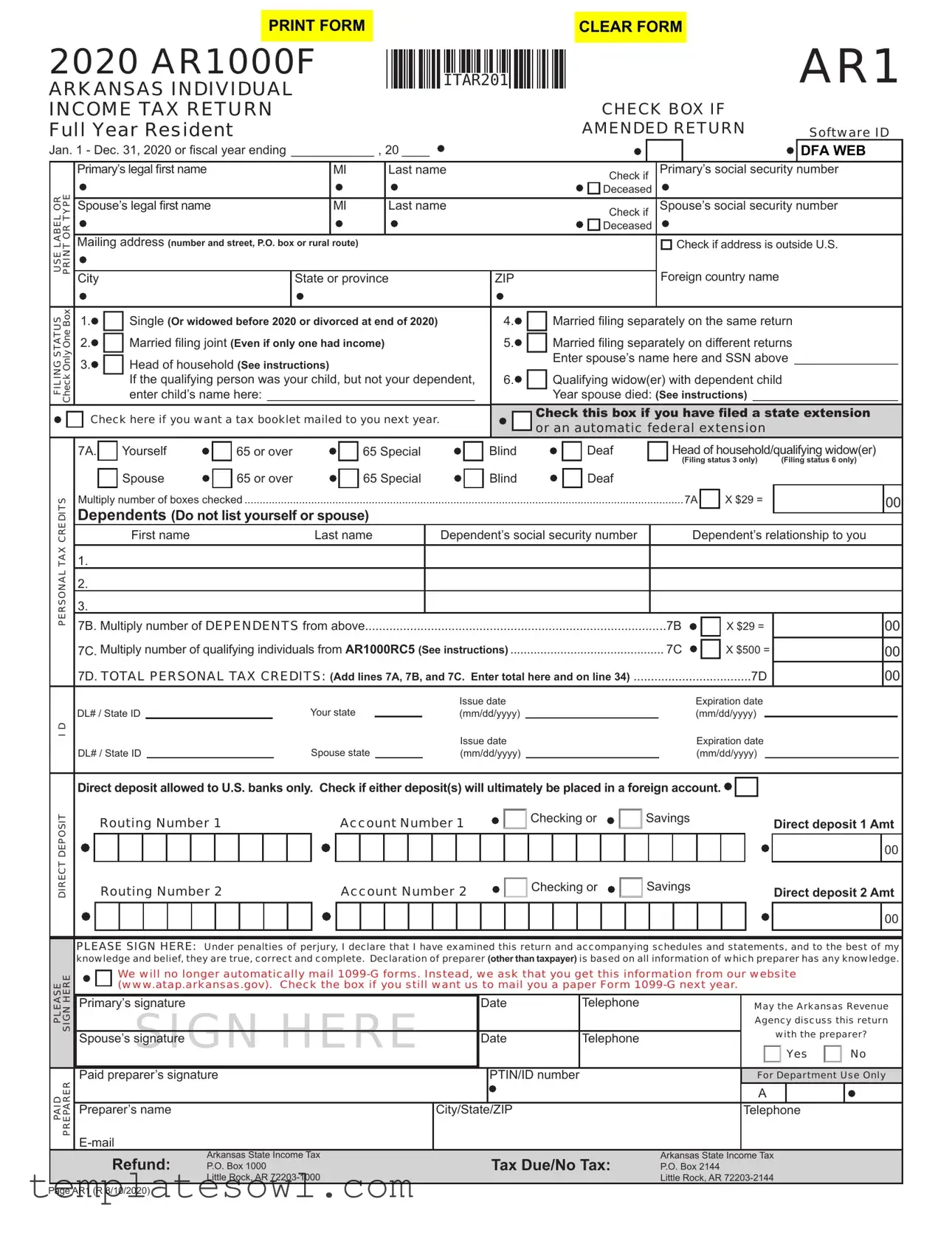

Fill Out Your Tax Ar1000F Form

The Arkansas AR1000F form is an essential document for individuals filing their state income taxes. This form is specifically designed for residents of Arkansas and must be submitted annually. The filing period typically aligns with the calendar year, from January 1 to December 31. Taxpayers must select their filing status, which ranges from single to married filing jointly, as this choice significantly influences calculations. It also incorporates various personal tax credits that taxpayers can utilize, offering potential reductions in their overall tax liability. In addition, the form requires applicants to detail their income sources, including wages, military pay, and investment earnings, ensuring that all income is accounted for. Taxpayers are also given the option to choose direct deposit for any refunds, making the process more efficient and convenient. Understanding the intricacies of the AR1000F form is crucial for accurate filing and maximizing any potential benefits, reflecting the importance of proactive tax planning in Arkansas.

