Fill Out Your Tc 201 Form

For property owners and managers in New York City, understanding Form TC201 is essential when dealing with income and expenses for rental-producing properties. This form serves as a critical attachment to applications such as Form TC150, and it has specific filing requirements, especially for properties assessed at $750,000 and above. A significant aspect of TC201 is that it must be filled out completely and accurately if it is to be valid and accepted. It requires detailed reporting of rental income and operating expenses from properties like apartment buildings and multi-tenant commercial spaces. Even special cases, such as leases between family members or related businesses, have distinct reporting protocols outlined in this form. For businesses that utilize properties for specific functions—like hotels, theaters, or storefronts—additional forms such as TC203 or TC208 come into play. Form TC201 also emphasizes the need for transparency; it requests that all income be itemized and that actual operational expenses—not projections or reserves—are reported. Moreover, especially for higher-value properties, an accountant’s certification may be necessary to support the information provided. To ensure compliance and maximize potential benefits, property owners should pay close attention to the nuances detailed in Form TC201.

Tc 201 Example

TAX COMMISSION OF THE CITY OF NEW YORK 1 Centre Street, Room 2400, New York, NY 10007

INCOME AND EXPENSE SCHEDULE

FOR RENT PRODUCING PROPERTIES

FORM TC201 INSTRUCTIONS FOR 2022/23

TC201INS

2022/23

Attachment to application. Form TC201 is an attachment to an application or supplemental application (Form TC150). It is not valid if submitted separately.

Attachment to Form TC150 or Form TC159. For properties assessed at $750,000 or more and for recently acquired properties, if a required income and expense schedule was not available by March 1 when the original application was filed, the Form TC201 may be attached to Form TC150 and filed between March 2 and March 24, 2022. Form TC201 must be complete when filed.

Who should use Form TC201? Use Form TC201 to report income and expenses from the operation of a rental property. For example, an apartment building or a multi- tenant commercial building. If the Applicant leases the entire property to an unrelated person, the income and expenses also should be reported on this form. For example, a vacant lot leased to a parking operator or a store building leased to a single tenant.

A net lessor leasing to a related lessee that occupies the property may use Form TC200, Part 5, instead of Form TC201. A net lessor with a related lessee that sublets to unrelated tenants must use Form TC201.

Cooperatives must use Form TC203. Hotels must use Form TC208. A property used by the Applicant to operate a business such as a theater, public parking garage or department store must use Form TC214.

A Form TC201 is NOT required to be filed for residential properties with six or fewer units and no commercial (e.g, retail or office) space.

Form TC201 Part 1. Related lots.

Form TC201 may cover a group of lots operated by the same landlord if one or more of the following tests are met:

i)all of the lots are contiguous, (i.e., sharing an edge or boundary; neighboring, adjacent or adjoining; ii) all of the lots are situated on the same or adjacent blocks and are operated as an economic unit; or iii) all of the lots are units in a single condominium and are covered by a single application (or if there are multiple blocks, by one application per block.).

Each lot requires a separate application (e.g., Form TC101) even if the income and expense schedule covers multiple lots (other than condominium units.) Attach the combined Form TC201 to the application for the first lot in the group. On the other applications, refer to that first lot or attach a copy of the Form TC201. If filing on Form TC150, file the combined schedule only for the first lot in the group.

File Form TC166 listing the related lots in a combined group. See Form TC166 instructions. If there has been a change in the lots in the combined group from the combined filing in the preceding year, or if no combined

filing was made in the prior year, provide a written explanation for any change in the combined filing. If the combined filing this year is different from prior years, a written explanation must be provided by someone with personal knowledge.

Rules based on assessed value relating to accountant certifications, supplemental applications and reporting prior calendar year income are governed by the highest assessment in the group.

Form TC201 Part 2. You must indicate whether the accounting basis used for the reporting year is the same as was used in the prior year. The accounting basis must be the same one used for federal, state and local income tax returns.

Form TC201 Part 3. Report monthly rent due on the December 2021 or January 2022 rent roll. Your application may be denied review if you divide residential income reported in Part 6 by 12 to calculate monthly rent in Part 3 instead of stating an actual month’s rent roll or if you report 12 times the monthly rent roll instead of the actual annual residential rental income.

Form TC201 Part 4. Nonresidential occupancy information may be reported line by line separately for specified floors or for the building as a whole. If reported separately line by line, each line totals 100% for the space on the floor(s). If reported as a whole, the area of each floor is a portion of the entire building area, and the sum of the

Form TC201 Part 4 information for certain Applicants not otherwise required to report rental income and expenses. An Applicant who owned an

Reporting year. A report covering the full calendar year ending on December 31, 2021, or full fiscal year ending after July 31, 2021, is considered a current statement. In most cases the Tax Commission requires a current statement.

If a current statement is unavailable, the Tax Commission will accept a statement for the calendar year ending December 31, 2020, but only if: i) the 2022/23 actual assessment is less than $750,000; ii) the Applicant operated the property for all of 2020; and iii) the Applicant does not use a fiscal year for federal income tax purposes.

1

A detailed explanation as to why current year figures are unavailable should be attached to the Form TC201.

