Fill Out Your Tax Rut 50 Form

When navigating the world of vehicle purchases in Illinois, understanding the Tax Rut 50 form is crucial for ensuring compliance and optimizing your financial decisions. This form outlines the Private Party Vehicle Use Tax, a tax applied when vehicles are purchased from private parties rather than through dealerships. Effective from January 1, 2016, through December 31, 2016, the tax is primarily based on the purchase price or the fair market value of the vehicle. There are structured guidelines to follow—Tables A and B—that help determine the tax amount owed based on the vehicle's model year and purchase price. For example, if you buy a vehicle worth less than $15,000, the tax due can vary significantly depending on its age. Interestingly, exemptions also exist; certain transactions may require no tax at all. For instance, if you receive a vehicle as an estate gift or are purchasing on behalf of a tax-exempt organization, you might not have to pay the tax. Both motorcycles and all-terrain vehicles also have their own specific tax rates. Understanding these details is essential, not just for your wallet but to ensure smoother transactions and peaceful ownership of your vehicle.

Tax Rut 50 Example

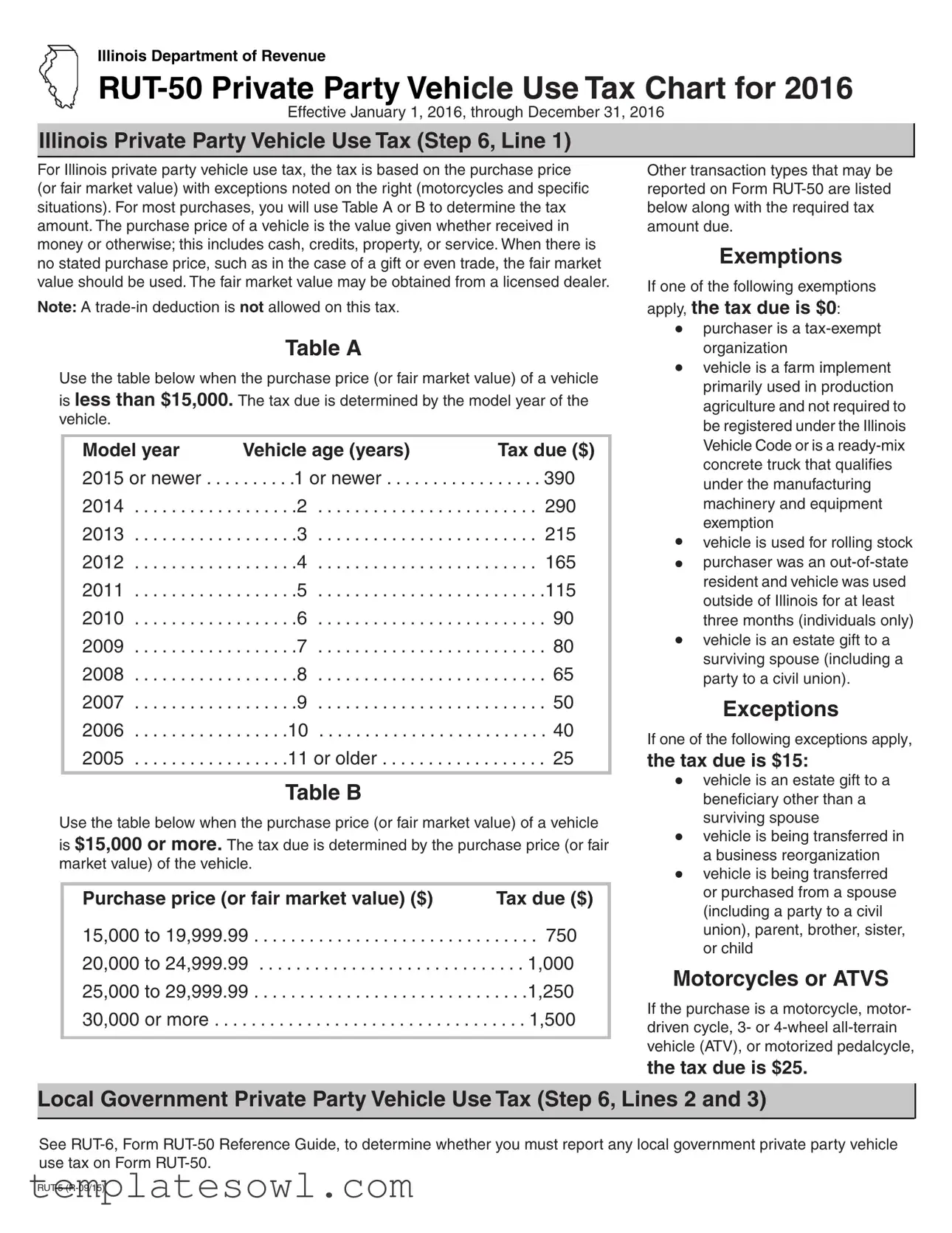

Illinois Department of Revenue

Effective January 1, 2016, through December 31, 2016

Illinois Private Party Vehicle Use Tax (Step 6, Line 1)

