Fill Out Your Texas 00 132 Form

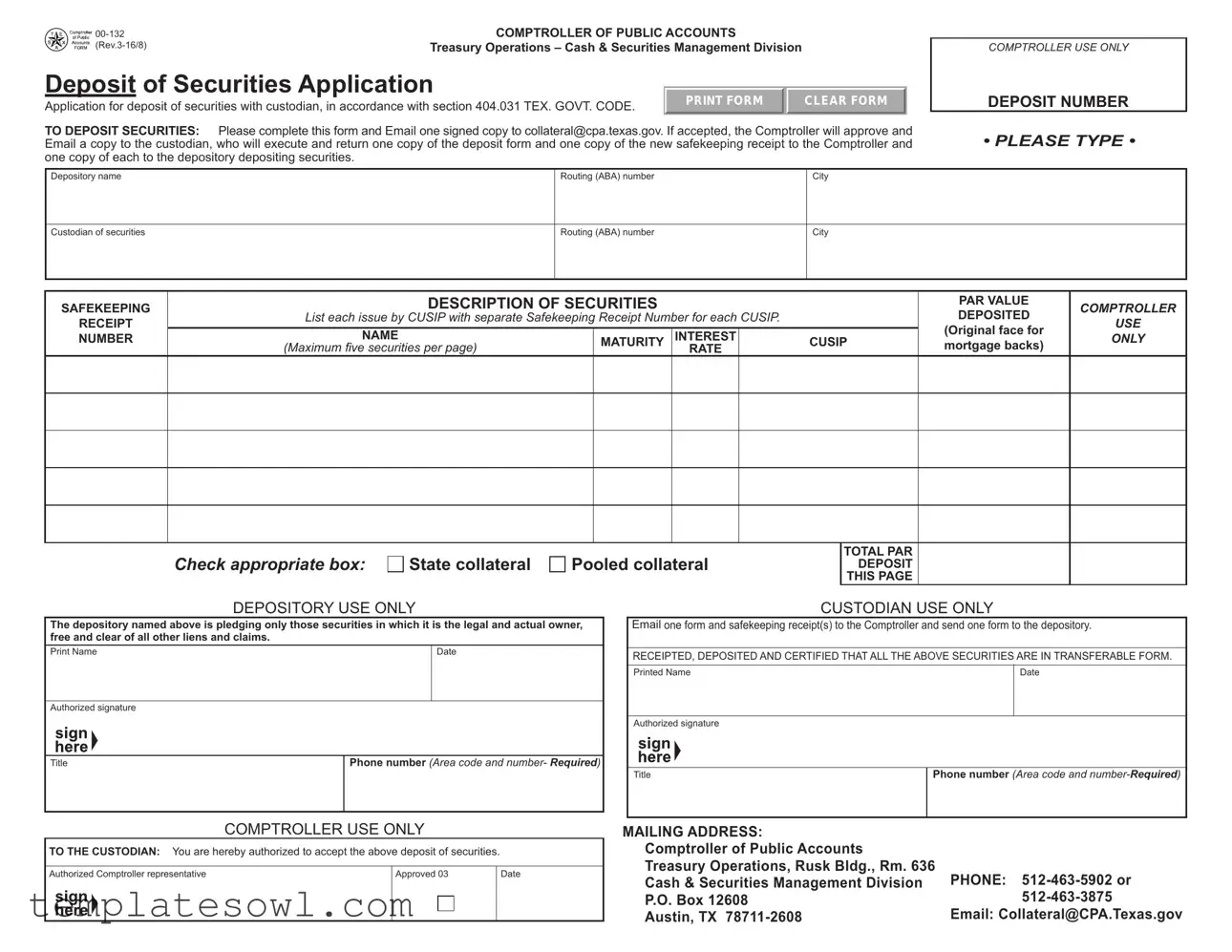

The Texas 00-132 form serves as an essential tool for financial institutions seeking to deposit securities with a custodian. This application adheres to the legal framework set forth in section 404.031 of the Texas Government Code. Completing this form requires careful attention to several key details, including the identification of the depository, the custodian, and comprehensive descriptions of the securities intended for deposit. Each security must be listed by its unique CUSIP number, along with pertinent attributes such as maturity date, interest rate, and par value. While submitting the form, the depository must assert its ownership of the securities, confirming they are free from any liens or claims. After processing, an authorized representative from the Comptroller will provide approval and relay the necessary documentation back to the custodian, ensuring a smooth transaction. Accurate completion of the Texas 00-132 form not only guarantees compliance but also facilitates effective cash and securities management in Texas's financial landscape.