If the Applicant uses a fiscal year for federal income tax purposes ending before July 31, the schedule may report income for the most recently ended fiscal year, as of a date six months prior to the date the application is filed.

The form has space for figures for the year prior to the current year. The Tax Commission requests that Applicants provide this information, if available for the full year prior to the current year.

Income and expenses to be reported. Report all income received or accrued in connection with the property. Report only actual operating expenses. Do not report projections or reserves. Do not report payments to related persons as expenses, unless disclosure is made as directed in the instructions for Part 7 below.

Income and expenses must be itemized as indicated in Form TC201 Parts 6 through 9 or review will be denied.

Income and expense figures should be reported to the nearest whole dollar amount. Using estimated or rounded figures may result in your application being denied a merits review.

Accountant certification. If the actual assessment is above $5,000,000, Form TC201 (or a corrected Form TC201, if any) must be accompanied by Form TC309, which must be signed by an independent certified public accountant who has conducted an appropriate audit of the Applicant’s records. NOTE: THE THRESHOLD HAS BEEN RAISED TO $5,000,000 FROM $1,000,000. The accountant must sign his or her own name, not the firm name.

Required substantiation in 2022. Submit substantiation to explain the following 13 items:

1.Operating loss

2.More than 10% decrease in gross income

3.Continuing vacancy of 15% or more

4.Decrease or increase in operating expenses of 15% or more over the previous year’s expenses.

5.Average monthly rent per apartment $650 or less, or $850 or less per apartment in Manhattan on or south of 110th Street.

6.Repairs and maintenance higher than 15% of gross rent

7.More than 15 percentage point increase in vacancy

8.Residential rent roll times 12 less than total residential income

9.Residential rent roll times 12 110% or more of total residential income

10.Residential rent roll times 12 equals precisely total residential income

11.Wages higher than normal for the type of property or the level of income

2

12.Total commercial rent substantially below market rental levels

13.Apparent inconsistency between RPIE and TCIE information or in the property’s

status.

How to substantiate these items.

Item 1. State the specific circumstances causing the operating loss, such as the number of tenants, time period and extent of vacancies, unusual expenses, or physical conditions.

Items 2, 3, 4, 7, 12, 13. State specifics that would explain the situation.

Items 5, 8, 9 and 10. Submit a copy of the December 2021 or January 2022 rent roll or the 2022 DHCR filing for the building. Tenants, apartment numbers, apartment rents and a total of the month’s residential rents must be stated. Item 11. Submit a weekly payroll statement from January 2022 with job descriptions, employee names, total gross salary and benefits. Social security numbers should be crossed out on any documentation submitted.

Item 6. Submit an itemized breakdown of repair and maintenance costs.

Substantiation must be either: (b) written on Form TC159, or (c) attached to Form TC159. See Form TC600A for details on when substantiation for the previous year is required. Failure to submit substantiation may result in a denial of review of the application. NOTE NEW SINCE 2020: substantiation of items 1 through 10 must be submitted with the application or at the hearing. Cases will NOT be placed on hold to submit substantiation after the hearing.

Supplemental information. You should strengthen your application by supplementing the income and expense schedule even when substantiation is not required. Copies of leases or abstracts, a rent roll, and itemizations of expenses may be useful. Supplementation is especially useful when there is no prior filing, there is a single major tenant, there is a substantial increase in the income from the prior year, or the building has unusual operating characteristics, for example, an unusually high expense item. A DHCR report is helpful to support below market rents. Use Form TC159 when the supplemental information is not attached to the application.

Department of Finance RPIE requirements. By June 1 each year,

Failure to timely comply with RPIE filing requirements results in the loss of eligibility for Tax Commission review of the assessment the following year and subjects the owner to liability for fines.

Filing Form TC201 does not satisfy the RPIE filing requirement in 2022. Finance RPIE rules require electronic filing of RPIEs. Information on 2022 RPIE filing

requirements is posted at www1.nyc.gov/site/finance/taxes/property.page.

Filing of the RPIE with the Department of Finance also does not satisfy the requirement to file an income and expense statement with the Tax Commission.

FORM TC201 PART 6. INCOME INFORMATION

Report all operating income received or accrued in connection with the property.

Definitions for purposes of Form TC201.

Related persons. Related persons include individuals related by blood, marriage or adoption, individuals and the business entities they control, business entities under common control, and fiduciaries and the beneficiaries for whom they act. A person includes a corporation or other business entity.

Floor area. Where floor area is called for, state the approximate gross floor area to the best of your knowledge and ability. The measurement should be from exterior wall to exterior wall for each floor.

Lines a - h. Rent received or accrued for space occupied by tenants. Do not include space occupied by the owner, applicant, related parties or affiliates. Rent must be correctly identified by use (apartments, offices, stores, loft, factory, warehouse, storage, parking) and should be consistent with the property description in Parts 7 and 8 of Form TC101 or Form TC109 (where Form TC201 is filed for condo units.) Regulated and unregulated residential rent must be reported separately on the two lines indicated in Part 6. When reporting rental income on the accrual basis and the reporting entity’s leases call for scheduled increases in rent, do not

Line i. Income from related persons must be segregated from other income and listed only on line i. State the amount carried on the owner or Applicant’s books for space occupied by the owner, Applicant, related parties or affiliates. If such rental income is not reflected on the reporting entity’s books, an estimated fair market rental may be stated instead. Whether or not rent is stated, report the number of residential units on line i and non- residential floor area in Part 4 on page 1 of Form TC201.

