Fill Out Your Td F 90 22 1 Form

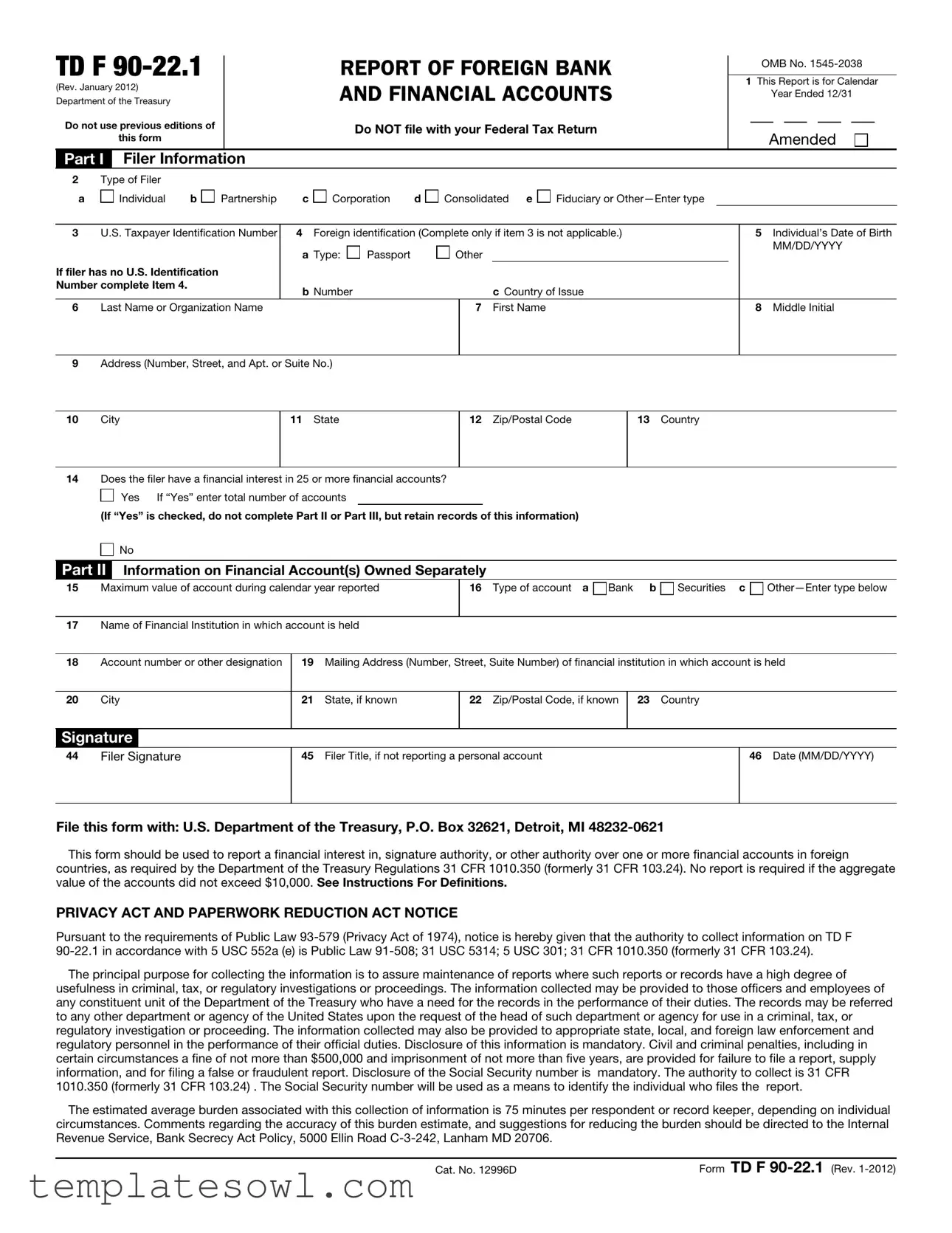

The TD F 90-22.1 form, officially titled the Report of Foreign Bank and Financial Accounts, is a crucial document managed by the Department of the Treasury. It serves as a means for U.S. taxpayers to report their financial interests in foreign accounts. Specifically designed to aid in the compliance with regulations, this form must be filed if the aggregate value of these accounts exceeds $10,000 at any point during the calendar year. By capturing diverse details, the form requires information such as the type of filer—whether individual, partnership, corporation, or fiduciary—along with essential identifying information including taxpayer identification numbers and individual birth dates. Those reporting accounts must provide specific details about each account, including its maximum value during the reporting period, the name and address of the financial institution, and any associated account numbers. Furthermore, the form includes sections for accounts owned jointly and for those over which a filer has signature authority but no financial interest. Ultimately, understanding and properly filling out the TD F 90-22.1 form can help individuals avoid potential financial penalties and legal complications, ensuring transparent reporting of foreign financial activities.

Td F 90 22 1 Example

TD F

(Rev. January 2012) Department of the Treasury

Do not use previous editions of

this form

REPORT OF FOREIGN BANK AND FINANCIAL ACCOUNTS

Do NOT file with your Federal Tax Return

OMB No.

1This Report is for Calendar Year Ended 12/31

Amended

Part I Filer Information

2Type of Filer

a |

Individual |

b |

Partnership c

Corporation d

Consolidated e

Fiduciary or

3 |

U.S. Taxpayer Identification Number |

4 Foreign identification (Complete only if item 3 is not applicable.) |

|

5 |

Individual’s Date of Birth |

||||

|

|

a Type: |

Passport |

Other |

|

|

MM/DD/YYYY |

||

|

|

|

|

|

|||||

If filer has no U.S. Identification |

|

|

|

|

|

|

|

|

|

Number complete Item 4. |

b Number |

|

|

|

c Country of Issue |

|

|

|

|

|

|

|

|

|

|

|

|

||

6 |

Last Name or Organization Name |

|

|

|

7 First Name |

|

8 |

Middle Initial |

|

|

|

|

|

|

|

|

|

|

|

9Address (Number, Street, and Apt. or Suite No.)

10City

11State

12Zip/Postal Code

13Country

14Does the filer have a financial interest in 25 or more financial accounts?

Yes If “Yes” enter total number of accounts

(If “Yes” is checked, do not complete Part II or Part III, but retain records of this information)

No

Part II Information on Financial Account(s) Owned Separately

15Maximum value of account during calendar year reported

16 Type of account a

Bank b

Securities c

17Name of Financial Institution in which account is held

18Account number or other designation

19Mailing Address (Number, Street, Suite Number) of financial institution in which account is held

20City

21State, if known

22Zip/Postal Code, if known

23Country

Signature

44Filer Signature

45Filer Title, if not reporting a personal account

46Date (MM/DD/YYYY)

File this form with: U.S. Department of the Treasury, P.O. Box 32621, Detroit, MI

This form should be used to report a financial interest in, signature authority, or other authority over one or more financial accounts in foreign countries, as required by the Department of the Treasury Regulations 31 CFR 1010.350 (formerly 31 CFR 103.24). No report is required if the aggregate value of the accounts did not exceed $10,000. See Instructions For Definitions.

