Fill Out Your Tennessee Exemption Certificate Form

The Tennessee Exemption Certificate form plays a critical role for eligible organizations seeking relief from sales or use tax on tangible personal property and taxable services. Issued by the Tennessee Department of Revenue, this certificate empowers qualifying entities, such as non-profits or educational institutions, to make purchases without incurring these taxes, provided the items are used for their own purposes or distributed without charge. The form must be meticulously filled out and presented to suppliers as proof of the organization's exempt status. Importantly, the organization must retain the original certificate for its records, while the supplier is required to keep a file copy to verify the tax-exempt transactions. This authority, however, does not extend to purchases intended for resale or personal expenses. Organizations must also inform the Department of Revenue of any significant changes, such as relocation or dissolution. Understanding the stipulations of this certificate is essential to avoid potential tax liabilities and ensure compliance with state regulations.

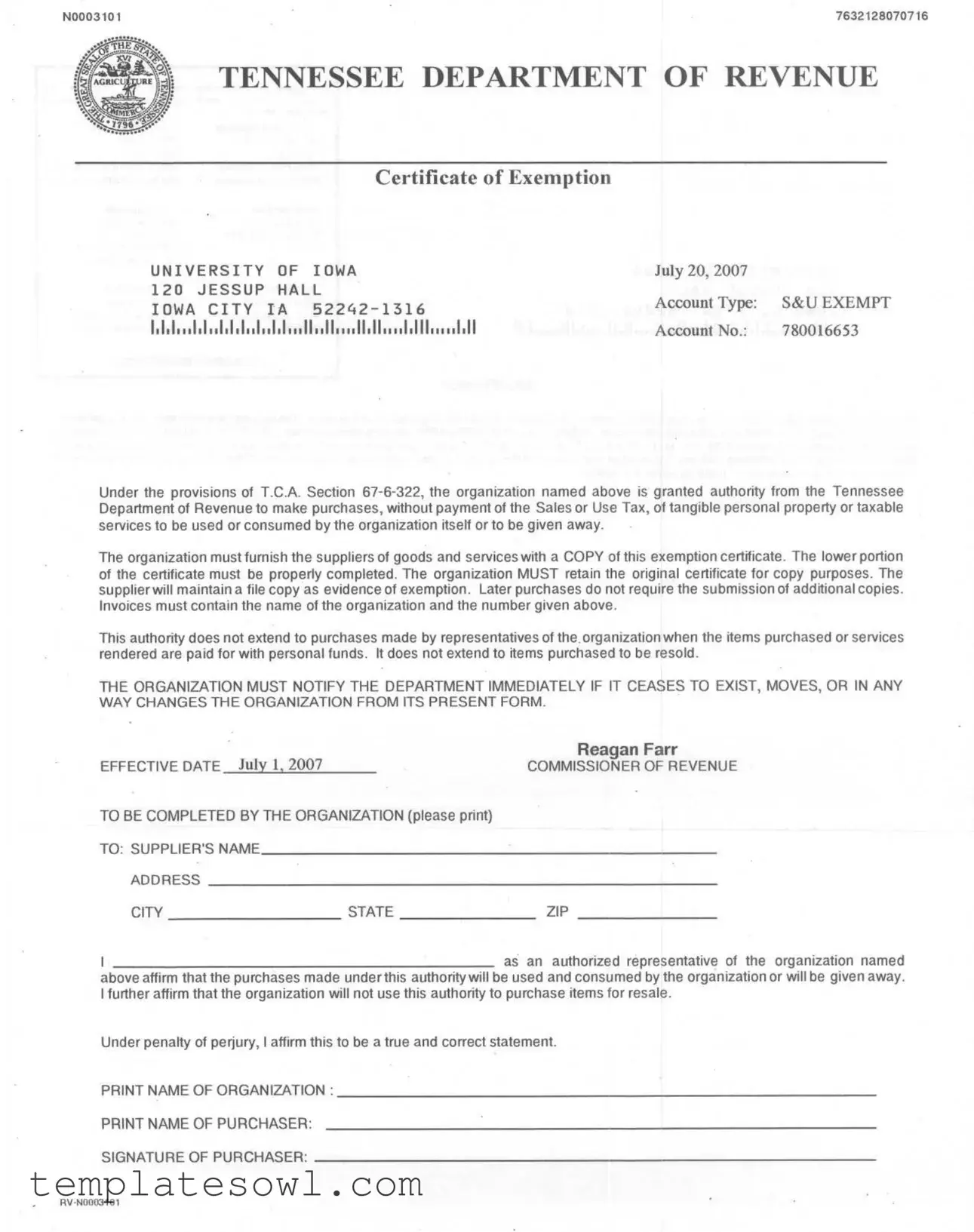

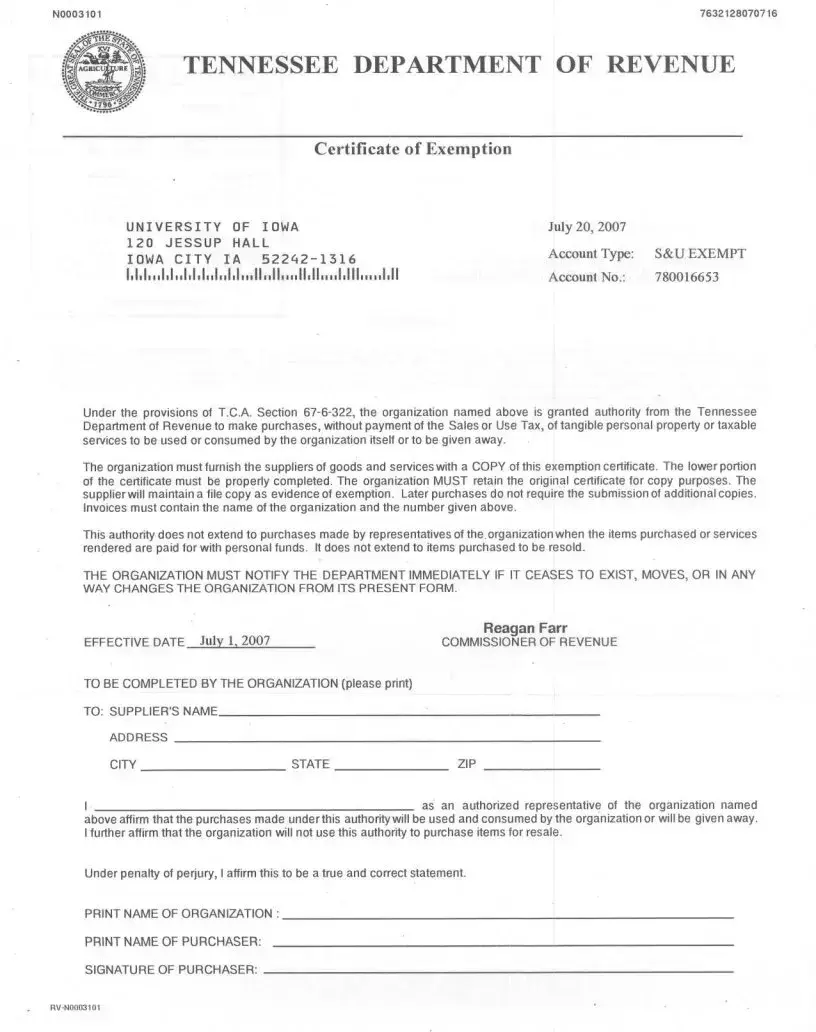

Tennessee Exemption Certificate Example

N0003101 |

7632128070716 |

TENNESSEE DEPARTMENT OF REVENUE

Certificate of Exemption

UNIVERSITYOF IOWA

120 JESSUP HALL

IOWA CITY IA

1,1,1".1,1"1.1,1,,1,,1,1,,, 11"11",, 11,11" "1,111,,, "I,ll

July 20, 2007

Account Type: S&U EXEMPT

Account No.: 780016653

Under the provisions of T.CA Section

The organization must furnish the suppliers of goods and services with a COPY of this exemption certificate. The lower portion of the certificate must be properly completed. The organization MUST retain the original certificate for copy purposes. The supplier will maintain a file copy as evidence of exemption. Later purchases do not require the submission of additional copies. Invoices must contain the name of the organization and the number given above.

