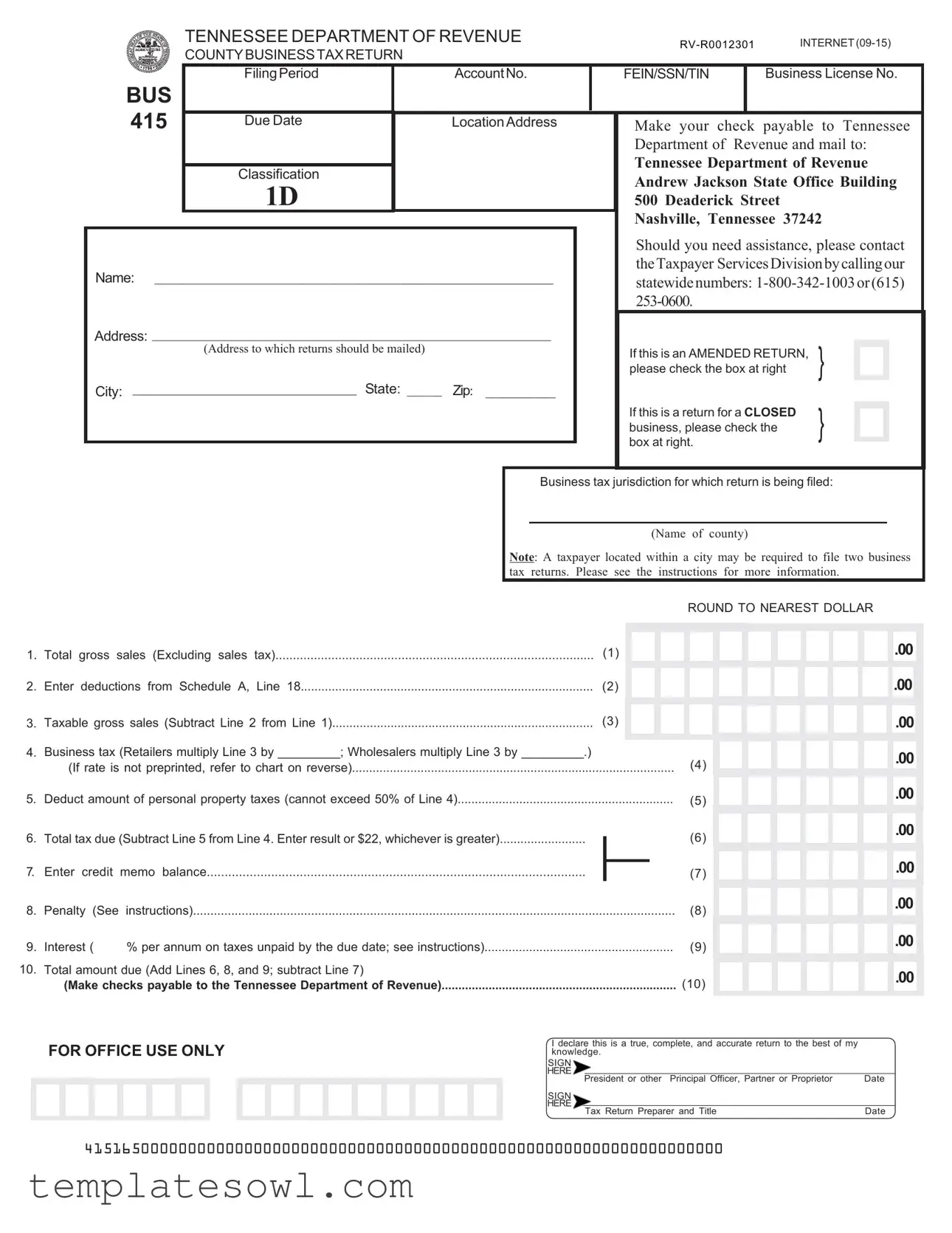

Fill Out Your Tennessee Bus 415 Form

The Tennessee Bus 415 form is an essential document for businesses operating within the state and is used to report business taxes. This form captures vital information, including the filing period, account number, and business license number. The return requires businesses to declare their total gross sales while providing space to indicate any deductions, such as returned merchandise and bad debts. Businesses must calculate their taxable gross sales and apply the appropriate tax rate, which varies depending on whether the business is a retailer or wholesaler. Amended returns and closed business returns require special attention, and all taxpayers should be aware of potential penalties and interest associated with missed deadlines. Additionally, it is crucial for businesses located within a city to check if two returns are needed. A checklist is included in the form, guiding users in accurately completing the submission. Contacting the Taxpayer Services Division can provide assistance for any questions or uncertainties regarding the form. Properly filing Bus 415 is vital for compliance and helps ensure smooth business operations in Tennessee.

Tennessee Bus 415 Example

TENNESSEE DEPARTMENT OF REVENUE

COUNTYBUSINESSTAXRETURN

|

|

FilingPeriod |

|

AccountNo. |

|

|

FEIN/SSN/TIN |

|

Business License No. |

|

|||||||||||||||||||

|

BUS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

415 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Due Date |

|

LocationAddress |

|

|

|

|

Make your |

check payable |

to Tennessee |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Department of Revenue and mail to: |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Tennessee Department of Revenue |

|

|||||||||||||||||

|

|

Classification |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Andrew Jackson State Office Building |

|

||||||||||||||||||

|

|

1D |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

500 Deaderick Street |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

Nashville, Tennessee 37242 |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Should you need assistance, please contact |

|

|||||||||||||||||

|

Name: _________________________________________________________ |

|

|

|

|

theTaxpayer ServicesDivisionbycallingour |

|

||||||||||||||||||||||

|

|

|

|

|

statewidenumbers: |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Address: _________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

(Address to which returns should be mailed) |

|

|

|

|

|

|

If this is an AMENDED RETURN, |

} |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

please check the box at right |

|

|

|

|

|

|

|

||||||||||||

|

City: ________________________________ State: _____ |

Zip: __________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

