Fill Out Your Texas 802 Form

The Texas 802 form serves as an essential periodic report for nonprofit corporations operating within the state. This document fulfills the filing requirements set forth by Section 22.357 of the Texas Business Organizations Code. It is important to note that this report is not simply a checklist; it requires detailed information about the corporation's governance structure, including the names and addresses of all directors and officers. Generally, nonprofits must submit this report once every four years, and failure to do so can lead to serious consequences, such as involuntary termination of the corporation's status. The Texas Secretary of State oversees the submission and processing of this form, and it is critical that correct information is provided to avoid penalties and ensure compliance. Privacy concerns are also taken into account, as it is advisable to furnish a business or post office box address instead of a residential address when providing details about directors and officers. In addition to the key components of the form, such as information about the registered agent and the principal office address, the form also contains sections dedicated to the corporation’s officers and directors, specifying their respective titles and roles. The process of completing the form includes understanding various instructions, filing fees, and potential documentation needed for changes in the corporate name or reinstatement after termination.

Texas 802 Example

Form

(Periodic Report – Nonprofit Corporation)

The attached form is drafted to meet minimal statutory filing requirements pursuant to the relevant code provisions. This form and the information provided are not substitutes for the advice and services of an attorney and tax specialist.

Commentary

A nonprofit corporation is required by Section 22.357 of the Texas Business Organizations Code (BOC) to file a periodic report that lists the names and addresses of all directors and officers of the corporation. The Office of the Secretary of State may require a domestic nonprofit corporation or a foreign nonprofit corporation registered to transact business in this state to file a report not more than once every four years. The failure to file the report when due will result, after notice, in the involuntary termination of the domestic corporation or the revocation of the registration of the foreign corporation.

Please note that a document on file with the Secretary of State is a public record that is subject to public access and disclosure. When providing address information for a director or officer, use a business or post office box address rather than a residence address if privacy concerns are an issue.

Instructions for Form

File Number: It is recommended that the file number assigned by the Secretary of State be provided to facilitate processing of the document.

Consent: A person designated as the registered agent of an entity must have consented, either in a written or electronic form, to serve as the registered agent of the entity. Although consent is required, a copy of the person’s written or electronic consent need not be submitted with the periodic report. The liabilities and penalties imposed by Sections 4.007 and 4.008 of the BOC apply with respect to a false statement in a filing instrument that names a person as the registered agent of an entity without that person’s consent. (BOC § 5.207)

Form 802 ─ Page 1 of 5

Execution: Pursuant to Section 4.001 of the BOC, the periodic report must be signed by a person authorized by the BOC to act on behalf of the entity in regard to the filing instrument. Generally, a governing person or managerial official of the entity signs a filing instrument. The periodic report need not be notarized; however, before signing, please read the statements on this form carefully. The designation or appointment of a person as registered agent by an organizer or managerial official is an affirmation by the organizer or managerial official that the person named in the instrument as registered agent has consented to serve in that capacity. (BOC § 5.2011)

A person commits an offense under Section 4.008 of the BOC if the person signs or directs the filing of a filing instrument the person knows is materially false with the intent that the instrument be delivered to the Secretary of State for filing. The offense is a Class A misdemeanor unless the person’s intent is to harm or defraud another, in which case the offense is a state jail felony.

Filing Fees: The filing fee for a periodic report for a nonprofit corporation is $5. If the corporation has forfeited its right to conduct affairs for failure to file the periodic report within thirty (30) days of the first notification, the fee is the original $5 plus a late fee of $1 per month or part of a month for one hundred twenty (120) days following the forfeiture, but not less than $5 nor more than $25.

Additional Documentation:

Name Change (optional): To change the name of the corporation at the same time of filing the required periodic report, an amendment (Form 424 or 412, as appropriate) and filing fee of $25 and Form 802 and filing fee (as stated in Filing Fees), must be submitted at the same time to the Reports Unit for filing.

Reinstatement: If the report is not filed within the one hundred twenty (120) day period from the date of the second notification, the domestic corporation will be involuntarily terminated or the registration of the foreign corporation will be revoked. The corporation may be relieved of the involuntary termination or revocation and reinstated by filing the required periodic report (Form 802) and filing fee of $25.