Line j. ANCILLARY INCOME

1.OPERATING ESCALATION INCOME - Additional rent received or accrued above the base rent, as provided for in the lease, for increases in operating expenses, CPI clauses, etc.

3

2.REAL ESTATE TAX ESCALATION - Additional rent received or accrued above the base rent, as provided for in the lease, for increases in real estate taxes.

3.SALE OF UTILITY SERVICES - The gross amount received or accrued from the sale of utility services such as electricity, gas and air conditioning. Do not deduct the landlord’s costs.

4.SALE OF OTHER SERVICES. - The gross amount received or accrued for services such as laundry, valet, vending machines, etc.

5.GOVERNMENT RENT SUBSIDIES - Direct rent subsidies received or accrued (for example, Section 8) and any abatement of real estate taxes or

6.SIGNAGE/BILLBOARD – The gross amount received from unrelated persons from renting any signage or billboard space on your property.

7.CELL TOWERS – The gross amount received for placing a cell tower or other telecommunications equipment on your property.

Line k. OTHER OPERATING INCOME - Any other operating income derived from the property not previously specified (do not include interest on bank accounts and tenants’ deposits). Identify the source or sources of income on line k. Lease termination payments should be reported and specified on line k.

Line l. TOTAL GROSS INCOME - Add all items on lines a through k.

FORM TC201 PART 7. EXPENSE INFORMATION Report only actual operating expenses to the nearest whole dollar amount in the appropriate category. Do not report projections or reserves. Do not include any personal or business expenses for space occupied by the Applicant or a related party. All related party expenses must be disclosed in an attachment to Form TC201 or noted on Form TC309, stating: the nature, amount of the expense(s) and on what line of Part 7 the expense is reported. An example of a related party disclosure is a management fee, reported on line f of Part 7, representing 5% of rent collected during the year. Services or goods provided by related parties for which no charge was made may be disclosed on an attachment to Form TC201 or noted on Form TC309 and a fair market expense estimated. For example, an owner of the property may provide management services at no charge.

Line a. FUEL - Amount paid or incurred for heating and for supply of hot water. Include the cost of gas provided to tenants.

Line b. LIGHT and POWER - Amount paid or incurred for electricity. Include electricity supplied or sold to tenants; do not include electricity consumed for the owner’s personal or business use.

Line c. CLEANING CONTRACTS - Amount paid or incurred for cleaning contracts

Line d. WAGES and PAYROLL - Wages and related payroll taxes and employee benefits paid or incurred to employees responsible for the operation or maintenance of the property. Do not include salaries or commissions paid to directors, officers or management employees or agents.

Line e. REPAIRS and MAINTENANCE - Amount paid or incurred for contracted labor and materials for the general maintenance and repair of the property. Do not include reserves for replacements, amounts attributable to capital improvements and common area improvements (see instructions for line l below). See instructions above for required substantiation of expenses for repairs and maintenance in excess of 15% of gross income.

Line f. MANAGEMENT and ADMINISTRATION - Amount paid or incurred for management, legal and accounting services attributable to operation of the property.

Line g. INSURANCE - Annual charges paid or incurred for fire and other insurance premiums relating to the real property. Prorate

Line h. WATER and SEWER - Amount paid or incurred for water and sewer usage.

Line i. ADVERTISING - Amount paid or incurred for advertising space for rent.

Line j. INTERIOR PAINTING and DECORATING - The cost of all contracted labor and decorating materials for interior painting and decorating, including paint, wallpaper and brushes). This item may be combined with REPAIRS and MAINTENANCE if the Applicant’s books are maintained on that basis, and line e should be so marked.

Line k. AMORTIZED LEASING and TENANT IMPROVEMENT COSTS - The amortization of all costs incurred to lease space to tenants over the term of their respective leases. Examples of such costs are legal fees, brokers’ commissions, tenant improvements, etc.

Line l. MISCELLANEOUS EXPENSES - Other expenses paid or accrued not previously specified which are related to the operation and maintenance of the property, including amortization of common area improvements and amortization of certain lease buyout costs defined below.

Do not include income tax, commercial rent tax, rent, ground lease rent, capital costs, depreciation, mortgage payments and acquisition costs, interest, and uncollectible accounts receivable originating in a previous year.

Amortization of common area improvements having a useful life of more than one year may be included in line l if you itemize the amortized costs and the amount is amortized over the useful life of the item. For those costs that are amortized, provide a schedule showing a brief description, cost, date placed in service, period of

4

amortization, and amount of amortization included in line l this year and accumulated amortization.

Common area improvements include replacements of existing building components, major repairs, and installation of safety and health systems. Examples of replacement costs are replacement of boilers, roofs, elevators, and residential kitchen appliances and cabinets. Examples of safety and health systems are brick pointing, fire safety systems, and environmental remediation.

