Fill Out Your Texas Clm 2 Form

The Texas CLM 2 form, formally known as the Student Accident Claim Form, plays a crucial role in managing medical claims associated with student injuries in Texas schools. Designed to facilitate the claims process for parents and school officials, this form requires detailed information about the incident, including the nature of the injury and the circumstances leading up to it. Section 1 is primarily completed by a school official, capturing essential details such as the name of the school, the injured student's grade, and a narrative of how the accident occurred. For non-school-related injuries, parents or guardians can fill out Section 1 if they have opted for a 24-hour coverage plan. Section 2 places the responsibility on parents to provide their insurance details, further underscoring how the school’s policy may serve as a supplemental coverage option. Submitting the form is a straightforward process, but it requires careful adherence to timelines and procedures, such as filing within 90 days of the injury. This ensures a smoother pathway for securing benefits and minimizing out-of-pocket expenses for families. Understanding the intricacies of the Texas CLM 2 form not only helps in navigating the claims process effectively but also underscores the importance of safety and insurance in the educational environment.

Texas Clm 2 Example

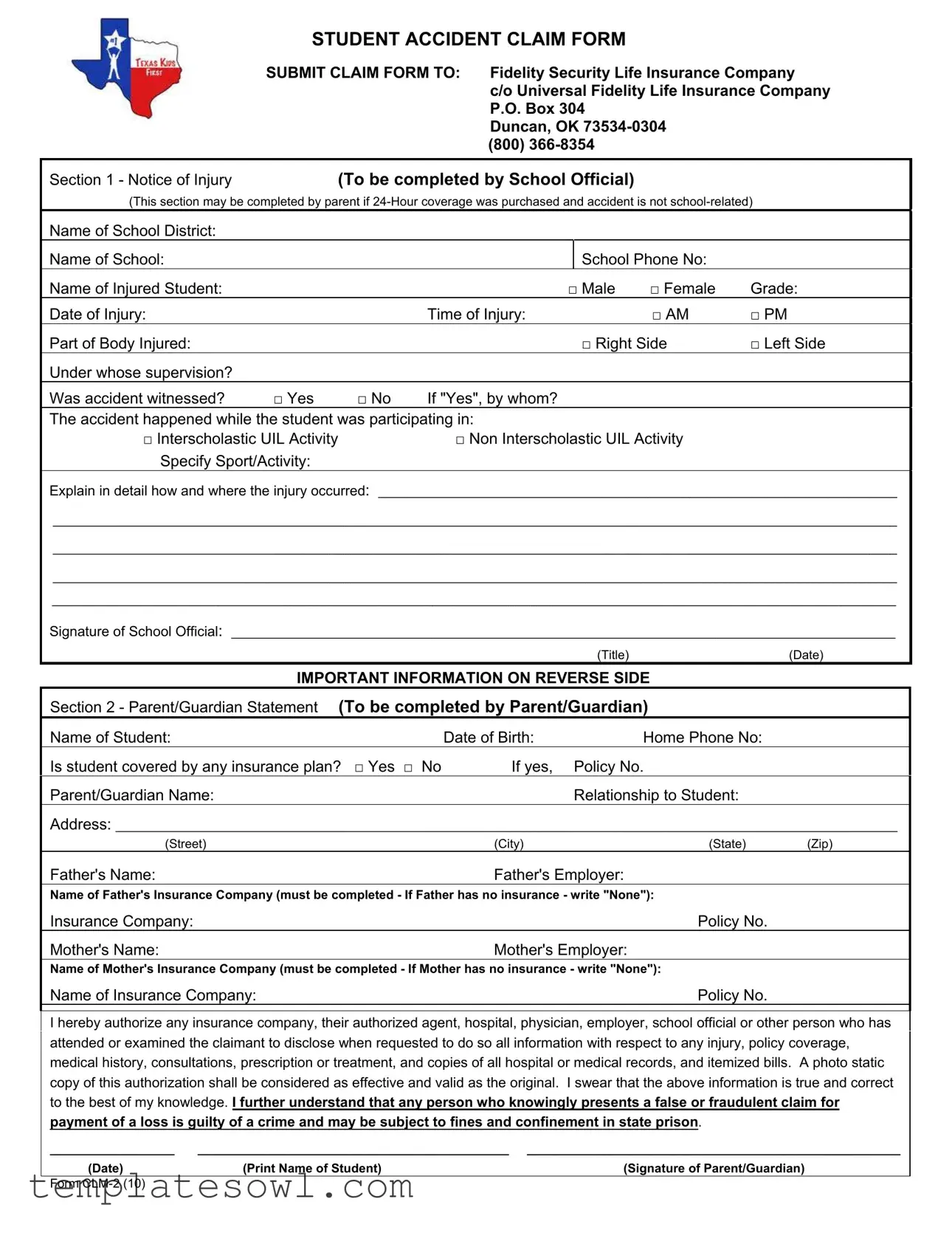

STUDENT ACCIDENT CLAIM FORM

SUBMIT CLAIM FORM TO: Fidelity Security Life Insurance Company c/o Universal Fidelity Life Insurance Company P.O. Box 304