This authority does not extend to purchases made by representatives of the. organization when the items purchased or services rendered are paid for with personal funds. It does not extend to items purchased to be resold.

THE ORGANIZATION MUST NOTIFY THE DEPARTMENT IMMEDIATELY IF IT CEASES TO EXIST, MOVES, OR IN ANY WAY CHANGES THE ORGANIZATION FROM ITS PRESENT FORM.

|

Reagan |

Farr |

EFFECTIVE DATE July 1, 2007 |

COMMISSIONER |

OF REVENUE |

TO BE COMPLETED BY THE ORGANIZATION (please print)

TO: SUPPLIER'S NAME |

|

|

|

_ |

ADDRESS |

|

|

|

_ |

CITY |

STATE |

_ |

ZIP |

_ |

I |

as |

an |

authorized |

representative of the organization named |

above affirm that the purchases made under this authority will be used and consumed by the organization or will be given away. I further affirm that the organization will not use this authority to purchase items for resale.

Under penalty of perjury, I affirm this to be a true and correct statement.

NAME OF ORGANIZATION: |

_ |

|

NAME OF PURCHASER: |

|

|

SIGNATURE OF PURCHASER: |

_ |

|

RV·N0003101

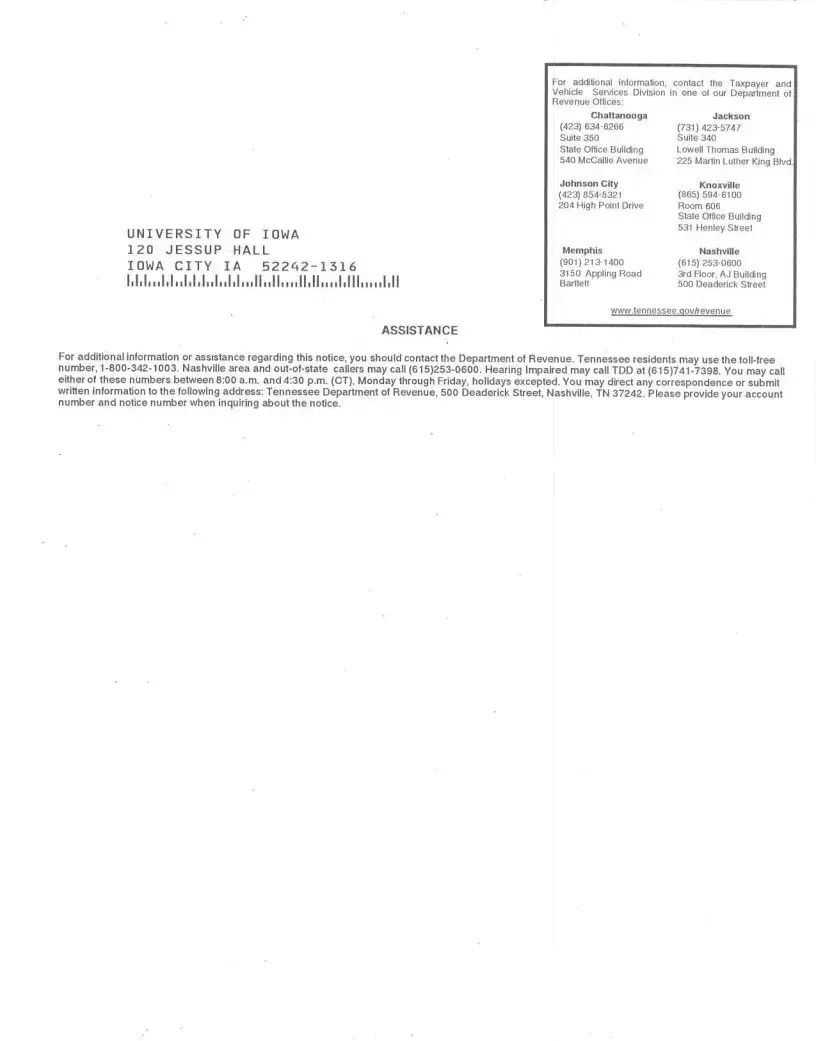

UNIVERSITY OF IOWA 120 JESSUP HALL

IOWA CITY IA

1,1,1"11,1111,1,111111111'11111111'11111,1111111,111111111,11

ASSISTANCE

For additional information, contact the Taxpayer and

Vehicle Services Division in one of our Department of Revenue Offices:

|

Chattanooga |

|

Jackson |

|

(423) |

(731) |

|||

Suite |

350 |

|

Suite |

340 |

State |

Office |

Building |

Lowell |

Thomas Building |

540 |

McCallie |

Avenue |

225 Martin Luther King Blvd. |

|

|

|

|

||

Johnson |

City |

|

Knoxville |

||

(423) |

|

(865) |

|||

204 High |

Point |

Drive |

Room 606 |

|

|

|

|

|

State |

Office |

Building |

|

|

|

531 |

Henley |

Street |

Memphis |

|

Nashville |

||

(901) |

(615) |

|||

3150 |

Appling Road |

3rd |

Floor, AJ |

Building |

Bartlett |

500 |

Deaderick |

Street |

|

www.tennessee.qov/revenue

For additional information or assIstance regarding this notice, you should contact the Department of Revenue. Tennessee residents may use the

number,

written information to the following address: Tennessee Department of Revenue, 500 Deaderick Street, Nashville, TN 37242. Please provide your account number and notice number when inquiring about the notice.

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Tennessee Exemption Certificate is governed by T.C.A. Section 67-6-322. |

