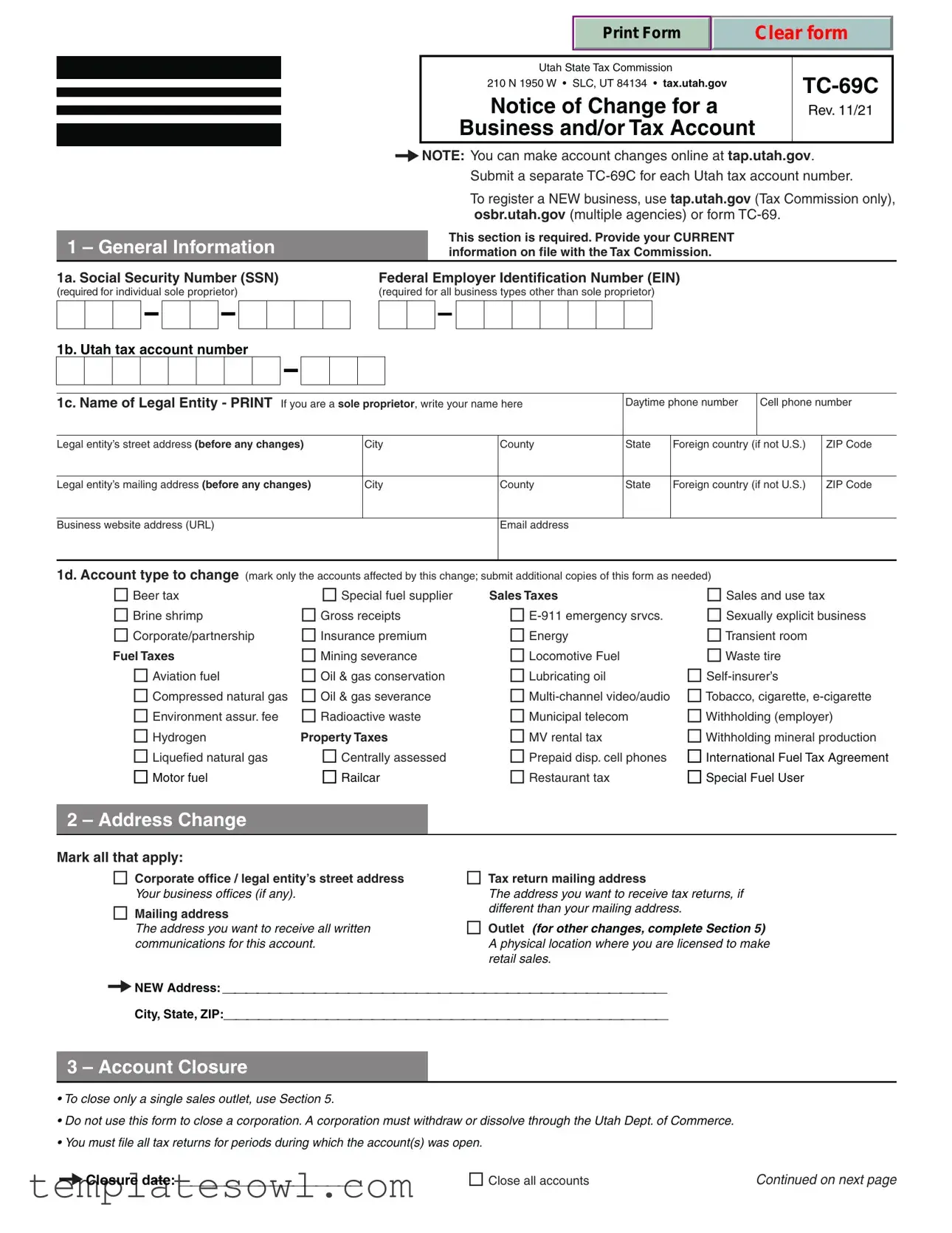

Fill Out Your Tax 69 C Form

The Tax 69 C form, also known as the TC-69C, serves as a crucial tool for current business owners in Utah who need to report changes related to their tax accounts. Whether you’re updating your business name, modifying your address, or closing a specific tax account, this form addresses a variety of administrative needs. For instance, you’ll need to provide your Social Security Number or Employer Identification Number, along with your Utah tax account number and business details. Each section is designed with specific changes in mind, from administrative contact updates to account closures. It's important to remember that any modifications must be submitted separately for each tax account, keeping in mind that you cannot use this form to register a new business. Additionally, the TC-69C process helps ensure the Tax Commission has the most accurate and timely information for tax management, ultimately aiming to streamline compliance for all Utah businesses. Ensure you have the right supporting documents prepared, as some sections may require additional attachments to be processed smoothly.