Duncan, OK

Section 1 - Notice of Injury |

(To be completed by School Official) |

|

|

|

(This section may be completed by parent if |

||||

Name of School District: |

|

|

|

|

Name of School: |

|

School Phone No: |

|

|

Name of Injured Student: |

□ Male |

□ Female |

Grade: |

|

Date of Injury: |

Time of Injury: |

□ AM |

□ PM |

|

Part of Body Injured: |

|

□ Right Side |

□ Left Side |

|

Under whose supervision?

Was accident witnessed? |

□ Yes |

□ No |

If "Yes", by whom? |

The accident happened while the student was participating in: |

|||

□ Interscholastic UIL Activity |

|

□ Non Interscholastic UIL Activity |

|

Specify Sport/Activity:

Explain in detail how and where the injury occurred: ___________________________________________________________________________

__________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________

Signature of School Official: ________________________________________________________________________________________________

|

|

(Title) |

(Date) |

IMPORTANT INFORMATION ON REVERSE SIDE |

|

||

Section 2 - Parent/Guardian Statement (To be completed by Parent/Guardian) |

|

||

Name of Student: |

Date of Birth: |

Home Phone No: |

|

Is student covered by any insurance plan? □ Yes □ No |

If yes, |

Policy No. |

|

Parent/Guardian Name: |

|

Relationship to Student: |

|

Address: _________________________________________________________________________________________________________________

(Street) |

(City) |

(State) |

(Zip) |

Father's Name: |

Father's Employer: |

|

|

Name of Father's Insurance Company (must be completed - If Father has no insurance - write "None"):

Insurance Company: |

Policy No. |

Mother's Name: |

Mother's Employer: |

Name of Mother's Insurance Company (must be completed - If Mother has no insurance - write "None"):

Name of Insurance Company: |

Policy No. |

I hereby authorize any insurance company, their authorized agent, hospital, physician, employer, school official or other person who has attended or examined the claimant to disclose when requested to do so all information with respect to any injury, policy coverage, medical history, consultations, prescription or treatment, and copies of all hospital or medical records, and itemized bills. A photo static copy of this authorization shall be considered as effective and valid as the original. I swear that the above information is true and correct to the best of my knowledge. I further understand that any person who knowingly presents a false or fraudulent claim for payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

__________________ |

_____________________________________________ |

______________________________________________________ |

(Date) |

(Print Name of Student) |

(Signature of Parent/Guardian) |

Form |

|

|

ATTENTION PARENTS

Dear Parents,

Below are instructions for filing the Claim Form. Should you have any questions, contact the school trainer or call the number listed below. The school is NOT responsible for medical payment for your child. The school may have purchased a supplemental Accident Only Policy which may cover charges in excess of your own insurance policy. If you have no other insurance for your child, this policy may pay first or primary. This is a limited benefit policy and may not cover all medical bills for your child. Any charges not covered are YOUR RESPONSIBILITY.

For all

INSTRUCTIONS FOR FILING THE CLAIM FORM

Section 1 must be completed by a school official for all

Section 2 must be completed by the parent / guardian.

How to File A Claim

Step 1 - Complete and submit the claim form to the Claims Office at the address indicated below or send electronically to SAclaims@uflic.com. The claim form must be submitted within 90 days from the date of injury regardless of whether you have other insurance or not. Keep a copy of the claim form for your records and present a copy of the claim form to the provider or facility. DO NOT RELY on the provider or facility to submit the claim form.

Submit copies of itemized bills to the address indicated below. Itemized bills are original bills you receive, not monthly statements. Itemized bills are often called UB92 or HCFA1500 forms that provide the procedure code, diagnosis code, and the Providers’ address and Tax ID Number.

Step 2 - File a claim with your primary insurance first. insurance is your family and/or group insurance coverage.

Submit copies of all bills to your primary insurance first. Your primary The school’s policy is supplemental to all other valid coverage.

