Fill Out Your Texas 05 158 A Form

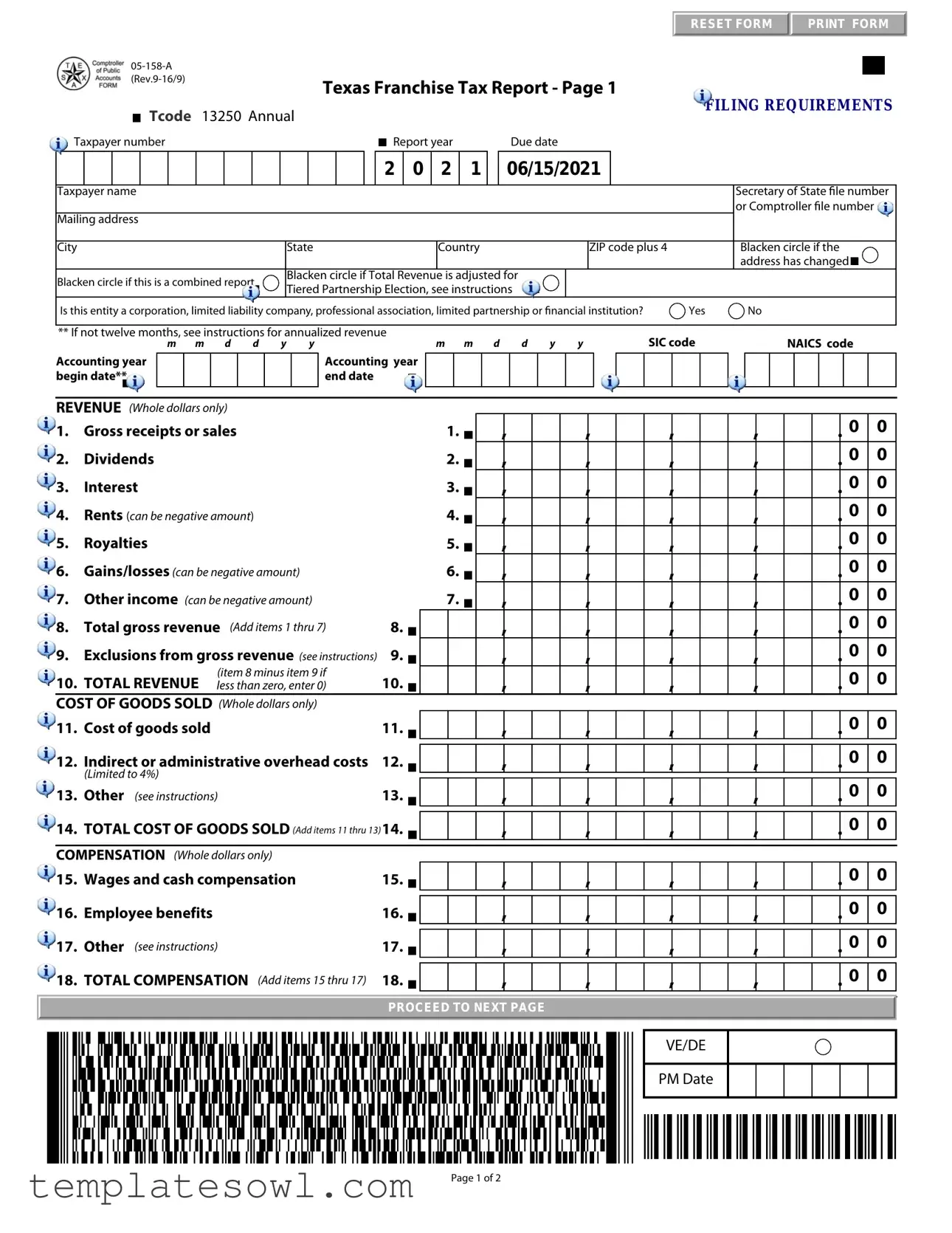

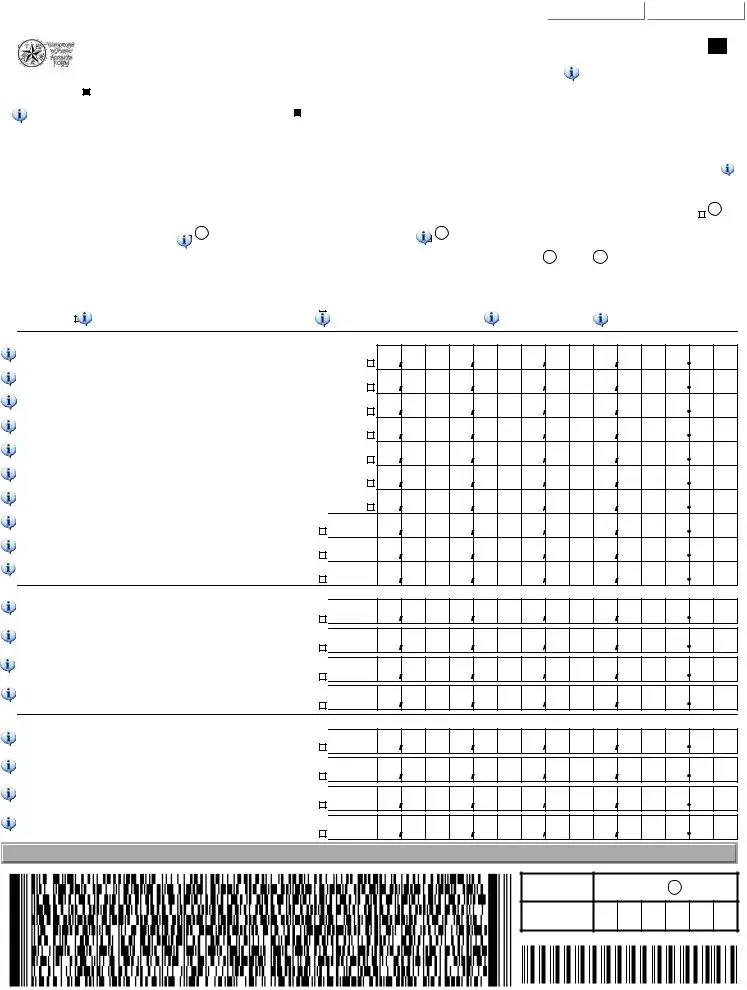

The Texas 05-158 A form is a crucial document for entities required to file the Texas Franchise Tax Report. This form captures critical financial information regarding a taxpayer's earnings and expenses, allowing the state to determine tax liabilities accordingly. One of the first steps involves identifying the taxpayer number, report year, and due date, ensuring timely submission. Various sections reflect different revenue types, such as gross receipts, dividends, and rents. Each of these income sources must be meticulously documented to arrive at the total gross revenue. Additionally, entities will detail their costs of goods sold, including direct costs and administrative overhead, which plays a vital role in calculating the taxable margin. The form also accommodates compensation figures, including wages and employee benefits, contributing to the overall tax calculation. Beyond these sections, the form includes an apportionment factor determining how much of the revenue is taxable within Texas. The final computations lead to the taxable margin, tax rates, and any applicable tax adjustments. Ultimately, correctness in filling out this form can avoid unnecessary penalties and ensure compliance with the state's fiscal regulations.

Texas 05 158 A Example

RESET FORM |

PRINT FORM |

|

|

Texas Franchise Tax Report - Page 1

Tcode |

13250 Annual |

FILING REQUIREMENTS |

|

Taxpayer number

Report year |

Due date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

0 |

|

2 |

|

1 |

|

|

|

06/15/2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secretary of State le number |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or Comptroller le number |

|||||||||

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

City |

|

|

|

|

|

|

State |

|

|

|

|

|

Country |

|

|

|

|

|

|

|

ZIP code plus 4 |

Blacken circle if the |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

address has changed |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Blacken circle if this is a combined report |

|

|

|

|

Blacken circle if Total Revenue |

is adjusted for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

Tiered Partnership Election, see instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Is this entity a corporation, limited liability company, professional association, limited partnership or nancial institution? |

|

Yes |

|

|

No |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

** If not twelve months, see instructions for annualized revenue |

|

|

|

|

m |

m |

d |

|

d |

|

y |

y |

SIC code |

|

|

|

NAICS code |

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

m m |

d |

d |

y |

|

|

y |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

Accounting year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounting year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