Amortization of lease buyout costs includes all costs to acquire the unexpired lease of a vacating tenant to secure an identified prospective tenant and may be included only on line l if you itemize the amortized costs and the amount is amortized over the term of the new lease. Lease buyout costs incurred without an identified replacement tenant should be deferred until a new tenant is secured; itemize and amortize such costs over the term of the new lease.

Line m. EXPENSES BEFORE TAXES - Add lines a through l.

Line n. REAL ESTATE TAXES - Total annual real property taxes paid or incurred. Where there are SCRIE abatements, state the total tax levied.

Line o. TOTAL EXPENSES - Add Lines m and n.

Public records. Tax Commission application forms and attachments are subject to public disclosure under the Freedom of Information Law. Details of rent rolls and lease schedules whose disclosure would cause substantial injury to the filer’s competitive position may be withheld if confidentiality is claimed.

Where to get additional forms and information. Copies of Tax Commission forms may be obtained at www1.nyc.gov/site/taxcommission/index.page, at the Tax Commission’s main office and at Finance Business Centers in each borough. Questions about RPIE filings, how your assessment was determined, or general questions about real property tax assessments should be

addressed to Finance. Contact Finance at www1.nyc.gov/site/finance/taxes/property.page

or call

TAX COMMISSION OF THE CITY OF NEW YORK |

High Value |

|

Copy |

||

1 Centre Street, Room 2400, New York, NY 10007 |

||

|

INCOME AND EXPENSE SCHEDULE FOR

TC201

2022/23

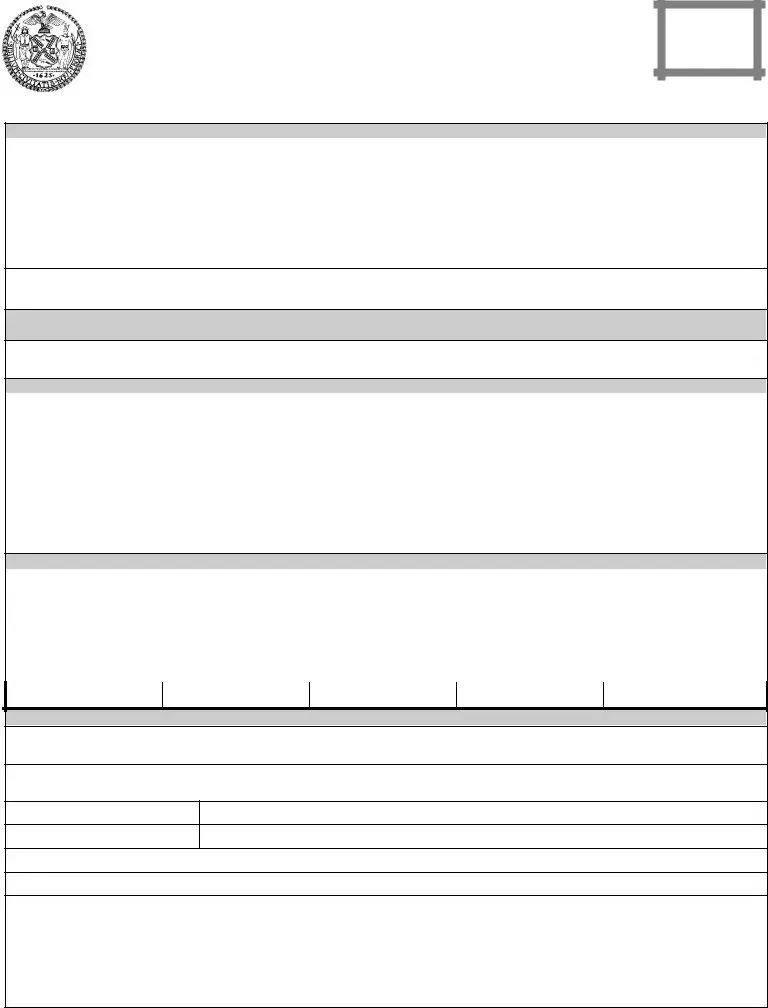

ATTACH TO AN APPLICATION. TC201 IS NOT VALID IF FILED SEPARATELY. READ TC201 INSTRUCTIONS BEFORE YOU BEGIN. COMPLETE ALL PARTS OF TC201. ANSWER ALL QUESTIONS MARKED .

ALL INCOME FROM THE PROPERTY, WHATEVER ITS SOURCE, MUST BE REPORTED IN PARTS

1. PROPERTY IDENTIFICATION

BOROUGH (Bronx, Brooklyn, Manhattan, Queens or Staten Island) |

BLOCK |

|

LOT |

|

TAX COMM. GROUP N0. |

|

ASSESSMENT YEAR |

|

|

|

|

|

|

|

2022/23 |

a. If property is a condominium, does this schedule cover all lots listed on Form TC109? ________ (Y/N). If yes, skip section b. |

|

||||||

b. Does this schedule cover more than one tax lot? ______(Y/N). If yes, state total number of lots ______, and list block and lot numbers: |

|

||||||

Block __________ Lots _____________________________ |

Block __________ Lots _____________________________ |

|

|||||

Block __________ Lots _____________________________ |

Block __________ Lots _____________________________ |

|

|||||

Check if applicable: Additional lots are listed on page _____ |

All lots are contiguous |

All lots are operated as a unit |

|

||||

c. Does this schedule report occupancy and income for the entire tax lot (or lots)? _________(Y/N). If no, describe portions not covered and reason for

omission: _____________________________________________________________________________________________________________________

