Fill Out Your Tax Worksheet Instruction Form

The Tax Worksheet Instruction form serves as a preliminary guide for taxpayers preparing to file their federal income tax returns. This draft, issued by the Internal Revenue Service (IRS), is not intended for submission but offers insights into significant changes and provisions affecting the current tax year. Among the notable updates are expansions related to the Child and Dependent Care Credit, the Earned Income Credit (EIC), and the Child Tax Credit, all of which derive from the American Rescue Plan of 2021. Taxpayers are reminded that revisions may occur before the official release of the final form, meaning users should consult the IRS website for the most accurate and recent developments. This document also outlines eligibility criteria for various schedules that taxpayers might need to complete based on their unique financial situations, such as claiming additional income or deductions. Furthermore, it provides guidance on accessing taxpayer assistance through resources like the Taxpayer Advocate Service, emphasizing the importance of understanding your taxpayer rights. The form's early release nature highlights the IRS's ongoing commitment to transparency, yet it carries a reminder that ultimate filing responsibilities lie with the taxpayer, necessitating careful consideration of the included instructions.

Tax Worksheet Instruction Example

Note: The draft you are looking for begins on the next page.

Caution:

This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information. Do not file draft forms and do not rely on draft forms, instructions, and publications for filing. We do not release draft forms until we believe we have incorporated all changes (except when explicitly stated on this coversheet). However, unexpected issues occasionally arise, or legislation is

Early release drafts are at IRS.gov/DraftForms and remain there after the final release is posted at IRS.gov/LatestForms. All information about all forms, instructions, and pubs is at IRS.gov/Forms.

Almost every form and publication has a page on IRS.gov with a friendly shortcut. For example, the Form 1040 page is at IRS.gov/Form1040; the Pub. 501 page is at IRS.gov/Pub501; the Form

If you wish, you can submit comments to the IRS about draft or final forms, instructions, or publications at IRS.gov/FormsComments. We cannot respond to all comments due to the high volume we receive and may not be able to consider many suggestions until the subsequent revision of the product.

If you have comments on reducing paperwork and respondent (filer) burden, with respect to draft or final forms, please respond to the relevant information collection through the Federal Register process; for more info, click here.

1040(and

1040(and

TAX

2021

DecemberINSTRUCTIONS Including3,the instructions2021for Schedules 1 through 3

2021 Changes

American Rescue Plan (ARP) of 2021. The following ARP provisions affect tax year 2021.

•Child and dependent care credit increased.

•

•Child tax credit expanded. Advance payments of the child tax credit were made in 2021.

For details on these and other changes, see What’s New in these instructions.

Future Developments

See IRS.gov and IRS.gov/Forms, and for the latest information about developments related to Forms 1040 and

Free File is the fast, safe, and free way to prepare and

Pay Online. It’s fast, simple, and secure. Go to IRS.gov/Payments.

Department of the Treasury Internal Revenue Service www.irs.gov

Dec 03, 2021 |

Cat. No. 24811V |

Table of Contents

Department |

|

Contents |

Page |

Contents |

Page |

|||||

|

What's New |

|

|

6 |

|

Sign Your Return |

|

|

63 |

|

of the |

|

. . . . |

|

. . . |

|

|||||

Treasury |

DRAFT AS OF |

. . . 64 |

||||||||

Internal |

|

. . . . . . . . . . . . . .Filing Requirements |

. . . . 9 |

|

|

|

|

|||

|

Do You Have To File? |

. . . . 9 |

2021 Tax Table |

. . . 65 |

||||||

Revenue |

|

When and Where Should You File? . . . . . 9 |

|

|

|

|

||||

Service |

|

General Information |

78 |

|||||||

|

Line Instructions for Forms 1040 and |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

. . . 13 |

|

Refund Information |

. . . 83 |

|||||

|

|

|

||||||||

|

|

|

|

|

|

|

||||

December |

|

3, 2021 |

||||||||

|

|

Filing Status |

. . . 13 |

|

Instructions for Schedule 1 |

. . . 84 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address |

. . . 15 |

|

|

|

|

|

||

|

|

|

Instructions for Schedule 2 |

96 |

||||||

|

|

Social Security Number (SSN) |

|

15 |

|

|||||

|

|

|

|

|

|

|

||||

|

|

|

|

. . 101 |

||||||

|

|

Dependents, Qualifying Child for |

|

|

|

|

.Instructions for Schedule 3 |

|||

|

|

Child Tax Credit, and Credit for |

. . . 18 |

|

Tax Topics |

|

105 |

|||

|

|

Other Dependents |

|

. . |

||||||

|

|

|

|

|||||||

|

|

Income |

. . . |

23 |

|

Disclosure, Privacy Act, and Paperwork |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Total Income and Adjusted Gross |

30 |

|

Reduction Act Notice |

. . 107 |

||||

|

|

. . . . . . . . . . . . . . . . . .Income |

|

Major Categories of Federal Income and |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax and Credits |