PRIVACY ACT AND PAPERWORK REDUCTION ACT NOTICE

Pursuant to the requirements of Public Law

The principal purpose for collecting the information is to assure maintenance of reports where such reports or records have a high degree of usefulness in criminal, tax, or regulatory investigations or proceedings. The information collected may be provided to those officers and employees of any constituent unit of the Department of the Treasury who have a need for the records in the performance of their duties. The records may be referred to any other department or agency of the United States upon the request of the head of such department or agency for use in a criminal, tax, or regulatory investigation or proceeding. The information collected may also be provided to appropriate state, local, and foreign law enforcement and regulatory personnel in the performance of their official duties. Disclosure of this information is mandatory. Civil and criminal penalties, including in certain circumstances a fine of not more than $500,000 and imprisonment of not more than five years, are provided for failure to file a report, supply information, and for filing a false or fraudulent report. Disclosure of the Social Security number is mandatory. The authority to collect is 31 CFR 1010.350 (formerly 31 CFR 103.24) . The Social Security number will be used as a means to identify the individual who files the report.

The estimated average burden associated with this collection of information is 75 minutes per respondent or record keeper, depending on individual circumstances. Comments regarding the accuracy of this burden estimate, and suggestions for reducing the burden should be directed to the Internal Revenue Service, Bank Secrecy Act Policy, 5000 Ellin Road

Cat. No. 12996D |

Form TD F |

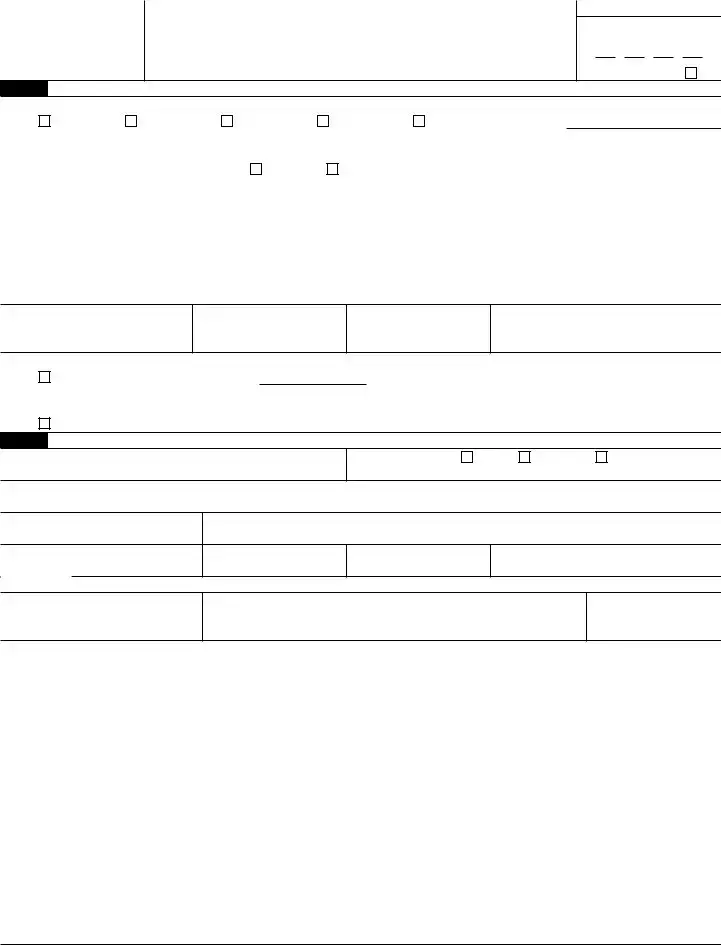

Part II |

|

|

Form TD F |

||||||||||||||

Complete a Separate Block for Each Account Owned Separately |

|

|

Page Number |

||||||||||||||

|

|

|

of |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

This side can be copied as many times as necessary in order to provide information on all accounts. |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Filing for calendar |

6 Last Name or Organization Name |

|

|

|

|

|

|

||||||||||

|

|

|

|

year |

Taxpayer Identification Number |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Identification Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter identification number here: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

15 Maximum value of account during calendar year reported |

16 Type of account a Bank b |

Securities c |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17Name of Financial Institution in which account is held

18 |

Account number or other designation |

19 |

Mailing Address (Number, Street, Suite Number) of financial institution in which account is held |

|||||||

|

|

|

|

|

|

|

|

|

|

|

20 |

City |

21 |

State, if known |

22 |

Zip/Postal Code, if known |

|

23 |

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

Maximum value of account during calendar year reported |

16 |

Type of account a |

Bank |

b |

Securities c |

||||

|

|

|

|

|

|

|

|

|

|

|

17Name of Financial Institution in which account is held

18 |

Account number or other designation |

19 |

Mailing Address (Number, Street, Suite Number) of financial institution in which account is held |

|||||||

|

|

|

|

|

|

|

|

|

|

|

20 |

City |

21 |

State, if known |

22 |

Zip/Postal Code, if known |

|

23 |

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

Maximum value of account during calendar year reported |

16 |

Type of account a |

Bank |

b |

Securities c |

||||

|

|

|

|

|

|

|

|

|

|

|

17Name of Financial Institution in which account is held

18 |

Account number or other designation |

19 |

Mailing Address (Number, Street, Suite Number) of financial institution in which account is held |

|||||||

|

|

|

|

|

|

|

|

|

|

|

20 |

City |

21 |

State, if known |

22 |

Zip/Postal Code, if known |

|

23 |

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

Maximum value of account during calendar year reported |

16 |

Type of account a |

Bank |

b |

Securities c |

||||

|

|

|

|

|

|

|

|

|

|

|

17Name of Financial Institution in which account is held

18 |

Account number or other designation |

19 |

Mailing Address (Number, Street, Suite Number) of financial institution in which account is held |

|||||||

|

|

|

|

|

|

|

|

|

|

|

20 |

City |

21 |

State, if known |

22 |

Zip/Postal Code, if known |

|

23 |

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

Maximum value of account during calendar year reported |

16 |

Type of account a |

Bank |

b |

Securities c |

||||

|

|

|

|

|

|

|

|

|

|

|

17Name of Financial Institution in which account is held

18 |

Account number or other designation |

19 |

Mailing Address (Number, Street, Suite Number) of financial institution in which account is held |

|||||||

|

|

|

|

|

|

|

|

|

|

|

20 |

City |

21 |

State, if known |

22 |

Zip/Postal Code, if known |

|

23 |

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

Maximum value of account during calendar year reported |

16 |

Type of account a |

Bank |

b |

Securities c |

||||

|

|

|

|

|

|

|

|

|

|

|

17Name of Financial Institution in which account is held

18Account number or other designation

19Mailing Address (Number, Street, Suite Number) of financial institution in which account is held

