Fill Out Your Texas 01 924 Form

The Texas Agricultural Sales and Use Tax Exemption Certificate, commonly referred to as Form 01-924, plays a critical role for commercial agricultural producers in Texas. This form allows eligible individuals and entities to claim an exemption from state sales and use tax on specific agricultural purchases that are intended for exclusive use in producing goods for sale. Producers must complete this certificate properly, providing their ag/timber number and ensuring the items fall within the qualifying categories. It is important to note that not all purchases qualify for this exemption; for instance, purchases related to motor vehicles must adhere to a different set of requirements, necessitating the Texas Motor Vehicle Tax Exemption Certificate for Agricultural and Timber Operations. Certain agricultural items, such as work animals and animal feed, are always exempt and do not require this certificate. Conversely, improper use of the exemption certificate can lead to severe penalties, highlighting the necessity for producers to understand which items are eligible. By documenting their sales tax exemptions through Form 01-924, agricultural producers not only ensure compliance but also contribute to the broader economic framework of Texas’ agricultural sector.

Texas 01 924 Example

PRINT FORM |

CLEAR FORM |

|

|

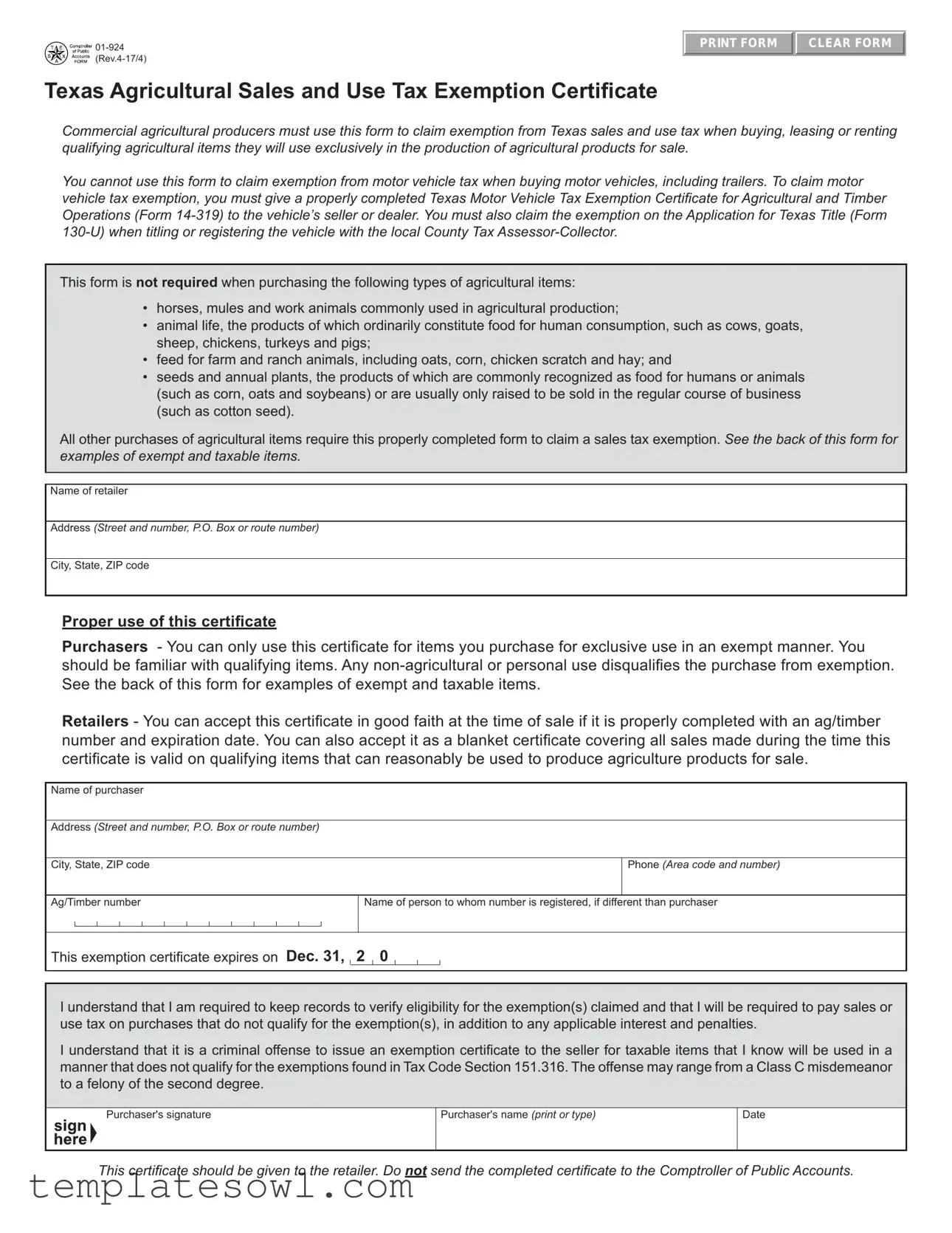

Texas Agricultural Sales and Use Tax Exemption Certificate

Commercial agricultural producers must use this form to claim exemption from Texas sales and use tax when buying, leasing or renting qualifying agricultural items they will use exclusively in the production of agricultural products for sale.