. . . 30 |

|

109 |

|||||

|

|

|

Outlays for Fiscal Year 2020 |

|||||||

|

|

Payments |

|

37 |

|

|||||

|

|

|

|

|

|

|

||||

|

|

Refund |

. . . 58 |

|

Index |

. . 111 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount You Owe |

. . . 61 |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Form 1040 and

Helpful Hints

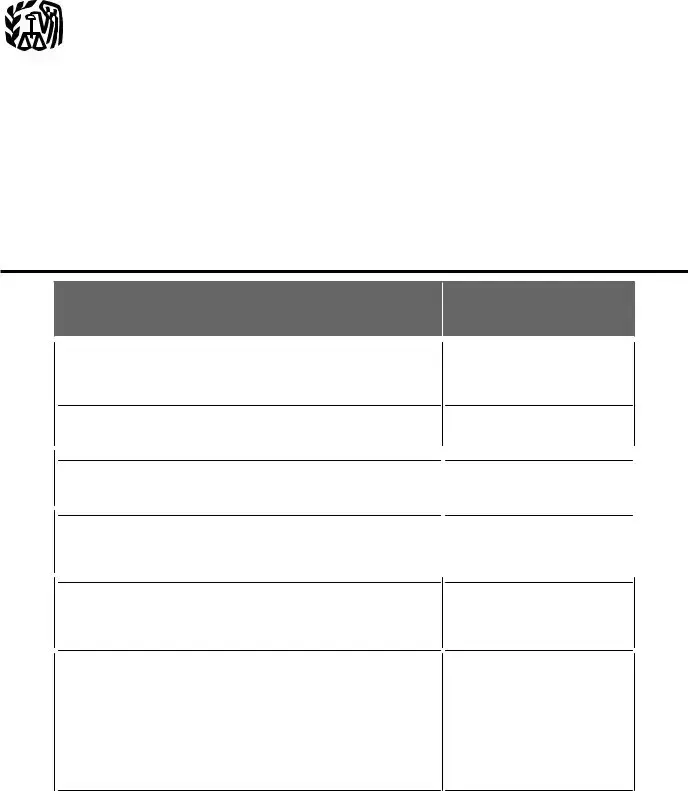

Helpful Hints

For 2021, youDRAFTwill use Form 1040 or, if you were born before ASJanuary 2, 1957, you haveOFthe option to use Form

You may only need to le Form 1040 or

additional taxes), you will need to complete one or more of the numbered schedules. Below is a general guide toDecemberwhich schedule(s) you will need to le based on your circumstances3,. See the instructions2021for the schedules for more information.

If you

IF YOU...

Have additional income, such as business or farm income or loss, unemployment compensation, prize or award money, or gambling winnings.

Have any deductions to claim, such as student loan interest,

THEN USE...

Schedule 1, Part I

Schedule 1, Part II

Owe alternative minimum tax (AMT) or need to make an excess advance premium tax credit repayment.

Owe other taxes, such as

Can claim a nonrefundable credit (other than the nonrefundable child tax credit or the credit for other dependents), such as the foreign tax credit, education credits, or general business credit.

Can claim a refundable credit (other than the earned income credit, American opportunity credit, refundable child tax credit, additional child tax credit, or recovery rebate credit), such as the net premium tax credit, health coverage tax credit, or qualied sick and family leave credits from Schedule H or Schedule SE.

Have other payments, such as an amount paid with a request for an extension to le or excess social security tax withheld.

Schedule 2, Part I

Schedule 2, Part I

Schedule 2, Part II

Schedule 2, Part II

Schedule 3, Part I

Schedule 3, Part II

The Taxpayer Advocate Service Is Here To Help You

What is the Taxpayer Advocate Service?

The Taxpayer Advocate Service (TAS) is an independent organization within the Internal Revenue Service (IRS) that helps taxpayers and protects taxpayer rights. TAS strives to ensure that every taxpayer is treated fairly and that you know and

understand your rights under the Taxpayer Bill of Rights.

What can TASDRAFTdo for you?AS OF

TAS can help you if your tax problem is causing a financial difficulty, you've tried and been unable to resolve your issue with the IRS, or you believe an IRS system, process, or procedure just isn't working as it should. And the service is free. If you

qualify for TAS assistance, you will be assigned to one advocate who will work with you throughout the process and will do everythingDecemberpossible to resolve your issue. TAS can help you if:3, 2021

• Your problem is causing a financial difficulty for you, your family, or your business.

• You face (or your business is facing) an immediate threat of adverse action.

• You’ve tried to contact the IRS but no one has responded, or the IRS hasn’t responded by the date promised.

How can you reach TAS?

We have offices in every state, the District of Columbia, and Puerto Rico. To find your advocate’s number:

•Go to

•Download Publication 1546, Taxpayer Advocate Service - We Are Here to Help You, available at

•Check your local directory; or

•Call TAS toll free at

How can you learn about your taxpayer rights?

The Taxpayer Bill of Rights describes ten basic rights that all taxpayers have when dealing with the IRS. The TAS Tax Toolkit at TaxpayerAdvocate.IRS.gov can help you understand what these rights mean to you and how they apply. These are your rights. Know them.

How else does the Taxpayer Advocate Service help taxpayers?

TAS works to resolve

Low Income Taxpayer Clinics Help Taxpayers

Low Income Taxpayer Clinics (LITCs) are independent from the Internal Revenue Service (IRS) and the Taxpayer Advocate Service (TAS). LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS. LITCs can represent taxpayers in audits, appeals, and tax collection disputes before the IRS and in court. In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. Services are offered for free or a small fee. For more information or to find an LITC near you, see the LITC page at TaxpayerAdvocate.IRS.gov/LITCMap or IRS Publication 4134, Low Income Taxpayer Clinic List. This publication is available online at

Suggestions for Improving the IRS

Taxpayer Advocacy Panel

Taxpayers have an opportunity to provide direct feedback to the Internal Revenue Service (IRS) through the Taxpayer Advocacy Panel (TAP). The TAP is a Federal Advisory Committee comprised of an independent panel of citizen volunteers who listen to taxpayers, identify taxpayers' systemic issues, and make suggestions for improving IRS customer service. Contact TAP at ImproveIRS.org.

Affordable Care

Requirement To Reconcile Advance Payments of the Premium Tax Credit

The premium tax credit helps pay premiums for health insurance purchased from the Marketplace. Eligible individuals mayDRAFThave advance payments of the premium tax creditASmade on their behalfOFdirectly to the insurance company.

