Fill Out Your Texas Employment Verification Form

The Texas Employment Verification form plays an essential role in connecting employers and employees, particularly when it comes to verifying an individual's employment status for state benefit applications. This form is designed for employers to provide specifics about current or former employees who are seeking state assistance. Key components of the form include details such as the employee's name, Social Security number, earnings, hours worked, and the nature of employment—whether full-time, part-time, temporary, or permanent. Employers must confirm the individual's employment status, specify the type of job held, and outline the financial compensation received, including regular salary, overtime, and any additional income from tips or bonuses. Additionally, the form requires employers to indicate if the employee has health insurance, along with relevant coverage details. It provides clear instructions for completion and submission via various methods, ensuring a streamlined process to assist those in need of public assistance. Timeliness is crucial; employers are urged to fill out and return the form promptly to avoid delays in the benefits process. Whether you're a current or former employee, understanding this form's requirements can significantly impact your state benefits application.

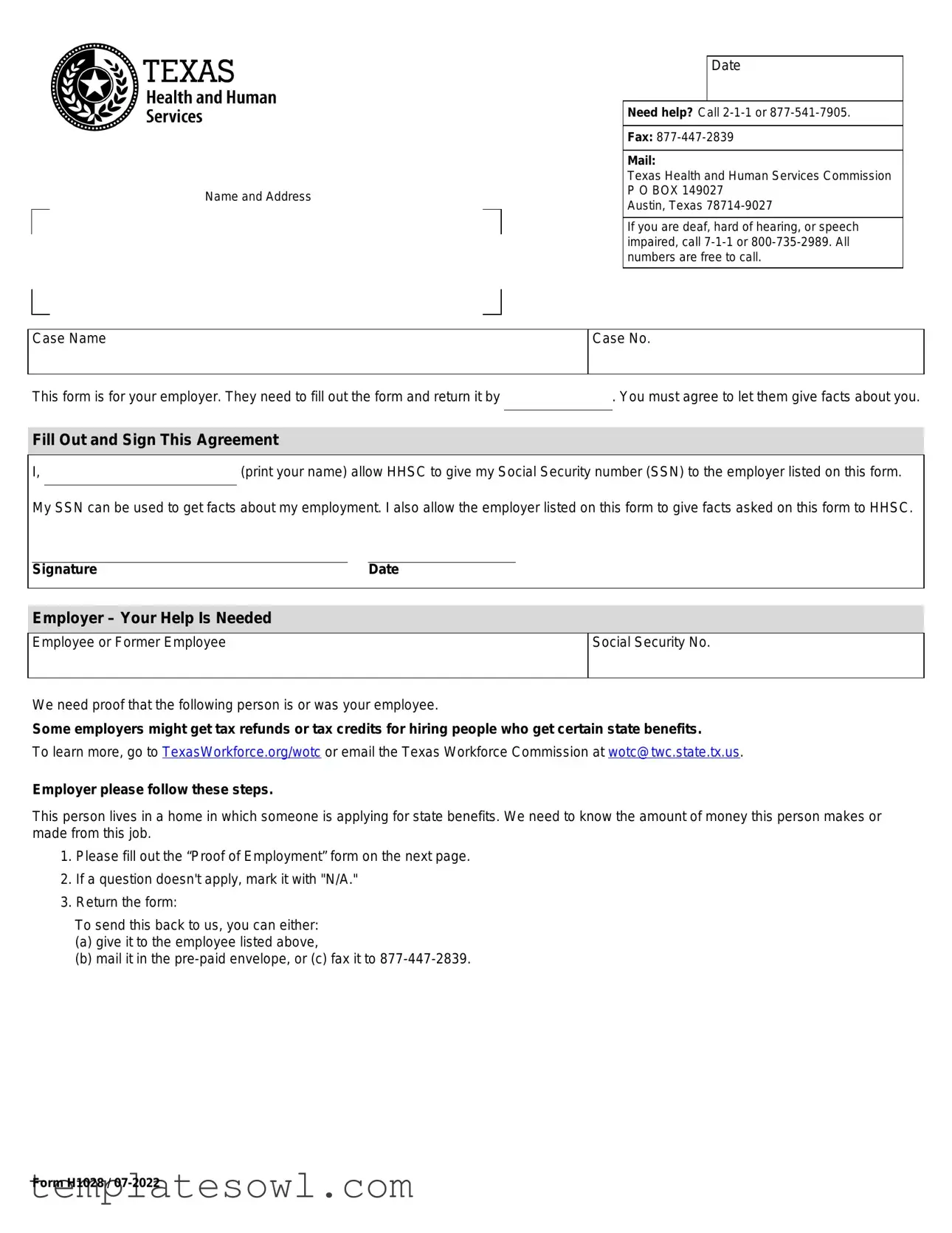

Texas Employment Verification Example

Name and Address

Date

Need help? Call

Fax:

Mail:

Texas Health and Human Services Commission

P O BOX 149027

Austin, Texas

If you are deaf, hard of hearing, or speech impaired, call

Case Name

Case No.

This form is for your employer. They need to fill out the form and return it by. You must agree to let them give facts about you.

Fill Out and Sign This Agreement

I, |

|

(print your name) allow HHSC to give my Social Security number (SSN) to the employer listed on this form. |

|

|

|

My SSN can be used to get facts about my employment. I also allow the employer listed on this form to give facts asked on this form to HHSC.

Signature |

Date |

Employer – Your Help Is Needed

Employee or Former Employee

Social Security No.

We need proof that the following person is or was your employee.

Some employers might get tax refunds or tax credits for hiring people who get certain state benefits.

To learn more, go to TexasWorkforce.org/wotc or email the Texas Workforce Commission at wotc@twc.state.tx.us.

Employer please follow these steps.

This person lives in a home in which someone is applying for state benefits. We need to know the amount of money this person makes or made from this job.

1.Please fill out the “Proof of Employment” form on the next page.

2.If a question doesn't apply, mark it with "N/A."

3.Return the form:

To send this back to us, you can either:

(a)give it to the employee listed above,

(b)mail it in the

Form H1028 /

Employment Verification

Form H1028

Page 2 /

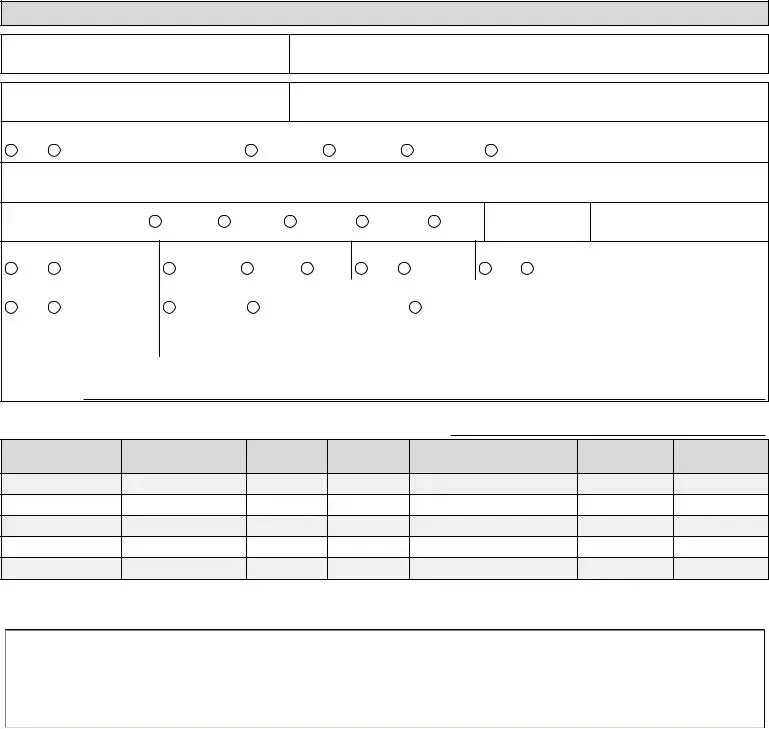

Proof of employment to be filled out by the employer.

Company or Employer

Address (Street, City, State, ZIP code)

Employee Name (as shown on your records)

Employee Address (Street, City, State, ZIP Code – as shown on your records)

Is (or was) this person employed by you? |

If yes, what type of job? |

|

|

||

Yes |

No |

Full Time |

Part Time |

Permanent |

Temporary |

If no: Stop here – sign and date the bottom of this form and return it.

If yes: Answer all the questions below. If a question doesn’t apply, write “N/A".

Rate of Pay |

Per Day |

Per Week |

Per Month |

Per Job |

Per Hour |

How Often Paid?