You cannot use this form to claim exemption from motor vehicle tax when buying motor vehicles, including trailers. To claim motor vehicle tax exemption, you must give a properly completed Texas Motor Vehicle Tax Exemption Certificate for Agricultural and Timber Operations (Form

This form is not required when purchasing the following types of agricultural items:

•horses, mules and work animals commonly used in agricultural production;

•animal life, the products of which ordinarily constitute food for human consumption, such as cows, goats, sheep, chickens, turkeys and pigs;

•feed for farm and ranch animals, including oats, corn, chicken scratch and hay; and

•seeds and annual plants, the products of which are commonly recognized as food for humans or animals (such as corn, oats and soybeans) or are usually only raised to be sold in the regular course of business (such as cotton seed).

All other purchases of agricultural items require this properly completed form to claim a sales tax exemption. See the back of this form for examples of exempt and taxable items.

Name of retailer

Address (Street and number, P.O. Box or route number)

City, State, ZIP code

Proper use of this certificate

Purchasers - You can only use this certificate for items you purchase for exclusive use in an exempt manner. You should be familiar with qualifying items. Any

Retailers - You can accept this certificate in good faith at the time of sale if it is properly completed with an ag/timber number and expiration date. You can also accept it as a blanket certificate covering all sales made during the time this certificate is valid on qualifying items that can reasonably be used to produce agriculture products for sale.

Name of purchaser

Address (Street and number, P.O. Box or route number)

City, State, ZIP code

Phone (Area code and number)

Ag/Timber number

Name of person to whom number is registered, if different than purchaser

This exemption certificate expires on Dec. 31, 2 0

I understand that I am required to keep records to verify eligibility for the exemption(s) claimed and that I will be required to pay sales or use tax on purchases that do not qualify for the exemption(s), in addition to any applicable interest and penalties.

I understand that it is a criminal offense to issue an exemption certificate to the seller for taxable items that I know will be used in a manner that does not qualify for the exemptions found in Tax Code Section 151.316. The offense may range from a Class C misdemeanor to a felony of the second degree.

Purchaser's signature

Purchaser's name (print or type)

Date

This certificate should be given to the retailer. Do not send the completed certificate to the Comptroller of Public Accounts.

Form

Always Exempt

These items are always exempt and do not require an exemption certificate or an ag/timber number.

•Horses, mules and work animals commonly used in agricultural production;

•Animal life, the products of which ordinarily constitute food for human consumption, such as cattle, goats, sheep, chickens, turkeys and hogs;

•Feed such as oats, hay, chicken scratch, wild bird seed and deer corn for livestock and wild game (pet food is not exempt); and

•Seeds and annual plants, the products of which are commonly recognized as food for humans or animals, such as corn, oats and soybeans or for fiber, such as cotton seed.

Exempt

Here are examples of items that are exempt from sales tax when used exclusively on a farm or ranch to produce agricultural products for sale and pur- chased by a person with a current ag/timber number.

Air tanks

Augers

Bale transportation equipment

Baler twine

Baler wrap

Balers

Binders

Branding irons

Brush hogs Bulk milk coolers Bulk milk tanks

Calf weaners and feeders

Cattle currying and oiling machines

Cattle feeders

Chain saws used for clearing fence lines or pruning orchards

Choppers

Combines

Conveyors

Corn pickers

Corral panels

Cotton pickers, strippers

Crawlers – tractors

Crushers

Cultipackers

Discs

Drags

Dryers

Dusters

Egg handling equipment

Ensilage cutters

Farm machinery and repair or replacement parts

Farm tractors Farm wagons

Farrowing houses (portable and crates)

Feed carts

Feed grinders

Feeders

Fertilizer

Fertilizer distributors

Floats for water troughs

Foggers

Forage boxes

Forage harvesters

Fruit graters

Fruit harvesters

Grain binders

Grain bins

Grain drills

Grain handling equipment

Greases, lubricants and oils for qualifying farm machinery and equipment

Harrows

Head gates

Hoists

Husking machines

Hydraulic fluid

Irrigation equipment

Manure handling equipment Manure spreaders Milking equipment

Mowers (hay and rotary blade)