If you or a family member enrolled in health insurance through the Marketplace and advance payments of the premium tax credit were made to your insurance company to reduce your monthly premium payment, you must attach Form 8962 to your return to reconcile (compare) the advance payments with your premium tax credit for the year. TheDecemberMarketplace is required to send Form

1. You will need Form

2. Complete Form 8962 to claim the credit and to reconcile your advance credit payments.

3. Include Form 8962 with your Form 1040, Form

Health Coverage Reporting

If you or someone in your family was an employee in 2021, the employer may be required to send you Form

Reminder: Health care coverage. If you need health care coverage, go to www.HealthCare.gov to learn about health insurance options for you and your family, how to buy health insurance, and how you might qualify to get nancial assistance to buy health insurance.

What's New

For information about any additional changes to the 2021 tax law or any other devel- opments affecting Form 1040 or

Due date of return. File Form 1040 or |

The Families First Coronavirus Re- |

$72,000 or less, or make an appointment |

||||||||||

don’t live in theDRAFTDistrict of Columbia. If |

ASfile yourOF2021 return after November 30, |

|||||||||||

sponse Act (FFCRA) helped |

to visit a Taxpayer Assistance Center. |

|||||||||||

date is April 18, instead of April 15, be- |

ployed individuals affected by coronavi- |

Direct deposit now available for re- |

||||||||||

cause of the Emancipation Day holiday |

rus by providing paid sick leave and |

turns filed late. You can now receive a |

||||||||||

in the District of Columbia – even if you |

paid family leave credits equivalent to |

direct deposit of your refund even if you |

||||||||||

|

|

|

those that employers are required to pro- |

|

|

2021 |

||||||

December 3, |

||||||||||||

you live in Maine or Massachusetts, you |

vide their employees for qualified sick |

2022. |

|

|

|

|

|

|||||

have until April 19, 2022. That is be- |

leave wages and qualified family leave |

Expanded dependent care assistance. |

||||||||||

cause of the Patriots' Day holiday in |

wages. The |

ARP expanded the child and dependent |

||||||||||

those states. |

|

Act of 2020 extended the period during |

care tax credit for 2021 by making it re- |

|||||||||

Tuition and fees deduction not availa- |

which individuals can claim these cred- |

fundable for certain taxpayers and mak- |

||||||||||

its. For more information, see the in- |

||||||||||||

ble. The tuition and fees |

deduction is |

ing it larger. For 2021, the dollar limit |

||||||||||

structions for Form 7202 and Schedule |

||||||||||||

not available after 2020. Instead, the in- |

on |

qualifying |

expenses |

increases |

to |

|||||||

3, line 13b. |

|

|||||||||||

come limitations for the lifetime learn- |

|

$8,000 for one |

qualifying person |

and |

||||||||

Extension and expansion of credits for |

||||||||||||

ing credit have been increased. See |

$16,000 for two or more qualifying per- |

|||||||||||

Form 8863 and its instructions. |

sick and family leave. The American |

sons. The rules for calculating the credit |

||||||||||

Economic |

impact |

Rescue Plan Act of 2021, enacted on |

have also changed; the percentage of |

|||||||||

Any economic impact payment you re- |

March 11, 2021 (ARP) provides that |

qualifying expenses eligible for the |

||||||||||

ceived is not taxable for federal income |

certain |

credit has increased, along with the in- |

||||||||||

tax purposes, but will reduce your re- |

claim credits for up to 10 days of “paid |

come limit at which the credit begins |

||||||||||

covery rebate credit. |

|

sick leave,” and up to 60 days of “paid |

phasing out. Additionally, for taxpayers |

|||||||||

2021 Recovery rebate credit. This |

family leave,” if they are unable to work |

who receive dependent care benefits |

||||||||||

or telework due to circumstances related |

from their employer, the dollar limit of |

|||||||||||

credit is figured like last year's economic |

to coronavirus. |

the exclusion amount increases for 2021. |

||||||||||

impact payment, EIP 3, except eligibili- |

als may claim these credits for the peri- |

For more information, see the Instruc- |

||||||||||

ty and the amount of the credit are based |

od beginning on April 1, 2021, and end- |

tions for Form 2441 and Pub. 503. |

|

|||||||||

on your tax year 2021 information. See |

ing September 30, 2021. For more |

Child tax credit. Under ARP, the child |

||||||||||

the instructions for line 30 and the Re- |

information, see the instructions for |

|||||||||||

covery Rebate Credit Worksheet to fig- |

Form 7202 and Schedule 3, line 13h. |

tax credit has been enhanced for 2021. |

||||||||||

ure your credit amount. |

|

Form 9000, Alternative Media Prefer- |

The child tax credit has been extended |

|||||||||

Standard deduction amount in- |

to qualifying children under age 18. De- |

|||||||||||

ence. Beginning in 2021, taxpayers |

pending on modified adjusted gross in- |

|||||||||||

creased. For 2021, the standard deduc- |

with print disabilities can use Form |

come, you may receive an enhanced |

||||||||||

tion amount has been increased for all |

9000, Alternative Media Preference, to |

credit amount of up to $3,600 for a qual- |

||||||||||

filers. The amounts are: |

|

elect to receive notices from the IRS in |

ifying child under |

age |

6 and up |

to |

||||||