Tax Clearance from Comptroller of Public Accounts: If the corporation is not tax exempt, a tax clearance letter from the Texas Comptroller of Public Accounts stating that the filing entity has satisfied all franchise tax liabilities and may be reinstated is required to be filed with Form 802 and filing fee of $25. Form 811 is not required when reinstating. Contact the Comptroller for assistance in complying with franchise tax filing requirements and obtaining the necessary tax clearance letter by email at: tax.help@cpa.state.tx.us or by calling (800)

Form 802 ─ Page 2 of 5

Amendment to Certificate of Formation or Registration: The name of the corporation must be available at the time of reinstatement. The administrative rules adopted for determining entity name availability (Texas Administrative Code, Title 1, Part 4, Chapter 79, subchapter C) may be viewed at: http://www.sos.state.tx.us/tac/index.shtml A preliminary determination on “name availability” may be obtained by calling (512)

At the time of reinstating, if the corporation name is no longer available, or if written consent is required but cannot be obtained for the use of the name, simultaneously submit: (A) a certificate of amendment to the certificate of formation to change the name of the domestic entity as a condition of reinstatement; or (B) an amended registration to state the assumed name under which the foreign entity shall transact business. The amendment (Form 424 or 412, as appropriate) and filing fee of $25 and Form 802 and filing fee of $25, and the tax clearance letter, must be submitted at the same time to the Reports Unit for filing. Forms 424 and 412 are available at: http://www.sos.state.tx.us/corp/forms_boc.shtml

Upon completing the reinstatement process of submitting all required forms, paying all applicable filing fees, and meeting all filing requirements, the status of the nonprofit corporation will be changed to in existence.

•Payment Instructions: Accepted methods of payment are: (1) a check or money order payable through a U.S. bank or financial institution made payable to the Secretary of State; (2) a valid American Express, Discover, MasterCard, or Visa credit card (subject to a statutorily authorized convenience fee of 2.7% of the total fees incurred); (3) a funded LegalEase account; or (4) a prefunded Secretary of State client account. Use Form 815 at: http://www.sos.state.tx.us/corp/forms_reports.shtml to pay by credit card, LegalEase, or client account.

•Delivery Instructions: Submit the completed form(s), with the filing fees, in duplicate to the Secretary of

State. Mail to: Secretary of State, Reports Unit, P.O. Box 12028, Austin, Texas

James Earl Rudder Office Building, Reports Unit, 1019 Brazos, Austin, Texas 78701; or fax to: (512)

Revised 08/12

Form 802 ─ Page 3 of 5

Form 802 |

|

|

This space reserved for filing office use. |

(Revised 08/12) |

|

|

|

Submit in duplicate to: |

|

|

|

Secretary of State |

|

|

|

Reports Unit |

|

|

|

P.O. Box 12028 |

|

|

|

Austin, TX |

Periodic Report |

|

|

Phone: (512) |

|

||

FAX: (512) |

of a |

|

|

Dial: |

Nonprofit Corporation |

|

|

Filing Fee: See Instructions |

|

||

|

|

|

|

File Number:

1.The name of the corporation is: (A name change requires an amendment; see Instructions)

2.It is incorporated under the laws of: (Set forth state or foreign country)

3.The name of the registered agent is:

A. The registered agent is a corporation (cannot be entity named above) by the name of:

OR

B. The registered agent is an individual resident of the state whose name is:

First Name |

MI |

Last Name |

Suffix |

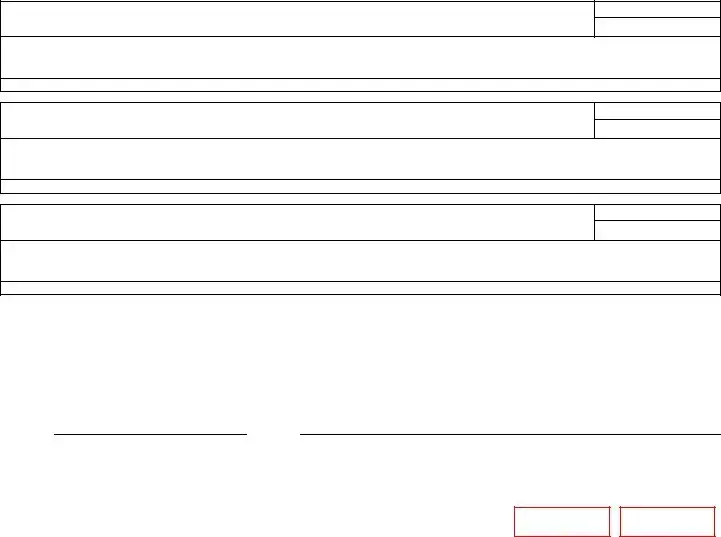

4. The registered office address, which is identical to the business address of the registered agent in Texas, is:

(Only use street or building address; see Instructions)

|

|

TX |

|

Street Address |

City |

State |

Zip Code |

5.If the corporation is a foreign corporation, the address of its principal office in the state or country under the laws of which it is incorporated is:

Street or Mailing Address |

City |

State |

Zip Code |

Country |

6. The names and addresses of all directors of the corporation are: (A minimum of three directors is required.)

(If additional space is needed, include the information as an attachment to this form for item 6.)

|

|

|

|

|

|

First Name |

MI |

Last Name |

|

|

Suffix |

|

|

|

|

|

|

Street or Mailing Address |

|

City |

State |

Zip Code |

Country |

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

MI |

Last Name |

|

|

Suffix |

|

|

|

|

|

|

Street or Mailing Address |

|

City |

State |

Zip Code |

Country |

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

MI |

Last Name |

|

|

Suffix |

|

|

|

|

|

|

Street or Mailing Address |

|

City |

State |

Zip Code |

Country |

Form 802 ─ Page 4 of 5

7. The names, addresses, and titles of all officers of the corporation are: (The offices of president and secretary

must be filled, but both may not be held by the same officer.)

(If additional space is needed, include the information as an attachment to this form for item 7.)

|

|

|

|

|

Officer Title |

First Name |

MI |

Last Name |

|

Suffix |

President |

|

|

||||

Street or Mailing Address |

|

City |

State |

Zip Code |

Country |

|

|

|

|

|

Officer Title |

First Name |

MI |

Last Name |

|

Suffix |

Secretary |

|

|

||||

Street or Mailing Address |

|

City |

State |

Zip Code |

Country |

|

|

|

|

|

Officer Title |

First Name |

MI |

Last Name |

|

Suffix |

|

Street or Mailing Address |

|

City |

State |

Zip Code |

Country |

Execution:

The undersigned affirms that the person designated as registered agent has consented to the appointment. The undersigned signs this document subject to the penalties imposed by law for the submission of a materially false or fraudulent instrument and certifies under penalty of perjury that the undersigned is authorized under the provisions of law governing the entity to execute the filing instrument.

Date:

Signature of authorized officer

Reset

Form 802 ─ Page 5 of 5

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Governing Law | Form 802 is governed by Section 22.357 of the Texas Business Organizations Code (BOC). |

| Filing Requirement | Nonprofit corporations must file a periodic report every four years. |

| Consequences of Non-filing | Failure to file the report can lead to involuntary termination or revocation of the corporation's registration. |

| Public Accessibility | All documents on file are public records accessible for public disclosure. |

| Registered Agent | The registered agent can be either a registered entity or an individual resident of Texas. |

| Filing Fees | The filing fee is $5, with additional fees for late filings. |

| Principal Office Address | The address must be the street address of the corporation’s principal place of business or another valid location. |

| Execution Requirement | The report must be signed by an authorized officer, but does not require notarization. |

Guidelines on Utilizing Texas 802

Completing the Texas 802 form is an essential step for nonprofit corporations in Texas to fulfill their reporting obligations. This process involves providing accurate information about the corporation’s directors, officers, and registered agent. Ensuring all required details are correctly filled out is vital, as failing to do so can lead to serious consequences for the corporation.

- File Number: Include the file number assigned by the Secretary of State, which can help speed up processing.