If this is a return for a CLOSED |

} |

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

business, please check the |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

box at right. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business tax jurisdiction for which return is being filed: |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

(Name of county) |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

Note: A taxpayer located within a city may be required to file two business |

|

|||||||||||||||||||||||

|

|

|

|

|

tax returns. Please see the instructions |

for more information. |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ROUND TO NEAREST DOLLAR |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Total gross sales (Excluding sales tax) |

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Enter deductions from Schedule A, Line 18 |

|

|

(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

||||||

|

............................................................................ |

|

|

|

|

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3. Taxable gross sales (Subtract Line 2 from Line 1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Business tax (Retailers multiply Line 3 by _________; Wholesalers multiply Line 3 by _________.) |

|

|

|

|

|

(If rate is not preprinted, refer to chart on reverse) |

(4) |

|||

5. |

Deduct amount of personal property taxes (cannot exceed 50% of Line 4) |

(5) |

|||

6. |

Total tax due (Subtract Line 5 from Line 4. Enter result or $22, whichever is greater) |

|

(6) |

||

|

|||||

7. |

Enter credit |

memo balance |

|

|

|

|

(7) |

||||

8. |

Penalty (See |

instructions) |

|||

9. |

Interest ( |

% per annum on taxes unpaid by the due date; see instructions) |

(9) |

||

10. |

Total amount due (Add Lines 6, 8, and 9; subtract Line 7) |

|

|

|

|

|

(Make checks payable to the Tennessee Department of Revenue) |

(10) |

|||

.00

.00

%.00

%.00

%.00

%.00

%.00

%.00

%.00

%.00

%.00

%.00

%.00

%.00

FOR OFFICE USE ONLY

I declare this is a true, complete, and accurate return to the best of my knowledge.

SIGN

HERE

|

President or other Principal Officer, Partner or Proprietor |

Date |

|

SIGN |

|

||

HERE |

|

|

|

Tax Return Preparer and Title |

Date |

||

|

|||

41516500000000000000000000000000000000000000000000000000000000000000

INTERNET

Schedule A. Deductions from Gross Sales |

|

1. Sales of services received by persons located in other states |

(1) |

2. Returned merchandise when the sales price is refunded to the customer |

(2) |

.00

.00

.00

.00

3.Sales in interstate commerce where the purchaser takes possession outside Tennessee for use or consumption outside Tennessee.......................................................................................................

