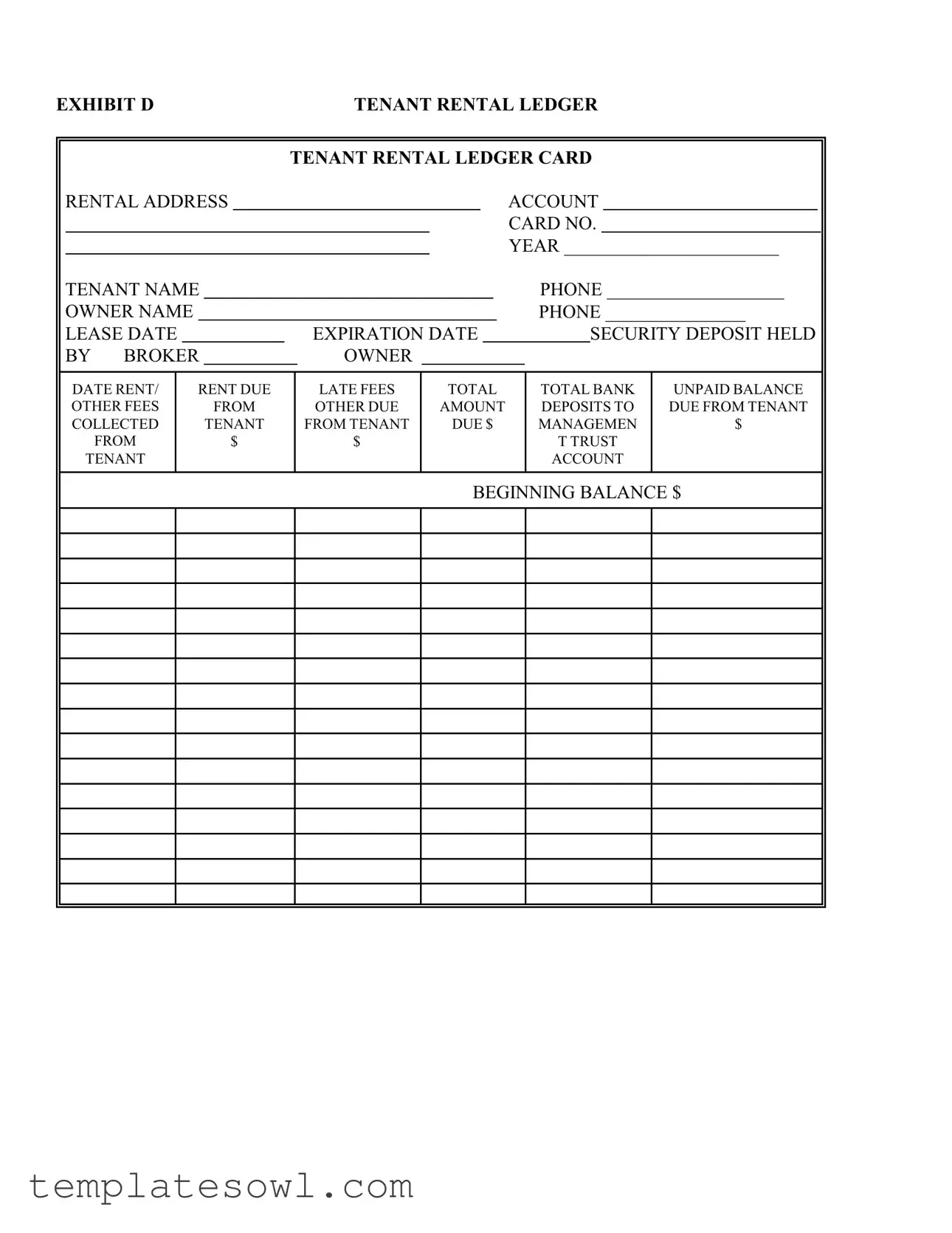

Fill Out Your Tenant Ledger Card Form

The Tenant Ledger Card form serves as an essential financial record for both landlords and tenants. This form captures vital information regarding the rental relationship, including the property address, account number, and lease dates. Tenants' names and contact details are prominently displayed, alongside the owners' information, ensuring clear communication between all parties. A careful accounting of rent and any additional fees collected from tenants is central to the document. It outlines important financial details such as the total amount due, security deposits, and late fees, creating transparency. Additionally, it notes any unpaid balances and provides a comprehensive overview of the account status. By organizing these components in one place, the Tenant Ledger Card empowers both landlords and tenants to maintain accurate financial records, fostering trust and clarity in the rental process.