Tax Ar1000F Example

|

PRINT FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CLEAR FORM |

AR1 |

2020 AR1000F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITAR201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

ARKANSAS INDIVIDUAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

INCOME TAX RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHECK BOX IF |

|||

Full Year Resident |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMENDED RETURN Software ID |

|||

Jan. 1 - Dec. 31, 2020 or fiscal year ending ____________ , 20 ____

|

|

Primary’s legal first name |

|

|

|

MI |

Last name |

|

TYPEOR |

|

|||||||

|

Spouse’s legal first name |

|

|

MI |

Last name |

|||

OR |

|

|

|

|||||

LABEL |

Mailing address (number and street, P.O. box or rural |

|

route) |

|

||||

|

|

|||||||

|

|

|

|

|

|

|

|

|

USE |

|

City |

|

|

State or province |

|||

|

|

|

||||||

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Box |

1. |

Single (Or widowed before 2020 or divorced at end of 2020) |

||||||

STATUS |

2. |

Married filing joint (Even if only one had income) |

|

|||||

One |

|

|||||||

Only |

3. |

Head of household (See instructions) |

|

|||||

FILING |

|

|

If the qualifying person was your child, but not your dependent, |

|||||

Check |

|

|

||||||

|

|

enter child’s name here: ______________________________ |

||||||

Check here if you want a tax booklet mailed to you next year.

|

DFA WEB |

Check if |

Primary’s social security number |

Deceased |

|

Check if |

Spouse’s social security number |

Deceased |

|

Check if address is outside U.S.

Check if address is outside U.S.

ZIP |

Foreign country name |

|

|

Married filing separately on the same return |

|

4. |

||

5. |

Married filing separately on different returns |

|

|

|

Enter spouse’s name here and SSN above _______________ |

6. |

Qualifying widow(er) with dependent child |

|

|

|

Year spouse died: (See instructions) _____________________ |

|

|

&KHFNWKLVER[LI\RXKDYHÀOHGDVWDWHH[WHQVLRQ |

|

|

|

|

|

or an automatic federal extension |

|

|

|

PERSONAL TAX CREDITS

I D

DIRECT DEPOSIT

PLEASE SIGN HERE

7A. |

|

Yourself |

|

|

65 or over |

|

|

65 Special |

|

|

|

|

Blind |

|

|

|

|

Deaf |

|

|

|

|

Head of household/qualifying widow(er) |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deaf |

|

|

|

|

(Filing status 3 only) |

(Filing status 6 only) |

||||||||||||

|

|

|

Spouse |

|

|

65 or over |

|

|

65 Special |

|

|

|

|

Blind |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

Multiply number of boxes checked |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7A |

|

X $29 = |

|

00 |

||||||||||||||||||||||

Dependents (Do not list yourself or spouse) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

First name |

|

|

|

|

|

Last name |

|

Dependent’s social security number |

|

|

|

|

Dependent’s relationship to you |

||||||||||||||||||||||||||||||||||||||

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.......................................................................................7B. Multiply number of DEPENDENTS from above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7B |

|

X $29 = |

|

00 |

||||||||||||||||||||||||||||||||

7C. Multiply number of qualifying individuals from AR1000RC5 (See instructions) |

|

|

|

|

|

|

|

|

|

|

7C |

|

X $500 = |

|

00 |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

7D. TOTAL PERSONAL TAX CREDITS: (Add lines 7A, 7B, and 7C. Enter total here and on line 34) |

|

|

|

|

|

|

|

|

7D |

|

00 |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your state |

|

|

|

|

|

|

|

|

Issue date |

|

|

|

|

|

|

|

|

|

|

|

Expiration date |

|

|

|

||||||||||||||

DL# / State ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse state |

|

|

|

|

|

|

|

Issue date |

|

|

|

|

|

|

|

|

|

|

|

|

Expiration date |

|

|

|

||||||||||||||

DL# / State ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|

|

|

|

|||||||||||||||||||||

Direct deposit allowed to U.S. banks only. Check if either deposit(s) will ultimately be placed in a foreign account. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

