Fill Out Your Tennessee Articles Organization Form

The Tennessee Articles Organization form, officially known as SS-4270, is an essential document for anyone looking to establish a Limited Liability Company (LLC) in the state. This form requires specific information to ensure proper registration, including the LLC’s proposed name, the initial registered agent’s details, and the number of members at the time of filing. Applicants have multiple options for submission, such as online filing, mailing, or even walking in to submit the form personally. Additionally, the form outlines requirements related to the business name, fiscal year closure, and management structure, all of which play crucial roles in the LLC's setup. Proper completion of the Articles of Organization is vital since incomplete or inaccurate submissions will be rejected. It’s also important to note the filing fee structure, which varies based on the number of members, and additional considerations if the LLC is designated as a non-profit or professional entity. Clear guidance is provided within the form to navigate these essential aspects, making it accessible for first-time business owners and seasoned entrepreneurs alike.

Tennessee Articles Organization Example

Business Services Division

Tre Hargett, Secretary of State

State of Tennessee

INSTRUCTIONS

ARTICLES OF ORGANIZATION

LIMITED LIABILITY COMPANY

LLC articles of organization may be filed using one of the following methods:

•

•Print and Mail: Go to http://tnbear.tn.gov/NewBiz. Use the online tool to complete the application. Print and mail the application along with the required filing fee to the Secretary of State’s office at 6th FL – Snodgrass Tower ATTN: Corporate Filing, 312 Rosa L. Parks AVE, Nashville, TN 37243.

•Paper submission: A blank application may be obtained by going to https://sos.tn.gov/sites/default/files/forms/ss- 4270.pdf, by emailing the Secretary of State at Business.Services@tn.gov, or by calling (615)

•

LLC Articles of Organization must be accurately completed in their entirety. Forms that are inaccurate, incomplete or illegible will be rejected.

Limited Liability Company Articles of Organization set forth the items required under T.C.A. §

ARTICLES OF ORGANIZATION

1.The name of the Limited Liability Company is – Enter the proposed name of the Limited Liability Company. The name of a new LLC must meet the requirements of T.C.A. §

2.Name Consent: (Written Consent for Use of Indistinguishable Name) – An applicant LLC can request to use a name that is not distinguishable from the name used by an existing business under certain circumstances detailed in T.C.A. §

3.This company has the additional designation of – If applicable to the specific nature of the LLC, enter any additional designation, including:

Page 1 of 3

•Bank

•Captive Insurance Company

•Insurance Company

•Litigation Financier

•

•Professional Limited Liability Company

•Series LLC

•Trust Company

If the LLC’s name contains the word “bank”, “banks”, “banking”, “credit union” or “trust”, written approval must first be obtained from the Tennessee Department of Financial Institutions before documents can be accepted for filing with the Division of Business Services. You may contact the Tennessee Department of Financial Institutions as (615)

If the LLC’s name contains the phrase “insurance company”, written approval must first be obtained from the Tennessee Department of Commerce & Insurance before documents can be accepted for filing with the Division of Business Services. You may reach the Tennessee Department of Commerce & Insurance at (615)

4.The name and complete address of the Limited Liability Company’s initial registered agent and office located in the state of Tennessee is – Enter the name of the LLC’s initial registered agent, the street address, city, state and zip code of the LLC’s initial registered office located in Tennessee and the county in which the office is located. The address will be verified and formatted to United States Postal Service address deliverability guidelines. If the address cannot be recognized as deliverable by the United States Postal Service, the form will be rejected by the Division of Business Services. A post office box is not acceptable for the registered agent/office address.

5.Fiscal Year Close Month – Enter the month of the year that concludes the LLC’s fiscal year. If a fiscal year close month is not indicated, the Division of Business Services will list the fiscal year close month as December by default. Please note that T.C.A. §

6.If the document is not to be effective upon filing by the Secretary of State, the delayed effective date and time is – If the existence of the LLC is to begin upon a future date, enter the future date. In no event can the future date or the actual occurrence of the specific event be more than ninety calendar days from the filing of the articles of organization.

7.The Limited Liability Company will be – Indicate whether the LLC will be Member Managed, Manager Managed or Director Managed by checking the appropriate box.

8.Number of Members at the date of filing – Enter the number of members of the LLC at the date of filing. If the number of members is not indicated, the Division of Business Services will list the number of members as one (1) by default.