Step 3. After receiving payment or copies of Explanation of Benefits (EOB) from your family and/or group insurance, submit a copy of this claim form along with copies of your itemized bills and EOBs from your primary insurance company to the address below:

Fidelity Security Life Insurance Company c/o Universal Fidelity Life Insurance Company

P.O. Box 304

Duncan, OK

(800)

Texas Kids First has unique access to one of the most creative innovations in the insurance industry – the Texas Kids First Provider Network (TKF Network)* – the first “no balance bill”

Please refer to the website www.texaskidsfirst.com or call

*The TKF Network is made available by Texas Kids First and is not affiliated with Fidelity Security Life Insurance Company.

FRAUDULENT CLAIM DISCLOSURE

Any person who knowingly presents a false or fraudulent claim for payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Form

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | The Texas CLM 2 form is specifically designed for reporting student injuries that occur while participating in school activities, whether interscholastic or non-interscholastic. |

| Filing Deadline | Claims must be submitted within 90 days from the date of injury. This is an important time frame to ensure that claims are processed without any complications. |

| Eligibility for Coverage | To be eligible for coverage, the injured student needs to be enrolled in the school district and the accident must occur during school-related activities, or 24-hour coverage must be purchased. |

| Insurance Coordination | The form indicates that it functions as a supplemental insurance policy. Parents should first file claims with their primary insurance before submitting claims to the Texas Kids First plan. |

| Legal Framework | This form is governed by state laws in Texas related to student health and safety, under the provisions that manage insurance claims for student injuries. |

Guidelines on Utilizing Texas Clm 2

Filing a claim for a student accident involves gathering necessary information and submitting the appropriate documentation. Ensure that all sections of the Texas Claim (CLM 2) form are completed accurately to facilitate the claims process.

- Download the Texas Claim (CLM 2) form from the appropriate website or receive it from the school.

- Section 1 must be filled out by a school official for school-related accidents. If the accident is not school-related and 24-Hour coverage was purchased, a parent or guardian can complete this section.

- In Section 1, provide the name of the school district, name of the school, school phone number, and name of the injured student. Indicate the student's gender, grade, date and time of the injury, as well as the part of the body injured.

- State under whose supervision the accident occurred and whether it was witnessed. If witnessed, fill in the name of the witness.

- Specify whether the accident happened during an interscholastic or non-interscholastic UIL activity, and include details of the sport or activity involved.

- Explain how and where the injury occurred in the space provided. Make sure to give a complete description.

- Ensure the section is signed and dated by the school official.

- Section 2 must be completed by the parent or guardian. Fill in the name and date of birth of the student, along with the home phone number.

- Indicate if the student has any other insurance coverage, and provide the policy number if applicable.

- Enter the parent/guardian's name, their relationship to the student, and their address.

- Include parental information: names of both parents, their employers, and insurance details for both, marking “None” if applicable.

- Sign and date the statement, affirming the truth of the provided information and understanding the implications of false claims.

- Submit the completed claim form to Fidelity Security Life Insurance Company’s address or electronically to the indicated email.

Keep a copy of the claim form for your records and provide a copy to any medical provider involved. If the care received is covered by another insurance plan, submit claims to that plan first. Follow up by sending the claim form and any necessary bills and Explanation of Benefits to complete your claim submission.

What You Should Know About This Form

What is the Texas CLM 2 form used for?

The Texas CLM 2 form is designed for filing a student accident claim. It is primarily used when a student is injured either during school-related activities or, if 24-hour coverage was purchased, during non-school-related activities. The form captures necessary details about the incident, including the student's information, the specifics of the injury, and insurance details.

Who is responsible for completing the Texas CLM 2 form?

The form consists of two sections. Section 1 should typically be completed by a school official if the injury is school-related. However, if the 24-hour coverage was purchased and the accident is not related to school, a parent or guardian may fill out this section. Section 2 is always to be completed by the parent or guardian, as it requires personal and insurance information relevant to the student.

How do I submit the form, and what is the deadline?

The completed Texas CLM 2 form must be submitted to the Fidelity Security Life Insurance Company at the address provided: P.O. Box 304, Duncan, OK 73534-0304. Alternatively, it can be sent electronically to SAclaims@uflic.com. All claims must be submitted within 90 days from the date of the injury, regardless of any other insurance coverage the student may have. It is crucial to keep a copy of the form for personal records.

What additional documentation is required to file a claim?

Along with the claim form, you must include itemized bills related to the medical treatment the injured student received. These itemized bills should be the original documents rather than monthly statements and must include specific details such as procedure codes and provider information. Additionally, if a primary insurance claim has been filed, you need to include the Explanation of Benefits (EOB) from that insurer with your claim submission.

What should I do if I have other insurance coverage?

