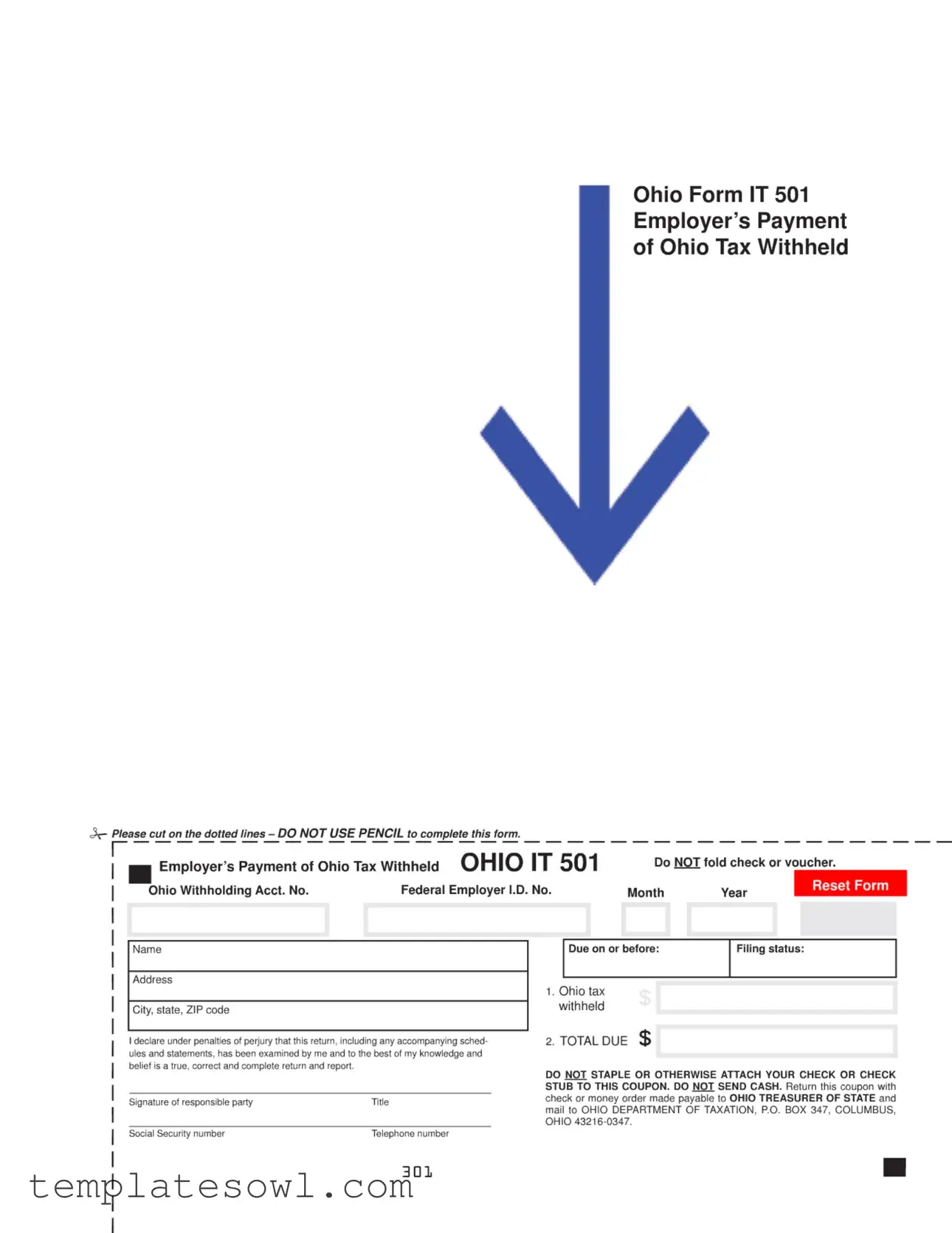

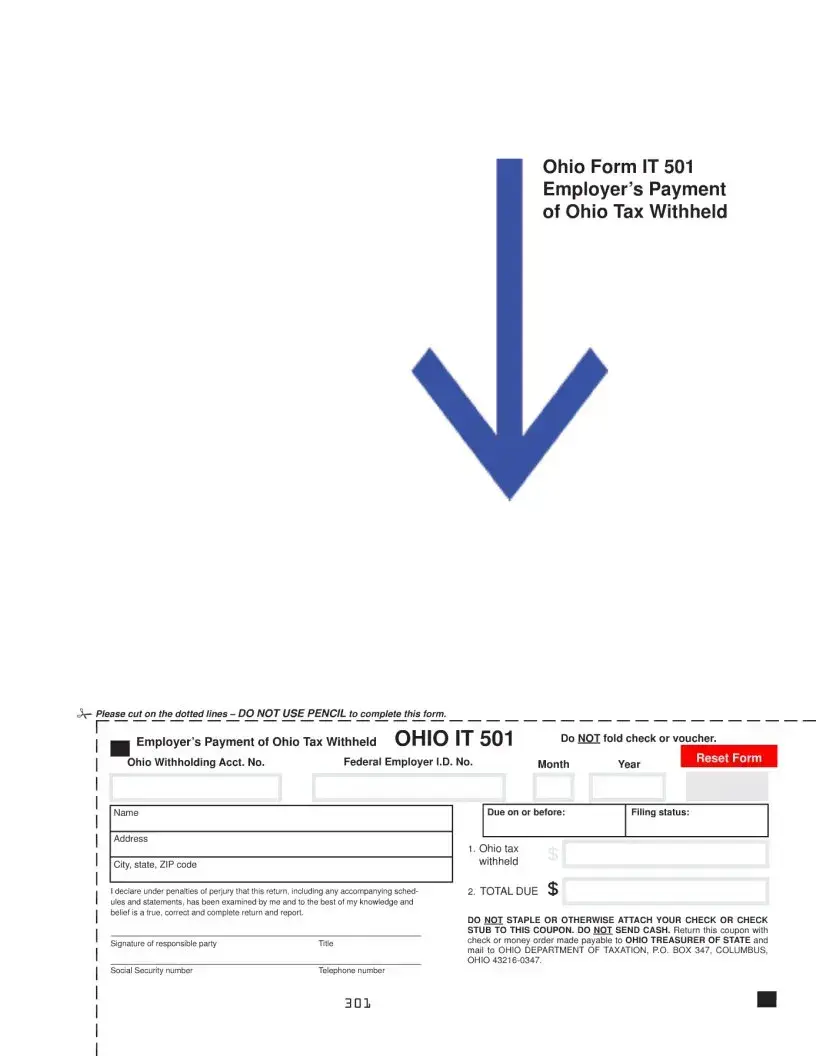

Fill Out Your Tax It 501 Form

When it comes to managing employee taxes in Ohio, the IT 501 form plays a crucial role. Designed for employers, this form facilitates the payment of state tax withheld from employees' wages. It is essential to fill it out accurately and submit it on time to avoid penalties. Key information required includes the employer's details, federal identification number, and the total amount of tax withheld. Along with the completed form, employers must provide a payment, typically through a check or money order, made out to the Ohio Treasurer of State. It is important to follow the instructions carefully, such as not stapling any documents and avoiding the use of pencil. This helps in ensuring that the submission is processed smoothly. Signatures on the form confirm the accuracy of the information provided, emphasizing the employer's responsibility in tax compliance. Understanding the requirements and guidelines of the Tax It 501 form is vital for employers to maintain their financial health and stay aligned with state regulations.

Tax It 501 Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | Form IT 501 is used by employers to pay withheld Ohio income taxes. |

| Filing Deadline | The form must be submitted on or before the scheduled due date. |

| Payment Instructions | Employers should send a check or money order, without attaching the check stub. |

| Submission Address | Mail payments to: Ohio Department of Taxation, P.O. Box 347, Columbus, Ohio 43216-0347. |