Pesticides

Pickers

Planters Poultry feeders

Poultry house equipment

Pruning equipment

Rollbar equipment Rollers

Root vegetable harvesters

Rotary hoes

Salt stands

Seed cleaners

Shellers

Silo unloaders

Soilmovers used to grade farmland

Sorters

Sowers

Sprayers

Spreaders

Squeeze chutes

Stalls

Stanchions

Subsoilers

Telecommunications services used to navigate farm machinery and equipment*

Threshing machines Tillers

Tires for exempt equipment Troughs, feed and water

Vacuum coolers

Vegetable graders

Vegetable washers

Vegetable waxers

* As of Sept. 1, 2015, telecommunications services used to navigate farm machinery and equipment are exempt.

Taxable

These items DO NOT qualify for sales and use tax exemption for agricultural production.

•Automotive parts, such as tires, for vehicles licensed for highway use, even if the vehicle has farm plates

•Clothing, including work clothing, safety apparel and shoes

•Computers and computer software used for any purposes other than agricultural production

•Furniture, home furnishings and housewares

•Golf carts, dirt bikes, dune buggies and

•Guns, ammunition, traps and similar items

*See

•Materials used to construct roads or buildings used for shelter, housing, storage or work space (examples include general storage barns, sheds or shelters)

•Motor vehicles and trailers*

•Pet food

•Taxable services such as nonresidential real property repairs or remodeling, security services, and waste removal

Tax Help: www.comptroller.texas.gov/taxes/ = Window on State Government: www.comptroller.texas.gov

Tax Assistance:

Sign up to receive email updates on the Comptroller topics of your choice at www.comptroller.texas.gov/subscribe.

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Texas 01-924 form is used by commercial agricultural producers to claim exemption from sales and use tax on qualifying agricultural items used exclusively in the production of agricultural products for sale. |

| Exemption Limitations | This form does not apply to motor vehicle tax exemptions. For such exemptions, a different form (Texas Motor Vehicle Tax Exemption Certificate for Agricultural and Timber Operations - Form 14-319) must be used. |

| Qualifying Items | Items such as horses, mules, certain feeds, and seeds are always exempt from sales tax without needing the exemption certificate. |

| Required Information | The form must be properly filled out with the purchaser's name, ag/timber number, and expiration date to be valid. Retailers can accept the form in good faith if it's completed correctly. |

| Governing Law | The use and guidelines for this exemption certificate are governed by Texas Tax Code Section 151.316. |

Guidelines on Utilizing Texas 01 924

Completing the Texas 01 924 form correctly is essential for agricultural producers to certify their eligibility for sales tax exemptions. This process involves providing necessary information about the purchaser, the retailer, and the specific purchase intended for agricultural use. Follow these steps to ensure accurate completion of the form.

- Obtain the Texas 01 924 form from the Texas Comptroller's website or any authorized source.

- Begin by filling out the Name of retailer section with the retailer’s name.

- Enter the retailer’s Address (Street and number, P.O. Box, or route number) in the corresponding field.

- Fill in the City, State, ZIP code for the retailer.

- Proceed to the Name of purchaser section and enter your name as the purchaser.

- In the Address field of the purchaser, provide your Street address, P.O. Box, or route number.

- Include the City, State, ZIP code for your address.

- Enter your Phone number (Area code and number).

- Fill in your Ag/Timber number in the relevant space.

- If applicable, provide the Name of person to whom number is registered, if different from the purchaser.

- Note the expiration date of the certificate (default is Dec. 31 of the current year) and fill it in.

- Read the acknowledgment about recordkeeping and penalties. Ensure that you are fully aware of the consequences of improper use.

- Sign the form in the Purchaser's signature section.

- Print or type your name under the Purchaser's name section.

- Fill in the Date on which you are completing the form.

- Submit the completed form to the retailer at the time of purchase; do not send it to the Comptroller of Public Accounts.

What You Should Know About This Form

What is the purpose of the Texas 01 924 form?

The Texas 01 924 form, also known as the Texas Agricultural Sales and Use Tax Exemption Certificate, is specifically designed for commercial agricultural producers. This form allows them to claim exemption from Texas sales and use tax when purchasing, leasing, or renting qualifying agricultural items that will be used exclusively for producing agricultural products for sale. It is essential to understand that this form cannot be used for motor vehicle tax exemption; a separate form is required for that purpose.

What items are exempt from sales tax when using the Texas 01 924 form?