begin date** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

end date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

REVENUE (Whole dollars only) |

|

|

|

|

|

|

|

||

1. |

Gross receipts or sales |

1. |

|

||||||

|

|||||||||

2. |

Dividends |

|

2. |

|

|||||

|

|

||||||||

3. |

Interest |

|

3. |

|

|||||

|

|

||||||||

4. |

Rents (can be negative amount) |

4. |

|

||||||

|

|||||||||

5. |

Royalties |

|

5. |

|

|||||

|

|

||||||||

6. |

Gains/losses (can be negative amount) |

6. |

|

||||||

|

|||||||||

7. |

Other income (can be negative amount) |

7. |

|

||||||

|

|||||||||

8. |

Total gross revenue (Add items 1 thru 7) |

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

9. |

Exclusions from gross revenue (see instructions) |

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

10. |

TOTAL REVENUE |

(item 8 minus item 9 if |

10. |

|

|

|

|

|

|

less than zero, enter 0) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

||||

COST OF GOODS SOLD (Whole dollars only) |

|

|

|

|

|

|

|

||

11. |

Cost of goods sold |

|

11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

12. |

Indirect or administrative overhead costs |

12. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

(Limited to 4%) |

|

13. |

|

|

|

|

|

|

13. |

Other (see instructions) |

|

|

|

|

|

|

||

|

|

|

|

|

|

||||

14. |

TOTAL COST OF GOODS SOLD (Add items 11 thru 13)14. |

|

|

|

|||||

|

|

|

|

|

|||||

|

|

||||||||

COMPENSATION (Whole dollars only) |

|

|

|

|

|

|

|

||

15. |

Wages and cash compensation |

15. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

16. |

Employee benefits |

|

16. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

17. |

Other (see instructions) |

17. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

18. |

TOTAL COMPENSATION (Add items 15 thru 17) |

18. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

PROCEED TO NEXT PAGE

VE/DE

PM Date

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

Page 1 of 2

Tcode 13251 Annual

Tcode 13251 Annual

Texas Franchise Tax Report - Page 2

Taxpayer number |

|

Report year |

Due date |

Taxpayer name |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

0 |

|

|

2 |

|

|

1 |

|

|

06/15/2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

MARGIN (Whole dollars only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

||||||||||||||||||

19. |

70% revenue (item 10 x .70) |

19. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

20. |

Revenue less COGS (item 10 - item 14) |

20. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

Revenue less compensation (item 10 - item 18) |

21. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

22. |

Revenue less $1 million (item 10 - $1,000,000) |

22. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

23. |

MARGIN (see instructions) |

23. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APPORTIONMENT FACTOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

24. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||||

24. |

Gross receipts in Texas (Whole dollars only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

25. |

Gross receipts everywhere (Whole dollars only) |

25. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

26. |

APPORTIONMENT FACTOR (Divide item 24 by item 25, round to 4 decimal places) |

|

|

|

|

|

|

26. |

|

|

|

. |

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

TAXABLE MARGIN (Whole dollars only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

||||||||||||||||||

27. |

Apportioned margin (Multiply item 23 by item 26) |

27. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

28. |

Allowable deductions (see instructions) |

28. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

29. |

TAXABLE MARGIN (item 27 minus item 28) |

29. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

TAX DUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

X X |

|

|

|

. |

|

|

|

|

|

|

|

|

|

||||||||||||||||

30. |

Tax rate (see instructions for determining the appropriate tax rate) |

|

|

|

|

|

|

|

|

|

30. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31. |

Tax due (Multiply item 29 by the tax rate in item 30) (Dollars and cents) 31. |

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX ADJUSTMENTS (Dollars and cents) (Do not include prior payments) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

|

|

||||||||||||||||||||||||||||

32. |

Tax credits (item 23 from Form |

|

|

|

|

|

|

|

32. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

33. |

Tax due before discount (item 31 minus item 32) |

|

|

|

|

|

|

|

33. |

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

34. |

Discount (see instructions, applicable to report years 2008 and 2009) |

34. |

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

TOTAL TAX DUE (Dollars and cents) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