2. CURRENT YEAR REPORTING PERIOD AND ACCOUNTING BASIS

ACCOUNTANT’S CERTIFICATION FORM TC309 MAY BE REQUIRED SEE INSTRUCTIONS

Current year reporting period: From _______/_______/_______ to _______/_______/_______ |

Accounting basis: Cash Accrual |

Has the accounting basis changed from the prior reporting period? Y N |

|

3. RESIDENTIAL OCCUPANCY AS OF JANUARY 5, 2022 - Number of dwelling units, rent by type of occupancy.

TYPE OF OCCUPANCY |

NUMBER OF UNITS |

MONTHLY RENT |

RENTED, REGULATED |

|

$ |

RENTED, UNREGULATED |

|

$ |

OWNER OCCUPIED |

|

$ |

VACANT |

|

$ |

TOTAL |

|

$ |

Does rent reported include all recurring charges, such as parking, subsidies and SCRIE abatements? _____.

4. NONRESIDENTIAL OCCUPANCY AS OF JANUARY 5, 2022 – Approximate gross percent.

FLOOR |

APPLICANT OR RELATED |

RENTED (UNRELATED) |

VACANT |

TOTAL |

FLOOR |

% |

% |

% |

% |

2ND FLOOR |

% |

% |

% |

% |

1ST FLOOR |

% |

% |

% |

% |

BASEMENT |

% |

% |

% |

% |

ENTIRE BUILDING |

% |

% |

% |

100% |

5. LAND OR BUILDING LEASE INFORMATION AS OF JANUARY 5, 2022

Is the entire tax lot (or lots) or the entire land portion of the tax lot (or lots) subject to an

If the Applicant is the lessee(tenant), does Applicant receive any rental income from the property? ______ (Y/N). If YES, Applicant must complete Parts 6

through 10 on page 2. If NO, complete this Part or report lease information on Form TC200.

LESSOR (LANDLORD)

LESSEE (TENANT)

IF NOT OWNER OF RECORD, DESCRIBE RELATION TO PROPERTY

IF NOT APPLICANT, DESCRIBE RELATION TO APPLICANT

Term of lease: from _______/_______ to _______/_______Annual rent $ ________________________________

Start date of annual rent stated: ______/______. End date of annual rent stated ______/______. End date of lease option: ______/______.

Does lessor receive any sums in addition to annual rent stated? ______(Y/N). If yes, state additional sums here: $ ___________________________

Does lessor pay any of the operating expenses or real estate taxes? ______(Y/N). If yes, specify: ________________________________________

_______________________________________________________________________________________________________________

Is the lease a lease of the land portion of the property only? _____(Y/N).