Tax 69 C Example

Print Form

Clear form

Utah State Tax Commission |

||

210 N 1950 W • SLC, UT 84134 • tax.utah.gov |

||

|

||

Notice of Change for a |

Rev. 11/21 |

Business and/or Tax Account

NOTE: You can make account changes online at tap.utah.gov.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Submit a separate |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To register a NEW business, use tap.utah.gov (Tax Commission only), |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

osbr.utah.gov (multiple agencies) or form |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This section is required. Provide your CURRENT |

|

||||||||||||

1 – General Information |

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

information on file with the Tax Commission. |

|

||||||||||||||||||||||||||||||||||||||

1a. Social Security Number (SSN) |

|

Federal Employer Identification Number (EIN) |

|

||||||||||||||||||||||||||||||||||||||||||

(required for individual sole proprietor) |

|

(required for all business types other than sole proprietor) |

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1b. Utah tax account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1c. Name of Legal Entity - PRINT If you are a sole proprietor, write your name here |

Daytime phone number |

Cell phone number |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal entity’s street address (before any changes) |

City |

|

|

|

|

|

|

County |

State |

Foreign country (if not U.S.) |

ZIP Code |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal entity’s mailing address (before any changes) |

City |

|

|

|

|

|

|

County |

State |

Foreign country (if not U.S.) |

ZIP Code |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business website address (URL) |

|

|

|

|

|

|

|

|

|

|

Email address |

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1d. Account type to change (mark only the accounts affected by this change; submit additional copies of this form as needed)

Beer tax

Brine shrimp

Corporate/partnership

Fuel Taxes

Aviation fuel

Compressed natural gas

Environment assur. fee

Hydrogen

Liquefied natural gas

Motor fuel

Special fuel supplier

Gross receipts

Insurance premium

Mining severance

Oil & gas conservation

Oil & gas severance

Radioactive waste

Property Taxes

Centrally assessed

Railcar

Sales Taxes

Energy

Locomotive Fuel

Lubricating oil

Municipal telecom

MV rental tax

Prepaid disp. cell phones

Restaurant tax

Sales and use tax

Sexually explicit business

Transient room

Waste tire

Tobacco, cigarette,

Withholding (employer)

Withholding mineral production

International Fuel Tax Agreement

Special Fuel User

2 – Address Change

Mark all that apply:

Corporate office / legal entity’s street address

Your business offices (if any).

Mailing address

The address you want to receive all written communications for this account.

Tax return mailing address

The address you want to receive tax returns, if different than your mailing address.

Outlet (for other changes, complete Section 5)

A physical location where you are licensed to make retail sales.

NEW Address: _______________________________________

City, State, ZIP:_______________________________________

3 – Account Closure

•To close only a single sales outlet, use Section 5.

•Do not use this form to close a corporation. A corporation must withdraw or dissolve through the Utah Dept. of Commerce.

•You must file all tax returns for periods during which the account(s) was open.

Closure date: ________________ |

Close all accounts |

Continued on next page |

4 — Other Account Changes

Print Form

Clear form

4a. New phone number(s)

Day: ____________ Evening: ____________ Mobile: ____________

4b. Change or add email address:

The Tax Commission will send all electronic mail to this address. |

|

|||

New email address: _______________________________________ |

|

|||

4c. Change DBA/Business name: |

|

DBA |

|

|

|

Legal business name |

|

||

|

Mark here and attach Dept. of Commerce Articles of Incorporation (not required for sole proprietors) |

|||

New name: ___________________________________________ |

|

|||

4d. Add/remove officer/owner: |

|

|

|

|

|

Mark here and attach Dept. of Commerce Change Form. |

|

||

Add (name and address): |

___________________________________ |

SSN: ____________ |

||

Add (name and address): |

___________________________________ |

SSN: ____________ |

||

Add (name and address): |

___________________________________ |

SSN: ____________ |

||

Add (name and address): |

___________________________________ |

SSN: ____________ |

||

Remove:_______________________________________________

4e. Other – explain: _____________________________________________________________

_________________________________________________________________________

5 — Outlet Changes and Closure

If changing more than one outlet, attach additional sheets in this format.

•Use Section 5 to report CHANGES to EXISTING outlets.

•To add NEW SALES TAX or TRANSIENT ROOM outlets, use form

•To add NEW CIGARETTE, TOBACCO or

Current physical street address for this sales tax outlet

Current physical street address for this sales tax outlet

Phone

City

County

State

ZIP code

Close sales tax outlet

Close transient room outlet

Close cigarette/tobacco license outlet Close

Change phone number: ____________________________

Other: ___________________________________________________________________

__________________________________________________________________________

6 — Authorized Signature |

This form will be rejected without a signature. |

|

|

SIGN HERE

Authorized Applicant or Owner |

Date |

Use this form to report changes to existing businesses already registered with the Tax Commission.