|

|

||||||||||||||||||

35. |

TOTAL TAX DUE (item 33 minus item 34) |

|

|

|

|

|

|

|

35. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

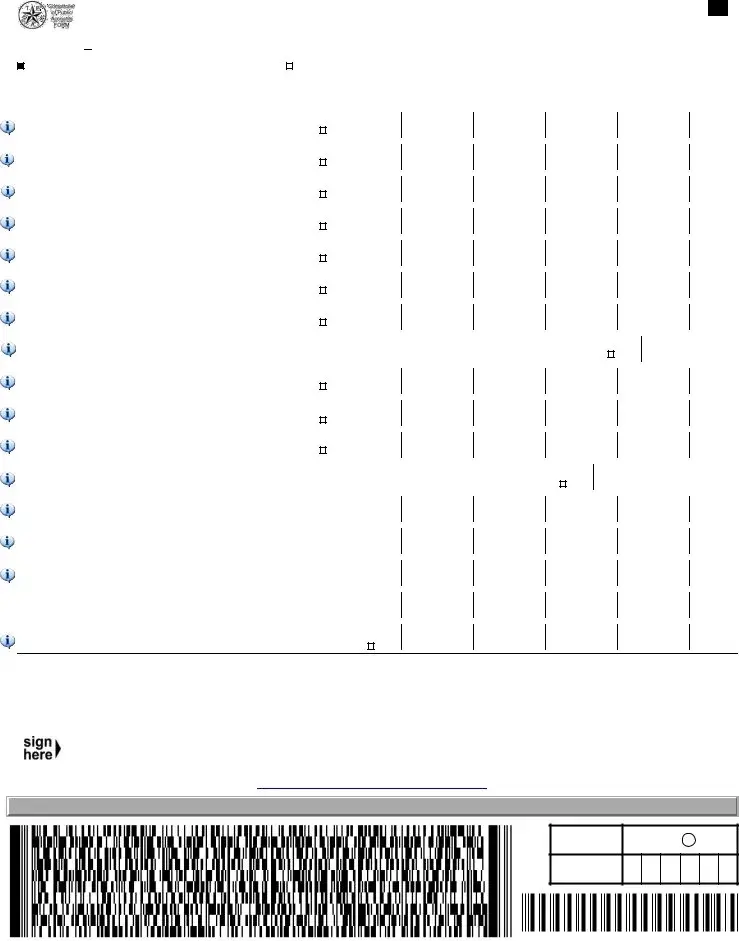

Do not include payment if item 35 is less than $1,000 or if annualized total revenue is less than the no tax due threshold (see instructions). If the entity

makes a tiered partnership election, ANY amount in item 35 is due. Complete Form

Print or type name |

Area code and phone number |

|||

|

|

( |

) |

- |

|

|

|

|

|

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and belief. |

|

|

Mail original to: |

|

|

|

|

Texas Comptroller of Public Accounts |

|

|

Date |

|

||

|

|

|

P.O. Box 149348 |

|

|

|

|

|

|

|

|

|

|

Austin, TX |

|

|

|

|

|

Instructions for each report year are online at www.comptroller.texas.gov/taxes/franchise/forms/. If you have any questions, call

RETURN TO PAGE 1

VE/DE

PM Date

Page 2 of 2

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Type | Texas Franchise Tax Report - Form 05-158-A |

| Governing Law | Texas Franchise Tax Act |

| Form Revision | Revised September 2016 |

| Filing Frequency | Annual filing is required for entities doing business in Texas. |

| Due Date | For 2021, the due date was June 15, 2021. |

| Entity Types | The form is applicable to corporations, LLCs, professional associations, limited partnerships, and financial institutions. |

| Total Revenue Calculation | Total revenue is calculated by adding gross receipts, dividends, interest, rents, royalties, gains/losses, and other income. |

| Cost of Goods Sold | The form includes a section to report the cost of goods sold, limited to specific deductions. |

| Margin Calculation | The margin is determined by applying specific calculations to total revenue and cost of goods sold. |

| Taxable Margin | The taxable margin is calculated after applying deductions and other factors, leading to the final tax due. |

Guidelines on Utilizing Texas 05 158 A

Filling out the Texas 05 158 A form requires careful attention to detail to ensure all financial information is accurately reported. The subsequent steps will guide you through the process of completing this document, helping to ensure compliance and clarity in your submission.