Tenant Ledger Card Example

EXHIBIT D |

|

|

TENANT RENTAL LEDGER |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TENANT RENTAL LEDGER CARD |

|

|||||||||||||

|

|

RENTAL ADDRESS |

|

|

|

|

|

|

|

|

ACCOUNT |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CARD NO. |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR _______________________ |

|

||||||

|

|

TENANT NAME |

|

|

|

|

|

|

|

|

|

|

PHONE ___________________ |

|

|||||||

|

|

OWNER NAME |

|

|

|

|

|

|

|

|

|

|

PHONE _______________ |

|

|||||||

|

|

LEASE DATE |

|

|

|

EXPIRATION DATE |

|

|

|

|

|

SECURITY DEPOSIT HELD |

|

||||||||

|

|

BY BROKER |

|

|

|

OWNER |

|

|

|

|

|

|

|

|

|

|

|

|

|||

DATE RENT/ OTHER FEES COLLECTED FROM TENANT

RENT DUE

FROM

TENANT

$

LATE FEES

OTHER DUE

FROM TENANT

$

TOTAL

AMOUNT

DUE $

TOTAL BANK |

UNPAID BALANCE |

DEPOSITS TO |

DUE FROM TENANT |

MANAGEMEN |

$ |

T TRUST |

|

ACCOUNT |

|

|

|

BEGINNING BALANCE $

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Tenant Ledger Card is used to track payments and balances between a tenant and a landlord or property manager. |

| Information Included | This form includes tenant information, account number, lease dates, security deposit details, and a summary of payments and balances. |

| Frequency of Use | |

| Governing Laws | In many states, such as California, the use of such forms is governed by the California Civil Code, which outlines the obligations of landlords regarding tenant payments and security deposits. |

| Components | The form includes sections for rent due, late fees, total amount due, and unpaid balances, which help clarify financial obligations. |

| Legal Importance | A completed and accurate Tenant Ledger Card can serve as important evidence in case of disputes between landlords and tenants regarding payments. |

| Accessibility | This form should be kept easily accessible for both tenants and landlords, ensuring transparency in financial transactions. |

Guidelines on Utilizing Tenant Ledger Card

Completing the Tenant Ledger Card form accurately is crucial for maintaining clear rental records. Follow these steps to ensure you fill out the form correctly, ensuring transparency and accountability in tenant management.

- Start with the Rental Address: Enter the full address of the rental property at the top of the form.

- Account Card Number: Fill in the account card number to identify the specific tenant.

- Year: Write the current year next to "YEAR."

- Tenant Information: Provide the tenant's name and phone number in the designated fields.

- Owner Information: Enter the owner’s name and phone number under the owner information section.

- Lease Dates: Fill in the lease date and expiration date to document the rental term.

- Security Deposit: Indicate the security deposit amount and which party is holding it.

- Fees Collected: Record all rent and other fees collected from the tenant.

- Rent Due: Specify the total amount of rent due from the tenant.

- Late Fees: List any late fees applicable to the tenant.

- Other Dues: Note any other amounts due from the tenant.

- Total Amount Due: Calculate and enter the total amount due, which includes rent and fees.

- Total Bank Unpaid Balance: Document any unpaid balances in the tenant's account.

- Deposits to Trust Account: Indicate any deposits made to the management trust account.

- Beginning Balance: Enter the beginning balance for the management trust account.

What You Should Know About This Form

What is the purpose of the Tenant Ledger Card form?

The Tenant Ledger Card form serves as a comprehensive record of all transactions between a tenant and their landlord or property management. It includes important details such as the names of both the tenant and the owner, the rental address, lease dates, and any associated fees. This form helps track rent payments, late fees, and security deposits, ensuring that both parties have a clear and documented history of their financial dealings.