If your child has other health insurance, you must first file the claim with your primary insurance provider. Submit all itemized bills to this primary insurance as a necessary step prior to filing with the Texas CLM 2 form. After receiving payment or the EOB from your primary insurance, you can then send a copy of this claim form along with the accompanying documentation to the Texas CLM 2 submission address.

Common mistakes

Filling out the Texas Clm 2 form can be straightforward, but many people make mistakes that can delay a claim or even lead to its denial. Here are nine common mistakes to avoid.

One mistake often made is failing to complete Section 1 correctly. This section is critical and must be filled out by a school official for all school-related accidents. If a parent has purchased 24-Hour coverage, they must ensure it is completed appropriately if the injury is not school-related. Leaving it incomplete can hinder the processing of the claim.

Another error that occurs is neglecting to include all necessary details about the injury. In the section asking for a detailed explanation of how and where the injury occurred, some individuals provide vague information. Specific details are crucial for assessing the claim accurately. It is essential to give a clear and concise account of the events leading up to the injury.

Many fail to provide accurate information about their insurance coverage. Parents sometimes skip the question asking whether the student is covered by any insurance plan. It is important to answer this accurately and include policy numbers where applicable. This information helps streamline the claim process and ensures all necessary coverage details are available.

Additionally, some parents overlook the signature requirement. The Parent/Guardian section not only requires an official declaration but also needs the signature of the parent or guardian. Submitting the form without this signature can lead to unnecessary delays.

Not submitting itemized bills can be another pitfall. Bills must clearly outline the services provided. Submitting monthly statements rather than itemized bills may result in the claim being rejected. Understanding what constitutes an itemized bill is essential in achieving a successful submission.

Another mistake is failing to file the claim within the specified time. The claim form must be submitted within 90 days from the date of injury. Missing this deadline might result in the inability to process the claim, potentially leaving medical expenses unpaid.

Moreover, some individuals assume that the school will submit the claim on their behalf. This misconception can cause issues. Parents need to take responsibility for submitting the claim form and ensure that they follow through with all requirements.

Incorrect or incomplete information on the form is also a frequent error that can complicate the claims process. Each section must be filled out with care, ensuring names, dates, and other relevant information are accurate. An error in any part of the form could result in processing delays or claim denials.

Lastly, misunderstanding the relationship between primary insurance and the school’s supplemental policy is a common issue. Parents should file claims with their primary insurance first and submit any necessary documentation to the school’s policy afterward. Misapplying these rules may complicate claims and result in denied payments.

Documents used along the form

In conjunction with the Texas CLM 2 form, several other documents are commonly required to facilitate a smooth claims process for student accidents. Each of these forms plays a crucial role in collecting necessary information, validating claims, or providing additional details pertinent to the situation. Below is a comprehensive list of these supporting documents.

- Itemized Medical Bills: Detailed invoices from healthcare providers that outline the services rendered, their costs, and necessary treatment codes.

- Explanation of Benefits (EOB): A statement provided by an insurance company detailing what portion of a claim has been paid, denied, or is the responsibility of the patient.

- Primary Insurance Claim Form: The specific form used to file a claim with the student’s primary insurance provider, ensuring all benefits are maximized before submitting to secondary insurance.

- Medical History Release Form: A document authorizing medical providers to share necessary health information with the insurance company or claims office, supporting the verification of the claim.

- School Accident Report: An internal form completed by school officials that documents the occurrence of the accident, including witness statements and a description of events.

- Parent/Guardian Consent Form: A signed document granting permission for medical treatment and information release regarding the injured student.

- Proof of Coverage: Documentation showing the specifics of the student’s insurance coverage, including policy numbers and effective dates.

- Claim Adjustment Form: A supplemental form utilized if there are discrepancies or adjustments needed in the original claim submission.

- Release of Liability Form: A form that may need to be signed, relinquishing the school or governing body of any future claims related to the incident.

- Witness Statements: Affidavits or written accounts from individuals who observed the accident, providing additional context to the situation for the claims adjuster.

Using these documents in conjunction with the Texas CLM 2 form will help ensure a comprehensive and effective claims process. Proper collection and submission of this paperwork facilitate timely responses and minimize the potential for claim denials.

Similar forms

- Student Health Insurance Claim Form - Similar to the Texas Clm 2 form, this document is also used to report injuries and seek reimbursement for medical expenses related to student accidents. Both forms collect detailed information about the injury and the parties involved.

- Accident Report Form - This form is often required in schools to document incidents resulting in injuries. Like the Texas Clm 2, it details the circumstances and responses involved in an accident.

- Medical Insurance Claim Form (HCFA-1500) - Often needed for medical providers to process claims, this document serves a similar purpose to the Texas Clm 2 form, where itemized bills and insurance details are submitted for payment.

