Fill Out Your Tcf Bank Direct Deposit Form

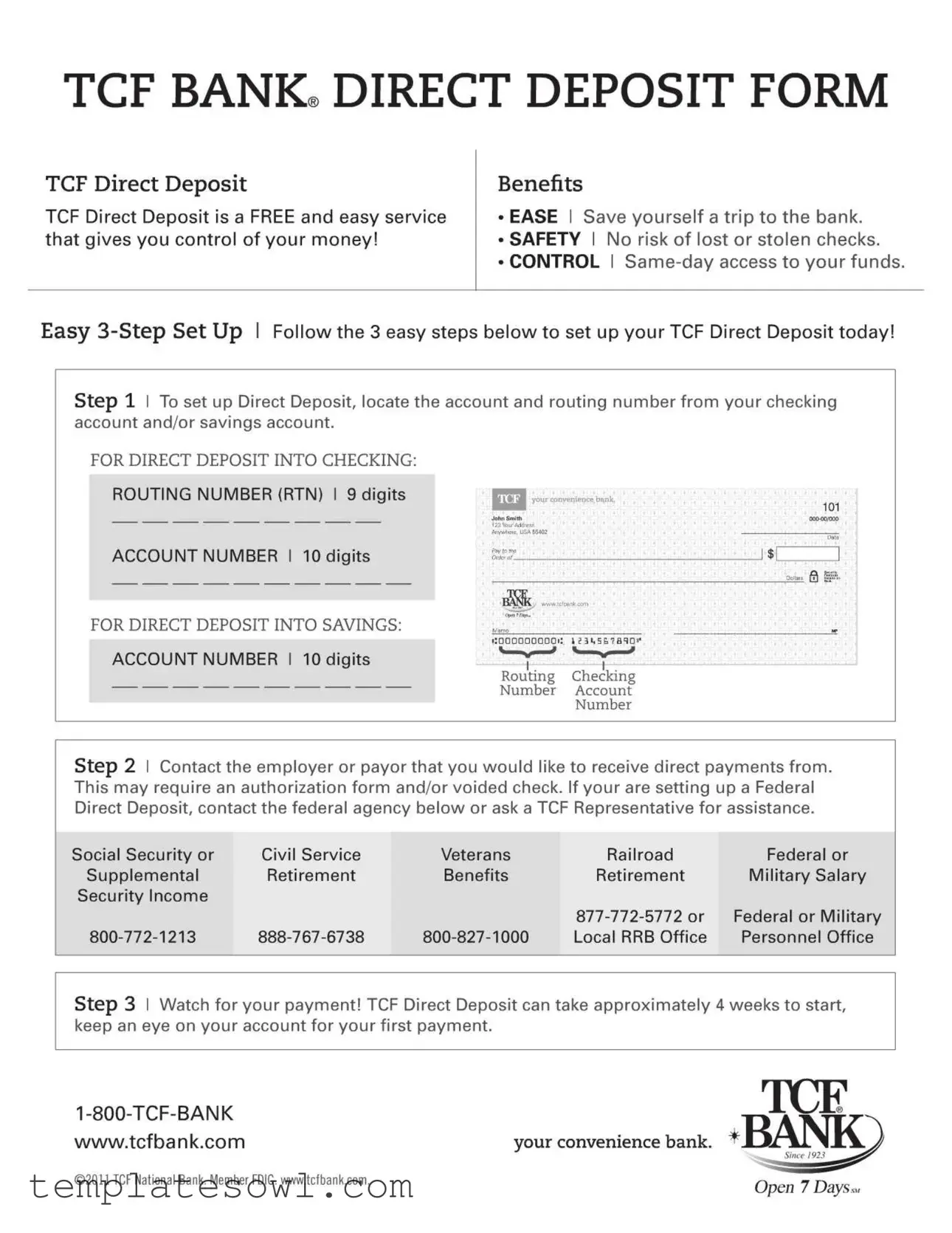

The TCF Bank Direct Deposit form is designed to simplify how you receive your payments. This service, available at no cost, allows you to manage your funds more effectively from the comfort of home. The benefits are clear: you save time by avoiding trips to the bank, there’s no worry about lost or stolen checks, and you gain same-day access to your money. Setting up direct deposit consists of three straightforward steps. First, identify your routing and account numbers from your checking or savings account. Next, you’ll need to notify your employer or the entity sending payments to you, which may involve filling out an authorization form or providing a voided check. If you are arranging for federal deposits, specific agencies like Social Security or military offices can assist you. Lastly, once your direct deposit is set up, keep a lookout for the first payment, which may take about four weeks to process. Overall, the TCF Direct Deposit form is a practical tool to help individuals gain better control over their finances.

Tcf Bank Direct Deposit Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Service Offering | TCF Direct Deposit is a free service allowing users to manage their finances conveniently. |

| Safety | Direct deposit eliminates the risk of lost or stolen checks, enhancing safety for your funds. |

| Access Speed | Account holders enjoy same-day access to their funds once deposited. |

| Setup Process | The setup process includes three easy steps to get started with direct deposit. |

| Routing Number | To set up direct deposit, provide a 9-digit routing number and a 10-digit account number. |

| Employer Contact | Contact your employer or payor to authorize direct payments; a voided check may be required. |

| Federal Deposits | If setting up Federal Direct Deposits, you must contact relevant federal agencies for assistance. |

| Processing Time | Direct deposits can take approximately four weeks to establish for initial setup. |

| Governing Laws | Direct deposit regulations are governed by federal banking laws that apply across the United States. |

Guidelines on Utilizing Tcf Bank Direct Deposit

Completing the TCF Bank Direct Deposit form can streamline your finances and ensure you receive your payments directly into your bank account. Once your information is submitted and processed, you will gain quicker access to your funds without the hassle of depositing physical checks.

- Gather Your Banking Information: Find your account and routing numbers. If you are setting up a direct deposit for a checking account, you will need a 9-digit routing number and a 10-digit account number. For a savings account, you will also need the 10-digit account number.