20City

21State, if known

22Zip/Postal Code, if known

23Country

Form TD F

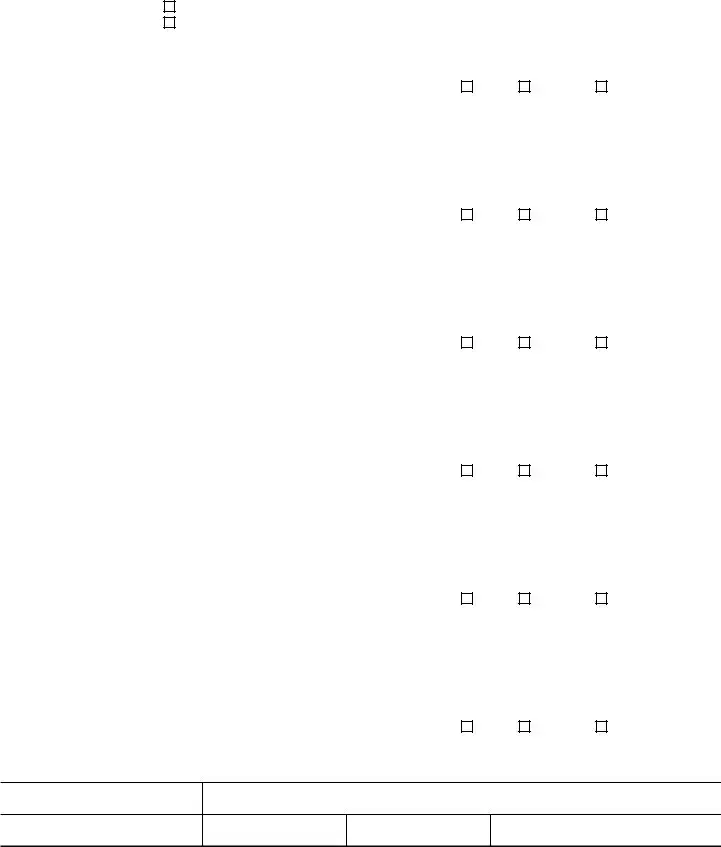

Part III |

Information on Financial Account(s) Owned Jointly |

|

|

Form TD F |

|||||||||||||

Complete a Separate Block for Each Account Owned Jointly |

|

|

Page Number |

||||||||||||||

|

|

|

of |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

This side can be copied as many times as necessary in order to provide information on all accounts. |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Filing for calendar |

6 Last Name or Organization Name |

|

|

|

|

|

|

||||||||||

|

|

|

|

year |

Taxpayer Identification Number |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Identification Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter identification number here: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

15 Maximum value of account during calendar year reported |

16 Type of account a Bank b |

Securities c |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17Name of Financial Institution in which account is held

18 |

Account number or other designation |

19 |

Mailing Address (Number, Street, Suite Number) of financial institution in which account is held |

||||

|

|

|

|

|

|

|

|

20 |

City |

21 |

State, if known |

22 |

Zip/Postal Code, if known |

23 Country |

|

|

|

|

|

|

|

|

|

24 |

Number of joint owners for this account |

25 |

Taxpayer Identification Number of principal joint owner, if known. See instructions. |

|

|||

|

|

|

|

|

|

||

26 |

Last Name or Organization Name of principal joint owner |

27 |

First Name of principal joint owner, if known |

28 Middle initial, if known |

|||

|

|

|

|

|

|

|

|

29Address (Number, Street, Suite or Apartment) of principal joint owner, if known

30 |

City, if known |

31 State, if known |

32 |

Zip/Postal Code, if known |

33 |

Country, if known |

|

|

|

|

|

|

|

|

|

|

|

15 |

Maximum value of account during calendar year reported |

16 |

Type of account a |

Bank b |

Securities c |

|||

|

|

|

|

|

|

|

|

|

17Name of Financial Institution in which account is held

18 |

Account number or other designation |

19 |

Mailing Address (Number, Street, Suite Number) of financial institution in which account is held |

||||

|

|

|

|

|

|

|

|

20 |

City |

21 |

State, if known |

22 |

Zip/Postal Code, if known |

23 Country |

|

|

|

|

|

|

|

|

|

24 |

Number of joint owners for this account |

25 |

Taxpayer Identification Number of principal joint owner, if known. See instructions. |

|

|||

|

|

|

|

|

|

||

26 |

Last Name or Organization Name of principal joint owner |

27 |

First Name of principal joint owner, if known |

28 Middle initial, if known |

|||

|

|

|

|

|

|

|

|

29Address (Number, Street, Suite or Apartment) of principal joint owner, if known

30 |

City, if known |

31 State, if known |

32 |

Zip/Postal Code, if known |

|

33 |

Country, if known |

|

|

|

|

|

|

|

|

|

|

|

|

15 |

Maximum value of account during calendar year reported |

16 |

Type of account a |

Bank |

b |

Securities c |

|||

|

|

|

|

|

|

|

|

|

|

17Name of Financial Institution in which account is held

18 |

Account number or other designation |

19 |

Mailing Address (Number, Street, Suite Number) of financial institution in which account is held |

||||

|

|

|

|

|

|

|

|

20 |

City |

21 |

State, if known |

22 |

Zip/Postal Code, if known |

23 Country |

|

|

|

|

|

|

|

|

|

24 |

Number of joint owners for this account |

25 |

Taxpayer Identification Number of principal joint owner, if known. See instructions. |

|

|||

|

|

|

|

|

|

||

26 |

Last Name or Organization Name of principal joint owner |

27 |

First Name of principal joint owner, if known |

28 Middle initial, if known |

|||

|

|

|

|

|

|

|

|

29Address (Number, Street, Suite or Apartment) of principal joint owner, if known

30 |

City, if known |

31 State, if known |

32 Zip/Postal Code, if known |

33 Country, if known |

|

|

|

|

|

Form TD F

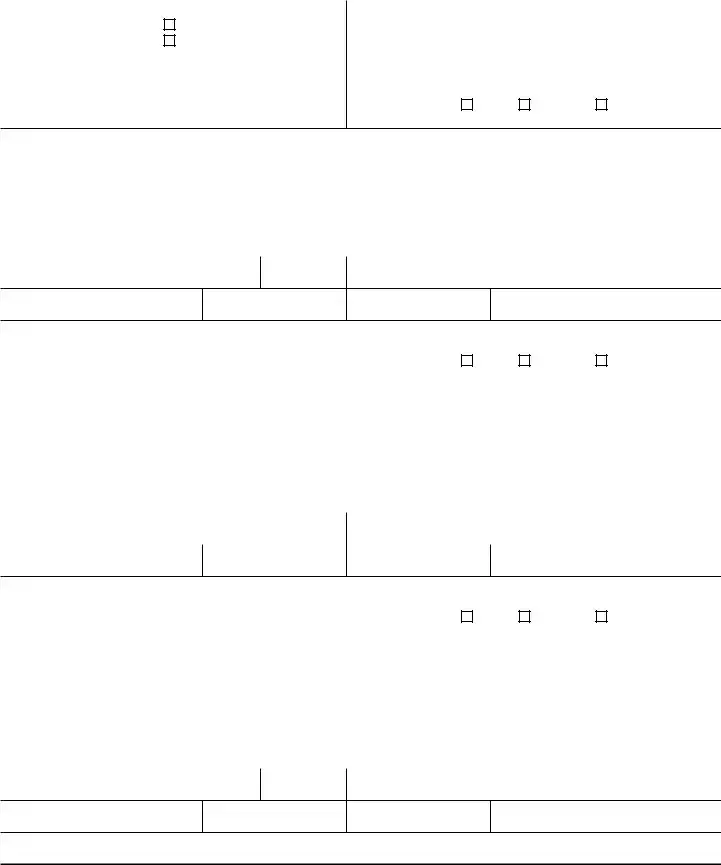

Part IV |

Information on Financial Account(s) Where Filer has Signature Authority but No |

|

Form TD F |

||||||||||||

|

|

|

Financial Interest in the Account(s) |

|

|

Page Number |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete a Separate Block for Each Account |