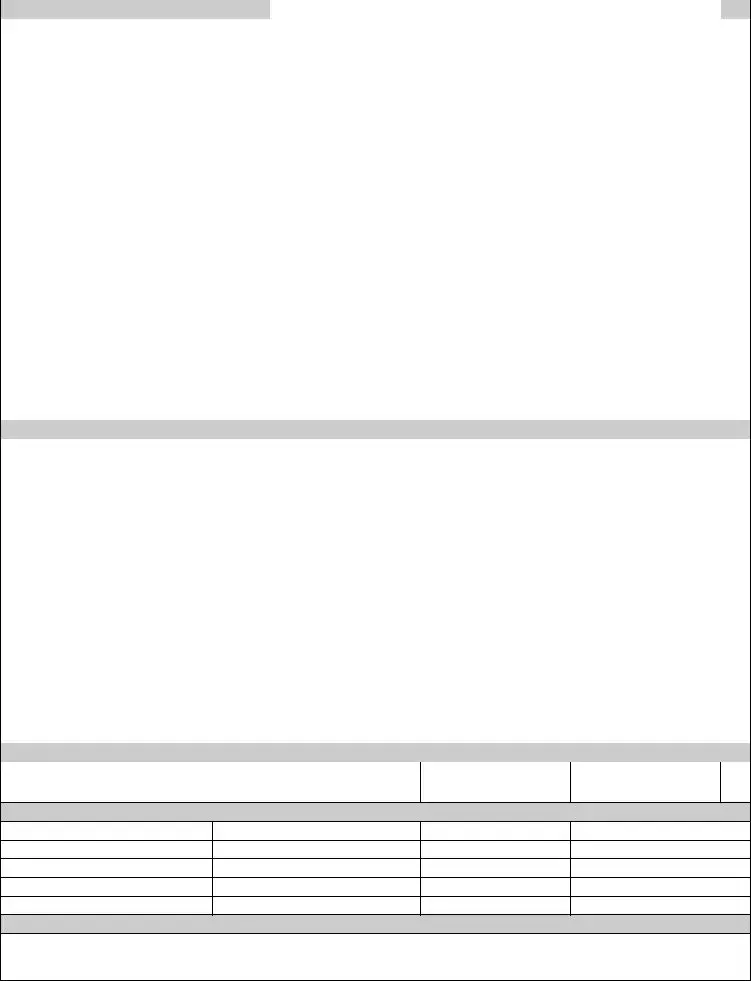

6. INCOME INFORMATION |

BOROUGH/BLOCK/LOT |

Prior year |

Current year |

|

|

|

|

||||

a. Residential: Regulated |

|

|

|

a. |

|

|

Unregulated |

|

|

|

|

b. Office |

|

|

|

b. |

|

c. Retail (including storefront professional offices, banks, restaurants) |

|

|

c. |

||

d. Loft |

|

|

|

d. |

|

e. Factory |

|

|

|

e. |

|

f. |

Warehouse |

|

|

|

f. |

g. Storage |

|

|

|

g. |

|

h. Garage/parking |

|

|

|

h. |

|

SUBTOTAL |

|

|

|

|

|

i. |

|

|

|

i. |

|

j. |

Ancillary Income: 1. Operating escalation |

|

|

|

j. |

|

2. Real estate tax escalation |

|

|

|

|

|

3. Sale of utility services |

|

|

|

|

|

4. Sale of other services |

|

|

|

|

|

5. Government rent subsidies |

|

|

|

|

|

6. Signage/billboard |

|

|

|

|

|

7. Cell towers/ telecommunications equipment |

|

|

|

|

k. Other (specify) |

|

|

|

k. |

|

l. TOTAL GROSS INCOME |

|

|

|

l. |

|

7. EXPENSE INFORMATION |

|

|

|

|

|

a. Fuel |

|

|

|

a. |

|

b. Light and power |

|

|

|

b. |

|

c. Cleaning contracts |

|

|

|

c. |

|

d. Wages and payroll |

|

|

|

d. |

|

e. Repairs and maintenance |

|

|

|

e. |

|

f. |

Management and administration |

|

|

|

f. |

g. |

Insurance (annual) |

|

|

|

g. |

h. |

Water and sewer |

|

|

|

h. |

i. |

Advertising |

|

|

|

i. |

j. Interior painting and decorating |

|

|

|

j. |

|

k. Amortized leasing and tenant improvement costs |

|

|

k. |

||

l. Miscellaneous expenses (from Part 9) |

|

|

|

l. |

|

m. EXPENSES BEFORE REAL ESTATE TAXES (add lines a through l) |

|

|

m. |

||

n. Real estate taxes (before any abatements) |

|

|

|

n. |

|

o. TOTAL EXPENSES (add lines m and n) |

|

|

|

o. |

|

8. NET PROFIT (OR LOSS) |

|

|

|

|

|

a. Net before real estate taxes (subtract Part 7 line m from Part 6 line l) |

|

|

a. |

||

b. Net after real estate taxes (subtract Part 7 line o from Part 6 line l) |

|

|

b. |

||

9. ITEMIZATION OF MISCELLANEOUS EXPENSES (do not include mortgage payments or depreciation)

ITEM |

AMOUNT |

ITEM |

AMOUNT |

10. TENANTS’ ELECTRICITY

Do tenants obtain electricity from the applicant or a related person? _____(Y/N)

Is there a separate charge for electricity in addition to the rent? _____(Y/N)

Page _____ |

TC201 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | Form TC201 is designed to report the income and expenses related to rental properties, helping owners provide detailed financial information to the Tax Commission. |

| Attachment Requirement | This form must be attached to either Form TC150 or Form TC159 and cannot be submitted on its own. |

| Filing Window | For properties assessed at $750,000 or more, the form can be filed between March 2 and March 24 if an income and expense schedule was unavailable by March 2. |

| Exempt Properties | The form is not required for residential properties that have six or fewer units and do not contain any commercial space. |

| Accountant Certification | If the actual assessment exceeds $5,000,000, an accountant must certify Form TC201. This requirement was recently raised from $1,000,000. |

| Governing Law | Form TC201 is governed by the laws relating to property taxes in the State of New York, which require accurate and timely reporting of income for tax assessment purposes. |

Guidelines on Utilizing Tc 201

When preparing to fill out the TC201 form for the evaluation of income and expenses for rent-producing properties, it's important to understand that this form must be attached to an application or supplemental application. Submitting this form separately will render it invalid. This process involves several distinct sections, where each section has specific instructions and requirements that need to be followed accurately. Here's a concise guide to help navigate the completion of the TC201 form.

- Begin with the Property Identification section. Fill in the borough, block, lot, and assessment year. Check if the property is a condominium and determine if it covers more than one tax lot.

- In the Current Year Reporting Period and Accounting Basis section, state the period for reporting and specify whether you are using cash or accrual accounting. Indicate if the accounting basis has changed from the prior reporting period.

- Provide details about Residential Occupancy as of January 5, 2021. Report the number of dwelling units and the rents associated with them, categorizing them as rented, regulated, rented, unregulated, owner-occupied, or vacant.

- For the Nonresidential Occupancy, report the gross percentage for each floor, specifying rented spaces, vacancy, and total occupancy as of January 5, 2021.

- Complete the Land or Building Lease Information section. Indicate whether the entire tax lot is subject to an arms-length lease, and if applicable, provide details about the lessee, term of lease, and any additional sums received by the lessor.

- In Part 6: Income Information, accurately report all operating income received or accrued from the property. Ensure to report related persons' income separately where applicable.