Items eligible for exemption under the Texas 01 924 form include a wide range of equipment and supplies utilized in agricultural production. Some common examples of exempt items are farm machinery, feed for livestock, and agricultural tools. However, it is important to note that any purchase intended for personal use or non-agricultural purposes disqualifies that item from tax exemption. The form includes guidance on many specific items that are exempt, ensuring you can accurately identify qualifying purchases.

Who is responsible for completing the Texas 01 924 form?

The responsibility of completing the Texas 01 924 form falls on the purchaser. It is crucial for the buyer to fill out the form accurately, providing necessary information such as their agricultural/timber number, name, and address. Retailers can accept the completed form in good faith if it includes a valid ag/timber number and expiration date. This creates a mutual understanding of the transaction's nature and compliance with Texas tax regulations.

What are the consequences of misusing the Texas 01 924 form?

Using the Texas 01 924 form incorrectly can result in serious penalties. If a purchaser issues this exemption certificate for items they know will not be used for exempt purposes, they may face legal consequences ranging from a Class C misdemeanor to a felony of the second degree. It is paramount for all parties involved to maintain accurate records and ensure eligibility for any claimed exemptions to avoid these penalties.

Common mistakes

Filling out the Texas 01-924 form requires attention to detail. A common mistake occurs when purchasers fail to understand the items that qualify for exemption. Users often submit the form for items that do not fit the exemption criteria. Always check the list of exempt items to avoid misunderstandings and ensure that every item listed on the form is used strictly for agricultural purposes.

Another frequent error is neglecting to provide the Ag/Timber number. Without this crucial identifier, the form cannot be processed correctly. This number validates your status as a commercial agricultural producer, confirming your eligibility for the tax exemption. Double-check that you have included it accurately before submitting your certificate.

Many people also overlook the expiration date on the certificate. The form clearly states that the exemption certificate expires on December 31 of the designated year. Submitting an expired form renders the exemption invalid, leading to unnecessary tax liabilities.

Inaccurate or incomplete information is a common pitfall. Fill in all required details, including the names, addresses, and signature of the purchaser. A missing signature or an improperly printed name could jeopardize the validity of the certificate.

It's essential to understand that this form is not a catch-all for every agricultural purchase. Some items, like horses, feed, and seeds, are always exempt, meaning they do not require this form. Misunderstanding this aspect can lead to unnecessary paperwork.

Skipping the instructions on the back of the form can also create issues. The back contains vital information about excluded and included items. Thoroughly review these details to ensure compliance and accurate completion of your exemption certificate.

Retailers make mistakes, too. Accepting the Texas 01-924 form in good faith without verifying that it’s filled out completely can lead to complications. Retailers should always confirm that the purchaser has a valid Ag/Timber number and is aware of the specifics regarding eligible items.

Purchasers might also forget to keep their records. You are required to maintain documentation proving your eligibility for exemptions claimed. Lack of proper records can result in penalties or interest charges on future audits.

Filing this form incorrectly can lead to significant consequences, including exposure to criminal liabilities if it is used to claim exemptions on taxable items knowingly. Therefore, ensure every step of the submission process is handled with care and precision.

Documents used along the form

When navigating the intricacies of agricultural sales and use tax exemptions in Texas, several documents accompany the Texas 01-924 form. Each plays a crucial role in ensuring proper tax compliance and facilitating the exemption process for agricultural producers. Understanding these forms helps clarify the specifics of what is exempt and what is not. Here is a list of the key documents often utilized alongside the Texas 01-924 form.

- Texas Motor Vehicle Tax Exemption Certificate for Agricultural and Timber Operations (Form 14-319): This certificate is essential for claiming tax exemptions on vehicles used directly for agricultural and timber operations. Unlike the 01-924 form, it applies specifically to automotive purchases.

- Application for Texas Title (Form 130-U): This form is necessary when titling or registering a vehicle in Texas. A properly completed exemption certificate for motor vehicles must be submitted alongside this application to verify tax exemption.

- Texas Agricultural and Timber Registration (Form 01-302): This registration form is required for individuals or entities to obtain their ag/timber number. This number is pivotal for claiming sales tax exemptions on qualifying agricultural purchases.

- Exempt Use Certificate (Form 01-339): This certificate is utilized by purchasers to claim exemption from sales tax on items they acquire for exempt use. It outlines goods intended solely for agricultural use, aligning closely with the intent of the 01-924 form.

- Texas Sales and Use Tax Return (Form 01-114): Agricultural producers must file this return periodically. It reports any taxable sales and claims exempt sales, helping maintain transparency and compliance with tax laws.