|

|

|

of |

|||||||||||

This side can be copied as many times as necessary in order to provide information on all accounts. |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Filing for calendar |

6 Last Name or Organization Name |

|

|

|

|

|

|||||||||

|

|

|

year |

Taxpayer Identification Number |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Identification Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter identification number here: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15Maximum value of account during calendar year reported

16 Type of account a

Bank b

Securities c

17Name of Financial Institution in which account is held

18 |

Account number or other designation |

19 |

Mailing Address (Number, Street, Suite Number) of financial institution in which account is held |

|||

|

|

|

|

|

|

|

20 |

City |

21 |

State, if known |

22 Zip/Postal Code, if known |

23 |

Country |

|

|

|

|

|

|

|

34 |

Last Name or Organization Name of Account Owner |

|

35 |

Taxpayer Identification Number of Account Owner |

||

|

|

|

|

|

|

|

36First Name

37Middle initial

38Address (Number, Street, and Apt. or Suite No.)

39City

40State

41Zip/Postal Code

42Country

43Filer's Title with this Owner

15 |

Maximum value of account during calendar year reported |

16 Type of account a |

Bank b |

Securities c |

|

|

|

|

|

|

|

17Name of Financial Institution in which account is held

18 |

Account number or other designation |

19 |

Mailing Address (Number, Street, Suite Number) of financial institution in which account is held |

|||||

|

|

|

|

|

|

|

|

|

20 |

City |

21 |

State, if known |

22 |

Zip/Postal Code, if known |

23 |

Country |

|

|

|

|

|

|

|

|

|

|

34 |

Last Name or Organization Name of Account Owner |

|

|

35 |

Taxpayer Identification Number of Account Owner |

|||

|

|

|

|

|

|

|

|

|

36 |

First Name |

|

|

37 Middle initial |

38 |

Address (Number, Street, and Apt. or Suite No.) |

||

|

|

|

|

|

|

|

|

|

39City

40State

41Zip/Postal Code

42Country

43Filer's Title with this Owner

15 |

Maximum value of account during calendar year reported |

16 Type of account a |

Bank b |

Securities c |

|

|

|

|

|

|

|

17Name of Financial Institution in which account is held

18 |

Account number or other designation |

19 |

Mailing Address (Number, Street, Suite Number) of financial institution in which account is held |

|||

|

|

|

|

|

|

|

20 |

City |

21 |

State, if known |

22 Zip/Postal Code, if known |

23 |

Country |

|

|

|

|

|

|

|

34 |

Last Name or Organization Name of Account Owner |

|

35 |

Taxpayer Identification Number of Account Owner |

||

|

|

|

|

|

|

|

36First Name

37Middle initial

38Address (Number, Street, and Apt. or Suite No.)

39City

40State

41Zip/Postal Code

42Country

43Filer's Title with this Owner

Form TD F

Part V |

Information on Financial Account(s) Where the Filer is Filing a |

|

|

Form TD F |

||||||||||||

|

|

|

Consolidated Report |

|

|

|

Page Number |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete a Separate Block for Each Account |

|

|

|

|

of |

|||||||||||

This side can be copied as many times as necessary in order to provide information on all accounts. |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Filing for calendar |

6 Last Name or Organization Name |

|

|

|

|

|

|

|||||||||

|

|

|

year |

Taxpayer Identification Number |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Identification Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter identification number here: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

15 Maximum value of account during calendar year reported |

16 Type of account a Bank b |

Securities c |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17Name of Financial Institution in which account is held

18 |

Account number or other designation |

19 |

Mailing Address (Number, Street, Suite Number) of financial institution in which account is held |

|||

|

|

|

|

|

|

|

20 |

City |

21 |

State, if known |

22 Zip/Postal Code, if known |

23 |

Country |

|

|

|

|

|

|

|

34 |

Corporate Name of Account Owner |

|

|

|

35 |

Taxpayer Identification Number of Account Owner |

|

|

|

|

|

|

|

38Address (Number, Street, and Apt. or Suite No.)

39 |

City |

40 State |

41 Zip/Postal Code |

42 Country |

|

|

|

|

|

15Maximum value of account during calendar year reported

16 Type of account a

Bank b

Securities c

17Name of Financial Institution in which account is held

18 |

Account number or other designation |

19 |

Mailing Address (Number, Street, Suite Number) of financial institution in which account is held |

|||

|

|

|

|

|

|

|

20 |

City |

21 |

State, if known |

22 Zip/Postal Code, if known |

23 |

Country |

|

|

|

|

|

|

|

34 |

Corporate Name of Account Owner |

|

|

|

35 |

Taxpayer Identification Number of Account Owner |

|

|

|

|

|

|

|

38Address (Number, Street, and Apt. or Suite No.)

39 |

City |

40 State |

41 |

Zip/Postal Code |

|

|

42 |

Country |

|

|

|

|

|

|

|

|

|

|

|

15 |

Maximum value of account during calendar year reported |

16 |

Type of account |

a |

Bank b |

Securities c |

|||

|

|

|

|

|

|

|

|

|

|

17Name of Financial Institution in which account is held

18 |

Account number or other designation |

19 |

Mailing Address (Number, Street, Suite Number) of financial institution in which account is held |

|||

|

|

|

|

|

|

|

20 |

City |

21 |

State, if known |

22 Zip/Postal Code, if known |

23 |

Country |

|

|

|

|

|

|

|

34 |

Corporate Name of Account Owner |

|

|

|

35 |

Taxpayer Identification Number of Account Owner |

|

|

|

|

|

|

|

38Address (Number, Street, and Apt. or Suite No.)

39 |

City |

40 State |

41 Zip/Postal Code |

42 Country |

|

|

|

|

|

Form TD F

Form TD F |

Page 6 |

|

|

General Instructions

Form TD F

Who Must File an FBAR. A United States person that has a financial interest in or signature authority over foreign financial accounts must file an FBAR if the aggregate value of the foreign financial accounts exceeds $10,000 at any time during the calendar year. See General Definitions, to determine who is a United States person.