• Single or Married filing separate- |

an alternative format including Braille, |

$3,000 for a qualifying child over age 5 |

||||||||||

|

large print, audio, and electronic. You |

and under age 18. The enhanced credit |

||||||||||

• Married filing jointly or Qualify- |

can attach Form 9000 to your Form |

amount begins to phase out where modi- |

||||||||||

ing |

|

1040 or |

fied |

|

adjusted |

gross |

income exceeds |

|||||

• Head of |

arately. For more information, see Form |

$150,000 in the case of a joint return or |

||||||||||

Virtual currency. If, in 2021, you en- |

9000. |

|

surviving spouse, $112,500 in the case |

|||||||||

gaged in a transaction involving virtual |

All taxpayers now eligible for Identity |

of a head of household, and $75,000 in |

||||||||||

currency, you will need to answer “Yes” |

Protection PIN. Beginning in 2021, the |

all other cases. |

|

|

|

|

||||||

to the question on page 1 of Form 1040 |

IRS Identity Protection PIN (IP PIN) |

If you (or your spouse if filing joint- |

||||||||||

or |

ly) lived in the United States for more |

|||||||||||

for information on transactions involv- |

all taxpayers who can properly verify |

than half the year, the child tax credit |

||||||||||

ing virtual currency. Do not leave this |

their identity. An IP PIN helps prevent |

will be fully refundable even if you don't |

||||||||||

field blank. The question must be an- |

your social security number from being |

have earned income. If you don't meet |

||||||||||

swered by all taxpayers, not just taxpay- |

used to file a fraudulent federal income |

this residency requirement, your child |

||||||||||

ers who engaged in a transaction involv- |

tax return. You can use the Get An IP |

tax credit will be a combination of a |

||||||||||

ing virtual currency. |

|

PIN tool on IRS.gov to request an IP |

nonrefundable child tax credit and a re- |

|||||||||

Credits for sick and family leave for |

PIN, file Form 15227 if your income is |

fundable additional child tax credit, as |

||||||||||

certain |

individuals. |

|

|

was the case in 2020. The credit for oth- |

||||||||

er dependents has not been enhanced |

EIC with a qualifying child, you should |

of claiming the EIC, complete and at- |

|||||||||

and is figured as it was in 2020. |

follow the rules that apply to filers with |

tach Schedule EIC to your Form 1040 or |

|||||||||

Changes to Schedule 8812. Because of |

a qualifying child or children when de- |

||||||||||

the changes made by ARP, detailed dis- |

termining whether you are eligible to |

a valid SSN. For more information, in- |

|||||||||

cussion of the child tax credit, and how |

claim the EIC even if your qualifying |

cluding how to complete Schedule EIC |

|||||||||

to figure your child tax credit and credit |

child hasn't been issued a valid SSN on |

if your qualifying child doesn't have a |

|||||||||

for other dependents, which were previ- |

or before the due date of your return (in- |

valid SSN, see the line 27a instructions |

|||||||||

ously part of these instructions, has been |

cluding extensions). However, when de- |

and Schedule EIC. |

|

|

|

||||||

moved to the Instructions for Schedule |

termining the amount of EIC that you |

Forgiveness |

of Paycheck |

Protection |

|||||||

8812 (Form 1040). If you are claiming |

are eligible to claim on your return, you |

Program (PPP) Loans. The forgive- |

|||||||||

the nonrefundable child tax credit, re- |

should follow the rules that apply to tax- |

ness of a PPP Loan creates |

|||||||||

|

payers who do not have a qualifying |

|

|

|

|

|

|

||||

fundable childDRAFTtax credit, additional |

ASincome,OFso you don't need to report the |

||||||||||

pandedDecemberthe |

3, 2021 |

||||||||||

child tax credit, or credit for other de- |

child. |

|

|

|

income on Form 1040 or |

||||||

pendents, complete Schedule 8812 and |

• Phaseout |

amounts increased. |

you do need to report certain informa- |

||||||||

attach it to your Form 1040 or |

The amount of the credit has been in- |

tion related to your PPP Loan. To find |

|||||||||

Premium tax credit (PTC). ARP ex- |

creased and the phaseout income limits |

out how to report information related to |

|||||||||

PTC by eliminating the limi- |

at which you can claim the credit have |

your PPP Loan, see Forgiveness of Pay- |

|||||||||

been expanded. |

|

|

|

check Protection Program (PPP) Loans, |

|||||||

tation that a taxpayer's household in- |

|

|

|

||||||||

come may not exceed 400% of the |

• Rules for separated spouses. If |

under Income, later. |

|

|

|

||||||

Federal Poverty Line and generally in- |

you are married but don't file a joint re- |

Identity |

verification. The |

IRS |

|||||||

turn, you may qualify to claim the EIC if |

|||||||||||

creases the credit amounts. In addition, |

launched an improved identity verifica- |

||||||||||

you live with a qualifying child for more |

|||||||||||

in 2021, if you receive unemployment |

tion |

and |

|||||||||

than half the year and either live apart |

|||||||||||

compensation, you are generally eligible |

more people to securely access and use |

||||||||||

from your spouse for the last 6 months |

|||||||||||

to claim the PTC if you meet the other |

IRS |

online tools and |

applications. To |

||||||||

of 2021 or are legally separated accord- |

|||||||||||

requirements. For more information, see |

provide verification services, the IRS is |

||||||||||