Routing Number 1 |

|

|

|

|

|

|

Account Number 1 |

|

|

Checking or |

Savings |

|

|

|

|

|

|

Direct deposit 1 Amt |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

Routing Number 2 |

|

|

|

|

|

|

Account Number 2 |

|

Checking or |

Savings |

|

|

|

|

|

|

Direct deposit 2 Amt |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE SIGN HERE: Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

We will no longer automatically mail

|

Primary’s signature |

Date |

Telephone |

May the Arkansas Revenue |

||||

|

SIGN HERE |

|

|

|

|

Yes |

|

No |

|

|

|

|

Agency discuss this return |

||||

|

Spouse’s signature |

Date |

Telephone |

|

with the preparer? |

|||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid preparer’s signature

PTIN/ID number

For Department Use Only

PREPARER |

|

|

|

|

|

A |

|

|

PAID |

|

|

|

|

|

|

|

|

|

Preparer’s name |

|

City/State/ZIP |

|

|

Telephone |

|

|

|

|

|

|

|

|

|

|

|

|

Refund: |

Arkansas State Income Tax |

Tax Due/No Tax: |

Arkansas State Income Tax |

||||

|

P.O. Box 1000 |

P.O. Box 2144 |

||||||

|

|

Little Rock, AR |

|

Little Rock, AR |

||||

Page AR1 (R 8/10/2020)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AR2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITAR202 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Primary SSN _______- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ROUND ALL AMOUNTS TO WHOLE DOLLARS |

|

|

|

|

|

|

|

|

|

|

|

(A) Primary/Joint |

|

|

(B) Spouse’s Income |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Income |

|

|

|

Status 4 Only |

||||||||||||||||||||||||||||||||||||||||

2(s)/1099(s) |

8. |

Wages, salaries, tips, etc: (Attach |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

00 |

|

|

00 |

|||||||

9. |

Military pay: |

|

Primary |

|

|

|

|

|

00 |

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

10. |

Interest income: (If over $1,500, Attach AR4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||

11. |

Dividend income: (If over $1,500, Attach AR4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||

W- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

12. |

Alimony and separate maintenance received: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

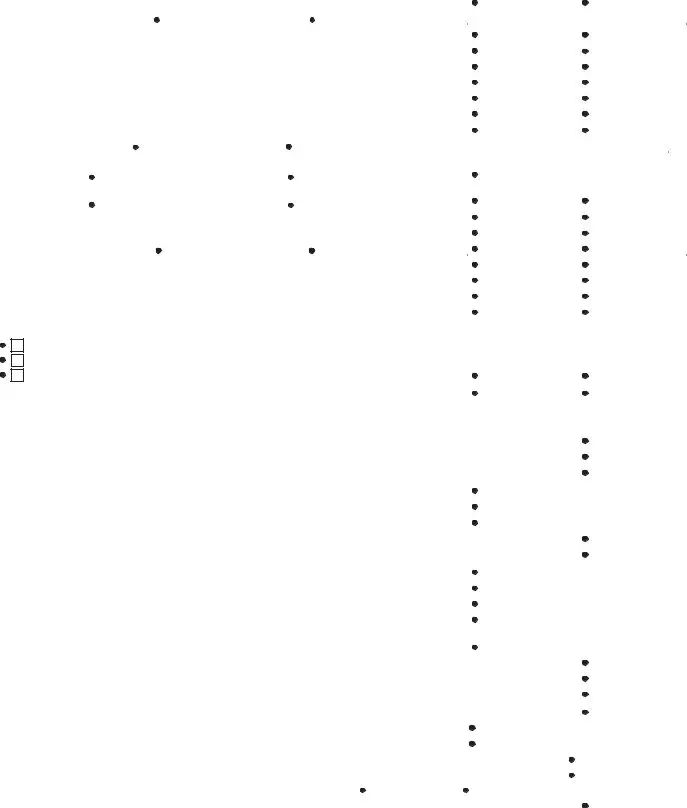

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||

of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

13. |

Business or professional income: (Attach federal Schedule C) |

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||

on top |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

14. |

Capital gains/(losses) from stocks, bonds, etc: (See instructions, Attach federal Schedule D) |