You can make most tax account changes online. Before filling out this form, see:

tap.utah.gov

Do not use this form to register a new business.

To register a new business, use from

tap.utah.gov or osbr.utah.gov

To register a new business location (outlet) for an existing sales tax account, use form

Get forms online at:

tax.utah.gov/forms

Section Instructions

Section 1 Fill out Section 1 completely.

In 1c, provide your business information as it was or is before the change you are reporting on this form. For example, if you are changing your business name, enter the old business name in Section 1.

Only report changes for one Utah account number on this form. If you need to report changes for multiple account numbers, submit separate copies of this form.

Section 2 Use Section 2 to report address changes. Mark the box matching the type of address you are changing.

If you are reporting a new address for an outlet that has moved, complete Section 5 and provide the address currently on file with the Tax Commission.

You cannot use this form to report a new outlet for a sales tax account. Use form

Business Locations for a Sales Tax Account).

Section 3 Use Section 3 to close your tax account. If this account has outlets, all outlets will also be closed.

If you only need to close a single outlet for a sales tax account, complete Section 5.

Section 4 Use Section 4 to report all other account changes.

Section 5 Use Section 5 to report changes to single sales outlets, such as a closure or new phone number.

If changing more than one outlet, attach additional sheets in the same format.

Section 6 Sign and date. We will not process this form without an authorized signature.

Return this form to:

Master Records

Utah State Tax Commission

210 N 1950 W

Salt Lake City, UT

or fax to

___________________

If you need an accommodation under the Americans with Disabilities Act, email taxada@utah.gov, or call

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The TC-69C form is used to report changes to existing businesses registered with the Utah State Tax Commission. |

| Submission Requirement | A separate TC-69C must be submitted for each tax account number affected by the change. |

| Account Changes | To make changes online, visit tap.utah.gov. This form is not for registering new businesses. |

| Closure Process | This form cannot close a corporation. Instead, corporations must dissolve through the Utah Department of Commerce. |

| Governing Laws | The form operates under Utah tax laws, specifically outlined by the Utah State Tax Commission. |

Guidelines on Utilizing Tax 69 C

The Tax 69 C form is necessary for updating certain business and tax account information with the Utah State Tax Commission. It is important to ensure that your information is accurate and current, as it streamlines communication and compliance with tax obligations. The following steps will guide you through the process of filling out this form correctly.

- Begin with General Information: In Section 1, fill in your Social Security Number (SSN) or Employer Identification Number (EIN), depending on your business structure. Additionally, provide your Utah tax account number and the legal entity's name. Include your contact information and business addresses as they currently exist.

- Specify Account Type Changes: Check the boxes for each account type that is affected by the changes you are making. This could include categories like beer tax, sales tax, or withholding tax.

- Address Changes: In Section 2, indicate which address types need changing. This may include your corporate office, mailing address, or tax return mailing address. Provide the new address details clearly.

- Account Closure: If you need to close an account, complete Section 3. Provide the closure date and indicate if all accounts should be closed or just specific outlets.

- Other Account Changes: Use Section 4 to report any additional changes, such as a new email address, a change in the business name, or updates to ownership. Attach required documents as noted.

- Outlet Changes and Closure: If you are making changes to sales tax outlets, use Section 5. Clearly state the physical street address and any new information or closures for the outlets.

- Sign the Form: Finally, section 6 requires the authorized applicant's signature and date. This signature is crucial for processing the form, so ensure it is completed before submission.

Once you have completed the form, return it to the address provided: Master Records, Utah State Tax Commission, 210 N 1950 W, Salt Lake City, UT 84134-3310. Alternatively, you can fax it to 801-297-3573. It is advisable to keep a copy for your records as well.

What You Should Know About This Form

What is the purpose of the TC-69C form?

The TC-69C form is used to notify the Utah State Tax Commission of changes related to existing businesses or tax accounts. This could include various modifications such as address changes, account closures, or updates to business information. It is important to only report changes for a single Utah tax account on this form. If changes are needed for multiple accounts, separate copies of the form must be submitted for each account.

Who needs to fill out the TC-69C form?

The form is designed for individuals or businesses already registered with the Utah State Tax Commission that need to communicate changes associated with their tax accounts. This includes business owners, sole proprietors, or representatives of partnerships and corporations that manage tax-related activities. New businesses should not use this form; instead, they need to register using form TC-69 or through the online registration portals.