- Move to Part 7: Expense Information, where you will need to report actual operating expenses accurately in the relevant categories. Be mindful of disclosing expenses related to any dealings with related persons.

- Review Part 8: Accountant Certification, if applicable, particularly if your property’s assessment is above $5 million. Make sure to attach Form TC309 with the accountant’s signature.

- Conclude by ensuring that all parts of the form are complete, and all questions marked with a triangle are answered accordingly.

- Attach any additional documents or substantiations required for the review, and make copies of all submitted forms and documents for your records.

Following these steps will help ensure that your TC201 form is filled out correctly and submitted in compliance with the required guidelines. It's crucial to keep in mind that the information provided must be accurate and reflect the actual operating status of the property. Any discrepancies or incomplete sections may impede the review process.

What You Should Know About This Form

What is the purpose of Form TC201?

Form TC201 is used to report income and expenses associated with the operation of rental properties. This can include apartment buildings or commercial properties, such as office space or retail stores. It's an important step in assessing the property for tax purposes and must be filed alongside an application, specifically Form TC150 or Form TC159.

Who is required to submit Form TC201?

Anyone who operates a rental property, such as an apartment building or commercial space, is required to use this form. It is particularly necessary for properties assessed at $750,000 or more. Additionally, if a property has recently changed ownership, Form TC201 is needed if the income and expense schedule was not available by the original application deadline.

When should Form TC201 be filed?

Form TC201 must be submitted as part of the application process and cannot be filed alone. If you missed the March 2 deadline, you can still file the form between March 2 and March 24, provided it is attached to Form TC150 or TC159. Ensure that the form is completed fully when filed.

What information is required on Form TC201?

The form requires detailed reporting of income received or accrued from the property and all actual operating expenses. Information should be itemized accurately, including monthly rents, operating costs, and other income sources. Avoid estimates or rounded figures, as these may lead to denial of your application.

What types of properties are exempt from using Form TC201?

Properties with six or fewer residential units and no commercial space do not require the filing of Form TC201. Cooperatives, hotels, and businesses operating a theater or similar facility must use different forms, like TC203, TC208, or TC214, respectively.

What happens if the income or expense information is unavailable?

If you cannot provide a current income and expense statement, you may submit data from the prior calendar year, but certain conditions must be met. If your property’s actual assessment is less than $750,000 and the property was operated for the entire previous year, this may be acceptable. Always include a detailed explanation for any missing information.

Is accountant certification necessary when submitting Form TC201?

If the assessment of the property is above $5,000,000, you must also submit an accountant certification on Form TC309. This certification must be signed by an independent certified public accountant who has audited your records. Ensure that the accountant signs their name, not just the firm name.

Common mistakes

Filling out the TC201 form accurately is crucial for ensuring a successful filing with the Tax Commission of the City of New York. One common mistake that applicants make is submitting the form separately from the required attachment. Form TC201 is an attachment to the application, specifically Form TC150 or Form TC159. Without this attachment, Form TC201 is considered invalid. Always double-check to confirm that you're submitting both forms together to avoid unnecessary delays in your application.

Another frequent error involves inaccuracies in reporting income and expenses. It's important to report all operating income received or accrued without making estimates. For instance, many people mistakenly report rounded figures or projections, which can lead to a denial of merits review. Precise reporting to the nearest whole dollar amount is essential. Additionally, all expenses should be actual operating expenses only and exclude any personal expenses or projections. Ensure that you read the instructions carefully regarding what qualifies as an acceptable expense.

Failing to provide required substantiation is also a common oversight. If your application includes indications of operating loss or a notable decrease in gross income, proper documentation must be submitted to support these claims. For instance, itemized breakdowns, such as payroll statements or itemized repair costs, are critical. This documentation must accompany your application; cases will not be placed on hold to gather these documents after a hearing. Therefore, preparing these materials in advance can save you time and frustration later.

Lastly, many applicants do not review the property identification section thoroughly. Incorrect information regarding block and lot numbers can cause significant issues. Every section must be filled out completely, including confirming if the property covered is a condominium or if more than one tax lot is reported. Simple oversights in this area can delay processing or even result in denial of your application. Ensure that every detail is correct and complete before submission.

Documents used along the form

The TC201 form is a critical document used by property owners to report income and expenses from rent-producing properties in New York City. When filing this form, several supplementary documents may also be required to provide a comprehensive financial picture. The following list outlines five other forms that often accompany the TC201, providing additional details for clarity and accuracy in the reporting process.

- Form TC150: This is the primary application for property tax review. Form TC201 is attached to TC150 when submitting income and expense data for properties that meet specific criteria, ensuring that the Tax Commission can properly assess the property’s valuation.

- Form TC159: This form may be used for submitting supplemental information related to the TC201. If there are additional documents or explanations necessary for a complete understanding of the income and expenses, they can be attached to the TC159 for review by the Tax Commission.

- Form TC309: Required for properties assessed at over $5,000,000, this form must be signed by an independent certified public accountant. It serves to certify the accuracy of the financial information provided in the TC201, enhancing the credibility of the application.

- Form TC166: For properties covering multiple lots operated under the same landlord, TC166 lists these related lots in a combined application. This attachment ensures transparency regarding the properties included in the income and expense reporting.