Average Hours Per Pay Period

Commissions Tips Bonuses |

Overtime Pay |

|

|

FICA or FIT Withheld |

Profit Sharing or Pension Plan |

|||

Yes |

No |

Frequently |

Rarely |

Never |

Yes |

No |

Yes |

No If yes, current value? |

Health insurance available? |

If yes, employee is: |

|

|

|

Name of Insurance Company |

|||

Yes |

No |

Not Enrolled |

Enrolled with Family Member |

Enrolled for Self Only |

|

|

||

|

|

|

|

|

|

|||

Date Hired |

|

Date First Check Received |

Average Hours Per Week |

If Employee |

is or was on Leave Without Pay: |

|||

|

|

|

|

|

|

Start Date: |

End Date: |

|

|

|

|

|

|

|

|

|

|

Do you expect any changes to the above information within the next few months?  Yes

Yes  No

No

If yes, explain:

On the chart below, list all wages received by this employee during the month(s) of:

Date Pay

Period Ended

Date Employee

Received Paycheck

Actual Hours

Gross

Pay

Other Pay*

(tips, commissions, bonuses)

EITC

Advance

Total Pretax

Contributions

*Please explain (in comments section below) when and how often tips, commissions, or bonuses are received. Comments

If this person is no longer in your employ.

|

Date Separated |

Reason for Separation |

|

|

|

|

Date Final Check Received |

|

|

Gross Amount of Final Check |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer – Read, Sign and Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

I confirm that this information is true and correct to the best of my knowledge: |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer Signature |

|

Date |

Title |

Area Code and Phone No. |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Texas Employment Verification form is used by employers to verify the employment status and earnings of employees or former employees who are applying for state benefits. |

| Governing Law | This form is governed by regulations from the Texas Health and Human Services Commission (HHSC) and related workforce laws in Texas. |

| Usage Protocol | Employers must fill out the form and return it to HHSC. It is important that the employee agrees to share their information with the employer using this form. |

| Contact Information | For assistance, individuals can call 2-1-1 or 877-541-7905. If hearing impaired, calls can be made via 7-1-1 or 800-735-2989. |

| Submission Methods | Employers can return the completed form by handing it to the employee, mailing it in a pre-paid envelope, or faxing it to 877-447-2839. |

| Employee Consent | Employees must sign the form, allowing their Social Security number to be used for verification purposes by the employer and HHSC. |

| Information Required | Employers need to provide detailed information about employment, including job type, pay rate, hours worked, and any benefits offered. |

Guidelines on Utilizing Texas Employment Verification

Completing the Texas Employment Verification form involves providing essential details about the employee’s employment status. Employers must accurately fill out the form to ensure it can be processed efficiently. This verification is crucial for the employee’s eligibility for certain state benefits.

- Gather necessary information: Collect the employee's name, address, and Social Security number (SSN), as well as accurate details on their employment status.

- Fill in the employer section: Enter the company name, address, and contact information. Make sure these details are up to date.

- Indicate the employee's status: Answer whether the person is or was employed by your company. If "No," stop and sign the form. If "Yes," continue with the next steps.

- Provide job details: Specify the type of job the employee held (full-time, part-time, temporary, permanent), along with the rate of pay (per hour, day, week, or month).

- Complete compensation details: Include information about any additional pay received, such as commissions, tips, bonuses, and whether FICA or FIT was withheld.

- State insurance information: Indicate if health insurance was offered, and specify the insurer’s name and the employee’s enrollment status.

- Document employment dates: Fill in the date hired, the date the first paycheck was received, and the average hours worked per week.

- If applicable, list leave without pay: Include start and end dates for any unpaid leave taken by the employee.

- Report changes: Indicate if you expect any changes to the employment situation in the next few months.

- Complete pay period details: List wages by completing the chart for the relevant pay periods, including gross pay and any other applicable earnings.

- Provide comments: Use the comments section to clarify how often the employee received any additional pay.

- Complete separation information: If the employee is no longer with your company, provide the separation date, reason for departure, and final payment information.

- Finally, sign and date the form: The employer must confirm that all provided information is accurate and complete by signing and dating the form.

What You Should Know About This Form

What is the purpose of the Texas Employment Verification form?

The Texas Employment Verification form is designed to gather essential information regarding an employee’s employment status and income. This information is crucial for individuals applying for state benefits. The completion of this form helps streamline the verification process for both employees and employers.

Who should fill out the Employment Verification form?