- Corporation Name: Enter the legal name of the corporation. Remember, if any changes are needed, you'll require an amendment.

- Jurisdictional Information: State the jurisdiction under which the corporation is formed.

- Registered Agent: Select either an individual resident of Texas or a registered foreign entity as the registered agent. Make sure not to list the corporation itself.

- Registered Office Address: Provide a physical street address where the registered agent can be contacted during business hours. Avoid using a mailbox service.

- Principal Office Address: If the corporation is foreign, supply the principal office address as per the laws of its incorporation.

- Directors: List the names and addresses of all members of the board of directors, ensuring there are at least three. If there’s not enough space, attach a separate sheet.

- Officers: Provide the names, addresses, and titles of each officer. Include at least a president and a secretary. If more space is needed, attach additional information.

- Execution: Sign and date the form, confirming that the registered agent has consented to their role. Note, this does not require notarization.

- Filing Fees: Prepare the necessary fees, which amount to $5 for the periodic report, and additional fees may apply for late filings.

- Additional Documentation: If applicable, include any amendments for name changes or reinstatement requests along with the required paperwork and fees.

- Payment Instructions: Choose your payment method and follow the instructions provided for acceptable forms of payment.

- Delivery Instructions: Submit the completed form in duplicate along with the filing fee, either through mailing or delivery to the Secretary of State.

What You Should Know About This Form

What is the Texas 802 Form?

The Texas 802 Form, also known as the periodic report for nonprofit corporations, is a document required by the Texas Business Organizations Code. It provides essential information about the nonprofit's directors and officers and ensures compliance with the state's filing requirements. Nonprofits must submit this form at least once every four years to maintain their status.

Who is required to file the Texas 802 Form?

All nonprofit corporations operating in Texas must file the Texas 802 Form. This includes both domestic nonprofit corporations and foreign nonprofit corporations that are registered to do business in Texas. Failure to submit the report can lead to penalties, including involuntary termination for domestic corporations or revocation of registration for foreign entities.

What information must be included in the Texas 802 Form?

The form requires the names and addresses of all directors and officers, including at least three directors. It also asks for the corporation's name, jurisdiction of formation, registered agent, and addresses for the registered office and principal office. If spaces on the form are insufficient, supplementary attachments may be attached.

When is the Texas 802 Form due?

The form must be filed every four years. However, if the organization receives a notification about needing to file, it must do so within 30 days to avoid penalties. The periodic report should always be filed in a timely manner to maintain the corporation's good standing.

What are the consequences of not filing the Texas 802 Form?

If a nonprofit fails to file the Texas 802 Form by the due date, it can face serious consequences. After a notice period, the organization may be involuntarily terminated, or if it is a foreign corporation, its registration may be revoked. This can impact the corporation's ability to operate legally in Texas.

How much does it cost to file the Texas 802 Form?

The filing fee for the Texas 802 Form is $5. If filing is late beyond 30 days from the initial notification, additional fees may accumulate. The total can rise with late penalties, reaching a maximum of $25, depending on the duration of the delay.

Can the corporation change its name when filing the Texas 802 Form?

Yes, a corporation can file for a name change when submitting the Texas 802 Form. To do this, it must also complete an amendment form (either Form 424 or 412) along with the requisite fees. Both should be filed simultaneously to ensure all changes are processed correctly.

Who can act as a registered agent for a nonprofit corporation?

The registered agent can be either a domestic or foreign entity registered to do business in Texas or an individual resident of the state. However, the corporation itself cannot serve as its own registered agent. Consent from the registered agent must be obtained before submitting the form.

Where do I submit the Texas 802 Form?

The completed Texas 802 Form must be submitted in duplicate to the Secretary of State in Austin, Texas. It can be mailed, delivered in person, or faxed, provided that the necessary fees are submitted with the form. For emailed assistance, the reports unit can be contacted at the provided phone number.

Common mistakes

Filling out the Texas 802 form can be straightforward, but many make common mistakes that can cause delays or additional fees. One major error is not providing the correct File Number. The Secretary of State assigns this number, and including it helps ensure your document is processed accurately and promptly. Omitting this number can lead to unnecessary complications.