For Illinois private party vehicle use tax, the tax is based on the purchase price (or fair market value) with exceptions noted on the right (motorcycles and specific situations). For most purchases, you will use Table A or B to determine the tax amount. The purchase price of a vehicle is the value given whether received in money or otherwise; this includes cash, credits, property, or service. When there is no stated purchase price, such as in the case of a gift or even trade, the fair market value should be used. The fair market value may be obtained from a licensed dealer.

Other transaction types that may be reported on Form

Exemptions

If one of the following exemptions

Note: A

Table A

Use the table below when the purchase price (or fair market value) of a vehicle is less than $15,000. The tax due is determined by the model year of the vehicle.

Model year |

Vehicle age (years) |

Tax due ($) |

2015 or newer . . . . |

. . . . . .1 or newer |

. . . . . 390 |

2014 |

. . . . . .2 |

. . . . 290 |

2013 |

. . . . . .3 |

. . . . 215 |

2012 |

. . . . . .4 |

. . . . 165 |

2011 |

. . . . . .5 |

. . . . .115 |

2010 |

. . . . . .6 |

. . . . . 90 |

2009 |

. . . . . .7 |

. . . . . 80 |

2008 |

. . . . . .8 |

. . . . . 65 |

2007 |

. . . . . .9 |

. . . . . 50 |

2006 |

. . . . .10 |

. . . . . 40 |

2005 |

. . . . .11 or older |

. . . . . 25 |

|

|

|

Table B

Use the table below when the purchase price (or fair market value) of a vehicle is $15,000 or more. The tax due is determined by the purchase price (or fair market value) of the vehicle.

Purchase price (or fair market value) ($) |

Tax due ($) |

15,000 to 19,999.99 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 750 20,000 to 24,999.99 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,000 25,000 to 29,999.99 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1,250 30,000 or more . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,500

apply, the tax due is $0:

•purchaser is a

•vehicle is a farm implement primarily used in production agriculture and not required to be registered under the Illinois Vehicle Code or is a

•vehicle is used for rolling stock

•purchaser was an

•vehicle is an estate gift to a surviving spouse (including a party to a civil union).

Exceptions

If one of the following exceptions apply,

the tax due is $15:

•vehicle is an estate gift to a beneficiary other than a surviving spouse

•vehicle is being transferred in a business reorganization

•vehicle is being transferred or purchased from a spouse (including a party to a civil union), parent, brother, sister, or child

Motorcycles or ATVS

If the purchase is a motorcycle, motor- driven cycle, 3- or 4‑wheel

the tax due is $25.

Local Government Private Party Vehicle Use Tax (Step 6, Lines 2 and 3)

See

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Body | The Illinois Department of Revenue oversees the implementation of the RUT-50 form. |

| Tax Rate Basis | The tax is based on the vehicle's purchase price or fair market value. |

| Exemptions | Some exemptions include tax-exempt organizations and certain agricultural vehicles. |

| Tax Amounts | Tax amounts vary depending on vehicle age (Table A) or purchase price (Table B). |

| Special Cases | Motorcycles and ATVs have a fixed tax amount of $25 regardless of purchase price. |

| Form Reference | For local taxes, report information on Lines 2 and 3 as necessary in conjunction with RUT-6. |

Guidelines on Utilizing Tax Rut 50

Completing the Tax Rut 50 form is essential for reporting vehicle use tax in Illinois. Following the steps accurately will help ensure the proper amount is reported and paid. Below are clear instructions to guide you through the process of filling out the form.

- Obtain the Tax Rut 50 form from the Illinois Department of Revenue website or your local office.

- Enter the purchaser's name and address in the designated fields at the top of the form.

- Provide the vehicle identification number (VIN) in the appropriate section.

- Fill in the purchase price or fair market value of the vehicle.

- Determine if the vehicle is subject to tax using Table A or Table B based on your purchase price or fair market value. Use the model year and age of the vehicle to find the correct tax amount in Table A, or reference Table B for vehicles valued at $15,000 or more.

- Record the calculated tax amount due on the form.

- If applicable, indicate any exemptions or exceptions by checking the relevant boxes provided on the form.

- For motorcycles or ATVs, enter a tax amount of $25 as required.

- Complete the local government private party vehicle use tax section using Form RUT-6, if necessary.

- Review all entered information for accuracy. Verify that the tax amount is correct and that all required fields are filled out.