What information is included in the Tenant Ledger Card?

The Tenant Ledger Card contains vital data that outlines the financial relationship between the tenant and the property owner. Key components include the tenant's name and contact information, owner's contact information, lease start and expiration dates, and details about the security deposit. Additionally, it lists the rent due, late fees, other charges, total amounts due, and any outstanding balances. This information allows for transparency and accountability.

How can I use the Tenant Ledger Card to resolve disputes?

If a dispute arises between a tenant and a landlord, the Tenant Ledger Card can act as an important piece of evidence. It provides a documented history of payments made, late fees charged, and other financial obligations. By reviewing this ledger, both parties can clarify any misunderstandings regarding rent payments or fees. In cases where further action is needed, this document may be useful in negotiations or legal proceedings.

Who is responsible for maintaining the Tenant Ledger Card?

Common mistakes

Filling out the Tenant Ledger Card form can seem straightforward, but mistakes can lead to complications down the road. One common mistake is not including all required information. For instance, failing to enter the tenant's name or the rental address can create confusion. This critical data ensures that all financial transactions are accurately associated with the correct tenant.

Another frequent error involves inaccurate amounts. It's vital to double-check figures entered, such as the total rent due or any late fees. Calculating the totals incorrectly can result in disputes between the landlord and tenant. Always verify the numbers before finalizing the document.

Additionally, some individuals neglect to record any additional fees when applicable. Not including charges for repairs or other services may create issues later if the tenant believes they owe less than what is accurate. Documenting all fees clearly allows both parties to maintain transparency.

Finally, failing to update the expiration date of the lease can lead to misunderstandings. Keeping this information current ensures that both landlords and tenants are on the same page regarding lease terms and obligations. It is essential to review the form carefully, ensuring no vital details have been overlooked.

Documents used along the form

The Tenant Ledger Card is a vital document for tracking rent payments and managing a tenant's account. However, several other forms and documents complement this form and contribute to effective property management. Understanding these documents is essential for landlords, property managers, and tenants alike.

- Lease Agreement: This formal contract outlines the terms of the rental arrangement between the landlord and tenant, including duration, rent, and obligations.

- Move-In/Move-Out Checklist: This document helps to outline the condition of the property before tenants move in and after they leave. It aids in identifying any damages for security deposit assessments.

- Security Deposit Receipt: This receipt serves as proof that the tenant paid a security deposit and specifies how much was collected and its intended use.

- Rent Payment Receipts: These receipts provide acknowledgment of rent payments made by the tenant, documenting the amount and date of each transaction.

- Notice to Pay Rent or Quit: This legal document informs the tenant of overdue rent, giving them an opportunity to pay before further action is taken.

- Eviction Notice: This document is used when a tenant must be formally notified of an eviction process due to non-payment or lease violations.

- Maintenance Request Form: This form allows tenants to report maintenance issues, ensuring prompt attention to property upkeep.

- Rental Application Form: Potential tenants complete this form to provide personal and financial information necessary for screening before lease approval.

- Tenant Information Sheet: This document collects essential details about the tenant, such as emergency contacts and vehicle information, facilitating communication.

Each of these documents plays a crucial role in the rental process, ensuring clarity and legal compliance for both landlords and tenants. Proper management of these forms can enhance communication and foster positive tenant relationships.

Similar forms

The Tenant Ledger Card form is an important document for landlords and tenants, tracking rent and related financial transactions. Here are seven documents that share similarities with the Tenant Ledger Card, outlining how they relate:

- Lease Agreement: This document outlines the terms of tenancy, including rent amount and due dates. While the Tenant Ledger records payments, the lease specifies the payment structure.

- Rent Receipts: When tenants pay rent, they often receive a receipt. This document serves a similar purpose to the Tenant Ledger by confirming payment but focuses more on individual transactions rather than ongoing balances.

- Move-In/Move-Out Inspection Report: This report documents the condition of the property when a tenant moves in or out. While the Tenant Ledger tracks financial aspects, the inspection report deals with the physical state of the rental.