| Purpose | This form allows organizations to make purchases of tangible personal property and taxable services without paying sales or use tax. |

| Transaction Types | Purchases made using this certificate must be used or consumed by the organization itself or given away. |

| Submission Requirements | Organizations must provide a copy of the exemption certificate to suppliers when making exempt purchases. |

| Record Keeping | Organizations are required to retain the original certificate for their records and suppliers must keep a file copy as evidence of the exemption. |

| Limitations | The exemption does not apply to purchases made with personal funds nor does it extend to items intended for resale. |

| Notification Requirement | Organizations must inform the Tennessee Department of Revenue immediately if they cease to exist, move, or change their structure. |

Guidelines on Utilizing Tennessee Exemption Certificate

Once you have gathered the necessary information, filling out the Tennessee Exemption Certificate form will be straightforward. This form facilitates your organization’s ability to make tax-exempt purchases in compliance with Tennessee law. Here’s how to complete it properly.

- At the top of the form, under "TO," write the supplier's name.

- Fill in the supplier's address on the next line, followed by the city, state, and ZIP code.

- As an authorized representative, confirm that purchases will be used by the organization or given away. This affirmation is important to maintain compliance.

- Print the name of your organization in the indicated space.

- Next, print the name of the purchaser clearly.

- The purchaser must provide their signature in the designated area.

- Ensure that the effective date, account type, and account number are noted as required.

- Retain the original certificate for your records, and provide a copy to the supplier.

After completing the form, check all entries for accuracy. Once everything is confirmed, you can proceed with your purchases under the established exemption. Keep the original for your records and make sure the supplier has the copy for their files.

What You Should Know About This Form

What is the purpose of the Tennessee Exemption Certificate?

The Tennessee Exemption Certificate allows eligible organizations to make purchases without paying sales or use tax for tangible personal property or taxable services. This certificate is intended for items used or consumed by the organization or given away, rather than for resale.

Who is eligible to use the Tennessee Exemption Certificate?