The form must be completed by the employer of the individual applying for state benefits. Employers are responsible for providing accurate information regarding the employee's job status, pay rate, and any benefits that may apply. This ensures that the state can assess the employee’s eligibility for assistance effectively.

What information must the employer provide on the form?

Employers are required to include details such as the employee’s name, job type, pay rate, hours worked, employment status, and any deductions or employer-provided benefits. The form also asks for the dates of employment and reasons for separation if applicable. This thoroughness helps ensure that all relevant details are available for review.

How should the completed form be submitted?

Once the employer has completed the Texas Employment Verification form, it can be submitted in several ways. The options include handing the form back to the employee, mailing it using the provided pre-paid envelope, or faxing it to the designated number. Employers should choose the method that is most convenient and secure for them.

What should I do if I need help with the Employment Verification process?

If assistance is required while completing the Employment Verification form, individuals can reach out to Texas Health and Human Services Commission by calling 2-1-1 or 877-541-7905. For the hearing impaired, a special service is available at 7-1-1 or 800-735-2989. These resources are free and can provide valuable guidance throughout the process.

Common mistakes

Filling out the Texas Employment Verification form can be straightforward, yet many people make mistakes that can delay the process or lead to confusion. One common error occurs when individuals skip the section for Company or Employer Address. Providing the full address is essential, as it identifies who the employer is and where to direct any inquiries.

Another frequent mistake involves failing to completely fill out the Employee Name and Employee Address fields. If the employee’s name is not exactly as it appears in company records, it might cause delays in processing. Similarly, an incorrect or incomplete address can hinder communication, so ensuring accuracy in these fields is vital.

Some employers forget to indicate whether the individual is currently employed. Leaving the Is (or was) this person employed by you? question unanswered or marked incorrectly leads to confusion. If the employee is no longer with the company, it is crucial to indicate that and complete the remaining sections accurately.

People often overlook the Rate of Pay section, which should clearly state whether the employee is paid per hour, day, week, or month. Not specifying how often the employee is paid can lead to misunderstandings regarding compensation. Additionally, forgetting to include Average Hours Per Pay Period can affect the total calculations and benefits assessment.

Another common issue arises when employers fail to provide the correct Date Hired or Date First Check Received. These dates provide critical context about the employee's tenure, impacting their eligibility for certain benefits. Inconsistencies can cause complications and delay processing.

Not completing the Current Value field for health insurance can also be a notable error. The form requests information on the employee’s health insurance status, which can be essential for understanding their benefits. Missing this data complicates the assessment of state assistance eligibility.

When asked about required changes in the future, some forget to answer the question regarding expected changes to the above information. Clarity here helps to avoid misunderstandings later on, so taking the time to provide comprehensive responses remains important.

Contrarily, another mistake people can make is including too much information, which can overwhelm or confuse the reviewers. Providing only the necessary details without unnecessary elaboration simplifies the verification process.

Once completed, the form needs to be signed and dated by the employer. Some individuals neglect to sign or omit their title, which can invalidate the form. Failing this step means the verification will not be processed, prolonging the employee's wait for benefits.

Finally, not adhering to the submission instructions can lead to delays. Whether the form is sent via mail or fax, following the correct process is critical. Using the designated means of submission simplifies the handling of the request and ensures it reaches the right destination without unnecessary delay.

Documents used along the form

When completing the Texas Employment Verification form, several other documents might be needed to support the employment verification process. Below is a list of commonly used forms and documents that provide necessary information regarding an employee's work status and benefits.

- Employee's Pay Stub: This document shows the employee's earnings and deductions for a specific pay period and can offer insights into their pay structure.

- W-2 Form: A summary of an employee's annual wages and taxes withheld, the W-2 is essential for confirming income and employment history.

- IRS Form 4506-T: This form allows individuals to request a transcript of their tax return, which can substantiate income claims made by the employee.

- Employment Contract: A document outlining the terms of employment, including job responsibilities and compensation, useful for verifying employment agreements.

- Social Security Card: The card serves as proof of the employee's eligibility to work and can be used alongside employment verification.

- Benefits Enrollment Form: This shows the employee's current benefits status, which might be relevant if the employer needs to confirm health insurance availability.

- Termination Letter: If applicable, this document updates the status of employment termination and can clarify the reasons and terms behind it.

- Direct Deposit Authorization Form: This form indicates how an employee receives payment, providing additional context to the verification of their employment.