Another frequent mistake occurs when individuals incorrectly list the Corporation Name. It is vital to provide the legal name as registered. If a name change is desired, an amendment must be submitted alongside the report. Failure to address this correctly might result in processing delays.

Many people also struggle with the Jurisdictional Information. They might fail to include the correct state or country under which the corporation was formed. Providing inaccurate jurisdiction information can hinder the filing process, as it is essential for verifying the corporation's legal standing.

A common oversight involves the declaration of the Registered Agent. Some filers mistakenly attempt to list the corporation itself as the registered agent. This is not allowed. Instead, a designated individual or permissible entity must be identified. Remember, consent from the agent is necessary, although this does not need to be submitted with the form.

Individuals often neglect to accurately provide a Registered Office Address. This address must be a physical location where the registered agent can be served with legal documents. It cannot be a P.O. Box or solely a mailbox service. Lack of adherence to this requirement can result in legal repercussions.

The section for Directors frequently poses problems too. A minimum of three directors must be listed. Some filers either list too few or miss providing sufficient information, which would require them to submit additional documentation—a potential delay in the process.

Similarly, when detailing the Officers, filers often overlook the requirement of including specific positions, such as president and secretary. Failing to provide this critical information correctly can lead to rejection of the form.

Another error arises when signers fail to recognize the Execution requirements. The report must be signed by an authorized person, which might be overlooked by those unfamiliar with the rules. Moreover, signing without ensuring the information is accurate can lead to significant legal issues.

People may also make mistakes regarding Filing Fees. It's crucial to ensure that the correct amount accompanies the form. If the corporation has previously forfeited its right to conduct business, additional fees apply. Failing to include the appropriate fees may delay processing or even invalidation of the filing.

Finally, some individuals disregard the Delivery Instructions. Properly submitting the completed form is essential. Many might choose the wrong delivery method or fail to understand that duplicates are required. This can complicate matters further and inhibit timely processing.

Documents used along the form

The Texas 802 form is a critical document for nonprofit corporations in Texas, as it ensures compliance with the periodic reporting requirements set forth in the Texas Business Organizations Code. Along with this form, several other documents may be necessary for complete corporate governance and reporting. Below is a list of related forms and documents typically used in conjunction with the Texas 802 form.

- Form 424: Certificate of Amendment - This form is used when a nonprofit needs to amend its certificate of formation, such as changing the corporation's name, purpose, or other key details.

- Form 412: Amendment to Registration - Foreign nonprofit corporations use this form to amend their registration details in Texas, ensuring information is current and accurate.

- Form 815: Credit Card Payment Form - Nonprofits can use this form to make payments for filing fees via credit card, ensuring a convenient and electronic method of payment.

- Tax Clearance Letter - Nonprofits must submit a tax clearance letter from the Texas Comptroller of Public Accounts indicating that all franchise tax obligations have been met before reinstatement or during periodic reporting.

- Form 801: Application for Certificate of Status - This form allows a nonprofit corporation to request a certificate of good standing, confirming that it is active and compliant with state laws.

- Form 402: Application for Registration - This form is for foreign nonprofits wishing to register and operate in Texas, laying the groundwork for compliance with Texas laws.

- Form 803: Certificate of Dissolution - If a nonprofit decides to dissolve, this form is required to legally complete the process and close its operations in Texas.

- Form 953: Annual Report - This report may additionally be required for nonprofits to provide financial and operational information on an annual basis, supplementing the periodic report.

- Bylaws of the Corporation - While not a report filed with the Secretary of State, the bylaws govern the internal management of the nonprofit and should be kept updated and available.

Understanding these related documents is essential for maintaining compliance and ensuring the smooth operation of a nonprofit corporation in Texas. Always consider consulting with legal professionals for guidance tailored to particular needs or situations.

Similar forms

Annual Report: Similar to the Texas 802 form, the Annual Report also requires a summary of the organization’s activities over the past year, along with detailing its current directors and officers. Like the periodic report, failing to file an annual report can result in penalties or loss of status.

Statement of Information: This document serves a similar purpose by providing essential information about the nonprofit’s current operations, including the names and addresses of its directors and officers. It needs to be filed at regular intervals to ensure compliance.

