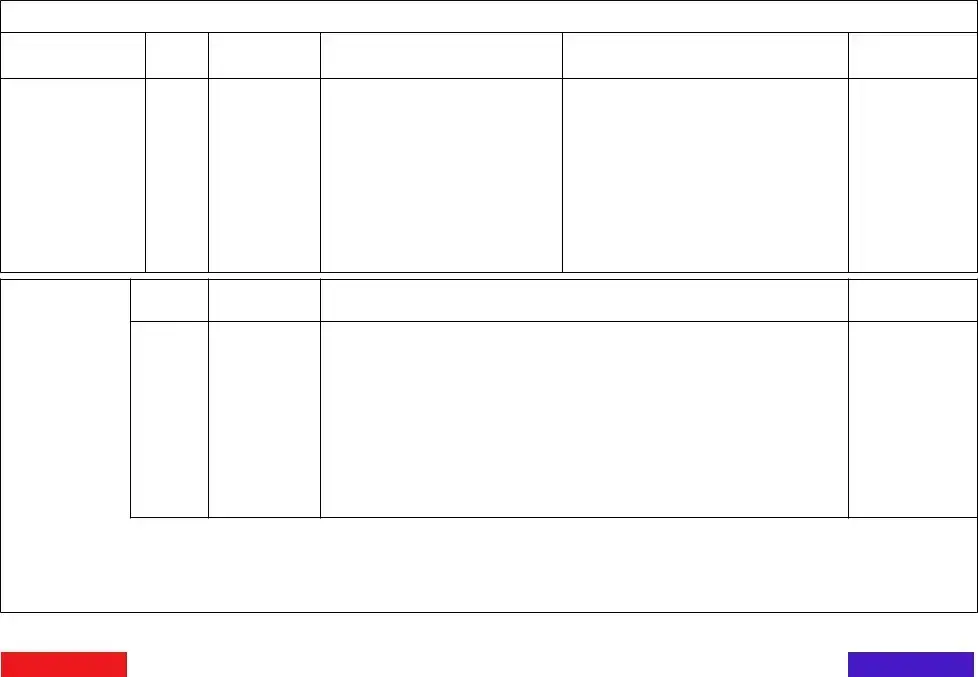

Fill Out Your Tax Certificate Pa Form

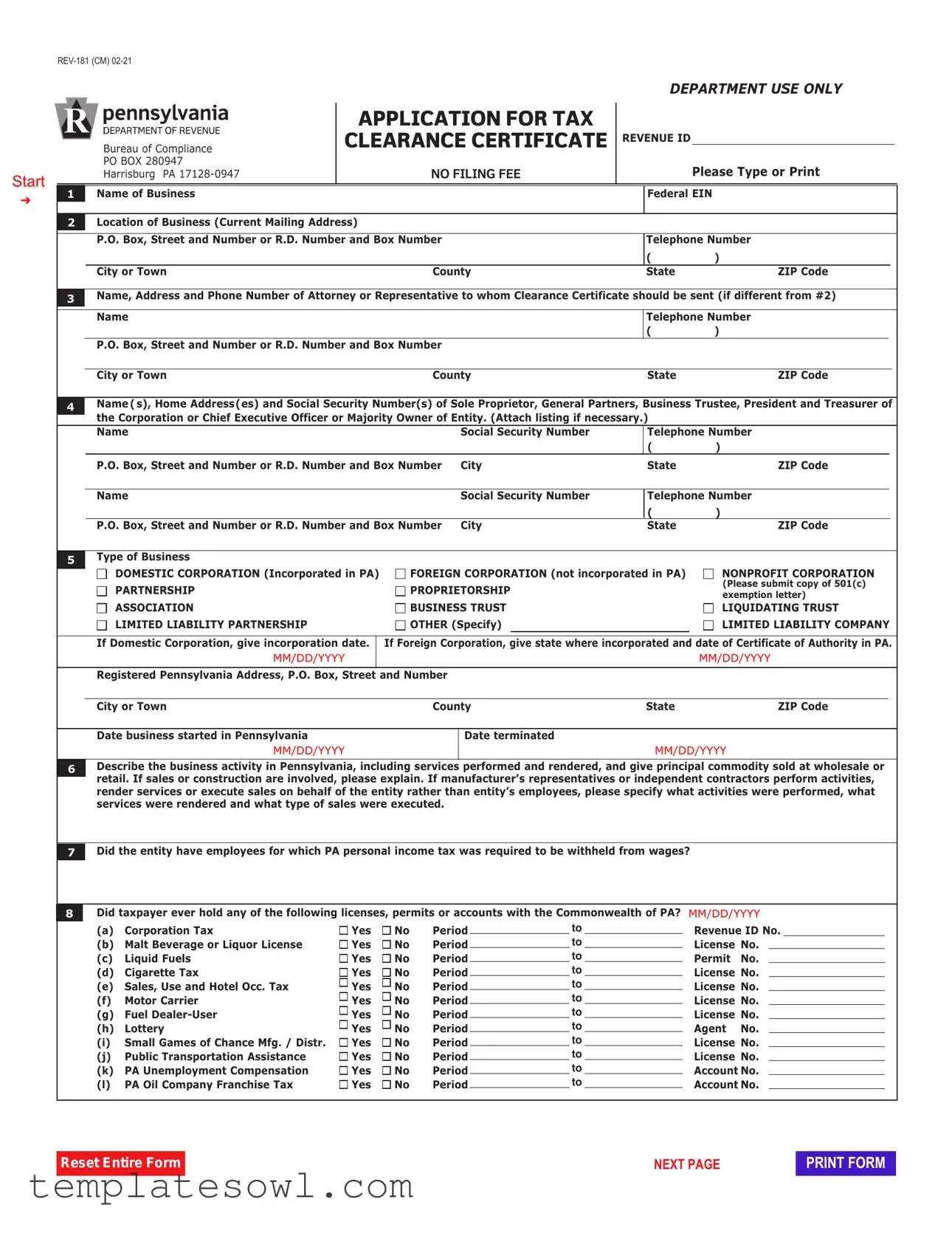

The Tax Certificate PA form is an essential document for businesses operating within Pennsylvania. It's primarily used to request clearance from various tax obligations, ensuring that a business is compliant with state regulations before undertaking actions such as dissolution, withdrawal, or transfer of assets. This form collects critical information about the business, including its name, location, and the types of business activities conducted. Additionally, it requires details about the officers or owners, tax identification numbers, and specific business activities in Pennsylvania. The applicant must provide information regarding any licenses or permits held, as well as previous tax filings with the Commonwealth. Furthermore, if applicable, the form addresses real estate ownership and any pending matters with the PA Department of Revenue. Completing this form accurately is vital for businesses, as it helps facilitate smooth transactions and legal compliance within the state. By obtaining a Tax Clearance Certificate, business owners can assure potential buyers or partners of their adherence to tax obligations, promoting trust and transparency in Pennsylvania's business landscape.

Tax Certificate Pa Example

Start

➜

Department Use Only

|

|

APPLICATION FOR TAX |

|

|

|

|

|

Bureau of Compliance |

CLEARANCE CERTIFICATE |

Revenue id |

|

|

|

|

|

|||||

|

PO BOX 280947 |

NO FILING FEE |

|

Please Type or Print |

|

|

|

Harrisburg PA |

|

|

|||

1 |

name of Business |

|

|

Federal ein |

|

|

|

|

|

|

|

|

|

2Location of Business (Current Mailing Address)

|

|

P.O. Box, Street and number or R.d. number and Box number |

|

|

|

|

|

Telephone number |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

City or Town |

|

|

|

County |

|

|

State |

|

|

ZiP Code |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

3 |

name, Address and Phone number of Attorney or Representative to whom Clearance Certificate should be sent (if different from #2) |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

name |

|

|

|

|

|

|

|

|

|

Telephone number |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

P.O. Box, Street and number or R.d. number and Box number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

City or Town |

|

|

|

County |

|

|

State |

|

|

ZiP Code |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

4 |

name(s), Home Address(es) and Social Security number(s) of Sole Proprietor, General Partners, Business Trustee, President and Treasurer of |

||||||||||||||||||||||||

|

|

the Corporation or Chief executive Officer or Majority Owner of entity. (Attach listing if necessary.) |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

name |

|

|

|

|

Social Security number |

Telephone number |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

P.O. Box, Street and number or R.d. number and Box number |

City |

|

|

State |

|

|

ZiP Code |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

name |

|

|

|

|

Social Security number |

Telephone number |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

P.O. Box, Street and number or R.d. number and Box number |

City |

|

|

State |

|

|

ZiP Code |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Type of Business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