4.Cash discounts allowed and taken on sales.......................................................................................

5.Repossessions - The portion of the unpaid principal balance in excess of $500 due on tangible per- sonal property repossessed from customers.......................................................................................

6.The amount allowed as

7.Bad debts written off during the reporting period and eligible to be deducted for federal income tax purposes.........................................................................................................................................

8.Amounts paid by a contractor to a subcontractor holding either a business license or contractor's license for performing activities described in Tenn. Code Ann. Section

complete Schedule B and file with the return......................................................................................

Federal and Tennessee privilege and excise taxes:

(3)

.00

.00

(4)

.00

.00

(5)

.00

.00

(6)

.00

.00

(7)

.00

.00

(8)

.00

.00

(Note: All deductions must have adequate records maintained to substantiate deductions claimed or they will be disallowed.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

...............................................................................................9. Federal and Tennessee gasoline tax |

(9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

10. |

Federal and Tennessee motor fuel tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

||

11. |

Federal and Tennessee tobacco tax on cigarettes |

(11) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||

12. Federal and Tennessee tobacco tax on all other tobacco products |

(12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13.Federal and Tennessee beer tax....................................................................................................

14.Tennessee special tax on petroleum products........................................................

15.Tennessee liquified gas tax for certain motor vehicles..............................................

16.Tennessee beer wholesale tax..........................................................................................................

17.Other deductions not taken elsewhere on the return.........................................................................

(Specify)

18. Total Deductions. Add Lines 1 through 17. Enter here and in Page 1, Line 2 |

(18) |

(13)

.00

.00

(14)

.00

.00

(15)

.00

.00

(16)

.00

.00

(17)

.00

.00

.00

.00

CLASSIFICATION |

RETAILER RATES |

WHOLESALER RATES |

TAX PERIOD |

DUE DATE |

Class 1A |

0.001 |

0.00025 |

|

|

Class 1B & 1C |

0.001 |

0.000375 |

|

Not later than the |

Class 1D |

0.0005 |

Notapplicable |

|

15th day of the 4th |

Class 1E |

Notapplicable |

0.0003125 |

Fiscal Year |

month following the |

Class 2 |

0.0015 |

0.000375 |

|

end of the tax |

Class 3 |

0.001875 |

0.000375 |

|

period. |

Class 4 |

0.001 |

Not applicable |

|

|

Class 5 |

0.003 |

Not applicable |

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Title | Bus 415, Tennessee County Business Tax Return |

| Governing Law | Tennessee Code Annotated, Title 67, Chapter 4, Part 7 |

| Filing Period | Annual, with returns due within 15 days of the end of the tax period |

| Account Number | A unique number assigned to each registered business by the Tennessee Department of Revenue |

| Payment Instructions | Checks made payable to Tennessee Department of Revenue |

| Location for Submission | Tennessee Department of Revenue, Andrew Jackson State Office Building, 500 Deaderick Street, Nashville, TN |

| Amended Returns | Check the box provided if submitting an amended return |

| Deductions | Taxpayers can deduct certain eligible expenses with adequate documentation |

| Penalty for Late Filing | A penalty may be applied for returns filed after the due date |

| Interest on Unpaid Taxes | Interest accrues on any unpaid taxes as stated in the instructions |

Guidelines on Utilizing Tennessee Bus 415

Filling out the Tennessee Bus 415 form involves several steps to ensure accuracy and compliance with tax regulations. This process includes gathering necessary information about the business, calculating gross sales and applicable deductions, and determining taxes due. Each section of the form must be completed thoughtfully, ensuring all required information is provided.

- Obtain the Tennessee Bus 415 form from the Tennessee Department of Revenue website or other reliable sources.

- Complete the filing period, account number, and business identification details, including FEIN/SSN/TIN and business license number.

- Note the due date of the return.

- Fill in the location address and contact information for the taxpayer services division, including your name and address where the return should be mailed.

- If applicable, check the designated boxes for an amended return or for a closed business.