ing to your state law under a written sep- |

|||||||||||

Pub. 974 and Form 8962 and its instruc- |

using ID.me, a trusted technology pro- |

||||||||||

aration agreement or a decree of sepa- |

|||||||||||

tions. |

vider. The new process is one more step |

||||||||||

rate maintenance and do not live in the |

|||||||||||

Changes to the earned income credit |

the IRS is taking to ensure that taxpayer |

||||||||||

same household as your spouse at the |

|||||||||||

(EIC). For 2021, the following changes |

end 2021. |

|

|

|

information is provided only to the per- |

||||||

have been made to the EIC. |

• Investment |

income |

limit in- |

son who legally has a right to the data. |

|||||||

• EIC rules for taxpayers without |

creased. The amount of investment in- |

Taxpayers using the new |

|||||||||

a qualifying child. Special rules apply |

come you can receive and still be eligi- |

ly verification procedure can gain entry |

|||||||||

if you are claiming the EIC without a |

ble to claim the EIC has increased to |

to existing IRS online services such as |

|||||||||

qualifying child. In these cases, the min- |

$10,000. |

|

|

|

the Child Tax Credit Update Portal, On- |

||||||

imum age has been lowered to age 19 |

• Prior year (2019) earned income. |

line Account, Get Transcript Online, Get |

|||||||||

an Identity Protection PIN (IP PIN), and |

|||||||||||

except for specified students who must |

You can elect to use your 2019 earned |

||||||||||

be at least age 24 at the end of the year. |

income to figure your 2021 earned in- |

Online Payment Agreement. Additional |

|||||||||

However, the applicable minimum age |

come credit if your 2019 earned income |

IRS applications will transition to the |

|||||||||

is lowered further for former foster |

is more than your 2021 earned income. |

new method over the next year. Each |

|||||||||

youth and qualified homeless youth to |

See the instructions for line 27a. |

online service will also provide informa- |

|||||||||

age 18. Additionally, you no longer need |

File Schedule EIC (Form 1040) if you |

tion that will instruct taxpayers on the |

|||||||||

to be under age 65 to claim the EIC |

steps they need to follow for access to |

||||||||||

without a qualifying child. |

have a qualifying child. If you have at |

the |

service. |

You |

can |

also |

see |

||||

• EIC rules for taxpayers with a |

least one child who meets the conditions |

|

|||||||||

to be your qualifying child for purposes |

|

|

|

|

|

|

|||||

qualifying child. If you are claiming the |

|

|

|

|

|

|

|

|

|

|

|

Free Software Options for Doing Your Taxes

Why have 49 million Americans used Free File?

•

• Greater

• Quick

• Go

• Faster

Do Your Taxes for Free

If your adjusted gross income was $73,000 or less in 2021, you can use free tax software to prepare and

Free File. This

Just visit IRS.gov/FreeFile for details. Free File combines all the benets of

You can review each software provider’s criteria for free usage or use an online tool to nd which free software products match your situation. Some software providers offer state tax return preparation for free.

Free File Fillable Forms. The IRS offers electronic versions of IRS paper forms that can also be

Free Tax Help Available Nationwide

Volunteers are available in communities nationwide providing free tax assistance to

See How To Get Tax Help near the end of these instructions for additional information or visit IRS.gov (Keyword: VITA) for a VITA/TCE site near you!

IRS.gov is the gateway to all electronic services offered by the IRS, as well as the spot to download forms at IRS.gov/Forms.

Make your tax payments

You can make payments online, by phone, or from a mobile device. Paying online is safe and secure; it puts you in control of paying your tax bill and gives you peace of mind. You determine the payment date, and you will receive an immediate conrmation from the IRS. Go to IRS.gov/Payments to see all your online payment options.

Filing Requirements

These rules apply to all U.S. citizens, regardless of where they live, and resident ali- ens.

Have you tried IRS

|

|

|

|

|

|

|

|

|

|

|||||||||||||

File? |

DRAFTage 19 or full- |

AS OF |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

2021 return, you do not have to attach |

lumbia – even if you don’t live in the |

|||||||||||

Do You Have To |

|

|

|

Form 8962. |

|

|

|

|

District of Columbia. If you live in |

|||||||||||||

|

|

|

Exception for certain children under |

Maine or Massachusetts, you have until |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

time students. If certain |

April 19, 2022, because of the Patriots' |

||||||||||

RicoDecembercan use Tax Topic 901 to see if |

3,If you2021 |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

conditions apply, you can elect to in- |

Day holiday in those states. If you file |

|||||||||||

Use Chart A, B, or C to see if you must |

clude on your return the income of a |

after this date, you may have to pay in- |

||||||||||||||||||||

file a return. U.S. citizens who lived in |

child who was under age 19 at the end |

terest and penalties. See Interest and |

||||||||||||||||||||

or had income from a U.S. possession |

of 2021 or was a |

Penalties, later. |

||||||||||||||||||||

should see Pub. 570. Residents of Puerto |

age 24 at the end of 2021. To do so, use |

|

were serving in, or in support |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Form 8814. If you make this election, |