General Definitions

Financial Account. A financial account includes, but is not limited to, a securities, brokerage, savings, demand, checking, deposit, time deposit, or other account maintained with a financial institution (or other person performing the services of a financial institution). A financial account also includes a commodity futures or options account, an insurance policy with a cash value (such as a whole life insurance policy), an annuity policy with a cash value, and shares in a mutual fund or similar pooled fund (i.e., a fund that is available to the general public with a regular net asset value determination and regular redemptions).

Foreign Financial Account. A foreign financial account is a financial account located outside of the United States. For example, an account maintained with a branch of a United States bank that is physically located outside of the United States is a foreign financial account. An account maintained with a branch of a foreign bank that is physically located in the United States is not a foreign financial account.

Financial Interest. A United States person has a financial interest in a foreign financial account for which:

(1)the United States person is the owner of record or holder of legal title, regardless of whether the account is maintained for the benefit of the United States person or for the benefit of another person; or

(2)the owner of record or holder of legal title is one of the following:

(a)An agent, nominee, attorney, or a person acting in some other capacity on behalf of the United States person with respect to the account;

(b)A corporation in which the United States person owns directly or indirectly: (i) more than 50 percent of the total value of shares of stock or (ii) more than 50 percent of the voting power of all shares of stock;

(c)A partnership in which the United States person owns directly or indirectly: (i) an interest in more than 50 percent of the partnership's profits (e.g., distributive share of partnership income taking into account any special allocation agreement) or (ii) an interest in more than 50 percent of the partnership capital;

(d)A trust of which the United States person: (i) is the trust grantor and (ii) has an ownership interest in the trust for United States federal tax purposes. See 26 U.S.C. sections

(e)A trust in which the United States person has a greater than 50 percent present beneficial interest in the assets or income of the trust for the calendar year; or

(f)Any other entity in which the United States person owns directly or indirectly more than 50 percent of the voting power, total value of equity interest or assets, or interest in profits.

Person. A person means an individual and legal entities including, but not limited to, a limited liability company, corporation, partnership, trust, and estate.

Signature Authority. Signature authority is the authority of an individual (alone or in conjunction with another individual) to control the disposition of assets held in a foreign financial account by direct communication (whether in writing or otherwise) to the bank or other financial institution that maintains the financial account. See Exceptions, Signature Authority.

United States. For FBAR purposes, the United States includes the States, the District of Columbia, all United States territories and possessions (e.g., American Samoa, the Commonwealth of the Northern Mariana Islands, the Commonwealth of Puerto Rico, Guam, and the United States Virgin Islands), and the Indian lands as defined in the Indian Gaming Regulatory Act. References to the laws of the United States include the laws of the United States federal government and the laws of all places listed in this definition.

United States Person. United States person means United States citizens; United States residents; entities, including but not limited to, corporations, partnerships, or limited liability companies created or organized in the United States or under the laws of the United States; and trusts or estates formed under the laws of the United States.

Note. The federal tax treatment of an entity does not determine whether the entity has an FBAR filing requirement. For example, an entity that is disregarded for purposes of Title 26 of the United States Code must file an FBAR, if otherwise required to do so. Similarly, a trust for which the trust income, deductions, or credits are taken into account by another person for purposes of Title 26 of the United States Code must file an FBAR, if otherwise required to do so.

United States Resident. A United States resident is an alien residing in the United States. To determine if the filer is a resident of the United States apply the residency tests in 26 U.S.C. section 7701(b). When applying the residency tests, use the definition of United States in these instructions.

Exceptions

Certain Accounts Jointly Owned by Spouses. The spouse of an individual who files an FBAR is not required to file a separate FBAR if the following conditions are met: (1) all the financial accounts that the

Consolidated FBAR. If a United States person that is an entity is named in a consolidated FBAR filed by a greater than 50 percent owner, such entity is not required to file a separate FBAR. See Explanations for Specific Items, Part V.

Correspondent/Nostro Account. Correspondent or nostro accounts (which are maintained by banks and used solely for

Governmental Entity. A foreign financial account of any governmental entity of the United States (as defined above) is not required to be reported by any person. For purposes of this form, governmental entity includes a college or university that is an agency of, an instrumentality of, owned by, or operated by a governmental entity. For purposes of this form, governmental entity also includes an employee retirement or welfare benefit plan of a governmental entity.

International Financial Institution. A foreign financial account of any international financial institution (if the United States government is a member) is not required to be reported by any person.

IRA Owners and Beneficiaries. An owner or beneficiary of an IRA is not required to report a foreign financial account held in the IRA.

Participants in and Beneficiaries of

Signature Authority. Individuals who have signature authority over, but no financial interest in, a foreign financial account are not required to report the account in the following situations:

(1)An officer or employee of a bank that is examined by the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, the Office of Thrift Supervision, or the National Credit Union Administration is not required to report signature authority over a foreign financial account owned or maintained by the bank.

(2)An officer or employee of a financial institution that is registered with and examined by the Securities and Exchange Commission or Commodity Futures Trading Commission is not required to report signature authority over a foreign financial account owned or maintained by the financial institution.

Form TD F |

Page 7 |

|

|

(3)An officer or employee of an Authorized Service Provider is not required to report signature authority over a foreign financial account that is owned or maintained by an investment company that is registered with the Securities and Exchange Commission. Authorized Service Provider means an entity that is registered with and examined by the Securities and Exchange Commission and provides services to an investment company registered under the Investment Company Act of 1940.

(4)An officer or employee of an entity that has a class of equity securities listed (or American depository receipts listed) on any United States national securities exchange is not required to report signature authority over a foreign financial account of such entity.

(5)An officer or employee of a United States subsidiary is not required to report signature authority over a foreign financial account of the subsidiary if its United States parent has a class of equity securities listed on any United States national securities exchange and the subsidiary is included in a consolidated FBAR report of the United States parent.

(6)An officer or employee of an entity that has a class of equity securities registered (or American depository receipts in respect of equity securities registered) under section 12(g) of the Securities Exchange Act is not required to report signature authority over a foreign financial account of such entity.

Trust Beneficiaries. A trust beneficiary with a financial interest described in section (2)(e) of the financial interest definition is not required to report the trust's foreign financial accounts on an FBAR if the trust, trustee of the trust, or agent of the trust: (1) is a United States person and (2) files an FBAR disclosing the trust's foreign financial accounts.

United States Military Banking Facility. A financial account maintained with a financial institution located on a United States military installation is not required to be reported, even if that military installation is outside of the United States.

Filing Information

When and Where to File. The FBAR is an annual report and must be received by the Department of the Treasury on or before June 30th of the year following the calendar year being reported. Do Not file with

federal income tax return.

File by mailing to:

Department of the Treasury Post Office Box 32621 Detroit, MI

If an express delivery service is used, file by mailing to:

IRS Enterprise Computing Center

ATTN: CTR Operations Mailroom, 4th Floor 985 Michigan Avenue

Detroit, MI 48226

The FBAR may be hand delivered to any local office of the Internal Revenue Service for forwarding to the Department of the Treasury, Detroit, MI. The FBAR may also be delivered to the Internal Revenue Service's tax attaches located in United States embassies and consulates for forwarding to the Department of the Treasury, Detroit, MI. The FBAR is not considered filed until it is received by the Department of the Treasury in Detroit, MI.