- Security Deposit Statement: This document details the amount held as a security deposit and conditions for its return. Like the Tenant Ledger, it reflects financial relationships but focuses specifically on the deposit's management.

- Rent History Report: This summaries all transactions related to rent over a specific period, similar to the Tenant Ledger Card. However, it typically provides a more extensive overview of the entire rental history instead of just the current status.

- Billing Statements: These statements are issued by property management and detail charges incurred by the tenant. They share the layout style of the Tenant Ledger but may include utility bills and other fees as well.

- Payment Agreement: This agreement may outline special payment terms for the tenant, such as installment plans. While the Tenant Ledger Card shows payments made, the payment agreement sets the structure for those payments ahead of time.

Dos and Don'ts

When filling out the Tenant Ledger Card form, there are important dos and don'ts to keep in mind. Following these guidelines will help ensure that the form is completed accurately and efficiently.

- Do fill in all required fields completely.

- Do double-check all amounts before finalizing the document.

- Do keep a copy of the form for your records.

- Do clearly indicate the rental address and tenant name.

- Do ensure that dates are filled in the correct format.

- Don't leave any sections blank unless specified as optional.

- Don't forget to include security deposit information if applicable.

- Don't use confusing abbreviations that may not be understood by all readers.

- Don't mix up payment types; clearly separate rent and other fees.

- Don't overlook reviewing for accuracy after completing the form.

Misconceptions

Understanding the Tenant Ledger Card can be crucial for both landlords and tenants. However, several misconceptions often arise about this document. Here are five common misunderstandings:

- Misconception 1: The Tenant Ledger Card is only for landlords.

- Misconception 2: The ledger only tracks monthly rent payments.

- Misconception 3: Once completed, the ledger cannot be corrected.

- Misconception 4: The account balance on the ledger is always accurate.

- Misconception 5: The Tenant Ledger Card is a legal document.

This form is useful for both parties. Tenants can see their payment history, while landlords can track their collection efforts.

The card includes all financial interactions, such as late fees and security deposits, providing a comprehensive overview of the tenant's account.

While accuracy is essential, corrections can be made as necessary. It's important to document any changes to maintain a clear record.

The balance may not reflect recent payments if updates are not timely made. Regularly reviewing and reconciling the account is necessary.

Though it can be used in legal contexts, the form itself is primarily a record-keeping tool. Its goal is to aid in understanding financial transactions.

Key takeaways

The Tenant Ledger Card form is an essential document for both landlords and tenants, providing a clear record of rental transactions. Here are some key takeaways regarding its use and importance:

- Comprehensive Recordkeeping: It serves as a vital tool for tracking the financial relationship between the tenant and the landlord.

- Details Matter: Each section of the form requires accurate information, including tenant and owner names, contact numbers, lease dates, and expiration dates.

- Security Deposits: Documenting the security deposit amount is crucial, as it can prevent disputes over return claims upon lease termination.

- Clear Payment Tracking: The form helps in tracking rent payments, other fees, and any outstanding balances, ensuring transparency.

- Late Fees Clarity: Including late fees clearly on the ledger helps tenants understand potential penalties for delayed payments.

- Monthly Updates: Regularly updating the ledger with collected amounts and dues provides an accurate snapshot of the current status.

- Legal Documentation: Periodically maintaining this ledger can serve as important evidence in case of legal disputes regarding payment history.

- Building Trust: Using the Tenant Ledger Card fosters trust, as both parties can reference the same documented financial history.

- Management Efficiency: For property managers, this tool is invaluable in overseeing multiple tenants within an organized framework.

- Bank Deposits: Recording deposits made into the management trust account ensures fiscal responsibility and accountability.

Utilizing the Tenant Ledger Card effectively can lead to better communication, fewer conflicts, and overall smoother rental experiences for both landlords and tenants.

Browse Other Templates

Fmla Fitness for Duty Form - Documenting pain and its implications in the evaluation is important.

Lic9054 - Local fire authorities use this information to conduct inspections efficiently.