- Indicate the specific business tax jurisdiction by entering the name of the county.

- Calculate total gross sales (excluding sales tax) and enter the amount on Line 1.

- Enter deductions on Line 2 from Schedule A, Line 18, and calculate the taxable gross sales by subtracting Line 2 from Line 1; enter this amount on Line 3.

- Determine business tax based on the classification of the business (retailer or wholesaler) by multiplying the taxable gross sales by the appropriate rate, and enter the amount on Line 4.

- If applicable, calculate the deduction for personal property taxes on Line 5, ensuring it does not exceed 50% of Line 4.

- Calculate total tax due on Line 6 by subtracting Line 5 from Line 4 and enter the greater of the result or $22.

- Enter any credit memo balance on Line 7.

- If applicable, calculate penalties and interest on Lines 8 and 9.

- Calculate the total amount due on Line 10 and ensure it reflects the correct sum after adding and subtracting the appropriate lines.

- Sign and date the form in the designated areas for both the principal officer and the tax return preparer.

After completing the form, review it carefully for any errors. Once verified, mail it to the Tennessee Department of Revenue at the specified address. If assistance is needed, reach out to the Taxpayer Services Division using the provided contact numbers.

What You Should Know About This Form

What is the Tennessee Bus 415 form?

The Tennessee Bus 415 form is a tax return document used by businesses in Tennessee to report their gross sales and calculate the business tax owed to the state. It is typically submitted to the Tennessee Department of Revenue and contains details such as total gross sales, deductions, and the resulting taxable gross sales. This form is crucial for businesses operating within Tennessee’s jurisdiction to ensure compliance with state tax regulations.

Who needs to file the Bus 415 form?

How do I complete the Tennessee Bus 415 form?

Completing the Bus 415 form involves several steps. First, gather financial records that outline your gross sales for the reporting period. Then, fill in the total gross sales on Line 1, followed by entering any deductions on Line 2. Next, calculate your taxable gross sales by subtracting deductions from total gross sales. Finally, multiply your taxable gross sales by the appropriate tax rate based on your classification, and adjust for any deductions and penalties as outlined in the form. Make sure to sign the form before submission.

What should I do if I am filing an amended return?

If you need to file an amended return, check the box that indicates it is an amended return on the form. This helps the tax authorities understand that you are making corrections to a previous submission. Be sure to provide accurate and complete information, as any discrepancies can lead to further scrutiny or penalties.

What payment methods are accepted when submitting the Bus 415 form?

The form instructs businesses to make checks payable to the Tennessee Department of Revenue. All payments should be enclosed when mailing the form to the designated address. Additional payment methods are not specified in the form, so it is advisable to confirm with the Tennessee Department of Revenue if electronic payments or credit card options are available.

When is the Bus 415 form due?

The due date for submitting the Bus 415 form typically falls on the 15th day of the fourth month following the end of the tax period. For example, if your tax period ends on December 31, the form would be due by April 15 of the following year. It is vital to adhere to this timeline to avoid penalties and interest on unpaid taxes.

What happens if I do not file the Bus 415 form on time?

Failure to file the Bus 415 form by the due date can result in penalties and interest on the taxes owed. The specific rates for penalties and interest are detailed in the instructions on the form. To mitigate consequences, it is important to file the return as soon as possible, even if the payment cannot be made in full at that time.

Common mistakes

Completing the Tennessee Bus 415 form can be straightforward, but many individuals make mistakes that can lead to delays in processing or even penalties. One common error is failing to check the appropriate boxes for whether the return is amended or if the business is closed. Leaving these sections unchecked can create confusion for tax authorities, potentially leading to unnecessary follow-up communications.

Another frequent oversight involves not rounding amounts correctly to the nearest dollar. The form explicitly requires rounding, but sometimes individuals enter exact figures without rounding, which can lead to discrepancies. This simple calculation can be the difference between a return being accepted or rejected by the Tennessee Department of Revenue.

People also often forget to include the classification of the business when filling out the form. Providing the specific tax jurisdiction where the return is being filed is crucial. Without this information, the return may not be processed correctly, potentially putting the business at risk of penalties or increased scrutiny.

