Fill Out Your Texas 401 Form

The Texas 401 form serves as a crucial tool for entities wishing to update their registered agent or office. This form, created to align with the Texas Business Organizations Code, necessitates proper compliance to avoid penalties or revocation of registration. When a registered agent or office address changes, it is essential to act swiftly, as failure to maintain this information can lead to termination. The 401 form allows an entity to clearly declare these changes and affirms that the designated agent has consented to their role. It's important to note that the registered office must be a physical street address where legal documents can be served, not merely a mailbox or answering service. The form must include the entity's name, current registered agent details, and the address being changed. Additionally, it includes a statement of approval to ensure that the modifications have the backing of the entity’s governing persons. Understanding the specific requirements and ensuring that the information is accurate can simplify compliance and maintain the entity's good standing with the state.

Texas 401 Example

Form

The attached form is drafted to meet minimal statutory filing requirements pursuant to the relevant code provisions. This form and the information provided are not substitutes for the advice and services of an attorney and tax specialist.

Commentary

This form has been promulgated to comply with the provisions of the Texas Business Organizations Code (BOC) regarding changes to registered agent and office of entities filed with the secretary of state. A nonprofit corporation formed for a special purpose under a statute or code other than the BOC may be required to meet other filing requirements than those imposed by the BOC. This form may not comply with the requirements imposed under the special statute or code governing the special purpose corporation. Please refer to the statute or code governing the special purpose corporation for specific filing requirements.

Section 5.202 of the BOC specifies the procedure to be followed when a Texas or foreign filing entity that is subject to the BOC desires to make changes to its registered office or registered agent. Since an entity may be terminated or its registration revoked for failure to maintain a registered office and agent, any change should be submitted promptly. Changes to registered office and agent may also be included as part of a certificate of amendment or restated certificate, as an amendment in a plan of merger, and in the certificate of formation for a converted entity. Use this form if the only changes to be made to the certificate of formation or registration are to the registered office or agent or both.

Consent: Effective January 1, 2010, a person designated as the registered agent of an entity must have consented, either in a written or electronic form, to serve as the registered agent of the entity. Although consent is required, a copy of the person’s written or electronic consent need not be submitted with the statement of change. The liabilities and penalties imposed by sections 4.007 and 4.008 of the BOC apply with respect to a false statement in a filing instrument that names a person as the registered agent of an entity without that person’s consent. (BOC § 5.207)

Office Address Requirements: The registered office address must be located at a street address where service of process may be personally served on the entity’s registered agent during normal business hours. Although the registered office is not required to be the entity’s principal place of business, the registered office may not be solely a mailbox service or telephone answering service (BOC § 5.201).

Unincorporated nonprofit associations, Texas financial institutions, or defense base development authorities should use form 707 rather than this form to change the statement of appointed agent.

Instructions for Form

Items

Item 4: Changes to Registered Office and/or Registered Agent. Complete item 4 to effect a change to the registered agent or registered office address. The registered agent can be either (option

Form 401 |

1 |

A)a domestic entity or a foreign entity that is registered to do business in Texas or (option B) an individual resident of the state. The filing entity cannot act as its own registered agent.

If the registered office is changed, complete section C. The registered office must be located at a street address where service of process may be personally served on the entity’s registered agent during normal business hours. Although the registered office address is not required to be the entity’s principal place of business, the registered office may not be solely a mailbox service or a telephone answering service (BOC § 5.201).

The statement of change must recite that the street address of the registered office is the same as the registered agent’s business address.

Statement of Approval: As required by section 5.202(b)(6) of the BOC, the form includes a recitation that the change specified in the statement is authorized by the entity. While the statement of change has the effect of amending the entity’s certificate of formation or registration, the BOC does not provide that the procedures to amend the certificate of formation are applicable. In general, the statement of change should be adopted and approved by the governing persons or by a person authorized to act on behalf of the entity.

Effectiveness of Filing: A statement of change becomes effective when filed by the secretary of state (option A). However, pursuant to sections 4.052 and 4.053 of the BOC the effectiveness of the instrument may be delayed to a date not more than ninety (90) days from the date the instrument is signed (option B). The effectiveness of the instrument also may be delayed on the occurrence of a future event or fact, other than the passage of time (option C). If option C is selected, you must state the manner in which the event or fact will cause the instrument to take effect and the date of the 90th day after the date the instrument is signed. In order for the instrument to take effect under option C, the entity must, within ninety (90) days of the filing of the instrument, file a statement with the secretary of state regarding the event or fact pursuant to section 4.055 of the BOC.