How do I change my business address?

To update your business address using the TC-69C form, you’ll locate Section 2, where you can specify the type of address change. You should mark the appropriate box to indicate whether you are changing your corporate office address, mailing address, or tax return mailing address. Be sure to provide the new address in the designated area and ensure that the information matches the format required by the Tax Commission to avoid any delays in processing.

What if I need to close my business account?

If you are looking to close a business account, you would use Section 3 of the TC-69C form. This section allows you to indicate the closure date and specifies whether you are closing just one sales outlet or all accounts associated with your business. It is important to note that you need to file all necessary tax returns for the periods during which the account was active. If you are only closing an outlet, you should use Section 5 instead.

Is it possible to make changes online instead of using the TC-69C form?

Yes, many account changes can be conveniently made online. The Utah State Tax Commission encourages individuals and businesses to use the online systems available at tap.utah.gov for making updates. Using the online platform can often be quicker and more efficient, saving time for your tax-related modifications. However, if your specific change is not available online, then the TC-69C form is the appropriate alternative.

Common mistakes

When filling out the Tax TC-69C form, many individuals and businesses make common mistakes that can delay processing or result in incorrect information being submitted. One frequent error is failing to complete Section 1 entirely. Users often skip the Social Security Number (SSN) or Federal Employer Identification Number (EIN) field, which is mandatory for accurate identification. Omitting any part of this section can lead to rejection of the form.

Another common mistake occurs in Section 2, where individuals mistakenly provide incorrect or outdated address information. It's crucial to double-check all current addresses, both for the legal entity and for mailing purposes. Incorrect addresses can lead to miscommunication and missed deadlines for important tax documents.

Many people also overlook the requirement to select the appropriate account types for changes in Section 1d. Failure to mark the relevant boxes may cause processing delays since the Tax Commission needs specific information about the changes to understand the nature of the request.

In Section 3, some individuals choose to close their accounts without first ensuring that all tax returns have been filed. This results in complications and potential penalties. Closing an account without fulfilling tax obligations can reflect negatively on the business and lead to further issues down the line.

Additionally, many users forget to sign and date the form in Section 6. This section is vital because forms submitted without a signature are automatically rejected. Ensuring that all required signatures are included can significantly hasten the review process.

Some applicants fail to attach necessary supporting documentation when reporting changes, especially for changing or adding an officer/owner in Section 4. If the required Department of Commerce Change Form is not included, the Tax Commission cannot process those changes correctly.

Finally, individuals may use the TC-69C form to report changes for multiple Utah tax accounts instead of submitting separate forms for each account. This mistake can cause confusion and result in furthers delays. It’s important to restrict each TC-69C submission to just one account to avoid complications.

Documents used along the form

The Tax 69 C form is essential when reporting changes to an existing business registered with the Utah Tax Commission. To effectively manage your business tax account, it is often necessary to complete and submit additional documents. Below is a list of other forms and documents frequently used alongside the Tax 69 C form.

- TC-69: This form is used to register a new business in Utah. If you are starting a new business, this is the primary form to submit.

- TC-69B: This form is for adding new business locations (outlets) to an existing sales tax account. Use it when your business expands.

- Department of Commerce Articles of Incorporation: Required to register a corporation, these documents provide foundational information about the business entity.

- Department of Commerce Change Form: This document is vital when adding or removing an officer or owner from your entity. It must be completed and submitted as part of the account change process.

- Sales Tax License: This document confirms your business's authorization to collect sales tax in Utah. Maintaining this is crucial for compliance.

- W-9 Form: A Request for Taxpayer Identification Number and Certification, required for businesses to provide information to contractors or clients who need to report payments to the IRS.

- IRS Form SS-4: Used to apply for an Employer Identification Number (EIN), which is vital for many business operations and tax filings.

- Operational Plan: While not a formal tax document, this guideline helps outline the business's operations and is often necessary for regulatory compliance.

- Bank Account Setup Documents: These documents are necessary to establish a business bank account, which is essential for managing business finances and tax payments.

- Annual Tax Returns: Filing annual tax returns is mandatory for all businesses. These documents summarize your business’s financial activities and tax liabilities over the year.

Completing and submitting these forms accurately and in a timely manner can help ensure your business remains compliant with state regulations. Always check with the appropriate agency if any uncertainties arise regarding which documents to submit. Prompt action can prevent delays and potential penalties.