| Penalties for False Information | Submitting inaccurate information may lead to penalties under perjury laws. |

| Do Not Fold | Checks and vouchers should not be folded to ensure proper processing. |

| Tax Identification | Employers need to provide their Ohio Account Number and Federal I.D. Number. |

Guidelines on Utilizing Tax It 501

Once you have the Tax It 501 form ready, filling it out accurately is crucial for a smooth tax process. Follow each step carefully to ensure all necessary information is included.

- Begin by entering your Ohio Account Number at the designated spot on the form.

- Next, provide your Federal I.D. Number.

- Fill in your name in the appropriate section.

- In the Due on or before field, write the due date for this payment.

- Indicate your filing status by checking the relevant box.

- Complete your address, including your street address, city, state, and ZIP code.

- In the section for Ohio tax withheld, enter the total amount of tax withheld.

- Calculate the TOTAL DUE and input that number in the provided space.

- Sign the form where it says Signature of responsible party.

- Include the title of the responsible party next to their signature.

- Add the Social Security number of the responsible party.

- Finally, provide the telephone number of the responsible party.

After completing the form, do not staple or attach anything to it. Send the coupon along with your check or money order made out to the Ohio Treasurer of State. Mail it to Ohio Department of Taxation, P.O. Box 347, Columbus, Ohio 43216-0347. Make sure to send it before the due date to avoid penalties.

What You Should Know About This Form

What is the Tax It 501 form?