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||

check |

15. |

Other gains or (losses): (Attach federal Form 4797 and/or AR4684 if applicable) |

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

00 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||

16. |

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

00 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||||

INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

Military retirement: Primary |

|

|

|

|

|

|

00 |

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18A. Primary employer pension plan(s)/qualified IRA(s): (See instructions, Attach all 1099Rs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

Attach |

|

|

|

|

|

Less |

|

|

|

|

|

|

|

00 |

|

|

|

||||||||||||||||||||||||||||||||||||||||

/ |

|

Gross distribution |

|

|

|

|

00 |

|

Taxable amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

18A |

|

|

|

|

|

|

|||||||||||||||||

here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$6,000 |

|

|

|

|

|

|

|||||||||||||||||||||||

18B. Spouse employer |

pension plan(s)/qualified |

IRA(s): (See instructions, Attach all 1099Rs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||

|

Gross distribution |

|

|

|

|

00 |

|

Taxable amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

Less |

18B |

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$6,000 |

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

00 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||

19. |

Rents, royalties, |

partnerships, estates, trusts, |

etc.: (Attach federal |

Schedule E) |

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

20. |

Farm income: (Attach federal Schedule F) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||

21. |

Unemployment: |

|

Primary/Joint |

|

|

|

|

|

00 |

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

21 |

|

|

|

|

|

|

00 |

|

|

00 |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||

Attach |

22. |

Other income/depreciation differences: (Attach Form AR |

|

.................................................................. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

|||||||||||||||

23. |

TOTAL INCOME: (Add lines 8 through 22) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||

24. |

TOTAL ADJUSTMENTS: (Attach Form AR1000ADJ) |

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

25. |

ADJUSTED GROSS INCOME: (Subtract line 24 from line 23) |

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

00 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||

|

26. |

Select tax table: (Select only one) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

|

|

||||||

|

27. |

Low income table ($0), For low income qualifications see line 26 instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

COMPUTATION |

|

Standard deduction ($2,200 or $4,400 for filing status 2 only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

Itemized deductions (Attach AR3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

00 |

|

|

00 |

|||||||

28. |

NET TAXABLE INCOME: (Subtract line 27 from line 25) |

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||

29. |

TAX: (Enter tax from tax table) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||

30. |

Combined tax: (Add amounts from line 29, columns A and B) |

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||||

TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

31. |

Enter tax from Lump Sum Distribution Averaging Schedule: (Attach AR1000TD) |

|

|

|

|

|

|

|

|

|

|

|

|

|

31 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||||

|

32. |

Additional tax on IRA and qualified plan withdrawal and overpayment: (Attach federal Form 5329, if required) |

|

|

32 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

33. |

TOTAL TAX: (Add lines 30 through 32) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

|

|

00 |

||||||||

CREDITS |

34. |

Personal tax credit(s): (Enter total from line 7D) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34 |

|

|

|

|

|

|

00 |

|

|

|

|||||||

35. |

Child care credit: (20% of federal credit allowed; attach federal Form 2441) |

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

00 |

|

|

|

||||||||||||||||||||||||||||||||||||||

36. |

Other credits: (Attach AR1000TC) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36 |

|

|

|

|

|

|

00 |

|

|

|

||||||||

TAX |

37. |

TOTAL CREDITS: (Add lines 34 through 36) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

|

|

00 |

||||||||

38. |

NET TAX: (Subtract line 37 from line 33. If line 37 is greater than line 33, enter 0) |