Organizations that qualify under the provisions of T.C.A Section 67-6-322 are eligible. These typically include non-profit organizations, educational institutions, and similar entities that are exempt from sales tax for specified purposes.

How does an organization obtain the Tennessee Exemption Certificate?

Organizations must apply directly to the Tennessee Department of Revenue to receive the exemption. Once granted, they will receive an exemption certificate, which they must keep on file.

What must an organization do with the exemption certificate when making purchases?

The organization must provide a copy of the exemption certificate to suppliers when making tax-exempt purchases. The certificate needs to be properly completed, and the original must be retained by the organization for their records.

Are multiple copies of the exemption certificate required for future purchases?

No, organizations do not need to submit additional copies of the exemption certificate for future purchases. Keeping a file copy with suppliers is sufficient, as long as the initial copy was submitted correctly.

What should organizations do if they cease to exist or change their status?

If an organization ceases to exist, moves, or undergoes any structural changes, it must notify the Tennessee Department of Revenue immediately to ensure compliance with sales tax laws.

What happens if an organization uses the exemption certificate for unauthorized purchases?

Using the certificate to purchase items for resale or using personal funds for purchases can lead to penalties. Organizations must ensure that all purchases comply with the stated guidelines to avoid tax liabilities.

How can organizations contact the Tennessee Department of Revenue for assistance?

Organizations can contact the Taxpayer and Vehicle Services Division through several offices located across Tennessee. The toll-free number for inquiries is 1-800-342-1003, and this is available from 8:00 a.m. to 4:30 p.m. (CT), Monday through Friday.

What information should be provided when contacting the Department of Revenue?

When making inquiries, organizations should provide their account number and notice number to assist in the identification and resolution of their queries effectively.

Where can further information about the Tennessee Exemption Certificate be found?

Further information is available on the Tennessee Department of Revenue's website at www.tennessee.gov/revenue. Key details about tax regulations and exemption processes can typically be found there.

Common mistakes

Filling out the Tennessee Exemption Certificate form may seem straightforward, but many individuals make mistakes that could lead to complications down the line. Understanding these common errors can help ensure that the process goes smoothly and that the organization successfully maintains its tax-exempt status.

One frequent mistake involves incomplete information. Many individuals fail to fill out all required fields, such as the supplier’s name, address, and other pertinent details. Leaving any section blank can raise red flags and potentially jeopardize the exemption status. It is vital to ensure every section is addressed thoroughly to avoid unnecessary delays.

Another common error is the failure to sign the certificate. Authorization is key; without a signature from the purchaser, the exemption certificate may be deemed invalid. This oversight often results in rejected purchases or unnecessary tax payments, which could have easily been avoided with a simple signature.

Some individuals incorrectly assume that a single exemption certificate covers all future purchases. In reality, although later purchases don’t require additional copies, the original certificate must still be properly maintained and referenced. This means keeping the certificate accessible for suppliers and ensuring it is utilized only for eligible transactions.

Misunderstanding the purpose of the exemption is also a prevalent issue. Many mistakenly believe that the exemption applies to personal purchases or items intended for resale. It’s important to remember that the exemption is strictly for purchases made on behalf of the organization and not for individual benefit.

Errors in writing the organization’s name can also cause problems. If the name on the certificate doesn’t exactly match the official registration of the organization, it may lead to disputes about legitimacy. Consistency is crucial; ensure that the organization's name is spelled out exactly as it appears in the official documents.

A significant mistake occurs when organizations do not immediately notify the Department of any changes. If the organization ceases to exist, moves, or undergoes any significant transformation, it is essential to inform the Tennessee Department of Revenue promptly. Failure to do so can result in unintended tax liabilities.

Finally, many fail to understand the importance of keeping records. It is not enough to submit the certificate; organizations must retain a copy for their records. This documentation can serve as evidence of their tax-exempt status during audits or inquiries. Keeping organized records helps maintain compliance and provides peace of mind.