No Extension of Time to File. There is no extension of time available for filing an FBAR. Extensions of time to file federal tax returns do NOT extend the time for filing an FBAR. If a delinquent FBAR is filed, attach a statement explaining the reason for the late filing.

Amending a Previously Filed FBAR. To amend a filed FBAR, check the "Amended" box in the upper right hand corner of the first page of the FBAR. Complete the form in its entirety and include the amended information. Do not attach a copy of the original FBAR. An amendment should not be made until at least 120 calendar days after the original FBAR is filed.

Record Keeping Requirements. Persons required to file an FBAR must retain records that contain the name in which each account is maintained, the number or other designation of the account, the name and address of the foreign financial institution that maintains the account, the type of account, and the maximum account value of each account during the reporting period. The records must be retained for a

period of 5 years from June 30th of the year following the calendar year reported and must be available for inspection as provided by law. Retaining a copy of the filed FBAR can help to satisfy the record keeping requirements.

An officer or employee who files an FBAR to report signature authority over an employer's foreign financial account is not required to personally retain records regarding these accounts.

Questions. FBAR help is available by telephone or

Explanations for Specific Items

Part I — Filer Information

Item 1. The FBAR is an annual report. Enter the calendar year being reported. If amending a previously filed FBAR, check the “Amended” box.

Item 2. Check the box that describes the filer. Check only one box. Individuals reporting only signature authority, check box “a”. If filing a consolidated FBAR, check box “d”. To determine if a consolidated FBAR can be filed, see Part V. If the type of filer is not listed in boxes “a” through “c”, check box “e”, and enter the type of filer. Persons that should check box “e” include, but are not limited to, trusts, estates, limited liability companies, and

Item 3. Provide the filer's United States taxpayer identification number. Generally, this is the filer's United States social security number (SSN), United States individual taxpayer identification number (ITIN), or employer identification number (EIN). Throughout the FBAR, numbers should be entered with no spaces, dashes, or other punctuation. If the filer does NOT have a United States taxpayer identification number, complete Item 4.

Item 4. Complete Item 4 only if the filer does NOT have a United States taxpayer identification number. Item 4 requires the filer to provide information from an official foreign government document to verify the filer's nationality or residence. Enter the document number followed by the country of issuance, check the appropriate type of document, and if “other” is checked, provide the type of document.

Item 5. If the filer is an individual, enter the filer's date of birth, using the month, day, and year convention.

Items 9, 10, 11, 12, and 13. Enter the filer's address. An individual residing in the United States must enter the street address of the individual's United States residence, not a post office box. An individual residing outside the United States must enter the individual's United States mailing address. If the individual does not have a United States mailing address, the individual must enter a foreign residence address. An entity must enter its United States mailing address. If the entity does not have a United States mailing address, the entity must enter its foreign mailing address.

Item 14. If the filer has a financial interest in 25 or more foreign financial accounts, check “Yes” and enter the number of accounts. Do not complete Part II or Part III of the FBAR. If filing a consolidated FBAR, only complete Part V, Items

Note. If the filer has signature authority over 25 or more foreign financial accounts, only complete Part IV, Items

Filers must comply with applicable recording keeping requirements. See Record Keeping Requirements.

Part II — Information on Financial Account(s) Owned Separately

Enter information in the applicable parts of the form only. Number the pages used, and mail only those pages. If there is not enough space to provide all account information, copy and complete additional pages of the required Part as necessary. Do not use any attachments unless otherwise specified in the instructions.

Form TD F |

Page 8 |

|

|

Item 15. Determining Maximum Account Value.

Step 1. Determine the maximum value of each account (in the currency of that account) during the calendar year being reported. The maximum value of an account is a reasonable approximation of the greatest value of currency or nonmonetary assets in the account during the calendar year. Periodic account statements may be relied on to determine the maximum value of the account, provided that the statements fairly reflect the maximum account value during the calendar year. For Item 15, if the filer had a financial interest in more than one account, each account must be valued separately.

Step 2. In the case of

If the aggregate of the maximum account values exceeds $10,000, an FBAR must be filed. An FBAR is not required to be filed if the person did not have $10,000 of aggregate value in foreign financial accounts at any time during the calendar year.

For United States persons with a financial interest in or signature authority over fewer than 25 accounts that are unable to determine if the aggregate maximum account values of the accounts exceeded $10,000 at any time during the calendar year, complete Part II, III, IV, or V, as appropriate, for each of these accounts and enter “value unknown” in Item 15.

Item 16. Indicate the type of account. Check only one box. If “Other” is selected, describe the account.

Item 17. Provide the name of the financial institution with which the account is held.

Item 18. Provide the account number that the financial institution uses to designate the account.

Items

Part III — Information on Financial Account(s) Owned Jointly

Enter information in the applicable parts of the form only. Number the pages used, and mail only those pages. If there is not enough space to provide all account information, copy and complete additional pages of the required Part as necessary. Do not use any attachments unless otherwise specified in the instructions.

For Items

Item 24. Enter the number of joint owners for the account. If the exact number is not known, provide an estimate. Do not count the filer when determining the number of joint owners.

Items

Part IV — Information on Financial Account(s) Where Filer has Signature Authority but No Financial Interest in the Account(s)

Enter information in the applicable parts of the form only. Number the pages used, and mail only those pages. If there is not enough space to provide all account information, copy and complete additional pages of the required Part as necessary. Do not use any attachments unless otherwise specified in the instructions.

25 or More Foreign Financial Accounts. Filers with signature authority over 25 or more foreign financial accounts must complete only Items

Modified Reporting for United States Persons Residing and Employed Outside of the United States. A United States person who

(1)resides outside of the United States, (2) is an officer or employee of an employer who is physically located outside of the United States, and

(3)has signature authority over a foreign financial account that is owned or maintained by the individual's employer should only complete Part I and Part IV, Items

For Items

Items

Item 43. Enter filer's title for the position that provides signature authority (e.g., treasurer).

Part V — Information on Financial Account(s) Where Filer Is Filing a Consolidated Report

Enter information in the applicable parts of the form only. Number the pages used, and mail only those pages. If there is not enough space to provide all account information, copy and complete additional pages of the required Part as necessary. Do not use any attachments unless otherwise specified in the instructions.

Who Can File a Consolidated FBAR. An entity that is a United States person that owns directly or indirectly a greater than 50 percent interest in another entity that is required to file an FBAR is permitted to file a consolidated FBAR on behalf of itself and such other entity. Check box “d” in Part I, Item 2 and complete Part V. If filing a consolidated FBAR and reporting 25 or more foreign financial accounts, complete only Items

For Items

Items

Signatures

Items

An individual must leave “Filer's Title” blank, unless the individual is filing an FBAR due to the individual's signature authority. If an individual is filing because the individual has signature authority over a foreign financial account, the individual should enter the title upon which his or her authority is based in Item 45.