|

|

|

|

|

|

|

|

|

|

|

|

|

38 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

39. |

Arkansas income tax withheld: (Attach state copies of |

|

|

|

|

|

|

|

39 |

|

|

|

|

|

|

00 |

|

|

|

|||||||||||||||||||||||||||||||||||||

|

40. |

Estimated tax paid or credit brought forward from 2019: |

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

00 |

|

|

|

|||||||||||||||||||||||||||||||||||||

PAYMENTS |

41. |

Payment made with extension: (See instructions) |

|

|

|

|

|

|

|

41 |

|

|

|

|

|

|

00 |

|

|

|

|||||||||||||||||||||||||||||||||||||

42. |

AMENDED RETURNS ONLY - Previous payments: (See instructions) |

|

|

|

|

|

|

|

42 |

|

|

|

|

|

|

00 |

|

|

|

||||||||||||||||||||||||||||||||||||||

43. |

Early childhood program: Certification number: |

|

|

|

|

|

|

|

|

43 |

|

|

|

|

|

|

00 |

|

|

|

|||||||||||||||||||||||||||||||||||||

|

(20% of federal credit; Attach federal Form 2441 and Form AR1000EC) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

44. |

TOTAL PAYMENTS: (Add lines 39 through 43) |

|

|

|

|

|

|

|

|

|

|

|

|

|

44 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||

|

45. |

AMENDED RETURNS ONLY - Previous refund: (See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

45 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||

|

46. |

|

|

|

|

|

|

|

|

................................................................................................................. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

46 |

|

|

|

|||

|

Adjusted total payments: (Subtract line 45 from line 44) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

||||||||||||||||||||||||||||||||||||||||

DUE |

47. |

AMOUNT OF OVERPAYMENT/REFUND: (If line 46 is greater than line 38, enter difference) |

|

|

|

|

|

47 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||

48. |

Amount to be applied to 2021 estimated tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

48 |

|

|

|

|

|

00 |

|

|

|

|||||||||

TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

49. |

Amount of |

|

|

|

|

|

|

|

49 |

|

|

|

|

|

00 |

|

|

|

|||||||||||||||||||||||||||||||||||||||

OR |

50. |

AMOUNT TO BE REFUNDED TO YOU: (Subtract lines 48 and 49 from line 47) |

|

|

|

|

|

|

|

|

|

|

|

REFUND 50 |

- |

|

00 |

||||||||||||||||||||||||||||||||||||||||

REFUND |

51. |

AMOUNT DUE: (If line 46 is less than line 38, enter difference; If over $1,000, continue to 52A) |

|

|

|

TAX DUE |

51 |

/ |

|

00 |

|||||||||||||||||||||||||||||||||||||||||||||||

52A. UEP: Attach Form AR2210 or AR2210A. If required, enter exception in box 52A |

|

|

|

|

|

|

|

Penalty 52B |

|

|

|

00 |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

52C.Add lines 51 and 52B: (See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL DUE 52C |

|

|

00 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

PAY ONLINE: Please visit our secure site ATAP (Arkansas Taxpayer Access Point) at www.atap.arkansas.gov. ATAP allows taxpayers or their representatives to |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

log on, make payments and manage their account online. ATAP is available 24 hours. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

PAY BY CREDIT CARD: (See instructions) |

|

|

|

|

|

|

PAY BY MAIL: (See instructions) |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

Page AR2 (R 3/2/2021)

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Form Purpose | The AR1000F form is used by Arkansas residents to report their individual income tax for the tax year. |

| Eligibility | Both full-year residents of Arkansas and part-year residents can use this form to calculate and file their state income taxes. |

| Filing Status Options | Taxpayers can choose from various filing statuses including Single, Married Filing Jointly, and Head of Household among others. |

| Governing Law | The AR1000F form is governed by the Arkansas Code Title 26, Chapter 51, which outlines the taxation policies for individual income in the state. |

Guidelines on Utilizing Tax Ar1000F

Completing the Tax AR1000F form is an essential step in filing your Arkansas individual income tax return. Ensuring you accurately fill out all required sections will help facilitate a smoother filing process and keep any potential errors at bay. Carefully follow each step outlined below for a successful submission.

- Begin by indicating whether this is an amended return by checking the appropriate box at the top of the form.

- Enter your legal first name, middle initial, and last name in the designated fields. Complete the same for your spouse, if applicable.

- Provide your mailing address, including city, state, and ZIP code. If applicable, check the box to indicate if either you or your spouse has passed away.

