in full and submitted with all required documents to the local county tag office. |

| Required Documentation | A current Georgia title is a mandatory requirement when submitting the T-16 form. |

| Fee Structure | The submission of this affidavit incurs a standard fee of $18.00, along with any applicable penalties and Title Ad Valorem Tax (TAVT). |

| Information Accuracy | The form must be filled out legibly; any corrections or alterations will render the affidavit invalid. |

| Notarization Requirement | Certification by a Notary Public is required, affirming the truthfulness of the information provided. |

| Contact for Assistance | For questions, individuals can visit the Georgia Department of Revenue website or scan the QR code provided on the form for guidance. |

Guidelines on Utilizing T 16

After gathering the necessary documents and understanding the requirements, you can fill out the T 16 form. Make sure to provide accurate information to avoid any issues. Follow the steps below to complete the form correctly.

-

Section A - Owner Information:

- Write the primary owner's first name, middle initial, last name, and suffix.

- Fill in the full legal name and mailing address for the primary owner, including street number, street name, apartment or suite number, city, state, and ZIP code.

- Provide the primary owner's telephone number.

- Repeat the same steps for the secondary owner, if applicable.

-

Section B - Lienholder or Security Interest Holder Information:

- Enter the lienholder’s or security interest holder’s name and mailing address details.

- Record the date of repossession.

-

Section C - Vehicle Information:

- Fill in the Vehicle Identification Number (VIN).

- Provide the make, model, and year of the vehicle.

- Record the current title number.

-

Section D - Certification:

- Certify that all information provided is complete and accurate.

- Include your authorized position or job title, your name, and the date.

- Sign the form as the agent.

-

Section E - Notary Public Acknowledgment:

- Find a Notary Public to witness your signature.

- Complete the acknowledgment section, including the date, notary seal or stamp, and notary’s full legal name.

- Provide the notary's physical address, telephone number, email address, and signature.

Ensure all information is legibly printed or typed. Review the completed form for any errors, corrections, or alterations that may void the affidavit. Then, gather the required documents like the current Georgia title, and any applicable fees before submitting the form to your local county tag office.

What You Should Know About This Form

What is the purpose of the T 16 form?

The T 16 form, also known as the Affidavit of Repossession, is used by repossessors to certify that a motor vehicle has been repossessed. This action usually occurs due to the vehicle owner’s failure to fulfill their financial obligations related to a lien or security interest on the vehicle. Essentially, the form serves as a legal declaration that the repossession process has been appropriately carried out.

How do I submit the T 16 form?

To submit the T 16 form, you must complete it entirely, ensuring that all entries are legible, either printed or typed. Once completed, the affidavit must be submitted to the county tag office in your residential county, along with any required documents and fees. You can find your local county tag office through the Georgia Department of Revenue's website.

What documents do I need to include with the T 16 form?

The primary document required is the current Georgia title of the vehicle. Additionally, if there are any penalties or Title Ad Valorem Taxes (TAVT) applicable, those fees need to be addressed. If a Georgia title is not available, you will need to obtain the title first, unless the vehicle is classified as "exempt" from certain disclosure requirements.

What fees must be paid when submitting the T 16 form?

When submitting the T 16 form, you are responsible for an $18.00 title fee. You may also incur any penalties associated with late submissions or relevant Title Ad Valorem Taxes (TAVT), depending on your specific circumstances. Ensure that all fees are paid to avoid delays in processing.

Can I make corrections to the T 16 form?

No, any corrections or alterations made to the T 16 form will void the affidavit. It is crucial to complete the form carefully and accurately from the outset. If you need to make changes after printing or typing, you must start with a new form.

What if the repossessor is not listed as the lienholder on the title?

If the repossessor is not identified on the title or in the title assignment as the lienholder or security interest holder, they must provide a copy of the contract between themselves and the individual from whom the vehicle was repossessed. This documentation is necessary to validate that the repossession was executed legally and appropriately.

Common mistakes

Filling out the T-16 Form accurately is essential for a successful repossession process. One common mistake is failing to print clearly or using illegible handwriting. This form must be filled out legibly, either in blue or black ink or typed. If not, the submission may be voided, leading to unnecessary complications.

Another frequent error arises when individuals do not complete all sections of the form. Each section from owner information to vehicle details must be filled out in its entirety. Omissions can delay the process and create additional hurdles that can easily be avoided by simply checking that all fields are completed before submission.