On the filing of a document with a delayed effective date or condition, the computer records of the secretary of state will be changed to show the filing of the document, the date of the filing, and the future date on which the document will be effective or evidence that the effectiveness was conditioned on the occurrence of a future event or fact.

On acceptance of the statement of change by the secretary of state, the statement is effective as an amendment to the appropriate provision of the entity’s certificate of formation or the foreign filing entity’s registration.

Execution: Pursuant to section 4.001 of the BOC, the statement of change must be signed by a person authorized by the BOC to act on behalf of the entity in regard to the filing instrument. Generally, a governing person or managerial official of the entity signs a filing instrument.

The statement of change need not be notarized. However, before signing, please read the statements on this form carefully. The designation or appointment of a person as the registered agent by a managerial official is an affirmation by that official that the person named in the instrument has consented to serve as registered agent. (BOC § 5.2011, effective January 1, 2010)

A person commits an offense under section 4.008 of the BOC if the person signs or directs the filing of a filing instrument the person knows is materially false with the intent that the instrument be

Form 401 |

2 |

delivered to the secretary of state for filing. The offense is a Class A misdemeanor unless the person’s intent is to harm or defraud another, in which case the offense is a state jail felony.

Payment and Delivery Instructions: The filing fee for a change of registered office/agent is $15, unless the filing entity is a nonprofit corporation or a cooperative association. The filing fee for a nonprofit corporation or a cooperative association is $5. Fees may be paid by personal checks, money orders, LegalEase debit cards, or American Express, Discover, MasterCard, and Visa credit cards. Checks or money orders must be payable through a U.S. bank or financial institution and made payable to the secretary of state. Fees paid by credit card are subject to a statutorily authorized convenience fee of 2.7 percent of the total fees.

Submit the completed form in duplicate along with the filing fee. The form may be mailed to P.O. Box 13697, Austin, Texas

Revised 05/11

Form 401 |

3 |

Form 401 (Revised 05/11)

Submit in duplicate to: Secretary of State P.O. Box 13697 Austin, TX

512

Filing Fee: See instructions

This space reserved for office use.

Statement of Change of

Registered Office/Agent

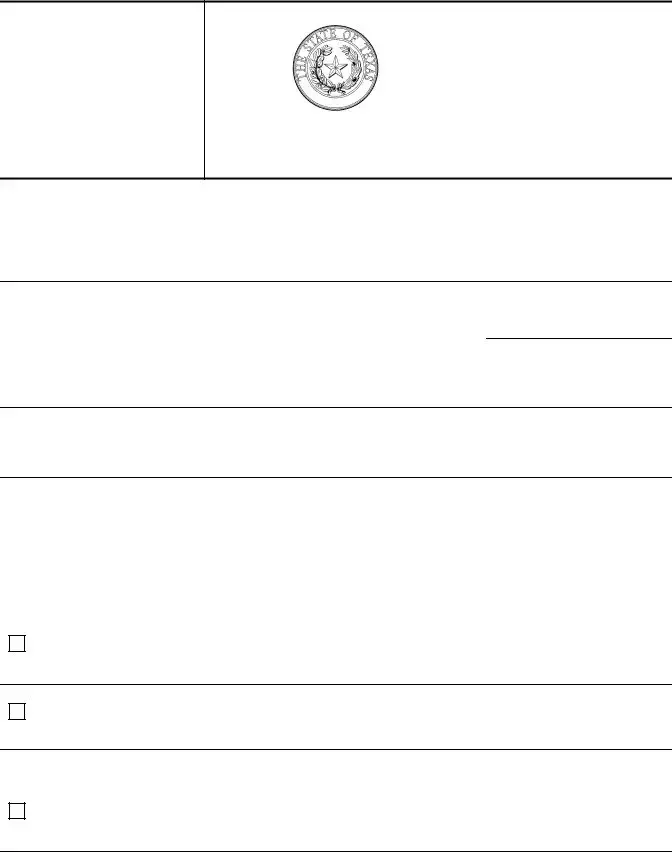

Entity Information

1. The name of the entity is:

State the name of the entity as currently shown in the records of the secretary of state.

2.The file number issued to the filing entity by the secretary of state is:

3.The name of the registered agent as currently shown on the records of the secretary of state is:

Registered Agent Name

The address of the registered office as currently shown on the records of the secretary of state is:

TX

Street Address |

City |

State Zip Code |

Change to Registered Agent/Registered Office

4.The certificate of formation or registration is modified to change the registered agent and/or office of the filing entity as follows:

Registered Agent Change

(Complete either A or B, but not both. Also complete C if the address has changed.)