- Check the appropriate box to indicate your filing status: single, married filing jointly, head of household, etc.

- If you are the head of household, enter the name of the qualifying child who is not your dependent.

- Complete personal tax credits by checking the boxes that apply to you and your spouse, then multiply checked boxes by $29 and enter the total in line 7D.

- List all dependents’ first names, last names, Social Security numbers, and their relationship to you in the respective sections.

- Record your income by filling in lines 8 through 22. Attach any necessary W-2 or 1099 forms as noted.

- Calculate your total income by adding lines 8 through 22. This total goes on line 23.

- Account for any adjustments to your income on line 24, including attaching Form AR1000ADJ if needed.

- Subtract line 24 from line 23 to get your adjusted gross income and record it on line 25.

- Determine your deductions and record them on line 27, selecting from standard or itemized deductions as applicable.

- Calculate your net taxable income by subtracting line 27 from line 25, placing the result on line 28.

- Using the tax table, determine your tax amount and enter it on line 29, then total your tax in line 33.

- List any applicable credits, including personal tax credits, child care credits, and others, adding them on line 37.

- Subtract line 37 from line 33 to calculate your net tax, placing it on line 38.

- Document any taxes withheld and payments made, totaling them on line 44.

- Determine if you have an overpayment or a balance due. If you are owed a refund, enter it on line 50. If you owe tax, enter the amount on line 51.

- Sign and date the form to finalize your submission and provide a contact number, if relevant.

What You Should Know About This Form

What is the AR1000F form?

The AR1000F form is the Arkansas Individual Income Tax Return. It is used by residents of Arkansas to report their income and calculate their state tax liability. This form covers income earned between January 1 and December 31 of the tax year. Taxpayers can also file an amended return using this form if they need to correct any previous filings.

Who needs to file the AR1000F form?

Any individual who is a resident of Arkansas and needs to report their income for state tax purposes must file the AR1000F form. This includes single filers, married couples filing jointly or separately, and heads of household. If you earned income in the state, it is essential to submit this form by the filing deadline.

What information do I need to complete the AR1000F?

To complete the AR1000F form, you'll need personal information such as your name, address, and Social Security number. You must also report details about your income, including wages, self-employment earnings, interest, dividends, and any other income sources. Additionally, you should have documentation for any deductions or credits you plan to claim.

Can I file the AR1000F form online?

Yes, you can file the AR1000F form online through the Arkansas Taxpayer Access Point (ATAP) website. This secure site allows taxpayers to complete, submit, and manage their tax returns electronically, making the process more convenient and efficient.

What if I owe taxes?

If you owe taxes after completing your AR1000F, you will find the amount due on Line 51 of the form. You have several options for payment, including paying online via ATAP, by credit card, or by mailing a check with your completed tax return. Be sure to pay any taxes owed by the filing deadline to avoid penalties and interest.

How do I apply for a refund?

If you overpaid your taxes and are due a refund, you’ll see this amount calculated on Line 50 of the AR1000F form. To receive your refund, you can choose direct deposit into your bank account, which is the fastest option, or you can opt for a paper check to be mailed to you.

What if I need to amend my return?

If you discover an error after submitting your AR1000F, you can file an amended return using the same form. Make sure to check the box indicating it is an amended return and provide the correct information. It’s important to complete this as soon as you notice the mistake to minimize any potential penalties.

Common mistakes

Filling out the Tax AR1000F form can be a daunting task, and many individuals make mistakes that can lead to delays or complications in processing their returns. Awareness of common pitfalls can help taxpayers streamline this process. Here are some frequent errors to watch out for when completing the form.

One major mistake is failing to check the correct filing status. Taxpayers can choose from options such as single, married filing jointly, or head of household. Each status has different implications for tax rates and credits. Selecting the wrong status may result in a higher tax liability, potentially missing out on valuable credits.

Another common error is neglecting to provide all required identification numbers. Every taxpayer must enter their Social Security Number (SSN), as well as that of their spouse, if applicable. Missing or incorrect SSNs can delay the processing of the return and any potential refunds, creating unnecessary complications.