- Contact Your Employer or Payor: Reach out to the organization that will be making the direct payments. You may need to fill out an authorization form or provide a voided check. For federal direct deposits, you should contact the appropriate agency for instructions.

- Monitor Your Account: After your application is submitted, keep an eye on your bank account. It typically takes about 4 weeks to initiate direct deposit. Look for your first payment to confirm everything is set up correctly.

What You Should Know About This Form

What is the TCF Bank Direct Deposit form?

The TCF Bank Direct Deposit form is a document that allows individuals to set up direct deposit for their payments directly into their TCF Bank checking or savings account. This service is free, offering a convenient and safe way to manage funds without the worry of lost or stolen checks.

What are the benefits of using TCF Direct Deposit?

TCF Direct Deposit provides several advantages. It offers ease by eliminating the need for trips to the bank. Additionally, it ensures safety by reducing the risk of checks getting lost or stolen. Most importantly, it gives users control over their finances, allowing for same-day access to their funds.

How do I fill out the TCF Bank Direct Deposit form?

To fill out the form, first locate your account and routing numbers. For checking accounts, the routing number consists of 9 digits while the account number contains 10 digits. For savings accounts, you will need to provide your 10-digit account number. Make sure to enter this information accurately on the form.

What do I need to do after filling out the form?

Once you have completed the TCF Direct Deposit form, the next step is to contact your employer or the payor from whom you wish to receive deposits. It may be necessary to provide them with an authorization form and/or a voided check to verify your information. If you are setting up Federal Direct Deposit, reach out to the appropriate federal agency for further assistance.

How long does it take for TCF Direct Deposit to start?

Typically, TCF Direct Deposit may take approximately 4 weeks to be activated. Be patient and regularly check your account for your first payment during this period.

Who can I contact for assistance with TCF Direct Deposit?

If you need help setting up your Direct Deposit, you can call TCF Bank at 1-800-TCF-BANK. Additionally, if you’re setting up Federal Direct Deposit, you may contact the relevant federal agencies such as Social Security or Veterans Benefits for guidance.