9.Period of Duration if not perpetual – Indicate if the duration of the LLC is perpetual or has a specific end date by checking the appropriate box. If “other” is checked, indicate the specific date on which the duration of the LLC’s existence will end.

10.The complete address of the Limited Liability Company’s principal executive office is – Enter the street address, city, state and zip code of the principal executive office of the LLC and the county in which the office is located. The address will be verified and formatted to United States Postal Service address deliverability guidelines. If the address cannot be recognized as deliverable by the United States Postal Service, the form will be rejected by the Division of Business Services unless a deliverable mailing address is also provided. A post office box address is not acceptable for the principal office address. Please provide a business email address. All reminders and notifications will be sent via email.

11.The complete mailing address of the entity (if different from the principal office) is – If notifications from the Division of Business Services should be sent to an address other than the principal office address, enter that address. The address will be verified and formatted to United States Postal Service address deliverability guidelines. If the address cannot be recognized as deliverable by the United States Postal Service, the form will be rejected by the Division of Business Services. A post office box address is acceptable for a mailing address.

Page 2 of 3

12.

13.Professional LLC (required only if the Additional Designation of “Professional LLC” is entered in section 3) – If “Professional Limited Liability Company” is indicated in section 3 of the articles of organization, check the box certifying that the statement in this section is true. Indicate the licensed profession in the space provided.

14.Series LLC (required only if the Additional Designation of “Series LLC” is entered in section 3.) – If “Series LLC” is indicated in section 3 of the articles of organization, check the box certifying that the statement in this section is true.

15.Obligated Member Entity (list of obligated members and signatures must be attached) – If the LLC elects to be registered as an Obligated Member Entity pursuant to T.C.A. §

If the box indicating registration as an Obligated Member Entity is checked, the articles of organization must be accompanied by a duly executed Obligated member Entity Addendum (Form

16.This entity is prohibited from doing business in Tennessee – Check the box if the LLC, while being formed under Tennessee law, is prohibited from engaging in business in Tennessee.

17.Other Provisions – Including any further information in this space is strictly optional. Use this section to set forth other details of the LLC that are not required to be included in the articles of organization. Such items could include the names of the LLC members, the purpose of the LLC, the names of the LLC management, and provisions regulating the affairs of the LLC. If the form does not allow enough space, enter “see attached” and include the desired details in an attachment.

Signature

•The person executing the document must sign it and indicate the date of signature in the appropriate spaces.

Failure to sign and date the application will result in the application being rejected.

•Type or Print Name. Failure to type or print the signature name and title of the signer will result in the application being rejected.

•Type or Print Signer’s Capacity. If other than the person’s individual capacity, the signer must indicate the capacity in which such person signs. Failure to indicate the signer’s capacity will result in the application being rejected.

FILING FEE

•The filing fee for articles of organization is $50.00 per member in existence on the date of the filing, with a minimum fee of $300.00 and a maximum fee of $3,000.00. If its articles of organization prohibit the LLC from doing business in Tennessee, the filing fee is $300.00, regardless of the number of members in existence on the date of the filing.

•Make check, cashier’s check or money order payable to the Tennessee Secretary of State. Cash is only accepted for