dOMeSTiC CORPORATiOn (incorporated in PA) |

|

FOReiGn CORPORATiOn (not incorporated in PA) |

nOnPROFiT CORPORATiOn |

|||||||||||||||||||

|

|

|

PARTneRSHiP |

|

|

|

PROPRieTORSHiP |

|

|

|

|

|

(Please submit copy of 501(c) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

exemption letter) |

||||||||||||||

|

|

|

ASSOCiATiOn |

|

|

|

BuSineSS TRuST |

|

|

|

|

|

LiquidATinG TRuST |

||||||||||||

|

|

|

LiMiTed LiABiLiTy PARTneRSHiP |

|

|

|

OTHeR (Specify) |

|

|

|

|

|

LiMiTed LiABiLiTy COMPAny |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if domestic Corporation, give incorporation date. |

if Foreign Corporation, give state where incorporated and date of Certificate of Authority in PA. |

||||||||||||||||||||||

|

|

|

MM/DD/YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

MM/DD/YYYY |

|||||||||

|

|

Registered Pennsylvania Address, P.O. Box, Street and number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

City or Town |

|

|

|

County |

|

|

State |

|

|

ZiP Code |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

date business started in Pennsylvania |

|

|

|

|

date terminated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

MM/DD/YYYY |

|

|

|

|

|

|

|

|

|

MM/DD/YYYY |

|

|

|

|

|

|

|

|

|

|||

6 |

describe the business activity in Pennsylvania, including services performed and rendered, and give principal commodity sold at wholesale or |

||||||||||||||||||||||||

|

|

retail. if sales or construction are involved, please explain. if manufacturer’s representatives or independent contractors perform activities, |

|||||||||||||||||||||||

|

|

render services or execute sales on behalf of the entity rather than entity’s employees, please specify what activities were performed, what |

|||||||||||||||||||||||

|

|

services were rendered and what type of sales were executed. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

7 |

did the entity have employees for which PA personal income tax was required to be withheld from wages? |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

8 |

did taxpayer ever hold any of the following licenses, permits or accounts with the Commonwealth of PA? MM/DD/YYYY |

||||||||||||||||||||||||

|

|

(a) |

Corporation Tax |

yes |

no |

Period |

|

|

to |

|

|

|

|

Revenue id no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(b) |

Malt Beverage or Liquor License |

yes |

no |

Period |

|

|

to |

|

|

|

|

License no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(c) |

Liquid Fuels |

yes |

no |

Period |

|

|

to |

|

|

|

|

Permit |

no. |

|

|

||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(d) |

Cigarette Tax |

yes |

no |

Period |

|

|

to |

|

|

|

|

License no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(e) |

Sales, use and Hotel Occ. Tax |

yes |

no |

Period |

|

|

to |

|

|

|

|

License no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(f) |

Motor Carrier |

yes |

no |

Period |

|

|

to |

|

|

|

|

License no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(g) |

Fuel |

yes |

no |

Period |

|

|

to |

|

|

|

|

License no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(h) |

Lottery |

yes |

no |

Period |

|

|

to |

|

|

|

|

Agent |

no. |

|

|

||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(i) Small Games of Chance Mfg. / distr. |

yes |

no |

Period |

|

|

to |

|

|

|

|

License no. |

|

|

||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(j) |

Public Transportation Assistance |

yes |

no |

Period |

|

|

to |

|

|

|

|

License no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(k) |

PA unemployment Compensation |

yes |

no |

Period |

|

|

to |

|

|

|

|

Account no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(l) PA Oil Company Franchise Tax |

yes |

no |

Period |

|

|

to |

|

|

|

|

Account no. |

||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reset Entire Form |

NEXT PAGE |

PRINT FORM |

Page 2

9Were the assets or activities of the business acquired in whole or in part from a prior business entity?  Yes

Yes  No ( If “Yes”, give predecessor’s name, address and acquisition date. )

No ( If “Yes”, give predecessor’s name, address and acquisition date. )

|

Name |

|

|

|

Acquisition Date |

|

|

|

|

|

|

MM/DD/YYYY |

|

|

P.O. Box, Street and Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

City or Town |

County |

State |

|

ZIP Code |

|

|

|

|

|

|

||

10 |

Has the business held title to any real estate in the last five years from the date of this application? |

Yes |

No |

|

||

|

|

|

|

|

|

|

lIf “Yes”, complete Schedule A (last page).

lIf you currently hold title to real estate in PA, complete Schedule B (last page).