A. The new registered agent is an organization (cannot be entity named above) by the name of:

OR

B. The new registered agent is an individual resident of the state whose name is:

First Name |

M.I. |

Last Name |

Suffix |

Registered Office Change

C. The business address of the registered agent and the registered office address is changed to:

TX

Street Address (No P.O. Box) |

City |

State Zip Code |

The street address of the registered office as stated in this instrument is the same as the registered agent’s business address.

Form 401 |

4 |

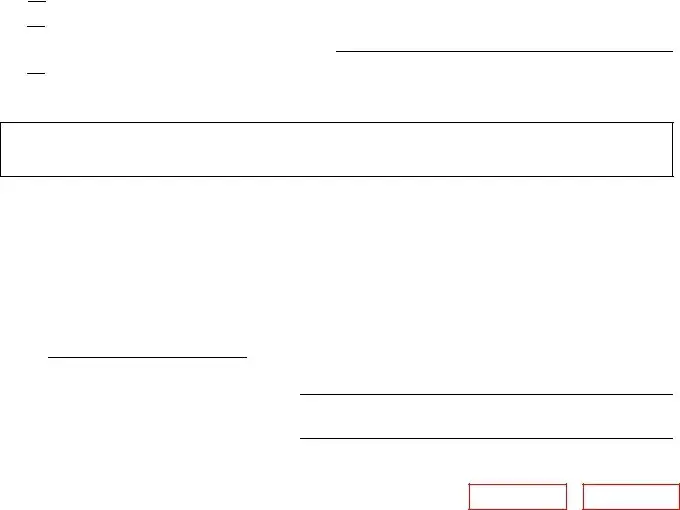

Statement of Approval

The change specified in this statement has been authorized by the entity in the manner required by the BOC or in the manner required by the law governing the filing entity, as applicable.

Effectiveness of Filing (Select either A, B, or C.)

A.

This document becomes effective when the document is filed by the secretary of state.

This document becomes effective when the document is filed by the secretary of state.

B.  This document becomes effective at a later date, which is not more than ninety (90) days from the date of signing. The delayed effective date is:

This document becomes effective at a later date, which is not more than ninety (90) days from the date of signing. The delayed effective date is:

C.

This document takes effect upon the occurrence of a future event or fact, other than the passage of time. The 90th day after the date of signing is:

This document takes effect upon the occurrence of a future event or fact, other than the passage of time. The 90th day after the date of signing is:

The following event or fact will cause the document to take effect in the manner described below:

Execution

The undersigned affirms that the person designated as registered agent has consented to the appointment. The undersigned signs this document subject to the penalties imposed by law for the submission of a materially false or fraudulent instrument and certifies under penalty of perjury that the undersigned is authorized to execute the filing instrument.

Date:

Signature of authorized person

Printed or typed name of authorized person (see instructions)

Reset

Form 401 |

5 |

Form Characteristics

| Fact | Description |

|---|---|

| Form Purpose | The Texas 401 Form is used to change the registered agent or registered office of an entity. |

| Governing Law | This form complies with the Texas Business Organizations Code (BOC) Section 5.202. |

| Filing Fee | The filing fee is $15 for most entities, while non-profit corporations pay $5. |

| Effective Date | The change takes effect upon filing unless a delayed effective date is specified. |

| Agent Consent | The registered agent must consent to the appointment, but written consent is not required at filing. |

| Office Address Requirements | The registered office must be a physical address, not a P.O. Box or virtual office. |

| Signature Requirement | The form must be signed by a person authorized by the BOC to represent the entity. |

| Submission Methods | The completed form can be mailed, faxed, or delivered in person to the Secretary of State. |

| Contribution of False Information | Providing false information can result in penalties under BOC Sections 4.007 and 4.008. |

Guidelines on Utilizing Texas 401

After gathering all necessary information and documentation required, the Texas 401 form can be filled out with attention to detail. Ensure that all fields are accurately completed to avoid any issues during processing. Below are steps to guide the completion of the form.

- Entity Information: Fill in the name of the entity exactly as it appears in the records of the secretary of state.

- File Number: Provide the file number that the secretary of state assigned to the entity.

- Registered Agent Information: Enter the name of the current registered agent as listed in the records.

- Current Office Address: Write the street address, city, state, and zip code of the current registered office, ensuring not to use a P.O. Box.

- Changes to Registered Agent/Office: Indicate either option A (new registered agent as an organization) or option B (new registered agent as an individual). Complete section C if the registered office address has changed.

- New Registered Agent's Information: If selecting option A, input the name of the organization. If selecting option B, provide the first name, middle initial, last name, and any suffix of the individual.