Page 3 of 3

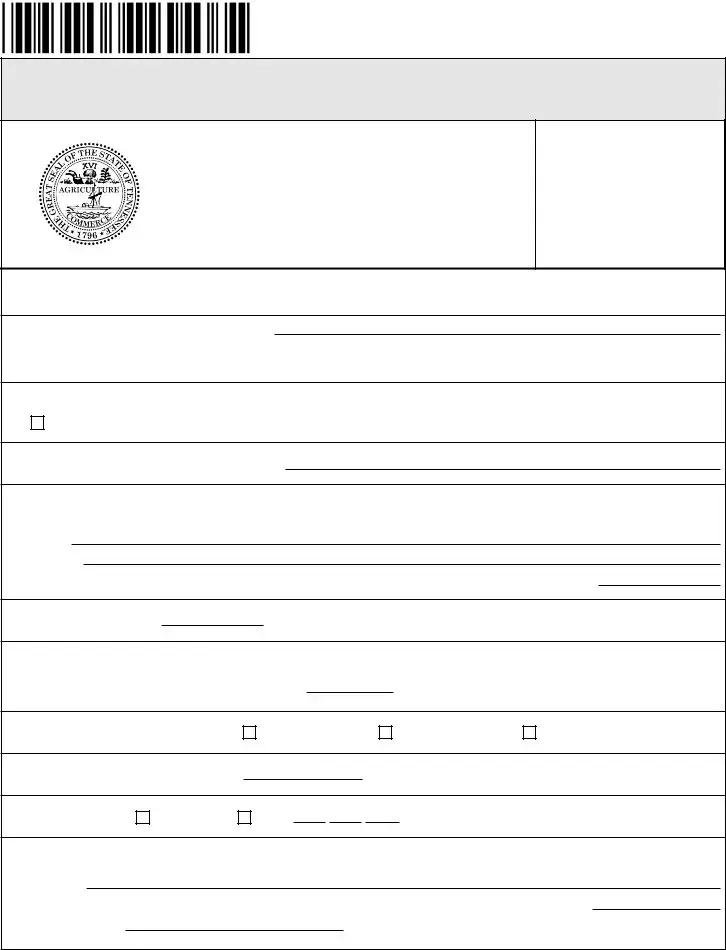

ARTICLES OF ORGANIZATION |

|

LIMITED LIABILITY COMPANY |

Page 1 of 2 |

BUSINESS SERVICES DIVISION

Tre Hargett, Secretary of State

State of Tennessee

312 ROSA L. PARKS AVE, 6TH FL.

NASHVILLE, TN

(615)

Filing Fee: $50.00 per member

(minimum fee = $300, maximum fee = $3,000)

For Office Use Only

The Articles of Organization presented herein are adopted in accordance with the provisions of the Tennessee Revised Limited Liability Company Act.

1.The name of the Limited Liability Company is:

(NOTE: Pursuant to the provisions of T.C.A. §

2.Name Consent: (Written Consent for Use of Indistinguishable Name)

This entity name already exists in Tennessee and has received name consent from the existing entity.

3.This company has the additional designation of:

4.The name and complete address of ithe Limited Liability Company’s initial registered agent and office located in the state of

Tennessee is:

Name:

Address:

City: |

|

State: |

|

Zip Code: |

|

County: |

5.Fiscal Year Close Month:

6.If the document is not to be effective upon filing by the Secretary of State, the delayed effective date and time is: (Not to exceed 90 days)

Effective Date: |

|

/ |

|

/ |

|

|

Time: |

|

Month |

|

Day |

Year |

|||

7. The Limited Liability Company will be:

Member Managed

Manager Managed

Director Managed

8. Number of Members at the date of filing:

9. Period of Duration:

Perpetual

Other / /

Month Day Year

10.The complete address of the Limited Liability Company’s principal executive office is:

Address:

City: |

|

State: |

|

Zip Code: |

|

County: |

Business Email:

Rev. 12/19 |

RDA 2458 |

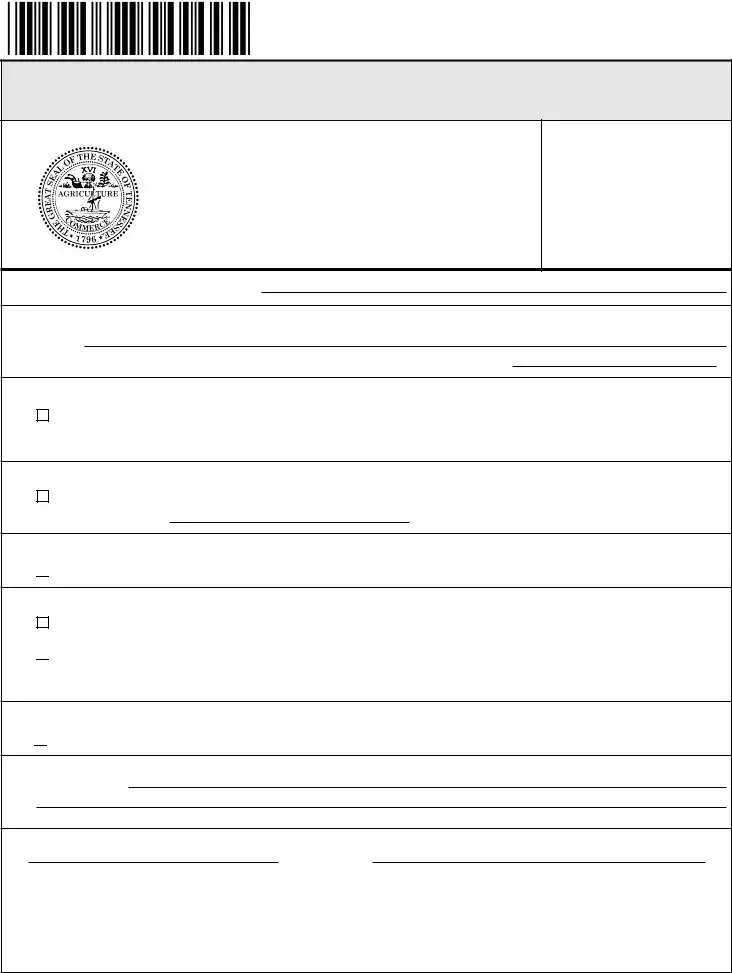

ARTICLES OF ORGANIZATION |

|

LIMITED LIABILITY COMPANY |

Page 2 of 2 |

BUSINESS SERVICES DIVISION

Tre Hargett, Secretary of State

State of Tennessee

312 ROSA L. PARKS AVE, 6TH FL.

NASHVILLE, TN

(615)

Filing Fee: $50.00 per member

(minimum fee = $300, maximum fee = $3,000)

For Office Use Only

The name of the Limited Liability Company is:

11. The complete mailing address of the entity (If different from the principal office) is:

Address:

City: |

|

State: |

|

Zip Code: |

12.

I certify that this entity is a

13. Professional LLC (required only if the Additional Designation of “Professional LLC” is entered in section 3.)

I certify that this PLLC has one or more qualified persons as members and no disqualified persons as members or holders.

Licensed Profession:

14.Series LLC (required only if the Additional Designation of “Series LLC” is entered in section 3.)

I certify that this entity meets the requirements of T.C.A. §

I certify that this entity meets the requirements of T.C.A. §

15.Obligated Member Entity (list of obligated members and signatures must be attached)

This entity will be registered as an Obligated Member Entity (OME) |

Effective Date: |

/ |

/ |

|||

|

|

Month |

|

Day |

|

Year |

I understand that by statute: THE EXECUTION AND FILING OF THIS DOCUMENT WILL CAUSE THE MEMBER(S) TO BE PERSONALLY LIABLE FOR THE DEBTS, OBLIGATIONS AND LIABILITIES OF THE LIMITED LIABILITY COMPANY TO THE SAME EXTENT AS A GENERAL PARTNER OF A GENERAL PARTNERSHIP. CONSULT AN ATTORNEY.

I understand that by statute: THE EXECUTION AND FILING OF THIS DOCUMENT WILL CAUSE THE MEMBER(S) TO BE PERSONALLY LIABLE FOR THE DEBTS, OBLIGATIONS AND LIABILITIES OF THE LIMITED LIABILITY COMPANY TO THE SAME EXTENT AS A GENERAL PARTNER OF A GENERAL PARTNERSHIP. CONSULT AN ATTORNEY.

16. This entity is prohibited from doing business in Tennessee:

This entity, while being formed under Tennessee law, is prohibited from engaging in business in Tennessee.

This entity, while being formed under Tennessee law, is prohibited from engaging in business in Tennessee.

17. Other Provisions:

Signature Date |

|

Signature |

|

|

|

Signer’s Capacity (if other than individual capacity) |

|

Name (printed or typed) |

Rev. 12/19 |

RDA 2458 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Filing Fee | The filing fee for the Articles of Organization is $50 per member, with a minimum fee of $300 and a maximum fee of $3,000. |

| Methods of Filing | Applicants can file online, print and mail the application, submit it in person, or send in a paper submission. Each method has specific steps to follow. |

| Registered Agent Requirement | The LLC must provide a registered agent's name and address located in Tennessee. P.O. boxes are not acceptable for this address. |

| Governing Law | The formation of a Limited Liability Company in Tennessee is governed by T.C.A. § 48-249-202. |

Guidelines on Utilizing Tennessee Articles Organization

Completing the Tennessee Articles of Organization form is an essential step in establishing your Limited Liability Company (LLC). This document outlines key information about your LLC and must be filed with the Secretary of State. Before submitting, ensure that all sections are filled out accurately to avoid rejection. Below are the steps to effectively complete this form.

- Name of LLC: Enter the proposed name of your Limited Liability Company. Ensure it includes “Limited Liability Company,” “LLC,” or “L.L.C.”