|

|||||||||||

they must file. |

|

|

|

|

|

|

|

of, the U.S. Armed Forces in a designa- |

||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

your child doesn't have to file a return. |

|||||||||||||||

|

|

Even |

if you do |

not |

otherwise |

For |

details, use |

Tax Topic 553 |

or see |

ted combat zone or contingency opera- |

||||||||||||

|

|

tion, you may be able to file later. See |

||||||||||||||||||||

TIP |

have |

to |

file |

a |

return, |

you |

Form 8814. |

|

|

|

|

|||||||||||

|

|

|

|

Pub. 3 for details. |

||||||||||||||||||

|

|

should file one to get a refund |

A child born on January 1, 1998, is |

|||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||

of any federal income tax withheld. You |

considered to be age 24 at the end of |

If you |

||||||||||||||||||||

should also file if you are eligible for |

2021. Do not use Form 8814 for such a |

need to mail it. However, if you choose |

||||||||||||||||||||

any of the following credits. |

|

|

|

child. |

|

|

|

|

to mail it instead, filing instructions and |

|||||||||||||

• Earned income credit. |

|

|

|

Resident aliens. These rules also apply |

addresses are at the end of these instruc- |

|||||||||||||||||

|

|

|

tions. |

|

|

|

|

|||||||||||||||

• |

Refundable child tax credit or ad- |

if you were a resident alien. Also, you |

|

|

|

|

||||||||||||||||

ditional child tax credit. |

|

|

|

|

|

may qualify for certain tax treaty bene- |

|

The chart at the end of these in- |

||||||||||||||

• |

American opportunity credit. |

|

|

fits. See Pub. 519 for details. |

|

|

TIP structions provides the current |

|||||||||||||||

• |

Credit for federal tax on fuels. |

|

|

|

|

|

|

|

|

address for mailing your re- |

||||||||||||

• |

Premium tax credit. |

|

|

|

|

Nonresident aliens and |

turn. Use these addresses for Forms |

|||||||||||||||

• |

Health coverage tax credit. |

|

|

ens. These rules also apply if you were |

1040 or |

|||||||||||||||||

• |

Recovery rebate credit. |

|

|

|

a nonresident alien or a |

dress for returns filed after 2022 may be |

||||||||||||||||

• |

Credits for sick and family leave. |

and both of the following apply. |

|

|

different. See IRS.gov/Form1040 for any |

|||||||||||||||||

• |

Child and dependent care credit. |

• |

You were married to a U.S. citizen |

updates. |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

or resident alien at the end of 2021. |

What if You Can't File on |

|||||||||||

See Pub. 501 for details. Also see |

• |

You elected to be taxed as a resi- |

||||||||||||||||||||

Pub. 501 if you do not have to file but |

dent alien. |

|

|

|

|

Time? |

|

|

|

|

||||||||||||

received a Form |

See Pub. 519 for details. |

|

|

|

|

|

|

|

|

|||||||||||||

statement). |

|

|

|

|

|

|

|

|

Specific rules |

apply to |

deter- |

You can get an automatic |

||||||||||

Requirement |

to |

reconcile |

advance |

! |

tension if, no later than the date your re- |

|||||||||||||||||

mine if you are a resident alien, |

||||||||||||||||||||||

turn is due, you file Form 4868. For de- |

||||||||||||||||||||||

payments of the premium tax credit. |

CAUTION nonresident alien, or |

tails, see Form 4868. Instead of filing |

||||||||||||||||||||

If you, your spouse with whom you are |

tus alien. Most nonresident aliens and |

|||||||||||||||||||||

Form 4868, you can apply for an auto- |

||||||||||||||||||||||

filing a joint return, or a dependent was |

different |

filing |

||||||||||||||||||||

matic extension by making an electronic |

||||||||||||||||||||||

enrolled in coverage through the Mar- |

requirements and may have to file Form |

|||||||||||||||||||||

payment by the due date of your return. |

||||||||||||||||||||||

ketplace for 2021 and advance payments |

||||||||||||||||||||||

|

An automatic |

|||||||||||||||||||||

of the premium tax credit were made for |

quirements and other information to |

! |

||||||||||||||||||||

this coverage, you must file a 2021 re- |

help aliens comply with U.S. tax law. |

sion to file doesn't extend the |

||||||||||||||||||||

turn and attach Form 8962. You (or |

|

|

|

|

|

|

|

CAUTION |

time to pay your tax. If you |

|||||||||||||

whoever enrolled you) should have re- |

|

|

|

|

|

|

|

don’t pay your tax by the original due |

||||||||||||||

ceived Form |

When and Where |

|

|

date of your return, you will owe interest |

||||||||||||||||||

place with information about your cov- |

|

|

on the unpaid tax and may owe penal- |

|||||||||||||||||||

You must attach Form 8962 even if |

Should You File? |

|

|

ties. See Form 4868. |

||||||||||||||||||

erage and any advance payments. |

|

|

|

|

|

|

|

|

|

|||||||||||||

someone else enrolled you, your spouse, |

File Form 1040 or |

If you are a U.S. citizen or resident |

||||||||||||||||||||

or your dependent. If you are a depend- |

2022. The due date is April 18, instead |

alien, you may qualify for an automatic |

||||||||||||||||||||

ent who |

is claimed on |

someone |

else's |

of April 15, because of the Emancipa- |

extension of time to file without filing |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

tion Day holiday in the District of Co- |

Form 4868. You qualify if, on the due |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Draft Status | This is a draft form and should not be filed. It's labeled "DRAFT—NOT FOR FILING." |

| Purpose of the Draft | The IRS provides drafts for informational purposes only, allowing users to prepare for the upcoming tax year. |

| Legislative Changes | Provisions from the American Rescue Plan (ARP) affect tax year 2021, including expanded child care credit and child tax credit. |

| Final Forms Approval | Forms undergo OMB approval before being officially released, which means drafts may have changes before final versions. |

| Where to Find Information | For updates, users can visit IRS.gov/Form1040 and IRS.gov/Forms for developments and changes after publication. |

| Comment Submissions | Taxpayers can submit comments on the drafts via IRS.gov/FormsComments; however, responses may not be guaranteed. |

| Free Filing Options | IRS offers Free File services that allow taxpayers to prepare and e-file their taxes at no cost. |

| Taxpayer Advocate Service | The Taxpayer Advocate Service provides free help to resolve tax problems and protect taxpayer rights. |

| Access to Help Resources | Individuals can find assistance through Low Income Taxpayer Clinics, which help with tax issues and provide information in multiple languages. |

Guidelines on Utilizing Tax Worksheet Instruction

Filling out the Tax Worksheet Instruction form can help you prepare for tax filing. It’s essential to have accurate information organized to ensure your return is completed correctly. Follow the steps below to fill out the form efficiently.

- Gather all necessary documents such as your income statements, tax forms, and any relevant financial records.

- Start with your personal information. Fill in your name, address, and Social Security Number (SSN) as required at the beginning of the form.

- Select the correct tax year you are filing for, which will typically be indicated at the top of the form.

