Fill Out Your T Account Form

The T Account form serves as a fundamental tool in financial accounting, offering a structured way to analyze and record transactions within a general ledger. Featuring a simple yet effective design, this form organizes financial data into debits and credits, making it easier to track changes in account balances. At the core of T Accounts are visual representations that mimic the letter 'T,' providing an intuitive way to see how financial events affect various accounts. Each side of the 'T' is dedicated to a specific type of entry—debits on the left and credits on the right—facilitating a clear understanding of how different transactions impact an organization’s financial standing. This instructional aid, prepared by the Learning Commons at Tallahassee Community College, not only supports students in mastering these concepts but also emphasizes the importance of accuracy and consistency in bookkeeping. Engaging with T Accounts fosters a deeper comprehension of fundamental accounting principles, setting the stage for more complex financial analysis and reporting.

T Account Example

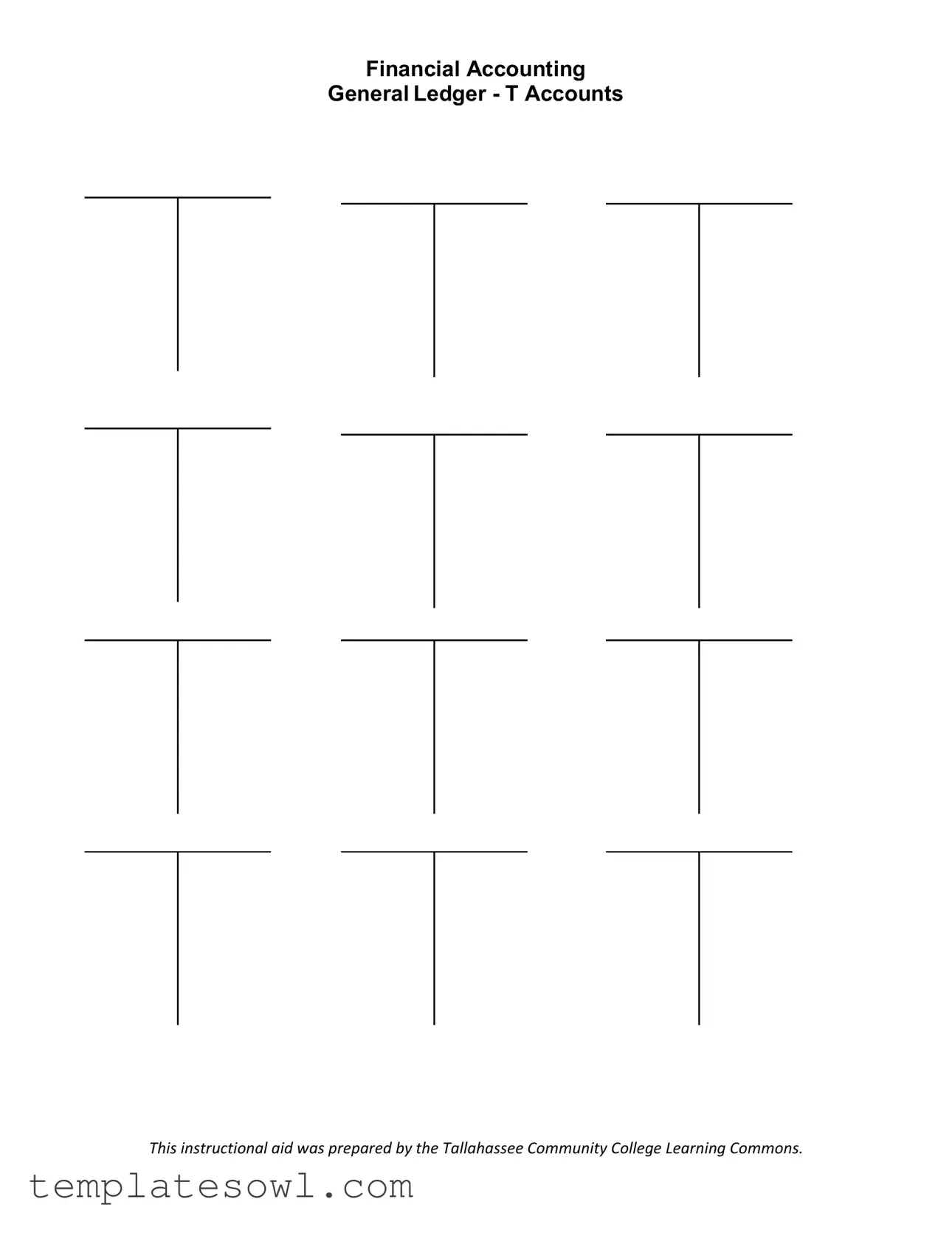

Financial Accounting

General Ledger - T Accounts

This instructional aid was prepared by the Tallahassee Community College Learning Commons.

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Definition | A T Account is a visual representation used in financial accounting to depict the effects of transactions on individual accounts. |

| Structure | The account is shaped like a "T", where the left side records debits and the right side records credits. |

| Uses | T Accounts are commonly used for teaching and understanding how transactions affect different accounts in double-entry bookkeeping. |

| Debits and Credits | In accounting, debits and credits must always balance, which T Accounts help illustrate clearly. |

| Visual Learning | This format aids in visual learning, making it easier for individuals to grasp accounting concepts. |

| General Ledger Integration | T Accounts are often integrated into the general ledger to summarize the transactions that occur within various accounts. |

| State-Specific Use | While T Accounts are universally accepted, specific accounting standards may vary by state; users should refer to their state's financial reporting laws. |

| Resource Reference | This instructional aid was prepared by the Tallahassee Community College Learning Commons, providing guidance and resources for learners. |

Guidelines on Utilizing T Account