Sometimes, taxpayers miscalculate their deductions. It's important to ensure accuracy when subtracting deductions from the gross sales. Review each deduction item carefully and refer to Schedule A if necessary to validate amounts. Any errors in deductions can skew the taxable gross sales and impact the overall tax due.

Another mistake many make is neglecting to fill in the FEIN/SSN/TIN correctly. Inputting this number inaccurately can cause significant delays in processing since the tax authority relies on these identifiers to match the return with the corresponding business entity.

There's also the issue of not keeping records to substantiate claimed deductions. Each deduction requires that adequate records are maintained. If the records aren't available, the deductions may be disallowed, leading to unexpected tax liabilities down the line.

People occasionally overlook signing the form. Both the principal officer and the tax preparer need to provide signatures and the corresponding dates. A missing signature is a common error that can halt the entire process, requiring additional communication to rectify.

Lastly, individuals often misunderstand the tax rates applicable to their business classification. It's crucial to refer to the chart provided on the form and ensure that the correct tax rate is being utilized. Failing to do so can result in underpayment or overpayment, complicating the tax situation.

Documents used along the form

The Tennessee Bus 415 form is a critical document for businesses in the state, detailing business tax returns. Along with this form, several other documents may be used to support the filing process. Each document serves a distinct purpose and assists in ensuring compliance with state regulations.

- Schedule A: Deductions from Gross Sales - This document itemizes specific deductions a business may claim against gross sales. Acceptable deductions include sales of services out of state or bad debts, among others. It is essential for accurately reporting taxable sales and ensuring that only the necessary tax is paid.

- Schedule B - Required for certain businesses, this schedule provides detailed records of contractor payments to subcontractors. It helps clarify the tax liabilities associated with contracted work, particularly when filing under specific codes.

- Business License - This document proves that a business is authorized to operate within its locality. It is often required when submitting tax returns to demonstrate that the business complies with local regulations.

- Amended Return Form - If a business needs to correct previously submitted tax information, this form is necessary. It allows businesses to officially amend errors such as incorrect income figures or unreported deductions.

- Tax Payment Confirmation - This serves as proof of payment made to the State Department of Revenue. It is important to retain this document for record-keeping and to substantiate claims made on the tax return.

- Federal Employer Identification Number (EIN) Verification - This document provides verification of a business's EIN, which is often necessary for state tax filings. It helps confirm the legitimacy of the business entity when submitting forms to the state.

Gathering these documents while preparing the Bus 415 form can streamline the filing process and minimize the risk of errors. Thorough attention to detail aids in ensuring compliance with Tennessee's tax obligations and contributes to the overall efficiency of business operations.

Similar forms

- Form 1065 (U.S. Return of Partnership Income): Similar to the Bus 415, Form 1065 reports a partnership's income and deductions. Both require detailed financial information and the declaration of total sales while identifying applicable deductions.

- Form 1120 (U.S. Corporation Income Tax Return): This form is used by corporations to file their income taxes, paralleling the Bus 415 in basic financial reporting. Both documents necessitate reporting total income, applicable deductions, and calculating tax owed.

- Form 940 (Employer’s Annual Federal Unemployment (FUTA) Tax Return): Like the Bus 415, Form 940 requires reporting of financial data related to a business's operations. Both are used to determine tax liability based on a business's earnings.

- Form 941 (Employer’s Quarterly Federal Tax Return): Form 941 is another tax return focused on reporting payroll and withholdings. Similar to the Bus 415, it requires careful documentation of income and deductions relevant to the business's tax calculations.

- Schedule C (Profit or Loss from Business): Schedule C is used by sole proprietors to report income and expenses. The need for reporting gross sales and deductions makes it similar to the information required on the Bus 415.

- Form 990 (Return of Organization Exempt from Income Tax): Nonprofits file Form 990 to report financial information. Like the Bus 415, it aims to promote transparency, detailing income, deductions, and finances related to operations for tax-exempt organizations.

Dos and Don'ts

When filling out the Tennessee Bus 415 form, there are several important things to keep in mind. Here is a list of what you should and shouldn’t do to ensure the process goes smoothly.