Incorrect information can derail your efforts as well. Some people mistakenly provide outdated addresses or inaccurate vehicle information, such as the Vehicle Identification Number (VIN). Ensure that all details are up-to-date and accurately reflect what is on the current Georgia title to avoid complications with the county tag office.

Many people overlook the requirement to include the current Georgia title along with the affidavit. Submitting the T-16 without the accompanying title can lead to instant rejection of the affidavit. Double-check that you have this important document ready to go when submitting your form.

Additionally, individuals often neglect to include the required fees. The T-16 Form entails an $18.00 Title Fee, along with any applicable penalty fees and Title Ad Valorem Tax (TAVT). Not budgeting for these fees may create frustrating delays while waiting for a response.

Misunderstanding the conditions under which a Georgia title is required can also lead to errors. If the title is not in the repossessor's name, they must secure a Georgia title before proceeding. This misconception can lead to costly delays in the repossession process.

Some individuals forget the importance of having their signatures notarized. A notary public must attest to the form, confirming that all statements are true. Failing to include this step can void the affidavit, causing additional rounds of resubmission.

Lastly, neglecting to confirm that all holders of unsatisfied liens and/or security interests have been notified can lead to disputes after the fact. Make it a point to notify any interested parties, as required, to safeguard against future complications. By taking the time to address these potential pitfalls, the process becomes smoother and more efficient.

Documents used along the form

The T-16 form, also known as the Affidavit of Repossession, plays a crucial role in the repossession of vehicles in Georgia. However, it is often accompanied by other documents that provide additional verification and context. Below is a list of documents commonly used alongside the T-16 form.

- Georgia Title: This document proves ownership of the vehicle. It must be current and properly assigned to the repossessor if it’s not in their name.

- Bill of Sale: When a vehicle is sold post-repossession, a bill of sale documents the transaction details between the repossessor and the new purchaser.

- Repossession Agreement: This contract outlines the terms between the repossessor and the previous owner. It provides legal backing for the repossession process.

- Confirmation of Notification: A document indicating that all lienholders have been notified about the repossession in accordance with the law.

- Proof of Payment: This includes any receipts or records showing fees paid during the repossession process, like the title fee or any penalties.

- Notary Acknowledgment: A section of the T-16 form where a notary public affirms the identity of the signer and the authenticity of the affidavit.

- Vehicle Identification Number (VIN) verification: A document confirming the VIN of the vehicle to ensure that the right vehicle is being repossessed and reported.

Each of these documents helps to clarify the details of the repossession process and ensures that all parties involved adhere to legal requirements. Having them in order can facilitate a smoother transaction and protect the rights of the repossessor and the previous owner alike.

Similar forms

The T-16 form, used for certifying the repossession of a motor vehicle, shares similarities with several other documents in the realm of vehicle ownership and liens. Below is a list of nine such documents, each with a brief description of its similarity to the T-16 form.

- Vehicle Title Application: Similar to the T-16, this document is necessary when transferring ownership or obtaining a new title for a vehicle. It requires accurate owner information and vehicle details.

- Bill of Sale: Like the T-16, a bill of sale documents the transfer of ownership. It often includes similar information regarding the buyer, seller, and vehicle to ensure clarity in the transaction.

- Affidavit of Loss: This affidavit serves as a declaration when a vehicle title is lost or destroyed, similar to how the T-16 confirms the repossession of a vehicle under specific circumstances.

- Power of Attorney for Vehicle Transactions: This document allows one individual to act on behalf of another regarding vehicle matters, akin to how the T-16 requires an authorized agent to certify repossession details.

- Notice of Sale: This notice informs interested parties about the sale of a repossessed vehicle, paralleling the T-16's purpose of documenting the repossession itself.

- Title Assignment: Used to transfer title during sales or repossessions, this form includes similar details to the T-16, such as identification of the parties involved and vehicle specifics.

- Lien Release Form: When a lien on a vehicle is satisfied, this form is generated to confirm the release, comparable to how the T-16 documents the repossession due to lien defaults.

- Security Agreement: This document outlines the terms of a loan backed by the vehicle, similar in intent to the T-16, which deals with the consequences of failing to comply with the agreement.

- Notification of Repossession: This serves to officially inform parties of a repossession event, much like the T-16 which certifies that the vehicle has been repossessed and details have been communicated appropriately.