Filling out the T Account form is a straightforward process that can help you organize your financial transactions. Understanding the layout can make things easier as you record debits and credits. Follow these steps to ensure accuracy as you fill in the necessary information.

- Gather Your Information: Collect all financial transaction records you need to input, such as invoices, receipts, and bank statements.

- Draw the T Account: On a piece of paper or digitally, create a large letter "T." Label the left side as "Debit" and the right side as "Credit."

- Title the Account: Write the name of the account you are working with at the top of the T, such as "Cash" or "Accounts Payable."

- Input Date: For each transaction, note the date on the left side (Debit) or the right side (Credit) of the T Account.

- Add Transactions: For each transaction, write the amount in the appropriate side (Debit or Credit) under its corresponding date.

- Include Descriptions: Add a brief description of each transaction beside the amounts to provide clarity on what each entry represents.

- Calculate Totals: At the bottom, sum up the totals for both the Debit and Credit columns to ensure they balance out.

- Double Check: Review all entries for accuracy, making sure amounts and descriptions are correct before finalizing.

What You Should Know About This Form

What is a T Account?

A T Account is a visual representation of individual accounts in accounting that resembles the letter "T." The left side of the "T" is typically used for debits, while the right side is for credits. This structure helps accountants track the changes in each account over time, making it easier to prepare financial statements.

How do I create a T Account?

To create a T Account, draw a large “T” on a sheet of paper or a digital document. Label the left side as "Debit" and the right side as "Credit." Then, enter the relevant transactions below each side according to their respective categories. Ensure that you record the dates and amounts clearly for better tracking.

Why are T Accounts important?

T Accounts are essential because they provide a straightforward way to visualize and analyze financial transactions. They help in understanding how debits and credits impact specific accounts, facilitating accurate bookkeeping and ultimately aiding in the creation of financial reports.

Can I use T Accounts for any type of financial transaction?

Yes, T Accounts can be used for various types of financial transactions. Whether it's sales, expenses, or asset purchases, you can record all transactions using T Accounts. They work well for both simple and complex accounting scenarios, enhancing clarity in financial analysis.

What types of accounts can be represented in a T Account?