- Name Consent: If applicable, indicate whether you are requesting to use a name indistinguishable from an existing business by checking the consent box.

- Additional Designation: If relevant, specify any additional designation such as “Bank,” “Non-profit Limited Liability Company,” etc.

- Registered Agent: Provide the complete name and address of your LLC's initial registered agent and office in Tennessee. Remember, a post office box is not acceptable.

- Fiscal Year Close Month: Indicate the month that concludes your LLC’s fiscal year. If left blank, the default is December.

- Delayed Effective Date: If your LLC is to begin on a future date, enter that date here (within 90 days of filing).

- Management Structure: Select whether your LLC will be Member Managed, Manager Managed, or Director Managed by checking the appropriate box.

- Number of Members: Enter the number of members at the time of filing. If not specified, it will default to one.

- Duration: State whether the LLC is perpetual or has a specific end date by checking the relevant box. If applicable, note the end date if “other” is selected.

- Principal Executive Office: Provide the complete address of your LLC’s principal executive office. A post office box is not valid here.

- Mailing Address: If different from your principal office, provide the mailing address. A post office box is acceptable for this section.

- Non-Profit LLC: If applicable, certify your LLC’s non-profit status by checking the box.

- Professional LLC: If indicated, check the box certifying that your LLC has qualified members and specify the licensed profession.

- Series LLC: If applicable, check the certification box confirming compliance with state regulations.

- Obligated Member Entity: If opting for this designation, check the box, enter the effective date, and understand the statutory requirements.

- Prohibited Business: Check this box if your LLC is prohibited from conducting business in Tennessee.

- Other Provisions: If desired, include any additional information relevant to your LLC in this optional section.

- Signature: Ensure the form is signed and dated by the responsible individual. Also, print the name and title clearly, noting their capacity if not signing in an individual capacity.

After completing the form, review it carefully. Ensure all fees are included and the form is submitted through one of the acceptable methods: e-filing, print and mail, paper submission, or in-person. Accurate submission is key to successfully establishing your LLC in Tennessee.

What You Should Know About This Form

What is the purpose of the Tennessee Articles of Organization form?

The Tennessee Articles of Organization form is used to officially create a Limited Liability Company (LLC) in Tennessee. This document outlines essential information about the LLC, such as its name, registered agent, management structure, and filing fee.

How can I file the Articles of Organization?

There are several methods to file the Articles of Organization:

- E-file: Complete the online application at tnbear.tn.gov/NewBiz and pay the filing fee using a credit or debit card, noting that a convenience fee applies.

- Print and Mail: Use the online tool to complete the application, then print and mail it with the required fee to the Secretary of State’s office.

- Paper Submission: Obtain a blank application online or by email, fill it out, and mail it with the filing fee.

- Walk-in: Pick up a blank application in person at the Secretary of State Business Services Division.

What information is needed to complete the form?

Essential information includes the proposed name of the LLC, the registered agent's name and address, the number of members, fiscal year closing month, and management structure (member-managed, manager-managed, or director-managed). Additional designations or certifications may also be required, depending on the LLC's nature.

What are the filing fees for the Articles of Organization?

The filing fee is $50.00 for each member at the time of filing, with a minimum fee of $300.00 and a maximum fee of $3,000.00. If the LLC is prohibited from doing business in Tennessee, the filing fee remains at $300.00 regardless of the number of members.

Can I use a name that is similar to an existing business?

Yes, but you must obtain written consent to use a name that is indistinguishable from an existing business name. This consent must be indicated on the Articles of Organization, along with an additional $20 filing fee.

What happens if the application is incomplete or incorrect?

If the Articles of Organization are inaccurate, incomplete, or illegible, the Division of Business Services will reject the application. It’s essential to ensure all required fields are properly filled out to avoid delays.

When will my LLC be officially recognized?

The LLC will be recognized upon filing unless a delayed effective date is specified. The delayed date cannot exceed ninety calendar days from the date of filing.

Do I need to provide a business email with my submission?

Yes, a business email address is required. Notifications and reminders from the Division of Business Services will be sent to this address, ensuring you stay informed about your LLC’s status.

Common mistakes

Filling out the Tennessee Articles of Organization form can seem straightforward, but many people run into common pitfalls. Understanding these mistakes can help ensure a smoother application process. Here are eight common errors to avoid.