Dos and Don'ts

When completing the T-16 form, it is essential to ensure that the information provided is accurate and thorough. Below are some tips on what to do and what to avoid during this process:

- Print clearly in blue or black ink or type the information.

- Complete the form in its entirety, providing all required information.

- Use the full legal name of the vehicle owner, ensuring spelling accuracy.

- Submit the affidavit along with all required documents and fees to the correct county tag office.

- Do not make any corrections or alterations on the form, as this will void the affidavit.

- Do not submit an incomplete form; missing information can lead to processing delays.

- Avoid using a mailing address that does not reflect the owner’s physical address.

- Do not forget to include the necessary fees, ensuring full payment to avoid additional penalties.

Misconceptions

Understanding the T-16 form is crucial for anyone involved in vehicle repossession in Georgia. However, several misconceptions often cloud clarity regarding its purpose and requirements. Below is a list of common misunderstandings associated with this affidavit:

- Misconception 1: The T-16 form can be modified.

- Misconception 2: The T-16 form does not need to be notarized.

- Misconception 3: You can submit the T-16 form without any additional documentation.

- Misconception 4: The repossessor can sign the affidavit on behalf of the vehicle owner.

- Misconception 5: All vehicles require a Georgia title before filing a T-16.

- Misconception 6: The T-16 form is the only document needed for repossession.

- Misconception 7: Any notary public can serve for the T-16 affidavit.

- Misconception 8: The fee for filing the T-16 form is fixed.

- Misconception 9: Once submitted, the T-16 form cannot be challenged.

In truth, any correction or alteration to the affidavit will void it. The form must be completed as directed, without any modifications.

Certification before a Notary Public is necessary. The affidavit must be sworn to and subscribed before a notary to be valid.

The affidavit must accompany a current Georgia title and any applicable fees. These documents are essential for processing.

This is incorrect. The repossessor has to provide their own information and certify the document; they cannot impersonate the vehicle owner.

If the vehicle is exempt from the odometer disclosure requirements, obtaining a title in the repossessor's name is not necessary. However, a completed affidavit is still required.

This is not the case. In addition to the T-16 form, a copy of the contract between the repossessor and the party from whom the vehicle was repossessed must be submitted if the repossessor is not named on the title.

The notary public must be authorized to perform acknowledgments in Georgia, and preferably, they should be familiar with vehicle repossession laws.

While a base fee of $18.00 exists, additional charges may apply, such as penalty fees or Title Ad Valorem Tax (TAVT), depending on specific circumstances.

The validity of the affidavit may be scrutinized by the authorities, especially if discrepancies arise or if the interests of lienholders are not clearly represented.

Addressing these misconceptions can help prevent complications during the repossession process, ensuring that all parties involved understand their obligations and rights.

Key takeaways

Filling out the T-16 form is an essential process for repossessors in Georgia. Here are key takeaways to ensure compliance and proper submission:

- The T-16 form, titled "Affidavit of Repossession," certifies that a vehicle has been repossessed due to the owner's failure to meet lien obligations.

- It is crucial to fill out the form completely and legibly. Corrections or alterations will void the affidavit.

- Owners’ information must include complete names, addresses, and contact numbers for both primary and secondary owners.

- Record accurate details regarding the lienholder or security interest holder, including their name and address.

- Vehicle information such as the VIN, make, model, and year must be accurately provided to avoid complications.

- Certification must be made before a Notary Public to confirm the truthfulness of the information submitted.

- Submission requires the current Georgia title, with specific provisions for cases involving out-of-state titles or exempt vehicles.

- Associated fees include an $18.00 Title Fee and any applicable penalties or Title Ad Valorem Tax (TAVT).

- The T-16 form should be submitted to the local county tag office. Refer to the Georgia Department of Revenue website to locate your office.

- For further inquiries or assistance, the official Georgia Department of Revenue website provides additional resources and answers to common questions.

Browse Other Templates

How to Get Transcript From High School - Don’t let the lack of records hinder your educational or career aspirations—take advantage of this service!

County Business Tax Return,TN Business Status Report,Tennessee Business Tax Declaration,Tennessee Revenue Collection Form,Business Tax Compliance Statement,Tennessee Local Business Tax Form,Tennessee Business Tax Obligations,Business Revenue Tax Noti - It is essential for reporting gross sales within a particular county.