- Refer to the instructions for any specific requirements related to your filing status. This includes determining if you need Schedules 1 through 3.

- Identify any additional income sources, such as business income or unemployment compensation. Provide details for any income not reported on recently provided tax forms.

- Enter any deductions you are claiming. Be specific and ensure that you have documentation to support these claims, as they may be requested later.

- If applicable, note any tax credits you may qualify for. This could include the child tax credit or education credits, which might enhance your refund.

- Complete the sections for federal income tax withholding if you expect to owe taxes. Review your payment status and provide precise amounts.

- After completing the form, review all information. Ensure that entries are accurate and that calculations are correct.

- Sign and date the form. If filing jointly, your spouse will also need to sign where indicated.

- Keep a copy of the completed Tax Worksheet Instruction form for your records. This information may be useful for future tax returns or in the event of an audit.

What You Should Know About This Form

What is the Tax Worksheet Instruction form?

The Tax Worksheet Instruction form is an early draft version of an IRS document that provides guidelines for filling out your tax forms. This draft helps taxpayers understand how to complete various sections of the tax forms, including Form 1040 and its schedules. However, it is important to remember that it is not to be filed with the IRS; it serves purely for informational purposes.

Can I file the draft of the Tax Worksheet Instruction form?

No, you should not file any draft form, including the Tax Worksheet Instruction form. The IRS clearly states that drafts are not meant for filing. They often make revisions before a final version is released, ensuring updates are incorporated based on feedback and changing laws.

Where can I find the latest version of the Tax Worksheet Instruction form?

You can find the latest version of the Tax Worksheet Instruction form on the IRS website at IRS.gov. The IRS keeps all its forms, including drafts and final versions, accessible. Specific pages exist for various forms, like Form 1040 at IRS.gov/Form1040.

What types of changes might occur between a draft and the final version?

Changes between a draft and the final version can include adjustments to instructions, clarity of terms, or updates based on new legislation. The IRS may also incorporate feedback from taxpayers about the usefulness and clarity of the form.

What is the American Rescue Plan (ARP) and how does it relate to the tax forms?

The American Rescue Plan (ARP) is legislation enacted in 2021 that made several changes to tax benefits for that year. For example, the child and dependent care credit was increased, and the child tax credit was expanded. Instructions related to these changes will be addressed in updated tax form instructions.

How do I know if I need to file additional schedules with my Form 1040?

If your tax situation is more complicated, you will likely need to file additional schedules alongside Form 1040. This includes situations where you have extra income sources or specific deductions you plan to claim. The Tax Worksheet Instruction should help you determine which schedules are necessary based on your unique circumstances.

What resources does the IRS provide for free tax filing?

The IRS offers the Free File program, allowing eligible taxpayers to prepare and e-file their tax returns at no cost. You can find more information on this program and see if you qualify by visiting IRS.gov/FreeFile.

What is the Taxpayer Advocate Service (TAS)?

The Taxpayer Advocate Service (TAS) is an independent organization within the IRS dedicated to helping taxpayers. It aims to ensure fair treatment and provide assistance with tax-related issues that may cause financial hardship. TAS services are free, and they assign an advocate to help you navigate your tax problems.

How can I provide feedback on IRS forms or services?

You can submit comments about IRS forms or services through the IRS website at IRS.gov/FormsComments. However, due to the volume of feedback received, the IRS may not respond to every comment. Providing constructive feedback may improve future forms and the filing process.

Common mistakes

When completing the Tax Worksheet Instruction form, many taxpayers inadvertently make mistakes that can complicate their filing process. One common error involves not paying attention to whether they are using a draft version of the form. Drafts are not for filing, and relying on them can lead to confusion regarding correct procedures and requirements. It is essential to check that the version being completed is the final release, which can be verified by visiting the IRS website.

Another frequent mistake is failing to read the instructions thoroughly. The forms contain important details about eligibility, necessary schedules, and specific income categories. Skipping these instructions may result in incomplete or incorrect filings. Taxpayers should carefully review what is required based on their personal circumstances, especially if their tax situation is complex.

Inconsistent or incorrect Social Security Numbers (SSNs) also lead to significant issues. Each taxpayer’s identification is critical for processing returns accurately. When an SSN does not match IRS records, it can delay refunds or trigger audits. Therefore, double-checking this information before submission is vital.

Some individuals misunderstand which tax credits they qualify for. The American Rescue Plan introduced various changes, expanding certain credits. Taxpayers must stay informed about these updates to ensure they claim the correct credits on their forms. Claiming credits incorrectly can lead to reductions in refunds or increased tax liabilities.

Many people overlook the requirement to sign their return. A form that is not signed is generally considered invalid. This essential step may seem minor, but it is a critical part of the filing process. Including a date next to the signature can also help confirm the filing date, providing an additional layer of clarity.

In addition, not considering additional documentation can be a mistake. Some situations require supporting documents to substantiate claims, such as proof of income or receipts for deductions. Taxpayers should compile and include such documents when necessary to bolster their claims.

Finally, individuals often forget to review their worksheets for basic errors. Simple mistakes in math, transposed numbers, or overlooked entries can accumulate and lead to significant discrepancies. Taking the time for a thorough review can prevent unnecessary stress and complications during the tax year.

Documents used along the form

The Tax Worksheet Instruction form is an essential guide that helps individuals navigate the complexities of preparing their tax returns. It acts as a thorough source of information regarding required documentation, changes in tax laws, and any important updates for the tax year. To ensure that you have all necessary elements in hand, consider the following additional forms and documents that are commonly used when completing your taxes.

- Form 1040: This is the main income tax form that individuals use to report their annual earnings and calculate their tax obligations. Different versions, like 1040-SR, exist for specific populations, particularly seniors.