11 |

Will the assets or activities of the business be transferred to another? |

|

|

|

If “Yes”, complete: |

|

|

|

||||||

|

A. |

Corporation |

Yes |

No |

F. Other |

Yes |

No |

|

|

|

Name of New Owner |

|

||

|

|

|

|

|

|

|

||||||||

|

B. |

Partnership |

Yes |

No |

Explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address of New Owner |

|

||||||

|

C. |

Proprietorship |

Yes |

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||||

|

D. |

Liquidating Trust |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

ZIP Code |

|

|||||

|

E. |

Association |

Yes |

No |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12Purpose of Clearance Certificate (check appropriate block):

A. Dissolution of Corporation or Association through Department of State.

A. Dissolution of Corporation or Association through Department of State.

B. Dissolution of Corporation or Association through Court of Common Pleas. Date Court was petitioned and county:

B. Dissolution of Corporation or Association through Court of Common Pleas. Date Court was petitioned and county:

(date) MM/DD/YYYY(county)

C. Withdrawal of Foreign Corporation through Department of State

C. Withdrawal of Foreign Corporation through Department of State

D. Merger or consolidation of two or more Corporations or Associations where surviving Corporation or Association is not subject to the

D. Merger or consolidation of two or more Corporations or Associations where surviving Corporation or Association is not subject to the

|

jurisdiction of Pennsylvania. (See 15 Pa C.S. § 139.) |

|

|

|

|||

E. Bulk Sale Clearance Certificate under Section 1403 of the Fiscal Code. Sale date: |

|

MM/DD/YYYY |

|||||

|

Copy of settlement statement: |

|

|

|

|

|

|

|

Corporation Tax Purposes |

|

Employer Withholding Tax Purposes |

|

Sales, Use and Hotel Occupancy Tax Purposes |

||

|

Unemployment Compensation Tax Purposes |

|

|

|

|||

|

|

|

STATEMENT OF AUTHORIZATION |

||||

I authorize the PA Department of Revenue to disclose, verbally or in written form, all tax filings, payments or delinquencies

requested by the buyer or his representatives for the bulk sale transfer provision. |

|

MM/DD/YYYY |

||

|

|

|

|

|

Authorized by |

|

|

Title |

Date |

F. Foreign Corporation Clearance Certificate under the provisions of the Act of 1947, P.L. 493, Contract Number and Political Subdivision:

F. Foreign Corporation Clearance Certificate under the provisions of the Act of 1947, P.L. 493, Contract Number and Political Subdivision:

13Location of business records, available for audit of Pennsylvania operations.

P.O. Box, Street and Number |

City |

State |

ZIP Code |

|

|

|

|

Telephone Number |

|

|

|

14List any matters pending with the PA Department of Revenue (e.g. petitions, appeals):

15 |

Did the business ever, within the Commonwealth of PA: |

|

|

|

|

MM/DD/YYYY |

|

||||

|

(a) |

........................................................Engage in the sale of soft drinks or soft drink syrup |

Yes |

No |

Period |

|

to |

|

|

||

|

(b) |

Own or lease and operate |

Yes |

No |

Period |

|

to |

|

|

||

|

(c) |

..........................Engage in the sale of diesel fuel to motor vehicles using PA highways? |

Yes |

No |

Period |

|

to |

|

|

||

|

(d) |

Engage in the sale or lease of tangible personal property since Sept. 1, 1953? |

Yes |

No |

Period |

|

to |

|

|

||

|

(e) |

File PA Unemployment Compensation Reports? |

Yes |

No |

Period |

|

to |

|

|||

|

|

If “Yes”, give Account Number |

(See question 8k.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16Have you terminated your business activities in Pennsylvania?

Yes

Yes

No

No

l |

If “Yes”, give distribution of assets date: |

MM/DD/YYYY |

|

|

|

l |

If “No”, explain: |

|

|

|

|

l |

If a Foreign Corporation, have you terminated business in the state of your incorporation? |

Yes No |

|

||

Reset Entire Form |

RETURN TO PAGE 1 |

NEXT PAGE |

PRINT FORM |

Page 3

17number of employees and total gross payrolls during the last five operating years (as reported to the Social Security Administration):

yeAR |

TOTAL eMPLOyeeS |

PA |

TOTAL GROSS |

|

PA |

|||

|

|

|

|

eMPLOyeeS |

PAyROLL |

|

GROSS PAyROLL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18Have the officers received any remuneration, in cash or other other form, for services performed in Pennsylvania during the current calendar year or during any of the preceding four calendar years?