- Claims Authorization Form - This document, which grants permission for insurance companies to access medical records, parallels Section 2 of the Texas Clm 2, allowing providers to share important information about the injury.

- Dependent Coverage Enrollment Form - This form enrolls dependents under health insurance, comparable to the Texas Clm 2, which collects insurance information to determine coverage for the injured student.

- Parental Consent Form for Medical Treatment - This document gives consent for medical treatment, similar to the parental signature requirement found in the Texas Clm 2 for claims related to student injuries.

- Health Insurance Claim Form for Schools - Used specifically for school incidents, it shares similarities with the Texas Clm 2 by documenting injuries and facilitating claims to receive benefits from school accident policies.

- Incident Report for Injury Claims - This form collects detailed information about an incident, just like the Texas Clm 2, and is used to file claims for any resulting medical costs.

- Release of Information Form - This form allows specific information about the student’s medical records to be shared, echoing the authorization sections of the Texas Clm 2 that require similar declarations.

- Insurance Information Update Form - This document captures updates to insurance details when submitting claims for reimbursement, akin to the information provided within the Texas Clm 2 regarding the student's insurance policies.

Dos and Don'ts

When filling out the Texas Clm 2 form, there are several key practices to keep in mind to ensure a smooth process. Here are some things to do and avoid:

- Do ensure accuracy: Double-check all information for any mistakes or omissions before submitting.

- Do follow instructions: Carefully read the instructions provided on the form to understand how to fill it out correctly.

- Do submit on time: Make sure to turn in the claim form within 90 days of the date of the injury.

- Do keep copies: Retain a copy of the completed claim form and itemized bills for your records.

- Don’t rely on others: Do not count on medical providers or facilities to submit the claim form on your behalf.

- Don’t provide incomplete information: Avoid leaving any fields blank or providing vague descriptions of the injury or accident.

These practices can help ensure that the claim process is as efficient as possible, minimizing delays and complications that may arise from errors or oversights.

Misconceptions

Misconceptions about the Texas Clm 2 form can lead to confusion for parents and guardians navigating student accident claims. Understanding these misconceptions is essential for successfully filing a claim.

- The school is responsible for medical payments. Many individuals assume the school will cover all medical expenses. However, schools typically purchase a supplemental insurance policy. Parents are responsible for any charges not covered by this policy.

- Only school officials can complete the form. This belief is incorrect. Section 1 of the form may be filled out by a school official for school-related accidents. If the accident is not school-related and 24-hour coverage was purchased, a parent can complete this section.

- The claim form can be submitted anytime after the injury. Contrary to this idea, the claim form must be submitted within 90 days from the date of the injury. Delaying submission risks denial of the claim.

- Itemized bills are not necessary when filing a claim. On the contrary, itemized bills are essential for submitting a claim. These documents provide critical details about medical services rendered and should accompany the claim form.

- Submitting the claim form to a provider is enough. It is a common misunderstanding that providers will submit the claim on behalf of the parents. Parents should always submit the claim form themselves. Relying on providers can lead to significant delays.

- The Texas Kids First policy covers all medical expenses. Some may believe this policy covers every medical bill incurred due to an accident. This policy offers limited benefits and may not cover all costs, leaving parents with some responsibility for unpaid charges.

- Fraudulent claims only lead to fines. While it is true that submitting a fraudulent claim can result in fines, it can also lead to confinement in state prison. Understanding the seriousness of providing false information is crucial.

Key takeaways

Here are key takeaways regarding the Texas Clm 2 form:

- Submit Timely: The claim form must be submitted within 90 days from the date of injury.

- Separate Sections: Section 1 is for school officials; Section 2 is for parents/guardians.

- Injury Details: Accurate injury details, including time, place, and supervision, are essential.

- Coverage Clarification: Schools are not financially responsible for medical payments; parents may have supplemental coverage.

- Itemized Bills: Submit original bills rather than monthly statements; these must show specific codes and provider information.

- Primary Insurance First: File claims with primary insurance before submitting to the school’s policy.

- Use the Correct Address: Claims should be sent to Fidelity Security Life Insurance at the address provided.

- Provider Network: Texas Kids First offers a non-profit provider network that prevents balance billing.

- Keep Records: Retain copies of all documents submitted, including the claim form and itemized bills.

- Fraud Alert: Providing false information on the claim form can lead to severe penalties.

Browse Other Templates

Ds 160 Appointment - The form simplifies the process of authorizing officers to execute necessary loan documents.

Passport Application Form - Provide the applicant's full name and title.