- Real Property Income and Expense (RPIE) Statement: While related to financial reporting, the RPIE is distinct from the TC201. It must be filed annually to report income and expenses for properties assessed for $40,000 or more. Timely submission is essential to avoid penalties and maintain eligibility for further review of assessments.

In summary, these forms and documents play an integral role in the property assessment and tax review process. They ensure that all financial activities related to rent-producing properties are thoroughly disclosed, allowing the Tax Commission to accurately value the property for tax purposes.

Similar forms

- Form TC150: This is a supplemental application form used to request assessment reductions. Similar to TC201, it must be filed following the completion of required income and expense schedules for properties that exceed a specified value. Both forms share the need for detailed financial documentation related to real estate income.

- Form TC159: Used for submitting additional information in support of applications, this form often accompanies TC201 when more detail is required. Each form emphasizes the need for accurate financial disclosures regarding property management and operations.

- Form TC203: This form is specifically for cooperatives reporting income and expenses. Like TC201, it emphasizes the need to report operating income and exact expenses to ascertain property value.

- Form TC208: Designed for hotel properties, TC208 is similar to TC201 in that it requires detailed reporting of income generated from rental operations, ensuring transparency regarding the financial condition of the property.

- Form TC214: This form is utilized by properties where a business operation is involved, such as theaters and public parking garages. Both TC201 and TC214 necessitate the comprehensive reporting of income and operational expenses to reflect the property's value appropriately.

- Form TC200: A variant used for net lessors with related lessees, TC200 can be filed in lieu of TC201 under specific circumstances. Both forms require similar types of income and expense data pertaining to the property.

- Form TC101: This application form for real property is essential for describing the property’s overall condition and usage. Like TC201, complete financial data is central to both, ensuring authorities understand the property's operational context.

- Form TC166: This is used for listing related lots, and it complements the information provided in TC201 regarding combined properties. Both forms underscore the interconnected nature of reporting income and expenses for properties managed under single ownership.

- RPIE (Real Property Income and Expense) Statement: Required annually, this statement also necessitates reporting operating income and expenses of rent-producing properties. Like TC201, the RPIE emphasizes the importance of accurate financial disclosures for property tax assessments.

- Form TC600A: This form relates to the substantiation requirements for previous year's filings, similar to the verification needs stated in TC201. Both forms require applicants to provide detailed documentation to validate their reported financial data.

Dos and Don'ts

- Do ensure that you attach Form TC201 to the relevant application (Form TC150 or Form TC159).

- Do report all actual income and expenses accurately.

- Do provide a complete and detailed rent roll for December 2020 or January 2021.

- Do itemize all income and expenses as instructed in Parts 6 through 9.

- Do submit the required substantiation for any item requiring explanation.

- Don't submit Form TC201 on its own; it must accompany an application.

- Don't include projections or reserves in your reported expenses.

- Don't report income from related persons without proper disclosure.

- Don't neglect to check the accuracy of all figures provided to avoid application denial.

Misconceptions

- Form TC201 can be filed independently. This form must always be attached to an application, such as Form TC150 or Form TC159. Submitting it separately will render it invalid.

- Only large properties need to file Form TC201. Although properties assessed at $750,000 or more are mandated to submit a TC201, any rental property generating income, regardless of value, must file if it meets the criteria outlined in the instructions.

- Reporting inaccuracies on Form TC201 are minor. Any errors, such as calculating rent incorrectly or not reporting all income and expenses, can lead to a denial of the review of the property assessment. Accuracy is critical.

- Cooperative and hotel owners can use Form TC201. Cooperatives must use Form TC203, and hotels should utilize Form TC208. Each type of property has specific forms tailored to their needs.

- Only residential properties need accurate rent rolls. All rental income must be documented, including commercial leases. Reporting must be compliant with the requirements stated for both residential and nonresidential occupancy.

- Filing Form TC201 satisfies RPIE requirements. Filing of Form TC201 does not fulfill the obligation to submit a Real Property Income and Expense statement with the Department of Finance. These filings are separate and distinct.

Key takeaways

1. Form TC201 must be submitted as an attachment to either Form TC150 or Form TC159. It is not valid when filed separately.

2. This form is specifically designed for reporting income and expenses associated with rental properties. Examples include apartment buildings, commercial buildings, and other properties leased to unrelated persons.

3. Ensure all required sections are complete before submission. Incomplete forms may lead to denial of application review.

4. For properties assessed at $750,000 or more, the TC201 can be submitted between March 2 and March 24 if a required income and expense schedule was unavailable at the original application filing.

5. It is essential to report actual operating income and expenses. Projections or reserves should not be included.

6. If filing for properties with multiple lots operated as a single economic unit, provide a written explanation if any changes occurred from the previous year’s filing.

7. Be prepared to substantiate significant items indicated on the form and ensure all disclosures about related party transactions are clear and documented.

Browse Other Templates

Da Form 5841 Example - The expiration of this Power of Attorney can be defined by the grantor.

Dd Form 2536 - The information requested on the DD 2536 is intended to streamline the military's involvement in public engagements.

What Is a Woman Entitled to in a Divorce - The summons affixed to this form outlines the obligations of the defendant clearly.