A spouse included as a joint owner, who does not file a separate FBAR in accordance with the instructions in Part III, must also sign the FBAR (in Item 44) for the jointly owned accounts. See the instructions for Part III.

Penalties

A person who is required to file an FBAR and fails to properly file may be subject to a civil penalty not to exceed $10,000 per violation. If there is reasonable cause for the failure and the balance in the account is properly reported, no penalty will be imposed. A person who willfully fails to report an account or account identifying information may be subject to a civil monetary penalty equal to the greater of $100,000 or

50 percent of the balance in the account at the time of the violation. See 31 U.S.C. section 5321(a)(5). Willful violations may also be subject to criminal penalties under 31 U.S.C. section 5322(a), 31 U.S.C. section 5322(b), or 18 U.S.C. section 1001.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used to report foreign bank and financial accounts if the aggregate value exceeds $10,000 at any point during the calendar year. |

| Filing Deadline | The form must be filed annually by June 30 for the prior calendar year, without extension. |

| Filing Requirement | Individuals and entities with financial interests or signature authority over foreign accounts must file, unless exempted. |

| Aggregate Account Value | No report is required if total foreign accounts do not exceed $10,000 in value at any time during the year. |

| Amendments | Filers may amend previous filings by submitting a revised Form TD F 90-22.1. |

| Identification Requirements | Filers must provide their U.S. Taxpayer Identification Number or Foreign Identification Number. |

| Privacy Regulations | Information collected is governed by the Privacy Act of 1974 and must be treated as confidential. |

| Potential Penalties | Failure to file can result in civil and criminal penalties, including fines of up to $500,000 or imprisonment. |

| Governing Law | This form is regulated under 31 CFR 1010.350 concerning foreign financial accounts. |

Guidelines on Utilizing Td F 90 22 1

Filling out the TD F 90-22.1 form is an important task for individuals with foreign financial accounts. It can be essential to ensure that all necessary information is provided accurately and clearly. Once the form is completed, it will need to be submitted to the U.S. Department of the Treasury, which plays a crucial role in processing these reports.

- Start by locating the TD F 90-22.1 form. Ensure you have the most recent version available, which is the one dated January 2012.

- Fill in the reporting year at the top of the form, specifically for the calendar year ended 12/31.

- Indicate the type of filer by checking the appropriate box: Individual, Partnership, Corporation, Consolidated, or Fiduciary/Other. If you select "Other," please specify the type.

- Enter your U.S. Taxpayer Identification Number on the designated line.

- If you do not have a U.S. identification number, complete the foreign identification section. Include the type of identification (such as a passport), the identification number, and the country of issue.

- Provide your last name, first name, and middle initial (if applicable).

- Fill in your mailing address, including the number, street, and apartment or suite number.

- Complete the city, state, zip/postal code, and the country sections.

- Answer whether you have a financial interest in 25 or more financial accounts. If yes, enter the total number of accounts. If you select "Yes," skip Part II and Part III, but retain the records.

- If you answered "No" to the previous question, proceed to Part II. Indicate the maximum value of each financial account during the reporting year.

- Check the type of account (Bank, Securities, or Other) and specify the type if “Other” is selected.

- Provide the name of the financial institution where the account is held, along with the account number or other identification.

- Include the mailing address of the financial institution in the provided fields.

- For each account, provide the city, state (if known), zip/postal code (if known), and country.

- Repeat Part II for each financial account you own separately, ensuring that a separate block is completed for each account.

- In the signature section, sign the form, include your title (if not reporting a personal account), and fill in the date.

- Ensure that you review all sections for accuracy and completeness before submitting.

- Finally, mail the completed form to the U.S. Department of the Treasury, at the address provided.

What You Should Know About This Form

What is the TD F 90-22.1 form?

The TD F 90-22.1 form, also known as the Report of Foreign Bank and Financial Accounts (FBAR), is a document that U.S. taxpayers must file to report foreign financial accounts. This includes bank accounts, brokerage accounts, and other types of financial accounts held outside the United States. The form aims to ensure transparency and prevent tax evasion by requiring individuals with foreign accounts to disclose their holdings to the U.S. Department of the Treasury.

Who needs to file the TD F 90-22.1 form?

U.S. citizens and residents must file this form if they have a financial interest in, or signature authority over, one or more foreign financial accounts when the total value of these accounts exceeds $10,000 at any point during the calendar year. This requirement applies to individuals, partnerships, corporations, and fiduciaries. Failure to file can result in significant penalties.

When is the TD F 90-22.1 form due?

The form must be submitted annually by April 15. An automatic extension of six months is available, but the request for extension should be made prior to the due date. It's crucial to note that unlike tax returns, this form cannot be filed together with your federal tax return. Non-compliance can lead to serious repercussions.

What accounts are covered by this form?

Accounts that fall under the reporting requirement include, but are not limited to, foreign bank accounts, securities accounts, and any other types of financial accounts in foreign institutions. If the filer has a financial interest in 25 or more accounts, they are required to report only the total number of accounts and do not need to complete specific details for each account.

What happens if I do not file this form?

Failure to file the TD F 90-22.1 form can incur both civil and criminal penalties. Civil penalties can reach up to $500,000, while criminal penalties can involve imprisonment of up to five years. The penalties vary depending on whether the failure to file was willful or non-willful. Therefore, it is essential to comply with this requirement to avoid severe consequences.

How do I file the TD F 90-22.1 form?

The form can be filed electronically through the Financial Crimes Enforcement Network (FinCEN) website or mailed to the designated address provided by the Department of the Treasury. Ensure that all information is accurate and complete, as inaccuracies may lead to complications and possible penalties.

Can I amend my filing after submission?

Yes, if you discover an error after submitting your TD F 90-22.1 form, you can file an amended report. It is important to make corrections as soon as possible to minimize potential penalties associated with incorrect or incomplete filings. Retain all documents related to your foreign accounts for record-keeping purposes in case they are required for future inquiries.

Common mistakes

When completing the TD F 90-22.1 form, people often make several common mistakes. One frequent error involves not checking the correct type of filer. It’s crucial to select the appropriate category—whether you are an individual, partnership, corporation, or another type. An incorrect selection can lead to a delayed or rejected submission.

Another common oversight is related to the Taxpayer Identification Number (TIN). Failing to provide a valid TIN or opting to leave it blank will create headaches down the line. If you don't have a U.S. TIN, ensure to fill in the foreign identification number correctly. Always double-check this information for accuracy.

Many filers fail to report all foreign accounts. If you have financial interests in 25 or more accounts, indicate this clearly. Skipping this step means you won’t need to complete further sections, but it’s essential that this information is correctly reported to avoid issues.

In the account information sections, numerous folks overlook providing the maximum value during the reported calendar year. This is a key piece of information that the form requires. Not including this can result in fines and penalties, so make sure to gather the necessary documentation to report this accurately.