yes

yes  no

no

19Were any remunerated services performed for the business in PA, which you believe did not constitute “employment” as defined in the PA unemployment Compensation Law?  yes

yes  no

no

if “yes”, explain:

20A. Average number of stockholders during the last five years:

B.number of stockholders as of this report:

C.List names and home addresses of stock transfer agents who have handled the corporation’s stock:

name:Address:

|

|

d. Were all shares presented and property redeemed from any stock called for redemption or retired? |

yes |

no |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

21 |

|

The figures below must agree with the last corporate tax report filed with the PA department of Revenue. |

|

|

|

|

|||||||||

|

|

date of Report: |

MM/DD/YYYY |

|

Total Liabilities: |

|

|

|

|

|

|

||||

|

|

Total Assets: |

|

|

|

|

Total equity (net worth): |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|

A. List the amount of corporate bonds issued and still outstanding as of this report. Show each issue separately and include name and |

|||||||||||||

|

|

|

address of any transfer or paying agents. |

Agent |

number of Outstanding Bonds |

Amount |

|||||||||

|

|

issue |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

B. List names and addresses of transfer or paying agents not listed above who have handled corporate bond issues. |

|

|

|

||||||||||

|

|

name: |

|

|

Address: |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23Have you consumed or used in Pennsylvania any tangible personal property or acquired such, after March 6, 1956, on which no PA sales or use tax was paid? if “yes”, please explain:

yes

yes  no

no

24do you have within your custody, possession or control any abandoned and unclaimed (escheatable) funds or assets such as dividends, payroll, deposits, outstanding checks, stock certificates, unidentified deposits, accounts payable debit balances, gift certificates, outstanding debentures or interest, royalties, mineral rights or funds due missing shareholders or other unclaimed amounts payable?

yes

yes  no

no

25Has the business filed a PA Abandoned and unclaimed Property Report for the preceding year?  yes

yes  no

no

26CeRTiFiCATiOn: i certify that the information provided (including Schedules, if applicable) on this application has been examined by me and is, to the best of my knowledge, true and correct. (Certification must agree with individuals listed in question 4.)

Print name |

|

Original Signature |

Signature of Officer – Please sign after printing |

Print name |

|

Original Signature |

Signature of Officer – Please sign after printing |

This form will serve as an application for clearances from both the PA department of Revenue and PA department of Labor & industry.

nOTe: l Submit typed original to the PA department of Revenue (address on Page 1) and one copy to the PA dePARTMenT OF LABOR & induSTRy, OFFiCe OF uneMPLOyMenT COMPenSATiOn TAX SeRviCeS,

ldirect telephone inquiries to the PA department of Revenue at

Reset Entire Form |

RETURN TO PAGE 1 |

NEXT PAGE |

PRINT FORM |

SCHEDULE A - STATEMENT OF ACQUISITION AND/OR DISPOSITION OF PENNSYLVANIA REAL ESTATE WITHIN FIVE YEARS FROM THE DATE OF THIS APPLICATION

Name of Transferee (EE) or Transferor (OR).

Indicate each by symbol EE or OR.

Date of Transfer

Property Location by

Local Political Subdivision

& County

Acquisition

Date

Original Cost |

County |

|

|

|

|

Land |

Building |

Assessed Value |

|

|

|

Actual Consider- |

Actual Monetary Worth |

Amount of PA Realty |

|

ation including |

|||

(Market Value) |

Stamps Affixed to |

||

Encumbrance |

|||

at Time of Transfer* |

Document** |

||

Assumed* |

|||

|

|

|

Explanation

SCHEDULE B STATEMENT OF ALL PENNSYLVANIA REAL ESTATE NOW OWNED

Property Location by Local Political Subdivision & County

Acquisition

Date

Original Cost |

County |

Actual Consider- |

Actual Monetary Worth |

Amount of PA Realty |

|

|

|

ation including |

(Market Value) |

Stamps Affixed to |

|

Land |

Building |

Assessed Value |

Encumbrance |

at Time of Transfer * |

Document** |

|

|

|

Assumed* |

||

|

|

|

|

|

|

Explanation

List all real estate now owned in PA that the business will dispose of prior to or at the time of the action for which a clearance is required. If under agreement of disposition, attach copy of executed agreement for each property so affected.