Is there any cost associated with TCF Direct Deposit?

No, there are no costs associated with using TCF Direct Deposit. This service is provided free of charge, allowing you to manage your money conveniently and efficiently.

Common mistakes

Filling out the TCF Bank Direct Deposit form involves specific details that must be completed accurately. One common mistake is providing an incorrect routing number. The routing number must be exactly 9 digits long. If someone enters the wrong number, their direct deposit could be delayed or sent to the wrong account. Always double-check the routing number from the appropriate source, such as the bank or official documentation.

Another mistake often made involves the account number. The account number for a checking account should be precisely 10 digits. Failing to enter the correct number can result in lost funds. It is crucial to verify the account number by checking a recent bank statement or contacting the bank.

Many people overlook the requirement to contact their employer or payor about setting up direct deposit. Step two of the process is vital. Neglecting to inform them may delay the initiation of payments. Understand that many organizations will need an authorization form or a voided check to confirm the details provided on the form. Without this step, the setup may remain incomplete.

Timing can also be an issue. Some individuals expect their direct deposit to start immediately after submitting the form. However, it typically takes around four weeks for the first payment to be deposited. Failure to monitor the account during this period could lead to unnecessary concern if no payment appears.

Finally, not keeping a copy of the submitted form for personal records presents yet another mistake. This documentation serves as a reference and is helpful if issues arise. It is advisable to retain a copy of any forms submitted to ensure all information matches and to have a record of the submission.

Documents used along the form

When setting up a Direct Deposit with TCF Bank, several other forms and documents may accompany your Direct Deposit form to ensure a smooth process. Each of these documents plays a vital role in confirming your banking information or authorizing direct payments from specific sources.

- Authorization Form: This form is often required by employers or payors to officially permit them to deposit funds directly into your account. It typically includes your signature for verification.

- Voided Check: A voided check may be needed to provide your account and routing numbers. It indicates to your employer or payor the exact account where funds should be deposited. The word "VOID" should be written across the face of the check.

- Employer Direct Deposit Enrollment Form: In cases where your employer has a specific direct deposit process, they'll likely ask you to complete their internal enrollment form. This document collects your employment details and banking information.

- Federal Direct Deposit Request Form: If you are setting up a direct deposit for federal benefits, this specialized form needs to be completed. It establishes your eligibility for direct payment from the federal government.

- Bank Account Verification Letter: Sometimes, a letter from TCF Bank confirming your account details may be necessary. This document verifies your identification and account info to the payor, ensuring proper processing.

- Retirement Account Direct Deposit Form: If you receive retirement benefits, this form specifically authorizes the transfer of those payments into your bank account. Providing your banking details is essential for this setup.

Always double-check with your employer or payor to confirm which specific documents are required for your situation. Ensuring all necessary forms are completed correctly will help this process go smoothly and get your funds into your account without unnecessary delays.

Similar forms

-

W-4 Form: Similar to the TCF Bank Direct Deposit form, the W-4 form is essential for providing information to your employer about how much federal tax should be withheld from your paycheck. Both documents facilitate a process that affects your income management.

-

Direct Deposit Authorization Form: This form, often required by employers, grants permission to deposit funds directly into your bank account. Like the TCF form, it includes your banking information such as account and routing numbers.

-

Payroll Deduction Authorization Form: This document allows deductions from your paycheck for various purposes, such as retirement savings or health insurance. Both this form and the TCF Direct Deposit form streamline how payments are processed and managed.

-

Bank Account Opening Form: When you open a bank account, this form collects important details like your identification and funding source. Both forms rely on accurate banking information to function correctly.

-

Change of Address Form: This document informs your employer and bank of your new address. It’s similar to the TCF form in that it plays a crucial role in ensuring that your financial matters are properly managed and up-to-date.

-

Employee Information Form: Often filled out when starting a new job, this form gathers essential details, including banking data for direct deposit. Just like the TCF Direct Deposit form, it aims to facilitate efficient payment processes.

-

Social Security Administration Direct Deposit Form: This form sets up direct deposits for Social Security benefits. It mirrors the TCF form as both need specific banking information to ensure timely payments.