Texas 00 132 Example

COMPTROLLER OF PUBLIC ACCOUNTS |

|

Treasury Operations – Cash & Securities Management Division |

Deposit of Securities Application

Application for deposit of securities with custodian, in accordance with section 404.031 TEX. GOVT. CODE. |

PRINT FORM |

CLEAR FORM |

|

|

TO DEPOSIT SECURITIES: Please complete this form and Email one signed copy to collateral@cpa.texas.gov. If accepted, the Comptroller will approve and Email a copy to the custodian, who will execute and return one copy of the deposit form and one copy of the new safekeeping receipt to the Comptroller and one copy of each to the depository depositing securities.

COMPTROLLER USE ONLY

DEPOSIT NUMBER

• PLEASE TYPE •

Depository name

Routing (ABA) number

City

Custodian of securities

Routing (ABA) number

City

SAFEKEEPING

RECEIPT

NUMBER

DESCRIPTION OF SECURITIES

List each issue by CUSIP with separate Safekeeping Receipt Number for each CUSIP.

NAME |

MATURITY |

INTEREST |

CUSIP |

(Maximum five securities per page) |

|

RATE |

|

PAR VALUE

DEPOSITED

(Original face for mortgage backs)

COMPTROLLER

USE

ONLY

Check appropriate box: |

State collateral |

Pooled collateral |

TOTAL PAR DEPOSIT THIS PAGE

DEPOSITORY USE ONLY

The depository named above is pledging only those securities in which it is the legal and actual owner, free and clear of all other liens and claims.

Print Name |

Date |

|

|

Authorized signature

Title |

Phone number (Area code and number- Required) |

|

|

COMPTROLLER USE ONLY

TO THE CUSTODIAN: You are hereby authorized to accept the above deposit of securities.

Authorized Comptroller representative |

Approved 03 |

Date |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSTODIAN USE ONLY

Email one form and safekeeping receipt(s) to the Comptroller and send one form to the depository.

RECEIPTED, DEPOSITED AND CERTIFIED THAT ALL THE ABOVE SECURITIES ARE IN TRANSFERABLE FORM.

Printed Name |

|

Date |

||

|

|

|

|

|

Authorized signature |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

Phone number (Area code and |

|||

|

|

|

|

|

MAILING ADDRESS: |

|

Comptroller of Public Accounts |

|

Treasury Operations, Rusk Bldg., Rm. 636 |

PHONE: |

Cash & Securities Management Division |

|

P.O. Box 12608 |

|

Austin, TX |

Email: Collateral@CPA.Texas.gov |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used to apply for a deposit of securities with a custodian. |

| Governing Law | The application follows section 404.031 of the Texas Government Code. |

| Submission Method | Signed forms must be emailed to collateral@cpa.texas.gov. |

| Comptroller's Role | After accepting the application, the Comptroller will approve it and send a copy to the custodian. |

| Information Required | Depository name, ABA routing number, custodian details, and securities information must be provided. |

| Limitation on Securities | The form allows a maximum of five securities per page, listed by their CUSIP numbers. |

| Contact Information | The Comptroller's office can be reached at 512-463-5902 for any inquiries. |

Guidelines on Utilizing Texas 00 132

To properly complete the Texas 00 132 form, it is essential to follow the outlined steps carefully. After filling out the form, it should be emailed to the designated email address for further processing.

- Obtain the latest version of the Texas 00 132 form.

- Type the depository name in the designated field at the top of the form.

- Enter the Routing (ABA) number associated with the depository.

- Fill in the city where the depository is located.

- Indicate the name of the custodian of the securities.

- Provide the Routing (ABA) number of the custodian.

- Enter the city where the custodian is located.

- Note the Safekeeping Receipt Number provided by the custodian.

- List each issue of securities by CUSIP, including the maximum of five securities on the page.

- For each security, complete the following details:

- Name of the security

- Maturity date

- Interest rate

- CUSIP identification number

- Par value deposited (original face value for mortgage-backed securities)

- Select the appropriate box to denote whether the deposit is state collateral or pooled collateral.

- Calculate and total the par value deposited on this page.

- Print your name and date the form in the designated area.

- Provide your authorized signature, job title, and phone number (with area code) in the specified sections.

- Email one signed copy of the completed form to collateral@cpa.texas.gov.

What You Should Know About This Form

What is the Texas 00 132 form used for?

The Texas 00 132 form is an application used for the deposit of securities with a custodian. It is designed to ensure that the deposit complies with section 404.031 of the Texas Government Code, allowing depositories to pledge securities safely. This form is essential for managing cash and securities effectively within Texas state operations.