Awareness of these common pitfalls can lead to a more streamlined process when filling out the Tennessee Exemption Certificate form. Attention to detail and careful adherence to guidelines will help organizations effectively utilize their tax-exempt privileges without unnecessary hitches.

Documents used along the form

The Tennessee Exemption Certificate is an important document that allows certain organizations to make tax-exempt purchases. When using this certificate, several other forms and documents may also be needed to ensure compliance with tax regulations. Below is a list of related documents often used alongside the Tennessee Exemption Certificate.

- Sales Tax Return: This document is used by businesses to report sales and use tax collected during a specific period. It indicates total sales, the amount of sales tax collected, and any exemptions claimed.

- Resale Certificate: A Resale Certificate allows a business to purchase items tax-free that are intended for resale. It must be presented to the supplier to avoid paying sales tax on those items.

- Purchase Order: A Purchase Order is a document that a buyer sends to a supplier, specifying the type and quantity of goods or services they wish to purchase. It helps in formalizing the order and may include tax exemption details if applicable.

- Invoices: When a purchase is made, an invoice is generated showing the items purchased and the total cost. The exemption certificate should be referenced on the invoice to indicate any tax-exempt status for the transaction.

These documents play essential roles in helping organizations manage their tax responsibilities effectively. Being aware of each document's purpose ensures proper usage and compliance, making the purchasing process smoother and more efficient.

Similar forms

- Sales Tax Exemption Certificate: Similar to the Tennessee Exemption Certificate, this document allows exempt organizations to purchase goods tax-free. It is issued by different states, and its purpose remains the same: to prevent the imposition of sales tax on qualifying purchases.

- Form ST-5 (Massachusetts): This certificate serves a similar function in Massachusetts. It allows certain organizations to make tax-exempt purchases under specified conditions, ensuring that tax does not apply to items exclusively for the organization's use.

- Form ST-3 (New Jersey): In New Jersey, this form is used to claim sales tax exemption. Like the Tennessee Exemption Certificate, it must be presented to vendors at the time of purchase to validate the tax-exempt status of the buyer.

- IRS Form 990: Nonprofit organizations in the U.S. file this form with the Internal Revenue Service to maintain their tax-exempt status. While its purpose differs slightly, it shares the overarching theme of exempting organizations from certain tax obligations.

- Certificate of Exemption from Use Tax (Arizona): This document allows certain purchases to be exempt from use tax in Arizona. Its process parallels that of the Tennessee Exemption Certificate, necessitating immediate notification to the state if changes occur.

- Nonprofit Organization Purchase Exemption Certificate (California): This California-specific form is utilized by nonprofit organizations to claim exemption from sales and use tax. Both certificates require proper usage limits, akin to those found in the Tennessee document.

- Exempt Organization Certificate (Texas): Issued for tax-exempt purchases in Texas, this certificate operates similarly in requiring exempt organizations to confirm their status to vendors at the time of purchase.

- Form 501 (Florida): Florida’s Form 501 allows qualified entities to claim exemptions from sales tax. The guidelines stress the importance of using the certificate only for eligible purchases, mirroring Tennessee's stipulations.

- Form ST-2 (Illinois): This form provides sales tax exemption for qualified organizations in Illinois. It operates similarly to the Tennessee Exemption Certificate but is subject to the specific laws and regulations of Illinois.

- Nonprofit Purchase Exemption Certificate (Virginia): Similar in function, this document allows Virginia-based nonprofits to purchase goods without incurring sales tax. Just like its Tennessee counterpart, it demands the preservation of proper records for tax-exempt transactions.

Dos and Don'ts

When filling out the Tennessee Exemption Certificate, it’s essential to ensure that the process is done correctly. Here’s a list of things you should and shouldn’t do to avoid any issues:

- DO provide accurate information about your organization, including the correct name and address.

- DO include your organization's account number as required by the Tennessee Department of Revenue.

- DO retain the original exemption certificate for your records after copying it for suppliers.

- DO submit the certificate only for qualifying purchases made on behalf of your organization.