- Sign and date the form before submitting.

What You Should Know About This Form

What is the Tax Rut 50 form?

The Tax Rut 50 form is used for reporting Illinois private party vehicle use tax. This tax applies to individuals who purchase a vehicle from a private party. The form helps determine the tax amount based on the vehicle's purchase price or fair market value, taking into account certain exemptions and exceptions.

How is the tax amount calculated for vehicles under $15,000?

If the purchase price or fair market value of the vehicle is less than $15,000, you will use Table A from the RUT-50 form. The tax amount depends on the vehicle's model year, with specific tax amounts assigned to vehicles based on their age. For example, a vehicle from 2015 or newer has a tax due of $390, whereas a vehicle from 2005 or older has a tax due of $25.

What if my vehicle purchase price is $15,000 or more?

For vehicles priced at $15,000 or more, Table B is used to calculate the tax. The tax amount increases with the purchase price. For example, if your vehicle's fair market value is between $15,000 and $19,999.99, the tax due is $750. As the value increases, the tax can rise to as much as $1,500 for vehicles priced at $30,000 or more.

Are there any exemptions that apply?

Yes, certain exemptions allow for a tax amount of $0. These include: if the purchaser is a tax-exempt organization, if the vehicle is used for rolling stock, or if the vehicle is an estate gift to a surviving spouse. Additionally, if the purchaser was an out-of-state resident and the vehicle was used outside Illinois for at least three months, no tax is due.

What exceptions are available that change the tax amount?

Some exceptions apply which set the tax due at $15. This includes cases where the vehicle is an estate gift to a beneficiary other than a surviving spouse or if the vehicle is transferred within a family, such as between a spouse, parent, or child. It's important to understand these situations to calculate your tax obligation correctly.

What about motorcycles or ATVs?

If you purchase a motorcycle, motor-driven cycle, or an all-terrain vehicle, the tax due is a flat rate of $25. This simplifies the process as there are no variations based on the vehicle’s purchase price or fair market value in these cases.

Do I need to report any local government taxes?

If applicable, you must check RUT-6 and the Form RUT-50 Reference Guide to determine if local government private party vehicle use tax should be reported on Form RUT-50. This ensures complete compliance with all tax obligations related to your vehicle purchase.

Where can I find more information about the Tax Rut 50 form?

For more detailed information, including instructions and guidance, you can visit the Illinois Department of Revenue website or refer to the official documentation associated with the RUT-50 form. This can help you better understand your responsibilities and complete the form accurately.

Common mistakes

When filling out the Tax Rut 50 form, individuals often make avoidable errors that can lead to potential overpayment or complications with tax authorities. One common mistake occurs when taxpayers incorrectly assess the vehicle's purchase price. The form requires that the tax be calculated based on either the purchase price or the fair market value. Some individuals mistakenly assume that they can estimate a lower value to reduce their tax burden. This can result in penalties or a requirement to pay the correct amount later.

Additionally, people often overlook the specific exemptions listed on the form. For instance, not all private party transactions require tax payments. Individuals might not consider that vehicles transferred as gifts or as part of a business reorganization qualify for tax exemptions. Failing to reference these conditions thoroughly can lead to unnecessary tax liabilities for transactions that may not even fall under the jurisdiction of the Tax Rut 50.

A further error arises in the use of Tables A and B, which dictate the tax based on vehicle age and value. Taxpayers sometimes misclassify their vehicle’s age or overlook the correct table entirely. This misstep frequently stems from confusion regarding model years or current valuations compared to the fair market value. As a result, individuals might end up paying a significantly higher tax than required.

Lastly, many filers tend to skip the mandatory cross-references and additional guidelines laid out in the accompanying reference material. Not consulting the RUT-6 Reference Guide can lead to a lack of understanding about local government tax obligations. This oversight frequently results in tax reporting that is incomplete or inaccurate, which may cause further inquiries from tax authorities and additional complications down the line.

Documents used along the form

When dealing with the Tax RUT-50 form in Illinois, several other forms and documents may be necessary to ensure compliance and facilitate transactions. Understanding these documents can help streamline the process and avoid potential issues.

- Form RUT-6: This document is utilized for reporting local government private party vehicle use tax. It assists in determining whether any additional local taxes are applicable on top of the state tax. Including this form with your RUT-50 can help capture any local tax responsibilities and support accurate reporting.

- Form RUT-1: This form serves as the Illinois Vehicle Use Tax Return. Individuals may be required to file it for vehicles purchased outside the state or for those who did not pay tax at the time of the purchase. It is important for documenting the vehicle's usage and ensuring proper taxation.