- Locate the Taxpayer Number section on the form. Enter your unique taxpayer number.

- Next, fill in the Report Year and the Due Date fields with the respective information.

- Provide your Taxpayer Name, Mailing Address, City, State, Country, and ZIP Code.

- Indicate if your address has changed by blackening the circle provided.

- If this report is a combined report, blacken the appropriate circle.

- Blacken the circle if Total Revenue is adjusted for Tiered Partnership Election.

- Identify the type of entity (corporation, LLC, etc.) by answering Yes or No.

- For Accounting Year, enter the begin date and end date in the specified format.

- Proceed to report Revenue. Fill in each category as appropriate: Gross receipts/sales, Dividends, Interest, Rents, Royalties, Gains/losses, Other income.

- Calculate Total Gross Revenue by adding items 1 through 7.

- Subtract any Exclusions from Gross Revenue to determine Total Revenue.

- In the next section, report the Cost of Goods Sold. Enter values for Cost of Goods Sold, Indirect or Administrative Overhead Costs, and Other (if applicable).

- Add items 11 through 13 to calculate the Total Cost of Goods Sold.

- Next, report Compensation, entering amounts for Wages and Cash Compensation, Employee Benefits, and Other.

- Calculate the Total Compensation by adding these three figures.

- If there is a second page, continue filling out the Margin calculations following the instructions.

- Complete the Apportionment Factor section, dividing gross receipts in Texas by gross receipts everywhere.

- Calculate Taxable Margin and enter the relevant amounts.

- Determine the tax due by multiplying the Taxable Margin by the tax rate.

- Indicate any Tax Adjustments, such as tax credits.

- Finally, sum up the Total Tax Due and ensure you print or type your name with your contact information.

- Date the form and submit it to the Texas Comptroller of Public Accounts.

Completing this form diligently ensures all necessary financial data is provided accurately. It is recommended to review entries for completeness and correctness before submission. If questions arise, resources are available through the Comptroller’s office for assistance.

What You Should Know About This Form

What is the Texas 05 158 A form?

The Texas 05 158 A form is the Franchise Tax Report required for certain entities operating in Texas. Businesses such as corporations, limited liability companies (LLCs), professional associations, limited partnerships, and financial institutions typically use this form to report their revenue and calculate their franchise tax obligations. It must be completed annually and involves detailing various categories of revenue and expenses.

When is the Texas 05 158 A form due?

The due date for filing the form is generally June 15 of the reporting year. For example, the 2021 form was due by June 15, 2021. It's essential to file on time to avoid penalties and interest on any taxes owed. Entities that do not meet the due date may be subject to late fees.

What information is required on the form?

You will need to provide several details on the Texas 05 158 A form. Key elements include your taxpayer number, the report year, and the entity’s name and address. Additionally, you must report your gross receipts or sales, dividends, interest, rents, royalties, and other forms of income. The form also requires details about cost of goods sold and total compensation paid, which will help calculate your taxable margin.

How do I calculate the tax due on the Texas 05 158 A form?

To determine your tax due, several calculations are required. Begin by establishing your taxable margin, typically calculated by deducting specific costs from total revenue. After identifying your taxable margin, apply the appropriate tax rate as instructed on the form. Make sure to check if any tax credits or discounts apply, which will further adjust your final tax due amount.

Where do I send the completed Texas 05 158 A form?

The completed Texas 05 158 A form should be mailed to the Texas Comptroller of Public Accounts at P.O. Box 149348, Austin, TX 78714-9348. Be sure to send the original form. For more detailed guidance, you can also visit the Texas Comptroller’s website or reach out via phone at 1-800-252-1381 for assistance.

Common mistakes

Filling out the Texas 05 158 A form can be complex, and many individuals and businesses often make mistakes that can hinder their filing. One common error is not using whole dollars for reporting gross revenue and expenses. The form specifically asks for amounts in whole dollars only, and entering cents can lead to confusion or rejection.