- DO notify the Department of Revenue immediately if your organization changes, ceases to exist, or relocates.

- DON'T use the exemption certificate for items that are intended for resale.

- DON'T pay for any items with personal funds and expect the exemption to apply.

Ensuring compliance with these guidelines can save time and prevent potential penalties or complications. Take the process seriously, and consult the Tennessee Department of Revenue if you have questions.

Misconceptions

- Misconception 1: The certificate allows anyone to make tax-free purchases.

- Misconception 2: You can use the exemption certificate for personal purchases.

- Misconception 3: You need to submit a new certificate for every purchase.

- Misconception 4: The certificate is only for tangible goods, excluding services.

- Misconception 5: The exemption is permanent and never requires updates.

- Misconception 6: Any employee can use the certificate for purchases on behalf of the organization.

- Misconception 7: The organization can use the exemption for resale of purchased items.

- Misconception 8: Keeping the original certificate is unnecessary once you have submitted a copy.

- Misconception 9: There are no penalties for failing to follow exemption guidelines.

This is not true. Only organizations that qualify and have received the certificate can make purchases exempt from sales tax. It’s important to ensure that your organization fits the requirements outlined by the Tennessee Department of Revenue.

This is incorrect. The certificate is strictly for purchases used or consumed by the organization. If items are personally purchased, even if they’re for the organization, they do not qualify for the tax exemption.

Many believe that every purchase demands a new certificate; however, that’s not the case. Once the supplier has a copy of the certificate, no additional copies are necessary for future purchases, as long as the organization remains the same.

False! The exemption also covers taxable services. The certificate allows for both tangible personal property and specific services to be purchased without sales tax when used by the organization.

This is misleading. Organizations must notify the Tennessee Department of Revenue if they change in any way, such as moving or ceasing to exist. An outdated certificate could lead to compliance issues.

This isn’t true. Only authorized representatives of the organization can use the exemption certificate. Clear protocols should be established to prevent misuse.

This is incorrect. The certificate does not permit the purchase of items for resale. The organization must use the items purchased under this exemption for its own purposes or give them away, not sell them.

This is false. Organizations must keep the original certificate to maintain proper records. Suppliers also must retain a copy for their documentation.

This is a risky belief. Misusing the exemption certificate could result in penalties, including back taxes owed, interest, or even legal complications. It's essential to understand and follow the rules associated with the exemption.

Key takeaways

The Tennessee Exemption Certificate is essential for qualifying organizations to make tax-exempt purchases. Here are key takeaways about filling it out and using it:

- Eligibility: Only organizations designated by the Tennessee Department of Revenue can use the exemption certificate to buy tangible personal property or taxable services without paying sales tax.

- Submission Requirements: Organizations must provide a copy of the exemption certificate to suppliers for each purchase. However, additional copies are not required for subsequent purchases.

- Record Keeping: It is necessary for both the organization and the supplier to retain a copy of the exemption certificate for record-keeping and to substantiate the tax-exempt status of the purchase.

- Limitation of Use: The authority granted does not extend to purchases made for resale or those paid for with personal funds by representatives of the organization.

- Notification Obligation: Organizations must inform the Department of Revenue immediately if there are any changes to their status, such as ceasing to exist or changes in address.

Ensuring compliance with these guidelines can help organizations effectively use the Tennessee Exemption Certificate while avoiding potential issues with tax authorities.

Browse Other Templates

Volunteer Template - Specify your writing ability for languages beyond English.

State Farm Life Insurance Cash Surrender Form - A comprehensive understanding of the form will aid in a smoother claims experience with State Farm.

Abandoned Vehicle Ownership Transfer,MVT Title Transfer Form,Alabama Abandoned Vehicle Sale Document,Motor Vehicle Abandonment Transfer Form,Vehicle Status Resolution Document,Abandoned Motor Vehicle Sale Receipt,Ownership Transfer for Abandoned Vehi - Filing this form initiates legal ownership transfer of the abandoned vehicle.