Some individuals also overlook entering all sources of income. The AR1000F has specific sections to report wages, interest, dividends, and more. If any sources are omitted, taxpayers could end up underreporting their income, which might trigger an audit or penalties from the state.

Many taxpayers fail to sign and date the form before submission. A missing signature invalidates the entire return. This small oversight can cause frustration, as the return may be sent back for correction while deadlines approach.

Incomplete or incorrect calculations present another significant issue. Taxpayers need to be diligent when calculating their income, adjustments, and credits. Miscalculating any figures can lead to an incorrect tax bill, resulting in either underpayment or overpayment.

Some filers do not take advantage of available credits. Tax credits, like those for dependents, can significantly reduce tax liability. Those completing the AR1000F should ensure they check all applicable boxes and carefully calculate these credits, as failing to do so can mean missing out on substantial savings.

Lastly, not keeping copies of submitted forms for personal records can lead to confusion in the future. Retaining a copy helps in case of inquiries or discrepancies, making it easier to resolve any issues that may arise.

By being mindful of these common mistakes, taxpayers can approach the AR1000F with greater confidence and accuracy. Double-checking each section and ensuring all information is correct can lead to a smoother tax-filing experience, minimizing potential delays and complications.

Documents used along the form

When filing your Arkansas individual income tax return using the AR1000F form, several additional documents and forms may also be necessary or helpful in accurately reporting your financial situation. Familiarizing yourself with these materials can streamline the tax preparation process, ensuring all pertinent information is provided and enhancing the accuracy of your filings. Here’s a brief overview of some commonly associated documents.

- W-2 Form: This document reports wages, salaries, and tips earned by an employee, along with the taxes withheld. Employers are required to provide their employees with W-2 forms by the end of January each year, making it essential for accurately calculating taxable income.

- Form 1099: There are various types of 1099 forms, each designed to report different kinds of income, such as freelance income or interest earned. For instance, a 1099-MISC includes payments made to independent contractors, while a 1099-INT reports interest income from banks.

- AR1000ADJ: This adjustment form is used to report adjustments to income, such as contributions to an IRA or student loan interest. Including this form can impact your total tax liability and potentially increase your refund.

- AR1000RC: The Arkansas Personal Tax Credits form requires taxpayers to declare any eligible tax credits they wish to claim. This is helpful for reducing your overall tax obligation.

- AR3: Taxpayers who choose to itemize their deductions instead of taking the standard deduction need to complete this form. It details various deductible expenses, such as mortgage interest and charitable donations.

- AR1000TC: This form is used to report additional tax credits that may apply to your situation, providing an opportunity for further reductions in your overall tax liability.

Understanding these additional forms will enable you to prepare your individual income tax return more effectively. Gather all necessary documentation ahead of time, and consult with a tax professional if needed, ensuring you make the most of your eligible deductions and credits.

Similar forms

Form 1040: Like the AR1000F, the federal Form 1040 is an individual income tax return. Both forms require taxpayers to report their income, deductions, and credits to determine their tax liability.

Form 1040-SR: This form is designed for seniors who may find the layout more accessible. Similar to AR1000F, it allows seniors to report income and claim deductions and credits.

Form 1040-NR: Non-resident aliens use the 1040-NR form to file their U.S. taxes. It shares the same basic purpose as the AR1000F: determining tax liability based on income.

Form 1065: Partners in a partnership file this form to report income, deductions, and credits. While AR1000F is exclusive to individuals, both forms calculate taxable income and share similar sections for deductions.

Form W-2: Employers use the W-2 form to report employee wages and taxes withheld throughout the year. Like the AR1000F, it is crucial for accurate income reporting on tax returns.

Form 1099-MISC: This form is used to report various types of income outside of employment. For the AR1000F, income reported on 1099 forms may influence the overall tax liability, creating a direct connection.

Form 8862: This form is used to claim the Earned Income Tax Credit (EITC) after a disallowance. Much like AR1000F, it is crucial for taxpayers seeking credits to reduce their tax burden.

Form 8888: Taxpayers can use this form to allocate their federal tax refund among multiple accounts. Similar to the AR1000F's direct deposit section, it provides options for receiving refunds.