- Schedule 1: This form is used for reporting additional income and adjustments to income, such as unemployment compensation and educator expenses, which are not listed directly on the Form 1040.

- Schedule 2: This document reports additional taxes owed, such as the alternative minimum tax or excess advance premium tax credit repayments. It is used for those who may have complex tax situations.

- Schedule 3: This form is utilized to claim nonrefundable and refundable credits. Examples include the foreign tax credit and the net premium tax credit.

- Form W-2: Employers furnish this form to employees and the IRS, documenting wages earned and taxes withheld throughout the year. It's crucial for accurately reporting income.

- Form 1099: This series of forms is issued for various types of income received during the year, such as freelance payments or interest income. It is essential for reporting non-employment income.

- Form 8862: This form is filed to claim the Earned Income Credit after prior disallowance. Understanding its requirements can be important for eligible taxpayers.

Having these forms prepared and organized can make the tax filing process smoother and help to ensure that nothing is overlooked. Always remember to check for updates or changes in tax laws that may affect your specific situation. It is wise to consult with a tax professional if uncertainties arise, as they can provide further assistance and guidance tailored to your needs.

Similar forms

The Tax Worksheet Instruction form shares similarities with various other important IRS documents. Each of these documents serves a distinct purpose, helping taxpayers understand and navigate their tax obligations effectively. Here are five documents related to the Tax Worksheet Instruction form:

- Form 1040: This is the main form used by individuals to file their federal income tax returns. Like the Tax Worksheet Instruction form, it provides guidelines on how to report income, claim deductions, and calculate taxes owed or refunds due.

- Form 1040-SR: Designed for seniors, this form allows them to report income similarly to Form 1040. It includes standard deductions and offers a simplified approach, much like the instructional guides on the Tax Worksheet Instruction form.

- Schedule A: This document is used for itemizing deductions. It complements the Tax Worksheet Instruction form by clarifying how and what deductions can be claimed, thus helping taxpayers understand additional credits and benefits.

- Publication 501: This publication deals with exemptions, standard deductions, and filing statuses. Like the Tax Worksheet Instruction form, it aims to offer clear and comprehensive information necessary for taxpayers to prepare their returns accurately.

- Publication 1546 (Taxpayer Advocate Service): This document outlines the rights of taxpayers. While the Tax Worksheet Instruction form focuses on filling out forms, Publication 1546 ensures taxpayers know their rights, supporting them in understanding all aspects of the tax process.

Dos and Don'ts

When filling out the Tax Worksheet Instruction form, consider the following do's and don'ts to ensure the process goes smoothly.

- Do read all instructions carefully.

- Do ensure that you are using the most recent draft available.

- Do enter all required information accurately to avoid delays.

- Do check for any additional tax credits that may apply to your situation.

- Don't submit the draft form; it is not meant for filing.

- Don't hesitate to seek help if you encounter complex issues or have questions.

Following these guidelines can help in efficiently managing your tax-related tasks. Remember to stay updated on any changes that might affect your return.

Misconceptions

Misconceptions about the Tax Worksheet Instruction form can lead to confusion during tax season. Here are seven common misunderstandings:

- Draft forms are ready for filing. Many believe that the draft version is acceptable for submission. However, it is crucial to remember that drafts are not for filing and should only be used for informational purposes.

- All changes are reflected in the final form immediately. Some think that changes are posted as soon as the IRS notices them. In reality, there can be a delay in updates, and viewing the most recent draft does not guarantee completeness.

- Taxpayers must file every schedule listed. There is a common belief that all schedules mentioned must be completed regardless of one's tax situation. In fact, many taxpayers may only need to file Form 1040 or 1040-SR without additional schedules if their tax situation is uncomplicated.

- Submitting comments guarantees a response from the IRS. Taxpayers often assume that if they comment on drafts, there will be direct follow-up. The IRS receives high volumes of inquiries and does not respond to every comment.

- Free File is only for certain taxpayers. There is a misconception that only low-income individuals can utilize the Free File program. In truth, it is designed for a broad range of taxpayers who meet certain criteria, making it accessible to many.

- Only new changes apply to the current tax year. Many individuals think that prior changes or updates to the form are irrelevant. However, prior years' guidelines can impact the understanding of new changes, particularly for ongoing credits or deductions.

- The Taxpayer Advocate Service (TAS) only assists with specific problems. Some believe TAS can only help with severe issues. In reality, TAS is available for a variety of tax-related inquiries and challenges, regardless of complexity or scale.

Understanding these misconceptions can enhance awareness and ensure that taxpayers navigate the complexities of tax preparation more effectively.

Key takeaways

When filling out the Tax Worksheet Instruction form, it’s essential to keep a few key points in mind:

- Do not file draft forms. The Tax Worksheet Instruction you are looking at is a draft and is not intended for filing. Always wait for the final version.

- Check for updates regularly. Since changes can happen after a draft is released, visit the IRS website frequently for the most current information.

- Understand your filing requirements. Depending on your financial situation, you may need to complete Schedules 1 through 3 along with your Form 1040 or 1040-SR.

- Use IRS shortcuts wisely. Each form and publication has a unique shortcut link (like IRS.gov/Form1040). Using these can save you time.

- Get help if needed. The Taxpayer Advocate Service offers assistance if you encounter issues with the IRS. Don’t hesitate to reach out if you need support.

- Participate in feedback opportunities. The Taxpayer Advocacy Panel is a platform for taxpayers to share feedback and suggest improvements. Your voice matters!

Browse Other Templates

Pt-1 - The provider's signature must be dated for the request to be valid.

Printable Body Shop Quality Control Checklist - Engaging local resources can provide additional support for businesses.