- Do ensure accurate information: Double-check all figures and details before submitting the form. Accuracy is vital to avoid penalties or delays.

- Do review instructions carefully: Go through the guidelines provided with the form to understand each section’s requirements.

- Do keep records: Maintain supporting documents for any deductions claimed, as they may be needed for review.

- Do submit on time: Be aware of the due date and make sure to file your return promptly to avoid late penalties.

- Don’t leave sections blank: If a section is not applicable, write "N/A" instead of leaving it empty. This shows that you are aware of the requirement.

- Don’t forget to sign: Ensure that the required signatures are present. An unsigned form could be returned or rejected.

- Don’t use non-standard payment methods: Make your check payable to the Tennessee Department of Revenue. Avoid cash payments or other forms that are not accepted.

By following these guidelines, you'll ensure that your Bus 415 form is accurately completed and submitted in a timely manner. Should questions arise, don’t hesitate to reach out for assistance. Proper preparation can make this process much smoother for you.

Misconceptions

Understanding the Tennessee Bus 415 form can be crucial for businesses operating in the state. However, several misconceptions may confuse taxpayers. Here are ten common misunderstandings about this form:

- Misconception 1: The Bus 415 form is only for large businesses.

- Misconception 2: Filing an amended return means my original return was wrong.

- Misconception 3: I can submit the form anytime without consequence.

- Misconception 4: Deductions do not need substantiation.

- Misconception 5: The tax rates are the same for all businesses.

- Misconception 6: I only pay taxes on my business profits.

- Misconception 7: Closed businesses do not need to file a return.

- Misconception 8: I can fill out the form without financial records.

- Misconception 9: I can pay my taxes whenever I want after filing the form.

- Misconception 10: The Bus 415 form is the only tax form I need to file.

This form is applicable to all types of businesses, regardless of size. Even small businesses are required to file.

An amended return can be filed for various reasons, including updates from new information. It does not imply that the original return was incorrect.

There are specific due dates for submission. Late filings may incur penalties and interest.

All deductions claimed on the form must be supported with adequate records to be accepted. Lack of proper documentation could lead to disallowance.

Tax rates vary based on the classification of the business. The form specifies different rates for retailers and wholesalers.

The business tax is based on gross sales, not profits. Understanding this distinction is vital for accurate reporting.

If your business is closed, you must indicate this on the form to avoid future penalties or complications.

Using financial records is essential for accurately completing the Bus 415. Inaccurate information could lead to errors in tax amount calculations.

Taxes are due by a specified deadline, and failing to pay on time can result in penalties and interest on the outstanding amount.

Depending on your business structure and operations, you may need to file additional forms. It's crucial to assess your specific situation.

Being informed about these misconceptions can help ensure compliance with tax regulations and promote responsible business practices.

Key takeaways

The Tennessee Bus 415 form is essential for businesses operating within the state. Here are some key takeaways about filling out and using this form:

- The form is officially known as the Tennessee County Business Tax Return.

- It is important to fill in your Account Number and Federal Employer Identification Number (FEIN) at the top of the form.

- The due date for submission is typically the 15th day of the 4th month following the end of the tax period.

- Make checks payable to the Tennessee Department of Revenue when submitting payment.

- Ensure that you correctly classify your business as a retailer or wholesaler, as the tax rates will vary.

- If you are filing an amended return, check the designated box to indicate this clearly.

- Keep a detailed record of your gross sales and any deductions claimed, as they must be supported by adequate documentation.

- Check the box if the business has been closed, which may alter the filing requirements.

- Be aware that sales in interstate commerce may qualify for deduction under certain conditions.

- If assistance is needed, contact the Taxpayer Services Division at 1-800-342-1003 or (615) 253-0600.

Completing the form accurately will help ensure compliance with Tennessee tax laws, and taking the necessary steps to maintain proper records is vital for future submissions.

Browse Other Templates

Utrgv Gpa Calculator - By default, your Social Security number will appear on your transcript unless you request otherwise.

Florida Oversize Permit Login - Submission deadlines can influence the need for expedited processing for specific permits.