- New Registered Office Address: For section C, specify the new business address of the registered agent, ensuring it is not a P.O. Box. Confirm that this address is the same as the registered agent's business address.

- Statement of Approval: Check that the changes have received proper authorization from the entity as mandated by the BOC.

- Effectiveness of Filing: Choose and complete either option A (effective upon filing), option B (effective at a specific later date), or option C (take effect upon a certain event).

- Execution: The designated authorized person must sign the form, affirming that the registered agent has consented to the appointment.

- Submission: Submit the completed form in duplicate along with payment, either by mail, fax, or in person.

What You Should Know About This Form

What is the Texas 401 Form, and when should it be used?

The Texas 401 Form is used to change the registered agent or registered office address for businesses filed with the Secretary of State. Organizations should use this form when they need to make a change solely to the registered office or agent without altering other aspects of their registration. It's essential to submit this form promptly, as failing to maintain a registered office may lead to termination or revocation of business registration.

Who can be designated as a registered agent on the Texas 401 Form?

A registered agent can be an individual resident of Texas or a domestic or foreign business entity that is registered to do business in Texas. However, the entity cannot act as its own registered agent. It’s important to ensure that the designated registered agent has consented to this role, even though you do not need to submit proof of that consent with the 401 Form.

What address is required for the registered office?

The registered office address must be a physical street address and cannot be merely a mailbox service or telephone answering service. It should be a location where the registered agent can be served with legal documents during regular business hours. While the registered office does not need to be the entity’s principal place of business, it must be accessible for service of process.

What happens once the Texas 401 Form is filed?

Once the Texas 401 Form is filed and accepted by the Secretary of State, the changes become effective. The effective date can be immediate upon filing, or it can be set to a later date or contingent upon a future event, as specified in the form. If the document specifies a delayed effective date, the entity must also file a statement regarding the related event within 90 days of the original filing to finalize changes.

What are the fees associated with filing the Texas 401 Form?

The filing fee for changing the registered agent or office is typically $15. However, if the entity is a nonprofit corporation or cooperative association, the fee is reduced to $5. Payments can be made via checks, money orders, or credit cards, with some additional convenience fees for credit card transactions. Be sure to submit the form in duplicate alongside the payment to ensure processing.

Common mistakes

Filling out the Texas 401 form can be a straightforward process, but many make common mistakes that can lead to delays or complications. One frequent error is failing to provide the correct legal name of the entity. This name should match exactly with what is on file with the Secretary of State. Mismatches can cause the form to be rejected.

Another mistake people often make is neglecting to include the entity's file number. This number helps the Secretary of State's office process the change more efficiently. Omitting it can slow down the processing time or lead to unnecessary back-and-forth communications.

Providing inaccurate or outdated information about the registered agent is a common error. The form needs the name and address of the current registered agent. If this information has changed, it must be updated correctly. Failure to do so can prevent the form from being processed and put the entity at risk.

Some people also forget that the registered office must be a physical street address. Using a P.O. Box or a mailbox service violates the requirements. It’s important that individuals include a valid street address where legal documents can be served.

Not securing the consent of the new registered agent is another significant oversight. Since consent is a legal requirement, be sure to obtain it either in writing or electronically. While you don't need to submit proof of this consent, failing to have it can create legal issues down the line.

Additionally, many forget to complete the statement of approval. This statement verifies that the changes were authorized by the entity. Omitting this statement not only affects the validity of the submission but also raises questions about organizational compliance.

Errors in selecting the effectiveness of the filing date compound issues further. The form must clearly state when the changes should take effect. If individuals select a future date or event without properly describing it, complications can arise regarding the timing of the changes.

A common misconception is that the form needs to be notarized. In reality, notarization is not required for the Texas 401 form. However, the document must be signed by an authorized person, confirming their authority to act on behalf of the entity.

Another critical mistake is related to payment. The filing fee varies based on the type of entity. Failing to include the correct amount can lead to rejection of the form. It’s essential to check current fee schedules and have the right amount ready when submitting the form.

Lastly, duplicates are often neglected. When submitting the Texas 401 form, it should be provided in duplicate along with the filing fee. A single copy can lead to processing issues and delays since the Secretary of State needs a copy for their records. Taking care to address these common mistakes can make the filing process smoother and more efficient.

Documents used along the form

The Texas 401 form, used for updating the registered agent or registered office of a business entity, often requires other documents to ensure compliance with state regulations. Below are several key forms that frequently accompany the Texas 401 for a smoother filing process.

- Certificate of Amendment: This document is used when an entity wishes to make changes to its certificate of formation, which can include updates to the registered office or agent. It outlines the amendments being made and must be filed with the Secretary of State.