T Accounts can represent various types of accounts, including asset accounts, liability accounts, equity accounts, income accounts, and expense accounts. Each type of account serves a specific purpose in the financial transactions being recorded.

How do I balance a T Account?

To balance a T Account, sum the amounts recorded on the debit side and the credit side. If both totals are equal, then the account is balanced. If not, review the entries to ensure accuracy. Balancing T Accounts is crucial to maintaining the integrity of financial records.

Can T Accounts be used in accounting software?

While T Accounts have traditionally been used on paper, modern accounting software often utilizes similar principles in a digital format. Most accounting programs automatically manage this process for you. However, understanding T Accounts can enhance your comprehension of the software’s functionality and reporting features.

Is it necessary to use T Accounts for every transaction?

No, it is not necessary to use T Accounts for every transaction. Many businesses and accountants find it practical to use T Accounts primarily for complex transactions or when needing to clarify specific account activities. For routine transactions, simpler methods may suffice.

Where can I find resources for using T Accounts?

Resources for using T Accounts can be found in accounting textbooks, online educational platforms, and community colleges. Additionally, financial accounting software often includes tutorials or help sections that explain how T Accounts work within their systems.

Common mistakes

When filling out a T Account form, accuracy is crucial. Many individuals make common mistakes that can lead to misunderstandings in their financial records. One of the most frequent errors is failing to correctly label the accounts. Each side of the T must be clearly identified. Without proper labels, tracking financial transactions becomes challenging and can lead to significant discrepancies.

Another mistake often made is neglecting to balance the accounts appropriately. It's essential to remember that every transaction affects at least two accounts. If an entry is made in one account, the corresponding entry must also be recorded in another. Failing to do this results in an unbalanced T Account, which can misrepresent a financial situation.

Inaccurate entry of amounts is another error that can easily occur during this process. Numbers must be double-checked, as a simple typographical mistake can alter the outcome entirely. Inputting the wrong value may mislead others reviewing the T Account, leading to poor financial decision-making.

People often overlook the importance of distinguishing between debits and credits. Confusion between these two elements can cause significant issues. Posting a credit instead of a debit, or vice versa, directly affects the accuracy of financial reporting and could result in overstated or understated balances.

Lastly, individuals sometimes fail to maintain consistency in their accounting policies when completing T Accounts. Using different methods for similar transactions can lead to conflicting reports and confusion. Establishing and adhering to a consistent methodology is vital for reliable financial assessments.

Documents used along the form

The T Account form is a fundamental tool in financial accounting, helping individuals visualize and track the flow of debits and credits within accounts. While the T Account itself is very useful, several other forms and documents accompany it to enhance understanding and ensure accuracy in accounting practices. Below is a list of seven essential documents that are commonly used alongside the T Account form.

- Journal Entry Form: This document records all transactions in chronological order. Each entry includes the date, accounts involved, amounts, and a brief description. Journal entries serve as the foundation for further accounting analysis.

- General Ledger: The general ledger is a comprehensive collection of all accounts used by the business. It organizes the accountability of each account and summarizes the effects of all transactions over a specified period.

- Trial Balance: This summary report lists all accounts along with their balances. It is used to ensure that the total debits equal total credits, helping to identify any discrepancies before preparing financial statements.

- Balance Sheet: The balance sheet provides a snapshot of a company’s financial condition at a specific moment in time. It lists assets, liabilities, and equity, offering a clear overview of what the company owns and owes.

- Income Statement: Often referred to as the profit and loss statement, this document outlines the revenues and expenses over a particular period. It highlights the company's profitability, illustrating how the business performs financially.

- Adjusting Entries: These adjustments are made at the end of an accounting period to update the balances in the general ledger. They ensure that revenues and expenses are recognized in the period they occur, aligning with the accrual basis of accounting.

- Cash Flow Statement: This report tracks cash inflows and outflows over a specific period. It provides insights into a company's liquidity and financial flexibility, showing how cash is generated and used in operating, investing, and financing activities.