-

Payment Authorization Form: Used for recurring payments, such as utility bills, this form ensures that funds are transferred automatically. Like the TCF Direct Deposit form, it simplifies managing regular financial transactions.

Dos and Don'ts

When filling out the TCF Bank Direct Deposit form, keeping a few important points in mind can help ensure a smooth and successful process. Here’s a helpful list of things to do and avoid.

- Do enter your account and routing numbers accurately. Double-check these numbers to prevent any issues with deposits.

- Do provide necessary details to your employer or payor. They might need specific information or a voided check to process your request.

- Do monitor your account after submission. It typically takes about four weeks for your first deposit to appear.

- Do keep a copy of your completed form for your records. This can be useful if any questions arise later.

- Don't rush through the process. Take your time to ensure all sections of the form are filled out correctly.

- Don't forget to contact your federal agency if you are setting up a Federal Direct Deposit.

- Don't use temporary or old checks that have expired bank details. Stick with current information.

By following these tips, you can help make your experience with the TCF Bank Direct Deposit form as easy and efficient as possible.

Misconceptions

When using the TCF Bank Direct Deposit form, several misconceptions may arise. It's important to clear these up to ensure a smooth experience when setting up your direct deposit.

- Misconception 1: Direct deposit is complicated to set up.

- Misconception 2: I need to provide extra fees to use direct deposit.

- Misconception 3: I can only use direct deposit with my checking account.

- Misconception 4: The setup process takes too long.

- Misconception 5: My funds won't be available immediately.

In reality, setting up direct deposit is straightforward. It typically involves just three simple steps, which include locating your account and routing numbers, contacting your employer, and monitoring your account for the first payment.

TCF Bank offers direct deposit as a free service. You do not have to pay any hidden fees to access the benefits of having your funds deposited directly into your bank account.

This is not true. You can set up direct deposit for both checking and savings accounts, as long as you provide the appropriate account and routing numbers on the TCF Bank Direct Deposit form.

While it may take around four weeks for the first payment to process, once set up, payments will be made on time and without additional work each pay period.

One of the benefits of direct deposit is same-day access to your funds. This means that once the deposit is made, you can withdraw or use the money right away.

Understanding these points can help alleviate concerns and make your experience with TCF Bank's Direct Deposit service more enjoyable and efficient.

Key takeaways

Filling out and using the TCF Bank Direct Deposit form can greatly enhance the management of your finances. Here are some key takeaways to understand the process better:

- Convenience: Direct deposit eliminates the need to visit the bank, saving time and effort.

- Security: There is no risk of lost or stolen checks, making your funds safer.

- Immediate Access: You gain same-day access to your funds, so your money is available when you need it.

- Account Numbers: Ensure you correctly locate your account and routing numbers. For checking accounts, the routing number is 9 digits, and the account number is 10 digits.

- Direct Deposit Setup: The process consists of three straightforward steps, making it easy for anyone to follow.

- Communication with Employer: You will need to contact your employer or payor to set up direct deposit. This may include completing an authorization form or providing a voided check.

- Federal Direct Deposits: Specific instructions must be followed when setting up direct deposits for federal benefits, and it's advisable to reach out to TCF representatives or federals agencies for assistance.

- Duration for Setup: Be aware that the direct deposit process can take approximately four weeks to initiate, so patience is essential.

- Monitoring Your Account: After setting up direct deposit, regularly check your account to ensure that payments are starting as expected.

- Contact Information: If you have questions or need help, you can reach TCF Bank at 1-800-TCF-BANK.

Understanding these elements ensures a smooth onboarding experience with TCF Bank Direct Deposit. Prepare with the necessary information and stay informed throughout the process for a seamless transaction experience.

Browse Other Templates

Signs of Neglect - Serves as a foundational document to track child welfare concerns and responses.

Dcf Income Verification Form - It's important to address why any variations in pay or hours occurred during the last pay period.

Eservices for Business - There is a section to indicate if reporting only Voluntary Plan Disability Insurance wages.