- Certificate of Formation: This form provides essential information about a new entity, including its registered agent and office address. If changes are made to these details, the certificate may need to be amended or restated.

- Plan of Merger: In cases where entities merge, this document can include changes to the registered agent or office. It details the terms of the merger and must be approved by the governing persons of the entities involved.

- Form 707: This form is specifically for unincorporated nonprofit associations and Texas financial institutions that need to change their registered agent or office. It satisfies the regulatory requirements unique to these types of entities.

Completing the Texas 401 form along with any necessary supporting documents helps ensure that the filing is compliant and that your entity is properly registered with the state. Pay attention to all guidelines to avoid potential issues down the line.

Similar forms

- Certificate of Formation: Similar to Form 401, the Certificate of Formation is a key document for entities in Texas. It establishes the entity's existence and can also include changes to the registered agent or office when needed.

- Certificate of Amendment: This document modifies the existing Certificate of Formation. It can address changes in management or registered office, similar to the changes allowed in Form 401.

- Statement of Change of Registered Agent Form 707: For unincorporated nonprofit associations and certain financial institutions, Form 707 is used. It serves a purpose akin to Form 401 for those specific entities and includes updates regarding the registered agent.

- Plan of Merger: A Plan of Merger can outline changes to registered agents and offices as part of the merger process. This aligns with the purpose of Form 401 in updating key organizational details.

- Application for Registration of Foreign Entity: Foreign entities must file this application to operate in Texas. The application requires providing a registered agent and office, making it comparable to the requirements of Form 401.

- Withdrawal of Registration: If an entity decides to cease operations in Texas, it must file a withdrawal document that includes changes to its registered agent and office, similar to Form 401’s focus on registration details.

- Annual Franchise Tax Report: This report includes information about the entity’s registered agent and can be seen as a regular update comparable to the occasional use of Form 401 to maintain current records.

Dos and Don'ts

When filling out the Texas 401 form, there are several important dos and don'ts to keep in mind.

- Do: Include the legal name of the entity as it appears in the Secretary of State's records.

- Do: Ensure that the registered office address is a physical location and not just a P.O. Box.

- Do: Confirm that the registered agent has given consent to serve in that capacity.

- Do: Submit the form promptly to avoid penalties related to maintaining a registered office and agent.

- Don't: Forget to provide the entity's current registered agent and office address.

- Don't: Assume that the filing can be done later; delays can lead to complications.

- Don't: List the entity itself as its own registered agent, as this is not allowed.

- Don't: Leave any sections unfinished; incomplete forms may be rejected.

Misconceptions

- Misconception: The Texas 401 Form can be used for all types of organizations. This form is specifically designed for Texas entities subject to the Texas Business Organizations Code (BOC). Nonprofit corporations with special purposes may have different filing requirements that this form does not address.

- Misconception: Consent from the registered agent must be submitted with the form. While the registered agent must consent to their appointment, their consent does not need to be included with the statement of change. However, it's crucial that this consent is obtained.

- Misconception: Changes can be made to the registered office or agent at any time without consequences. Failing to maintain a registered office and agent can lead to the termination or revocation of an entity's registration. Therefore, changes should be submitted without delay.

- Misconception: The registered office can simply be a mailbox or answering service. The registered office must be a physical street address where legal documents can be served during normal business hours. It cannot solely be a mailbox service or telephone answering service.

Key takeaways

Filling out and using the Texas 401 form requires careful attention to detail. The following points highlight key takeaways that will help ensure proper use of this form.

- Consent Requirement: The designated registered agent must consent to their appointment, either in written or electronic form. You do not need to submit this consent with the filing.

- Address Requirements: The registered office must be a physical street address. It cannot be merely a mailbox or telephone answering service. Ensure that service of process can be delivered during normal business hours.

- Entity Information: Provide the legal name, current registered agent's name, and the registered office address accurately. Including your file number can expedite processing.

- Effective Date: The change becomes effective upon filing, but you can choose to delay it up to 90 days or upon a specific future event. Make sure to specify the conditions if delaying the effective date.

- Execution: An authorized person must sign the form, affirming that all information is accurate. The signature does not need notarization, but it carries legal responsibility for any false statements.

- Filing Fee: The standard fee for filing is $15, but nonprofits or cooperative associations pay $5. Prepare payment and submit the form in duplicate to the Secretary of State.

Browse Other Templates

How to Make Family Tree Chart - A practical application for historians tracking ancestry.

Letter Formal - This structure helps the reader focus on your main points without distractions.

Chapter 128 Wisconsin Forms - Debtors must provide a list of all creditors, including outstanding balances and account numbers, in the Affidavit of Debts.