- Sales Invoice or Bill of Sale: A sales invoice or bill of sale provides documentation of the vehicle purchase. It details the sale price, date of purchase, and information about both the buyer and seller. Keeping this document on hand is crucial as it may serve as proof of the purchase price or fair market value when completing the RUT-50.

- Proof of Exemption Documentation: If your vehicle qualifies for an exemption, appropriate documents must be submitted. This could include letters or certificates proving the vehicle's eligibility under specific exemption categories, such as nonprofit status or agricultural use. Having this information ready will help ensure you meet all requirements.

Gathering these supporting documents alongside the Tax RUT-50 form can simplify the tax filing process. It helps clarify your tax obligations, ensures accurate reporting, and potentially saves time when addressing any discrepancies that may arise.

Similar forms

-

Form RUT-6: This form is used for local government vehicle use tax in Illinois. Like RUT-50, it requires the purchaser to report the tax based on the purchase price or fair market value of the vehicle. The RUT-6 provides additional details specific to local taxes, ensuring compliance with both state and local regulations.

-

Form ST-556: The ST-556 is the Illinois Sales Tax Transaction Return. Similar to the RUT-50, it requires information about the purchase and tax due, but applies to a broader range of taxable sales. Both forms emphasize the need to assess the transaction’s tax obligations based on purchase price.

-

Form ST-2: This is the Sales Tax Exemption Certificate. Individuals or organizations using this document can assert their tax-exempt status during a transaction. Like the RUT-50, it serves as a means for certain entities to register their non-taxable transactions when acquiring vehicles.

-

Form IT-5: The Illinois Individual Income Tax Declaration of Estimated Payments is used by individuals to report estimated tax payments. In understanding tax obligations, the IT-5 is similar to RUT-50 in that both address the need for taxpayers to be proactive in ensuring they meet their respective tax responsibilities.

-

Form 1040: This is the U.S. Individual Income Tax Return. Though at the federal level, it shares similarities with RUT-50 by requiring information about income and applicable taxes—both forms aim to ensure that taxpayers report necessary financial information to accurately assess their liabilities.

Dos and Don'ts

When filling out the Tax Rut 50 form, it is important to follow specific guidelines to ensure accuracy and compliance. Here is a helpful list of things to do and not do:

- Do double-check the purchase price or fair market value of the vehicle.

- Do use the correct tax table (Table A or B) based on the vehicle's purchase price.

- Do accurately report any exemptions that may apply to you.

- Do include all necessary information about the vehicle, like its model year and type.

- Do reference the RUT-6 guide for local government tax requirements.

- Don’t leave out any requested information on the form.

- Don’t claim a trade-in deduction, as it is not allowed for this tax.

- Don’t forget to verify your residency status if you are claiming an exemption.

- Don’t assume that a gift or trade has no tax implications; always check fair market value.

Following these guidelines will help you complete your form accurately, reducing the likelihood of errors and potential issues with the Illinois Department of Revenue.

Misconceptions

Here are five common misconceptions about the Tax Rut 50 form, along with clarifications:

- Misconception 1: The Tax Rut 50 form is only for new vehicles.

- Misconception 2: A trade-in can reduce the taxable amount.

- Misconception 3: There are no exemptions available.

- Misconception 4: Fair market value must always be determined by the buyer.

- Misconception 5: Motorcycles are taxed the same way as cars.

This is incorrect. The form applies to both new and used vehicles. It is based on the purchase price or fair market value, regardless of the vehicle's age.

This is a misunderstanding. The Tax Rut 50 specifically states that trade-in deductions are not allowed. The tax is based solely on the purchase price or fair market value.

In fact, several exemptions exist. For example, tax-exempt organizations and certain types of vehicles used primarily in agriculture may not owe any tax.

This isn't true. Fair market value can be determined by a licensed dealer, providing an external assessment that can be more accurate than a personal estimate.

This is misleading. Motorcycles and certain ATVs have a separate tax rate of only $25, which differs from the rates applicable to cars based on their purchase price or model year.

Key takeaways

Here are some key takeaways regarding filling out and using the Tax RUT-50 form:

- The Illinois Private Party Vehicle Use Tax is based on the purchase price or fair market value of the vehicle, with specific calculations for motorcycles and certain transactions.

- For vehicles valued under $15,000, the tax amount varies depending on the model year and age of the vehicle according to Table A.

- For vehicles valued at $15,000 or more, Table B outlines the appropriate tax amount based on the purchase price or fair market value.

- Exemptions apply for certain situations, such as tax-exempt organizations or estate gifts to spouses, where the tax due may be $0. However, other exceptions can result in a flat tax due of $15.

Browse Other Templates

Ohio Sui Employer Login - If using FEIN for the contractor, check the specified box on the form.

Clearinghouse Transcripts - If you're mailing transcripts to a third party, include their complete address on the form.