*Complete if applicable. If transfer represents less than a full

If application is for a Bulk Sale Clearance Certificate, attach a list of PA properties that will be retained. For each property, provide the complete address, including county, date of acquisition and nature of property (residential, industrial, acreage, commercial or farmland). If none, state none.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Designation | REV-181 (CM), Application for Tax Clearance Certificate |

| No Filing Fee | There are no fees associated with filing this application form. |

| Business Information Required | Applicants must provide business name, federal EIN, address, and contact details. |

| Governing Law | The application and clearance are governed by the Pennsylvania Fiscal Code. |

| Representative Information | If applicable, the name and contact information of an attorney or representative must be included. |

| Business Type Options | Applicants can specify if they are a domestic corporation, foreign corporation, nonprofit, and more. |

| Clearance Purpose | The form allows for multiple purposes, including corporation dissolution and withdrawal of foreign entities. |

| Record Keeping | Businesses must provide location details for business records available for state audit. |

| Personal Liability | The form requires officers' names and social security numbers of key personnel, ensuring accountability. |

Guidelines on Utilizing Tax Certificate Pa

Completing the Tax Certificate PA form requires thorough attention to detail, as the accuracy of the information provided is crucial for the next steps in the process. This form lays the groundwork for obtaining a clearance certificate from the Pennsylvania Department of Revenue. Ensure that all required fields are filled out correctly, as omissions or inaccuracies could delay your application.

- Gather Information: Collect all necessary details regarding your business, including its name, address, federal EIN, and the names of any involved representatives or officers.

- Complete Section 1: Fill in the name of the business and the federal EIN. Provide the current mailing address and telephone number.

- Fill Out Section 3: If different from Section 2, provide the name, address, and phone number of your attorney or representative to whom the clearance certificate should be sent.

- Provide Personal Information: In Section 4, list the names, home addresses, and Social Security numbers of key individuals associated with the business, such as owners or officers.

- Describe Your Business: In Section 6, detail the nature of your business activities in Pennsylvania, including any services rendered and products sold.

- Answer Employment Questions: Respond to questions regarding employees and if PA personal income tax was withheld from wages in Section 7.

- Indicate License Information: Complete Section 8 by checking any relevant licenses and providing the license numbers and periods as necessary.

- Address Asset Acquisition: In Section 9, indicate if your business acquired assets from a prior entity, including details of the predecessor's name and date.

- Real Estate Holdings: Answer Section 10 regarding real estate ownership and fill out Schedule A or B if applicable.

- Clarify Asset Transfers: In Section 11, address if business assets or activities will be transferred, providing pertinent details.

- State the Purpose: Mark the appropriate checkbox in Section 12 to clarify the purpose of the clearance certificate.

- Complete Business Records Location: Provide the location of your business records in Section 13 for auditing purposes.

- Acknowledge Pending Matters: List any matters pending with the PA Department of Revenue in Section 14.

- Review Business Activities: In Section 15, address specific activities your business may have engaged in and whether the business has terminated activities in Pennsylvania.

- Document Employment and Payroll: Fill in details about employees and payroll from the last five operating years in Section 17.

- Verify Compensation Status: Section 18 requires information on any officer remuneration received during the past calendar years.

- Stockholder Information: Provide stockholder details in Section 20, including numbers and transfer agents.

- Certification: In the final section, certify that the information is correct by printing and signing your name.

After completing the form, submit the original to the Pennsylvania Department of Revenue and send a copy to the Pennsylvania Department of Labor & Industry. Retain a copy for your records. It is advisable to keep a close eye on your application to ensure a smooth review process.

What You Should Know About This Form

What is the Tax Certificate Pa form?

The Tax Certificate Pa form, also known as the Application for Tax Clearance Certificate, is a document used by businesses in Pennsylvania to request a tax clearance certificate from the Pennsylvania Department of Revenue. This certificate is often necessary for various business transactions such as dissolutions, mergers, or other changes in business structure. It confirms that a business has fulfilled its tax obligations in Pennsylvania.

Who needs to fill out the Tax Certificate Pa form?

The form needs to be completed by businesses that are either incorporated within Pennsylvania or conducting business in the state. This includes domestic corporations, foreign corporations, partnerships, and sole proprietors. Individuals or representatives managing the business may also complete it on behalf of the business.

Is there a fee to apply for the Tax Certificate Pa?

No, there is no filing fee required to submit the Tax Certificate Pa form. Businesses can apply for the certificate at no cost, which may encourage compliance and upkeep of tax responsibilities.

What information is required to complete the form?

The form requires various details, including the name and address of the business, the type of business entity, the names and social security numbers of key personnel, and a history of the business in Pennsylvania. Additional information may involve any licenses held and a description of business activities. All fields must be filled out accurately for proper processing.