Another mistake appears when people do not provide complete addresses for the financial institutions holding their accounts. Incomplete addresses can delay processing and might raise questions during audits. Ensure you include the complete mailing address, including country names and postal codes where applicable.

Finally, the signature section is often where errors occur. Filers sometimes forget to sign the form or fail to enter the date correctly. Both actions are mandatory for validation. Take a moment to review this section carefully before submission to avoid unnecessary complications.

Documents used along the form

The TD F 90-22.1 form is essential for U.S. citizens and residents who have financial interests in foreign bank accounts. This report helps the U.S. government track foreign financial activities to combat tax evasion and money laundering. Several other forms and documents are often used alongside the TD F 90-22.1 to provide complete financial disclosures. Each of these documents serves a unique purpose in the reporting process.

- FBAR (FinCEN Form 114): This form is required for U.S. persons with foreign bank accounts exceeding an aggregate value of $10,000 at any point during the year. It is filed electronically with the Financial Crimes Enforcement Network (FinCEN).

- Form 8938: Used by specified individuals and certain entities to report foreign financial assets. This form is filed with the annual income tax return and is part of the IRS's effort to ensure compliance with tax reporting obligations related to foreign assets.

- Form 1040: The standard individual income tax return form used to report income, claim deductions, and calculate taxes owed. The integrated information from other forms, including foreign account disclosures, is included here.

- Form 3520: This form is required for reporting transactions with foreign trusts and receipt of certain foreign gifts. It helps the IRS track international financial transactions that might have tax implications.

- Form 5471: Used to report information about foreign corporations in which a U.S. person has a certain level of ownership or control. It ensures U.S. taxpayers report their interests in foreign companies.

- Form 8865: This form is for reporting certain information regarding foreign partnerships. Like Form 5471, its purpose is to ensure transparency in foreign investments and partnerships involving U.S. taxpayers.

Each of these forms plays a crucial role in the broader framework of international financial reporting. Ensuring accurate and timely submissions can help individuals avoid potential penalties and stay compliant with federal regulations.

Similar forms

The TD F 90-22-1 form is used to report foreign bank and financial accounts. It shares similarities with several other documents that involve reporting financial interests or accounts. Below is a list of seven such documents, along with a brief description of their similarities to the TD F 90-22-1 form.

- FBAR (FinCEN Form 114): Like the TD F 90-22-1, the FBAR is used to report foreign bank accounts. All U.S. citizens and residents with foreign accounts exceeding $10,000 in aggregate must file it annually.

- Form 8938 (Statement of Specified Foreign Financial Assets): This form is filed with U.S. tax returns and requires reporting of foreign financial assets. It is similar as both forms help the IRS track overseas financial interests.

- Form 5471 (Information Return of U.S. Persons with Respect to Certain Foreign Corporations): This document is for U.S. citizens or residents who are officers, directors, or shareholders in foreign corporations. Like the TD F 90-22-1, it involves detailed disclosures about foreign financial positions.

- Form 8865 (Return of U.S. Persons with Respect to Certain Foreign Partnerships): This form requires reporting for U.S. owners of a foreign partnership. Its purpose of identifying foreign financial interests aligns closely with that of the TD F 90-22-1.

- Form 2555 (Foreign Earned Income): While primarily used to report foreign income, it requires information on foreign financial accounts, making it related to the reporting functions of the TD F 90-22-1.

- Schedule B (Interest and Ordinary Dividends): This tax form requires disclosure of foreign bank accounts in Part III. The information helps the IRS monitor overseas investments, similar to the TD F 90-22-1.

- Form 1040 (U.S. Individual Income Tax Return): Although it is a tax return, it includes questions about foreign financial assets, mandating reporting of international accounts and financial positions.

These documents collectively serve to promote compliance and transparency regarding foreign financial interests for U.S. persons. Each varies slightly in reporting requirements, yet they all share a common goal of ensuring accurate disclosure of foreign accounts and assets.

Dos and Don'ts

When completing the TD F 90-22.1 form, attention to detail is crucial. Here are seven essential do's and don'ts to ensure your submission is accurate and compliant.

- Do verify that you are using the latest version of the form to avoid penalties associated with outdated editions.

- Do carefully check the U.S. Taxpayer Identification Number section. Accurate identification is key.

- Do report all financial accounts when the aggregate value exceeds $10,000. This avoids non-compliance issues.

- Do provide your complete mailing address, as missing information can lead to delays in processing.

- Don't skip any questions. Every section must be accurately filled out to prevent complications.

- Don't forget to sign the form. Your signature is a legal affirmation that the information provided is true.

- Don't file this form alongside your federal tax return. It must be submitted separately to the Department of the Treasury.

Adhering to these guidelines can help avoid unnecessary penalties and ensure a smoother filing process. Your diligence is appreciated and essential for compliance.

Misconceptions

-

Misconception 1: The TD F 90-22.1 form is the same as a tax return.

This form is not filed with your federal tax return. It is a separate report required to disclose foreign bank and financial accounts, important for compliance with U.S. regulations.

-

Misconception 2: Only wealthy individuals need to file this form.

Anyone with foreign financial accounts totaling over $10,000 must file, regardless of their financial status. Even modest account values can trigger the reporting requirement.

-

Misconception 3: If I have a joint account, I don't need to report it.

Joint accounts must also be reported. The form requests information on all accounts where you have an ownership interest or signature authority.

-

Misconception 4: I don’t need to file if I have closed my foreign accounts.

If you held a foreign account at any point during the calendar year and the total value exceeded $10,000, you are still required to file for that year.

-

Misconception 5: The Social Security number is optional on the form.

Providing your Social Security number is mandatory as it helps identify the individual filing the report. Failure to provide it may result in penalties.

-

Misconception 6: Filing the TD F 90-22.1 form is a one-time requirement.

This form must be filed annually. Each year, you need to report your foreign accounts if applicable, as regulations change and account statuses may vary.

Key takeaways

Filing the TD F 90-22.1 form is essential for U.S. taxpayers with foreign financial accounts. Here are some key takeaways to keep in mind:

- Who Needs to File: If you have a financial interest in or signature authority over one or more foreign financial accounts, you must report this form. However, if the total value of your accounts does not exceed $10,000 at any time during the calendar year, you are not required to file.

- Types of Filers: Multiple taxpayer types can file the form, including individuals, partnerships, corporations, and fiduciaries. Each will have specific identifiers and requirements, so ensure you select the proper category when completing the form.

- Submitting the Form: Do not include the TD F 90-22.1 with your federal tax return. Instead, mail it separately to the specified address: U.S. Department of the Treasury, P.O. Box 32621, Detroit, MI 48232-0621.

- Consequences of Non-Compliance: Failing to file the form may result in significant penalties, including fines and possible imprisonment. It's crucial to provide accurate information and file on time to avoid these serious consequences.

Browse Other Templates

How Do I Get My 1095 From Unitedhealthcare - This form facilitates the referral process for TRICARE beneficiaries seeking specialized medical services.

Leatherman Warranty - Add any special instructions related to your warranty submission.

California Recs - It is designed to improve healthcare service delivery in California.