Omitting Required Information: One of the biggest mistakes is forgetting to fill in all required sections. Each part of the form must be completed. If any section is inaccurate, incomplete, or hard to read, the application risks rejection. Take the time to double-check that every necessary detail is included.

Using Inaccessible Addresses: The registered agent and office must have a deliverable street address. Many mistakenly try to use a post office box, which is not allowed. Ensure that the address complies with United States Postal Service guidelines to avoid rejection.

Another common oversight involves name requirements. The name of the LLC must include the phrase "Limited Liability Company" or the abbreviation "LLC." Failing to do this will lead to a delay in processing.

Skipping the fiscal year close month is another frequent error. If this month is not entered, the state will automatically declare December as the fiscal year close month. This default may not align with your actual business practices, which can cause issues down the line.

Incorrect Filing Fees: Many applicants miscalculate the required filing fees. Remember to pay $50.00 per member at filing time, with a minimum of $300.00. Ensure that the check or money order is made out correctly, as submissions with incorrect payments will be rejected.

Additionally, neglecting to sign and date the application is a common error. The person executing the form must sign it; otherwise, the application will be rejected. It is also crucial to type or print the name clearly, along with indicating the signer's capacity.

Another mistake is failing to provide complete contact information. If the mailing address differs from the principal office's, be sure to enter the mailing address correctly. If your business needs notifications but the address is unclear, your application may not be processed.

Lastly, misunderstanding entity designations can lead to errors. If the LLC is marked as a Non-Profit or Professional Limited Liability Company, additional certifications are required. Skipping these checks will result in further complications in your application process.

By avoiding these common mistakes, you can streamline the process of filing the Tennessee Articles of Organization. Take your time, review your application, and ensure every detail is correct to facilitate a smooth submission.

Documents used along the form

When forming a Limited Liability Company (LLC) in Tennessee, several documents often accompany the Articles of Organization to ensure compliance with state regulations. Below is a list of common forms that individuals may need to consider as part of the LLC formation process. Each document serves a specific purpose and addresses different aspects of LLC formation and operation.

- Operating Agreement – This internal document outlines the management structure, responsibilities, and operational procedures of the LLC. An operating agreement helps prevent disputes among members by clearly defining roles and expectations.

- Registered Agent Consent Form – This form confirms that the designated registered agent agrees to act on behalf of the LLC. It is essential to have a registered agent who can receive legal documents and official correspondence.

- Initial Report – Some states require an initial report to be filed shortly after the formation of the LLC. This report typically includes details about the management structure and contact information for members.

- Employer Identification Number (EIN) Application (Form SS-4) – Businesses often need to obtain an EIN from the IRS for tax reporting purposes. This form allows the LLC to open a business bank account, hire employees, and file federal taxes.

- Business License Application – Depending on the type of business and location, an LLC may need to apply for local and state business licenses. This ensures compliance with local regulations and allows the business to operate legally.

- Name Reservation Request – If the LLC name is not yet filed or if the applicant wants to secure the name before submitting the Articles of Organization, a name reservation request can be submitted. This holds the desired name for a specified period.

- Obligated Member Entity Addendum (Form SS-4600) – This addendum is necessary if the LLC opts to register as an Obligated Member Entity, which involves specific statutory requirements regarding member liability and structure.

Completing these forms accurately is crucial for the successful formation and operation of an LLC in Tennessee. Each document plays a role in ensuring that the LLC adheres to legal requirements, facilitates proper management, and prepares the entity for future business activities.

Similar forms

- Articles of Incorporation: Similar to the Articles of Organization, Articles of Incorporation establish a corporation and outline essential details such as the company name, purpose, registered agent, and the number of shares issued. Both documents are foundational for forming a business entity in their respective legal structures.

- Operating Agreement: Whereas the Articles of Organization focus on the formation of an LLC, the Operating Agreement lays out the internal governance, member responsibilities, and operational procedures. It complements the Articles by providing detailed rules for managing the LLC.

- Bylaws: Like the Operating Agreement, Bylaws govern the internal management processes of a corporation. These documents detail the structure of the corporation, including the roles of officers, meetings, and voting procedures. Both serve to regulate how the entity operates after formation.

- Certificate of Formation: In various states, this document performs the same function as the Articles of Organization, establishing the existence of a limited liability company and containing similar required information such as name, address, and member details.

- Business License Application: The Articles of Organization initiate the formation of a business entity, while a Business License Application is necessary for legally operating that entity within a jurisdiction. Both documents are part of the overall business establishment process.