The Tax It 501 form, also known as Ohio Form IT 501, is used by employers to report and make payments for Ohio income tax withheld from employees' wages. This form ensures that the state receives the appropriate tax contributions from employers, aiding in the maintenance of state services and infrastructure.

Who needs to file the Tax It 501 form?

Any employer in Ohio who withholds state income tax from their employees’ wages is required to file the Tax It 501 form. This includes businesses of all sizes that employ individuals subject to Ohio income tax withholding. It is essential for employers to ensure compliance with state tax regulations to avoid potential penalties.

When is the Tax It 501 form due?

The Tax It 501 form must be submitted by the due date specified on the form. Generally, the form and the payment are due on or before specific dates as outlined by the Ohio Department of Taxation. Employers should keep track of these deadlines to ensure timely submissions and prevent additional fees.

How should the payment be made with the Tax It 501 form?

Payment should be made using a check or money order, made payable to the "Ohio Treasurer of State." It is important not to send cash and to ensure that the check is not folded or stapled to the voucher. The completed form and payment should be mailed to the Ohio Department of Taxation at the specified address on the form.

What information needs to be included on the form?

When completing the Tax It 501 form, employers must provide their Ohio account number, federal identification number, name, address, and the total amount of Ohio tax withheld. Additionally, the form requires the signature of a responsible party to certify the accuracy of the information provided.

What happens if the Tax It 501 form is filed late?

If the Tax It 501 form is submitted after the due date, the employer may be subject to penalties or interest charges on the unpaid tax amount. To avoid such issues, timely submission is crucial. Employers should also stay informed about any changes to deadlines or filing requirements from the Ohio Department of Taxation.

Can the Tax It 501 form be submitted electronically?

As of now, the Tax It 501 form must be filed in paper form; electronic filing options may not be available. Employers should always check the Ohio Department of Taxation's official website for the most current options regarding tax reporting and payments, as procedures may change.

What should I do if I make a mistake on the Tax It 501 form?

If an error is discovered after submitting the Tax It 501 form, it is essential to address it promptly. Contacting the Ohio Department of Taxation for guidance on correcting the error is advisable. They can provide instructions on whether a corrected form is needed or any additional steps that should be taken.

Common mistakes

Filling out the Ohio Form IT 501 requires attention to detail. One common mistake is using a pencil instead of ink. This form clearly states that it should be completed using ink, as pencil can smudge or fade, rendering the information unreadable. Always use a pen to ensure that your submission is clear and legible.

Another frequent error is not cutting along the dotted lines as instructed. Failing to do so can confuse tax officials or cause delays in processing your payment, as the form needs to be properly separated from the check or money order. To avoid any complications, make sure to properly cut along the lines.

Many individuals also neglect to include their tax withheld amount in the appropriate space. This oversight leads to discrepancies in their payments and can result in additional penalties or interest charges. Be diligent in calculating your total and ensure it is correctly reported on the form.

It is essential to provide your complete business name and address. Omitting this information can lead to processing delays or misdirected payments. Ensure that each field is filled out accurately and completely, including city, state, and ZIP code.

Some people do not sign the form. The signature of the responsible party is a critical part of the submission process, confirming the accuracy of the information provided. Avoid leaving this blank, as it is necessary for the form’s validity.

When making a payment, individuals sometimes staple their check or money order to the form. This is expressly prohibited. Instead, the form should be returned with the payment enclosed but without any staples or other attachments.

Another mistake is sending cash. The instructions clearly state to avoid sending cash with your submission. Only checks or money orders made payable to the Ohio Treasurer of State will be accepted. Ensure you plan ahead to obtain the correct form of payment.

Beyond these common errors, failing to double-check the accuracy of your Federal I.D. number and the Ohio account number can lead to significant issues. These identifiers must match your records. Any discrepancies can lead to delays in processing or incorrect payment applications.

Lastly, many overlook timely submission. The form is due on or before a specific deadline. Delaying your submission can incur penalties and interest, complicating your financial situation. Ensure that you file this form in a timely manner to avoid additional charges.

Documents used along the form

The Tax It 501 form is an important document for employers to report and pay Ohio state income tax withheld from employees. In addition to this form, there are several other documents that may be utilized in the tax preparation and reporting process. Below is a list of these documents, along with a brief description of each one.

- Form W-2: This form reports annual wages and the amount of taxes withheld from an employee’s paycheck, which employers must provide to employees and the IRS.

- Form W-3: This form summarizes all W-2s for a given tax year. Employers must submit it along with their W-2 forms to the Social Security Administration.

- Form 1040: This is the standard individual income tax return form used by U.S. taxpayers to report their income and calculate their tax obligations.

- Form IT 1040: This form is specific to Ohio. It is used by residents to file individual income tax returns and report state tax obligations.