How do I submit the Texas 00 132 form?

To submit the Texas 00 132 form, complete all required sections and email one signed copy to collateral@cpa.texas.gov. Ensure that all details, including the routing numbers and descriptions of the securities, are accurate. After the Comptroller reviews and approves your application, they will email a copy back to you and to the custodian for further processing.

What information must be included on the Texas 00 132 form?

You must provide detailed information about the depository, including the name and routing number. Additionally, specify the custodian of the securities, the description of the securities using their CUSIP numbers, maturity dates, interest rates, and the total par value deposited. It is important to fully disclose each issue, ideally with a separate safekeeping receipt number for each CUSIP.

What happens after I submit the Texas 00 132 form?

Once submitted, the Comptroller's office will review your application. If approved, they will send an email confirmation to the custodian, who will then execute and return a copy of the deposit form along with a safekeeping receipt. You will receive one copy of both documents for your records. This process ensures the proper acknowledgment and safeguarding of your deposited securities.

Common mistakes

Filling out the Texas 00-132 form can be straightforward, but certain mistakes can complicate the process. One common error occurs when applicants fail to provide accurate routing numbers. Routing numbers are critical for identifying the financial institution involved in the transaction. If the routing number for either the depository or custodian is incorrect, it can lead to delays or even rejection of the application.

Another frequent mistake involves the incomplete listing of securities. Each security must be listed by its CUSIP number along with details such as maturity date, interest rate, and par value. Omitting any of these details can make it difficult for the Comptroller's office to process the application efficiently. It is essential to verify that each entry is correct and complete before submitting the form.

Some applicants overlook the necessity of a signature from an authorized representative. Without this signature, the form is not valid. The authorized representative must also include their printed name, title, and a valid phone number. Failing to include these details can result in the application being set aside.

Another area where mistakes often occur is the selection of the collateral type. The applicant must check the appropriate box indicating whether they are pledging state or pooled collateral. Misunderstanding these categories can lead to incorrect submissions and further complications.

Furthermore, ensuring that the information is typed rather than handwritten is crucial. The form specifically requests that applicants type their entries. Handwritten submissions can be difficult to read and may result in misunderstandings or errors in processing. Always use a computer or typewriter to fill out the form.

Lastly, some applicants neglect the emailing instructions. It is vital to send one signed copy to the designated email address provided on the form. Missing this step can slow down the entire process, as the Comptroller's office will not have the necessary paperwork to review. Following these steps carefully can help ensure a smooth and efficient application process.

Documents used along the form

The Texas 00 132 form is essential for depositing securities with a custodian in Texas. When dealing with financial transactions, several other documents might be necessary to ensure compliance and proper record-keeping. Below are a few key forms that are commonly used alongside the Texas 00 132 form.

- Safekeeping Receipt: This document serves as proof that the securities have been deposited with the custodian. It details the type of securities, their values, and confirms the safe-keeping arrangement. This receipt is crucial for both verification and future reference.

- Depository Agreement: This contract outlines the terms of the relationship between the depository and custodian regarding the management of the deposited securities. It specifies responsibilities, liabilities, and the procedures for handling the deposited assets.

- Collateral Agreement: If the securities are being used as collateral, this agreement is necessary to define the terms and conditions under which the collateral is pledged. It ensures that both parties understand the obligations related to the collateralized securities.

- Notice of Deposit: This is a formal notification to the involved parties that securities have been deposited. It ensures that all stakeholders are informed and can take appropriate action regarding the deposited securities.

These documents work together to provide a comprehensive framework for managing securities and ensure compliance with relevant regulations. Proper organization and timely completion of each form aid in maintaining financial integrity and security.

Similar forms

Deposit Account Agreement: Similar to the Texas 00 132 form, a Deposit Account Agreement outlines the terms and conditions for depositing assets into a financial institution. This document defines the roles and responsibilities of both the depositor and the bank, much like how the Texas form specifies the handling and management of deposited securities.

Securities Transfer Form: This form facilitates the transfer of securities from one entity to another. It serves a similar purpose as the Texas 00 132 by documenting the transaction and ensuring compliance with relevant regulations.

Custodial Agreement: A Custodial Agreement establishes a relationship between the custodial entity and the depositor regarding the safekeeping of assets. This document is akin to the Texas 00 132 in that it specifies the custodial responsibilities and ensures the protection of the securities held.

Collateral Agreement: This agreement outlines the terms under which collateral is provided to secure a loan or obligation. Just like the Texas 00 132 form, it necessitates detailed descriptions of the collateral being pledged, including specifics like CUSIP numbers and valuation.