- Texas Agricultural Products Tax Exemption Certificate (Form 14-295): This document applies to individuals purchasing agricultural products for resale. It allows vendors to claim an exemption on items directly related to their agricultural ventures.

By utilizing these forms correctly and understanding their functions, agricultural producers can navigate the sales and use tax landscape more effectively. Each document is integral to maintaining compliance and ensuring that exemptions are appropriately claimed, contributing to a smoother operation within the agricultural sector.

Similar forms

-

Texas Motor Vehicle Tax Exemption Certificate for Agricultural and Timber Operations (Form 14-319): This form is essential for claiming an exemption from the motor vehicle sales tax when purchasing vehicles for agricultural operations. Similar to the Texas 01 924, it provides tax relief for items used solely in production, but it is specifically tailored to vehicle transactions.

-

Application for Texas Title (Form 130-U): This document is used when titling or registering a vehicle. It requires an exemption claim if the vehicle falls under agricultural use. Like the 01 924, it necessitates information about the intended use of the vehicle to ensure it meets exemption criteria.

-

Texas Agricultural and Timber Use Tax Exemption Certificate (Form 14-319A): This certificate is meant for agricultural producers to claim sales tax exemption on items related to timber operations. It shares a similar purpose with the Texas 01 924 in certifying eligible purchases when utilized exclusively for agricultural activities.

-

Texas Sales and Use Tax Resale Certificate (Form 01-339): This document allows businesses to purchase items without paying sales tax if those items are intended for resale. Both forms focus on tax exemptions, although the resale certificate is geared toward businesses rather than agricultural producers only.

Dos and Don'ts

When filling out the Texas 01 924 form, it’s important to adhere to certain guidelines to ensure the process goes smoothly. Below is a list of dos and don’ts to help you navigate this essential certificate.

- Do ensure you are a qualified agricultural producer who intends to use the items solely for agricultural purposes.

- Do provide complete and accurate information, including your ag/timber number and expiration date.

- Do submit the form directly to the retailer, avoiding any unnecessary delays.

- Do keep a copy of the completed exemption certificate for your records.

- Do understand which items are exempt from sales tax as outlined on the form.

- Don't use the form for purchases such as motor vehicles; a different form is required for those transactions.

- Don't use the exemption certificate for personal use or non-agricultural purposes.

- Don't forget that providing false information can lead to serious criminal charges.

- Don't send the completed certificate to the Comptroller of Public Accounts; it should only go to the retailer.

Following these guidelines will assist you in successfully claiming your sales and use tax exemptions in Texas.

Misconceptions

The Texas 01-924 form is essential for agricultural sales and use tax exemptions, but misconceptions can lead to confusion. Here are four common misunderstandings:

- All agricultural purchases qualify for exemption. This form only applies to certain purchases. Items like feed, seeds, and animals used in production are exempt without the form. Understanding the specifics is crucial.

- This form can be used for motor vehicle tax exemptions. The Texas 01-924 form cannot be used to claim exemptions for motor vehicle taxes. For vehicle exemptions, a different form, the Texas Motor Vehicle Tax Exemption Certificate (Form 14-319), is required.

- Exempt purchases can be for any use. A purchase must be exclusively for agricultural production to qualify for the exemption. Any personal or non-agricultural use disqualifies the purchase.

- Once submitted, there’s no need to keep records. It's essential to maintain records to verify eligibility for any claimed exemptions. This includes proof of purchase and intended use for agricultural purposes.

Key takeaways

Filling out and using the Texas 01-924 form is critical for agricultural producers seeking tax exemptions. The following key points summarize the essential aspects to consider:

- Qualified Use: This form is specifically for purchasing items that will be used exclusively in agricultural production. Any personal or non-agricultural use disqualifies the exemption.

- Motor Vehicle Exemption: The Texas 01-924 form cannot be used for motor vehicle tax exemptions. Instead, a different form, the Texas Motor Vehicle Tax Exemption Certificate for Agricultural and Timber Operations (Form 14-319), is necessary.

- Exempt Items: Certain items, such as horses and animal feed, do not require the exemption certificate. Understanding which items qualify as exempt is crucial for compliance.

- Record Keeping: It is vital to maintain accurate records to verify eligibility for the claimed exemptions. Failure to do so may result in the obligation to pay taxes, with potential interest and penalties.

It is important to carefully read and follow the guidelines provided within the form. Proper use of the Texas 01-924 can facilitate significant savings for qualifying agricultural operations.

Browse Other Templates

Tourist Visa Australia - This visa may allow single or multiple entries to Australia.

Cac2 Form - Incorrect or incomplete forms may lead to rejections or delays.