How long does it take to receive the Tax Clearance Certificate?

The processing time for the Tax Clearance Certificate can vary. Generally, it may take several weeks for the Pennsylvania Department of Revenue to review the application and issue the certificate. It is advisable to apply well in advance of any official business transactions to ensure timely receipt.

What should I do if my business is no longer operating in Pennsylvania?

If the business has ceased operations in Pennsylvania, this should be indicated in the form. The applicant must also provide details regarding the distribution of assets if the business has been terminated. If necessary, the applicant should file any final tax reports to ensure compliance.

Can a representative complete the form on behalf of the business?

Yes, a designated representative such as an attorney can fill out the form on behalf of the business. The representative’s name, address, and phone number should be included on the form to ensure the clearance certificate is sent to the appropriate person.

What happens if there are outstanding tax obligations?

If there are outstanding tax obligations, the Pennsylvania Department of Revenue will not issue the tax clearance certificate until those issues are resolved. It is crucial for businesses to ensure that their tax filings and payments are up to date prior to submitting the form, as this may delay or prevent the issuance of the certificate.

Where should I submit the Tax Certificate Pa form?

The completed form should be submitted to the Pennsylvania Department of Revenue at the address specified on the form. A copy must also be sent to the Pennsylvania Department of Labor and Industry. Retaining a copy for your records is highly recommended for future reference.

Common mistakes

Filling out the Tax Certificate PA form can be a straightforward process, but mistakes often occur that can lead to delays or complications. One common error is failing to enter the correct business name and address. It is essential that the information provided matches what is registered with the state. Errors in the name or address can lead to a rejection of the application, requiring a resubmission and additional processing time.

Another frequent mistake involves leaving sections incomplete or unanswered. Many applicants may overlook questions that require a "yes" or "no" response. Skipping these questions can result in unnecessary delays as the reviewing department may need to reach out for clarifications. Attention to detail is vital, and all sections should be thoroughly reviewed before submission.

In addition, failure to provide supporting documentation can hinder the application process. Certain parts of the form request attachments such as proof of tax exemption or details on business activities. Omitting these documents can lead to further inquiries and extend the time it takes to receive the clearance certificate. Applicants should ensure all required documents are included with the submission.

Lastly, some individuals do not double-check for correct signatures on the certification section of the application. The form requires signatures from authorized individuals within the organization. Missing or incorrect signatures will cause delays, as the application will not be processed until all required signatures are provided. Verifying that all necessary parties have signed will help ensure a smoother process.

Documents used along the form

The Tax Certificate PA form is an important document that businesses in Pennsylvania may need to submit for various reasons, such as dissolution or withdrawal. Alongside this form, several other documents may be required or helpful in the process. Below is a list of some common forms and documents that are often used in conjunction with the Tax Certificate PA form, along with brief descriptions.

- Application for Sales Tax License (REV-1220): This application is necessary for businesses that sell taxable items and services in Pennsylvania. It allows businesses to collect tax from customers and remit it to the state.

- Corporation Tax Reports (CT-1): Corporations must file annual reports detailing their income and activities in Pennsylvania. These reports inform the Department of Revenue about the tax liability of the corporation.

- Unemployment Compensation Tax Report (UC-2): Employers are required to file this report to provide information on employee wages and determine the unemployment compensation tax owed to the Commonwealth.

- Bulk Sale Notification Form: This form is used to notify the Pennsylvania Department of Revenue about a bulk sale of business assets. This notification is essential in ensuring all taxes owed are settled before the sale occurs.

- Schedule A (Statement of Acquisition/Disposition of Real Estate): When real estate is involved in business activities, this schedule must detail any properties acquired or disposed of within a specific timeframe to ensure tax compliance.

- Schedule B (Statement of Real Estate Owned): This schedule requires businesses to list all real estate currently owned in Pennsylvania, which helps to clarify tax responsibilities related to property ownership.

- Employer Information Report (R-1): Businesses need to submit this report to detail their employee information, which can affect their unemployment compensation rate and other business taxes.

Gathering all necessary documents ensures a smoother application process. Each form or schedule plays a crucial role in providing the Pennsylvania Department of Revenue with complete and accurate information about a business's operations and tax obligations.

Similar forms

- Tax Clearance Certificate: Similar to the Tax Certificate PA form, this document signifies that a business has paid all necessary taxes and is in good standing with tax authorities. It often serves as a prerequisite for business transactions such as sales or mergers.