Form for Pledge of Securities: Similar in purpose, this form is used when an entity pledges securities as collateral for a financial obligation. It requires detailed disclosures about the pledged securities, mirroring the requirements of the Texas 00 132.

Investment Management Agreement: This document delineates the terms between a client and an investment manager. Both documents emphasize the importance of proper documentation and management of financial assets, albeit in different contexts.

Brokerage Account Application: The application to open a brokerage account collects information on existing securities to be managed by a brokerage firm. Like the Texas form, it often requires similar details on each security for compliance and operational purposes.

Loan Agreement with Collateral Documentation: This type of agreement stipulates the terms under which a loan is secured by specific securities. It is parallel to the Texas 00 132 form as both involve the obtainment and documentation of securities as collateral.

Dos and Don'ts

When completing the Texas 00 132 form, keeping several key points in mind can ensure a smoother process. The following list outlines important dos and don’ts.

- Do: Read the entire form carefully before filling it out.

- Do: Complete all required fields to avoid delays.

- Do: Use the correct routing numbers for your depository and custodian.

- Do: List securities by CUSIP, providing a separate safekeeping receipt number for each.

- Do: Ensure accuracy in the description of securities, including maturity dates and interest rates.

- Do: Sign the form in the designated area to validate your submission.

- Do: Email a signed copy to the specified collateral email address.

- Do: Keep copies of all submitted documents for your records.

- Do: Contact the Comptroller’s office if you have questions before submitting.

- Do: Follow up after submission to confirm receipt and status.

- Don't: Leave any mandatory fields blank.

- Don't: Submit the form without a proper review, as mistakes may lead to rejection.

- Don't: Use outdated versions of the form; ensure you have the most current revision.

- Don't: Forget to confirm that all securities listed are in transferable form.

- Don't: Rely solely on electronic submissions without obtaining confirmation from the Comptroller.

- Don't: Misrepresent ownership of the securities pledged.

- Don't: Ignore submission deadlines and requirements set by the Comptroller’s office.

- Don't: Provide inaccurate contact information that may hinder follow-up.

- Don't: Submit the form without an authorized signature.

- Don't: Hesitate to seek assistance if you are unsure about any part of the form or process.

Misconceptions

- Anyone can use the Texas 00 132 form at any time. This form is specifically for governmental entities and non-profits that wish to deposit securities with a custodian.

- Submitting the form guarantees acceptance. The submission of the form does not guarantee that the Securities will be accepted. The Comptroller of Public Accounts reviews each application to determine acceptance.

- Only a single security can be deposited at a time. In fact, you can list up to five securities per page on the form. Each security must be identified by its unique CUSIP number.

- The form is only for cash deposits. This form is specifically for the deposit of securities, not cash. Ensure you understand the type of assets you are dealing with.

- There’s no need for a custodian to be involved. A custodian is essential in this process. The custodian accepts the securities and is responsible for holding them safely.

- Using the form is a complicated process. While there are several steps, the process is straightforward. Fill out the form, email it as instructed, and wait for confirmation from the Comptroller's office.

- A hard copy submission is required. You can submit the form electronically by emailing a signed copy to the specified email address. A hard copy is not mandatory for the initial submission.

- Once submitted, changes cannot be made. If you need to make changes after submitting, contact the Comptroller’s Office for guidance on how to proceed.

Key takeaways

The Texas 00-132 form is essential for the deposit of securities with a custodian. Here are nine key takeaways to understand its purpose and usage:

- Application Purpose: The form serves as an application to deposit securities under section 404.031 of the Texas Government Code.

- Submission Process: To complete the process, email one signed copy of the form to collateral@cpa.texas.gov.

- Approval Notification: If the deposit is accepted, the Comptroller will approve the form and send a copy to the custodian.

- Custodian's Role: The custodian must execute the deposit form and return it along with a new safekeeping receipt to the Comptroller.

- Information Required: Fill in details such as depository name, routing number, custodian information, and specifics about the securities.

- Securities Listing: Each security must be listed by its CUSIP, with a separate safekeeping receipt number provided for each.

- Authorized Signatures: The form must be signed by an authorized individual from the depository, including their title and contact information.

- Custodian Authorization: The custodian is specifically authorized to accept the securities deposit as indicated on the form.

- Contact Information: The Comptroller's contact details are provided for any questions or clarifications regarding the process.

Browse Other Templates

Essentials of Firefighting 6th Edition - A Quantitative Fit Test (QNFT) measures the effectiveness of a respirator's fit with numerical data.

Food Depot Job Application Pdf - List the name and details of the school you attended.