Another mistake is failing to properly blacken the circles indicating changes in address or reporting type. Not marking these sections can delay the processing of your form and lead to unnecessary complications. Additionally, omitting responses about whether the entity is a corporation or another type of business can result in incorrect tax calculations.

Many filers overlook the importance of adjusting total revenue for a Tiered Partnership Election, if applicable. Failing to do so may lead to inaccuracies in the revenue reported. It's also essential to remember to check the instructions when the accounting year is not a full twelve months. Doing so ensures compliance with the requirements.

Inaccuracies in calculating total gross revenue often arise as well. Adding incorrect figures from line items 1 to 7 can lead to significant errors in tax due. Failing to account for exclusions from gross revenue is another issue that can inflate tax obligations erroneously.

Another area of confusion is the cost of goods sold section. Mistakes are frequently made in reporting indirect or administrative overhead costs. Remember, these costs are limited to 4%, and not adhering to this rule can change the margin calculations drastically. It's vital to check that all total computations are correct.

Compensation reporting can also pose challenges. Filers sometimes fail to include all types of employee compensation. Additionally, skipping the summation of wages, benefits, and other compensations can lead to an inaccurate total, impacting the taxable margin calculation.

Finally, some filers forget to include the necessary tax credits, leading to inflated tax liabilities. Ignoring this section can cost businesses more than anticipated. Always double-check to ensure that tax adjustments are accounted for correctly to avoid excessive payments.

Documents used along the form

When filing the Texas Franchise Tax Report using the Texas 05 158 A form, you might also need to submit additional documents. Each of these documents plays a significant role in ensuring compliance and clarity in your tax reporting. Below is a list of often-required forms that accompany the Texas 05 158 A.

- Form 05-160 - Texas Franchise Tax Credit Application: This form is used to apply for tax credits that may reduce your overall tax liability. You’ll need to provide details about the tax credit you are seeking.

- Form 05-170 - Texas Franchise Tax Payment Voucher: When you have tax due, this voucher is required for making payments. It contains information that links your payment to your Franchise Tax Report.

- Form 05-157 - Information Report: This form is essential for entities looking to provide additional financial information as required by the state. This may include owner information or business structure details.

- Form 05-158-C - Texas Franchise Tax Report for Limited Liability Companies: If your business is structured as an LLC, this specialized form might be necessary to capture specific details concerning LLC taxes.

- Form 05-162 - Texas Franchise Tax Affidavit: This affidavit may be needed to validate certain claims made in your Franchise Tax Report, including information about revenue and expenses.

- Form 05-159 - Texas Franchise Tax Notice of Report: This document serves as a reminder from the Comptroller’s office regarding your filing obligations and deadlines, ensuring you do not overlook important dates.

- Form 05-152 - Entity Status Report: Used to confirm the operational status of your business entity with the state, this report helps maintain compliance and can be required alongside your Franchise Tax Report.

- Form 05-173 - Texas Franchise Tax Estimates: This form is used to estimate future tax liabilities and can be helpful for planning your business’s financial obligations throughout the year.

Each of these documents must be prepared accurately and submitted in a timely manner to avoid any penalties. Understanding how these forms integrate with the Texas 05 158 A will help clarify your tax obligations and ensure you remain compliant with state regulations. It is always prudent to review instructions and consult with a tax professional if you have any uncertainties.

Similar forms

The Texas 05 158 A form is part of the Texas Franchise Tax Report process and has several similar forms with distinct purposes. Below is a list of similar documents and how they relate to the Texas 05 158 A form:

- Texas 05 160 - This form is used to claim tax credits. Like the 05 158 A, it helps businesses calculate their tax obligations, but it addresses the credits that may reduce the overall tax due.

- Texas 05 163 - This is the Texas Franchise Tax Exemption form. It provides entities with a way to claim an exemption from the franchise tax, similar to how the 05 158 A assesses gross revenue.

- Texas 05 171 - This form is for reporting income for non-profit organizations. Both forms report financial figures, but the 05 171 caters specifically to non-profits and their revenue streams.