Understanding these documents enhances the ability to manage and interpret financial information effectively. Together, they create a comprehensive accounting framework that supports robust financial analysis and decision-making.

Similar forms

The T Account form is a helpful tool in financial accounting, serving as a visual representation of how transactions affect various accounts. It is similar to several other documents used in accounting and finance. Here are four documents that share similarities with the T Account form:

- General Ledger: Like T Accounts, the general ledger consolidates all accounts for a business. It provides a comprehensive record of transactions and serves as the primary source for creating financial statements.

- Trial Balance: The trial balance summarizes the balances of all the accounts in the general ledger. Similar to T Accounts, it helps ensure that debits and credits are equal, confirming the accuracy of recorded transactions.

- Journal Entries: Journal entries are the first point of record for financial transactions. They resemble T Accounts in that they also categorize transactions by debit and credit. Both are essential for maintaining accurate financial records.

- Balance Sheet: A balance sheet provides a snapshot of a company's financial position at a specific time. It mirrors the effects shown in T Accounts by displaying assets, liabilities, and equity, highlighting how transactions impact a business's financial health.

Dos and Don'ts

When filling out the T Account form, there are several important items to consider. Here are some do's and don'ts that can help ensure accuracy.

- Do double-check your entries for accuracy.

- Do use clear labels for each transaction.

- Do keep the format consistent throughout the form.

- Do record all amounts in a timely manner to avoid errors.

- Don’t leave any sections blank unless advised.

- Don’t mix up debits and credits; this can lead to confusion.

- Don’t rush through the process; take your time to ensure precision.

- Don’t ignore any instructions provided with the form.

By following these guidelines, you can fill out the T Account form effectively and minimize mistakes.

Misconceptions

Misconceptions about the T Account form can cloud understanding of financial accounting. Here are five common myths and their clarifications:

-

Misconception 1: T Accounts are only used by accountants.

This is not true. While they are a fundamental tool in accounting, T Accounts can also benefit business owners and financial students. Understanding T Accounts helps anyone grasp basic financial concepts.

-

Misconception 2: T Accounts are complicated and hard to understand.

In reality, T Accounts provide a simple visual representation of debits and credits. The straightforward layout makes tracking financial transactions more manageable and intuitive.

-

Misconception 3: Each transaction only needs one T Account.

This is a misunderstanding. Each financial transaction often affects at least two accounts. T Accounts help illustrate the dual aspects of transactions clearly.

-

Misconception 4: T Accounts replace standard accounting methods.

Actually, T Accounts supplement traditional methods rather than replace them. They serve as a teaching tool and guide for understanding how transactions impact the overall financial picture.

-

Misconception 5: T Accounts are obsolete in modern accounting.

Despite advancements in technology, T Accounts remain relevant. Many accounting software programs still use the concepts behind T Accounts to organize and present financial data.

Key takeaways

The T Account form is a fundamental tool in financial accounting, particularly useful for understanding the double-entry bookkeeping system. Here are some key takeaways regarding its use:

- Visual Representation: T Accounts provide a clear visual format that distinguishes debits from credits. This helps users quickly identify changes in accounts.

- Double-Entry System: Each transaction affects at least two accounts—one account is debited and another is credited. T Accounts facilitate tracking these transactions efficiently.

- Balance Calculation: After entering all transactions, users can easily calculate the balance of each account by comparing totals on both sides of the T Account.

- Learning Tool: T Accounts serve as an effective learning aid for accounting students, offering a hands-on experience with the principles of debits and credits.

Browse Other Templates

How to Site a Quote - Citing interviews shows the importance of personal experience in research.

Idr Payment Plan - Be transparent about all earnings to ensure the best payment options.

Direct Pension Deposit Form,SERS Pension Payment Authorization,Pension Direct Deposit Request,SERS Member Payment Transfer,Retirement Payment Direct Deposit,SERS Monthly Pension Deposit Form,State Pension Direct Deposit Agreement,Direct Deposit Enrol - Part I requires personal details such as name, address, and Social Security Number.