- Fictitious Name Registration: If an LLC operates under a name different from its formal Articles of Organization, filing for a fictitious name is required. Both the Articles and the fictitious name registration are intended to establish the legitimacy of a business and inform the public of its operations.

- Annual Report: Similar in purpose, though different in function, the Articles of Organization set up an LLC, while an Annual Report updates the state on the LLC’s activities, financial condition, and any changes to its management structure. Both documents maintain the entity's compliance and good standing with the state.

Dos and Don'ts

When filling out the Tennessee Articles of Organization form, it is crucial to ensure accuracy and completeness. The following list outlines essential dos and don'ts to guide applicants through this process.

- Do use the correct name format for your company, ensuring it includes "Limited Liability Company," "LLC," or "L.L.C." per Tennessee law.

- Do verify that the chosen company name is distinguishable from existing businesses in Tennessee.

- Do provide a complete and deliverable street address for the LLC's registered agent, as P.O. boxes are not acceptable.

- Do include the required filing fee of $50 per member, with a minimum of $300, to avoid rejection.

- Do be vigilant about your signatures. Ensure they are dated, properly printed, and indicate the signer’s capacity, if necessary.

- Don't leave sections unfilled. Incomplete forms will be returned and may delay the registration process.

- Don't forget to double-check for accuracy before submission. Errors can lead to rejections or delays.

By adhering to these guidelines, applicants can facilitate a smoother filing experience and increase the likelihood of successful registration for their Limited Liability Company in Tennessee.

Misconceptions

Understanding the Tennessee Articles Organization form is essential for anyone looking to establish a Limited Liability Company (LLC) in the state. However, several misconceptions can lead to confusion. Here are ten common misunderstandings:

- Filing online is the only option. Many believe that the only way to file the Articles of Organization is online. In reality, applicants can also print the form and mail it or submit it in person.

- Once filed, the LLC name cannot be changed. This is not true. While the name is established during filing, LLCs can amend their name after the initial organization.

- Any name can be used for the LLC. There are specific naming requirements. The new LLC name must include “Limited Liability Company” or its abbreviations, and it must not be identical to any existing business name.

- PO Boxes are acceptable as registered agent addresses. This is a misconception. The registered agent's address must be a physical location, not a post office box.

- The filing fee is a flat rate. Some applicants think there is a single fee regardless of the number of members. The fee is actually $50 per member, with a minimum fee of $300.

- All LLCs must have perpetual duration. This is incorrect. Limited Liability Companies can specify a duration, meaning they can exist for a fixed term if desired.

- There are no requirements for a registered agent. In fact, designating a registered agent is mandatory. The registered agent must be available to receive legal documents on behalf of the LLC.

- The Articles of Organization can be filled out loosely. Forms must be completed accurately and legibly; otherwise, they will be rejected by the Division of Business Services.

- Emails are not necessary for communication. On the contrary, providing a business email address is crucial as all notifications from the Division of Business Services will be sent via email.

- LLCs are exempt from annual filings. This is a dangerous assumption. All LLCs are required by law to file an annual report with the Secretary of State, typically due four months after the end of their fiscal year.

Being aware of these misconceptions can save time and prevent potential issues when filing Articles of Organization in Tennessee. Careful attention to the requirements is vital for a smooth formation process.

Key takeaways

Filing the Articles of Organization for an LLC in Tennessee is a crucial step in formally establishing your business.

Complete the form accurately and entirely; any inaccuracies or incomplete details can lead to rejection.

Choose your filing method: you can e-file, print and mail, submit on paper, or walk into the Secretary of State's office.

When using the e-filing option, remember there’s a convenience fee for credit and debit card payments.

The name of your LLC must meet specific state requirements including the use of "Limited Liability Company" or "LLC."

Provide a valid street address for your registered agent; P.O. boxes are not acceptable.

Be aware of how many members are in your LLC at the time of filing; not indicating this could result in a default of one member.

Clearly indicate whether the LLC is member-managed, manager-managed, or director-managed.

The filing fee is $50 per member with a minimum of $300 and a maximum of $3,000; pay correctly to avoid rejection.

Browse Other Templates

Dhr Huntsville Al - Ineligibility may result if information is found to be misleading or incorrect.

How Long Does a Father Have to Sign a Birth Certificate in Texas - A sworn declaration establishing non-paternity during marital relations.