Similar forms

The Tax 69 C form, formally known as the Notice of Change for a Business and/or Tax Account in Utah, serves as a means for businesses to report changes in their tax accounts. Several other documents serve similar purposes in the realm of business and tax management. Here’s a look at nine such forms:

- Internal Revenue Service Form 8832: This form allows businesses to elect how they are classified for federal tax purposes. Similar to the Tax 69 C, it updates essential account information with the IRS.

- IRS Form SS-4: Applying for an Employer Identification Number (EIN) can be done using this form. Like the Tax 69 C, it ensures proper identification of a business for tax purposes.

- State Business License Application: This document is required for obtaining a business license at the state level. It gathers crucial information similar to that required on the Tax 69 C.

- Form TC-69B: Also from the Utah State Tax Commission, this form specifically pertains to additional business locations for a sales tax account, akin to the outlet change section of the TC-69C.

- IRS Form 1120: This corporate tax return form allows businesses to report their income and expenses, similar to how the Tax 69 C reports changes relevant to tax accounts.

- State Tax Registration Form: Businesses must complete this form to register for various state taxes, paralleling the registration aspect of the Tax 69 C.

- Form 940: For reporting federal unemployment taxes, this form shares similarities with the Tax 69 C in terms of updating and maintaining compliance with tax obligations.

- Form 941: This form is used to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks, much like how the Tax 69 C reports changes that impact tax responsibilities.

- Change of Business Name Application: This application, often required by state agencies, allows businesses to officially change their name, similar to Section 4c of the Tax 69 C.

Dos and Don'ts

When filling out the Tax 69 C form, certain practices can enhance your accuracy and efficiency, while others could lead to complications or delays. Here is a guide highlighting what to do and what to avoid.

- Do: Ensure all your information is current and accurately reflects your business status.

- Do: Submit a separate form for each tax account number affected by the changes.

- Do: Use clear and legible handwriting or fill out the form digitally, ensuring that all entries are easily readable.

- Do: Include a signature and date on the form to validate your request.

- Don't: Use this form to register a new business; doing so will lead to rejection of the submission.

- Don't: Forget to inform the Tax Commission of all address changes accurately, marking the appropriate sections as needed.

Remember, following these guidelines can help streamline your process and ensure that your tax records remain up to date with minimal hassle.

Misconceptions

There are several misconceptions surrounding the Tax 69 C form that can lead to confusion for businesses. Here are six of the most common misunderstandings, along with clarifications:

- It can be used to register a new business. The Tax 69 C form is not intended for registering a new business. Instead, it is specifically for reporting changes to existing businesses already registered with the Tax Commission.

- All account changes can be reported on a single form. Each Tax 69 C form should only report changes for one Utah tax account number. If multiple account changes are necessary, separate forms must be submitted for each.

- Changes to business names do not require additional documentation. When changing the Doing Business As (DBA) or legal business name, it is often necessary to attach the Department of Commerce Articles of Incorporation, except for sole proprietors.

- The form can be used to close a corporation. This form cannot be used to close a corporation. Corporations must go through the Utah Department of Commerce for withdrawal or dissolution.

- Address changes do not need to specify the type of address. It is important to indicate the type of address being changed, whether it is the corporate office, mailing address, or tax return mailing address.

- Leaving the signature blank will not affect processing. The Tax 69 C form requires an authorized signature to be processed. Any form submitted without a signature will be rejected.

This understanding can help streamline the reporting process and ensure compliance with Utah tax regulations.

Key takeaways

Understanding how to accurately fill out and utilize the Tax 69 C form is crucial for business owners in Utah. Here are some key takeaways to consider:

- Individual Submission: Each change to a Utah tax account requires a separate TC-69C form. If you have multiple accounts, be sure to fill out a form for each one.

- Registration for New Businesses: If you are registering a new business or location, the TC-69C is not the appropriate form. For new business registrations, you should use the TC-69 or register online at tap.utah.gov.

- Complete Information: Make sure to fill out Section 1 in its entirety. This includes providing your previous business information accurately, especially if you are making changes such as a name change.

- Address Changes: Utilize Section 2 for reporting any changes in addresses. Select the type of address that is being changed and ensure you provide all relevant new address details.

- Account Closure Procedures: If closing an account, be aware that all outlets associated with that account will also be closed. If you only wish to close a single outlet, use Section 5 instead.

- Signature Requirement: The Tax 69 C form must include an authorized signature. Without this, the form will be rejected. Always remember to sign and date the form before submission.

By keeping these points in mind, you can navigate the process of updating or modifying your tax account more effectively, ensuring compliance with Utah's tax regulations.

Browse Other Templates

Lynn University Transcript - Transcripts are essential documents that reflect a student's academic journey and achievements.

Service About Self - Dedicates time to improving literacy, ensuring educational resources are accessible.