- Business License: A Business License is necessary to legally operate within a certain jurisdiction, just like the Tax Certificate PA form is needed to confirm tax compliance before concluding business activities.

- Sales Tax Permit: This permit allows businesses to collect sales tax from customers. Like the Tax Certificate PA form, it ensures that a business adheres to local tax regulations before making sales.

- Certificate of Good Standing: This certificate, issued by a state agency, confirms that a business is legally registered and compliant with all regulations. Similar to the Tax Certificate PA form, it is often required for various business transactions, such as obtaining loans or entering into contracts.

Dos and Don'ts

When filling out the Tax Certificate PA form, it's important to ensure accuracy and clarity. Here are four key dos and don'ts to keep in mind:

- Do: Type or print clearly to avoid misinterpretation of your information.

- Do: Double-check addresses and contact numbers for accuracy.

- Do: Provide all required signatures, ensuring they match the individuals listed on the form.

- Do: Retain a copy of your completed form for your records.

- Don’t: Leave any fields blank unless instructed; this can delay processing.

- Don’t: Use special characters or unnecessary abbreviations; clarity is crucial.

- Don’t: Forget to sign and date the certification section of the form.

- Don’t: Submit the form without reviewing it for errors or omissions.

Misconceptions

1. Misconception: The Tax Certificate PA form is only for corporate entities.

Many believe this form is exclusively for corporations. However, it applies to various types of businesses, including sole proprietorships, partnerships, and nonprofit organizations.

2. Misconception: There is a filing fee associated with the Tax Certificate PA form.

This form does not require a filing fee, making it accessible for all business types seeking tax clearance.

3. Misconception: Submitting the Tax Certificate PA form guarantees instant clearance.

While submitting the form starts the clearance process, it does not guarantee immediate approval. The processing time can vary based on the specific circumstances of the business.

4. Misconception: All businesses need to have been active for five years to apply.

New businesses can apply as well. The form can be filled out by any business operating in Pennsylvania, regardless of how long it has been active.

5. Misconception: Only the business owner can submit this form.

Authorized representatives, such as attorneys or accountants, can submit the Tax Certificate PA form on behalf of the business. This can streamline the process for busy owners.

6. Misconception: The form does not require detailed information about past activities.

The Tax Certificate PA form asks for comprehensive details about previous business activities, including licenses held and types of services provided, to assess tax obligations accurately.

7. Misconception: This form is only needed for businesses closing operations.

While it is often associated with dissolution, businesses can require this certificate for various purposes, including mergers and sales that involve changing ownership.

8. Misconception: All tax filings must be fully up to date before applying.

Though businesses should strive to be compliant, delays in payments or filings do not automatically disqualify a business from obtaining a tax clearance certificate. However, it may affect processing time.

9. Misconception: The information provided in the application is confidential.

Filing the Tax Certificate PA form allows the Pennsylvania Department of Revenue to disclose tax information related to the business to authorized parties, which can include potential buyers in a sale situation.

10. Misconception: A lack of past licenses means no need for the form.

All businesses, even without licenses, should submit this form to clarify their tax statuses and responsibilities, especially during ownership transitions or business closures.

Key takeaways

When preparing to fill out the Tax Certificate PA form, keep these important points in mind:

- Ensure all requested information is accurate and complete. Inaccuracies may cause delays.

- This form is essential for obtaining tax clearance in Pennsylvania. It verifies that a business has met its tax obligations.

- Type or print neatly to ensure legibility. Illegible submissions may not be processed.

- Include a detailed description of your business activities in Pennsylvania, including services offered and goods sold.

- If applicable, attach documentation for employees, business licenses, and prior tax filings to support your application.

- Be prepared to provide details on any business changes, such as mergers or acquisitions, as this may impact your eligibility for the certificate.

- Remember to certify your application. The certification should be signed by an officer and must match the individuals listed on the form.

- A copy of the form must be submitted to both the PA Department of Revenue and the PA Department of Labor and Industry.

- Maintain a copy for your records as proof of submission and for future reference.

Keep these key takeaways in mind to navigate the completion and submission of the Tax Certificate PA form effectively. Your diligence will help ensure a smoother process in securing the necessary clearance for your business activities.

Browse Other Templates

Sbi Health - Claimants must specify the particulars of each bill for clarity.

Disability Payments Taxable - Using the DE 1 EDD form can help businesses avoid unnecessary fines or delays in registration.

Form Wh-58 - The form can be essential in employee disputes over unpaid wages or compensation.