- Job Description: Provides details about the responsibilities and expectations of the employee’s role, assisting in understanding the nature of their employment.

- Time Cards or Timesheets: These records provide a history of hours worked and can verify actual attendance and work periods for payroll audits.

Utilizing these documents in conjunction with the Texas Employment Verification form can ensure a thorough understanding of an employee’s work status, income, and benefits. Gathering and reviewing this information can facilitate accurate assessments and support claims related to employment and financial assistance programs.

Similar forms

-

W-2 Form: This document provides information about an employee's annual wages and the taxes withheld. Similar to the Texas Employment Verification form, it requires employer confirmation of employment details, including income.

-

I-9 Form: Used to verify an employee's identity and eligibility to work in the U.S., the I-9 form also requires employers to confirm the employment status of individuals, akin to the requirements of the Employment Verification form.

-

Pay Stub: This document shows an employee’s earnings for a specific pay period, including hours worked and deductions. Like the Employment Verification form, it helps establish proof of income to various entities.

-

Employment Confirmation Letter: A letter from an employer verifying the details of a current or former employee’s job. This format parallels the Texas Employment Verification form as it seeks to affirm employment status and income.

-

State Unemployment Insurance (UI) Benefits Verification: This document verifies income and employment history for the purpose of applying for unemployment benefits. It shares the same goal of confirming employment details as the Texas Employment Verification form.

Dos and Don'ts

When filling out the Texas Employment Verification form, consider the following guidelines:

- Do: Print clearly and legibly to ensure readability.

- Do: Provide accurate and complete information about the employee.

- Do: Sign and date the form to confirm the provided information is correct.

- Do: Return the form promptly using the provided methods (mail, fax, or in-person).

- Don't: Leave any required fields blank; mark them as "N/A" if not applicable.

- Don't: Use abbreviations that may confuse the reader; write out full terms.

Misconceptions

-

Misconception: The form is optional for employers. Many people believe that employers can choose to ignore the Texas Employment Verification form. In reality, employers are required to complete it when requested by the Texas Health and Human Services Commission (HHSC) in connection with a state benefits application.

-

Misconception: The employee must complete the entire form. Some assume that employees are responsible for filling out the whole form. However, the employee is only required to provide their name, signature, and consent for information sharing. The employer fills out the rest of the form.

-

Misconception: Employers cannot use the SSN for verification purposes. A common belief is that providing a Social Security number (SSN) to an employer is unnecessary or risky. In fact, the form clearly states that employees needs to authorize employers to use their SSN for employment verification related to state benefits.

-

Misconception: The form is only for current employees. Many think the form is applicable solely to current employees. However, it can also apply to former employees when verifying past employment for state assistance benefits.

-

Misconception: Employers can take too long to submit the form. Some believe that there are no deadlines for submitting the Employment Verification form. In truth, employers must return the completed form promptly, as delays can affect the employee's eligibility for benefits.

Key takeaways

Filling out and using the Texas Employment Verification form requires attention to detail and accuracy. Here are key takeaways to ensure the process is smooth.

- This form is designed for employers to provide verification of an employee's work history or current employment status.

- Both the employee and employer must agree to share necessary personal information, including the employee's Social Security Number (SSN).

- Employers should ensure that they complete the “Proof of Employment” section thoroughly, addressing all relevant questions.

- If a question does not apply, it is important to mark it with “N/A” to avoid delays in processing.

- There are multiple options for returning the completed form: hand it to the employee, mail it in a pre-paid envelope, or fax it.

- Employers are required to provide accurate information, such as the type of job, pay rate, and hours worked.

- If the employee is not currently employed, the employer should still fill out the relevant sections and indicate the reason for separation.

- It is crucial for employers to sign and date the form, confirming the information provided is true and correct.

Following these guidelines will help facilitate the verification process and ensure timely receipt of state benefits for the employee in question.

Browse Other Templates

Audition Forms - We hope to learn about your unique skills and experiences.

Fort Hood Vehicle Safety Checklist,III Corps Vehicle Examination Form,Fort Hood Auto Compliance Report,Fort Hood Vehicle Inspection Report,III Corps Motor Vehicle Assessment,Fort Hood Driver Safety Evaluation,Fort Hood Vehicle Condition Survey,III Co - Information required on the form is straightforward and clear.

Form 2055 - Subject property and comparable sales are evaluated based on exterior observations and public records.