- Form IT 4: An Employee's Withholding Exemption Certificate that allows employees to claim exemptions from taxes, adjusting the amount withheld from their paychecks.

- Form IT 941: This quarterly form is used to report Ohio income tax withheld from employees' wages for certain payroll periods.

- Form 1099: This form is used to report non-employee income, often for freelancers and contractors, indicating income not subject to withholding.

- Payroll Records: Employers should keep organized records of each employee’s wages, tax withholdings, and hours worked for accurate reporting and compliance.

- Form ST 4: This is a sales tax exemption certificate used for purchases that are exempt from Ohio sales tax, often pertinent for certain businesses.

- Form IT 3: This form allows employers to claim a refund of overpaid income tax withholdings for employees, ensuring accuracy in tax payments.

Each of these documents plays a critical role in ensuring compliance with tax regulations and facilitating accurate reporting. Properly managing these forms can help both employers and employees navigate their tax responsibilities more effectively.

Similar forms

- W-2 Form: The W-2 form reports wages paid to employees and the taxes withheld. Like Form IT 501, it is submitted annually to ensure accurate tax reporting.

- 1040 Form: The 1040 form is an individual income tax return. Similar to Form IT 501, it provides a comprehensive overview of an individual's income and tax liabilities.

- Payroll Tax Report: Employers use this document to report their payroll expenses and withholdings. Both documents require accurate reporting of withheld amounts to avoid penalties.

- State Payment Voucher: This voucher is a payment method for state taxes owed. It parallels the IT 501 as it offers a structured way to remit owed taxes directly to the state treasury.

Dos and Don'ts

When filling out the Tax It 501 form, keeping the following guidelines in mind can help ensure that the process goes smoothly. Here’s a list of what you should and shouldn’t do:

- Do fill out the form using blue or black ink. Avoid using pencil.

- Do double-check all the information for accuracy before submitting.

- Do declare under penalties of perjury, confirming your information is truthful.

- Do ensure you include your check or money order with the form but do not staple it.

- Do send your completed form to the correct address: Ohio Department of Taxation, P.O. Box 347, Columbus, Ohio 43216-0347.

- Don't fold the check or the voucher.

- Don't forget to include your Ohio account number and Federal I.D. number.

- Don't send cash to the Ohio Department of Taxation.

- Don't neglect to fill in all required fields, including your Social Security number and contact information.

- Don't assume that a single mistake is permissible; double-check all entries thoroughly.

Misconceptions

Here are five common misconceptions about the Ohio Form IT 501, which is used for the payment of Ohio tax withheld:

- This form is only for large employers. Many believe that only large businesses need to file this form. In reality, any employer who withholds Ohio tax from employees must complete and submit Form IT 501.

- Filing the form is optional. Some think that submitting Form IT 501 is optional if the withheld amount is small. However, all employers are required to file this form regardless of the amount withheld.

- Payments can be made via cash. There's a common misunderstanding that cash payments are accepted. Instead, payments must be made by check or money order, payable to the Ohio Treasurer of State.

- The form can be completed with a pencil. Many individuals erroneously believe that they can use a pencil for this form. It's specified that the form should be completed using ink, not pencil, to avoid any issues with readability.

- Filing late results in no penalties. Some think that if they file Form IT 501 late, they won’t incur penalties. Unfortunately, late submissions can lead to fines and interest charges, so timely filing is crucial.

Key takeaways

When filling out the Tax IT 501 form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are key takeaways:

- Use Black Ink: Complete the form using black ink. Do not use a pencil, as it can lead to errors that may cause delays in processing.

- Avoid Folding: Do not fold the check or the voucher. A flat submission helps in the proper processing of your payment.

- Double-Check Information: Carefully review all sections, including the Ohio Account Number and Federal ID Number. Accurate information prevents issues with your state tax obligations.

- Mailing Instructions: After completing the form, return it with a check or money order made payable to the Ohio Treasurer of State. Send it to the designated address: Ohio Department of Taxation, P.O. Box 347, Columbus, Ohio 43216-0347.

- Sign the Form: Remember to sign the form. Your signature certifies that the information you provided is true and complete, which is crucial for avoiding penalties.

Each of these steps plays a critical role in ensuring that your Ohio tax withholdings are managed correctly. Taking the time to fill out the Tax IT 501 form properly can save time and prevent financial complications down the line.

Browse Other Templates

Us Certificate of Citizenship - Applicants can file on behalf of their minor children if they are U.S. citizens.

Certificate of Conformance - This certificate supports regulatory compliance by confirming that all necessary documentation is accurate.

Wordly Wise 3000 Book 5 Test Booklet Pdf - Details general strategies for teaching vocabulary across various grade levels.