Nonprofit Registration Renewal: This document is required for nonprofits to maintain their active status and reflect any changes in leadership or address, just like the Texas 802 form does.

Application for Incorporation: When a nonprofit is first established, this document is crucial in outlining the structure and purpose of the organization, mirroring the Texas 802 form's requirement for director and officer details.

Articles of Incorporation: This foundational document is similar because it lays out the initial governance structure, including directors and officers, which is updated periodically through the Texas 802 form.

Change of Registered Agent Form: Whenever a nonprofit changes its registered agent, this form must be filed, similar to how the Texas 802 form records current registered agent information.

Bylaws Amendment: When amendments to the bylaws are made regarding organizational structure or governance, similar information regarding directors and officers may need to be submitted, which is also included in the periodic report.

Revocation of Nonprofit Status: This is a related document that may be initiated following a failure to submit the Texas 802 form on time, indicating the importance of timely compliance.

Dos and Don'ts

When filling out the Texas 802 form, consider the following do's and don'ts:

- Do provide the legal name of the corporation accurately.

- Do include the addresses of all directors and officers as required.

- Do ensure that the registered office address is a physical location, not just a mailbox.

- Do file your periodic report on time to avoid penalties.

- Don't use the corporation's name as the registered agent.

- Don't submit incomplete information; additional attachments may be necessary.

- Don't forget to indicate consent from the registered agent.

- Don't use a personal residential address for directors or officers if privacy is a concern.

Misconceptions

-

Misconception 1: The Texas 802 form is only for Texas nonprofit corporations.

Many people assume this form applies only to organizations established in Texas. In reality, the Texas 802 form is also relevant for foreign nonprofit corporations that are registered to conduct business in Texas. If a foreign entity operates in the state, it must comply with local requirements, including the submission of this form.

-

Misconception 2: Filing the Texas 802 form is optional for nonprofit corporations.

This form is, in fact, mandatory under Texas law. Nonprofit corporations must file a periodic report detailing their directors and officers. Failing to file this report can lead to serious consequences, such as the involuntary termination of the corporation or revocation of its registration.

-

Misconception 3: Privacy concerns are not an issue when submitting the Texas 802 form.

Some believe that the public nature of the form means privacy concerns do not matter. However, individuals concerned about their residential addresses being public may choose to provide a business address or a post office box. This option is available to protect personal information while still meeting filing requirements.

-

Misconception 4: The registered agent can be the nonprofit corporation itself.

It is a common misunderstanding that a corporation can act as its own registered agent. The regulations specify that the registered agent must either be a domestic or foreign entity registered to do business in Texas or an individual resident of the state. Corporations are not permitted to serve in this role for themselves, which underscores the importance of understanding who can act as a registered agent.

Key takeaways

Understanding the Texas 802 form is crucial for nonprofit corporations operating in Texas. Here are key takeaways to guide you through the filing process:

- Periodic Reporting Requirement: Nonprofit corporations must file the Texas 802 form periodically, typically every four years. Missing the deadline may lead to involuntary termination of the corporation.

- Information Disclosure: The information provided in the Texas 802 form is considered a public record. If privacy is a concern, use a business or post office box address instead of a personal residence address for officers and directors.

- Registered Agent Necessity: Every corporation must designate a registered agent, which can be an individual resident of Texas or a registered entity. The corporation cannot serve as its own registered agent.

- Execution Responsibility: The form must be signed by someone authorized to act on behalf of the corporation. Be sure to read the form carefully before signing, as misrepresentation can lead to legal repercussions.

- Filing Fees and Payment: A $5 filing fee is required, with potential late fees if the report is not filed on time. Various payment methods are accepted, including credit card options subject to a convenience fee.

Ensure compliance with the filing requirements to maintain the integrity and operation of your nonprofit corporation. Timely submission of the Texas 802 form will safeguard against penalties and uphold your organization’s standing.

Browse Other Templates

Aws Meaning Welding - Specifies the laboratory conducting the welding tests.

Attendance Sheet in Excel With Formula - Maintaining attendance records for up to three years is a significant requirement noted on the form.