- Texas 05 169 - This form is for the Texas Franchise Tax Annual Report. It is similar to the 05 158 A, as it is also a requirement for franchises, providing comprehensive financial data.

- Texas 05 088 - This is the Texas Franchise Tax Public Information Report. Like the 05 158 A, it requires detailed financial information, but it focuses on transparency and public disclosure.

- Texas 05 195 - This form assists with making estimated payments of franchise tax. It shares the purpose of determining tax obligations but specifically facilitates prepayments.

- Texas 05 153 - This is the Texas Franchise Tax Combined Report form. Similar to the 05 158 A, it allows multiple affiliated entities to file a single tax report, simplifying the filing process.

- Texas 05-158-C - This form requests a change for annualized revenue. Like the 05 158 A, it is linked to revenue calculations but focuses on requesting adjustments rather than initial reporting.

Dos and Don'ts

Things You Should Do:

- Read the instructions carefully before starting the form.

- Fill in the taxpayer name and number accurately to avoid delays.

- Provide whole dollar amounts for all revenue and costs.

- Check all calculations to ensure accuracy.

- Complete every section that applies to your business entity.

- Mail the completed form to the specified address by the due date.

- Keep a copy of the completed form for your records.

- Contact the Texas Comptroller's office if you have any questions.

Things You Shouldn't Do:

- Do not leave any required fields blank.

- Avoid using decimal points in revenue and cost entries.

- Do not submit outdated forms; ensure you have the latest version.

- Do not guess on revenue amounts; use accurate figures.

- Do not mix up the due dates; ensure you file on time.

- Do not include personal information that is not relevant to the form.

- Refrain from sending incomplete forms to avoid penalties.

- Don't ignore the specific instructions for tiered partnership elections if applicable.

Misconceptions

Understanding the Texas 05 158 A form can be challenging, and several misconceptions often arise. Here are six common misunderstandings regarding this important document:

- Misconception 1: The Texas 05 158 A form is only for corporations. Many businesses, including limited liability companies (LLCs) and professional associations, must also file this form. It is not exclusive to corporations.

- Misconception 2: The due date is always the same. While the form typically has a due date of June 15 for the report year of 2021, this date can vary depending on the specific tax year and regulations. Always verify the deadline for your report year.

- Misconception 3: Only large businesses are required to file. Regardless of a company's size, any business generating revenue in Texas may be required to submit this form, as long as they meet certain thresholds.

- Misconception 4: You don’t need to report losses. The form requires disclosure of all income sources, including losses. This information helps determine the business's total revenue accurately.

- Misconception 5: You can skip calculations if you have no tax due. Even if the total tax due ends up being less than $1,000, businesses must still file the form. There are important reporting obligations regardless of the tax amount.

- Misconception 6: It’s unnecessary to familiarize yourself with the instructions. Many people believe they can complete the form without reading the instructions. However, the instructions provide critical guidance to ensure accurate reporting and avoid mistakes.

Being aware of these misconceptions can help ensure a smoother filing process and compliance with Texas tax regulations.

Key takeaways

The Texas 05-158 A form is essential for businesses to report their Franchise Tax obligations to the state of Texas.

Make sure to fill out the form accurately, as errors can lead to penalties or delays in processing.

Check the due date for submission; for example, the due date for the 2021 report was June 15, 2021.

Be aware that the form requires detailed information about your business's gross revenue, such as sales, dividends, interest, rents, and royalties.

Calculate total revenue carefully. This is done by subtracting exclusions from gross revenue, ensuring that any negative amounts are accurately accounted for.

The cost of goods sold (COGS) section includes indirect or administrative costs; limit these to 4% per the guidelines.

The margin calculation is significant. Review your revenue against COGS, compensation, and specific thresholds to determine the taxable margin.

Incorporate any applicable tax credits when determining your total tax due, but remember not to include prior payments in this calculation.

Submit the completed form to the Texas Comptroller of Public Accounts, ensuring the mailing address is correct to avoid issues.

Browse Other Templates

Trec License - This amendment form allows buyers to adjust notification deadlines regarding financing approvals.

Virginia Medicaid Income Limits 2024 Calculator - Accurate completion of the DMAS 225 form can save time and resources for both providers and staff at social services.