Form 8863: This form is for educational credits. It is comparable to the credits section in AR1000F, allowing taxpayers to claim benefits that can reduce their taxes owed.

State Income Tax Extensions (e.g., Form AR1055): Similar to how AR1000F allows for filing extensions, these forms give taxpayers additional time to report income while maintaining compliance with state tax laws.

Dos and Don'ts

- Do double-check your personal information, including your social security number and address.

- Don't leave any sections blank; fill in all required fields.

- Do calculate your income and credits carefully to ensure accuracy.

- Don't forget to sign and date your form before submitting it.

- Do keep a copy of your completed form for your records.

- Don't use a pencil; print your form using blue or black ink only.

Misconceptions

Understanding the Tax AR1000F form is crucial for anyone navigating the Arkansas individual income tax return process. However, several misconceptions can lead to confusion and errors. Clarifying these misunderstandings can greatly assist taxpayers in fulfilling their obligations accurately.

- The AR1000F form is only for state residents. Many believe this form is exclusively for permanent residents of Arkansas. In reality, any individual who earned income in Arkansas, regardless of residency status, must file.

- Only individuals with high incomes need to file the AR1000F. This is misleading. Even if your earnings are minimal, certain conditions may require you to file this form, such as eligibility for tax credits or other deductions.

- Filing an amended return is unnecessary if there are minor errors. It is vital to correct mistakes, no matter how trivial they may seem. An amended return helps ensure that you receive any rightful refund or avoid unnecessary penalties.

- All income types are treated the same. Different types of income, such as military pay or unemployment benefits, have specific reporting requirements. Misunderstanding these distinctions can lead to incorrect filings.

- Tax credits will automatically reduce taxes owed. While it's true that claiming tax credits can lower your tax bill, each credit has rules and qualifications. You must determine your eligibility accurately.

- Filing electronically guarantees faster refunds. While electronic filing can speed up the process, delays may still occur based on other factors, such as errors, additional verification requirements or the complexity of your return.

- Dependent qualifications are straightforward. The rules for claiming dependents can be complex. A misunderstanding of the guidelines may lead to improper claims or missed opportunities for credits.

- All taxpayers must itemize deductions to benefit. Some taxpayers qualify for the standard deduction, which can often provide greater tax relief without the complexity of itemizing. Understanding which option works better for you is essential.

- While using a tax preparer, personal responsibility is lessened. Taxpayers are ultimately responsible for the accuracy of their returns. Ensuring the preparer understands your circumstances is essential for proper filing.

- Once filed, the AR1000F form cannot be changed. This is incorrect. Taxpayers can file an amended return if cirumstances change or mistakes are found, ensuring that your tax record remains accurate.

Being informed about these misconceptions can help in taking necessary actions before the approaching filing deadline. Awareness promotes compliance and can lead to potential savings, as well as a smoother tax season overall.

Key takeaways

- Know Your Filing Status: Select the correct filing status, such as single, married filing jointly, or head of household. This will affect your tax rates and available credits.

- Social Security Numbers: Ensure that you enter the correct Social Security numbers for yourself and your spouse if applicable. Incorrect information can delay your processing.

- Claim Personal Tax Credits: Identify and claim any eligible personal tax credits. These can significantly lower your overall tax liability.

- Review Income Sources: Clearly list all sources of income, such as wages, interest, and other earnings. Attach necessary forms like W-2s or 1099s where required.

- Calculate Adjusted Gross Income: Keep track of adjustments. This helps you determine your adjusted gross income accurately, which is essential for calculating your taxes.

- Understand Deductions: Choose between the standard deduction and itemizing your deductions. Knowing which option provides a better tax benefit is crucial.

- Sign and Date: Don't forget to sign and date your return. An unsigned form may not be processed, leading to delays.

- Consider Electronic Filing: Filing electronically can streamline the process and reduce the chance of errors. Plus, it typically results in quicker refunds.

Browse Other Templates

Ohio Real Estate Disclosure Form - Owners can list any other known material defects that could impact the safety or use of the property.

Reasons for Emergency Custody California - The L 1124 form is used for verifying postgraduate training for physician licensure in Texas.

Free Diabetes Record Book - Record daily measurements to manage glucose effectively.